TIDMGKP

RNS Number : 4691K

Gulf Keystone Petroleum Ltd.

02 September 2021

2 September 2021

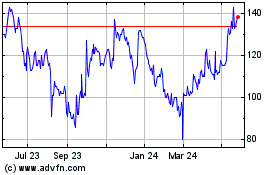

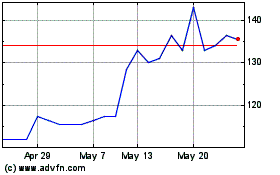

Gulf Keystone Petroleum Ltd. (LSE: GKP)

("Gulf Keystone", "GKP", "the Group" or "the Company")

2021 Half Year Results Announcement

Gulf Keystone, a leading independent operator and producer in

the Kurdistan Region of Iraq, today announces its results for the

half year ended 30 June 2021.

Jon Harris, Gulf Keystone's Chief Executive Officer, said:

"I am pleased to report strong operational and financial

performance in the first half of 2021, despite the continuing

challenges of the COVID-19 pandemic. Our leverage to the recovery

in oil prices, combined with safe and reliable production towards

the top end of our guidance range and a continued sharp focus on

costs, has resulted in significant cash flow generation. With

continued strong production performance from the Shaikan Field, we

are tightening the 2021 production guidance range to 42,000 -

44,000 bopd.

We continue to deliver against our commitment to balance

investment in growth and returns to shareholders. Today, we are

pleased to declare an interim dividend for 2021 of $50 million,

bringing total dividends this year to $100 million.

The early restart of the drilling campaign in June enables us to

maintain production growth momentum and to drill an additional

well, SH-G, in 2021 after completion of SH-14, the final well in

the 55,000 bopd investment programme. SH-14 is expected to come

onstream in Q4 2021, while we expect SH-G to come onstream in Q1

2022.

We continue to work closely with the MNR and our partner on the

preparation of the Shaikan FDP and expect to submit the FDP to the

MNR in Q4 2021 for approval."

Highlights to 30 June 2021 and post reporting period

Operational

-- Remain focused on safe and reliable operations with No Lost

Time Incident ("LTI") recorded for over 600 days and no recordable

incidents for around 550 days

-- Continuing to manage the challenges presented by COVID-19 to

protect the health of staff and contractors

-- Strong average gross 2021 production to 31 August 2021 of

c.42,900 bopd, up 18% from the corresponding period in 2020 and

towards the top end of 2021 guidance; gross production on 31 August

2021 was 42,842 bopd

-- Drilling activities progressing well following early restart

in June; SH-13 expected to come onstream imminently ; drilling of

SH-14 underway with completion and hook-up expected in Q4 2021

-- Capitalising on early restart of drilling and opportunity to

maintain a continuous drilling programme, planning to spud SH-G in

Q4 2021, after completion of SH-14. SH-G is expected to commence

production in Q1 2022

-- SH-G, the first well after the 55,000 bopd expansion

programme, is an opportunity to maintain growth and momentum while

we prepare the Shaikan Field Development Plan ("FDP")

-- Completed debottlenecking of PF-2, increasing total field

processing capacity to c.57,500 bopd

Financial

-- H1 2021 revenue up 162% to $130.7 million (H1 2020: $49.9m)

contributing to a return to profit after tax of $64.8 million (H1

2020: $33.1 million loss)

-- Adjusted H1 2021 EBITDA of $93.8 million, more than triple

$27.5 million in H1 2020, driven by the Company's strong leverage

to the recovery in oil prices, increase in production and low-cost

base:

o Realised price up 129% to $43.7/bbl (H1 2020: $19.1/bbl)

o H1 2021 gross average production up 17% to 43,516 bopd (H1

2020: 37,159 bopd)

o H1 2021 gross Opex per barrel of $2.4/bbl, below 2021 guidance

range of $2.5-$2.9/bbl

-- Net Capex of $14.1 million (H1 2020: $38.5 million), with the

restart of the 55,000 bopd expansion programme

-- Total dividends of $50 million paid to date, including an

annual dividend of $25 million and a special dividend of $25

million

-- Robust cash balance of $177.4 million at 1 September 2021

Outlook

-- Tightening 2021 average gross production guidance range from

40,000 - 44,000 bopd to 42,000 - 44,000 bopd

-- Maintaining 2021 gross Opex per barrel guidance of $2.5 to $2.9/bbl

-- The addition of SH-G increases 2021 net Capex guidance from

$55-$65 million to $75-$85 million

-- With continued constructive engagement with the Ministry of

Natural Resources ("MNR") and the Company's partner Kalegran B.V.

(a subsidiary of MOL Hungarian Oil & Gas plc) ("MOL"), Gulf

Keystone is expecting to submit an FDP in Q4 2021 to the MNR for

approval

o The FDP includes the continued ramp-up of Jurassic oil

production, appraisal of the Triassic reservoir and a Gas

Management Plan

o We continue to optimise the scope, schedule and cost of the

FDP

-- Developing Gulf Keystone's sustainability strategy, with the

primary environmental focus on more than halving CO(2) per barrel

by 2025 by eliminating flaring

-- In line with the Company's strategy of balancing investment

in growth and returns to shareholders, Gulf Keystone is pleased to

declare an interim dividend for 2021. The 2021 interim dividend is

$50 million to be paid on 8 October 2021 based on a record date of

24 September 2021

-- Following payment of the interim dividend, the Company will

have distributed $100 million of dividends in 2021

-- With continuing strong oil prices and cash flow generation,

there may be opportunities to consider further distributions to

shareholders and to optimise the capital structure

Investor & analyst presentation

Gulf Keystone's management team will be presenting the Company's

2021 Half Year Results at 10:00am (BST) today via live audio

webcast:

https://webcasting.brrmedia.co.uk/broadcast/60e86de51ba1724bfa9a0d87

This announcement contains inside information for the purposes

of the UK Market Abuse Regime.

Enquiries:

Gulf Keystone: +44 (0) 20 7514 1400

Aaron Clark, Head of Investor Relations aclark@gulfkeystone.com

Celicourt Communications: + 44 (0) 20 8434 2754

Mark Antelme GKP@Celicourt.uk

Jimmy Lea

or visit: www.gulfkeystone.com

Notes to Editors:

Gulf Keystone Petroleum Ltd. (LSE: GKP) is a leading independent

operator and producer in the Kurdistan Region of Iraq. Further

information on Gulf Keystone is available on its website

www.gulfkeystone.com

Disclaimer

This announcement contains certain forward-looking statements

that are subject to the risks and uncertainties associated with the

oil & gas exploration and production business. These statements

are made by the Company and its Directors in good faith based on

the information available to them up to the time of their approval

of this announcement but such statements should be treated with

caution due to inherent risks and uncertainties, including both

economic and business factors and/or factors beyond the Company's

control or within the Company's control where, for example, the

Company decides on a change of plan or strategy. This announcement

has been prepared solely to provide additional information to

shareholders to assess the Group's strategies and the potential for

those strategies to succeed. This announcement should not be relied

on by any other party or for any other purpose.

CEO Statement

The first half of 2021 has been characterised by a significant

recovery in spot and forward oil prices as economies around the

world have begun the early stage of their recoveries, even while

the course and eventual conclusion of the COVID-19 pandemic remains

uncertain. Against this more favourable economic backdrop, Gulf

Keystone has delivered strong operational and financial

performance, and demonstrated our commitment of balancing

shareholder returns with investment in growth.

The foundation of our performance remains our strong health,

safety, security and environment ("HSSE") culture. Our focus on

HSSE has been more critical than ever with the restart of expansion

activities. I'm pleased to report today that we have now had over

600 LTI free days. That said, we are not being complacent, and all

of Gulf Keystone's people are continuing to live and breathe the

target of zero personal and process safety incidents.

We continue to implement measures to protect our workforce and

operations from COVID-19. While we still face challenges on the

ground because of the pandemic, we continue to manage them well,

and we have limited the impact of COVID-19 on our operations to

date.

Year-to-date to 31 August 2021, we have delivered safe and

reliable production towards the upper end of our 2021 guidance,

with gross average production of c.42,900 bopd, up 18% from the

corresponding period in 2020. Gross production on 31 August 2021

was 42,842 bopd. To date, we have produced around 92 million stock

tank barrels ("MMstb") from the Shaikan Field and have c.500

million barrels of gross 2P reserves yet to produce.

In June, we were able to successfully restart drilling

activities, two months ahead of schedule, and have made good

progress since then executing the programme. Following the

completion of SH-13, the drilling rig was moved on the same well

pad to drill SH-I (now SH-14). We expect SH-13 to come onstream

imminently and expect completion and hook-up of SH-14 to take place

in Q4 this year. We continue to expect gross production to increase

towards 55,000 bopd in Q4 2021.

The early restart of drilling enables us to drill an additional

well in 2021 after completion of SH-14, the final well in the

55,000 bopd investment programme. We expect the new well, SH-G, to

spud later this year and come online in Q1 2022. SH-G is an

excellent opportunity to maintain growth and momentum in developing

our world-class resource base while we finalise the FDP.

Since the appointment of the new Minister of Natural Resources

at the beginning of 2021, GKP and MOL have been meeting frequently

with the MNR to progress the preparation of the FDP. Engagement has

been constructive, and we are expecting to submit the FDP in Q4

2021 to the MNR for approval.

Gulf Keystone's leverage to the recovery in oil price, combined

with safe and reliable production towards the upper end of the 2021

guidance range and our low-cost structure, has enabled us to more

than triple Adjusted EBITDA year-on-year to $93.8 million. We

continue to balance investment in growth and returns to

shareholders, with total dividends of $100 million to be

distributed this year following the declaration of a $50 million

interim dividend for 2021, announced today. With continuing strong

oil prices and cash flow generation, there may be opportunities to

consider further distributions to shareholders and to optimise the

capital structure.

Looking ahead to the remainder of the year, we are tightening

our 2021 average gross production guidance range to between 42,000

- 44,000 bopd. We are maintaining our gross Opex per barrel

guidance of $2.5 to $2.9/bbl, while we are increasing our net Capex

guidance from $55-$65 million to $75-$85 million to reflect the

addition of SH-G.

After almost eight months in the CEO role, I'm delighted with

the performance of the Company and the energy and commitment of our

people. It is thanks to their passion and resilience that Gulf

Keystone has hit the ground running in 2021 following the

challenges of 2020 created by the COVID-19 pandemic and the oil

price crash. I am excited about finalising the FDP to provide

visibility around the significant potential of the Shaikan Field

and I am confident that by executing our strategy and striving for

the highest operational and financial delivery in a sustainable way

we will create significant value for all our stakeholders.

Jon Harris

Chief Executive Officer

Operational Review

Gulf Keystone's strong operational performance has continued

into the first half of 2021. We have maintained safe and reliable

production towards the upper end of 2021 guidance, successfully

restarted the 55,000 bopd investment programme ahead of schedule,

maintained momentum by approving the drilling of SH-G, and advanced

the preparation of the FDP, with expected submission to the MNR

later this year.

All of our operational activity is underpinned by our rigorous

focus on safety. We have had over 600 LTI free days and around 550

recordable incident free days. We have taken extra precautions as

drilling activities have restarted by ensuring all drilling and

operational staff on site received appropriate training and safety

refresher courses at the beginning of the campaign. The emphasis

remains on steady, careful progress.

Similarly, we have continued to manage the impact of COVID-19 on

our operations. As in other countries, the COVID-19 pandemic

remains a challenge in the Kurdistan Region of Iraq and we continue

to take measures, such as testing and quarantine, to protect our

staff and contractors across our field operations and offices.

In the period to 31 August 2021, gross average production was

c.42,900 bopd, up 18% from the corresponding period in 2020. Gross

production on 31 August 2021 was 42,842 bopd. Average year-to-date

production is towards the top end of guidance, with record monthly

production in January of more than 44,400 bopd. As a result, we are

tightening our 2021 average gross production guidance from 40,000

to 44,000 bopd to between 42,000 to 44,000 bopd.

Following a hiatus due to the sharp decline in oil prices and

COVID-19 pandemic, we successfully restarted drilling activities in

June 2021, two months ahead of schedule. Following the restart,

SH-13 was completed as planned, and the well is expected to come

onstream imminently. SH-14, which is adjacent to SH-13 on the same

well pad, is expected to be completed and hooked up in Q4 2021. The

installation of two electric submersible pumps in two existing

wells is currently expected to follow.

The early restart of drilling activities has given us the

opportunity to complete the 55,000 bopd programme and then

immediately drill the next well in the sequence, SH-G. SH-G will be

located around 2 km to the east of SH-7 and will be tied into PF-1.

SH-G is currently expected to come on-stream in Q1 2022.

In addition to the drilling campaign, we have just completed the

debottlenecking of PF-2, increasing the total processing capacity

of PF-1 and PF-2 to c.57,500 bopd. SH-13 and SH-14 will be tied

into PF-2.

Our strong operational performance has been accompanied by

progress in preparing the FDP, as we seek to develop and produce

Shaikan Field's significant reserves and resources. With continuing

constructive engagement with the MNR and our partner MOL, we expect

to submit the FDP in Q4 2021 to the MNR for approval. The FDP

currently includes the continued ramp-up of Jurassic oil

production, appraisal of the Triassic reservoir and a Gas

Management Plan. Gulf Keystone is targeting to more than halve

Scope 1 and 2 CO(2) emissions per barrel by eliminating flaring. We

are continuing to work with the MNR to optimise scope, schedule and

cost.

Finally, we continue to progress the development of Gulf

Keystone's sustainability strategy. This work will build on our

high environmental, social and governance ("ESG") standards by

defining a corporate strategy, aligned to internationally

recognised frameworks, to drive further improvements in

performance, underpinned by targets and transparent disclosure.

Stuart Catterall

Chief Operating Officer

Financial Review

Key financial highlights

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

Gross average production(1) bopd 43,516 37,159 36,625

---------------------------------- -------- ----------- ----------- -------------

Realised price(1) $/bbl 43.7 19.1 20.9

---------------------------------- -------- ----------- ----------- -------------

Revenue $m 130.7 49.9 108.4

---------------------------------- -------- ----------- ----------- -------------

* Oil sales $m 133.4 49.9 108.4

---------------------------------- -------- ----------- ----------- -------------

* Hedging costs $m (2.7) - -

---------------------------------- -------- ----------- ----------- -------------

Operating costs $m (15.0) (14.2) (27.4)

---------------------------------- -------- ----------- ----------- -------------

Gross operating costs per

barrel(1) $/bbl (2.4) (2.6) (2.6)

---------------------------------- -------- ----------- ----------- -------------

Share option (expense)/credit $m (6.5) 0.1 (1.2)

---------------------------------- -------- ----------- ----------- -------------

Other general and administrative

expenses $m (5.4) (5.5) (12.3)

---------------------------------- -------- ----------- ----------- -------------

- Incurred in relation

to Shaikan Field $m (2.1) (2.8) (5.0)

---------------------------------- -------- ----------- ----------- -------------

- Corporate G&A $m (3.3) (2.7) (7.3)

---------------------------------- -------- ----------- ----------- -------------

Adjusted EBITDA(1) $m 93.8 27.5 56.7

---------------------------------- -------- ----------- ----------- -------------

Profit/(loss) after tax $m 64.8 (33.1) (47.3)

---------------------------------- -------- ----------- ----------- -------------

Basic earnings/(loss) per

share cents 30.52 (15.64) (22.45)

---------------------------------- -------- ----------- ----------- -------------

Revenue receipts(1,2) $m 106.4 52.1 101.1

---------------------------------- -------- ----------- ----------- -------------

Net capital expenditure(1) $m 14.1 38.5 45.9

---------------------------------- -------- ----------- ----------- -------------

Net cash(1) $m 85.1 39.2 43.4

---------------------------------- -------- ----------- ----------- -------------

Net increase/(decrease)

in cash and cash equivalents $m 41.7 (47.2) (43.0)

---------------------------------- -------- ----------- ----------- -------------

(1.) Gross average production, realised price, gross operating

costs per barrel, Adjusted EBITDA, net capital expenditure, revenue

receipts and net cash are either non-financial or non-IFRS measures

and, where necessary, are explained in the Non-IFRS measures

section.

(2.) Revenue receipts include the recovery of overdue November

2019 - February 2020 invoices.

Gulf Keystone continues to maintain a sharp focus on capital

discipline. In H1 2021, with the benefit of all-time high Adjusted

EBITDA resulting from leverage to strengthening oil prices,

increased oil production and cost reductions, GKP reinstated an

annual dividend of at least $25.0 million and declared a special

dividend of $25.0 million. The dividends were paid in July and

August, respectively. The Company is pleased today to announce an

interim dividend of $50.0 million for 2021. The Company continues

to progress its drilling activities and the preparation of the FDP

and remains committed to striking a balance between investments in

growth and distributions to shareholders.

Adjusted EBITDA

In H1 2021, Adjusted EBITDA increased significantly to $93.8

million (H1 2020: $27.5 million).

Average production in H1 2020 was 43,516 bopd, up 17% from H1

2020 and the highest half-yearly rate from the Shaikan Field to

date. With GKP's leverage to the strengthening of Brent oil prices

from an average of $40.1/bbl in H1 2020 to $64.8/bbl in H1 2021,

the realised price per barrel more than doubled in the period to

$43.7/bbl resulting in an increase in revenue from $49.9 million in

H1 2020 to $130.7 million in H1 2021.

The Company continues to maintain strict control over its cost

base. Gross operating costs per barrel decreased by 8% from $2.6 in

the same period last year to $2.4, which is just under the 2021

guidance range of $2.5 to $2.9/bbl. Operating costs were $0.8

million higher in the period primarily due to the execution of

deferred maintenance activity and costs associated with the

increased production.

H1 2021 Other G&A expenses were in line with the same period

last year. Share option expense in the period increased by $6.6

million principally due to tax settlements being made in cash,

instead of selling additional shares, on the exercise of the Value

Creation Plan share options by former Directors.

Cash flow

Cash increased during the first half of 2021 by $41.7 million,

from $147.8 million to $189.5 million. The Company has Notes

outstanding with a principal balance of $100.0 million (FY20:

$100.0 million) that mature in July 2023 resulting in net cash of

$85.1 million at 30 June 2021.

During H1 2021, the Company generated cash from operating

activities of $77.8 million up from $24.2 million in H1 2020 due

principally to the increase in Adjusted EBITDA.

The Company continued to receive regular payments for its oil

sales in the period, although the Kurdistan Regional Government

("KRG") advised IOCs that the monthly payment terms would increase

from 30 to 60 days starting with payments related to March 2021.

During the period, the KRG commenced repayment of the net $73.3

million outstanding for November 2019 - February 2020 oil sales. A

total of $14.5 million was received in respect of overdue invoices

in the reporting period and a further $4.0 million was received up

to the date of this report, resulting in a current outstanding

amount of net $54.8 million. The repayments related to January and

February were calculated based on 50% of the difference between

average monthly dated Brent price and $50/bbl multiplied by the

gross Shaikan crude sold in a month. The KRG advised IOCs that

since the dated Brent price had remained consistently well above

$50/bbl, the 50% difference would be changed to 20% from March 2021

and onwards. The Company continues to engage with the KRG regarding

its proposed amendment to payment terms.

With the improvement in oil prices and continuous payments from

the KRG, GKP restarted its 55,000 bopd expansion programme. During

the period, GKP invested net capital expenditures of $14.1 million

(H1 2020: $38.5 million; FY 2020: $45.9 million) with most of the

work programme investment planned for H2 2021. Capital was invested

in completing the SH-13 well, facilities debottlenecking

activities, flowlines and studies.

During the period, the Company reinstated the annual dividend

policy of at least $25.0 million, declared a $25.0 million ordinary

dividend for 2020 and also declared a $25.0 million special

dividend. Towards the end of period, the Company transferred $25.0

million to the share registrar to pay the ordinary dividend on 2

July 2021. The special dividend was paid on 6 August. Today, we are

pleased to declare an interim dividend of 50.0 million for 2021,

which is to be paid on 8 October 2021, based on a record date of 24

September 2021, in line with our strategy of balancing investment

in growth and returns to shareholders.

The Group performed a cash flow and liquidity analysis based on

which the Directors have a reasonable expectation that the Group

has adequate resources to continue to operate for the foreseeable

future. Thus, the going concern basis of accounting is used to

prepare the financial statements.

Profit after tax

Profit after tax increased to $64.8 million (H1 2020: $33.1

million loss). The increase in Adjusted EBITDA was the main

contributor together with lower depreciation, depletion and

amortisation ("DD&A") expense of $28.2 million (H1 2020: $41.8

million) and trade receivables impairment reversal of $5.0 million

(H1 2020: $12.8 million charge).

In 2021, the Company issued a revised Competent Person's Report

from its reserves auditor, ERC Equipoise Limited, with updated

Shaikan 2P reserves estimates at 31 December 2020. The use of the

report's updated 2P reserves, entitlement production and future

development costs resulted in a decrease in the DD&A per barrel

rate, which was applied prospectively from 1 January 2021.

The trade receivables impairment reversal represents a reduction

in the expected credit losses ("ECL") provision related to past due

trade receivables from the KRG for November 2019 to February 2020

invoices (30 June 2021: $3.2 million; 30 June 2020: $14.2 million;

31 December 2020: $8.2 million). The reduction in the provision is

driven by the decrease in the past due receivables balance and the

acceleration of the expected recovery of the remaining balance due

to improvements in forward Brent oil prices.

Outlook

Given strong production performance, we are pleased to tighten

the 2021 average gross production guidance range from 40,000 -

44,000 bopd to 42,000 - 44,000 bopd. We maintain our gross Opex per

barrel target at $2.50 - $2.90 as an increase in operating costs is

expected in H2 2021 due to additional maintenance activities and

costs associated with the ramp up of production.

Given the drilling programme restarted earlier than expected,

after the completion of drilling SH-14, the final well in the

55,000 bopd expansion programme, the Company plans to drill SH-G to

maintain production growth momentum. As a result of the addition of

SH-G, net Capex for the year is expected to increase from $55-65

million to $75-85 million.

The Company has a strong balance sheet with cash and cash

equivalents of $177.4 million at 1 September 2021. We are pleased

to have declared an aggregate of $100.0 million of dividends this

year, a clear testament to the cash generating potential of the

Shaikan Field and in keeping with our commitment to continue to

balance investment in growth and distributions to shareholders.

Ian Weatherdon

Chief Financial Officer

Non-IFRS measures

The Group uses certain measures to assess the financial

performance of its business. Some of these measures are termed

"non-IFRS measures" because they exclude amounts that are included

in, or include amounts that are excluded from, the most directly

comparable measure calculated and presented in accordance with

IFRS, or are calculated using financial measures that are not

calculated in accordance with IFRS. These non-IFRS measures include

financial measures such as operating costs and non-financial

measures such as gross average production.

The Group uses such measures to measure and monitor operating

performance and liquidity, in presentations to the Board and as a

basis for strategic planning and forecasting. The directors believe

that these and similar measures are used widely by certain

investors, securities analysts and other interested parties as

supplemental measures of performance and liquidity.

The non-IFRS measures may not be comparable to other similarly

titled measures used by other companies and have limitations as

analytical tools and should not be considered in isolation or as a

substitute for analysis of the Group's operating results as

reported under IFRS. An explanation of the relevance of each of the

financial non-IFRS measures and a description of how they are

calculated is set out below. Additionally, a reconciliation of the

financial non-IFRS measures to the most directly comparable

measures calculated and presented in accordance with IFRS and a

discussion of their limitations is set out below, where applicable.

The Group does not regard these non-IFRS measures as a substitute

for, or superior to, the equivalent measures calculated and

presented in accordance with IFRS or those calculated using

financial measures that are calculated in accordance with IFRS.

Gross operating costs per barrel

Gross operating costs are divided by gross production to arrive

at gross operating costs per bbl.

Six months Six months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

$'000 $'000 $'000

------------------------------------- ------------- ------------- ------------

Gross production (MMbbls) 7.9 6.8 13.4

Gross operating costs ($ million)(1) 19.1 17.7 34.2

------------------------------------- ------------- ------------- ------------

Gross operating costs per barrel

($ per bbl) 2.4 2.6 2.6

===================================== ============= ============= ============

(1) Gross operating costs equate to operating costs (see note 5)

adjusted for the Group's 80% working interest in the Shaikan

Field.

Adjusted EBITDA

Adjusted EBITDA is a useful indicator of the Group's

profitability, which excludes the impact of costs attributable to

income tax (expense)/credit, finance costs, finance revenue,

depreciation and amortisation and impairment of receivables.

Six months Six months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

$'000 $'000 $'000

------------------------------------ ------------- ------------- ------------

Profit/(loss) after tax 64.8 (33.1) (47.3)

Finance costs 5.7 5.7 14.1

Finance revenue (0.4) (1.0) (1.3)

Tax expense (0.0) 0.5 0.3

Depreciation of oil & gas assets 28.2 41.8 82.8

Other depreciation and amortisation 0.5 0.8 1.3

Impairment of receivables (5.0) 12.8 6.8

Adjusted EBITDA 93.8 27.5 56.7

==================================== ============= ============= ============

Net capital expenditure

Net capital expenditure is the value of the Group's additions to

oil and gas assets excluding any movements in decommissioning

assets.

Six months Six months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

$'000 $'000 $'000

------------------------------------ ------------- ------------- ------------

Additions to oil & gas assets (note

11) 14.1 38.5 45.9

Net capital expenditure 14.1 38.5 45.9

==================================== ============= ============= ============

Net cash

Net Cash is a useful indicator of the Group's indebtedness and

financial flexibility because it indicates the level of cash and

cash equivalents less cash borrowings within the Group's business.

Net cash is defined as cash and cash equivalents less current and

non-current borrowings and non-cash adjustments. Non-cash

adjustments include unamortised arrangement fees and other

adjustments.

Six months Six months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

$'000 $'000 $'000

---------------------------- ------------- ------------- ------------

Cash and cash equivalents 189.5 143.6 147.8

Outstanding Notes (note 14) (98.9) (98.4) (98.6)

Unamortised issue costs (1.1) (1.6) (1.4)

Accrued interest (note 13) (4.4) (4.4) (4.4)

Net cash 85.1 39.2 43.4

============================ ============= ============= ============

Principal risks and uncertainties

The Board determines and reviews the key risks for the Group on

a regular basis. The principal risks, and how the Group seeks to

mitigate them, for the second half of the year are consistent with

those detailed in the management of principal risks and

uncertainties section of the 2020 Annual Report and Accounts. The

principal risks are listed below:

Strategic Operational Financial

Political, social Health, Safety, Security Liquidity and funding

and economic instability and Environment risks capability

------------------------- ----------------------

Disputes regarding Gas flaring Oil revenue payment

title or exploration mechanism

and production rights

------------------------- ----------------------

Business conduct and Security Commodity prices

anti-corruption

------------------------- ----------------------

Export route availability Field delivery risk

------------------------- ----------------------

Stakeholder misalignment Reserves

------------------------- ----------------------

Climate change and

sustainability

------------------------- ----------------------

Global pandemic (e.g.

COVID-19)

------------------------- ----------------------

Cyber security

------------------------- ----------------------

The Board continues to actively monitor the effect of COVID-19

on the macro environment and the Group's operations. The primary

risks associated with COVID-19 are considered separately and are

also embedded within the existing principal risks, including HSSE,

Field delivery risk, Liquidity and funding capability and Commodity

prices.

Responsibility statement

The Directors confirm that to the best of their knowledge:

a) the condensed set of financial statements has been prepared

in accordance with UK-adopted IAS 34 'Interim Financial

Reporting';

b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

and their impact during the first six months and description of

principal risks and uncertainties for the remaining six months of

the year); and

c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein).

By order of the Board

Jon Harris

Chief Executive Officer

1 September 2021

Independent review report to Gulf Keystone Petroleum Ltd

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly financial report for the

six months ended 30 June 2021 which comprises the condensed

consolidated income statement, condensed consolidated statement of

comprehensive income, the condensed consolidated balance sheet, the

condensed consolidated statement of changes in equity, the

condensed consolidated cash flow statement and related notes 1 to

17. We have read the other information contained in the half-yearly

financial report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

As disclosed in note 2, the annual financial statements of the

group are prepared in accordance with United Kingdom adopted

International Financial Reporting Standards. The condensed set of

financial statements included in this half-yearly financial report

has been prepared in accordance with United Kingdom adopted

International Accounting Standard 34, "Interim Financial

Reporting".

Our responsibility

Our responsibility is to express to the Company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Financial Reporting Council for use in

the United Kingdom. A review of interim financial information

consists of making inquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2021 is not prepared, in all material respects, in accordance

with United Kingdom adopted International Accounting Standard 34

and the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

Use of our report

This report is made solely to the company in accordance with

International Standard on Review Engagements (UK and Ireland) 2410

"Review of Interim Financial Information Performed by the

Independent Auditor of the Entity" issued by the Financial

Reporting Council. Our work has been undertaken so that we might

state to the company those matters we are required to state to it

in an independent review report and for no other purpose. To the

fullest extent permitted by law, we do not accept or assume

responsibility to anyone other than the company, for our review

work, for this report, or for the conclusions we have formed.

Deloitte LLP

Statutory Auditor

London, United Kingdom

1 September 2021

Condensed consolidated income statement

For the six months ended 30 June 2021

Six months

ended Six months Year ended

30 June ended 31 December

2021 30 June 2020 2020

Notes Unaudited Unaudited Audited

$'000 $'000 $'000

-------------------------------------- ----- ---------- ------------- ------------

Revenue 4 130,713 49,878 108,449

Cost of sales 5 (53,516) (60,245) (121,507)

Impairment reversal/(charge)

on trade receivables 12 5,034 (12,791) (6,776)

Gross profit/(loss) 82,231 (23,158) (19,834)

Share option related (expense)/credit 6 (6,533) 100 (1,235)

Other general and administrative

expenses (5,411) (5,528) (12,312)

Profit/(loss) from operations 70,287 (28,586) (33,381)

Finance revenue 400 997 1,278

Finance costs (5,674) (5,707) (14,087)

Foreign exchange (losses)/gains (235) 697 (841)

-------------------------------------- ----- ---------- ------------- ------------

Profit/(loss) before tax 64,778 (32,599) (47,031)

Tax credit/(expense) 7 (24) (538) (311)

-------------------------------------- ----- ---------- ------------- ------------

Profit/(loss) after tax 64,754 (33,137) (47,342)

-------------------------------------- ----- ---------- ------------- ------------

Profit/(loss) per share (cents)

Basic 8 30.52 (15.64) (22.45)

Diluted 8 28.87 (15.64) (22.45)

-------------------------------------- ----- ---------- ------------- ------------

Condensed consolidated statement of comprehensive income

For the six months ended 30 June 2021

Six months Six months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

Unaudited Unaudited Audited

$'000 $'000 $'000

------------------------------------- ------------- ------------- ------------

Profit/(loss) for the period 64,754 (33,137) (47,342)

Items that may be reclassified

subsequently to profit or loss:

------------------------------------- ------------- ------------- ------------

Fair value losses arising in

the period (2,013) - (1,732)

-------------------------------------- ------------- ------------- ------------

Cumulative losses arising on

hedging instruments reclassified

to revenue 2,710 - -

-------------------------------------- ------------- ------------- ------------

Exchange differences on translation

of foreign operations 279 (1,099) 707

-------------------------------------- ------------- ------------- ------------

Total comprehensive income/(expense)

for the period 65,730 (34,236) (48,367)

-------------------------------------- ------------- ------------- ------------

Condensed consolidated balance sheet

As at 30 June 2021

30 June 30 June 31 December

2021 2020 2020

Notes Unaudited Unaudited Audited

$'000 $'000 $'000

--------------------------------- ------- ---------- ---------- -----------

Non-current assets

Intangible assets 10 2,234 462 933

Property, plant and equipment 11 362,914 406,747 374,702

Trade receivables 12 12,641 72,213 59,096

Deferred tax asset 500 345 617

--------------------------------- ------- ---------- ---------- -----------

378,289 479,767 435,348

--------------------------------- ------- ---------- ---------- -----------

Current assets

Inventories 35,547 34,768 36,527

Trade and other receivables 12 111,628 13,322 37,832

Derivative financial instruments 8 - 977

Cash and cash equivalents 189,543 143,579 147,826

336,726 191,669 223,162

--------------------------------- ------- ---------- ---------- -----------

Total assets 715,015 671,436 658,510

--------------------------------- ------- ---------- ---------- -----------

Current liabilities

Trade and other payables 13 (81,518) (72,553) (69,123)

Dividends payable (25,000) - -

(106,518) (72,553) (69,123)

--------------------------------- ------- ---------- ---------- -----------

Non-current liabilities

Trade and other payables 13 (1,022) (2,096) (1,058)

Other borrowings 14 (98,872) (98,407) (98,633)

Provisions (38,839) (31,668) (35,671)

(138,733) (132,171) (135,362)

--------------------------------- ------- ---------- ---------- -----------

Total liabilities (245,251) (204,724) (204,485)

--------------------------------- ------- ---------- ---------- -----------

Net assets 469,764 466,712 454,025

--------------------------------- ------- ---------- ---------- -----------

Equity

Share capital 15 213,731 229,430 211,371

Share premium account 15 792,914 871,675 842,914

Treasury Shares - (49,812) (2,592)

Cost of hedging reserve (1,035) - (1,732)

Exchange translation reserve (2,235) (4,320) (2,514)

Accumulated losses (533,611) (580,261) (593,422)

--------------------------------- ------- ---------- ---------- -----------

Total equity 469,764 466,712 454,025

--------------------------------- ------- ---------- ---------- -----------

Condensed consolidated statement of changes in equity

For the six months ended 30 June 2021

Share Cost of Exchange

Share premium Treasury hedging translation Accumulated Total

capital account shares reserve reserve losses equity

$'000 $'000 $'000 $'000 $'000 $'000 $'000

------------------------ -------- -------- -------- -------- ------------ ----------- --------

Balance at 1 January

2020 (audited) 229,430 871,675 (29,749) - (3,221) (548,216) 519,919

------------------------ -------- -------- -------- -------- ------------ ----------- --------

Net loss for the period - - - - - (33,137) (33,137)

Other comprehensive

loss for the period - - - - (1,099) - (1,099)

------------------------ -------- -------- -------- -------- ------------ ----------- --------

Total comprehensive

loss for the period - - - - (1,099) (33,137) (34,236)

Share buy-back - - (20,165) - - - (20,165)

Employee share schemes - - - - - 1,194 1,194

Share options exercised - - 102 - - (102) -

Balance at 30 June

2020 (unaudited) 229,430 871,675 (49,812) - (4,320) (580,261) 466,712

------------------------ -------- -------- -------- -------- ------------ ----------- --------

Net loss for the period - - - - - (14,205) (14,205)

Cash flow hedge -

fair value movements - - - (1,732) - - (1,732)

Exchange difference

of translation of

foreign operations - - - - 1,806 - 1,806

Total comprehensive

(loss)/income for

the period - - - (1,732) 1,806 (14,205) (14,131)

Share cancellation (18,059) (28,761) 46,820 - - - -

Employee share schemes - - - - - 1,443 1,443

Share options exercised - - 400 - - (399) 1

Balance at 31 December

2020 (audited) 211,371 842,914 (2,592) (1,732) (2,514) (593,422) 454,025

------------------------ -------- -------- -------- -------- ------------ ----------- --------

Net profit for the

period - - - - - 64,754 64,754

Cash flow hedge -

fair value movements - - - 697 - - 697

Exchange difference

of translation of

foreign operations - - - - 279 - 279

Total comprehensive

(loss)/income for

the period - - - 697 279 64,754 65,730

Dividends - (50,000) - - - - (50,000)

Share issues 2,360 - - - - (2,360) -

Employee share schemes - - - - - 9 9

Share options exercised - - 2,592 - - (2,592) -

------------------------ -------- -------- -------- -------- ------------ ----------- --------

Balance at 30 June

2021 (unaudited) 213,731 792,914 - (1,035) (2,235) (533,611) 469,764

------------------------ -------- -------- -------- -------- ------------ ----------- --------

Condensed consolidated cash flow statement

for the six months ended 30 June 2021

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

Note Unaudited Unaudited Audited

$'000 $'000 $'000

--------------------------------------- ---- ---------- ---------- ------------

Operating activities

Cash generated in operations 9 83,487 28,082 50,873

Interest received 400 1,288 1,278

Interest paid (5,000) (5,121) (10,000)

Payment of put option premium (1,043) - (5,371)

Net cash generated in operating

activities 77,844 24,249 36,780

--------------------------------------- ---- ---------- ---------- ------------

Investing activities

Purchase of intangible assets (1,245) (7) (458)

Purchase of property, plant and

equipment (9,454) (50,109) (57,899)

Net cash used in investing activities (10,699) (50,116) (58,357)

--------------------------------------- ---- ---------- ---------- ------------

Financing activities

Payment of dividends (25,000) - -

Share buy-back - (20,165) (20,164)

Payment in lieu of options exercised - (330) -

Payment of leases (431) (718) (1,317)

Net cash used in financing activities (25,431) (21,213) (21,481)

--------------------------------------- ---- ---------- ---------- ------------

Net increase/(decrease) in cash

and cash equivalents 41,714 (47,080) (43,058)

Cash and cash equivalents at beginning

of period 147,826 190,762 190,762

Effect of foreign exchange rate

changes 3 (103) 122

--------------------------------------- ---- ---------- ---------- ------------

Cash and cash equivalents at end

of the period being bank balances

and cash on hand 189,543 143,579 147,826

--------------------------------------- ---- ---------- ---------- ------------

1. General information

The Company is incorporated in Bermuda (registered address:

Cedar House, 3rd Floor, 41 Cedar Avenue, Hamilton 12, Bermuda). The

Company's common shares are listed on the Official List of the

United Kingdom Listing Authority and are traded on the London Stock

Exchange's Main Market for listed securities. The Company serves as

the holding company for the Group, which is engaged in oil and gas

exploration, development and production, operating in the Kurdistan

Region of Iraq.

2. Summary of significant accounting policies

The Annual Report and Accounts of the Group are prepared in

accordance with United Kingdom adopted International Financial

Reporting Standards. The condensed set of financial statements

included in this half yearly financial report have been prepared in

accordance with United Kingdom adopted International Accounting

Standard 34 'Interim Financial Reporting' and the Disclosure and

Transparency Rules (DTR) of the Financial Conduct Authority (FCA)

in the United Kingdom as applicable to interim financial

reporting.

The condensed set of financial statements included in this half

yearly financial report have been prepared on a going concern basis

as the Directors consider that the Group has adequate resources to

continue operating for the foreseeable future.

The accounting policies adopted in the 2021 half-yearly

financial report are the same as those adopted in the 2020 Annual

Report and Accounts, other than the implementation of new IFRS

reporting standards.

The financial information for the year ended 31 December 2020

does not constitute the Group's financial statements for that year

but is derived from those Accounts. The auditor's report on these

Accounts was unqualified and did not include a reference to any

matters to which the auditor drew attention by way of emphasis of

matter.

Adoption of new and revised accounting standards

As of 1 January 2021, a number of accounting standard amendments

and interpretations became effective, as noted in the 2020 Annual

Report and Accounts (pages 114 and 115). The adoption of these

amendments and interpretations has not had a material impact on the

financial statements of the Group for the six months ended 30 June

2021.

Going concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the CEO Statement, Operational Review and Financial

Review, which includes the financial position of the Group at the

period end and its cash flows and liquidity position.

As at 1 September 2021, the Group had $177.4 million of cash.

The Group continues to closely monitor and manage its liquidity.

Cash forecasts are regularly produced, and sensitivities run for

different scenarios including, but not limited to, the impact of

COVID-19, commodity prices, different production rates from the

Shaikan block, cost contingencies, disruptions to revenue receipts,

etc. The Group's forecasts, taking into account the applicable

risks and the stress test scenarios, show that it has sufficient

financial resources for the 12 months from the date of approval of

the 2021 half year financial statements.

Based on the analysis performed, the Directors have a reasonable

expectation that the Group has adequate resources to continue to

operate for the foreseeable future. Thus, the going concern basis

of accounting is used to prepare the 2021 half year financial

statements.

Critical accounting judgements and key sources of estimation

uncertainty

In the application of the Group's accounting policies, the

directors are required to make judgements, estimates and

assumptions about the carrying amounts of assets and liabilities

that are not readily apparent from other sources. The estimates and

associated assumptions are based on historical experience and other

factors that are considered to be relevant. Actual results may

differ from these estimates.

The estimates and underlying assumptions are reviewed on an

ongoing basis. Revisions to accounting estimates are recognised in

the period in which the estimate is revised if the revision affects

only that period or in the period of revision and future periods if

the revision affects both current and future periods.

Critical accounting judgements and key sources of estimation

uncertainty remain consistent with those disclosed in the 2020

Annual Report and Accounts.

Critical accounting judgement

Revenue

The recognition of revenue is considered to be a key accounting

judgement. The Group began commercial production from the Shaikan

Field in July 2013 and historically made sales to both the domestic

and export markets. However, as the payment mechanism for sales to

the export market continues to develop within the Kurdistan Region

of Iraq, the Group considers revenue can only be reliably measured

when the cash receipt is assured. The assessment of whether cash

receipts are assured is based on management's evaluation of the

reliability of the Ministry of Natural Resources' (the "MNR")

payments to the IOCs operating in the Kurdistan Region of Iraq. The

Group also recognised payables to the MNR that were offset against

amounts receivable from the MNR for previously unrecognised revenue

in line with the terms of the Shaikan Production Sharing Contract

(the "PSC").

The judgement is not to recognise revenue in excess of the sum

of the cash receipt that is assured and the amount of payables to

the MNR that can be offset against amounts due for previously

unrecognised revenue in line with the terms of the Shaikan PSC,

even though the Group may be entitled to additional revenue under

the terms of the Shaikan PSC. Any future agreements between the

Company and the Kurdistan Regional Government ("KRG") might change

the amounts of revenue recognised.

Key sources of estimation uncertainty

The key assumptions concerning the future, and other key sources

of estimation uncertainty that may have a significant risk of

causing a material adjustment to the carrying amounts of assets and

liabilities, are discussed below.

Carrying value of producing assets

In line with the Group's accounting policy on impairment,

management performs an impairment review of the Group's oil and gas

assets at least annually with reference to indicators as set out in

IAS 36. The Group assesses its group of assets, called a

cash-generating unit ("CGU"), for impairment, if events or changes

in circumstances indicate that the carrying amount of an asset may

not be recoverable. Where indicators are present, management

calculates the recoverable amount using key estimates such as

future oil prices, estimated production volumes, the cost of

development and production, post-tax discount rates that reflect

the current market assessment of the time value of money and risks

specific to the asset, commercial reserves and inflation. The key

assumptions are subject to change based on market trends and

economic conditions. Where the CGU's recoverable amount is lower

than the carrying amount, the CGU is considered impaired and is

written down to its recoverable amount. The Group's sole CGU at 30

June 2021 was the Shaikan Field with a carrying value of $360.5

million.

The Group performed a full impairment indicator evaluation for

the H1 2021 and concluded that no impairment indicators arose.

The key areas of estimation in assessing the potential

impairment indicators are as follows:

- Commodity prices are based on latest internal forecasts,

benchmarked with external sources of information to ensure they are

within the range of available market and analyst forecasts;

$/bbl - real 2021 2022 onwards

30 June 2021 - base

case $69 $55

----- -------------

30 June 2021 - stress

case $45 $50

----- -------------

31 December 2020 - base

case $50 $55

----- -------------

31 December 2020 - stress

case $45 $50

----- -------------

- discount rates that are adjusted to reflect risks specific to

the Shaikan Field and the Kurdistan Region of Iraq. The post-tax

nominal discount rate was estimated to be 15%, unchanged from 31

December 2020;

- operating costs and capital expenditure that are based on

financial budgets and internal management forecasts. Costs

assumptions incorporate management experience and expectations, as

well as the nature and location of the operation and the risks

associated therewith. There were no indicators that costs will

increase in comparison to 31 December 2020 impairment

assessment;

- no adverse changes were noted for commercial reserves and production profiles; and

- timing of revenue receipts changed from 30 to 60 days

following the month of sale, however, this is a minor change and is

not considered to be an indicator of impairment.

3. Geographical information

The Group's non-current assets excluding deferred tax assets and

other financial assets by geographical location are detailed

below:

Six months Six months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

Unaudited Unaudited Audited

$'000 $'000 $'000

--------------- ------------- ------------- ------------

Kurdistan 361,921 407,017 369,761

United Kingdom 3,227 192 1,910

------------- ------------- ------------

365,148 407,209 371,671

============= ============= ============

The Chief Operating Decision Maker, as per the definition in

IFRS 8, is considered to be the Board of Directors. The Group

operates in a single segment, that of oil and gas explorations,

appraisal and production, in a single geographical location, the

Kurdistan Region of Iraq. As a result, the financial information of

the single segment is the same as set out in the condensed

consolidated statement of comprehensive income, the condensed

consolidated balance sheet, the condensed consolidated statement of

changes in equity, the condensed consolidated cash flow statement

and the related notes.

Information about major customers

Included in oil sales are $133.4 million, which arose from sales

to the KRG (H1 2020: $49.9 million; FY 2020: $108.4 million).

4. Revenue

Six months Six months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

Unaudited Unaudited Audited

$'000 $'000 $'000

--------------------------------------- ------------- ------------- ------------

Oil sales 133,423 49,878 108,449

Put option hedging losses reclassified

to revenue (2,710) - -

130,713 49,878 108,449

============= ============= ============

The Group accounting policy for revenue recognition is set out

in its 2020 Annual Report, with revenue recognised on a

cash-assured basis.

During the six months period ended 30 June 2021, the

cash-assured values recognised as oil sales was $133.4 million (H1

2020: $49.9 million; FY 2020: $108.4 million). The oil sales price

was calculated using the monthly dated Brent price less an average

discount of $21.2 (H1 2020: $21.1; FY 2020: $21.1) per barrel for

quality and pipeline tariffs.

In November 2020, the Company purchased put options effectively

establishing a floor price of $35/bbl on approximately 60% of its

H1 2021 production. The cost of the put option was $2.7 million and

it expired on 30 June 2021. The put option was designated as an

accounting hedge for the period prior to expiry, at which point the

associated hedging losses that had previously been deferred within

the hedging reserve were reclassified to revenue.

In February 2021 the Company purchased a put option establishing

a floor price of $40/bbl on approximately 60% of its Q3 2021

production. This put option has also been designated as an

accounting hedge with the hedging losses incurred as of 30 June

2021 of $1.0 million deferred within the hedging reserve. The cost

of the option will be reclassified to revenue in 2H 2021 upon the

expiry of the option.

5. Cost of Sales

Six months Six months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

Unaudited Unaudited Audited

$'000 $'000 $'000

----------------------------------- ------------- ------------- ------------

Operating costs 15,033 14,215 27,401

Capacity building payments 10,288 3,846 8,362

Changes in inventory valuation and

other write-offs (52) 411 2,923

Depreciation of oil and gas assets 28,223 41,773 82,797

Depreciation of operational assets 24 - 24

------------- ------------- ------------

53,516 60,245 121,507

============= ============= ============

A unit-of-production method has been used to calculate the

depreciation, depletion and amortisation ("DD&A") charge for

oil and gas assets. This is based on full entitlement production,

commercial reserves and capital costs for Shaikan. Commercial

reserves are proven and probable ("2P") reserves, estimated using

standard recognised evaluation techniques. In 2021, the Group

received a Competent Person's Report from ERC Equipoise Limited

with 2P reserves estimates at 31 December 2020. The use of the

report's entitlement production, commercial reserves and capital

costs for Shaikan resulted in a significant decrease in the

DD&A per barrel rate, which was applied prospectively from 1

January 2021.

6. Share option related expense/(credit)

Six months Six months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

Unaudited Unaudited Audited

$'000 $'000 $'000

-------------------------------------- ------------- ------------- ------------

Share-based payment expense 902 1,098 2,440

Payments related to share options

exercised 4,060 - -

Share-based payment related provision

for taxes 1,571 (1,198) (1,205)

6,533 (100) 1,235

============= ============= ============

On the exercise of the Value Creation Plan share options by

former Directors, tax settlements were made in cash instead of

selling additional shares. This and payment of dividends

accumulated during the vesting period are the main components of

the payments related to share options exercised.

7. Taxation

Six months Six months Year ended

ended ended 31 December

30 June 2021 30 June 2020 2020

Unaudited Unaudited Audited

$'000 $'000 $'000

--------------------------------- ------------- ------------- ------------

Corporation tax credit/(expense) 103 (90) (90)

Deferred tax credit/(expense) (127) (448) (221)

(24) (538) (311)

============= ============= ============

8. Profit/(loss) per share

The calculation of the basic and diluted profit/(loss) per share

is based on the following data:

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Profit/(loss) after tax for the purposes

of basic and diluted loss per share

($'000) 64,754 (33,137) (47,342)

----------------------------------------- ---------- ---------- ------------

Number of shares ('000s):

Basic weighted average number of

ordinary shares 212,138 211,934 210,893

--------------------------------- ------- ------- -------

Basic EPS (cents) 30.52 (15.64) (22.45)

--------------------------------- ------- ------- -------

The Group followed the steps specified by IAS 33 in determining

whether outstanding share options are dilutive or

anti-dilutive.

8. Profit/(loss) per share (continued)

Reconciliation of dilutive shares:

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

Number of shares ('000s):

Basic weighted average number of

ordinary shares 212,138 211,934 210,893

Effect of dilutive potential ordinary

shares 12,119 - -

-------------------------------------- ---------- ---------- ------------

Diluted number of ordinary shares

outstanding 224,257 211,934 210,893

Diluted EPS (cents) 28.87 (15.64) (22.45)

-------------------------------------- ---------- ---------- ------------

Weighted average number of ordinary shares excludes shares held

by Employee Benefit Trustee ("EBT") and the Exit Event Trustee of

0.1 million (H1 2020: 0.1 million; FY 2020: 0.1 million). On 30

June 2020 and 31 December 2020, weighted average number of shares

also excluded shares held in treasury (H1 2021: nil, H1 2020: 19.1

million, FY 2020: 1.0 million).

The dilutive number of ordinary shares relates to outstanding

share options and is calculated on the assumption of conversion of

all potentially dilutive ordinary shares. As the company reported a

loss for the six months ending 30 June 2020 and for the year ended

31 December 2020, the exercise of the outstanding share options

would have reduced the reported loss per share and, therefore,

these share options were anti-dilutive.

9. Reconciliation of profit from operations to net cash

generated in operating activities

Six months Six months

ended ended Year ended

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

$'000 $'000 $'000

------------------------------------------- ---------- ---------- ------------

Profit/(loss) from operations 70,287 (28,586) (33,381)

Adjustments for:

Depreciation of property, plant and

equipment (including right of use

assets) 28,737 42,570 84,119

Amortisation of intangible assets 1 6 3

Share-based payment expense 9 1,098 2,440

Lease modification 154 - (97)

(Credit)/expense due to change in

impairment of receivables provision (5,034) 12,791 6,776

Put option hedging losses reclassified

to revenue 2,710 - -

Decrease/(increase) in inventories 980 (3,728) (5,487)

Decrease/(increase) in receivables (22,260) 2,574 (523)

(Decrease)/increase in payables 7,903 1,357 (2,977)

------------------------------------------- ---------- ---------- ------------

Net cash generated in operating activities 83,487 28,082 50,873

------------------------------------------- ---------- ---------- ------------

10. Intangible assets

Computer software

$'000

----------------------------------------- -----------------

Period ended 30 June 2020

Opening net book value 454

Additions 15

Amortisation charge (1)

Foreign currency translation differences (6)

-----------------

Net book value at 30 June 2020 462

-----------------

Cost 1,351

Accumulated depreciation (889)

-----------------

Net book value at 30 June 2020 462

-----------------

Period ended 31 December 2020

Additions 451

Amortisation charge (3)

Foreign currency translation differences 23

Net book value at 31 December 2020 933

=================

Cost 1,980

Accumulated depreciation (1,047)

-----------------

Net book value at 31 December 2020 933

-----------------

Period ended 30 June 2021

Opening net book value 933

Additions 1,292

Amortisation charge (1)

Foreign currency translation differences 10

-----------------

Net book value at 30 June 2021 2,234

=================

Cost 3,282

Accumulated depreciation (1,048)

-----------------

Net book value at 30 June 2021 2,234

=================

The amortisation charge for computer software has been included

in general and administrative expenses.

11. Property, plant and equipment

Oil and Gas Fixtures Right of

Assets and use Total

$'000 Equipment Assets $'000

$'000 $'000

------------------------------ ----------- ---------- -------- ---------

Period ended 30 June 2020

Opening net book value 403,696 1,310 2,596 407,602

Additions 38,541 56 1,640 40,237

Disposals at cost - (492) - (492)

Revisions to decommissioning

asset 1,491 - - 1,491

Depreciation charge (41,773) (112) (685) (42,570)

Depreciation on disposals - 492 - 492

Foreign currency translation

differences - (13) - (13)

----------- ---------- -------- ---------

Net book value at 30 June

2020 401,955 1,241 3,551 406,747

Cost 736,640 6,442 5,132 748,214

Accumulated depreciation (334,685) (5,201) (1,581) (341,467)

----------- ---------- -------- ---------

Net book value at 30 June

2020 401,955 1,241 3,551 406,747

=========== ========== ======== =========

Period ended 31 December

2020

Additions 7,313 99 81 7,493

Revisions to decommissioning

asset 3,609 - - 3,609

Lease modifications - - (1,623) (1,623)

Depreciation charge (41,024) (166) (359) (41,549)

Foreign currency translation

differences - 13 12 25

Net book value at 31 December

2020 371,853 1,187 1,662 374,702

=========== ========== ======== =========

Cost 747,562 7,160 3,602 758,324

Accumulated depreciation (375,709) (5,973) (1,940) (383,622)

----------- ---------- -------- ---------

Net book value at 31 December

2020 371,853 1,187 1,662 374,702

=========== ========== ======== =========

Period ended 30 June 2021

Opening net book value 371,853 1,187 1,662 374,702

Additions 14,084 139 - 14,223

Disposals at cost - - (1,064) (1,064)

Revision to decommissioning

asset 2,814 - - 2,814

Lease modification - - (107) (107)

Depreciation charge (28,223) (168) (346) (28,737)

Depreciation on disposals - - 1,064 1,064

Foreign currency translation

differences - - 19 19

Closing net book value 360,528 1,158 1,228 362,914

========= ======= ======= =========

At 30 June 2021

Cost 764,460 7,299 2,450 774,209

Accumulated depreciation (403,932) (6,141) (1,222) (411,295)

--------- ------- ------- ---------

Net book value 360,528 1,158 1,228 362,914

========= ======= ======= =========

The additions to the Shaikan asset amounting to $14.1 million

during the period include the costs of completing SH-13, facilities

debottlenecking activities, flowlines and studies. The increase in

the decommissioning asset represents further decommissioning

obligations that arose on capital projects.

12. Trade and other receivables

Non-current receivables

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

$'000 $'000 $'000

--------------------------------- ----------- ----------- ------------

Trade receivables - non-current 12,641 72,213 59,096

Current receivables

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

$'000 $'000 $'000

-------------------------------- ----------- ----------- ------------

Trade receivables - current 106,788 7,961 34,021

Other receivables 4,036 4,725 2,963

Prepayments and accrued income 804 636 848

----------- ----------- ------------

111,628 13,322 37,832

=========== =========== ============

Reconciliation of trade receivables

30 June 30 June 31 December

2021 2020 2020

Unaudited Unaudited Audited

$'000 $'000 $'000

-------------------------------- ----------- ----------- ------------

Gross carrying amount 122,580 94,375 101,302

Less: impairment allowance (3,151) (14,200) (8,185)

Carrying value at 30 June 2021 119,429 80,175 93,117

=========== =========== ============

Trade receivables comprise invoiced amounts due from the KRG for

crude oil sales totalling $113.5 million (H1 2020: $85.3 million;

FY 2020: $92.2 million) and a share of Shaikan revenue arrears the

Group purchased from MOL in 2018 amounting to $9.1 million (H1

2020: $9.1 million; FY 2020: $9.1 million). The amount due from the

KRG includes past due trade receivables of $62.2 million(1) (H1

2020: $77.3 million; FY 2020: $77.3 million) related to November

2019 to February 2020 invoices. While the Group expects to recover

the full nominal value of the outstanding invoices and MOL

receivable, the ECL on the overdue receivable balance of $3.2

million was provided against the receivables balance in line with

the requirements of IFRS 9 resulting in a credit to income of $5.0

million in the reporting period (H1 2020: $12.8 million expense; FY

2020: $6.8 million expense).

In May 2021, the Company received a letter from the KRG

proposing an amendment to the 30-day payment terms, starting with

the March 2021 production invoice. The KRG stated that payment will

be 60 days after submission of each invoice. The KRG also stated

that from March 2021 the monthly repayment mechanism of past due

trade receivables will change from the previously agreed 50% to 20%

of the difference between average dated Brent price and $50/bbl,

multiplied by the gross Shaikan crude oil volumes sold. The Company

continues to engage with the KRG regarding its proposed amendment

to payment terms.

ECL sensitivities

No material changes to the Group's profit before tax arise when

considering reasonably possible changes to the estimates which are

used to calculate the ECL impairment allowance.

(1) The past due trade receivables amount excludes the

associated capacity building payments due to the KRG which reduce

the net amount due to GKP to $58.9 million.

12. Trade and other receivables (continued)

Other receivables

Included within Other receivables is an amount of $0.5 million

(H1 2020: $0.4 million; FY 2020 $0.4 million) being the deposits

for leased assets which are receivable after more than one year.

There are no receivables from related parties as at 30 June 2021

(H1 2020: nil; FY 2020: nil). No impairments of other receivables

have been recognised during the first half of the year (H1 2020:

nil; FY 2020: nil).

13. Trade and other payables

Current liabilities

30 June 2021 30 June 2020 31 December

Unaudited Unaudited 2020

$'000 $'000 Audited

Restated $'000

-------------------------- ------------ ------------ -----------

Trade payables 1,448 5,218 2,212

Accrued expenditures 19,828 14,857 14,481

Other payables 59,854 50,827 51,612

Finance lease obligations 388 1,561 718

Taxation payable - 90 100

81,518 72,553 69,123

============ ============ ===========

The Group changed the presentation of current liabilities in

2020 and the H1 2020 balances have been restated accordingly.

Accrued expenditures include $4.4 million interest payable as at

30 June 2021 (H1 2020: $4.4 million, FY 2020: $4.4 million) (note

14).

Other payables include $51.0 million (H1 2020: $44.7 million, FY

2020: $46.5 million) of amounts payable to the KRG that are

expected to be offset against revenue due from the KRG related to

pre-October 2017 oil sales, which have not yet been recognised in

the financial statements.

Non-current liabilities

31 December

30 June 2021 30 June 2020 2020

Unaudited Unaudited Audited

$'000 $'000 $'000

------------------------------------ ------------ ------------ -----------

Non-current finance lease liability 1,022 2,096 1,058

14. Long-term borrowings

In July 2018, the Company completed the private placement of a

5-year senior unsecured $100 million bond (the "Notes"). The

unsecured Notes are guaranteed by Gulf Keystone Petroleum

International Limited and Gulf Keystone Petroleum (UK) Limited, two

of the Company's subsidiaries, and the key terms are summarised as

follows:

- maturity date is 25 July 2023;

- at any time prior to maturity, the New Notes are redeemable in

part, or full, with a prepayment penalty;

- the interest rate is 10% per annum with semi-annual payment dates; and