TIDMEKF

RNS Number : 6648S

EKF Diagnostics Holdings PLC

13 March 2019

EKF Diagnostics Holdings plc

("EKF", the "Company" or the "Group")

Final results

EKF Diagnostics Holdings plc (AIM: EKF), the AIM listed

point-of-care business, announces its final results for the year

ended 31 December 2018.

Financial highlights

-- Revenue up 2% to GBP42.5m (2017: GBP41.6m)

-- Gross profit broadly flat at GBP22.7m (2017: GBP22.9m)

-- Adjusted EBITDA* up 15% to GBP10.7m (2017: GBP9.3m)

-- Profit before tax GBP12.2m (2017: GBP4.3m), over 2.8 times higher

-- Basic Earnings per share of 2.21p (2017: 0.59p), underlying

basic earnings (excluding exceptional items and share based

payments) of 1.01p (2017: 0.58p)

-- Cash generated from operations of GBP9.9m (2017: GBP10.1m)

-- Cash at 31 December 2018 of GBP10.3m (31 Dec 2017: GBP8.2m),

net cash of GBP9.4m (31 Dec 2017: GBP7.0m)

* Excluding exceptional items and share based payments

Operational Highlights

-- Successful flotation of Renalytix AI plc creating significant shareholder value

-- Achieved US FDA 510(k) clearance for point-of-care and CLIA waiver for the DiaSpect Tm

-- Major private label distribution agreement with McKesson for the Tm

-- US FDA 510(k) clearance for Quo-Test in clinical laboratory setting

-- Upgrade to Elkhart (Indiana, USA) enzyme facility and

contract to supply enzymes to US biopharma Oragenics for use in

their pharmaceutical products

Christopher Mills, Non-executive Chairman of EKF, said:

"This has been a very successful year, which has allowed us to

provide significant rewards for shareholders. We are confident that

we will continue to make progress in 2019. Trading in the first

quarter to date has been satisfactory, in line with management

expectation."

EKF Diagnostics Holdings plc Tel: 029 2071 0570

Christopher Mills, Non-executive Chairman

Julian Baines, CEO

Richard Evans, FD & COO

N + 1 Singer Tel: 020 7496 3000

Aubrey Powell / Lauren Kettle / George Tzimas

(Corporate Finance)

Tom Salvesen (Corporate Broking)

Walbrook PR Limited Tel: 020 7933 8780 or ekf@walbrookpr.com

Paul McManus Mob: 07980 541 893

Lianne Cawthorne Mob: 07584 391 303

CHAIRMAN'S STATEMENT

It is a pleasure to report to shareholders on another successful

year for EKF, with record revenue, earnings, and profits.

Strategy

Since I joined the business in April 2016, the Group has

followed a consistent strategy of concentrating on its

point-of-care diagnostics and central laboratory reagents business.

While the task of simplification of the business was largely

completed in 2017, we continue to actively seek cost saving

opportunities through improved efficiency and targeted action

plans, while seeking to position the business for further

growth.

Renalytix AI plc

In January 2018 we announced our intention to create value from

our sTNFR biomarker technology. In short order this process led to

the development, founding, and successful flotation on AIM of an

exciting developer of artificial intelligence-enabled diagnostics

for kidney disease, including the raising of GBP22.25m for working

capital. Of this, GBP3.1m was provided by EKF. As at the date of

this statement, Renalytix AI plc ("Renalytix") is valued at over

GBP75m in its own right, and is making good progress towards its

goals.

EKF's shareholding in Renalytix comprising 20,964,295 ordinary

shares was distributed to relevant EKF shareholders in October

2018. The market value of those shares at the date of this

statement, post admission to AIM, is circa GBP29.3m. As a

requirement of Renalytix's flotation, these shares are being held

in escrow and share certificates will be sent to the underlying

shareholders once the lock-in ends on 22 April 2019.

This process has been extremely successful and has provided a

very significant benefit to EKF shareholders. I would like to thank

the EKF directors and staff who put an enormous amount of work into

its achievement.

We remain very excited about the future prospects for Renalytix

and are confident that it will deliver further significant value to

shareholders over the longer term.

Share buy back

The Group has continued to acquire its own shares in the market.

During the year the Group has acquired and cancelled 3,461,409

shares representing 0.76% of the Ordinary shares in issue as at 1

January 2018, at a total cost of GBP940,000. Subject to continuing

shareholder approval, the Group intends to continue to acquire

shares for cancellation when it is appropriate to do so.

Results overview

The Chief Executive's and Finance Director's statements contain

a review of the year and an overview of the financial performance

of the Group.

Board and Corporate Governance

The make-up of the Board has once again remained stable. The

Non-executive Directors have again waived their salary but received

an appropriate bonus to recognise the very significant contribution

they make to the success of the Group over and above their duties

as directors.

The London Stock Exchange now requires AIM listed companies such

as EKF to adopt a recognised corporate governance code and we have

chosen that issued by the Quoted Companies Alliance. Further

details of compliance can be found in the Corporate Governance

Statement in the Annual Report, once published, and on the

Company's website in accordance with AIM Rule 26.

Outlook

This has been a very successful year, which has allowed us to

provide significant rewards for shareholders. We are confident that

we will continue to make progress in 2019. Trading in the first

quarter to date has been satisfactory, in line with management

expectations.

Christopher Mills

Non-executive Chairman

13 March 2019

Chief Executive's Review

In 2018 we have been highly successful in achieving the

operational goals we set ourselves at the beginning of the year. I

am pleased to announce that we delivered 6.3% year on year organic

growth excluding the effect of the completion of the Saudi Arabian

Quo-Test contract which had contributed circa GBP1.6m more to

revenues in 2017 than in 2018. The delivery of replacement revenues

through new contract wins and additional organic sales growth has

not only mitigated the impact of this source of revenue ending, but

has allowed us to maintain overall revenue growth.

Operations

In 2018 we promised to deliver in five main areas to ensure we

maintain sustainable organic growth for the foreseeable future,

which were: -

1. DiaSpect Tm FDA 510(k) CLIA Waiver.

2. Delivery of a major contract alongside this clearance - the McKesson OEM contract in the US.

3. Upgrade of our Elkhart (Indiana, USA) enzyme facility.

4. Deliver a major contract alongside the upgrade - the Oragenics contract.

5. FDA 510(k) clearance of Quo-Test.

I am proud to say that we have delivered on all the above,

although the Quo-Test 510(k) clearance crept into 2019. The OEM

contract with McKesson in the US for the DiaSpect Tm gives us an

opportunity to quickly expand our haemoglobin Point-of-Care

franchise in the US where we already have a strong foothold.

The Oragenics contract in Elkhart has enabled us to broaden our

offering in pharmaceutical enzymes. The additional investment has

led to a significant upgrade of the facility and we are now in a

position to attract other partners alongside Oragenics.

Point-of-Care

One of the two main strands of EKF's business involves the

development, manufacture, and sale of instruments and related

consumables for use in the diagnosis of conditions in situations

which are near-patient. They have the advantage of giving rapid

results which can be communicated and acted on immediately, yet

offer equivalent accuracy to laboratory based analysers.

Hematology

In 2018, sales of haematology products have risen by 6% to

GBP13.7m (2017: GBP12.9m).

For many years our Hemo Control analyser range (sold in the USA

as the HemoPoint H2) has been our best seller in this area.

Following FDA 510(k) clearance for the DiaSpect Tm in point-of-care

and CLIA waiver settings, we anticipate that future growth will be

maintained globally.

Once we had clearance, we signed a private label distribution

agreement with McKesson Medical-Surgical Inc., an affiliate of

McKesson Corporation, one of the largest companies in the US by

revenue, and one of the largest distributors of medical supplies,

who will sell the Tm as the McKesson Consult(R) Hb analyser. Whilst

this partnership is in its infancy we have already opened over 25

new accounts in the US.

Diabetes

Sales of diabetes products are down by 5% this year from

GBP11.5m to GBP11.0m, due to the end of the Quo-Test contract in

Saudi Arabia. Sales of Quo-Lab are up by 20%, and sales of Quo-Test

excluding Saudi Arabia are up by 6%.

We were pleased to announce that the Quo-Test analyser has

received US Food and Drug Administration 510(k) clearance for

professional use in a clinical laboratory setting. This will allow

us to enter the US market with this product.

Lactate Scout

Our new Lactate Scout 4 hand-held lactate analyser for fast and

accurate sports performance monitoring was launched at the Medica

2018 show. Lactate Scout 4 is designed for use in the field as a

training companion for individuals or sports teams. We are working

to adapt our existing lactate technology for use in clinical

settings. Having taken professional guidance, and consultations

with interest groups including potential end users, we are

determined to deliver the right solution for this market, which

will involve adapting the base product to ensure good usability in

this market, and subsequently carrying out some limited clinical

trials.

Central Laboratory

The second main strand of EKF's business is the supply of

reagents for use on central laboratory analysers. As an adjunct to

this, we also sell our own range of laboratory standard analysers.

In 2018, Central Laboratory sales were GBP13.3m, an increase of

5%.

During the year we signed a distribution agreement for Asahi

Kasei's Glycated Albumin products. This has now been launched in

the US and the first orders have been received.

We have continued to see strong performance from sales of

Beta-Hydroxybutyrate (<BETA>-HB) Liquicolor reagent, which

are up 10% in GBP terms. As mentioned earlier, our project to

increase capacity and significantly upgrade our main wet chemistry

site in Elkhart, Indiana has continued, and is expected to complete

in 2019. The work we have done there has enabled us to sign an

exclusive, multi-million dollar agreement with Oragenics, Inc., a

Florida-based biopharmaceutical company, for the manufacturing of

Oragenics' lantibiotic bulk drug substances in the United States.

Under the collaboration agreement, EKF Diagnostics will manufacture

compounds intended for preclinical and early stage clinical

trials.

Regulatory update

Our major successes in 2018 have been the achievement of FDA

510(k) clearances for the DiaSpect Tm and Quo-Test. In addition, we

have received regulatory approval for <BETA>-HB in both

Mexico and Colombia, as well as registration of DiaSpect Tm in

India. In China, we have had some successes but continue to work on

the complex process of getting registrations in place. We continue

to work using our own resources and with our partners to extend the

span of our registrations.

sTNFR Project - Renalytix AI plc

There has been a longstanding unmet need in the field of End

Stage Renal Disease ("ESRD"). Kidney disease costs the US

Healthcare system over $40bn per annum in dialysis alone. In 2017

we started looking for ways to maximise the value of our sTNFR

biomarker technology based around this unmet need. It soon became

clear that there was a significant opportunity to use this as the

springboard for a unique business with the ultimate aim being to

develop and sell artificial intelligence enabled diagnostics for

ESRD. It was also clear that it was best that this should be

progressed entirely outside EKF. A team was put in place to take

the new business forward, led by James McCullough. This team

rapidly assembled a set of partners including the world - leading

centre in the care of kidney disease, the Icahn School of Medicine

at Mount Sinai ("ISMMS"). In early November 2018, GBP22.5m was

raised with ISMMS becoming a major shareholder. The funds are

primarily being used for the acquisition of licences from ISMMS, to

develop the company's products and technology, for corporate

purposes, and for general working capital. The Renalytix AI shares

which EKF had received in return for its past investment and

technology have been distributed to EKF shareholders, and the

company has been floated separately on AIM. EKF retains an interest

in the business having participated in the fundraising. A company

as at the date of this statement valued at circa GBP75m, post

admission to AIM, has been created, which the Directors believe has

the potential to be a game changer in the diagnosis and treatment

of ESRD.

Outlook

2018 has been a year in which we have achieved all our major

milestones, including setting up a number of platforms for growth

in 2019 and beyond. We are continuing to build a solid and reliable

business with opportunities for significant growth, while ensuring

excellent financial results.

Julian Baines

Chief Executive Officer

13 March 2019

FINANCE DIRECTOR's Review

Revenue

Revenue for 2018 was GBP42.5m (2017: GBP41.6m), which is an

increase of 2%. At constant exchange rates, revenue for the year

would have been 1% higher, so organic growth is over 3%, despite

the ending of the large Saudi Arabia contract.

Revenue by disease state, which is presented for illustrative

purposes only, is as follows:

2018 2017

GBP'000 GBP'000 +/- %

Hematology 13,728 12,911 +6%

---------- --------- ------

Diabetes Care 10,964 11,547 (5%)

---------- --------- ------

Central Laboratory 13,289 12,597 +5%

---------- --------- ------

Other 4,562 4,529 +1%

---------- --------- ------

Total 42,543 41,584 +2%

---------- --------- ------

Gross profit

Gross profit is broadly flat at GBP22.7m (2017: GBP22.9m), while

the gross margin percentage on sales is 53.3% (2017: 55.0%). In

2017 there were releases of inventory provisions set in previous

years; this did not recur in 2018.

Administration costs and research and development

Administration costs have fallen substantially, to GBP10.6m

(2017: GBP18.2m), reflecting the focus on operational improvements.

The biggest factor was the effect of exceptional items, which are

again strongly positive in the year. The most important exceptional

item this year is the substantial gain made on the Group's shares

in Renalytix AI plc as a result of its successful separate

flotation. The gain recognised in EKF's books is discounted to take

account of the restrictions on the shares which were distributed to

EKF's shareholders prior to the flotation. In addition to

Renalytix, there was an exceptional gain following the satisfactory

conclusion to a loan agreement with a former employee, offset by

business restructuring costs. Excluding the effect of exceptional

items, administration costs reduced from GBP19.7m in 2017, to

GBP17.0m in 2018.

Research and development costs included in administration

expenses were GBP1.6m (2017: GBP2.2m). A further GBP0.6m was

capitalised as an intangible asset, bringing gross R&D

expenditure for the year to GBP2.2m, a reduction from the

expenditure in 2017 of GBP2.9m, largely caused by the completion of

expenditure last year on the DiaSpect Tm FDA clearance process.

The charge for depreciation of fixed assets and amortisation of

intangible assets reduced to GBP4.0m (2017: GBP4.6m). 2017 included

an impairment charge relating to the closure of our Polish

operations in that year.

Operating profit and adjusted earnings before interest, tax,

depreciation and amortisation

The Group made an operating profit of GBP12.2m (2017: GBP4.7m).

This again reflects the significant exceptional gain on Renalytix

and other items, without which operating profit would have been

GBP5.8m, still an increase of 23.4%. We continue to consider that

adjusted earnings before interest, tax, depreciation and

amortisation, share-based payments and exceptional items (adjusted

EBITDA) is a better measure of the Group's progress because the

Board believes it gives clearer comparability of operating

performance between periods. In 2018 we achieved adjusted EBITDA of

GBP10.7m (2017: GBP9.3m), an increase of 14.7%. The calculation of

this non-GAAP measure is shown on the face of the income statement.

It excludes the effect of non-cash share-based payment charges of

GBP0.9m (2017: GBP1.5m), and exceptional profits of GBP6.5m (2017:

GBP1.6m). The increase in adjusted EBITDA of GBP1.4m would be

higher by GBP0.2m without the effect of exchange rates, with

GBP1.6m therefore being attributable to improved underlying

performance.

Finance costs

Net finance costs have reduced to GBP0.03m (2017: GBP0.42m).

While interest costs on borrowings have continued to reduce, the

main effect is a result of a lower charge associated with the

change in fair value of deferred consideration.

Tax

There is an income tax charge of GBP1.9m, an increase from the

2017 charge of GBP1.4m. The charge is lower than would have been

expected because of the utilisation of past tax losses.

Balance sheet

Property plant and equipment

Additions to fixed assets were GBP1.2m (2017: GBP1.4m). The

major programme has been the continuing work on the upgrading and

refurbishment of the Group's facility in Elkhart, USA, where many

of the Group's central laboratory products are manufactured,

including those being supplied to Oragenics.

Intangible assets

The carrying value of intangible assets has continued to fall,

from GBP43.6m in 2017 to GBP41.8m as at 31 December 2018. This is

largely the result of the annual amortisation charge. There was a

GBP0.6m disposal of capitalised development costs which were sold

to Renalytix AI plc.

Investments

As part of the fund raising for the Renalytix project, EKF

agreed to invest the sum of GBP3.1m for 4.79% of Renalytix's

enlarged (post IPO) share capital.

Deferred consideration

The remaining deferred consideration relates to a share-based

payment to the former owner of EKF-Diagnostic GmbH, payment of

which is subject to an offsetting warranty related claim, the value

of which is held in receivables. Conclusion of the position has

taken longer than anticipated but is expected during this year.

Cash and working capital

Despite the GBP3.1m investment in Renalytix and share buy-backs

totalling GBP0.9m, net cash has increased from GBP7.0m to GBP9.4m.

Gross cash has increased to GBP10.3m (2017: GBP8.2m). Borrowings,

which were mainly used to fund a new building at our plant in

Barleben, Germany, are reducing over the loan period to 2023, while

the remaining balance of a loan from a former employee of EKF

Molecular was written back.

Inventory has increased slightly from GBP5.6m to GBP6.1m due to

a number of strategic decisions to increase raw material holdings

to ensure continuity of supply. Trade and other receivables have

dipped slightly, largely for non-trading reasons. Trade payables

have increased, chiefly because of the effect of the increased

liability relating to the cash settled share-based payments.

Richard Evans

Finance Director and Chief Operating Officer

13 March 2019

Consolidated Income Statement

FOR THE YEARED 31 DECEMBER 2018

2018 2017

GBP'000 GBP'000

------------------------------------ ------------------ -------------------

Revenue 42,543 41,584

Cost of sales (19,847) (18,721)

------------------------------------- ------------------ -------------------

Gross profit 22,696 22,863

Administrative expenses (10,586) (18,186)

Other income 89 52

------------------------------------- ------------------ -------------------

Operating profit 12,199 4,729

===================================== ================== ===================

Depreciation and amortisation (3,991) (4,623)

Share-based payments (939) (1,514)

Exceptional items 6,454 1,562

EBITDA before exceptional items and

share-based payments 10,675 9,304

===================================== ================== ===================

Finance income 43 53

Finance costs (77) (475)

------------------------------------- ------------------ -------------------

Profit before income tax 12,165 4,307

Income tax charge (1,866) (1,367)

------------------------------------- ------------------ -------------------

Profit for the year 10,299 2,940

------------------------------------- ------------------ -------------------

Profit attributable to:

Owners of the parent 10,110 2,715

Non-controlling interest 189 225

------------------------------------- ------------------ -------------------

10,299 2,940

------------------------------------ ------------------ -------------------

Pence Pence

----------------------------------------- ------- -------

Earnings per Ordinary Share attributable to the owners

of the parent during the year

From continuing operations

Basic 2.21 0.59

Diluted 2.19 0.58

------------------------------------------ ------- -------

Consolidated Statement of Comprehensive Income

FOR THE YEARED 31 DECEMBER 2018

2018 2017

GBP'000 GBP'000

------------------------------------------------------ -------- --------

Profit for the year 10,299 2,940

-------- --------

Other comprehensive income:

Items that may be subsequently reclassified to profit

or loss

Currency translation differences 1,383 (622)

======================================================= -------- --------

Other comprehensive gain for the year 1,383 (622)

======================================================= -------- --------

Total comprehensive gain for the year 11,682 2,318

======================================================= -------- --------

Attributable to:

Owners of the parent 11,526 2,096

Non-controlling interests 156 222

======================================================= -------- --------

Total comprehensive gain for the year 11,682 2,318

======================================================= -------- --------

Consolidated Statement of Financial Position

AS AT 31 December 2018

Group Group

2018 2017

GBP'000 GBP'000

-------------------------------------------- ------------- --------------

Assets

Non-current assets

Property, plant and equipment 12,469 12,121

Intangible assets 41,773 43,600

Investments 3,271 152

Deferred tax assets 36 47

--------------------------------------------- ------------- --------------

Total non-current assets 57,549 55,920

--------------------------------------------- ------------- --------------

Current assets

Inventories 6,115 5,638

Trade and other receivables 7,434 7,396

Cash and cash equivalents 10,282 8,203

--------------------------------------------- ------------- --------------

Total current assets 23,831 21,237

--------------------------------------------- ------------- --------------

Total assets 81,380 77,157

--------------------------------------------- ------------- --------------

Equity attributable to owners of the parent

Share capital 4,541 4,576

Other reserves 143 108

Foreign currency reserves 6,309 4,892

Retained earnings 52,536 50,394

--------------------------------------------- ------------- --------------

63,529 59,970

Non-controlling interest 375 528

--------------------------------------------- ------------- --------------

Total equity 63,904 60,498

--------------------------------------------- ------------- --------------

Liabilities

Non-current liabilities

Borrowings 695 872

Deferred tax liabilities 3,179 3,490

--------------------------------------------- ------------- --------------

Total non-current liabilities 3,874 4,362

--------------------------------------------- ------------- --------------

Current liabilities

Trade and other payables 10,094 9,429

Deferred consideration 1,104 1,062

Current income tax liabilities 2,219 1,473

Borrowings 185 333

--------------------------------------------- ------------- --------------

Total current liabilities 13,602 12,297

--------------------------------------------- ------------- --------------

Total liabilities 17,476 16,659

--------------------------------------------- ------------- --------------

Total equity and liabilities 81,380 77,157

--------------------------------------------- ------------- --------------

Consolidated Statement of Cash Flows

FOR THE YEARED 31 DECEMBER 2018

Group Group

2018 2017

GBP'000 GBP'000

--------------------------------------------- ----------- -------------

Cash flow from operating activities

Cash generated by operations 9,861 10,118

Interest paid (35) (106)

Income tax paid (1,503) (959)

---------------------------------------------- ----------- -------------

Net cash generated by operating activities 8,323 9,053

---------------------------------------------- ----------- -------------

Cash flow from investing activities

Purchase of investments (3,119) -

Purchase of property, plant and equipment

(PPE) (1,220) (1,361)

Purchase of intangibles (632) (852)

Proceeds from sale of PPE - 128

Interest received 43 53

---------------------------------------------- ----------- -------------

Net cash used in investing activities (4,928) (2,032)

---------------------------------------------- ----------- -------------

Cash flow from financing activities

Share based payments - (1,505)

Share buy back (940) (241)

Repayments on borrowings (242) (4,458)

Dividend payment to non-controlling interest (309) (215)

---------------------------------------------- ----------- -------------

Net cash used in financing activities (1,491) (6,419)

---------------------------------------------- ----------- -------------

Net increase in cash and cash equivalents 1,904 602

Cash and cash equivalents at beginning

of year 8,203 7,874

Exchange gains/(losses) on cash and cash

equivalents 175 (273)

---------------------------------------------- ----------- -------------

Cash and cash equivalents at end of year 10,282 8,203

---------------------------------------------- ----------- -------------

Consolidated Statement of Changes in Equity

Share Foreign

Share premium Other currency Retained Non-controlling Total

capital account reserves reserve earnings Total interest equity

Consolidated GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============================ ======== ======== ========= ========= ========= ======== =============== ========

At 1 January 2017 4,643 95,393 41 5,609 (45,236) 60,450 521 60,971

============================ ======== ======== ========= ========= ========= ======== =============== ========

Comprehensive income

Profit for the year - - - - 2,715 2,715 225 2,940

Other comprehensive income

Currency translation

differences - - - (717) 98 (619) (3) (622)

============================ ======== ======== ========= ========= ========= ======== =============== ========

Total comprehensive

(expense)/income - - - (717) 2,813 2,096 222 2,318

============================ ======== ======== ========= ========= ========= ======== =============== ========

Transactions with owners

Proceeds from shares issued (67) - 67 - (3,121) (3,121) - (3,121)

Capital reconstruction - (95,393) - - 95,393 - - -

Dividends to non-controlling

interest - - - - - - (215) (215)

Share-based payments - - - - 545 545 - 545

============================ ======== ======== ========= ========= ========= ======== =============== ========

Total distributions to

owners (67) (95,393) 67 - 92,817 (2,576) (215) (2,791)

============================ ======== ======== ========= ========= ========= ======== =============== ========

At 31 December 2017 and

1 January 2018 4,576 - 108 4,892 50,394 59,970 528 60,498

============================ ======== ======== ========= ========= ========= ======== =============== ========

Comprehensive income

Profit for the year - - - - 10,110 10,110 189 10,299

Other comprehensive income

Currency translation

differences - - - 1,417 (1) 1,416 (33) 1,383

============================ ======== ======== ========= ========= ========= ======== =============== ========

Total comprehensive income - - - 1,417 10,109 11,526 156 11,682

============================ ======== ======== ========= ========= ========= ======== =============== ========

Transactions with owners

Share cancellation (35) - 35 - (940) (940) - (940)

Dividends to non-controlling

interest - - - - - - (309) (309)

Distribution in specie - - - - (7,027) (7,027) - (7,027)

============================ ======== ======== ========= ========= ========= ======== =============== ========

Total distributions to

owners (35) - 35 - (7,967) (7,967) (309) (8,276)

============================ ======== ======== ========= ========= ========= ======== =============== ========

At 31 December 2018 4,541 - 143 6,309 52,536 63,529 375 63,904

============================ ======== ======== ========= ========= ========= ======== =============== ========

Notes to the Financial Statements

for the year ended 31 December 2018

1. Basis of presentation

EKF Diagnostics Holdings Plc is a company incorporated in the

United Kingdom. The Company is a public limited company, which is

listed on the AIM market of the London Stock Exchange.

The audited preliminary announcement has been prepared in

accordance with the Group's accounting policies as disclosed in the

financial statements for the year ended 31 December 2018 and

International Financial Reporting Standards ("IFRSs") and

International Financial Reporting Standards Interpretations

Committee (IFRS IC) interpretations as adopted by the European

Union and with those parts of the Companies Act 2006 applicable to

companies reporting under IFRS. This preliminary announcement was

approved by the Board of Directors on 13 March 2019. The

preliminary announcement does not constitute statutory financial

statements within the meaning of section 434 of the Companies Act

2006. Statutory accounts for the year to 31 December 2017 have been

delivered to the Registrar of Companies. The audit report for those

accounts was unqualified and did not contain statements under 498

(2) or (3) of the Companies Act 2006 and did not contain any

emphasis of matter.

Certain statements in this announcement constitute

forward-looking statements. Any statement in this announcement that

is not a statement of historical fact including, without

limitation, those regarding the Company's future expectations,

operations, financial performance, financial condition and business

is a forward-looking statement. Such forward-looking statements are

subject to risks and uncertainties that may cause actual results to

differ materially. These risks and uncertainties include, amongst

other factors, changing economic, financial, business or other

market conditions. These and other factors could adversely affect

the outcome and financial effects of the plans and events described

in this announcement and the Company undertakes no obligation to

update its view of such risks and uncertainties or to update the

forward-looking statements contained herein. Nothing in this

announcement should be construed as a profit forecast.

While the financial information included in this preliminary

announcement has been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting

Standards (IFRSs), this announcement does not itself contain

sufficient information to comply with IFRSs. The Company will

publish its full financial statements for the year ended 31

December 2018 by 9 April 2019, which will be available on the

Company's website at www.ekfdiagnostics.com and at the Company's

registered office at Avon House, 19 Stanwell Road Penarth CF64 2EZ.

The Annual General Meeting will be held on Thursday 2 May 2019.

2. Geographic sales

Disclosure of Group revenues by geographic location of customer

is as follows:

2018 2017

GBP'000 GBP'000

====================================== -------- -------------

Americas

United States of America 18,253 17,174

Rest of Americas 3,925 3,195

Europe, Middle East and Africa (EMEA)

Germany 6,208 6,016

United Kingdom 324 300

Rest of Europe 3,583 3,423

Russia 2,687 2,743

Middle East 1,467 2,912

Africa 1,229 1,611

Asia and Rest of World

China 994 915

Rest of Asia 3,751 3,168

New Zealand/Australia 122 127

====================================== -------- -------------

Total revenue 42,543 41,584

====================================== -------- -------------

No single external customer represented more than 10% of

revenues in either 2018 or 2017.

3. Exceptional items

Included within administrative expenses are exceptional items as

shown below:

2018 2017

Note GBP'000 GBP'000

===================================== ===== ======== ========

* Warranty claim a 31 339

* Business reorganisation costs b (120) (183)

- Cancellation of shares c - 1,406

- A Webb loan d 90 -

- Net receipt from legal action e 97 -

* Renalytix f 6,356 -

Exceptional items 6,454 1,562

============================================ ======== ========

a. Estimated warranty claim in relation to the acquisition of

EKF-diagnostic GmbH increased because of higher share price.

b. Restructuring costs, mainly redundancy and notice costs,

associated in 2018 with the closure of EKF's Polish facility and

other restructuring activities.

c. Fair value of shares released to EKF by former shareholders

of Selah Genomics Inc. which had been issued as part of the

consideration for the acquisition of Selah, but held in escrow.

These shares were subsequently cancelled.

d. Following settlement with Mr A Webb, the balance of the loan

made by him in relation to the molecular diagnostic business has

been written back.

e. Receipt from legal action against a customer net of legal costs.

f. The net profit made by the Group in relation to the Renalytix

transaction. Full details are given in note 9.

4. Finance income and costs

2018 2017

GBP'000 GBP'000

============================================================= ======== ========

Finance costs:

* Bank borrowings 25 83

* Other interest 10 23

* Financial liabilities at fair value through profit or

loss 42 369

Finance costs 77 475

============================================================= ======== ========

Finance income

- Interest income on cash and short-term deposits 9 14

- Other interest 34 39

Finance income 43 53

============================================================= ======== ========

Net finance costs 34 422

============================================================= ======== ========

5. Income tax

2018 2017

Group GBP'000 GBP'000

================================================== ======== ========

Current tax:

Current tax on profit for the year 2,248 2,045

Adjustments for prior periods 5 (100)

================================================== -------- ========

Total current tax 2,253 1,945

================================================== -------- ========

Deferred tax:

Origination and reversal of temporary differences (387) (578)

--------

Total deferred tax (387) (578)

================================================== -------- ========

Income tax charge 1,866 1,367

================================================== -------- ========

The Finance Act 2015, which was substantively enacted in 2015,

included legislation to reduce the main rate of UK corporation tax

to 19% from 1 April 2017 and the Finance Act 2016, which was

substantively enacted in 2016, included legislation to reduce the

main rate of UK corporation tax to 17% from 1 April 2020.

The tax on the Group's profit before tax differs from the

theoretical amount that would arise using the standard tax rate

applicable to the profits of the consolidated entities as

follows:

2018 2017

GBP'000 GBP'000

=============================================================== ======== ========

Profit before tax 12,165 4,307

--------------------------------------------------------------- ======== ========

Tax calculated at domestic tax rates applicable to UK standard

rate of tax of 19% (2017: 19.25%) 2,311 829

Tax effects of:

* Expenses not deductible for tax purposes 297 31

* Remeasurement of deferred tax - change in future tax

rate (19) (360)

* Income not subject to tax (238) 267

* Utilisation of losses (1,069) (178)

* Adjustment in respect of prior years 106 (100)

* Impact of different tax rates in other jurisdictions 277 634

* Other movements 201 244

--------------------------------------------------------------- ======== ========

Tax charge 1,866 1,367

--------------------------------------------------------------- ======== ========

There are no tax effects on the items in the statement of other

comprehensive income.

6. Earnings per share

(a) Basic

Basic earnings per share is calculated by dividing the profit

attributable to owners of the parent by the weighted average number

of Ordinary Shares in issue during the year.

2018 2017

GBP'000 GBP'000

==================================================== =========== ===========

Profit attributable to owners of the parent 10,110 2,715

==================================================== =========== ===========

Weighted average number of Ordinary Shares in issue 457,207,272 463,098,526

==================================================== =========== ===========

Basic profit per share 2.21 pence 0.59 pence

---------------------------------------------------- ----------- -----------

(b) Diluted

Diluted earnings per share is calculated by adjusting the

weighted average number of Ordinary Shares outstanding assuming

conversion of all dilutive potential Ordinary Shares. The Company

has one category of dilutive potential ordinary shares being share

options.

2018 2017

GBP'000 GBP'000

=================================================== =========== ===========

Profit attributable to owners of the parent 10,110 2,715

Weighted average diluted number of Ordinary Shares 461,489,617 469,343,547

=================================================== =========== ===========

Diluted profit per share 2.19 pence 0.58 pence

--------------------------------------------------- ----------- -----------

2018 2017

======================================================== =========== ===========

Weighted average number of Ordinary Shares in issue 457,207,272 463,098,526

Adjustment for:

* Assumed conversion of share awards 238,405 2,201,081

* Assumed payment of equity deferred consideration 4,043,940 4,043,940

======================================================== =========== ===========

Weighted average number of Ordinary Shares including

potentially dilutive shares 461,489,617 469,343,547

======================================================== =========== ===========

7. Dividends

On 24(th) October 2018 the Company made a distribution in specie

whereby the Company's shareholding in Renalytix AI plc, a developer

of artificial intelligence enabled diagnostics for kidney disease,

which has been floated separately from the Group, was distributed

to ordinary shareholders of the Company. The rate was one Renalytix

AI plc share for each 21.825 shares held in the company at a total

value of GBP7,027,000 (2017: nil). The fair value per EKF share was

1.5357p, which has been calculated based on the market value of the

Renalytix shares prior to the completion of the fundraising and

their flotation on the AIM market, less a discount to account for

the restrictions placed on the shares.

8. Cash generated by operations

Group

===============================

2018 2017

GBP'000 GBP'000

================================================== =============== ==============

Profit before tax 12,165 4,307

Adjustments for:

* Depreciation 1,158 1,160

* Amortisation 2,833 3,463

* Warranty claim (31) (339)

* Loss/ (profit) on disposal of fixed assets 13 (33)

* Share-based payments 939 1,510

* Escrow cancellation - (1,371)

* Profit on sale of Renalytix (6,356) -

* Fair value adjustment 42 369

- Foreign exchange (83) 233

* Net finance (income)/ costs (8) 53

* Loan write back (90) -

Changes in working capital

* Inventories (461) 306

* Trade and other receivables 11 1,535

* Trade and other payables (271) (1,075)

================================================== =============== ==============

Net cash generated by operations 9,861 10,118

-------------------------------------------------- --------------- --------------

In the statement of cash flows, proceeds from the sale of

property, plant and equipment comprise:

2018 2017

Group GBP'000 GBP'000

============================================================ ======== ========

Net book value 13 95

(Loss)/ profit on disposal of property, plant and equipment (13) 33

============================================================ ======== ========

Proceeds from disposal of property, plant and equipment - 128

============================================================ ======== ========

Non-cash transactions

The principal non-cash transactions are: the creation of

Renalytix AI plc and the subsequent distribution in specie,

movements on deferred consideration provisions; the fair value

adjustment relating to the deferred equity consideration in respect

of EKF Germany, the warranty claim, and release of accruals no

longer required.

9. Renalytix AI plc

During 2018, the Group founded Renalytix AI plc which, along

with its subsidiary company Renalytix AI Inc., were floated

separately from the Group in November 2018. The investment in

Renalytix was previously held as an asset available for sale.

Renalytix is a developer of artificial intelligence-enabled

diagnostics for kidney disease.

As part of the creation of a separate business, intangible

assets with a net value of GBP646,000 were sold to Renalytix by the

Group, and the Group's wholly owned subsidiary Renalytix AI Inc.

was sold to Renalytix AI plc, in return for shares in Renalytix AI

plc. Following these transactions, EKF's shareholding in Renalytix

comprised 20,964,295 ordinary shares.

The EKF holding was then distributed in specie to Relevant EKF

shareholders, being those on the EKF register as at the date of

record for the distribution in October 2018 at a rate of one

Renalytix AI plc ordinary share (a "RENX share") for each 21.825

EKF ordinary shares held. The fair value of the shares distributed

to Relevant EKF shareholders was calculated based on the proposed

flotation price, less a discount to account for the restrictions

placed on the shares. The discount was calculated taking into

account, amongst other factors, the 180 day lock up period, sector

volatility, and that the shares were issued pre-admission. The

total fair value of the distributed shares was calculated as

GBP7,027,000 with the profit on disposal, which has been shown as

an exceptional profit, being calculated net of expenses of

GBP25,000 and the value of the intangible asset transferred of

GBP6,356,000. Subsequent to the distribution, EKF invested GBP3.1m

in the shares of Renalytix at the same price as other new investors

and, as at the date of this announcement, holds 2,577,907 RENX

shares.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR SFWESEFUSELD

(END) Dow Jones Newswires

March 13, 2019 03:01 ET (07:01 GMT)

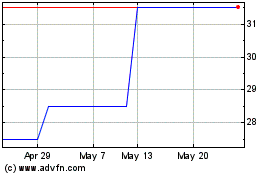

EKF Diagnostics (AQSE:EKF.GB)

Historical Stock Chart

From Sep 2024 to Oct 2024

EKF Diagnostics (AQSE:EKF.GB)

Historical Stock Chart

From Oct 2023 to Oct 2024