TIDMEEE

RNS Number : 5253U

Empire Metals Limited

30 July 2020

Empire Metals Ltd / AIM: EEE / Sector: Natural Resources

30 July 2020

Empire Metals Limited ('EEE' or the 'Company')

Interim Results

Empire Metals Ltd ('EEE' or the 'Company'), the natural resource

exploration and development company, is pleased to announce its

interim results for the six-month period ended 30 June 2020.

Chairman's Statement

The first half of 2020 has been productive for the Company and

has seen an expansion of our project portfolio, a refocus on our

growth strategy and a rebranding to Empire Metals Limited. I am

confident that the developments and achievements made over the past

six months have now laid the foundations for positive growth

throughout the remainder of 2020 and onwards.

The period started encouragingly in January 2020, with some of

the uncertainty surrounding the advancement of our Bolnisi Project

in Georgia being removed with the confirmation of tenure from the

National Agency of Mines ('NAM') for two key deposits in the

Bolnisi Project licence area, namely Kvemo Bolnisi East and

Dambludi. This was a significant milestone in EEE's ongoing efforts

to obtain the extension to the permit in Georgia. The Company plans

to recommence a work programme, directed primarily on Kvemo Bolnisi

East, the target which has been the focus of much of the Company's

investment to date, once the necessary amendments to the licence to

allow work to re-commence on these two projects have been processed

by the Georgian authorities.

As previously announced, an appeal process is currently underway

to challenge NAM's position on the remainder of the Bolnisi Project

licence area and Empire will provide further updates as

appropriate.

The most notable developments during the period have happened

outside of Georgia, with Empire making significant progress with

its strategy to identify compelling new assets through which the

Company can add short term value. As announced on 28 February 2020,

EEE raised GBP600,000 by way of a placing and subscription of new

ordinary shares with new and existing shareholders in the Company,

to advance this process.

After evaluating a number of potential opportunities, on 27

April 2020, EEE announced that it had entered into a Binding Heads

of Agreement with ASX listed Artemis Resources Limited ('Artemis')

to acquire a 41% interest (the 'Acquisition') in the Munni Munni

Palladium Project in the West Pilbara ('Munni Munni'), Western

Australia and has first right of refusal on a further 29% interest

in the project.

Munni Munni comprises four granted mining leases and an

exploration licence covering a 64km(2) tenement area. It is the

largest unexploited primary PGE resource in Australia and contains

the largest intrusion in the West Pilbara hosting a JORC-compliant

2004 Resource of 24Mt @ 2.9 g/t Platinum Group Element (PGE) and

gold (12.4Mt Measured, 9.8Mt Indicated, and 1.4Mt Inferred),

containing 1,140,000 ounces palladium, 830,000 ounces platinum,

152,000 ounces gold and 76,000 ounces rhodium. The teams at Artemis

and Empire Metals are making progress toward the completion of the

Acquisition and in the meantime agreed to commence with the planned

drilling programme at the project in order to take advantage of the

drilling season. This programme was designed to extend primary reef

mineralisation and test historical assay grades from diamond

drilling using RC drilling, test for the presence of a second reef

below the primary PGE reef and generate data that may contribute to

a JORC Code 2012 Mineral Resources Estimate in the future. On 30

June 2020, Empire announced the completion of the RC drilling of 12

drill holes for 1,928 metres, with drill holes spread through the

entire upper portion of the mineralisation, to a maximum dept of

200 metres. Samples were sent to ALS Global and the Company is

expecting to receive the results in due course.

Unfortunately, as announced by Empire on Monday 20 July 2020,

Artemis was served a writ of summons on Friday 17 July 2020 issued

by the Supreme Court of Western Australia as filed by Platina

Resources Limited ('Platina') , the 30% joint venture partner to

Artemis on the Munni Munni Project. Platina claims that Artemis and

its wholly owned subsidiary, MMPL, have breached the Heads of

Agreement entered into by the parties relating to the Munni Munni

Joint Venture as a result of the Company entering into the

agreement with Empire.

Artemis denies Platina's claim and state that they intend to

vigorously defend their position, and wish to move forwards with

Empire to develop the Mummi Munni project.

The Munni Munni Project satisfies EEE's objective of de-risking

the Company's growth strategy by diversifying away from a single

jurisdiction investment, combining an exceptional project with an

attractive and mature investment environment. The Acquisition

represents the start of a new chapter for Empire Metals and the

Board continues to actively review other opportunities with the

intention of identifying other compelling new assets, which meet

its stringent investment criteria and have the potential to add

short-term value. I look forward to providing further updates on

this process in due course.

Financial

For the six-month period ended 30 June 2020 the Group is

reporting a pre-tax profit of GBP256,515 (six months ended 30 June

2019: loss of GBP377,327). The current period profit arises as a

result of the write back of exploration and evaluation expenditure

incurred at the joint venture level following the reinstatement of

the Kvemo Bolnisi East and Dambludi licence areas. EEE's share of

profit from this write back at the joint venture company was

GBP471,307.

The Group's net cash balance as at 30 June 2020 was GBP364,369

(year ended 31 December 2019: GBP50,840).

Outlook

This has been significant period for EEE which has delivered

substantial developments, after what was a challenging 2019. The

Company has been strengthened both financially and corporately in

2020 and on behalf of the Board, I am optimistic about our ability

to deliver on our key strategic aims this year. We are of course

cognisant of the unprecedented global disruption which the COVID-19

pandemic is creating for communities and economies worldwide,

however the Board has adopted a prudent and responsible approach to

both our financial and operational activities and we are confident

that EEE is well equipped to weather the current market

turbulence.

We look forward to reporting on our activities in Georgia and in

new jurisdictions over the coming weeks and months. I would like to

take this opportunity to thank our shareholders and my fellow

directors for their continued support as we look forward to a

bright future as Empire Metals Limited.

Neil O'Brien

Non-Executive Chairman

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

**S**

For further information please visit

https://www.empiremetals.co.uk or contact:

Mike Struthers Empire Metals Ltd Company Tel: 020 7907

9327

Ewan Leggat S. P. Angel Corporate Nomad & Broker Tel: 020 3470

Finance LLP 0470

Soltan Tagiev S. P. Angel Corporate Nomad & Broker Tel: 020 3470

Finance LLP 0470

Damon Heath Shard Capital Partners Joint Broker Tel: 020 7186

LLP 9950

Susie Geliher St Brides Partners PR Tel: 020 7236

Ltd 1177

Beth Melluish St Brides Partners PR Tel: 020 7236

Ltd 1177

About Empire Metals Limited

Empire Metals Limited (formerly Georgian Mining Corporation) has

50% ownership of the Bolnisi Copper and Gold Project in Georgia,

situated on the prolific Tethyan Belt, a well-known geological

region and host to many high-grade copper-gold deposits and

producing mines. The Bolnisi concession covers an area of over 860

sq km and has a 30-year mining licence with a variety of targets

and projects ranging from greenfield exploration / target

definition phase through intermediate target-testing phases to more

advanced projects including Kvemo Bolnisi East which is due to

advance to Feasibility Study.

The acquisition of Munni Munni is a result of the Company's

ongoing assessments of the potential for expanding the Company's

portfolio through the addition of new assets which have the ability

to add value in the short term.

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

6 months to 6 months

30 June 2020 to 30 June

Unaudited 2019 Unaudited

Notes GBP GBP

---------------------------------------------- ------- --------------- -----------------

Continuing operations

Revenue 1,204 83,145

Administration expenses (223,013) (400,296)

Foreign exchange 7,017 (8,184)

Operating Loss (214,792) (325,335)

---------------------------------------------- ------- --------------- -----------------

Share of profit from joint venture 5 471,307 -

Impairments - (51,992)

Profit/(Loss) Before Income Tax 256,515 (377,327)

---------------------------------------------- ------- --------------- -----------------

Income tax expense - -

---------------------------------------------- ------- --------------- -----------------

Profit/(Loss) for the period 256,515 (377,327)

---------------------------------------------- ------- --------------- -----------------

Profit/(Loss) attributable to:

* owners of the Parent 256,515 (377,327)

* non-controlling interests - -

---------------------------------------------- ------- --------------- -----------------

Profit/(Loss) for the period 256,515 (377,327)

---------------------------------------------- ------- --------------- -----------------

Other comprehensive income

Items that may be subsequently reclassified

to profit or loss

Currency translation differences - 1,022

---------------------------------------------- ------- --------------- -----------------

Total comprehensive income 256,515 (376,305)

---------------------------------------------- ------- --------------- -----------------

Attributable to:

* owners of the Parent 256,515 (376,305)

* non-controlling interests - -

---------------------------------------------- ------- --------------- -----------------

Total comprehensive income 256,515 (376,305)

---------------------------------------------- ------- --------------- -----------------

Earnings per share (pence) from continuing

operations attributable to owners of

the Parent - Basic and diluted 6 0.150 (0.324)

---------------------------------------------- ------- --------------- -----------------

CONDENSED CONSOLIDATED BALANCE SHEET

30 June 2020 31 December

Unaudited 2019 Audited

Notes GBP GBP

-------------------------------------- ------- -------------- ---------------

Non-Current Assets

Property, plant and equipment 3,052 17,882

Investments in Joint Ventures 5 497,488 -

500,540 17,882

-------------------------------------- ------- -------------- ---------------

Current Assets

Trade and other receivables 182,667 167,971

Cash and cash equivalents 364,369 50,840

-------------------------------------- ------- -------------- ---------------

547,036 218,811

-------------------------------------- ------- -------------- ---------------

Total Assets 1,047,576 236,693

-------------------------------------- ------- -------------- ---------------

Current Liabilities

Trade and other payables 74,859 91,191

-------------------------------------- ------- -------------- ---------------

Total Liabilities 74,859 91,191

-------------------------------------- ------- -------------- ---------------

Net Assets 972,717 145,502

-------------------------------------- ------- -------------- ---------------

Equity Attributable to owners of

the Parent

Share premium account 6 39,836,337 39,265,637

Reverse acquisition reserve (18,845,147) (18,845,147)

Other Reserves 138,014 138,014

Retained losses (20,156,487) (20,413,002)

-------------------------------------- ------- -------------- ---------------

Total equity attributable to owners

of the Parent 972,717 145,502

-------------------------------------- ------- -------------- ---------------

Non-controlling interest - -

-------------------------------------- ------- -------------- ---------------

Total Equity 972,717 145,502

-------------------------------------- ------- -------------- ---------------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN SHAREHOLDERS'

EQUITY

Reverse

Share acquisition Other Retained Non-controlling Total

premium reserve Reserves losses Total interest equity

GBP GBP GBP GBP GBP GBP GBP

---------------- ------------ -------------- ----------- -------------- ----------- ----------------- -----------

As at 1

January

2019 38,904,337 (18,845,147) 136,020 (19,737,410) 457,800 - 457,800

----------------

Comprehensive

income

Loss for the

period - - - (377,327) (377,327) - (377,327)

---------------- ------------ -------------- ----------- -------------- ----------- ----------------- -----------

Other

comprehensive

income

Currency

translation

differences - - 1,022 - 1,022 - 1,022

---------------- ------------ -------------- ----------- -------------- ----------- ----------------- -----------

Total

comprehensive

income - - 1,022 (377,327) (376,305) - (376,305)

---------------- ------------ -------------- ----------- -------------- ----------- ----------------- -----------

Issue of

ordinary

shares 380,000 - - - 380,000 - 380,000

Issue costs (18,700) - - - (18,700) - (18,700)

Total

transactions

with owners 361,300 - - - 361,300 - 361,300

As at 30 June

2019 39,265,637 (18,845,147) 137,042 (20,114,737) 442,795 - 442,795

---------------- ------------ -------------- ----------- -------------- ----------- ----------------- -----------

Reverse

Share acquisition Other Retained Non-controlling Total

premium reserve Reserves losses Total interest equity

GBP GBP GBP GBP GBP GBP GBP

---------------- ------------ -------------- ----------- -------------- ----------- ----------------- -----------

As at 1

January

2020 39,265,637 (18,845,147) 138,014 (20,413,002) 145,502 - 145,502

----------------

Comprehensive

income

Profit/(Loss)

for the

period - - - 256,515 256,515 - 256,515

---------------- ------------ -------------- ----------- -------------- ----------- ----------------- -----------

Other

comprehensive

income

Currency

translation

differences - - - - - - -

---------------- ------------ -------------- ----------- -------------- ----------- ----------------- -----------

Total

comprehensive

income - - - 256,515 256,515 - 256,515

---------------- ------------ -------------- ----------- -------------- ----------- ----------------- -----------

Issue of

ordinary

shares 600,000 - - - 600,000 - 600,000

Issue costs (29,300) - - - (29,300) - (29,300)

Total

transactions

with owners 570,700 - - - 570,700 - 570,700

As at 30 June

2020 39,836,337 (18,845,147) 138,014 (20,156,487) 972,717 - 972,717

---------------- ------------ -------------- ----------- -------------- ----------- ----------------- -----------

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

30 June 30 June

2020 Unaudited 2019 Unaudited

GBP GBP

--------------------------------------------- ----------------- -----------------

Cash flows from operating activities

Profit/(Loss) before taxation 256,515 (377,327)

Adjustments for:

Depreciation 7,554 15,202

Gain on sale of PPE (12,724) -

Impairment of asset - 51,992

Share of profit on joint venture (471,307) -

Foreign exchange (7,017) (494)

Increase in trade and other receivables (7,679) (50,790)

Decrease in trade and other payables (16,332) (45,913)

Net cash used in operations (250,990) (407,330)

---------------------------------------------- ----------------- -----------------

Cash flows from investing activities

Loans granted to joint venture partners (26,181) (50,476)

Sale of property, plant & equipment 20,000 -

Additions to exploration and evaluation - -

intangibles

--------------------------------------------- ----------------- -----------------

Net cash used in investing activities (6,181) (50,476)

---------------------------------------------- ----------------- -----------------

Cash flows from financing activities

Proceeds from issue of shares 600,000 380,000

Cost of issue (29,300) (18,700)

---------------------------------------------- ----------------- -----------------

Net cash from financing activities 570,700 361,300

---------------------------------------------- ----------------- -----------------

Net (decrease) / increase in cash and cash

equivalents 313,529 (96,506)

Cash and cash equivalents at beginning

of period 50,840 525,354

Exchange differences on cash - -

--------------------------------------------- ----------------- -----------------

Cash and cash equivalents at end of period 364,369 428,848

---------------------------------------------- ----------------- -----------------

Major non-cash transactions

There were no major non-cash transactions in the period.

NOTES TO THE INTERIM FINANCIAL STATEMENTS

1. General Information

The principal activity of Empire Metals Limited ('the Company')

and its subsidiaries (together 'the Group') is the exploration and

development of precious and base metals. The Company's shares are

listed on the AIM Market of the London Stock Exchange. The Company

is incorporated in the British Virgin Islands and domiciled in the

United Kingdom. The Company was incorporated on 10 February 2010

under the name Gold Mining Company Limited. On 10 October 2016 the

Company changed its name from Noricum Gold Limited to Georgian

Mining Corporation and subsequently on 10 February 2020 changed its

name from Georgian Mining Corporation to Empire Metals Limited.

The address of the Company's registered office is Trident

Chambers, PO Box 146, Road Town, Tortola BVI.

2. Basis of Preparation

The condensed consolidated interim financial statements have

been prepared in accordance with the requirements of the AIM Rules

for Companies. As permitted, the Company has chosen not to adopt

IAS 34 "Interim Financial Statements" in preparing this interim

financial information. The condensed interim financial statements

should be read in conjunction with the annual financial statements

for the year ended 31 December 2019, which have been prepared in

accordance with International Financial Reporting Standards (IFRS)

as adopted by the European Union.

The interim financial information set out above does not

constitute statutory accounts. They have been prepared on a going

concern basis in accordance with the recognition and measurement

criteria of International Financial Reporting Standards (IFRS) as

adopted by the European Union. Statutory financial statements for

the year ended 31 December 2019 were approved by the Board of

Directors on 30 June 2020. The report of the auditors on those

financial statements was unqualified but included a material

uncertainty relating to going concern paragraph.

Going concern

The Directors, having made appropriate enquiries, consider that

adequate resources exist for the Group to continue in operational

existence for the foreseeable future and that, therefore, it is

appropriate to adopt the going concern basis in preparing the

condensed interim financial statements for the period ended 30 June

2020.

The factors that were extant at the 31 December 2019 are still

relevant to this report and as such reference should be made to the

going concern note and disclosures in the 2019 Annual Report.

Risks and uncertainties

The Board continuously assesses and monitors the key risks of

the business. The key risks that could affect the Group's

medium-term performance and the factors that mitigate those risks

have not substantially changed from those set out in the Group's

2019 Annual Report and Financial Statements, a copy of which is

available on the Group's website: https://www.empiremetals.co.uk .

The key financial risks are liquidity risk, foreign exchange risk,

credit risk, price risk and interest rate risk.

Critical accounting estimates

The preparation of condensed interim financial statements

requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities, income and

expenses, and disclosure of contingent assets and liabilities at

the end of the reporting period. Significant items subject to such

estimates are set out in note 4 of the Group's 2019 Annual Report

and Financial Statements. Actual amounts may differ from these

estimates. The nature and amounts of such estimates have not

changed significantly during the interim period.

3. Accounting Policies

The same accounting policies, presentation and methods of

computation have been followed in these condensed interim financial

statements as were applied in the preparation of the Group's annual

financial statements for the year ended 31 December 2019 except for

the impact of the adoption of the Standards and interpretations

described below and new accounting policies adopted as a result of

changes in the Group.

3.1 Changes in accounting policy and disclosures

(a) Accounting developments during 2020

(a) New and amended standards mandatory for the first time for

the financial periods beginning on or after 1 January 2020

As of 1 January 2020, the Company adopted the amedments to IFRS

3, IAS 1 and IAS 8. The transition to these standards had no

material impact on the Group.

b) New standards, amendments and interpretations in issue but

not yet effective or not yet endorsed and not early adopted

Standards, amendments and interpretations that are not yet

effective and have not been early adopted are as follows:

Standard Impact on initial application Effective date

---------- ------------------------------- -------------------

IAS 1 Classification of Liabilities * 1 January 2022

as Current or Non-Current.

------------------------------- -------------------

(*) Subject to EU endorsement

The Group is evaluating the impact of the new and amended

standards above which are not expected to have a material impact on

future Group financial statements s

4. Dividends

No dividend has been declared or paid by the Company during the

six months ended 30 June 2020 (2019: nil).

5. Joint venture

On 15 March 2018, the Company entered into a Deed of Variation

with its joint venture partner in Georgian Copper & Gold

('GCG') in relation to the ongoing operations of the operating

company, future work programmes and budgets. As a result, both

shareholders now have equal representation on the board of GCG and

therefore, from that date, the subsidiary was derecognised and the

ongoing 50% ownership accounted for as a joint venture.

Name of entity Address of the % of ownership Nature of relationship Measurement

registered office interest method

SI 2017/980

Georgian Copper 6 Saakadze Descent, 50 As above Equity

& Gold JSC 2(nd) Fl.

Tbilisi 0171, Georgia

On 28 January 2020 the Group announced that it had received

confirmation of tenure from the National Agency of Mines ('NAM')

for two key deposits in the Bolnisi Project licence area, namely

Kvemo Bolnisi East and Dambludi. As a result, the exploration and

evaluation expenditure related to these license areas, which was

previously impaired, has been reinstated. As such the carrying

value of the investment in GCG has also been uplifted by the

Company's share of profit for the period.

Summarised financial information of joint venture

31 December

30 June 2019

2020

------------------------------------ ----------- -------------

Property, plant and equipment 42,752 53,933

Cash 103 2,591

Intangibles 2,285,855 4,364

Other receivables 52,576 53,376

------------------------------------- ----------- -------------

Total assets 2,381,286 114,264

------------------------------------- ----------- -------------

Trade and other payables 246,837 210,830

Loan with GMC Investments Limited 979,883 955,222

------------------------------------- ----------- -------------

Total liabilities 1,226,720 1,166,052

------------------------------------- ----------- -------------

The joint venture generated a profit after tax of GBP2,215,265

for the period. The share of profit of the joint venture for the

period recognised was GBP1,107,633. As per IAS 28, the share of

profit can only be recognised in excess of the Company's share of

historic losses not recognised. As a result, the share of profit

recognised has been reduced by the Company's share of the joint

venture losses which it has not previously recognised, being

GBP636,326. There are no further unrecognised losses.

During the period, the Company loaned GCG GBP26,181 to finance

current operations.

The carrying value of the investment at 30 June 2020 is

summarised below:

Total

GBP

--------------------------------- -----------

As at 1 January 2020 -

Share of profit from joint

venture 1,107,633

Loans granted to joint venture 26,181

Recognition of unrecognised

losses from prior periods (636,326)

As at 30 June 2020 497,488

-----------

The Group has no obligation or commitments to contribute to any

losses in excess of the carrying value of the investment.

6. Share capital and share premium

Ordinary Share premium

Number of shares shares Total

GBP GBP GBP

-------------------- ------------------ ---------- --------------------- ------------

Issued and fully

paid

As at 1 January

2019 114,756,991 - 38,904,337 38,904,337

------------------ ---------- --------------------- ------------

Share issue -

23 May 2019 19,000,000 - 361,300 361,300

As at 30 June

2019 133,756,991 - 39,265,637 39,265,637

------------------ ---------- --------------------- ------------

As at 1 January

2020 133,756,991 - 39,265,637 39,265,637

------------------ ---------- --------------------- ------------

Share issue -

28 February 2020 60,000,000 - 570,700 570,700

As at 30 June

2020 193,756,991 - 39,836,337 39,836,337

------------------ ---------- --------------------- ------------

7. Loss per share

The calculation of the total basic earnings per share of 0. 150

pence (30 June 2019: loss of 0.324 pence) is based on the loss

attributable to equity owners of the parent company of GBP256,515

(30 June 2019: GBP377,327) and on the weighted average number of

ordinary shares of 174,636,112 (30 June 2019: 118,850,915) in issue

during the period.

No diluted earnings per share is presented as the effect on the

exercise of share options would be to decrease the loss per

share.

Details of share options that could potentially dilute earnings

per share in future periods are disclosed in the notes to the

Group's Annual Report and Financial Statements for the year ended

31 December 2019.

8. Fair value estimation

There are no financial instruments carried at fair value.

9. Fair value of financial assets and liabilities measured at amortised costs

Financial assets and liabilities comprise the following:

-- Trade and other receivables

-- Cash and cash equivalents

-- Trade and other payables

The fair values of these items equate to their carrying values

as at the reporting date.

10. Commitments

All commitments remain as stated in the Group's Annual Financial

Statements for the year ended 31 December 2019.

11. Events after the balance sheet date

There have been no events after the reporting date of a material

nature.

12. Approval of interim financial statements

The condensed interim financial statements were approved by the

Board of Directors on 29 July 2020.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR KKCBPPBKDPOB

(END) Dow Jones Newswires

July 30, 2020 02:00 ET (06:00 GMT)

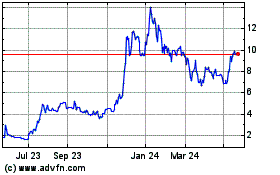

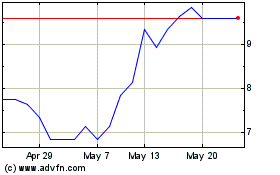

Empire Metals (AQSE:EEE.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Empire Metals (AQSE:EEE.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024