TIDMDXSP

DXS INTERNATIONAL PLC

(AQSE: DXSP)

HALF YEAR RESULTS

DXS International plc ("DXS" or the "Company"), the digital clinical

decision support company, is pleased to provide shareholders with its

unaudited interim results for the half year ending 31 October 2020.

Financial Highlights

-- Revenue for the six month period has increased marginally by 3% to

GBP1,716,423 (2019: GBP1,664,957);

-- Profit before tax is up by 68% to GBP150,556 (2019: GBP89,824) and profit

after tax up by 11% to GBP224,825 (2019: GBP202,018).

-- Overall revenue has held up well and the Company continues to maintain a

healthy balance sheet with GBP1.2 million in cash at the period end and

continues to trade profitably.

While the ongoing COVID situation continues to slow down the planned

market launches of our new solutions we are persevering with initiating

pilots and initial responses from GPs remain positive and enthusiastic.

From an operational perspective we are pleased to announce the following

important milestones.

Operational Highlights

-- To qualify for NHS GP IT Futures accreditation our hypertension solution

(ExpertCare) is classified as a medical device and therefore requires

certification within the UK and EU. We are pleased to announce that the

Hypertension Expert Solution is now CE accredited.

-- The company also attained ISO accreditation at three ISO standards:

-- ISO27001:2013 - Information Security Management.

-- ISO22301:2019 - Business Continuity Management.

-- ISO20000-1:2018 - Information Technology Service Management.

-- Progress with planned ExpertCare hypertension solution pilots with 37 GP

practices having indicated a willingness to participate with a number at

varying stages of progress.

As an accredited Supplier to the NHS we are required to migrate our DXS

Point of Care solution to a web--based system. We are currently

accelerating this process which, once complete, will provide additional

benefits to the business including the ability to scale more rapidly and

reduce support and maintenance costs. It will also enable enhanced

functionality for our customers thereby moving the solution to new

levels and revenue streams. This project is significant and will be

completed in a phased approach over the next 12 to 18 months.

David Immelman, Chief Executive Officer, commented:

I am extremely proud of our staff who have continued to mostly work from

home while maintaining excellent levels of service for our customers and,

when required, pivoting to adapt during these unusual times. We expect

our GP practice clients to remain busy with the planned vaccination

program over the coming months and hope that the situation should begin

to normalise towards March/April 2021.

INTERIM RESULTS to 31 OCTOBER 2020

CONSOLIDATED INCOME STATEMENT

for the six month period ended 31 October 2020

Unaudited Group Unaudited Audited

6 Months ended 6 Months ended Year to

31 Oct 2020 31 Oct 2019 30 April 2020

GBP GBP GBP

Turnover 1,716,424 1,664,957 3,279,787

Cost of Sales (177,367) (169,081) (318,424)

_________ _________ _________

Gross Profit 1,539,057 1,495,876 2,961,363

Administrative Costs (1,064,034) (1,113,939) (2,085,776)

Depreciation and

Amortisation (302,623) (257,637) (571,562)

_________ _________ _________

Operating Profit 172,398 124,300 304,025

Interest received and

similar income - 4,397 4,398

Interest payable and

similar charges (21,842) (38,873) (69,116)

_________ _________ _________

Profit on ordinary

activities before taxation 150,556 89,824 239,307

Tax on profit on ordinary

activities 74,269 112,194 189,195

_________ _________ _________

Profit / (Loss) for

the period 224,825 202,018 428,502

========= ========= =========

Profit per share

- basic 0.5p 0.6p 1.1p

- fully diluted 0.5p 0.5p 1.1p

========= ========= =========

STATEMENT of FINANCIAL POSITION

as at 31 October 2020

Unaudited Unaudited Audited

Group at Group at Group at

31 Oct 2020 31 Oct 2019 30 April 2020

GBP GBP GBP

Fixed Assets

Intangible Assets 4,273,801 3,855,025 4,007,411

Tangible Assets 1,680 2,196 1,105

_________ _________ _________

4,275,481 3,857,221 4,008,516

_________ _________ _________

Current assets

Debtors Amounts falling due

within one year 283,515 360,861 759,405

Cash at bank and in hand 1,207,205 134,249 1,010,645

_________ _________ _________

1,490,820 495,110 1,770,050

Creditors: amounts falling

due within one year (845,059) (766,043) (1,180,704)

_________ _________ _________

Net current assets /

(liabilities) 645,761 (270,933) 589,346

_________ _________ _________

Total assets less current

liabilities 4,921,242 3,586,288 4,597,862

Creditors: amounts falling

due after more than one year (563,580) (458,071) (376,289)

Deferred income (482,358) (642,619) (571,094)

_________ _________ _________

3,875,304 2,485,598 3,650,479

========= ========= =========

Capital and reserves

Called up share capital 159,246 117,419 159,246

Share Premium 2,676,321 1,790,979 2,676,321

Share option reserve 173,808 162,580 173,808

Retained earnings 865,929 414,620 641,104

_________ _________ _________

Shareholders' Funds 3,875,304 2,485,598 3,650,479

========= ========= =========

STATEMENT of CASH FLOWS

Six months ended 31 October 2020

Unaudited Unaudited

Group Group Audited Group

Six months ended Six months ended year ended

31 Oct 2020 31 Oct 2019 30 April 2020

GBP GBP GBP

Cash flow from operating

activities 435,895 259,430 777,709

Interest paid (21,842) (38,873) (69,116)

Interest received - 4,397 4,398

R&D tax credit 186,269 257,194 257,195

_________ _________ _________

Net Cash flow from operating

activities 600,322 482,148 970,186

_________ _________ _________

Cash flow from investing

activities

Payments to acquire intangible

fixed assets (568,259) (438,657) (904,503

Payments to acquire tangible

fixed assets (1,329) - -

Disposal of tangible fixed

assets - - 626

_________ _________ _________

(569,588) (438,657) (903,877)

_________ _________ _________

Financing activities

Net Proceeds on issue of

shares - 40,000 978,397

Repayment of long term loans (24,074) (4,484) (89,303)

Advance of long term loans 190,000 - -

_________ _________ _________

165,926 35,516 889,094

_________ _________ _________

Net increase in cash and

cash equivalent 196,660 79,007 955,403

Cash and Cash equivalents

at 1 May 2020 1,010,645 55,242 55,242

_________ _________ _________

Cash and Cash equivalents

at 3 October 2020 1,207,305 134,249 1,010,645

========= ========= =========

Cash and Cash equivalents

consists of:

Cash at bank and in hand 1,207,305 134,249 1,010,645

========= ========= =========

Net Debt Reconciliation

Current Non Current

Debt Debt Cash Total

GBP GBP GBP GBP

At 30 April 2019 (665,212) (464,951) 55,242 (1,074.921)

Cash flow 244,440 89,203 955,403 1,289,146

Transfer from Current to

Non Current Debt 641 (641) - -

_________ _________ _________ _________

At 30 April 2020 (420,131) (376,289) 1,010,645 214,225

Cash flow 360,351 (187,291) 196,660 369,720

Transfer from Current to

Non Current Debt - - - -

_________ _________ _________ _________

At 31 October 2020 (59,780) (563,580) 1,207,305 583,945

========= ========= ========= =========

The above figures have not been reviewed by the company's auditors Crowe

U.K. LLP.

The Directors of DXS International plc accept responsibility for this

announcement

Contacts:

David Immelman (Chief Executive) 01252 719800

DXS International plc david@dxs-systems.com

https://www.dxs-systems.co.uk

Corporate Advisor

City & Merchant

David Papworth 020 7101 7676

Corporate Broker

Hybridan LLP

Claire Louise Noyce 020 3764 2341

Notes to Editors

About DXS:

DXS International presents up to date treatment guidelines and

recommendations, from Clinical Commissioning Groups and other trusted

NHS sources, to doctors, nurses and pharmacists in their workflow and

during the patient consultation. This effective clinical decision

support ultimately translates to improved healthcare outcomes delivered

more cost effectively and which should significantly contribute towards

the NHS achieving its projected efficiency savings.

(END) Dow Jones Newswires

November 26, 2020 02:00 ET (07:00 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

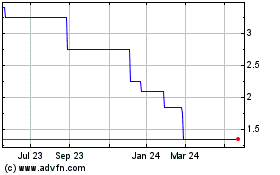

DXS (AQSE:DXSP)

Historical Stock Chart

From Jun 2024 to Jul 2024

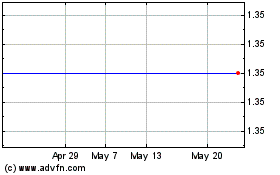

DXS (AQSE:DXSP)

Historical Stock Chart

From Jul 2023 to Jul 2024