TIDMCCT

RNS Number : 9162Z

Character Group PLC

28 January 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN OR INTO, THE UNITED STATES OF AMERICA (INCLUDING ITS

TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED STATES AND THE

DISTRICT OF COLUMBIA), AUSTRALIA, CANADA, JAPAN, NEW ZEALAND, THE

REPUBLIC OF SOUTH AFRICA.

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law pursuant to the Market Abuse

(Amendment) (EU Exit) regulations (SI 2019/310) ("MAR"), and is

disclosed in accordance with the Company's obligations under

Article 17 of MAR. Upon the publication of this announcement via

the Regulatory Information Service, this inside information is now

considered to be in the public domain.

THE CHARACTER GROUP PLC

("Character", the "Company" or "Group")

Designers, developers and international distributor of toys,

games and giftware

Tender Offer for up to 2,142,572 Ordinary Shares at 630 pence

per Ordinary Share

London: Friday, 28 January 2022

A circular explaining the terms of a Tender Offer for up to

2,142,572 Ordinary Shares at 630 pence per Ordinary Share (the

"Circular") will today be posted to Shareholders and published on

the Company's website at www.thecharacter.com.

Capitalised terms and expressions shall have the same meanings

as those attributed to them in the Circular.

1. Introduction

The Company intends to return up to approximately GBP13.5

million of cash to Qualifying Shareholders by way of the Tender

Offer and the subsequent repurchase from Panmure Gordon of the

Ordinary Shares successfully tendered. The Tender Offer will be

conducted at the Tender Price. If the maximum number of Ordinary

Shares under the Tender Offer is acquired, this would result in the

purchase of approximately 10 per cent. of the Company's current

issued share capital (excluding Ordinary Shares held in

treasury).

The Tender Offer will be conducted at a fixed price of 630 pence

per Ordinary Shares ("Tender Price"), which represents a premium of

approximately 8.4 per cent. to the average middle market closing

price of an Ordinary Share for the 60 trading days ended 27 January

2022, being the latest practicable date prior to the date of this

announcement.

The Company is authorised to buy back up to 3,200,000 Ordinary

Shares pursuant to the general authority for the Company to make

market acquisitions, including by way of a tender offer, which was

approved by Shareholders on 21 January 2022, since when the Company

has not acquired any Ordinary Shares.

2. Background to and reasons for the Tender Offer

The Company has pursued an active buyback strategy to return

surplus cash to Shareholders since 2004 and, since that time, has

acquired a total of approximately 39.6 million Ordinary Shares,

representing approximately 185 per cent. of the current issued

Ordinary Share capital (excluding Ordinary Shares held in

treasury). However, following the implementation of the EU's Market

Abuse Regulation in the UK from July 2016, the Company's ability to

sustain this strategy has been extremely limited and no buybacks

have been effected by the Company since October 2019.

On 29 April 2021, the Company announced that the Board had

resolved to pursue a new buyback initiative to purchase Ordinary

Shares. In an update issued by the Company on 30 September 2021,

the Board stated, due to adverse trading conditions, that a tender

offer would be deferred until after the announcement of the Group's

preliminary results for the financial year ended 31 August 2021.

Those preliminary results were announced by the Company on 15

December 2021. It is against this background that the Tender Offer

is now being made.

Current trading

On 21 January 2022, the Company provided the following update on

trading for the four months ending 31 December 2021:

"The Group maintained a steady performance in the lead up to and

through the Christmas 2021 period, notwithstanding global

logistical challenges which continue to impact the export of

product from the Far East to UK and our global markets. Whilst the

consequent escalation in freight rates from the Far East has

significantly increased costs, the Group has endeavoured, where

possible, to raise its prices in the UK and Scandinavia to mitigate

the impact on margins. Turnover increased by c.23% in the

four-month period ended 31 December 2021 compared to the previous

year (in part benefiting from delayed shipments in August 2021).

The bulk of this growth was attributable to sales to the USA and

Scandinavia, whilst turnover in the UK and the rest of the world

remained largely flat.

"Our sales levels are a reflection of the strong portfolio of

brands and products that we have at this time. In the UK, retailers

have reported good sell through of our products and this bodes well

for the rest of the financial year. Our teams are excited to be

presenting to our customers at the London Toy Fair at Olympia next

week (25 - 27 January) and showcasing the 2022 range and

introducing new products, brands and refreshed items.

"Assuming no further worsening of the trading conditions,

including adverse COVID developments impacting normal commercial

activity, the Board believes that the Group will achieve current

market expectations* for the year ending 31 August 2022.

"Subject to the share buyback authority being renewed at the

Annual General Meeting later today, the Company will be proceeding

with the tender offer proposed last year and full details of the

size, pricing and exact timing of the offer are expected to be

announced next week.

Note: *Current market consensus compiled by the Company for the

year ending 31 August 2022, prior to the release of this

announcement, is an underlying profit before tax averaging c.

GBP11.275m "

The ongoing cash-generative nature of the Group's business model

has resulted in the Group's cash balances as at 26 January 2022

standing at approximately GBP27 million. This strong cash

generation is anticipated to continue through and beyond the

current financial year. Taking account of the Group's future

working capital expenditure, the funding of the potential future

growth requirements of the business and to ensure the Company's

ability to maintain a progressive dividend, the Board has estimated

the surplus cash in the business to be at least GBP15.0 million.

The Board maintains that a buyback by way of a tender offer

provides the most efficient use of the Company's surplus cash at

this point in time and a means by which to re-establish a clear and

meaningful buyback strategy. Accordingly, the Board has resolved to

seek to return up to approximately GBP13.5 million to Qualifying

Shareholders under the Tender Offer.

3. Benefits of the Tender Offer

The benefits of the Tender Offer, compared to other available

options for a return of surplus cash to Shareholders, are that the

Tender Offer:

-- provides those Qualifying Shareholders who wish to sell

Ordinary Shares with the opportunity to do so;

-- allows the Company to broaden the return of cash to include

those Qualifying Shareholders whose Ordinary Shares might

not otherwise be purchased by the Company through a buy-back

in the market;

-- enables Qualifying Shareholders to decide whether to tender

none, some or all of their Ordinary Shares within the

overall limits of the Tender Offer;

-- enables those Qualifying Shareholders who do not wish

to receive capital at this time to maintain their full

investment in the Company;

-- enables Ordinary Shares to be sold free of commissions

or charges that would otherwise be payable if Qualifying

Shareholders were to sell their shares through their broker;

and

-- enhances earnings per share in respect of Ordinary Shares

and the percentage holdings of Ordinary Shares of Shareholders

not tendered under the Tender Offer.

4. Summary information on the Tender Offer

Structure of the Tender Offer

The Tender Offer will be implemented on the basis of Panmure

Gordon acquiring, as principal, the successfully tendered Ordinary

Shares at the Tender Price. The Company will purchase such Ordinary

Shares from Panmure Gordon at the same price under the Repurchase

Agreement. The Company will cancel the Ordinary Shares purchased by

it under the Repurchase Agreement.

Up to 2,142,572 Ordinary Shares will be purchased under the

Tender Offer, representing approximately 10 per cent. of the

Company's issued Ordinary Share capital (excluding Ordinary Shares

held in treasury) as at 27 January 2022, the latest practicable

date for such determination prior to this announcement, for a

maximum aggregate consideration of approximately GBP13.5

million.

The Tender Offer is conditional on receipt of valid tenders in

respect of at least 476,191 Ordinary Shares, representing an

aggregate value, at the Tender Price, of not less than GBP3.0

million.

Qualifying Shareholders can decide whether they want to tender

all, some or none of their Ordinary Shares in the Tender Offer.

The Tender Offer is being made available to all Qualifying

Shareholders who are on the Register at 6.00 p.m. on the Record

Date.

The Tender Offer will close at 1.00 p.m. (UK time) on 11

February 2022 and tenders received after that time will not be

accepted (unless the Tender Offer is extended).

The Tender Price

A tender price of 630 pence per Ordinary Share will be applied

to all Ordinary Shares purchased by Panmure Gordon pursuant to the

Tender Offer.

The Tender Price will allow Panmure Gordon to purchase the

maximum number of Ordinary Shares for a total cost not exceeding

GBP13,498,203.60 or, if the aggregate price of all Ordinary Shares

validly tendered by Qualifying Shareholders is less than

GBP13,498,203.60, all of the Ordinary Shares validly tendered

pursuant to the Tender Offer.

Number of Ordinary Shares to be purchased and scaling-back

Under the Tender Offer, each Qualifying Shareholder is entitled

to tender up to 10 per cent. of his or her shareholding to be

purchased by Panmure Gordon at the Tender Price (being their Basic

Entitlement).

Each Qualifying Shareholder's Basic Entitlement will be

calculated by the Registrars as at the Record Date by reference to

the Qualifying Shareholder's holding of Ordinary Shares as at that

date.

In addition, Qualifying Shareholders are entitled to make an

application to tender in excess of their Basic Entitlements. The

extent to which excess applications can be accepted will depend on

the number of Ordinary Shares tendered by other Qualifying

Shareholders.

Provided the conditions in paragraph 2.1 of Part III of the

Circular are met, if the aggregate value at the Tender Price of all

validly tendered Ordinary Shares is less than approximately GBP13.5

million (and not less than GBP3.0 million), then all Ordinary

Shares validly tendered (including applications in excess of Basic

Entitlements) will be purchased at the Tender Price.

If the number of Ordinary Shares validly tendered by

Shareholders is more than 2,142,572, tenders will be accepted in

the order set out below:

a) all Ordinary Shares tendered by Qualifying Shareholders

up to their Basic Entitlement will be accepted in full;

and

b) tenders of Ordinary Shares in excess of the Qualifying

Shareholders' Basic Entitlements will be satisfied

pro rata in proportion to the amount tendered in excess

of Basic Entitlements (rounded down to the nearest

whole number of Ordinary Shares) or otherwise at the

discretion of the Board, in agreement with Panmure

Gordon.

For the avoidance of doubt, the number of Ordinary Shares to be

purchased in the Tender Offer will not, in any event, exceed

2,142,572 Ordinary Shares.

Once lodged (in the case of a Tender Form) or settled (in the

case of a TTE Instruction) such Tender shall be irrevocable.

Ordinary Shares will be purchased pursuant to the Tender Offer

on or about 14 February 2022.

Successfully tendered Ordinary Shares will be purchased free of

commission and dealing charges.

Any Ordinary Shares repurchased by the Company from Panmure

Gordon following the purchase by Panmure Gordon will be cancelled.

Any rights of Ordinary Shareholders who do not tender their

Ordinary Shares will be unaffected.

Subject to any applicable rules and regulations, the Company

reserves the right at any time prior to the announcement of the

results of the Tender Offer, and with the prior consent of Panmure

Gordon, to extend the period during which the Tender Offer is open,

based on market conditions and/or other factors.

Basic Entitlement

Tenders in respect of up to approximately 10 per cent. of each

holding of Ordinary Shares of every Qualifying Shareholder on the

Record Date will be accepted in full at the Tender Price and will

not be scaled down, provided that such Ordinary Shares are validly

tendered. This percentage is known as the "Basic Entitlement".

Qualifying Shareholders may tender Ordinary Shares in excess of

their Basic Entitlement. However, if the Tender Offer is

oversubscribed, the tender of such excess Ordinary Shares will only

be successful to the extent that other Qualifying Shareholders have

tendered less than their Basic Entitlement and may be subject to

the scaling-back arrangements described above.

Circumstances in which the Tender Offer may not proceed

The Tender Offer is conditional on, among other things, receipt

of valid tenders in respect of Ordinary Shares to a value at the

Tender Price of not less than GBP3.0 million, by 1.00 p.m. (UK

time) on the Closing Date and the other conditions specified in

Part III of the Circular.

The Tender Offer is also conditional on no material adverse

change or certain other force majeure events arising prior to the

closing of the Tender Offer. Further details of these Conditions

are set out in Part III of the Circular.

Full terms and conditions of the Tender Offer are set out in

Part III of the Circular, which Shareholders are recommended to

read in full.

5. Repurchase Agreement

The Repurchase Agreement between the Company and Panmure Gordon

is dated 28 January 2022. Under this agreement, the parties agree

that, subject to the sum of GBP13,498,203.60 (equal to the Tender

Price multiplied by the maximum number of Ordinary Shares that

could be repurchased under the Tender Offer) being deposited by the

Company into a client account of Panmure Gordon by no later than

5.00 p.m. on 31 January 2022 or such later time and/or date as may

be agreed by Panmure Gordon and the Tender Offer becoming

unconditional in all respects and not lapsing or terminating in

accordance with its terms, Panmure Gordon shall, as principal,

purchase, "On Exchange", at the Tender Price, Ordinary Shares

successfully tendered to it, up to a maximum aggregate Tender Price

of GBP13,498,203.60.

The Company has agreed that, immediately following the purchase

by Panmure Gordon of all Ordinary Shares which it has agreed to

purchase as principal under the terms of the Tender Offer, the

Company will purchase from Panmure Gordon all such Ordinary Shares

at a price per Ordinary Share equal to the Tender Price. All

transactions will be carried out on the London Stock Exchange.

Under the Repurchase Agreement, the Company has agreed to cancel

any Ordinary Shares purchased by it under the Tender Offer

arrangements.

The Repurchase Agreement contains certain representations,

warranties and undertakings from Panmure Gordon in favour of the

Company concerning its authority to enter into the Repurchase

Agreement and to make the purchase of Ordinary Shares pursuant

thereto.

The Repurchase Agreement also contains representations,

warranties and undertakings from the Company in favour of Panmure

Gordon and incorporates an indemnity in favour of Panmure Gordon in

respect of any liability which it may suffer in relation to its

performance under the Tender Offer which is not due to its own

neglect or default.

6. Dividends

Successfully tendered Ordinary Shares will be cancelled and will

not rank for any future dividends. However, the right of

Shareholders, recorded on the Register on 14 January 2022, to

receive and be paid the final dividend declared at the Annual

General Meeting on 21 January 2022 will not be affected by

acceptance of the Tender Offer.

7. Overseas Shareholders

The attention of Qualifying Shareholders who are citizens,

residents or nationals of countries outside the UK wishing to

participate in the Tender Offer is drawn to paragraph 6 entitled

"Overseas Shareholders" in Part III of the Circular.

8. Taxation

Qualifying Shareholders should be aware that there may be tax

considerations that they should take into account when deciding

whether or not and/or the extent to which to participate in the

Tender Offer. A summary of the taxation consequences of the Tender

Offer for UK resident Shareholders is set out in Part IV of the

Circular. It should be noted that this tax summary is merely a

guide to current tax law and practice in the UK. Shareholders are

advised to consult their own professional advisers regarding their

own tax position.

9. Directors' Interests

The interests (all of which are beneficial unless stated

otherwise) of the Directors and of persons connected with them

(within the meaning of Section 252 of the 2006 Act) in the issued

ordinary share capital of the Company and the existence of which is

known to, or could with reasonable due diligence be ascertained by,

any Director as at the date of this announcement are as

follows:

Name Position Number of Percentage

Ordinary of

Shares issued share

capital

Joint Managing Director and

Kiran Shah(1) Group Finance Director 2,176,478 10.16%

------------------------------- ---------- --------------

Jon Diver(2) Joint Managing Director 1,428,248 6.67%

------------------------------- ---------- --------------

Managing Director - Character

Joseph Kissane Options Limited 518,757 2.42%

------------------------------- ---------- --------------

Richard King Non-Executive Chairman 336,286 1.57%

------------------------------- ---------- --------------

Managing Director- Far East

Michael Hyde Operations 268,888 1.25%

------------------------------- ---------- --------------

Jeremiah Healy(3) Group Marketing Director 73,000 0.34%

------------------------------- ---------- --------------

David Harris(4) Non-Executive Director 68,183 0.32%

------------------------------- ---------- --------------

Clive Crouch Non-Executive Director 15,358 0.07%

------------------------------- ---------- --------------

Carmel Warren Non-Executive Director nil nil

------------------------------- ---------- --------------

Notes:

(1) Mr Shah's interests comprise 176,478 Ordinary Shares held

personally by Mr Shah and 2,000,000 Ordinary Shares held by

Sarissa Holdings Limited.

(2) Mr Diver's interests comprise 876,381 Ordinary Shares held

personally by Mr Diver and 551,867 Ordinary Shares held by

Mr Diver's Self Invested Pension Plan.

(3) Mr Healy's interests comprise 16,000 Ordinary Shares held

personally by Mr Healy, 5,000 Ordinary Shares held by Mr Healy's

Self Invested Pension Plan, and 52,000 Ordinary Shares held

by Mr Healy's wife, Kathleen Ann Healy.

(4) Mr Harris's interests comprise 16,780 Ordinary Shares held

personally by Mr Harris and 51,403 Ordinary Shares held by

Mr Harris's Self Invested Pension Plan.

10. Intentions of the Directors in relation to the Tender Offer

The Directors are currently interested, in aggregate, in

4,885,198 Ordinary Shares, representing approximately 22.80 per

cent. of the issued Ordinary Share capital of the Company

(excluding Ordinary Shares held in treasury). The Directors have

indicated their intention to tender their Ordinary Shares (directly

or through their connected parties) as follows:

Name Applications to tender Applications in excess of

Basic Entitlement Basic Entitlement

(Ordinary Shares) (Ordinary Shares)

Kiran Shah 217,647 217,647

----------------------- --------------------------

Jon Diver 142,824 142,824

----------------------- --------------------------

Joseph Kissane 51,875 51,875

----------------------- --------------------------

Richard King 33,628 33,628

----------------------- --------------------------

Michael Hyde 26,888 26,888

----------------------- --------------------------

Jeremiah Healy 7,300 7,300

----------------------- --------------------------

David Harris 6,818 6,818

----------------------- --------------------------

Clive Crouch 1,535 1,535

----------------------- --------------------------

Carmel Warren nil nil

----------------------- --------------------------

Total 488,515 488,515

----------------------- --------------------------

Excess tenders by the Directors will be subject to the

scaling-back arrangement described in paragraph 4 above.

Assuming the maximum number of Ordinary Shares under the Tender

Offer is purchased and that the Directors' tenders (including

excess tenders) are satisfied in full, the Directors, following

completion of the Tender Offer, will be interested, in aggregate,

in 3,908,168 Ordinary Shares, representing approximately 20.27 per

cent. of the issued Ordinary Share capital of the Company

(excluding Ordinary Shares held in treasury).

11. Recommendation

The Directors are making no recommendation to Qualifying

Shareholders in relation to participation in the Tender Offer

itself. Whether or not Qualifying Shareholders decide to tender

their Ordinary Shares will depend, amongst other things, on their

view of the Company's prospects and on their own individual

circumstances (including their own tax position).

If Shareholders are in any doubt as to the action they should

take, they are recommended to seek their own independent

advice.

12. Expected Timetable of Events

The expected timetable for the Tender Offer is as follows:

Announcement of the Tender Offer 28 January 2022

Tender Offer opens 28 January 2022

-------------------------

Latest time and date for receipt of Tender Forms 1.00 p.m. on 11 February

or for settlement of TTE Instructions in respect 2022

of the Tender Offer

-------------------------

Record Date for the Tender Offer 6.00 p.m. on 11 February

2022

-------------------------

Announcement of the results of the Tender Offer 14 February 2022

-------------------------

Cheques despatched and CREST accounts credited On or before 21 February

with proceeds in respect of successfully tendered 2022

Ordinary Shares

-------------------------

CREST accounts credited with uncertificated On or before 21 February

Ordinary Shares unsuccessfully tendered and 2022

despatch of balance share certificates for unsold

certificated Ordinary Shares (if applicable)

-------------------------

Notes:

1. The above times and/or dates are indicative only and may change.

If any of the above times and/or dates change, the revised

times and/or dates will be notified by announcement through

a Regulatory Information Service.

2. All references to times in this announcement are to London

times unless otherwise stated.

Capitalised terms and expressions shall have the same meanings

as those attributed to them in the Circular.

A copy of the Circular will shortly be available for download

from the Company's website www.thecharacter.com.

The Character Group plc

FTSE sector : leisure goods:

FTSE AIM All-share: symbol: CCT

Market cap : GBP131.7m

Email: info@charactergroup.plc.uk

Group website: www.thecharacter.com

Product ranges can also be viewed at

www.character-online.co.uk

CHARACTER GROUP PLC CCT Stock | London Stock Exchange

Enquiries to:

The Character Group plc

Jon Diver, Joint Managing Director

Kiran Shah, Joint Managing Director & Group Finance Director

Office: +44 (0) 208 329 3377

Mobile: +44 (0) 7831 802219 (JD)

Mobile: +44 (0) 7956 278522 (KS)

Panmure Gordon (Nominated Adviser and Joint Broker)

Atholl Tweedie, Corporate Finance

Charles Leigh-Pemberton, Corporate Broking

Rupert Dearden, Corporate Broking

Tel: +44 (0) 20 7886 2500

Allenby Capital Limited (Joint Broker)

Nick Athanas, Corporate Finance

Amrit Nahal, Sales & Corporate Broking

Tel: +44 (0) 20 3328 5656

TooleyStreet Communications Limited (Investor and media relations)

Fiona Tooley

Tel: +44 (0) 7785 703523

Email: fiona@tooleystreet.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TENUBUORUOUAUUR

(END) Dow Jones Newswires

January 28, 2022 02:00 ET (07:00 GMT)

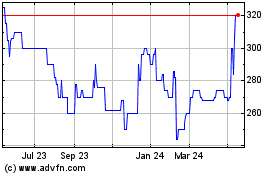

Character (AQSE:CCT.GB)

Historical Stock Chart

From Dec 2024 to Jan 2025

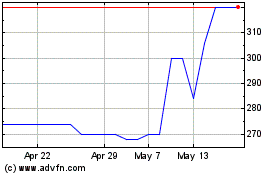

Character (AQSE:CCT.GB)

Historical Stock Chart

From Jan 2024 to Jan 2025