TIDMBZT

RNS Number : 4558N

Bezant Resources PLC

30 September 2021

30 September 2021

Bezant Resources Plc

("Bezant" or the "Company")

Interim Results for the Six Months Ended 30 June 2021

Bezant (AIM: BZT), the copper-gold exploration and development

company, announces its unaudited interim results for the six months

ended 30 June 2021.

Chairman's Statement

Dear Shareholder,

The first half of 2021 has been one of consolidation and a

further acquisition for Bezant in Southern Africa where we now have

projects in Zambia, Namibia and Botswana.

Financial highlights:

-- GBP486K loss after tax (2020: GBP261K)

-- Approximately GBP407K cash at bank at the period end (31 December 2020: GBP1,128K).

Operational and corporate events in six months to 30 June 2021

:

Copper and Gold Strategy: The period under review has been very

active in our mission to drive the company towards copper and gold,

with a view to establish new positions, consolidating current

positions and monetarising legacy positions.

Battery Metals Opportunity: In early February using our

connections in Southern Africa we acquired several licences for

manganese in the Kanye area of southern Botswana. High grade

manganese is forecasted to play a significant role in the storage

battery space. Whilst manganese is in relatively good supply, the

availability of high-grade manganese gives the Kanye Project a

decisive edge against other manganese projects. This project

provides an opportunity in the battery metal and storage new age

metal arena in a part of the world we know well.

Kalengwa Project in Zambia: During the period we drill tested

and geophysically tested several targets in the Zambian Kalengwa

copper licence area. The results in general were encouraging and we

have discovered an anomaly, which appears to have geological

signature similar to the high-grade open pit worked in the

1970s.

Hope Copper Gold Project In Namibia : We continued with our

efforts to further understand the open Gorob deposit and the

Matchless Copper Belt. We had in the latter part of 2020 drilled

the Gorob mine to test our theory that gold was present, when

previously it was unreported. We were pleased to report, that gold

was discovered, complementary to high grade copper, thus destroying

the myth that only the Hope area had gold values. We reported in

June that we had completed our helicopter-bourne survey of the

Matchless Copper Belt, which is over 130 km long and had identified

up to 8 potential drill targets based on the initial review.

Particularly encouraging is a cluster of anomalies nearby open

Gorob-Vendome projects, which provides encouragement for resource

expansion. As announced on 29 September 2021 we intend to drill

test these anomalies during the last quarter of 2021.

Mankayan Project in the Philippines: On the 28(th) of April 2021

we announced that we had terminated our transaction agreement with

MMIH for continuing exploration and potential development of the

Mankayan copper/gold project in the Philippines. Post balance sheet

on 13 September 2021 we announced that we have entered into a

conditional agreement with IDM Mankayan Pty Ltd (IDM) Australia to

take the Mankayan project forward. The new company is likely to be

listed on the Australian Stock Exchange and we believe that this

monetarising event will potentially add value to our project, since

we are working with a competent group well experienced in the

region.

Other prospects and outlook:

Caerus copper gold projects in Cyprus: Post balance sheet on 2

August 2021 we entered into an agreement with Caerus Mineral

Resources Plc ("Caerus") for exploration and possible development

of a number of copper/gold licences in Cyprus. We recently attended

a review meeting in Cyprus with Caerus and have selected the

initial targets for an exploration programme, which has already

commenced. We are extremely excited about the potential of this

joint venture and currently are establishing all the structural

components for the proposed joint venture to proceed on the chosen

projects and potential other projects.

Market Outlook: During the period the copper price has been

volatile, but generally very positive and the consensus for the

short term is that copper prices will gain momentum in 2022 and

beyond. We firmly believe that our copper initiatives are timeous,

well located and have the propensity for serious shareholder value

enhancement.

Eureka Project in Argentina: We maintain our Eureka Project in

good standing, but COVID-19 restrictions have delayed previous

plans to attempt to work the project either alone or in

collaboration or joint venture has a route to monetarising the

project. The effects of COVID-19 have not affected any of the other

of our operations and we remain optimistic that this will remain to

be the case.

We look forward to adding value to all of projects during the

second half and will keep shareholders fully advised of our

progress in this exciting new age metal arena.

Colin Bird

Executive Chairman

30 September 2021

For further information, please contact :

Bezant Resources plc

Colin Bird +44 (0) 20 3416 3695

Executive Chairman

Beaumont Cornish (Nominated Adviser) +44 (0) 20 7628 3396

Roland Cornish

Novum Securities Limited (Broker) Tel: +44 (0) 20 7399

Jon Belliss 9400

or visit http://www.bezantresources.com

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulation (EU) No. 596/2014.

Group Statement of Profit and Loss

For the six months ended 30 June 2021

Notes Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2021 2020

GBP'000 GBP'000

CONTINUING OPERATIONS

Group revenue - -

Cost of sales - -

------------ ------------

Gross profit - -

Operating expenses (350) (261)

Share based payments 4.1 (160) -

------------ ------------

Group operating loss (510) (261)

Interest income - -

Loss before taxation (510) (261)

Taxation - -

------------ ------------

Loss for the period (510) (261)

============ ============

Loss per share (pence)

Basic and diluted from continuing operations 4.2 (0.02) (0.02)

======= ========

Group Statement of Other Comprehensive Income

For the six months ended 30 June 2021

Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2021 2020

GBP'000 GBP'000

Other comprehensive income :

Loss for the period (510) (261)

Items that may be reclassified to profit

or loss:

Foreign currency reserve movement (1) 1

------------ ------------

Total comprehensive loss for the period (511) (260)

============ ============

Group S tatement of Changes in Equity

For the six months ended 30 June 2021

Share Share Retained Non-Controlling Total

Capital Premium Other Reserves(1) Losses interest Equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Unaudited - six months

ended 30 June 2021

Balance at 1 January

2021 2,049 39,125 1,523 (35,674) (12) 7,011

Current period loss - - - (510) - (510)

Foreign currency reserve - - (1) - - (1)

Total comprehensive

loss for the period - - (1) (510) - (511)

--------- --------- ------------------ --------- ---------------- ---------

Proceeds from shares -

issued - - - - -

Shares issued - Acquisitions 5 755 - - - 760

Warrants exercised 2 145 (51) 51 - 147

Share options granted - - 217 - - 217

--------- --------- ------------------ --------- ---------------- ---------

Balance at 30 June

2021 2,056 40,025 1,688 (36,133) (12) 7,624

========= ========= ================== ========= ================ =========

Unaudited - six months

ended 30 June 2020

Balance at 1 January

2020 2,003 36,429 840 (34,489) - 4,783

Current period loss - - - (261) - (261)

Foreign currency reserve - - 1 - - 1

Total comprehensive

loss for the period - - 1 (261) - (260)

------ ------- ---- --------- ---- ------

Proceeds from shares

issued 9 341 - - - 350

Share issue cost - (20) - - - (20)

Balance at 30 June

2020 2,012 36,750 841 (34,750) - 4,853

====== ======= ==== ========= ==== ======

(1) Other reserves is made up of the share-based payment and

foreign exchange reserve.

Group Balance Sheet

As at 30 June 2021

Unaudited Audited

30 31

June December

2021 2020

Notes GBP'000 GBP'000

ASSETS

Non-current assets

Plant and equipment 5 3 3

Investments 6 - -

Exploration and evaluation assets 8 7,554 6,405

---------- ----------

Total non-current assets 7,557 6,408

---------- ----------

Current assets

Trade and other receivables 47 28

Cash and cash equivalents 407 1,128

---------- ----------

Total current assets 454 1,156

----------

TOTAL ASSETS 8,011 7,564

----------

LIABILITIES

Current liabilities

Trade and other payables 387 553

Total current liabilities 387 553

---------- ----------

NET ASSETS 7,624 7,011

========== ==========

EQUITY

Share capital 9 2,056 2,049

Share premium 9 40,025 39,125

Share-based payment reserve 1,026 858

Foreign exchange reserve 662 665

Retained losses (36,133) (35,674)

---------- ----------

7,636 7,023

Non-controlling interests (12) (12)

---------- ----------

TOTAL EQUITY 7,624 7,011

========== ==========

Group Statement of Cash Flows

For the six months ended 30 June 2021

Unaudited Unaudited

Six months Six months

ended ended

30 June 30 June

2021 2020

Notes GBP'000 GBP'000

Net cash outflow from operating activities 10 (515) (271)

----------- -----------

Cash flows from/(used) in investing activities

Other income - 24

Deferred exploration expenditure (378) -

(378) 24

----------- -----------

Cash flows from financing activities

Proceeds from issuance of ordinary shares 148 330

----------- -----------

148 330

----------- -----------

Decrease in cash (745) 83

Cash and cash equivalents at beginning

of period 1,128 330

Foreign exchange movement 24 -

----------- -----------

Cash and cash equivalents at end of period 407 413

=========== ===========

Notes to the interim financial information

For the six months ended 30 June 2021

1. Basis of preparation

The unaudited interim financial information set out above,

which incorporates the financial information of the Company

and its subsidiary undertakings (the "Group"), has been prepared

using the historical cost convention and in accordance with

International Financial Reporting Standards ("IFRS"), including

IFRS 6 'Exploration for and Evaluation of Mineral Resources',

as adopted by the European Union ("EU") and with those parts

of the Companies Act 2006 applicable to companies reporting

under IFRS.

These interim results for the six months ended 30 June 2021

are unaudited and do not constitute statutory accounts as

defined in section 434 of the Companies Act 2006. The financial

statements for the year ended 31 December 2020 have been delivered

to the Registrar of Companies and the auditors' report on

those financial statements was unqualified and contained a

material uncertainty pertaining to going concern.

Going concern basis of accounting

The Group made a loss from all operations for the six months

ended 30 June 2021 after tax of GBP0.5 million (2020: GBP0.3

million), had negative cash flows from operations and is currently

not generating revenues. Cash and cash equivalents were GBP407,000

as at 30 June 2021. An operating loss is expected in the year

subsequent to the date of these accounts and as a result the

Company will need to raise funding to provide additional working

capital to finance its ongoing activities. Management has

successfully raised money in the past, but there is no guarantee

that adequate funds will be available when needed in the future.

The COVID-19 pandemic announced by the World Health Organization

on 20 January 2020 has had and may in the future have markedly

negative impacts on global stock markets, currencies and general

business activity. The Company has developed a policy and

is evolving procedures to address the health and wellbeing

of its directors, consultants and contractors, and their families,

in the face of the COVID-19 outbreak. The timing and extent

of the impact and recovery from COVID-19 is still unknown

but it may have an impact on activities and potentially a

post balance sheet date impact. Furthermore, the COVID-19

pandemic may adversely impact the ability of the Group to

raise the necessary funding.

Based on the Board's assessment that the Company will be able

to raise additional funds, as and when required, to meet its

working capital and capital expenditure requirements, the

Board have concluded that they have a reasonable expectation

that the Group can continue in operational existence for the

foreseeable future. For these reasons the Group continues

to adopt the going concern basis in preparing the annual report

and financial statements.

There is a material uncertainty related to the conditions

above that may cast significant doubt on the Group's ability

to continue as a going concern and therefore the Group may

be unable to realize its assets and discharge its liabilities

in the normal course of business.

The financial report does not include any adjustments relating

to the recoverability and classification of recorded asset

amounts or liabilities that might be necessary should the

entity not continue as a going concern.

2. Significant events

The World Health Organization declared coronavirus and COVID-19

a global health emergency on 30 January 2020 which is not

over and has had and may in the future have markedly negative

impacts on global stock markets, currencies and general business

activity. The directors have considered the impact of COVID-19

on the Group and do not believe that it has had a material

impact on carrying values and results during the reporting

period but given the timing and extent of the impact on recovery

from COVID-19 is unknown, it may have an impact on activities

of the company in the future.

3. Segment reporting

For the purposes of segmental information, the operations of

the Group are focused in geographical segments, namely the UK,

Argentina the Philippines, Namibia, Zambia and Botswana and comprise

one class of business: the exploration, evaluation and development

of mineral resources. The UK is used for the administration of

the Group.

The Group's loss before tax arose from its operations in the

UK, Argentina Namibia and Botswana.

For the six months

ended 30 June

2021 - unaudited

UK Argentina Philippines Namibia Zambia Botswana Total

GBP'000 GBP'000 GBP'000 GBP'000

Consolidated loss

before tax (437) (45) - (3) - (1) (486)

-------- ---------- ------------ -------- ------- --------- --------

Included in the

consolidated loss

before tax are

the following

income/(expense)

items:

Foreign currency

gain - - - -

Total Assets 430 5,581 - 1,792 208 8,011

Total Liabilities (357) (30) - (387)

-------- ---------- ------------ -------- ------- --------- --------

For the six months ended

30 June 2020 - unaudited

UK Argentina Philippines Total

GBP'000 GBP'000 GBP'000 GBP'000

Consolidated loss before

tax (228) (33) - (261)

-------- ---------- ------------ --------

Included in the consolidated

loss before tax are the

following income/(expense)

items:

Foreign currency gain - - - -

Total Assets 503 4,790 - 5,293

Total Liabilities (386) (54) - (440 )

-------- ---------- ------------ --------

4.1 Share based payments

6 months 6 months

ended 30 ended 30

June 2021 June 2020

GBP'000 GBP'000

Share option expense - Directors 115 -

Share option expense - Management 45 -

160 -

=========== ===========

4.2 Loss per share

The basic and diluted loss per share have been calculated using

the loss attributable to equity holders of the Company for the

six months ended 30 June 2021 of GBP510,000 (2020: GBP261,000).

The basic loss per share was calculated using a weighted average

number of shares in issue of 3,249,309,193 (2020: 1,503,488,058).

The weighted average number of shares in issue and to be issued

if calculating the diluted loss per share would amount to 3,540,171,693

(2020: 1,503,488,058).

The diluted loss per share and the basic loss per share are recorded

as the same amount, as conversion of share options decreases

the basic loss per share, thus being anti-dilutive.

5. Plant and equipment

Unaudited Audited

30 31

June December

2021 2020

GBP'000 GBP'000

5.1 Cost

Balance at beginning of period 67 68

Exchange differences - (1)

---------- ----------

At end of period 67 67

---------- ----------

5.2 Depreciation

Balance at beginning of period 64 64

Charge for the period - 1

Exchange differences - (1)

---------- ----------

At end of period 64 64

---------- ----------

Net book value at end of period 3 3

========== ==========

6. Investments

Unaudited Audited

30 31

June December

2021 2020

GBP'000 GBP'000

Investment in associates - -

Loan to associate 211 211

Impairment provision (211) (211)

---------- ----------

Total investments - -

========== ==========

The Mankayan project owned by Crescent Mining and Development

Corporation was fully impaired in 2016 due to then significant

lingering uncertainty concerning the political and tax environment

in the Philippines. Although the political and tax environment

has subsequently improved it was not considered prudent in the

2019 accounts to write back any of the provision made in prior

years.

In 2019, the Group sold 80% of its interest in the Mankayan copper-gold

project and derecognised its investment in its subsidiary, Asean

Copper Investments Limited and the loan balances outstanding

have been fully impaired.

On 28 April 2021 the Company announced that it had served notice

of termination of its transaction agreement (the "Transaction

Agreement") dated 4 October 2019 with Mining and Minerals Industries

Holding Pte. Ltd. ("MMIH"), a private company incorporated in

Singapore, with respect to the sale of 80 per cent. of the Company's

interest in the Mankayan copper -- gold project in the Philippines

(the "Mankayan Project") to MMJV Pte. Ltd. ("MMJV"), a 100 percent

subsidiary of MMIH, (the "Transaction") as MMIH has not met its

Total Funding Commitment as defined in the Transaction Agreement

and that the Company, would explore and pursue options including

the possibility of re -- positioning the Mankayan project within

the Company's portfolio of copper and gold assets but in the

meantime the previous provisions against the Company's investment

in the Mankayan Project writing it down to Nil have not been

written back.

As per Note 11 post the period end on 13 September 2021 the Company,

announced that it had entered into a conditional agreement with

IDM Mankayan Pty Ltd ("IDM"), a company incorporated in Australia,

to take the Mankayan Project in the Philippines forward (the

"IDM Agreement").

The project's MPSA was originally issued for a standard 25 year

period, which expires on 11 November 2021, and the current exploration

period under the MPSA, which is subject to certain work programme

commitments (the "Exploration Period Requirements"), was scheduled

to expire in April 2020 and was subsequently also extended to

11 November 2021.

7. Acquisition of subsidiaries

7.1 Acquisition of Metrock Resources Limited

Botswana

On 12 February 2021 the Company completed the acquisition of

100% of Metrock Resources Pty Ltd and its interest in the Kanye

Manganese Project.

The fair value of the assets and liabilities acquired were as

follows:

Unaudited

30

June

2021

GBP'000

Consideration

Equity consideration

- Ordinary shares (issued) 633

- Options 57

Cash consideration 13

----------

703

Net assets acquired (171)

Deemed fair value of exploration assets acquired 532

==========

8. Exploration and evaluation assets

Unaudited Audited

30 31

June December

2021 2020

GBP'000 GBP'000

Balance at beginning of period 6,405 4,778

Acquisitions during period

- Zambia - 131

- Botswana (Note 7.1) 532 -

- Namibia - 1,283

Exploration expenditure 617 218

Exchange differences (5)

Carried forward at end of period 7,554 6,405

========== ==========

Argentina

The amount of capitalised exploration and evaluation expenditure

relates to 12 licences comprising the Eureka Project and are

located in north-west Jujuy near to the Argentine border with

Bolivia and are formally known as Mina Eureka, Mina Eureka II,

Mina Gino I, Mina Gino II, Mina Mason I, Mina Mason II, Mina

Julio I, Mina Julio II, Mina Paul I, Mina Paul II, Mina Sur Eureka

and Mina Cabereria Sur, covering, in aggregate, an area in excess

of approximately 5,500 hectares and accessible via a series of

gravel roads. All licences remain valid and in May 2019 the Company

obtained a two-year renewal of its Environmental Impact Assessment

(EIA) approvals in respect of its Mina Eureka, Mina Gino I, Mina

Gino II, Mina Mason I, Mina Mason II, Mina Julio I, Mina Julio

II, Mina Paul I, Mina Paul II, being the 9 northern most licences

which are the intended focus of a future exploration programme

the Company is in the process of applying for the extension of

the validity period of the May 2019 EIA approvals.

Notwithstanding the absence of new exploration activities on-site

during the period the directors have assessed the value of the

intangible asset having considered any indicators of impairment,

and in their opinion, based on a review of the expiry dates of

licences, future expected availability of funds to develop the

Eureka Project and the intention to continue exploration and

evaluation, no impairment is necessary.

Namibia

On 14 August 2020 the Company completed the acquisition of 100%

of Virgo Resources Ltd and its interests in the Hope Copper-Gold

Project in Namibia. On 12 February 2021 further to its announcement

on 19 June 2020 that EPL 7170 which was under application when

the Company acquired Virgo Resources Ltd ("Virgo") the Company

announced that EPL 7170 has been granted and is now registered

in the name of the group's 80% owned subsidiary Hope Namibia

Mineral Exploration Pty Ltd Incorporated in Namibia ("Hope Namibia")

which also owns EPL 6605. The group also owns EPL 5796 through

its 70% owned subsidiary Hope and Gorob Mining Pty Ltd incorporated

in Namibia ("Hope and Gorob"). On 14 January 2021 and 2 June

2021 the Company announced positive results in relation to exploration

activities undertaken post acquisition which support the Company's

confidence in the Hope Copper-Gold Project. Post-acquisition

there have been no indications that any impairment provisions

are required in relation to the carrying value of the Hope Copper-Gold

Project.

Zambia

On 27 April 2020 the Company entered into a binding agreement

with KPZ International Limited ("KPZ Int") (the "KPZ Agreement")

in relation to the acquisition of a 30 per cent. interest in

the approximate 974 km(2) large scale exploration licence numbered

24401-HQ-LEL in the Kalengwa greater exploration area in The

Republic of Zambia (the "Licence") (the "Kalengwa Project") by

acquiring a 30 per cent. shareholding in KPZ Int. Under the terms

of the KPZ Agreement the Company has the right to appoint the

majority of directors to the Board of KPZ Int and has operational

control of the Kalengwa Project therefore in accordance with

IFRS 10 the Company's investment in KPZ Int has been consolidated.

The Licence is held by Kalengwa Processing Zone Ltd ("KPZ"),

a 100 per cent. (less one share) Zambian subsidiary of KPZ Int,

and is for the exploration of copper, cobalt, silver, gold and

certain other specified minerals. The Licence was granted on

2 April 2019 and is valid for an initial period up to 1 April

2023. Cash consideration for the acquisition was US$250,000 (LIR202,493)

which was settled on 6 November by the issue of 76,923,077 shares

and costs of GBP23,775. During the period on 12 April 2021 and

24 April 2021 and post the period end on 20 September 2021 the

Company announced results in relation to exploration activities

undertaken post acquisition which support the Company's confidence

in the Kalengwa Project. Post-acquisition there have been no

indications that any impairment provisions are required in relation

to the carrying value of the Kalengwa Project.

Botswana

On 12 February 2021 the Company further to its announcement on

22 December 2020 announced the completion of the acquisition

of 100% of Metrock Resources Ltd ("Metrock") and its manganese

mineral exploration licences in Southern Botswana comprising

the Kanye Manganese Project (the "Kanye Manganese Project").

The Kanye Manganese Project i) comprises a 4,043 sq km land package

with 125 km of potential on trend manganese mineralisation across

the licences ii) has historical trenching results have yielded

in the case on one prospect of between 53% and 74% manganese

oxide ("MnO"), and iii) project area is near the ground of a

TSX listed public company that has a preliminary economic assessment

showing high rates of return based on a MnO grade of 27.3.

On 24 June 2021 the Company announced it had completed reconnaissance

mapping, prospecting and sampling work on the Kanye Manganese

Project and that i) Up to four historic manganese occurrences

were successfully located and sampled in the field within an

8km-belt ii) 40 grab samples were obtained which assayed from

traces up to high-grade results of 67.18% MnO occurring at the

Moshaneng borrow pit and 68.01% MnO at the Mheelo prospect; iii)

the Mheelo prospect is located just 6km from the Giyani Metals

K-Hill manganese project where a feasibility study is due for

completion in Q3 2021 (April 2021 PEA indicates an 80% IRR) iv)

the Company plans to follow-up the main targets with clearance/trenching

by mechanical excavator to facilitate detailed mapping, prospecting

and more systematic sampling ; and confirmed targets will be

drill tested to define lateral and depth extent of deposits.

Note 7.1 provides details of the deemed fair value of the exploration

assets of GBP532,000 arising on the acquisition of Metrock. Post-acquisition

there have been no indications that any impairment provisions

are required in relation to the carrying value of the Kanye Manganese

Project.

9. Share capital

Unaudited Audited

30 31

June December

2021 2020

GBP'000 GBP'000

Number

Authorised (1)

5,000,000,000 ordinary shares of 0.002p

each 100 100

5,000,000,000 deferred shares of 0.198p

each 9,900 9,900

---------- ----------

10,000 10,000

========== ==========

Allotted ordinary shares, called up and

fully paid

As at beginning of the period 71 25

Share subscription - 24

Shares issued for exploration project acquisitions 5 12

Shares issued on exercise of warrants 2 10

Total ordinary shares at end of period 78 71

------ ------

Allotted deferred shares, called up and

fully paid

As at beginning of the period 1,978 1,978

Total deferred shares at end of period 1,978 1,978

Ordinary and deferred as at end of period 2,056 2,049

====== ======

Number of

Number of shares 31

shares 30 December

June 2021 2020

Ordinary share capital is summarised below:

As at beginning of the period 3,543,699,116 1,269,755,181

Share subscription - 1,218,750,000

Shares issued for exploration project acquisitions 304,064,999(2) 578,318,935(3)

Shares issued on exercise of warrants 92,187,500 476,874,500

As at end of period 3,939,951,615 3,543,699,116

================ ================

Deferred share capital is summarised below:

As at beginning of the period 998,773,038 998,773,038

As at end of period 998,773,038 998,773,038

================ ================

(1) On 24 May 2019, a resolution was passed at the Company's

Annual General Meeting to approve the reorganisation of the Company's

share capital pursuant to this resolution on 24 May 2019 share

capital of the Company was re-designated and sub-divided into

1 (one) new ordinary share of GBP0.00002 each ("Ordinary Shares")

and 1 (one) deferred share of GBP0.00198 each ("Deferred Shares").

The Ordinary Shares continue to carry the same rights (save for

the reduction in their nominal value) as the ordinary shares

in existence on 24 May 2019. The Deferred Shares have very limited

rights and are effectively valueless as they have no voting rights

and have no rights as to dividends and only very limited rights

on a return of capital. The Deferred Shares are not admitted

to trading or listed on any stock exchange and are not freely

transferable.

(2) The 304,064,999 shares issued during the period were detailed

in the Company's announcements' dated;

a) 12 February 2021 when the Company announced the completion

of its acquisition of 100% of Metrock Resources Pty Ltd and its

interest in the Kanye Manganese Project. The acquisition consideration

included the issue of 234,597,407 ordinary shares to the vendors

of the project (note 7.1);

b) 18 February 2021 when the Company announced the issue of 35,467,592

shares in relation to the acquisition of Virgo Resources Ltd

which completed on 14 August 2020; and

c) 1 March 2021 when the Company announced the issue of 34,000,000

deferred acquisition shares issued to the vendors of Virgo Resources

Ltd.

(3) The 578,318,935 shares issued during 2020 were detailed

in the Company's announcements dated;

a) 14 August 2020 when the Company announced the completion

of the acquisition of 100% of Virgo Resources Ltd and its interests

in the Hope Copper-Gold Project in Namibia. The acquisition

consideration included the issue of 501,395,858 ordinary shares

to the vendors of the project; and

b) 6 November 2020 when the Company announced that the consideration

of US$250,000 for a 30% shareholding in KPZ International Limited

("KPZ Int") had been settled by the issue of 76,923,077 shares.

Unaudited Audited

30 31

June December

2021 2020

GBP'000 GBP'000

The share premium was as follows:

As at beginning of year 39,125 36,429

Share subscription - 951

Share issued - Acquisitions 755 1,120

Share issue costs - (105)

Warrants exercised 145 730

As at end of period 40,025 39,125

========== ==========

Each fully paid ordinary share carries the right to one vote

at a meeting of the Company. Holders of ordinary shares also

have the right to receive dividends and to participate in the

proceeds from sale of all surplus assets in proportion to the

total shares issued in the event of the Company winding up.

10. Reconciliation of operating loss to net cash

outflow from operating activities

Unaudited Unaudited

Six Six

months months

ended ended

30 June 30 June

2020 2019

GBP'000 GBP'000

Operating loss from all operations (510) (261)

Depreciation and amortisation - -

VAT refunds received - (24)

Foreign exchange (gain)/loss 21 2

Share option expense 160 -

(Increase)/decrease in receivables (19) (34)

Increase in payables (167) 46

---------- ----------

Net cash outflow from operating activities (515) (271)

========== ==========

11. Subsequent events

On 2 August 2021 the Company announced it had entered into an

exclusive option agreement commencing 1 August 2021 with Caerus

Mineral Resources PLC (LON: CMRS) ("Caerus") to allow the parties

to review Caerus extensive portfolio of copper / gold projects

in Cyprus with a view to possible joint venture mining operations

(the "Agreement"). The Agreement; i) grants Bezant 18 months

to assess the merits and economic prospects of all Caerus potential

copper / gold hard rock mining assets in Cyprus ("Caerus' Cyprus

Properties") ; ii) provides for Bezant to review Caerus' Cyprus

Properties and for both parties to identify one project as a

potential development project; iii) provides that on identification

of a project the parties agree to jointly fund and explore up

to USD1million on the selected project; iv) provides that should

the project selected surpass the development criteria then Bezant

and Caerus will form a joint venture company to develop the

project and that Bezant will be responsible for the designing,

construction and operation of any mine developed under this

agreement; and v) that Caerus' expenditure during the pre-mining

exploration phase will be recovered from future cashflows and

Caerus will retain a 20% beneficial interest in all future revenues.

On 26 August 2021 the Company announced the Company and Caerus

had selected the Caerus ' Cyprus Projects for initial exploration

and, if appropriate, mining development (the "Selected Projects").

The Selected Projects comprise the Troulli, Kokkinapetra and

Anglisides licences. Having identified the Selected Projects

the parties intend to hold site meetings during early September

2021, to agree exploration and assessment programmes.

On 13 September 2021 the Company further to its announcements

on 28 April 2021 regarding the termination of its transaction

with Mining and Minerals Industries Holding Pte Ltd. ("MMIH")

in relation to the Mankayan project ("MMIH Transaction Agreement")

, has entered into a conditional agreement with IDM Mankayan

Pty Ltd ("IDM"), a company incorporated in Australia, to take

the Mankayan Project in the Philippines forward (the "IDM Agreement").

The main commercial terms of the IDM Agreement are that at completion

i) IDM will acquire 100% ownership of Asean Copper Investments

Ltd which holds its interest in the Mankayan Project via the

Asean Copper Ownership Structure (defined below); ii) Bezant

will own 27.5% of IDM with the remaining 72.5% owned by es tablished

investors in the mining sector (the "Other IDM Shareholders");

iii) Bezant will provide A$90,000 (approximately GBP48K) of

initial funding and the Other IDM Shareholders will provide

A$210,000 (approximately GBP 112K) ("Initial Funding"); iv)

IDM's initial objective is to assist and support Crescent Mining

Development Corporation ("CMDC") in its application to renew

t he Mineral Production Sharing Agreement No. 057-96-CAR (the

" MPSA ") in respect of the Mankayan Project which is due for

renewal on 11 November 2021. CMDC submitted its renewal application

on 16 March 2021 to the Mines and Geosciences Bureau of the

Department of Environment and Natural Resources of the Philippines

government ; and v) upon the renewal of the MPSA and the payment

of the Conditional Renewal Proceed Payment defined below of

up to A$500,000 due by IDM to MMIH which is to be funded by

the Other IDM Shareholders. Bezant's shareholding in IDM will

be increased to 27.5% of the then issued share capital of IDM

after the payment of the Conditional Renewal Proceed Payment.

Asean Copper holds a 40 per cent. shareholding in Crescent Mining

and Development Corporation (" CMDC "), which is incorporated

in the Philippines and is the sole holder of Mineral Production

Sharing Agreement No. 057-96-CAR (the " MPSA ") in respect of

the Mankayan Project. Asean Copper also holds a 40 per cent.

shareholding in Bezant Holdings Inc., which is incorporated

in the Philippines and holds the balancing 60 per cent. interest

in CMDC, and has a conditional option (scheduled to expire on

30 June 2022) to acquire the balancing 60 per cent. of Bezant

Holdings Inc. (together, the " Asean Copper Ownership Structure

").

Conditional upon renewal of the MPSA an amount of up to A$500,000

(approx. GBP267K) will be due to be paid to MMIH in two equal

instalments 7 days and 3 months after the renewal of the MPSA

which is to be funded by the Other IDM Shareholders rather than

Bezant (the "Conditional Renewal Proceed Payment") which will

be reduced by:

1. the Renewal Expenditure Excess being the amount in excess

of $200,000 incurred to renew the MPSA;

2. the Creditors Payment Excess being payments to c ertain creditors

in excess of $100,000; and

3. outstanding fees due to a consultant.

Other than these matters, no significant events have occurred

subsequent to the reporting date that would have a material

impact on the consolidated financial statements.

12. Availability of Interim Report

A copy of these interim results will be available from the Company's

registered office during normal business hours on any weekday

at Floor 6, Quadrant House, 4 Thomas More Square, London E1W

1YW and can also be downloaded from the Company's website at

www.bezantresources.com . Bezant Resources Plc is registered

in England and Wales with company number 02918391.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAXNNASAFEFA

(END) Dow Jones Newswires

September 30, 2021 02:00 ET (06:00 GMT)

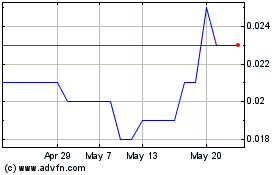

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

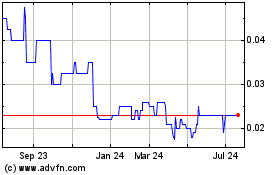

Bezant Resources (AQSE:BZT.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024