TIDMBIOM

RNS Number : 4859Z

Biome Technologies PLC

03 September 2018

3 September 2018

Biome Technologies plc

("Biome", "the Company" or "the Group")

Interim Results

Biome Technologies plc announces its Interim Results for the six

months ended 30 June 2018.

Highlights

-- Group revenues in H1 2018 increased by 47% to GBP4.4m

compared with the comparable period last year (H1 2017:

GBP3.0m)

-- Biome generated an operating profit of GBP0.2m compared to an

operating loss of GBP0.2m in the first half of 2017

-- Group cash position at 30 June 2018 of GBP2.3m (31 December 2017: GBP2.3m)

Paul Mines, Chief Executive Officer said:

"The Group had an outstanding first half to 2018 delivering an

operating profit in the period. Opportunities within the

Bioplastics division are increasing with substantial revenue

potential in the medium term whilst the Stanelco RF division has

delivered an exceptional start to the year. It is against this

backdrop that Board remains confident in the Group's outlook for

2018."

For further information please contact: Biome

Technologies plc

Paul Mines, Chief Executive Officer

Declan Brown, Group Finance Director

www.biometechnologiesplc.com Tel: +44 (0) 2380 867

100

Allenby Capital

David Hart/Alex Brearley (Nominated Adviser)

Kelly Gardiner (Broker)

www.allenbycapital.com Tel: +44 (0) 20 3328

5656

About Biome

Biome Technologies plc is an AIM listed, growth-orientated,

commercially driven technology group. Our strategy is founded on

building market-leading positions based on patented technology and

serving international customers in valuable market sectors. We have

chosen to do this by developing products in application areas where

the value-added pricing can be justified and that are not reliant

on government legislation. These products are driven by customer

requirements and are compatible with existing manufacturing

processes. They are market rather than technology-led.

The Group comprises two divisions, Biome Bioplastics Limited and

Stanelco RF Technologies Limited. Biome Bioplastics is a leading

developer of highly-functional, bio-based and biodegradable

plastics. The company's mission is to produce bioplastics that

challenge the dominance of oil-based polymers. Stanelco RF

Technologies designs, builds and services advanced radio frequency

(RF) systems. Dielectric and induction heating products are at the

core of a product offering that ranges from portable sealing

devices to large furnaces for the fibre optics markets.

In 2018, the Board has adopted the following three high level

KPIs for the next three years to continue its ambitious

momentum:

-- Compound revenue growth of 25% per annum across the Group and

40% compound revenue growth in the Bioplastics division

-- Diversify the Group's turnover by product and market to

ensure that no one product or end customer contributes more than

15% of revenues by 2020

-- Increase investment in the Group's next generation of

products by spending significantly more per annum on average than

the GBP0.3m per annum average spend over the previous strategic

objective cycle

www.biometechnologiesplc.com

www.biomebioplastics.com

www.stanelcorftechnologies.com

Chairman's Statement

The Group has reached an important milestone in the first half

of 2018 by reporting an operating profit of GBP0.2m, substantially

ahead of the operating loss of GBP0.2m in the prior year.

Group revenues were up 47% to GBP4.4m compared to GBP3.0m in the

first half of 2017 due to an exceptional increase in revenues in

the RF Technologies division. Gross profit of GBP2.3m was ahead of

the first half of 2017 (GBP1.5m). Margins, at 53%, were ahead of

the prior year due mainly to a favourable product mix. Overheads

increased by GBP0.4m over 2017 principally reflecting increased

staffing levels to support the increase in turnover as well as

increased research and development spend associated with the next

generation of products within the Bioplastics division.

The Group recorded a profit before interest, depreciation,

amortisation and share option charges for the six months to 30 June

2018 of GBP0.5m compared to a profit of GBP0.1m in the first half

of 2017. The profit after taxation was GBP0.2m (H1 2017: loss

GBP0.2m) equating to earnings per share of 9 pence on both a basic

and diluted basis (H1 2017 loss per share 9 pence).

The Group's cash position as at 30 June 2018 was GBP2.3m (31

December 2017: GBP2.3m).

Biome Bioplastics Division

Revenues in the Bioplastics division for the first half of 2018

were GBP0.9m (H1 2017: GBP1.2m) with the turnover in the second

quarter returning to a normal pattern within the existing single

serve coffee pod packaging business. Sales of the non-woven mesh

filtration product continued to grow as expected and Biome's work

to qualify a second manufacturing site in the USA in anticipation

of additional demand is nearing completion. It is anticipated that

sales of the reformulated rigid ring material for coffee pods will

commence in Q4 2018 and testing continues in this regard.

The operating loss for the period of GBP0.3m (2017: operating

loss of GBP0.1m) reflects the impact of the lower revenues as well

as the acceleration of research and development costs associated

with next generation products and the increase in staffing resource

to support the anticipated increase in demand for bioplastics

products. The division's development compounding capabilities were

expanded to a second location in Southampton during the period.

Biome continues its strategy of developing products where there

is specific customer demand for bio-based or biodegradable

solutions. It was noted in the July 2018 trading update that two

projects in particular are advancing encouragingly through the

development phase and, if successful, could lead to substantial

revenues in 2019 and 2020. These projects are both with new

customers. One of them has now completed its technical development

phase in the USA and commercial production is expected in 2019. The

second project, being developed in continental Europe, has passed

an important milestone in recent weeks and work continues to

support an aggressive launch timetable with the customer with

commercial revenues being anticipated in 2019. Additionally, in

recent weeks an initial six-month feasibility study, supported by

an international consumer goods company, has been completed and

discussions are underway regarding a product launch in 2020.

The division has continued with its mid-term strategy to develop

a new range of lignocellulose-derived bioplastics that have

increased performance characteristics and can be made at a

comparable cost to traditional petro-chemicals. This work continues

to be supported by various government grants and during the first

half of 2018 the Company accelerated expenditure in this area. The

Company has now filed a number of patent applications to protect

the emerging technology (details of these can be found under the

Biotechnology section of the Company's Biome Bioplastics website).

Further updates on the progress of these projects will be made as

they evolve.

Positive interest remains in the UK, with the Government looking

to progress innovative material solutions to the problem of single

use plastics in the medium term. This may provide an opportunity to

accelerate our work in industrial biotechnology solutions and Biome

is engaged with a number of parties in this area.

Stanelco RF Technologies Division

Revenues in the RF Technologies division were GBP3.5m (H1 2017:

GBP1.7m) reflecting exceptional demand in the period for fibre

optic furnaces. As a result of this substantial increase in

revenues, operating profit recorded in the first half increased to

GBP1.3m (H1 2017: GBP0.6m).

Strong demand for fibre optic furnaces continues into the second

half of this year. The design and manufacturing teams have

responded very well to the rapid and significant upturn in

activity. The manufacturing footprint was expanded during the

period providing increased production capacity.

Outlook

As can be seen from the above updates, our divisions are

maximising their opportunities within quite different business

environments and the Board remains confident in the Group's outlook

for 2018.

Bioplastics is developing a position in a new market with

substantial incremental growth prospects. The recent widening of

its customer base and products under development, as its

marketplace increases in size, is giving more evidence that we will

achieve our strategic goals on the three-year horizon set out in

our last annual report.

RF Technologies operates in a highly technical, export-led and

established market for its products. It is making the most of the

demand in this exceptional period of expansion, albeit the

likelihood of continuing on the present trajectory is not

anticipated in our current strategic assessment of RF

Technologies.

The above emphasises to us the importance of both a three-year

view and the benefit of balancing the current outperformance of RF

Technologies with the substantial opportunities available to Biome

in the mid-term.

We will be updating shareholders more fully at the end of the

year regarding our KPI performance.

John Standen

Chairman

CONSOLIDATED STATEMENT

OF COMPREHENSIVE INCOME

For the period ended 30 June 2018

Total Total

for for

6 Months 6 Months Total Year

Ended Ended Ended

30 June 30 June 31 December

2018 2017 2017

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

-------------------------------------------- ----- ---------- ---------- ------------

5a -

REVENUE 5c 4,391 2,979 6,233

Cost of sales (2,068) (1,497) (3,131)

GROSS PROFIT 2,323 1,482 3,102

Administrative expenses (2,117) (1,688) (3,513)

5a -

PROFIT/(LOSS) FROM OPERATIONS 5c 206 (206) (411)

Profit/(Loss) from operations before

share options charges 311 (180) (365)

Share options charges (105) (26) (46)

Investment revenue 2 1 1

Foreign exchange gain/(loss) 8 (14) (32)

PROFIT/(LOSS) BEFORE TAXATION 216 (219) (442)

Taxation 6 - - 210

TOTAL COMPREHENSIVE INCOME FOR THE

PERIOD ATTRIBUTABLE TO THE EQUITY HOLDERS

OF THE PARENT 216 (219) (232)

========== ========== ============

Basic earnings/(loss) per share - pence 7 9 (9) (10)

Diluted earnings/(loss) per share -

pence 7 9 (9) (10)

CONSOLIDATED STATEMENT

OF FINANCIAL POSITION

As at 30 June 2018

At At At

30 June 30 June 31 December

2018 2017 2017

Unaudited Unaudited Audited

Note GBP'000 GBP'000 GBP'000

--------------------------------------- ----- ---------- ---------- ------------

NON-CURRENT ASSETS

Other intangible assets 8 891 1,035 915

Property, plant and equipment 9 161 136 122

---------- ---------- ------------

1,052 1,171 1,037

---------- ---------- ------------

CURRENT ASSETS

Inventories 10 861 630 797

Trade and other receivables 11 1,555 1,515 1,335

Cash and cash equivalents 2,307 1,885 2,293

---------- ---------- ------------

4,723 4,030 4,425

---------- ---------- ------------

TOTAL ASSETS 5,775 5,201 5,462

========== ========== ============

CURRENT LIABILITIES

Trade and other payables 12 2,063 1,871 2,125

2,063 1,871 2,125

---------- ---------- ------------

TOTAL LIABILITIES 2,063 1,871 2,125

========== ========== ============

NET ASSETS 3,712 3,330 3,337

========== ========== ============

EQUITY

Share capital 118 117 117

Share premium account 793 740 740

Capital redemption reserve 4 4 4

Share options reserve 214 480 219

Translation reserve (85) (85) (85)

Retained profits/(losses) 2,668 2,074 2,342

EQUITY ATTRIBUTABLE TO EQUITY HOLDERS

OF THE PARENT AND TOTAL EQUITY 3,712 3,330 3,337

========== ========== ============

The interim statements were approved by the Board on 31 August

2018.

Signed on behalf of the Board of Directors

Paul R Mines (Chief Executive)

Declan L Brown (Group Finance Director)

31 August 2018

CONSOLIDATED STATEMENT

OF CHANGES IN EQUITY

As at 30 June 2018

Share Capital Share

Share premium redemption options Translation Retained TOTAL

capital account reserve reserve reserve earnings EQUITY

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Unaudited

Balance at 1 January

2018 117 740 4 219 (85) 2,342 3,337

========= ========= ============ ========= ============ ========== ========

Issue of share capital 1 53 - - - - 54

Share options issued

in share based payments - - - 105 - - 105

Cancellation of

time expired share

options - - - (110) - 110 -

--------- --------- ------------ --------- ------------ ---------- --------

Transactions with

owners 1 53 - (5) - 110 159

--------- --------- ------------ --------- ------------ ---------- --------

Profit for the period - - - - - 216 216

Total comprehensive

income for the period - - - - - 216 216

--------- --------- ------------ --------- ------------ ---------- --------

Balance 30 June

2018 118 793 4 214 (85) 2,668 3,712

========= ========= ============ ========= ============ ========== ========

Unaudited

Balance at 1 January

2017 117 740 4 454 (85) 2,293 3,523

========= ========= ============ ========= ============ ========== ========

Share options issued

in share based payments - - - 26 - - 26

Cancellation of

time expired share

options - - - - - - -

Transactions with

owners - - - 26 - - 26

--------- --------- ------------ --------- ------------ ---------- --------

Loss for the period - - - - - (219) (219)

Total comprehensive

income for the period - - - - - (219) (219)

--------- --------- ------------ --------- ------------ ---------- --------

Balance 30 June

2017 117 740 4 480 (85) 2,074 3,330

========= ========= ============ ========= ============ ========== ========

Share Capital Share

Share premium redemption options Translation Retained TOTAL

capital account reserve reserve reserves earnings EQUITY

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Audited

Balance at 1 January

2017 117 740 4 454 (85) 2,293 3,523

========= ========= ============ ========= ============ ========== ========

Share options issued

in share based payments - - - 46 - - 46

Cancellation of

time expired share

options - - - (281) - 281 -

Transactions with

owners - - - (235) - 281 46

--------- --------- ------------ --------- ------------ ---------- --------

Loss for the year - - - - - (232) (232)

Total comprehensive

income for the year - - - - - (232) (232)

--------- --------- ------------ --------- ------------ ---------- --------

Balance 31 December

2017 117 740 4 219 (85) 2,342 3,337

========= ========= ============ ========= ============ ========== ========

CONSOLIDATED STATEMENT

OF CASH FLOWS

For the period ended 30 June 2018

6 Months 6 Months Year

Ended Ended ended

30 June 30 June 31 December

2018 2017 2017

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

------------------------------------------- ---------- ---------- ------------

Profit/(loss) from operations 206 (206) (411)

Adjustment for:

Amortisation and impairment of intangible

assets 145 203 355

Depreciation of property, plant and

equipment 29 31 64

Share based payments 105 26 46

Foreign exchange 8 (11) (26)

---------- ---------- ------------

Operating cash flows before movement

of working capital 493 43 28

(Increase)/Decrease in inventories (63) (249) (417)

(Increase)/decrease in receivables (220) (174) 5

Increase/(decrease) in payables (62) 805 1,059

---------- ---------- ------------

Cash utilised in operations 148 425 675

Corporation tax (paid)/received - - 210

---------- ---------- ------------

Net cash inflow from operating activities 148 425 885

---------- ---------- ------------

Cash flows from investing activities

Interest received 2 1 1

Investment in intangible assets (122) (73) (106)

Purchase of property, plant and equipment (68) (3) (22)

---------- ---------- ------------

Net cash used in investing activities (188) (75) (127)

---------- ---------- ------------

Financing activities

Proceeds from issue of ordinary shares 54 - -

---------- ---------- ------------

Net cash inflow from financing activities 54 - -

---------- ---------- ------------

Net increase in cash and cash equivalents 14 350 758

Cash and cash equivalents at beginning

of period 2,293 1,535 1,535

---------- ---------- ------------

Cash and cash equivalents at end

of period 2,307 1,885 2,293

========== ========== ============

NOTES TO THE INTERIM CONSOLIDATED FINANCIAL STATEMENTS

For the period ended 30 June 2018

1. CORPORATE INFORMATION

The financial information for the year ended 31 December 2017

set out in this interim report does not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006. The

Group's statutory financial statements for the year ended 31

December 2017 have been filed with the Registrar of Companies. The

auditor's report on those financial statements was unqualified and

did not contain statements under Section 498 of the Companies Act

2006. The interim results are unaudited. Biome Technologies plc is

a public limited company incorporated and domiciled in England

& Wales. The company's shares are publicly traded on the AIM

market of the London Stock Exchange.

2. BASIS OF PREPARATION

These interim consolidated financial statements (the interim

financial statements) are for the six months ended 30 June 2018.

They have been prepared in accordance with IFRSs as adopted by the

European Union and IAS 34 Interim Financial Reporting. They do not

include all of the information required for full annual financial

statements, and should be read in conjunction with the consolidated

financial statements of the Group for the year ended 31 December

2017.

These interim financial statements have been prepared under the

historical cost convention.

These interim financial statements have been prepared in

accordance with the accounting policies adopted in the last annual

financial statements for the year to 31 December 2017 except for

the adoption of IFRS 15 as described below.

On 1 January 2018 the Group adopted IFRS 15 'Revenue from

Contracts with Customer' which supersedes IAS 18 'Revenue'. The

Group has adopted the 'Modified retrospective application' which

means there is no restatement of the comparative period but there

is an opening adjustment to retained earnings as at 1 January 2018

to account for any earnings taken in 2017 that need to be

reclassified to 2018. Following a review of all revenue streams it

has been determined that no opening adjustments with respect to the

adoption of IFRS 15 are required.

The accounting policies have been applied consistently

throughout the Group for the purposes of preparation of the interim

financial statements.

3. BASIS OF CONSOLIDATION

The Group interim financial statements consolidate the results

of the Company and all of its subsidiary undertakings drawn up to

30 June 2018. At 30 June 2018 the subsidiary undertakings were

Biome Bioplastics Limited, Stanelco RF Technologies Limited,

Aquasol Limited and InGel Technologies Limited.

4. GOING CONCERN

The directors have reviewed forecasts and budgets for the coming

12 months, which have been drawn up with appropriate regard for the

current macroeconomic environment and the particular circumstances

in which the Group operates. As a result of this process, the

directors are satisfied that the group have sufficient resources to

continue in operational existence for at least one year from the

date of approval of the interim report.

5a. SEGMENTAL INFORMATION FOR 6 MONTHSED 30 JUNE 2018

RF Central

Bioplastics Technologies Costs Total

6 Months 6 Months 6 Months 6 Months

Ended ended ended Ended

30 June 30 June 30 June 30 June

2018 2018 2018 2018

GBP'000 GBP'000 GBP'000 GBP'000

Unaudited

Revenue from external customers 932 3,459 - 4,391

(LOSS)/PROFIT FROM OPERATIONS (345) 1,279 (728) 206

Investment revenue 2

Foreign exchange gain 8

PROFIT ATTRIBUTABLE TO EQUITY

SHAREHOLDERS 216

=========

TOTAL ASSETS 1,940 1,931 1,904 5,775

================================= ============ ============== ========= =========

5b. SEGMENTAL INFORMATION FOR 6 MONTHSED 30 JUNE 2017

RF Central

Bioplastics Technologies Costs Total

6 Months 6 Months 6 Months 6 Months

ended Ended ended Ended

30 June 30 June 30 June 30 June

2017 2017 2017 2017

GBP'000 GBP'000 GBP'000 GBP'000

Unaudited

Revenue from external customers 1,241 1,738 - 2,979

(LOSS)/PROFIT FROM OPERATIONS (139) 558 (625) (206)

Investment revenue 1

Foreign exchange loss (14)

LOSS ATTRIBUTABLE TO EQUITY

SHAREHOLDERS (219)

=========

TOTAL ASSETS 1,550 1,754 1,897 5,201

================================= ============ ============== ========= =========

5c. SEGMENTAL INFORMATION FOR YEAR ENDED 31 DECEMBER 2017

RF Central

Bioplastics Technologies Costs Total

Year Year Year Year

ended ended ended ended

31 31 31

December December 31 December December

2017 2017 2017 2017

GBP'000 GBP'000 GBP'000 GBP'000

Audited

Revenue from external customers 2,279 3,954 - 6,233

(LOSS)/PROFIT FROM OPERATIONS (421) 1,338 (1,328) (411)

Investment revenue 1

Foreign exchange loss (32)

LOSS BEFORE TAXATION FROM

OPERATIONS (442)

Taxation 210

LOSS ATTRIBUTABLE TO EQUITY

SHAREHOLDERS (232)

==========

TOTAL ASSETS 1,795 1,380 2,287 5,462

================================= ============ ============== ============ ==========

6. TAXATION

The Group's policy is to recognise tax credits resulting from

tax R&D claims on a cash received basis. The claim in respect

of the year ended 31 December 2017 has not yet been settled and

there is therefore no tax credit recognised in the period under

review.

7. EARNINGS PER SHARE

The calculation of basic earnings per share is based on the

profit attributable to the equity holders of the parent for the six

months of GBP216,000 (2017: loss of GBP219,000) and a weighted

average of 2,352,465 (2017: 2,347,536) ordinary shares in

issue.

Diluted earnings per share for the six months ended 30 June 2018

were based on a weighted average of 2,484,334 shares which accounts

for all share options which are in the money, regardless of whether

they have yet vested. For 2017 the diluted earnings per share

equalled the basic earnings per share as all outstanding share

options were out of the money for the purposes of the diluted

earnings per share calculation.

8. OTHER INTANGIBLE ASSETS

Other intangible assets decreased in the period as a result of

the amortisation charge of GBP145,000 exceeding the capitalisation

of product development costs for the period of GBP122,000.

9. PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment increased in the reporting period

as a result of the purchase of property, plant and equipment of

GBP68,000 being more than the depreciation charge for the period of

GBP29,000.

10. INVENTORIES

The increase in inventories during the reporting period reflects

the increase in equipment orders under construction within the

Stanelco RF division. These orders are all due for shipment to the

customers over the next few months. The increase in inventories

within the Stanelco RF division was partially offset by a decrease

in inventories within the Bioplastics division.

11. TRADE AND OTHER RECEIVABLES

Trade and other receivables have increased during in the

reporting period mainly due to the increases in accrued revenue on

the equipment orders under construction within Stanelco RF

mentioned above as well as an increase in other debtors within the

Bioplastics division.

12. TRADE AND OTHER PAYABLES

The decrease in trade and other payables during the reporting

period primarily reflects the timing of trade creditors as at the

end of the period.

13. RISKS AND UNCERTAINTIES

The principal risks and uncertainties affecting the business

activities of the Group are detailed in the Strategic Report which

can be found on pages 6-11 of the Annual Report and Financial

Statements for the year ended 31 December 2017 ("the Annual

Report"). A copy of the Annual Report and

Financial Statements is available on the Company's website at

www.biometechnologiesplc.com

The risks affecting the business remain the same as in the

Annual Report. In summary, these risks

include:

-- changes in the regulatory environments in which the Group operates

-- fluctuations in exchange rates

-- volatility in raw material prices and supply

-- breach of intellectual property rights

-- competitors developing more attractive products

-- failure to commercialise products

-- reliance on a small number of customers for certain products

-- financial risks including exchange rate risk, liquidity risk,

interest rate risk and credit risk.

Further details of how these risks impact the business and how

the directors attempt to mitigate

the risks can be found in the Annual Report.

Copies of this interim report will be shortly available on the

Company's website at www.biometechnologiesplc.com.

INDEPENDENT REVIEW REPORT FOR BIOME TECHNOLOGIES PLC

Introduction

We have reviewed the condensed set of financial statements in

the half-yearly financial report of Biome Technologies Plc (the

'company') for the six months ended 30 June 2018 which comprises

the consolidated statement of comprehensive income, consolidated

statement of financial position, consolidated statement of changes

in equity, consolidated statement of cash flows and the related

notes. We have read the other information contained in the half

yearly financial report which comprises only the Chairman's

Statement and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

This report is made solely to the company, as a body, in

accordance with International Standard on Review Engagements (UK

and Ireland) 2410, 'Review of Interim Financial Information

performed by the Independent Auditor of the Entity'. Our review

work has been undertaken so that we might state to the company

those matters we are required to state to them in an independent

review report and for no other purpose. To the fullest extent

permitted by law, we do not accept or assume responsibility to

anyone other than the company as a body, for our review work, for

this report, or for the conclusion we have formed.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. As disclosed in note 2, the

annual financial statements of the group are prepared in accordance

with International Financial Reporting Standards as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared in

accordance with International Accounting Standard 34, 'Interim

Financial Reporting', as adopted by the European Union.

Our responsibility

Our responsibility is to express a conclusion to the company on

the condensed set of financial statements in the half-yearly

financial report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity'. A review of interim financial information consists

of making enquiries, primarily of persons responsible for financial

and accounting matters, and applying analytical and other review

procedures. A review is substantially less in scope than an audit

conducted in accordance with International Standards on Auditing

(UK) and consequently does not enable us to obtain assurance that

we would become aware of all significant matters that might be

identified in an audit. Accordingly, we do not express an audit

opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30

June 2018 is not prepared, in all material respects, in accordance

with International Accounting Standard 34, 'Interim Financial

Reporting', as adopted by the European Union.

GRANT THORNTON UK LLP

STATUTORY AUDITOR

CHARTERED ACCOUNTANTS

SOUTHAMPTON

31 August 2018

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR SDMFWFFASEDA

(END) Dow Jones Newswires

September 03, 2018 02:00 ET (06:00 GMT)

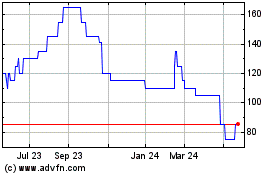

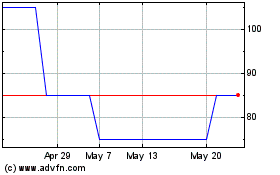

Biome Technologies (AQSE:BIOM.GB)

Historical Stock Chart

From Jun 2024 to Jul 2024

Biome Technologies (AQSE:BIOM.GB)

Historical Stock Chart

From Jul 2023 to Jul 2024