The Indian economy, at one time a favorite of foreign investors,

witnessed a rough patch after the Fed set the taper-talk in motion.

Weakening currency almost thwarted the country’s motion a few

months back.

However, the scenario took a surprising turn after the Fed’s ‘taper

hold’ decision in late September which sent Indian stocks rallying.

A deluge of measures taken by the new RBI Governor, improving

fundamentals, rebound in rupee and the foreign capital inflows were

held responsible for this bull run. The Sensex Index hit an

all-time high of 21,294 in early November as foreign investment in

September and October reached as high as $3.5 billion.

If this was not enough,

Goldman Sachs’

(GS) upgrade of its rating on Indian equities to

‘marketweight’ from ‘underweight’ added another reason to be a

little more optimistic on the nation. Goldman Sachs also upped its

target for the NIFTY benchmark to 6,900 by 2014-end indicating

about 9% upside in this Indian index from the current level.

Goldman is the third major brokerage to have a relatively

positive stance on the Indian market. Japanese brokerage firm

Nomura recently raised its Sensex target to 22,000 from 20,000 for

2014 and Deutsche Bank upgraded its Sensex target for 2013 to

22,000 from 21,000.

What’s Behind Goldman’s Optimism?

This brokerage firm mainly changed its view on Asia’s third largest

economy on improved investor sentiment. Improving corporate

earnings, easing pressure on external capital account and signs of

recovery in cyclical sectors were attributed to this upgrade.

Also, some credit goes to an anticipated political change in India.

The general election in India is due next year and the market

expects Narendra Modi – the opposition candidate for the post of

prime minister – to take the baton for India in 2014.

The market has perceived Mr. Modi’s nomination as business-friendly

and growth-oriented which is why foreign investments are flocking

to India with the NIFTY adding about 30% in USD terms from the lows

prevailing at August-end.

However, Goldman Sachs ruled out the charge of political bias in

its report labeled “Modi-fying our View: Raise India to

Marketweight” and said market opinion was the sole driver of the

upgrade.

This global investment bank also lifted its 2014 EPS growth

forecast for India from 8% to 11% and believes that valuations for

mid-cap Indian stocks are trading at a 30% discount to the broader

market.

ETF Impact

Most of India-based funds performed negatively in the last six

months while all of these saw decent returns, shedding all losses

within the last three months period. The Goldman news might act as

another driver for a number of funds in the India equity space and

could be the ones to watch for in the coming days:

WishdomTree India Earnings ETF

(EPI)

This ETF tracks the WisdomTree India Earnings Index and has amassed

$1.03 billion in its asset base. Of the total portfolio

consisting of 170 Indian securities, the fund invests nearly 44% of

its total assets in the top 10 holdings.

The fund charges investors 83 basis points a year in fees. EPI has

gained around 13% in the last three months ended November 6, 2013

and currently has a Zacks ETF Rank of 3 or ‘Hold’.

iShares India 50 ETF (INDY)

This ETF tracks the S&P CNX Nifty Index and has amassed $438.3

million in its asset base, which is spread across 51 Indian

securities. The fund invests more than 57% of its total assets in

the top 10 holdings and is pretty expensive in the emerging market

space, charging investors 93 basis points a year in fees.

INDY has added around 10% over the last three-month period and has

a Zacks ETF Rank of 3 or ‘Hold’.

PowerShares India Portfolio

(PIN)

This fund follows the Indus India Index, holding 50 stocks in the

basket. The ETF has managed assets of $374.5 million so far, and

has an expense ratio of 0.81%. PIN also returned over 9% in the

year-to-date time frame.

Bottom Line

One change – that of Raghuram Rajan’s appointment as RBI’s governor

– and one potential change – Modi’s nomination for the position of

prime minister – in addition to inflows seem to have boosted

India’s capital market growth in the near past.

However, on the downside, Purchasing Managers' Index or PMI for

services and manufacturing sectors in India have been below

the threshold limit for three months in a row in October. On

the other hand, the country is plagued with sky-high inflation and

the central bank RBI kept on increasing the repo rate to contain

it.

After a 25 bps hike in September, RBI resorted to another hike of

25 bps to 7.75% in late October which is a well-explained threat to

the country’s industrial output (read: India ETFs After the

Surprise Rate Hike).

Given this, though recent trends are certainly encouraging, we take

a cautiously optimistic stance on Indian markets. India needs some

more time, and some more measures to reach even close to its

previous glory of 8% growth rate. As for now, risk-tolerant

investors who think Indian concerns are bottoming out might

consider the above-mentioned ETFs, though volatility does look to

be high.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

WISDMTR-IN EARN (EPI): ETF Research Reports

GOLDMAN SACHS (GS): Free Stock Analysis Report

ISHARS-SP INDIA (INDY): ETF Research Reports

PWRSH-INDIA POR (PIN): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

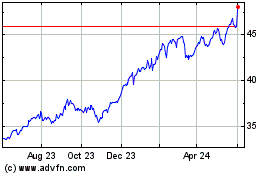

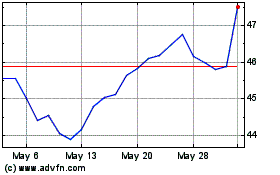

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Oct 2024 to Nov 2024

WisdomTree India Earnings (AMEX:EPI)

Historical Stock Chart

From Nov 2023 to Nov 2024