Go Local With Emerging Market Bond ETFs - Top Yielding ETFs

December 15 2011 - 4:17AM

Zacks

If one thing sticks out about 2011 for most investors, it is the

broad fears that struck the sovereign bond market throughout the

year. Both European and American bonds faced issues in the period

as worries over downgrades in the U.S. and outright default in

Europe dominated the headlines for much of the year. While U.S.

government bonds have managed to rally despite this news, many

European securities have not been so lucky, pushing yields to

levels not seen in the euro zone era.

In light of these issues, many investors have decided to take a

closer look at emerging market bonds for more diversified exposure

in their bond holdings. For investors seeking access to this area,

there are a number of choices including regional ETFs as well as

broad funds that target a wide range of countries around the globe.

In this global bond ETF space, investors have another choice to

make as well; dollar denominated or local currency-based bonds (see

ETFs vs. Mutual Funds).

Although the dollar has strengthened in recent weeks thanks to

broad European fears, one has to believe, given the poor fiscal

fundamentals of the nation, that the dollar could be headed lower

in the years ahead. For these investors, a purchase of a

locally-denominated bond ETF could be ideal as it could provide

capital appreciation, a solid yield, as well as gains from emerging

market currency appreciation. If the dollar weakens, this could

lead to an extra boost in gains for U.S. investors even if emerging

market bond performance is otherwise flat (read Three Outperforming

Active ETFs).

Thanks to these potential positives, it could be worthwhile to

take a look at any of the following ETFs as an interesting way to

diversify bond holdings. While the products may not do that well if

European turmoil continues in the near term, they seem poised for

strong long-term performance as a result of the robust fundamentals

underlying these nations and their fiscal positions. Most countries

in these funds have debt-to-GDP that is a fraction of their Western

counterparts suggesting that they may be safer than you think for

bond exposure. Add in the higher yields that stretch pretty much

across the board—none of the funds on this list yields less than

5%-- and an emerging market bond ETF could be an excellent choice

for most investors.

iShares Emerging Markets Local Currency Bond Fund

(LEMB)

This relatively new fund seeks investment results that

correspond generally to the price and yield performance, before

fees and expenses, of the Barclays Capital Emerging Markets Broad

Local Currency Bond Index. This benchmark seeks to give investors

broad exposure to a basket of sovereign bonds from emerging markets

that are denominated in a nation’s home currency. The product has

44 securities in total, charges investors 60 basis points in fees

and has just under $30 million in assets under management (see

India ETFs: Behind The Crash).

The product is heavily exposed to South Korean bonds (20%) which

are closely followed by Brazilian bonds which make up about 13.6%

of total assets. Other countries rounding out the top five include

Mexico, Poland, and Thailand, suggesting that the product has a

good level of geographic diversification. In terms of fundamentals,

the effective duration of the ETF is just under four years although

it should be noted that roughly 10% of the bond fund’s portfolio

consists of securities that mature in at least 15 years. Despite

the product’s tilt towards short-term securities, LEMB does pay out

a decent yield to investors, offering up payouts of close to 5.3%

in 30 Day SEC Yield terms.

Market Vectors Emerging Market Local Currency Bond ETF

(EMLC)

This bond ETF looks to replicate the price and yield performance

of the J.P. Morgan GBI-EMG Core Index. This benchmark provides

investors direct exposure to local currency bonds issued by

emerging market governments around the world. EMLC has just over

170 securities in its portfolio, has a gross expense ratio of 49

basis points and has amassed close to half a billion in assets

since its launch in the summer of 2010 (read German Bond ETFs In

Focus).

Unlike LEMB, this fund imposes a 10% cap on the weighting

allocated to a particular nation, ensuring that assets are well

spread throughout the countries. Four nations currently make up 10%

of total assets—Brazil, Poland, South Africa, and Mexico, while

Malaysia and Turkey both have bonds that constitute at least 9% of

the fund as well. Thanks to the broad trend towards safer assets,

EMLC has underperformed broad bond indexes so far in 2011, losing

about 8.8% year-to-date compared to a gain of about 4% for AGG.

However, it should be noted that the payout for this product is

quite impressive, coming in at 6.4% in 30 Day SEC yield terms.

SPDR Barclays Capital Emerging Market Local Bond ETF

(EBND)

This product from State Street also looks to provide exposure to

emerging market government bonds giving investment results that

correspond to the price and yield performance of the Barclays

Capital EM Local Currency Government Diversified Index. This

benchmark looks to include government bonds issued by developing

nations, in local currencies, that have a remaining maturity of one

year or more and are rated B3/B-/B- or higher. In addition, the

securities in the index must be fixed-rate and have certain minimum

amounts outstanding, depending upon the currency in which the bonds

are denominated. Much like EMLC, close to 170 securities are in

this fund’s portfolio but the product does charge more in fees—50

basis points—and have less in assets-- $47 million—than its Van Eck

counterpart (see Top Three High Yield Real Estate ETFs).

For individual country holdings, this product shares some

similarities with both of the aforementioned ETFs. South Korea and

Brazil take the top two spots, combining to make up close to 25% of

the portfolio, while Mexico, Poland, and Malaysia round out the top

five. The product is heavily concentrated in short-term securities

with close to 55% of the portfolio maturing within five years,

pushing the duration down to 4.6 years. Since launching

earlier this year, the product has lost about 2.2% but pays out

close to 5.6% in 30 Day SEC yield terms. Both of these figures,

along with its expense ratio and AUM, put it in the middle of the

back for local currency emerging market bond ETFs.

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

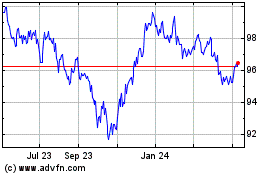

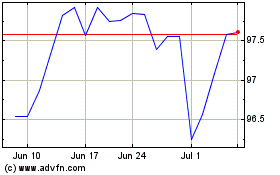

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Oct 2024 to Nov 2024

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Nov 2023 to Nov 2024