Forget UNG: Try These Natural Gas ETFs Instead - Commodity ETFs

December 14 2011 - 4:17AM

Zacks

Although concerns over the long-term impact of fracking are ever

present in the natural gas marketplace, many are beginning to see

the potential for the fuel to help wean America off of its foreign

oil addiction. The U.S. remains in the top two for production of

the fuel and has reserves that are only exceeded by five other

countries. This suggests that while oil may be in increasingly

short supply, natural gas has a near limitless potential to become

the fuel of choice for investors and consumers alike.

Thanks to these trends, some have decided to take a closer look

at putting assets to work in this interesting space with many

settling in on the United States Natural Gas ETF (UNG). The fund

looks to track the changes in the price of natural gas delivered at

the Henry Hub, Louisiana as measured by the changes in futures

prices traded on the NYMEX. The product will follow contracts that

are the near month to expire unless the nearest month is within two

weeks to expire. UNG is by far the most popular natural gas ETF on

the market today as the fund has more than $1.2 billion in assets

and average daily volume of just over 15.1 million shares. Yet,

while UNG may be extremely popular, any investor who has stayed in

the fund over the long term is likely to have been disappointed

with its performance (see Is USCI The Best Commodity ETF?).

In year-to-date terms, UNG is down 40.4% and over the past three

years the fund has lost 84.5% of its total value. While the natural

gas market has been weak, prices of natural gas per thousand cubic

feet have only lost about 18% in comparison on the year. The main

reason for this disconnect is the market phenomenon known as

contango, which can lead many investors to heavier losses than what

an investment in spot prices would suggest.

Contango & ETFs

In this situation, prices for futures contracts are trading at a

level of, for example, $4/mmBtu. for natural gas while the spot

price is around $3.5/mmBtu. As the contract gets closer to

expiration, the futures contract price converges towards the spot

price, pushing the contract towards $3.5/mmBtu. At this point, an

investor will roll out of a position and buy another contract,

expiring in a later month in order to avoid delivery of the product

in question. When investors do this in a contangoed market, the

price of the futures contract will again be higher than the spot

price, creating a loop of potential losses that can be built-in to

the market when a particular futures contract is experiencing

contango, unless of course the gains in the commodity are enough to

override this structural issue (read ETFs vs. ETNs: What’s The

Difference?).

While this situation is pretty much impossible to avoid when a

market is in contango, there a few ways that investors can try to

mitigate the issue. Chief among them is buying contracts with

varying maturities and only cycling over a small portion of the

basket at any one time. This avoids the issue of front-running and

it helps to lessen the blow of a month that is experiencing heavy

contango as well. For investors seeking to take a closer look at

funds that try to implement a methodology that keeps these ideas in

mind, either of these UNG alternatives could make for an

interesting choice:

United States 12 Month natural Gas Fund

(UNL)

Unlike UNG which only holds front-month contracts, this ETF

spreads its exposure across the maturity curve. In fact, the fund

consists of 12 natural gas futures contracts consisting of the near

month security as well as the next eleven months. This can help cut

down on contango because only 1/12th of the portfolio is

rolled at any one time and a month of heavy contango will only

impact a small portion of the holdings. Thanks to this focus, UNL

has lost 34.7% so far in 2011 and 53.6% over the past three years.

While these are obviously both pretty bad metrics, they are quite

impressive when compared to UNG, showing how powerful the impact of

contango can be on a portfolio of commodity securities (see Three

Best Gold ETFs).

Teucrium Natural Gas Fund (NAGS)

For investors seeking a new way to play the natural gas market,

NAGS could be an interesting choice. The product invests in futures

contracts in the nearest to spot month for the following four

periods; March, April, October, and November. All four months are

weighted equally giving the fund balanced exposure across these key

delivery dates. These four were chosen in particular because they

give the fund a focus on the key times in the natural gas season at

both the end of and beginning of the heating and cooling

seasons.

This method has had a spotty trading performance since its

launch earlier in the year as the product has underperformed since

inception, but it has outperformed its counterparts over the past

three months. Nonetheless, it is important to remember that all

three products track the same futures; the only difference is the

date until expiration for the contracts in the portfolio and the

weights given to these securities. Given how drastically different

products have performed tracking the same futures in different

ways, investors should realize how important the issue of contango

can be in a futures-based investment. Arguably, an investor’s

thoughts on the subject of the futures curve can be just as

important, if not more so, than a view on the underlying commodity,

making products like NAGS and UNL intriguing choices when the

futures curve is experiencing heavy contango in the natural gas

space (see Top Three Precious Metal Mining ETFs).

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

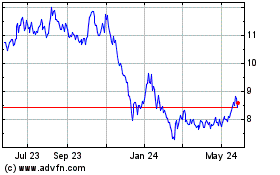

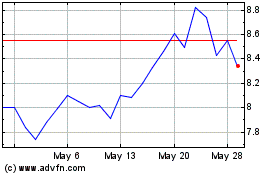

United States 12 Month N... (AMEX:UNL)

Historical Stock Chart

From Jun 2024 to Jul 2024

United States 12 Month N... (AMEX:UNL)

Historical Stock Chart

From Jul 2023 to Jul 2024