Form 424B3 - Prospectus [Rule 424(b)(3)]

June 14 2024 - 5:29PM

Edgar (US Regulatory)

File No. 333-263434

File No. 333-263438

File No. 333-263448

File No. 333-263293

File No. 333-263450

TEUCRIUM CORN FUND

TEUCRIUM SUGAR FUND

TEUCRIUM SOYBEAN FUND

TEUCRIUM WHEAT FUND

TEUCRIUM AGRICULTURAL FUND

Supplement dated June 14, 2024

to

Prospectuses dated April 30, 2024

This supplement updates the prospectuses dated April 30, 2024, as supplemented May 10, 2024, of the Teucrium Corn Fund, Teucrium Sugar Fund, Teucrium Soybean Fund, Teucrium Wheat Fund, and Teucrium Agricultural Fund, with the following information. It should be read in its entirety and kept together with your prospectus(es) for future reference.

WHAT ARE THE RISK FACTORS INVOLVED WITH AN INVESTMENT IN THE FUND – The Fund’s Operating Risks

The following information replaces the third risk factor of the above-referenced section of the prospectus.

The Sponsor is leanly staffed and relies heavily on key personnel to manage trading activities.

In managing and directing the day-to-day activities and affairs of the Fund, the Sponsor relies almost entirely on a small number of individuals, including Mr. Sal Gilbertie, Mr. Springer Harris and Ms. Cory Mullen-Rusin. If Mr. Gilbertie, Mr. Harris or Ms. Mullen-Rusin were to leave or be unable to carry out their present responsibilities, it may have an adverse effect on the management of the Fund. To the extent that the Sponsor establishes additional commodity pools, even greater demands will be placed on these individuals.

THE OFFERING – The Sponsor – Management of the Sponsor

The following information replaces the third sub-paragraph of the second paragraph of the above-referenced section of the prospectus:

Springer Harris, Chief Operating Officer, began working for Teucrium Trading in April 2011 as Director of Operations, working directly under the former COO for 13 years. Mr. Harris has served as the Vermont Branch Manager since July 2012 and as a FINRA Supervising Principal from 2014 to 2021. He also heads ETF Launchpad, Teucrium's multi-asset white-label ETF platform, which assists a diverse range of clients, from individuals to large asset managers, in launching their ETFs efficiently. On June 14, 2024, Mr. Harris was appointed COO of Teucrium Trading by majority vote of the Class A Members and will have primary responsibility for the Trade Operations for the Funds. Mr. Harris is primarily responsible for making trading and investment decisions for the Funds, and for directing the Funds’ trades for execution. Mr. Harris is an officer of Teucrium Investment Advisors, LLC, a wholly-owned subsidiary of Teucrium Trading, LLC, effective June 14, 2024, and he will generally assume the same roles and duties held in the parent company within the subsidiary. He graduated Cum Laude with a B.A. in Business Management from Washington College, where he was a four-year member and two-year captain of the Men’s Rowing Team. He maintains his main business office at Three Main Street, Suite 215, Burlington, Vermont 05401. Mr. Harris is 35 years old.

THE OFFERING – The Service Providers of the Fund (The Service Providers of the Fund and the Underlying Funds in the case of the Teucrium Agricultural Fund)

Effective on July 22, 2024, PINE Distributors, LLC, will replace Foreside Fund Services, LLC in providing certain distribution-related services to the Fund and will be referred to as the “Marketing Agent.” The following information regarding Pine Distributors replaces the information regarding Foreside Fund Services in the above-referenced section of the prospectus. In addition, all references in the prospectus to Foreside Services, LLC or the Distributor as of July 22, 2024 shall refer to Pine Distributors, LLC or the Marketing Agent.

The Fund employs PINE Distributors LLC, as the Marketing Agent for the Fund. The Marketing Agent Services Agreement is among the Marketing Agent and the Trust. It calls for the Marketing Agent to work with the Transfer Agent in connection with the receipt and processing of orders for Creation Baskets and Redemption Baskets and the review and approval of all Fund sales literature and advertising materials. The Marketing Agent and Teucrium Trading LLC have also entered into a Registered Representative Services Agreement under which certain employees and officers of the Sponsor are licensed as registered representatives or registered principals of the Marketing Agent under certain FINRA rules (“Registered Representatives”). As Registered Representatives of the Marketing Agent, these persons are permitted to engage in certain marketing activities for the Fund that they would otherwise not be permitted to engage in. Under the Registered Representative Services Agreement, the Sponsor is obligated to ensure that such marketing activities comply with applicable law and are permitted by the Registered Representative Services Agreement and the Marketing Agent’s internal procedures.

The Marketing Agent’s principal business address is 501 S. Cherry Street, Suite 610, Denver, CO 80264. The Marketing Agent is a broker-dealer registered with the U.S. Securities and Exchange Commission (“SEC”) and a member of FINRA.

With respect to compensation, the Marketing Agent receives an aggregate annual fee of $75,000 for all series in the Teucrium Commodity Trust, and an additional percentage of 0.0075% of average net assets under management. Under the Registered Representative Services Agreement, the Marketing Agent receives compensation from the Sponsor for its activities on behalf of all the Funds. The Registered Representative Services Agreement provides that the Sponsor shall pay the Marketing Agent (i) $7,500 per year, (ii) $3,500 per registered representative, per year, and (iii) $5,000 for 1 registered representative supervised, $5,000 additional for 2-5 subsequent additional representative supervised, and $10,000 additional for every 5 subsequent additional representatives supervised, starting with first subsequent representative. The Marketing Agent also will receive reimbursements relating to certain expenses relating to its provision of services under the Registered Representative Services Agreement.

THE OFFERING – Plan of Distribution

Effective on July 22, 2024, all references in the above-referenced section of the Corn, Soybeans and Wheat prospectuses to 1:15 p.m. (ET) as the time by which purchase orders must be received are replaced with 12:00 p.m. (ET) as the time by which purchase orders must be received.

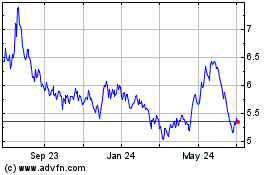

Teucrium Wheat (AMEX:WEAT)

Historical Stock Chart

From Nov 2024 to Dec 2024

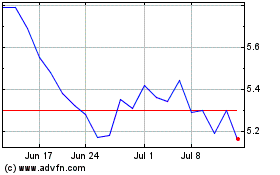

Teucrium Wheat (AMEX:WEAT)

Historical Stock Chart

From Dec 2023 to Dec 2024