SIFCO Industries, Inc. (NYSE MKT: SIF) today announced financial

results for its third quarter fiscal 2013, which ended June 30,

2013.

Third quarter

- Net sales from continuing operations in

the third quarter of fiscal 2013 increased 11.0% to $30.3 million,

compared with $27.3 million in the comparable period of fiscal

2012.

- Income from continuing operations in

the third quarter of fiscal 2013 was $2.6 million, or $0.47 per

diluted share, compared with $2.1 million, or $0.40 per diluted

share, in the comparable period in fiscal 2012.

- Net income in the third quarter of

fiscal 2013 was $2.5 million, or $0.46 per diluted share, compared

with $2.4 million, or $0.46 per diluted share, in the comparable

period in fiscal 2012.

- EBITDA in the third quarter of fiscal

2013 was $5.2 million, or 17.2% of net sales, compared with $4.7

million, or 17.2% of net sales, in the comparable fiscal 2012

period.

- Adjusted EBITDA in the second quarter

of fiscal 2013 was $5.2 million, or 17.1% of net sales, compared

with $5.1 million, or 18.5% of net sales, in the comparable fiscal

2012 period.

First nine months

- Net sales from continuing operations in

the nine months ended June 30, 2013 increased 7.8% to $88.6

million, compared with $82.1 million in the comparable period of

fiscal 2012.

- Income from continuing operations in

the first nine months of fiscal 2013 was $4.9 million, or $0.92 per

diluted share, compared with $4.4 million, or $0.82 per diluted

share, in the comparable fiscal 2012 period.

- Net income for the first nine months of

fiscal 2013 was $7.3 million, or $1.36 per diluted share, compared

with net income of $5.4 million, or $1.00 per diluted share, for

the comparable fiscal 2012 period.

- EBITDA in the first nine months of

fiscal 2013 was $11.8 million, or 13.3% of net sales, compared with

$11.5 million, or 13.9% of net sales, in the comparable period in

fiscal 2012.

- Adjusted EBITDA in the first nine

months of fiscal 2013 was $12.3 million, or 13.9% of net sales,

compared with $13.3 million, or 16.1% of net sales, in the

comparable period in fiscal 2012.

CEO Michael S. Lipscomb stated, "The Forged Components Group

continues to improve every aspect of its operational and financial

performance. Our across the board move into more commercial

business and our subsequent addition of General Aluminum Forgings

should help to sustain this trend."

The results for fiscal 2012 include the results of Quality

Aluminum Forge, which was acquired in October 2011.

Forward-Looking Language

Certain statements contained in this press release are

“forward-looking statements” within the meaning of the Private

Securities Litigation Reform Act of 1995, such as statements

relating to financial results and plans for future business

development activities, and are thus prospective. Such

forward-looking statements are subject to risks, uncertainties and

other factors, which could cause actual results to differ

materially from future results expressed or implied by such

forward-looking statements. Potential risks and uncertainties

include, but are not limited to, economic conditions, competition

and other uncertainties detailed from time to time in the Company's

Securities and Exchange Commission filings.

The Company's Form 10-Q for the quarter ended June 30, 2013 can

be accessed through its website: www.sifco.com, or on the Securities and Exchange

Commission's website: www.sec.gov.

SIFCO Industries, Inc. is engaged in the production and sale of

a variety of metalworking processes, services and products produced

primarily to the specific design requirements of its customers. The

processes and services include both conventional and precision

forging, heat-treating, coating, welding, and machining. The

products include both conventional and precision forged components,

machined forged parts and other machined metal components, and

remanufactured component parts for aerospace turbine engines. The

Company's operations are conducted in two business segments: (1)

Forged Components Group, and (2) Turbine Components Services and

Repair Group.

SIFCO Industries,

Inc.

Third Quarter Ended June 30, 2013

(Amounts in thousands, except per share

data)

Three Months Ended June

30,

Nine Months Ended June

30,

2013 2012 2013 2012 Net

sales

$ 30,284 $ 27,278

$ 88,578 $

82,147 Cost of goods sold

22,757 20,991

69,653 65,275 Gross margin

7,527 6,287

18,925 16,872 Selling, general and administrative expenses

3,371 2,661

10,433 8,342 Amortization of intangible

assets

492 709

1,544 2,186 Loss (gain) on disposal of

operating assets

33 —

(89 ) —

Operating income

3,631 2,917

7,037 6,344

Interest income

(4 ) (8 )

(18 ) (16 )

Interest expense

76 124

261 352 Foreign currency

exchange (gain) loss, net

7 (19 )

7 (22 ) Other

income, net

(108 ) (113 )

(294 ) (347 )

Income from continuing operations before income tax provision

3,660 2,933

7,081 6,377 Income tax provision

1,103 831

2,134 1,990

Income from continuing operations

2,557 2,102

4,947

4,387 Income (loss) from discontinued operations, net of tax

(79 ) 339

2,381 964 Net

income

$ 2,478 $ 2,441

$

7,328 $ 5,351 Income per share from continuing

operations Basic

$ 0.47 $ 0.40

$ 0.92

0.83 Diluted

$ 0.47 $ 0.40

0.92 0.82 Income

(loss) per share from discontinued operations, net of tax Basic

$ (0.01 ) $ 0.06

$ 0.44 0.18

Diluted

$ (0.01 ) $ 0.06

$ 0.44

0.18 Net income per share Basic

$ 0.46 $ 0.46

$ 1.36 1.01 Diluted

$ 0.46 $ 0.46

$ 1.36 1.00 Weighted-average number of common shares

(basic)

5,374 5,328

5,359 5,311 Weighted-average

number of common shares (diluted)

5,402 5,353

5,399

5,343

Supplemental Information -

Reconciliation of EBITDA and Adjusted EBITDA

Dollars in thousands

Three Months Ended Nine

Months Ended June 30, June 30, 2013

2012 2013 2012 Net income

$

2,478 $ 2,441

$ 7,328 $ 5,351 Less: Income

(loss) from discontinued operations, net of tax

(79 )

339

2,381 964 Income from continuing

operations

2,557 2,102

4,947 4,387 Adjustments:

Depreciation and amortization expense

1,479 1,637

4,465 4,741 Interest expense, net

72 116

243

336 Income tax provision

1,103 831

2,134 1,990 EBITDA

5,211 4,686

11,789 11,454 Adjustments: Foreign currency exchange (gain)

loss, net (1)

7 (19 )

7 (22 ) Other income, net (2)

(108 ) (113 )

(294 ) (347 ) Loss (gain)

on disposal of operating assets (3)

33 —

(89 )

— Inventory purchase accounting adjustments (4)

— (4 )

— 436 Non-recurring severance expense (5)

— —

658 — Equity compensation expense (6)

148 255

515 822 Pension settlement expense (7)

191 —

382 — Acquisition transaction-related expenses (8)

84

36

100 279 LIFO expense (income) (9)

(380 )

214

(787 ) 643 Adjusted EBITDA

$

5,186 $ 5,055

$ 12,281 $

13,265 (1) Represents the gain or loss from changes

in the exchange rates between the functional currency and the

foreign currency in which the transaction is denominated. (2)

Represents miscellaneous non-operating income or expense, primarily

rental income from our Irish subsidiary. (3) Represents the

difference between the proceeds from the sale of operating

equipment and the carrying value shown on the Company’s books. (4)

Represents accounting adjustments to value inventory at fair market

value associated with the acquisition of a business that was

charged to cost of goods sold when the inventory was sold. (5)

Represents severance expense related to the departure of an

executive officer. (6) Represents the equity-based compensation

expense recognized by the Company under its 2007 Long-term

Incentive Plan. (7) Represents expense incurred by a defined

benefit pension plan related to settlement of pension obligations.

(8) Represents transaction-related costs such as legal, financial,

tax due diligence expenses, valuation services costs, and executive

travel that are required to be expensed as incurred. (9)

Represents the increase (decrease) in the reserve for inventories

for which cost is determined using the last in, first out (“LIFO”)

method.

SIFCO Industries, Inc.Catherine M. Kramer,

216-881-8600www.sifco.com

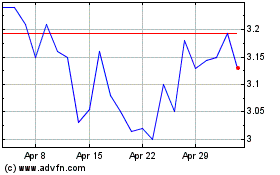

Sifco Industries (AMEX:SIF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sifco Industries (AMEX:SIF)

Historical Stock Chart

From Jul 2023 to Jul 2024