Filed pursuant to Rule 424(b)(3)

File No. 333-262859

January 18, 2023

PROSPECTUS SUPPLEMENT

(To Prospectus dated February 25, 2022, as supplemented

by the Prospectus Supplement dated August 24, 2022)

[SACHEM CAPITAL CORP.

Logo]

Up to $75,000,000 of Common Shares

Up to $25,000,000 of 7.75% Series

A Cumulative Redeemable Preferred Stock

(Liquidation Preference $25.00

Per Share)

This

Prospectus Supplement contains information that amends, supplements and modifies certain information contained in the prospectus dated

February 25, 2022 (the “Base Prospectus”) as supplemented by the prospectus supplement dated August 24, 2022 (the “Prior

Prospectus Supplement”, and together with the Base Prospectus and the Prior Prospectus Supplement, the “Prospectus”),

which relate to the sale of common shares, par value $0.001 per share (the “Common Shares”), and 7.75% Series A Cumulative

Redeemable Preferred Stock, par value $0.001 per share (the “Preferred Shares” and, together with the Common Shares, the “Shares”)

of Sachem Capital Corp. (the “Company”) in an “at-the-market” offering pursuant to an At Market Issuance Sales

Agreement, dated as of August 24, 2022, as amended on January 18, 2022 (unless specified otherwise, as amended, the “Sales Agreement”),

with Ladenburg Thalmann & Co. Inc. and Janney Montgomery Scott, LLC (the “Selling Agents”).

This

Prospectus Supplement supersedes the Prior Prospectus Supplement to the extent it contains information that is different from or in addition

to the information in the Prior Prospectus Supplements. Unless otherwise indicated, all other information included in the Prior Prospectus

Supplement that is not inconsistent with the information set forth in this prospectus supplement remains unchanged.

You

should carefully read the entire Prospectus before investing in the Shares. You should also review the information set forth under

the “Risk Factors” section beginning on page S-22 of the Prior Prospectus Supplement and page 15 of the Base Prospectus and

in our subsequent filings with the Securities and Exchange Commission (the “SEC”) that are incorporated by reference into

the Prospectus, before investing.

The

terms “Sachem,” “Sachem Capital,” the “Company,” “we,” “us” and “our”

generally refer to Sachem Capital Corp.

PRIOR SALES PURSUANT

TO THE “AT THE MARKET” OFFERING

From

August 24, 2022 through and including January 13, 2023, we sold 993,442 Common Shares and no Preferred Shares pursuant to the “at-the-market”

offering described in the Prior Prospectus Supplement. The total amount of capital raised as a result of the sales of Common Shares was

approximately $4.0 million and net proceeds were approximately $3.9 million, after deducting the sales agent’s commissions and

offering expenses.

UPDATE TO “AT-THE-MARKET”

OFFERING

On

January 18, 2023, the Company and the Selling Agents entered into Amendment No. 1 To At Market Issuance Sales Agreement, which adds Janney

Montgomery Scott, LLC as a Selling Agent thereunder.

All

references to Ladenburg Thalmann & Co. Inc. in the Prior Prospectus Supplement shall be deemed to refer to Ladenburg Thalmann &

Co. Inc. and Janney Montgomery Scott, LLC together as Selling Agents commencing as of January 18, 2023, unless otherwise stated in this

Prospectus Supplement or unless context requires otherwise.

USE OF PROCEEDS

Sales

of Shares, if any, under the Prospectus may be made in negotiated transactions or transactions that are deemed to be “at the market,”

as defined in Rule 415 under the Securities Act, including sales made directly on the NYSE American or similar securities exchange or

sales made to or through a market maker other than on an exchange, at prices related to the prevailing market prices or at negotiated

prices. There is no guarantee that there will be any sales of Shares pursuant to the Prospectus. If we sell Shares with an aggregate offering

price of $100 million, we anticipate that our net proceeds, after deducting sales agent commissions and estimated expenses payable by

us, will be approximately $97.75 million.

We intend to use the net

proceeds from the sale of Shares offered under the Prospectus for working capital and general corporate purposes, i.e., to fund

new real estate loans secured by first mortgage liens. Pending such use, the net proceeds from the sale of the Shares may be temporarily

invested in short-term government securities and other low risk investments.

PLAN OF DISTRIBUTION

We entered into an At Market

Issuance Sales Agreement, dated August 24, 2022, with Ladenburg Thalmann & Co., Inc. “”Ladenburg”), which was amended

on January 18, 2023 to add Janney Montgomery Scott LLC (“Janney” and, together with Ladenburg, the “Selling Agents”)

under which we may offer and sell up to an aggregate of $75,000,000 of our Common Shares and Preferred Shares with an aggregate liquidation

preference of $25,000,000 from time to time through Sales Agents. Sales of Shares, if any, under this Prospectus Supplement will be made

in transactions that are deemed to be “at the market offerings” as defined in Rule 415 under the Securities Act. Prior

to amending the Sales Agreement, Ladenburg Thalmann & Co. Inc. was the sole Selling Agent. The total amount of capital raised as a

result of the sales of Common Shares pursuant to the Sales Agreement from August 24, 2022 through and including January 13, 2023 was approximately

$4.0 million and the net proceeds, after deducting the sales agent’s commissions and offering expenses, were approximately $3.9

million. We paid Ladenburg Thalmann & Co. Inc. an aggregate agent fee of approximately $0.1 million in connection with such sales.

No shares of Series A Preferred Stock have been sold pursuant to the Sales Agreement.

The Selling Agents will offer

the Shares subject to the terms and conditions of the Sales Agreement daily or as otherwise agreed upon by us and the Selling Agents.

We will designate the maximum number of Common Shares and/or Preferred Shares to be sold through the Selling Agents daily or otherwise

determine such maximum amount together with the Selling Agents. Subject to the terms and conditions of the Sales Agreement, the Selling

Agents will use its commercially reasonable efforts to sell on our behalf all the Shares requested to be sold by us. We may instruct the

Selling Agents not to sell Shares if the sales cannot be settled at or above the price designated by us in any such instruction. The Selling

Agents or we may suspend the offering of Shares being made through the Selling Agents under the Sales Agreement upon proper notice to

the other party. The Selling Agents and we each have the right, by giving written notice as specified in the Sales Agreement, to terminate

the Sales Agreement in each party’s sole discretion at any time; provided, however, that any termination by Janney shall

only terminate Janney’s service as a Selling Agents and the Sales Agreement shall otherwise remain in full force and effect.

Under the terms of the Sales

Agreement, we may also sell Shares to the Selling Agents, as principal for their respective accounts, at a price negotiated at the time

of sale. If we sell shares to the Selling Agents in this manner, we will enter into a separate agreement setting forth the terms of such

transaction, and we will describe the agreement in a separate Prospectus Supplement or pricing supplement.

We will pay the Selling Agents

commissions for their services in acting as agent in the sale of Shares at a commission rate equal to 2.0% of the gross sale price per

share sold. We have also reimbursed the Selling Agents their reasonable out-of-pocket expenses, including attorney’s fees in the

amount of $30,000. We estimate that the total expenses for the offering, excluding compensation payable to the Selling Agents under the

Sales Agreement, but including the attorneys’ fees reimbursement, will be approximately $225,000.

Settlement for sales of Shares

will occur on the second business day following the date on which any sales are made, or on some other date that is agreed upon by us

and the Selling Agents in connection with a particular transaction, in return for payment of the net proceeds to us. There is no arrangement

for funds to be received in an escrow, trust or similar arrangement.

In connection with the sale

of Shares on our behalf, the Selling Agents will be deemed to be underwriters within the meaning of the Securities Act, and the compensation

of the Selling Agents will be deemed to be underwriting commissions or discounts. We have agreed to provide indemnification and contribution

to the Selling Agents against certain civil liabilities, including liabilities under the Securities Act.

The offering pursuant to the

Sales Agreement will terminate upon the earlier of (1) the issuance and sale of all Shares subject to the Sales Agreement; and (2) the

termination of the Sales Agreement as permitted therein.

The Selling Agents or their

affiliates have provided and may in the future provide various investment banking and other financial services for us and our affiliates,

for which services they may in the future receive customary fees. To the extent required by Regulation M, the Selling Agents will

not engage in any market making activities involving any of the Shares while the offering is ongoing under this Prospectus Supplement.

This summary of the material

provisions of the Sales Agreement does not purport to be a complete statement of its terms and conditions. A copy of the Sales Agreement

is filed with the SEC and is incorporated by reference into the registration statement of which this Prospectus Supplement is a part.

The

principal business address of Ladenburg Thalmann & Co. Inc. is 640 5th Avenue, 4th Floor, New York,

NY 10019 and the principal business address of Janney Montgomery Scott LLC is 1717 Arch Street, Philadelphia, PA 19103.

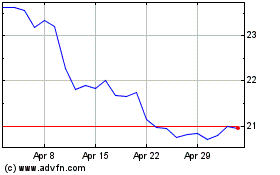

Sachem Capital (AMEX:SACH-A)

Historical Stock Chart

From May 2024 to Jun 2024

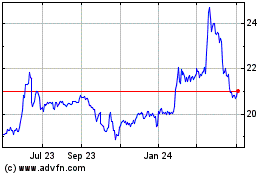

Sachem Capital (AMEX:SACH-A)

Historical Stock Chart

From Jun 2023 to Jun 2024