On the date hereof, based on the terms set forth

above, the estimated initial value of the notes is $962.30 per $1,000 in principal amount. The estimated initial value of the notes on

the Pricing Date may differ from this value but will not be less than $915.00 per $1,000 in principal amount. However, as discussed in

more detail below, the actual value of the notes at any time will reflect many factors and cannot be predicted with accuracy.

Key Terms of the Notes:

| Reference Asset: |

The shares of Global X Robotics & Artificial Intelligence ETF (ticker symbol "BOTZ"). See "The Reference Asset" below for additional information. |

| |

|

| Underlying Index: |

Indxx Global Robotics & Artificial Intelligence Thematic Index |

| |

|

| Payment at Maturity: |

If the Final Level of the Reference Asset is greater than its Initial

Level and the Percentage Change of the Reference Asset multiplied by the Upside Leverage Factor is greater than or equal to the Maximum

Return, the payment at maturity for each $1,000 in principal amount of the notes will equal the Maximum Redemption Amount.

If the Final Level of the Reference Asset is greater than or equal to

its Initial Level and the Percentage Change of the Reference Asset multiplied by the Upside Leverage Factor is less than the Maximum Return,

then the amount that investors will receive at maturity for each $1,000 in principal amount of the notes will equal:

$1,000 + ($1,000 x Percentage Change of the Reference

Asset x Upside Leverage Factor)

If the Final Level of the Reference Asset is less than its Initial Level,

but is not less than its Buffer Level, then investors will, for each $1,000 in principal amount of the notes, receive the principal amount

of $1,000 and no additional return.

If the Final Level of the Reference Asset is less than its Buffer Level,

then the amount that investors will receive at maturity for each $1,000 in principal amount of the notes will equal:

$1,000 + [$1,000 x (Percentage Change of the Reference

Asset + Buffer Percentage)]

In this case, investors will lose 1% of their principal for each

1% that the Final Level of the Reference Asset declines from its Initial Level in excess of 15.00%. You may lose up to 85.00% of the principal

amount of your notes.

|

| |

|

| Upside Leverage Factor: |

150.00% |

| |

|

| Maximum Return: |

27.00% |

| |

|

| Maximum Redemption Amount: |

The payment at maturity will not exceed the Maximum Redemption Amount of $1,270.00 per $1,000 in principal amount of the notes. |

| |

|

| Percentage Change: |

The quotient, expressed as a percentage, of the following formula:

(Final Level - Initial Level )

Initial Level

|

| |

|

| Initial Level:2 |

The closing level of the Reference Asset on the Pricing Date. |

| |

|

| Buffer Level:2 |

85.00% of the Initial Level. |

| |

|

| Buffer Percentage:2 |

15.00% Accordingly, you will receive the principal amount of your notes at maturity only if the level of the Reference Asset does not decrease by more than 15.00% over the term of the notes. If the Final Level of the Reference Asset is less than its Buffer Level, you will receive less than the principal amount of your notes at maturity and you could lose up to 85.00% of the principal amount of your notes. |

| |

|

| Final Level: |

The closing level of the Reference Asset on the Valuation Date. |

| |

|

| Pricing Date:1 |

June 16, 2023 |

| |

|

| Settlement Date:1 |

June 22, 2023 |

| |

|

| Valuation Date:1 |

June 16, 2025 |

| |

|

| Maturity Date:1 |

June 20, 2025 |

| |

|

| Physical Delivery Amount: |

We will only pay cash on the Maturity Date, and you will have no right to receive any shares of the Reference Asset. |

| |

|

| Calculation Agent: |

BMOCM |

| |

|

| Selling Agent: |

BMOCM |

1 Expected and subject to the occurrence of a market disruption

event, as described in the accompanying product supplement. If we make any change to the expected Pricing Date and Settlement Date, the

Valuation Date and Maturity Date will be changed so that the stated term of the notes remains approximately the same.

2As determined by the calculation agent and subject to adjustment

in certain circumstances. See “General Terms of the Notes — Anti-dilution Adjustments to a Reference Asset that Is an Equity

Security (Including Any ETF)” and “— Adjustments to an ETF” in the product supplement for additional information.

Payoff Example

The following table shows the hypothetical payout

profile of an investment in the notes based on various hypothetical Final Levels (and the corresponding Percentage Change) of the Reference

Asset reflecting the 150.00% Upside Leverage Factor, Maximum Return of 27.00% and Buffer Level of 85.00% of the Initial Level. Please

see “Examples of the Hypothetical Payment at Maturity for a $1,000 Investment in the Notes” below for more detailed examples.

|

Hypothetical Percentage Change

of the Reference Asset

|

Participation in Percentage

Change |

Hypothetical Return of the

Notes |

|

21.33%

18.00%

|

150% Upside Exposure, subject to the Maximum

Return

|

27.00%

27.00% |

|

12.00%

6.00%

|

150% Upside Exposure

|

18.00%

9.00% |

|

-10%

-15%

|

Buffer Level of 85.00% of Initial Level

|

0%

0% |

|

-25%

-35%

|

1x Loss Beyond Buffer Level

|

-10%

-20% |

Additional Terms of the Notes

You should read this document together with the

product supplement dated September 22, 2022, the prospectus supplement dated May 26, 2022 and the prospectus dated May 26, 2022. This

document, together with the documents listed below, contains the terms of the notes and supersedes all other prior or contemporaneous

oral statements as well as any other written materials including preliminary or indicative pricing terms, correspondence, trade ideas,

structures for implementation, sample structures, fact sheets, brochures or other educational materials of ours or the agent. You

should carefully consider, among other things, the matters set forth in Additional Risk Factors Relating to the Notes in the product supplement,

as the notes involve risks not associated with conventional debt securities. We urge you to consult your investment, legal, tax, accounting

and other advisers before you invest in the notes.

You may access these documents on the SEC website

at www.sec.gov as follows (or if such address has changed, by reviewing our filings for the relevant date on the SEC website):

Product supplement dated September 22, 2022:

https://www.sec.gov/Archives/edgar/data/927971/000121465922011396/j922220424b2.htm

Prospectus supplement dated May 26, 2022 and prospectus dated

May 26, 2022:

https://www.sec.gov/Archives/edgar/data/0000927971/000119312522160519/d269549d424b5.htm

Our Central Index Key, or CIK, on the SEC website

is 927971. As used in this document, "we", "us" or "our" refers to Bank of Montreal.

We have filed a registration statement (including

a prospectus) with the SEC for the offering to which this document relates. Before you invest, you should read the prospectus in that

registration statement and the other documents that we have filed with the SEC for more complete information about us and this offering.

You may obtain these documents free of charge by visiting the SEC's website at http://www.sec.gov. Alternatively, we will arrange to send

to you the prospectus (as supplemented by the prospectus supplement and product supplement) if you request it by calling our agent toll-free

at 1-877-369-5412.

Selected Risk Considerations

An investment in the notes involves significant

risks. Investing in the notes is not equivalent to investing directly in the Reference Asset. These risks are explained in more detail

in the “Additional Risk Factors Relating to the Notes” section of the product supplement.

Risks Related to the Structure or Features of the Notes

| · | Your investment in the notes may result in a loss. — The notes do not guarantee any return of principal. If the Final

Level is less than its Buffer Level, you will lose 1% of the principal amount for each 1% that the Final Level is less than the Initial

Level in excess of the Buffer Percentage. In such a case, you will receive at maturity a cash payment that is less than the principal

amount of the notes and may be significantly less than the principal amount of your notes. Accordingly, you could lose up to 85.00%

of the principal amount of your notes. |

| · | Your return on the notes is limited to the Maximum Redemption Amount, regardless of any appreciation in the levels of the Reference

Asset. — The return on your notes will not be greater than the Maximum Redemption Amount. This will be the case even if the

Percentage Change of the Reference Asset multiplied by the Upside Leverage Factor exceeds the Maximum Return. |

| · | Your return on the notes may be lower than the return on a conventional debt security of comparable maturity. — The

return that you will receive on your notes, which could be negative, may be less than the return you could earn on other investments.

The notes do not provide for interest payments and the payment you receive at maturity, if any, may be less than the principal amount

of the notes. Even if your return on the notes is positive, your return may be less than the return you would earn if you bought a conventional

senior interest bearing debt security of ours with the same maturity or if you invested directly in the Reference Asset. Your investment

may not reflect the full opportunity cost to you when you take into account factors that affect the time value of money. |

Risks Related to the Reference Asset

| · | Owning the notes is not the same as owning shares of the Reference Asset or a security directly linked to the Reference Asset.

— The return on your notes will not reflect the return you would realize if you actually owned shares of the Reference Asset or

a security directly linked to the performance of the Reference Asset and held that investment for a similar period. Your notes may trade

quite differently from the Reference Asset. Changes in the level of the Reference Asset may not result in comparable changes in the market

value of your notes. Even if the level of the Reference Asset increases during the term of the notes, the market value of the notes prior

to maturity may not increase to the same extent. It is also possible for the market value of the notes to decrease while the level of

the Reference Asset increases. In addition, any dividends or other distributions paid on the Reference Asset will not be reflected in

the amount payable on the notes. |

| · | You will not have any shareholder rights and will have no right to receive any shares of the Reference Asset (or any company included

in the Reference Asset) at maturity. — Investing in your notes will not make you a holder of any shares of the Reference Asset

or any securities held by the Reference Asset. Neither you nor any other holder or owner of the notes will have any voting rights, any

right to receive dividends or other distributions, or any other rights with respect to the Reference Asset or such underlying securities. |

| · | No delivery of shares of the Reference Asset. — The notes will be payable only in cash. You should not invest in the

notes if you seek to have the shares of the Reference Asset delivered to you at maturity. |

| · | Changes that affect the applicable Underlying Index will affect the market value of the notes and the amount you will receive at

maturity. — The policies of the applicable index sponsor concerning the calculation of the applicable Underlying Index, additions,

deletions or substitutions of the components of the applicable Underlying Index and the manner in which changes affecting those components,

such as stock dividends, reorganizations or mergers, may be reflected in the applicable Reference Asset and, therefore, could affect the

share price of the Reference Asset, the amounts payable on the notes, and the market value of the notes prior to maturity. The amount

payable on the notes and their market value could also be affected if the applicable index sponsor changes these policies, for example,

by changing the manner in which it calculates the applicable Underlying Index, or if the applicable index sponsor discontinues or suspends

the calculation or publication of the applicable Underlying Index. |

| · | We have no affiliation with the index sponsor of the applicable Underlying Index and will not be responsible for its actions.

— The sponsor of the applicable Underlying Index is not our affiliate and will not be involved in the offering of the notes in any

way. Consequently, we have no control over the actions of the index sponsor of the applicable Underlying Index, including any actions

of the type that would require the calculation agent to adjust the payment to you at maturity. The index sponsors have no obligation of

any sort with respect to the notes. Thus, the applicable index sponsor has no obligation to take your interests into consideration for

any reason, including in taking any actions that might affect the value of the notes. None of our proceeds from the issuance of the notes

will be delivered to the index sponsor of the applicable Underlying Index. |

| · | Adjustments to the Reference Asset could adversely affect the notes. — The sponsor and advisor of the Reference Asset

is responsible for calculating and maintaining the Reference Asset. The sponsor and advisor of the Reference Asset can add, delete or

substitute the stocks comprising the Reference Asset or make other methodological changes that could change the share price of the Reference

Asset at any time. If one or more of these events occurs, the calculation of the amount payable at maturity may be adjusted to reflect

such event or events. Consequently, any of these actions could adversely affect the amount payable at maturity and/or the market value

of the notes. |

| · | We and our affiliates do not have any affiliation with the applicable investment advisor or the Reference Asset Issuer and are

not responsible for their public disclosure of information. — The investment advisor of the Reference Asset advises the issuer

of the Reference Asset (the “Reference Asset Issuer” ) on various matters, including matters relating to the policies, maintenance

and calculation of the Reference Asset. We and our affiliates are not affiliated with the applicable investment advisor or the Reference

Asset Issuer in any way and have no ability to control or predict its actions, including any errors in or discontinuance of disclosure

regarding the methods or policies relating to the Reference Asset. Neither the applicable investment advisor nor the Reference Asset Issuer

is involved in the offerings of the notes in any way and has no obligation to consider your interests as an owner of the notes in taking

any actions relating to the Reference Asset that might affect the value of the notes. Neither we nor any of our affiliates has independently

verified the adequacy or accuracy of the information about the applicable investment advisor or the Reference Asset contained in any public

disclosure of information. You, as an investor in the notes, should make your own investigation into the Reference Asset Issuer. |

| · | The correlation between the performance of the Reference Asset and the performance of the applicable Underlying Index may be imperfect.

— The performance of the Reference Asset is linked principally to the performance of the applicable Underlying Index. However, because

of the potential discrepancies identified in more detail in the product supplement, the return on the Reference Asset may correlate imperfectly

with the return on the applicable Underlying Index. |

| · | The Reference Asset is subject to management risks. — The Reference Asset is subject to management risk, which is the

risk that the applicable investment advisor’s investment strategy, the implementation of which is subject to a number of constraints,

may not produce the intended results. For example, the applicable investment advisor may invest a portion of the Reference Asset Issuer’s

assets in securities not included in the relevant industry or sector but which the applicable investment advisor believes will help the

Reference Asset track the relevant industry or sector. |

| · | You must rely on your own evaluation of the merits of an investment linked to the Reference Asset. — In the ordinary

course of their businesses, our affiliates from time to time may express views on expected movements in the prices of the Reference Asset

or the prices of the securities held by the Reference Asset. One or more of our affiliates have published, and in the future may publish,

research reports that express views on the Reference Asset or these securities. However, these views are subject to change from time to

time. Moreover, other professionals who deal in the markets relating to the Reference Asset at any time may have significantly different

views from those of our affiliates. You are encouraged to derive information concerning the Reference Asset from multiple sources, and

you should not rely on the views expressed by our affiliates.

Neither the offering of the notes nor any views which our affiliates from time to time may express in the ordinary course of their businesses

constitutes a recommendation as to the merits of an investment in the notes. |

Risks Related to the Global X Robotics & Artificial Intelligence

ETF

| · | An investment in the notes is subject to risks relating to companies engaged in the technology sector. |

The securities held by the Reference Asset are concentrated

in the technology sector. Market or economic factors impacting technology companies and companies that rely heavily on technological advances

could have a major effect on the level of the Reference Asset. The value of stocks of technology companies and companies that rely heavily

on technology is particularly vulnerable to rapid changes in technology product cycles, rapid product obsolescence, government regulation

and competition, both in the U.S. and internationally. Stocks of technology companies and companies that rely heavily on technology tend

to be more volatile than the overall market. Technology companies are heavily dependent on patent and intellectual property rights, the

loss or impairment of which may adversely affect profitability. Additionally, companies in the technology sector may face dramatic and

often unpredictable changes in growth rates and competition for the services of qualified personnel. Any of these factors could reduce

the level of the Reference Asset, and adversely impact the payments on the notes.

| · | An investment in the notes is subject to risks associated with foreign securities markets. — The Reference Asset tracks

the value of certain foreign equity securities. You should be aware that investments in securities linked to the value of foreign equity

securities involve particular risks. The foreign securities markets comprising the Reference Asset may have less liquidity and may be

more volatile than U.S. or other securities markets and market developments may affect foreign markets differently from U.S. or other

securities markets. Direct or indirect government intervention to stabilize these foreign securities markets, as well as cross-shareholdings

in foreign companies, may affect trading prices and volumes in these markets. Also, there is generally less publicly available information

about foreign companies than about those U.S. companies that are subject to the reporting requirements of the U.S. Securities and Exchange

Commission, and foreign companies are subject to accounting, auditing and financial reporting standards and requirements that differ from

those applicable to U.S. reporting companies.

Prices of securities in foreign countries are subject to political, economic, financial and social factors that apply in those geographical

regions. These factors, which could negatively affect those securities markets, include the possibility of recent or future changes in

a foreign government’s economic and fiscal policies, the possible imposition of, or changes in, currency exchange laws or other

laws or restrictions applicable to foreign companies or investments in foreign equity securities and the possibility of fluctuations in

the rate of exchange between currencies, the possibility of outbreaks of hostility and political instability and the possibility of natural

disaster or adverse public health developments in the region. Moreover, foreign economies may differ favorably or unfavorably from the

U.S. economy in important respects such as growth of gross national product, rate of inflation, capital reinvestment, resources and self-sufficiency. |

| · | The notes are subject to currency exchange risk. — Because the prices of the non-U.S. equity securities held by the Reference

Asset are converted into U.S. dollars for purposes of calculating the net asset value of the Reference Asset, holders of the notes will

be exposed to currency exchange rate risk with respect to each of the currencies in which the non-U.S. equity securities held by the Reference

Asset trade. Your net exposure will depend on the extent to which those currencies strengthen or weaken against the U.S. dollar and the

relative weight of equity securities held by the Reference Asset denominated in each of those currencies. If, taking into account the

relevant weighting, the U.S. dollar strengthens against those currencies, the price of the Reference Asset will be adversely affected

and any payment on the notes may be reduced. |

General Risk Factors

| · | Your investment is subject to the credit risk of Bank of Montreal. — Our credit ratings and credit spreads may adversely

affect the market value of the notes. Investors are dependent on our ability to pay any amounts due on the notes, and therefore investors

are subject to our credit risk and to changes in the market’s view of our creditworthiness. Any decline in our credit ratings or

increase in the credit spreads charged by the market for taking our credit risk is likely to adversely affect the value of the notes. |

| · | Potential conflicts. — We and our affiliates play a variety of roles in connection with the issuance of the notes, including

acting as calculation agent. In performing these duties, the economic interests of the calculation agent and other affiliates of ours

are potentially adverse to your interests as an investor in the notes. We or one or more of our affiliates may also engage in trading

of shares of the Reference Asset or the securities held by the Reference Asset on a regular basis as part of our general broker-dealer

and other businesses, for proprietary accounts, for other accounts under management or to facilitate transactions for our customers. Any

of these activities could adversely affect the level of the Reference Asset and, therefore, the market value of, and the payments on,

the notes. We or one or more of our affiliates may also issue or underwrite other securities or financial or derivative instruments with

returns linked or related to changes in the performance of the Reference Asset. By introducing competing products into the marketplace

in this manner, we or one or more of our affiliates could adversely affect the market value of the notes. |

| · | Our initial estimated value of the notes will be lower than the price to public. — Our initial estimated value of the

notes is only an estimate, and is based on a number of factors. The price to public of the notes will exceed our initial estimated value,

because costs associated with offering, structuring and hedging the notes are included in the price to public, but are not included in

the estimated value. These costs include any underwriting discount and selling concessions, the profits that we and our affiliates expect

to realize for assuming the risks in hedging our obligations under the notes and the estimated cost of hedging these obligations. The

initial estimated value of the notes may be as low as the amount indicated on the cover page hereof. |

| · | Our initial estimated value does not represent any future value of the notes, and may also differ from the estimated value of any

other party. — Our initial estimated value of the notes as of the date hereof is, and our estimated value as determined on the

Pricing Date will be, derived using our internal pricing models. This value is based on market conditions and other relevant factors,

which include volatility of the Reference Asset, dividend rates and interest rates. Different pricing models and assumptions could provide

values for the notes that are greater than or less than our initial estimated value. In addition, market conditions and other relevant

factors after the Pricing Date are expected to change, possibly rapidly, and our assumptions may prove to be incorrect. After the Pricing

Date, the value of the notes could change dramatically due to changes in market conditions, our creditworthiness, and the other factors

set forth herein and in the product supplement. These changes are likely to impact the price, if any, at which we or BMOCM would be willing

to purchase the notes from you in any secondary market transactions. Our initial estimated value does not represent a minimum price at

which we or our affiliates would be willing to buy your notes in any secondary market at any time. |

| · | The terms of the notes are not determined by reference to the credit spreads for our conventional fixed-rate debt. —

To determine the terms of the notes, we will use an internal funding rate that represents a discount from the credit spreads for our conventional

fixed-rate debt. As a result, the terms of the notes are less favorable to you than if we had used a higher funding rate. |

| · | Certain costs are likely to adversely affect the value of the notes. — Absent any changes in market conditions, any secondary

market prices of the notes will likely be lower than the price to public. This is because any secondary market prices will likely take

into account our then-current market credit spreads, and because any secondary market prices are likely to exclude all or a portion of

any underwriting discount and selling concessions, and the hedging profits and estimated hedging costs that are included in the price

to public of the notes and that may be reflected on your account statements. In addition, any such price is also likely to reflect a discount

to account for costs associated with establishing or unwinding any related hedge transaction, such as dealer discounts, mark-ups and other

transaction costs. As a result, the price, if any, at which BMOCM or any other party may be willing to purchase the notes from you in

secondary market transactions, if at all, will likely be lower than the price to public. Any sale that you make prior to the Maturity

Date could result in a substantial loss to you. |

| · | Lack of liquidity. — The notes will not be listed on any securities exchange. BMOCM may offer to purchase the notes in

the secondary market, but is not required to do so. Even if there is a secondary market, it may not provide enough liquidity to allow

you to trade or sell the notes easily. Because other dealers are not likely to make a secondary market for the notes, the price at which

you may be able to trade the notes is likely to depend on the price, if any, at which BMOCM is willing to buy the notes. |

| · | Hedging and trading activities. — We or any of our affiliates have carried out or may carry out hedging activities related

to the notes, including purchasing or selling shares of the Reference Asset or securities held by the Reference Asset, futures or options

relating to the Reference Asset or securities held by the Reference Asset or other derivative instruments with return liked or related

to changes in the performance on the Reference Asset or securities held by the Reference Asset. We or our affiliates may also trade in

the Reference Asset, such securities, or instruments related to the Reference Asset or such securities from time to time. Any of these

hedging or trading activities on or prior to the Pricing Date and during the term of the notes could adversely affect the payments on

the notes. |

| · | Many economic and market factors will influence the value of the notes. — In addition to the level of the Reference Asset

and interest rates on any trading day, the value of the notes will be affected by a number of economic and market factors that may either

offset or magnify each other, and which are described in more detail in the product supplement. |

| · | Significant aspects of the tax treatment of the notes are uncertain. — The tax treatment of the notes is uncertain. We

do not plan to request a ruling from the Internal Revenue Service or from any Canadian authorities regarding the tax treatment of the

notes, and the Internal Revenue Service or a court may not agree with the tax treatment described herein.

The Internal Revenue Service has released a notice that may affect the taxation of holders of “prepaid forward contracts”

and similar instruments. According to the notice, the Internal Revenue Service and the U.S. Treasury are actively considering whether

the holder of such instruments should be required to accrue ordinary income on a current basis. While it is not clear whether the notes

would be viewed as similar to such instruments, it is possible that any future guidance could materially and adversely affect the tax

consequences of an investment in the notes, possibly with retroactive effect.

Please read carefully the section entitled "U.S. Federal Tax Information" herein, the section entitled "Supplemental Tax

Considerations–Supplemental U.S. Federal Income Tax Considerations" in the accompanying product supplement, the section entitled

"United States Federal Income Taxation" in the accompanying prospectus and the section entitled "Certain Income Tax Consequences"

in the accompanying prospectus supplement. You should consult your tax advisor about your own tax situation. |

Examples of the Hypothetical Payment at Maturity for a $1,000 Investment

in the Notes

The following table illustrates the hypothetical

payments on a note at maturity. The hypothetical payments are based on a $1,000 investment in the note, a hypothetical Initial Level of

100.00, a hypothetical Buffer Level of 85.00 (85.00% of the hypothetical initial level), the Maximum Return of 27.00%, the Maximum Redemption

Amount of $1,270.00, and a range of hypothetical Final Levels and the effect on the payment at maturity.

The hypothetical examples shown below are intended

to help you understand the terms of the notes. The actual cash amount that you will receive at maturity will depend upon the Final Level

of the Reference Asset. You may lose some or all of the principal amount at maturity.

| Hypothetical Final Level |

Hypothetical Final Level

Expressed as a Percentage of the

Initial Level |

Hypothetical Payment at

Maturity |

Hypothetical Return on the

Notes |

| 200.00 |

200.00% |

$1,270.00 |

27.00% |

| 180.00 |

180.00% |

$1,270.00 |

27.00% |

| 160.00 |

160.00% |

$1,270.00 |

27.00% |

| 140.00 |

140.00% |

$1,270.00 |

27.00% |

| 120.00 |

120.00% |

$1,270.00 |

27.00% |

| 118.00 |

118.00% |

$1,270.00 |

27.00% |

| 110.00 |

110.00% |

$1,150.00 |

15.00% |

| 105.00 |

105.00% |

$1,075.00 |

7.50% |

| 100.00 |

100.00% |

$1,000.00 |

0.00% |

| 95.00 |

95.00% |

$1,000.00 |

0.00% |

| 90.00 |

90.00% |

$1,000.00 |

0.00% |

| 85.00 |

85.00% |

$1,000.00 |

0.00% |

| 84.99 |

84.99% |

$999.90 |

-0.01% |

| 80.00 |

80.00% |

$950.00 |

-5.00% |

| 40.00 |

40.00% |

$550.00 |

-45.00% |

| 20.00 |

20.00% |

$350.00 |

-65.00% |

| 0.00 |

0.00% |

$150.00 |

-85.00% |

The following examples illustrate how the returns

set forth in the table above are calculated.

Example 1: The level of the Reference Asset decreases from the hypothetical

Initial Level of 100.00 to a hypothetical Final Level of 40.00, representing a Percentage Change of –60.00%. Because the Percentage

Change of the Reference Asset is negative and its hypothetical Final Level is less than its Buffer Level, the investor receives a payment

at maturity of $550.00 per $1,000 in principal amount of the notes, calculated as follows:

$1,000 + [$1,000 x (–60.00% + 15.00%)] = $550

Example 2: The level of the Reference Asset decreases from the hypothetical

Initial Level of 100.00 to a hypothetical Final Level of 95.00, representing a Percentage Change of -5.00%. Although the Percentage

Change of the Reference Asset is negative, because its hypothetical Final Level is greater than its Buffer Level, the investor receives

a payment at maturity equal to the principal amount of the notes.

Example 3: The level of the Reference Asset increases from the hypothetical

Initial Level of 100.00 to a hypothetical Final Level of 110.00, representing a Percentage Change of 10.00%. Because the hypothetical

Final Level of the Reference Asset is greater than its hypothetical Initial Level and the Percentage Change multiplied by the Upside Leverage

Factor does not exceed the Maximum Return, the investor receives a payment at maturity of $1,150.00 per $1,000 in principal amount of

the notes, calculated as follows:

$1,000 + $1,000 x (10.00% x 150.00%) = $1,150.00

Example 4: The level of the Reference Asset increases from the hypothetical

Initial Level of 100.00 to a hypothetical Final Level of 120.00, representing a Percentage Change of 20.00%. Because the hypothetical

Final Level of the Reference Asset is greater than its hypothetical Initial Level, and the Percentage Change multiplied by the Upside

Leverage Factor exceeds the Maximum Return, the investor receives a payment at maturity of $1,270.00 per $1,000 in principal amount of

the notes (the Maximum Redemption Amount). The return on the notes in this example is less than the Percentage Change of the Reference

Asset.

U.S. Federal Tax Information

By purchasing the notes, each holder agrees (in

the absence of a change in law, an administrative determination or a judicial ruling to the contrary) to treat each note as a pre-paid

derivative contract for U.S. federal income tax purposes. In the opinion of our counsel, Mayer Brown LLP, it would generally be reasonable

to treat the notes as pre-paid derivative contracts in respect of the Reference Asset for U.S. federal income tax purposes. However, the

U.S. federal income tax consequences of your investment in the notes are uncertain and the Internal Revenue Service could assert that

the notes should be taxed in a manner that is different from that described in the preceding sentence. Please see the discussion in the

product supplement dated September 22, 2022 under “Supplemental Tax Considerations—Supplemental U.S. Federal Income Tax Considerations—Notes

Treated as Pre-Paid Derivative Contracts,” which applies to the notes.

Supplemental Plan of Distribution (Conflicts of Interest)

BMOCM will purchase the notes from us at a purchase

price reflecting the commission set forth on the cover hereof. BMOCM has informed us that, as part of its distribution of the notes, it

will reoffer the notes to other dealers who will sell them. Each such dealer, or each additional dealer engaged by a dealer to whom BMOCM

reoffers the notes, will receive a commission from BMOCM, which will not exceed the commission set forth on the cover page. We or one

of our affiliates may also pay a referral fee to certain dealers in connection with the distribution of the notes.

Certain dealers who purchase the notes for sale

to certain fee-based advisory accounts may forego some or all of their selling concessions, fees or commissions. The public offering price

for investors purchasing the notes in these accounts may be less than 100% of the principal amount, as set forth on the cover page of

this document. Investors that hold their notes in these accounts may be charged fees by the investment advisor or manager of that account

based on the amount of assets held in those accounts, including the notes.

We will deliver the notes on a date that is greater

than two business days following the pricing date. Under Rule 15c6-1 of the Securities Exchange Act of 1934, as amended (the “Exchange

Act”), trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade

expressly agree otherwise. Accordingly, purchasers who wish to trade the notes more than two business days prior to the issue date will

be required to specify alternative settlement arrangements to prevent a failed settlement.

We own, directly or indirectly, all of the outstanding

equity securities of BMOCM, the agent for this offering. In accordance with FINRA Rule 5121, BMOCM may not make sales in this offering

to any of its discretionary accounts without the prior written approval of the customer.

We reserve the right to withdraw, cancel or modify

the offering of the notes and to reject orders in whole or in part. You may cancel any order for the notes prior to its acceptance.

You should not construe the offering of the notes

as a recommendation of the merits of acquiring an investment linked to the Reference Asset or as to the suitability of an investment in

the notes.

BMOCM may, but is not obligated to, make a market

in the notes. BMOCM will determine any secondary market prices that it is prepared to offer in its sole discretion.

We may use the final pricing supplement relating

to the notes in the initial sale of the notes. In addition, BMOCM or another of our affiliates may use the final pricing supplement in

market-making transactions in any notes after their initial sale. Unless BMOCM or we inform you otherwise in the confirmation of sale,

the final pricing supplement is being used by BMOCM in a market-making transaction.

For a period of approximately three months following

issuance of the notes, the price, if any, at which we or our affiliates would be willing to buy the notes from investors, and the value

that BMOCM may also publish for the notes through one or more financial information vendors and which could be indicated for the notes

on any brokerage account statements, will reflect a temporary upward adjustment from our estimated value of the notes that would otherwise

be determined and applicable at that time. This temporary upward adjustment represents a portion of (a) the hedging profit that we or

our affiliates expect to realize over the term of the notes and (b) any underwriting discount and the selling concessions paid in connection

with this offering. The amount of this temporary upward adjustment will decline to zero on a straight-line basis over the three-month

period.

The notes and the related offer to purchase notes

and sale of notes under the terms and conditions provided herein do not constitute a public offering in any non-U.S. jurisdiction, and

are being made available only to individually identified investors pursuant to a private offering as permitted in the relevant jurisdiction.

The notes are not, and will not be, registered with any securities exchange or registry located outside of the United States and have

not been registered with any non-U.S. securities or banking regulatory authority. The contents of this document have not been reviewed

or approved by any non-U.S. securities or banking regulatory authority. Any person who wishes to acquire the notes from outside the United

States should seek the advice or legal counsel as to the relevant requirements to acquire these notes.

British Virgin Islands. The notes have not

been, and will not be, registered under the laws and regulations of the British Virgin Islands, nor has any regulatory authority in the

British Virgin Islands passed comment upon or approved the accuracy or adequacy of this document. This pricing supplement and the related

documents shall not constitute an offer, invitation or solicitation to any member of the public in the British Virgin Islands for the

purposes of the Securities and Investment Business Act, 2010, of the British Virgin Islands.

Cayman Islands. Pursuant to the Companies

Law (as amended) of the Cayman Islands, no invitation may be made to the public in the Cayman Islands to subscribe for the notes by or

on behalf of the issuer unless at the time of such invitation the issuer is listed on the Cayman Islands Stock Exchange. The issuer is

not presently listed on the Cayman Islands Stock Exchange and, accordingly, no invitation to the public in the Cayman Islands is to be

made by the issuer (or by any dealer on its behalf). No such invitation is made to the public in the Cayman Islands hereby.

Dominican Republic. Nothing in this pricing

supplement constitutes an offer of securities for sale in the Dominican Republic. The notes have not been, and will not be, registered

with the Superintendence of Securities Market of the Dominican Republic (Superintendencia del Mercado de Valores), under Dominican Securities

Market Law No. 249-17 (“Securities Law 249-17”), and the notes may not be offered or sold within the Dominican Republic or

to, or for the account or benefit of, Dominican persons (as defined under Securities Law 249-17 and its regulations). Failure to comply

with these directives may result in a violation of Securities Law 249-17 and its regulations.

Israel. This pricing supplement is intended

solely for investors listed in the First Supplement of the Israeli Securities Law of 1968, as amended. A prospectus has not been prepared

or filed, and will not be prepared or filed, in Israel relating to the notes offered hereunder. The notes cannot be resold in Israel other

than to investors listed in the First Supplement of the Israeli Securities Law of 1968, as amended.

No action will be taken in Israel that would permit

an offering of the notes or the distribution of any offering document or any other material to the public in Israel. In particular, no

offering document or other material has been reviewed or approved by the Israel Securities Authority. Any material provided to an offeree

in Israel may not be reproduced or used for any other purpose, nor be furnished to any other person other than those to whom copies have

been provided directly by us or the selling agents.

Nothing in this pricing supplement or any other

offering material relating to the notes, should be considered as the rendering of a recommendation or advice, including investment advice

or investment marketing under the Law For Regulation of Investment Advice, Investment Marketing and Investment Portfolio Management, 1995,

to purchase any note. The purchase of any note will be based on an investor’s own understanding, for the investor’s own benefit

and for the investor’s own account and not with the aim or intention of distributing or offering to other parties. In purchasing

the notes, each investor declares that it has the knowledge, expertise and experience in financial and business matters so as to be capable

of evaluating the risks and merits of an investment in the notes, without relying on any of the materials provided.

Mexico. The notes have not been registered

with the National Registry of Securities maintained by the Mexican National Banking and Securities Commission and may not be offered or

sold publicly in Mexico. This pricing supplement and the related documents may not be publicly distributed in Mexico. The notes may only

be offered in a private offering pursuant to Article 8 of the Securities Market Law.

Switzerland. The notes may not be distributed

to retail investors in Switzerland. This pricing supplement shall not be dispatched, copied to or otherwise made available to any person

in Switzerland, and the notes may not be offered for sale to any person in Switzerland, except in accordance with Swiss law.

The notes are not offered, sold or advertised, directly

or indirectly, in, into or from Switzerland on the basis of a public offering and will not be listed on the SIX Swiss Exchange or any

other offering or regulated trading facility in Switzerland. Accordingly, neither this pricing supplement or any other marketing material

constitute a prospectus as defined in article 652a or article 1156 of the Swiss Code of Obligations or a listing prospectus as defined

in article 32 of the Listing Rules of the SIX Swiss Exchange or any other regulated trading facility in Switzerland. Any sales or resales

of the notes may only be undertaken on a private basis to selected individual investors in compliance with Swiss law. By accepting this

pricing supplement or by purchasing the notes, investors are deemed to have acknowledged and agreed to abide by these restrictions.

The notes may also be sold in the following jurisdictions,

provided, in each case, any sales are made in accordance with all applicable laws in such jurisdiction:

Additional Information Relating to the Estimated Initial Value of

the Notes

Our estimated initial value of the notes on the

date hereof, and that will be set forth on the cover page of the final pricing supplement relating to the notes, equals the sum of the

values of the following hypothetical components:

| · | a fixed-income debt component with the same tenor as the notes, valued using our internal funding rate for structured notes; and |

| · | one or more derivative transactions relating to the economic terms of the notes. |

The internal funding rate used in the determination

of the initial estimated value generally represents a discount from the credit spreads for our conventional fixed-rate debt. The value

of these derivative transactions is derived from our internal pricing models. These models are based on factors such as the traded market

prices of comparable derivative instruments and on other inputs, which include volatility, dividend rates, interest rates and other factors.

As a result, the estimated initial value of the notes on the Pricing Date will be determined based on the market conditions on the Pricing

Date.

The Reference Asset

We have derived the following information from publicly

available documents. We have not independently verified the accuracy or completeness of the following information. We are not affiliated

with the Reference Asset Issuer and the Reference Asset Issuer will have no obligations with respect to the notes. This document relates

only to the notes and does not relate to the shares of the Reference Asset or any securities included in the Underlying Index. Neither

we nor any of our affiliates participates in the preparation of the publicly available documents described below. Neither we nor any of

our affiliates has made any due diligence inquiry with respect to the Reference Asset in connection with the offering of the notes. There

can be no assurance that all events occurring prior to the date hereof, including events that would affect the accuracy or completeness

of the publicly available documents described below and that would affect the trading price of the shares of the Reference Asset, have

been or will be publicly disclosed. Subsequent disclosure of any events or the disclosure of or failure to disclose material future events

concerning the Reference Asset could affect the price of the shares of the Reference Asset on the Valuation Date, and therefore could

affect the payments on the notes.

The selection of the Reference Asset is not a recommendation

to buy or sell the shares of the Reference Asset. Neither we nor any of our affiliates make any representation to you as to the performance

of the shares of the Reference Asset. Information provided to or filed with the SEC under the Exchange Act and the Investment Company

Act of 1940 relating to the Reference Asset may be obtained through the SEC’s website at http://www.sec.gov.

The Global X U.S. Robotics & Artificial Intelligence ETF

The Global X U.S. Robotics & Artificial Intelligence ETF is an investment

portfolio maintained, managed and advised by Global X Management Company LLC. The Global X U.S. Robotics & Artificial Intelligence

ETF seeks to provide investment results that correspond generally to the price and yield performance, before fees and expenses, of the

Indxx Global Robotics & Artificial Intelligence Thematic Index. Information about the Global X U.S. Robotics & Artificial Intelligence

ETF filed with the SEC can be found by reference to its SEC file number: 333-151713 and 811-22209 or its CIK Code: 0001432353. Shares

of the Global X U.S. Robotics & Artificial Intelligence ETF are listed on the Cboe BZX under ticker symbol "BOTZ."

Indxx Global Robotics & Artificial Intelligence Thematic Index

The Indxx Global Robotics & Artificial Intelligence Thematic Index

is sponsored by Indxx, LLC (“Indxx” or the “index sponsor”). The Indxx Global Robotics & Artificial Intelligence

Thematic Index was first launched on September 12, 2016, and it has a base date of January 31, 2011 with an initial value of 1,000.

The Indxx Global Robotics & Artificial Intelligence Thematic Index

is designed to track the performance of companies listed in developed markets that that are expected to benefit from the increased adoption

and utilization of robotics and Artificial Intelligence (“AI”), including companies involved in Industrial Robotics and Automation,

Non-Industrial Robots, Artificial Intelligence and Unmanned Vehicles (collectively, “Global Robotics and Artificial Intelligence

Companies”), as defined by the index sponsor. The Indxx Global Robotics & Artificial Intelligence Thematic Index is a modified

market capitalization weighted index and is calculated in U.S. dollars ($) on a total return basis. We have derived all information contained

in this description regarding the Indxx Global Robotics & Artificial Intelligence Thematic Index from publicly available information.

Additional information is available on the following website: indxx.com/indxx-global-robotics--artificial-intelligence-thematic-index-tr.

We are not incorporating by reference the website or any material it includes in this pricing supplement.

Index Construction

Creation of the Initial Universe

To be eligible for inclusion in the initial universe, securities must

meet the following criteria:

• Their

primary listing is in a developed market.

• A

minimum total market capitalization of $300 million.

• A

6-month average daily turnover greater than $2 million. In the case of a significant initial public offering (IPO), a security must have

an average daily turnover greater than or equal to $2 million since the IPO launch date. An IPO is considered to be a significant IPO

if its company level total market capitalization is greater than the company level total market capitalization of at least 50% of the

ongoing index constituents as of the previous reconstitution selection day (defined below).

• Traded

on 90% of the eligible trading days in the last 6 months. A significant IPO will satisfy this condition if it has been listed at least

ten calendar days prior to the reconstitution selection day. An IPO that is not a significant IPO will satisfy this condition if it has

been listed at least 3 calendar months prior to the reconstitution selection day and has traded on at least 90% of the eligible trading

days for the 3 months preceding the reconstitution selection day. For IPOs with less than 6 calendar months of trading history as of the

reconstitution selection day to be considered for inclusion, the IPO must have been listed at least 10 calendar days prior to the reconstitution

selection day, in the case of significant IPOs; and 3 calendar months prior to the reconstitution selection day, in the case of other

IPOs.

• Common

stock, American depositary receipts and global depositary receipts are eligible for inclusion in the index.

In addition, all securities eligible for inclusion must have a minimum

free float equivalent to 10% of shares outstanding. Securities trading at a price of $10,000 or above are not eligible for inclusion in

the index. However, existing constituents shall remain in the initial universe irrespective of their stock price.

Security Selection Process

The security selection process entails the following steps:

• Research

is undertaken by the index sponsor to identify the industries and business segments that are expected to provide the most exposure to

increased investment in robotics and AI. The industries identified through this research-based approach are subject to change at every

annual reconstitution.

• As

of January 2023, Indxx has identified the following four robotics and AI themes:

o Industrial

Robots and Automation: Companies that provide robots and robotic automation products and services with a focus on industrial applications.

o Unmanned

Vehicles and Drones: Companies that are involved in the development and production of unmanned vehicles (including hardware and software

for autonomous cars), drones and robots for both military and consumer markets.

o Non-industrial

Robotics: Companies that are involved in developing robots and AI that are used for non-industrial applications, including but not limited

to agriculture, healthcare, consumer applications and entertainment.

o Artificial

Intelligence: Companies that develop or directly deliver artificial intelligence in form of products, software, or systems, and sell artificial

intelligence and do not utilize/leverage it to enhance their products.

• Only

those companies that derive a significant portion of their revenues from the above industries or have stated their primary business to

be in products and services focused on the above industries are eligible for inclusion in the index.

The top 100 robotics and AI companies by market capitalization will

form the final index. If fewer than 100 companies qualify for inclusion in the index, all of the qualifying companies will comprise the

index. If fewer than 30 companies qualify to be eligible for inclusion, the index committee would consider a secondary list of companies

with diversified revenue streams that (1) have a distinct business unit focused on robotics or artificial intelligence, and (2) have a

core competency that is expected to augment the adoption of robotics or artificial intelligence for inclusion until the count reaches

30.

Buffer rules are applied to reduce turnover of constituents in the Indxx

Global Robotics & Artificial Intelligence Thematic Index. First, a constituent shall continue to be included in the index if its market

capitalization is greater than or equal to 80% of the previously defined market capitalization limit. To illustrate, if an existing index

constituent satisfies all other selection criteria but does not satisfy the market capitalization criteria to the extent of 20% deviation,

then it will be retained in the new index member list. Second, a constituent shall continue to be included in the index if its 6-month

average daily trading volume is greater than or equal to 70% of the previously defined liquidity limit. To illustrate, if an existing

index constituent satisfies all other selection criteria but does not satisfy the liquidity criteria to the extent of 30% deviation, then

it will be retained in the new index member list. Additionally, an existing index constituent shall continue to remain in the index if

it is part of the top 120 companies by market capitalization, even if it is not a part of the top 100 constituents.

Constituent Weightings

The index applies a modified market cap-weighting approach at the time

of reconstitution. A single security weight cap of 8% is applied. Any security which has a weight of 8% or more is allocated 8%. The aggregate

weight of all the components with a weight greater than 5% is capped at 40%. All remaining securities are capped at 4.5%. Security-level

market capitalization is considered for calculating weights.

Index Calculation

The value of the Indxx Global Robotics & Artificial Intelligence

Thematic Index on a business day is determined by a fraction, the numerator of which is the aggregate of the market price of each index

constituent times the number of shares of such index constituent as of the business day the Indxx Global Robotics & Artificial Intelligence

Thematic Index is being calculated, and the denominator of which is the divisor, which is described more fully below. In addition, ordinary

cash dividends will be reinvested in the index, by adjusting the divisor on the ex-dividend date.

The divisor is calculated using a fraction, the numerator of which is

the divisor on the previous business day multiplied by the value of the Indxx Global Robotics & Artificial Intelligence Thematic Index

on the previous business day plus or minus the difference between the closing market capitalization of the Indxx Global Robotics &

Artificial Intelligence Thematic Index on the business day the Indxx Global Robotics & Artificial Intelligence Thematic Index is being

calculated and the adjusted closing market capitalization of the Indxx Global Robotics & Artificial Intelligence Thematic Index on

the previous business day, and the denominator of which is the value of the Indxx Global Robotics & Artificial Intelligence Thematic

Index on the previous business day. The divisor is adjusted on the ex-date of a corporate action. The adjustment is completed in such

a way that the value of the Indxx Global Robotics & Artificial Intelligence Thematic Index remains unchanged.

Index Maintenance

The Indxx Global Robotics & Artificial Intelligence Thematic Index

follows an annual reconstitution and rebalancing schedule. Index reconstitutions become effective at the close of the second Friday of

March each year (“effective day”). The security selection and portfolio creation process start on the close of the nearest

Friday falling at least one month before the effective day (the “reconstitution selection day”). Constituent weights are calculated

at the close of the seventh trading day prior to the effective day. Index shares are frozen using weights as of this day.

The index committee is responsible for setting policy, determining index

composition, and administering the Indxx Global Robotics & Artificial Intelligence Thematic Index in accordance with the index methodology.

The index committee reserves the right to use qualitative judgment to include, exclude, adjust, or postpone the inclusion of a stock.

Continued index membership of a constituent is not necessarily subject to the guidelines provided in the Indxx Global Robotics & Artificial

Intelligence Thematic Index methodology. A stock may be considered for exclusion by the Index Committee on the basis of corporate governance,

accounting policies, lack of transparency and lack of representation, despite meeting all the criteria provided in each of the Indxx index

methodology. Announcements of additions and deletions of constituents, due to various corporate actions mentioned below, in the middle

of the year will be decided by the index committee.

To index committee reviews the index composition on a semi-annual basis.

Any new addition or deletion to the index becomes effective at the close of the second Friday of September (the “review effective

day”). The selection date shall be the nearest Friday falling at least one month before the review effective day (the “review

selection day”). The weights calculation shall take place at the close of the seventh trading day prior to the review effective

day.

Corporate Actions

There is a large range of corporate actions that may affect companies

included in the Indxx Global Robotics & Artificial Intelligence Thematic Index. Corporate actions are applied to the Indxx Global

Robotics & Artificial Intelligence Thematic Index on the ex-date or earlier as decided by the index committee. The following is a

summary of the adjustments made to any index constituent for corporate actions and the effect of such adjustments on the divisor.

1. Cash

dividend

The following adjustment is implemented: adjusted opening price of index

constituent = closing price of the index constituent on the previous business day minus the dividend announced by the issuer of the index

constituent. The divisor will decrease.

2. Special

cash dividend

A special cash dividend is an extraordinary distribution in the form

of cash dividend which is outside the scope of dividend policy of the issuer. The following adjustment is implemented: adjusted opening

price = closing price of the index constituent on the previous business day minus the special dividend announced by the issuer of the

index constituent. The divisor will decrease.

3. Stock

dividend

A stock dividend is a distribution of additional shares instead of a

cash payout. The following adjustments are implemented: (a) the number of shares of the index constituent = the number of shares of the

index constituent on the previous business day times (1 + the percentage of the stock dividend announced by the issuer of the index constituent);

and (b) the adjusted opening price of the index constituent = the closing price of the index constituent on the previous business day

divided by (1 + the percentage of stock dividend announced by the issuer of the index constituent). The divisor will remain unchanged.

4. Split

and reverse split

A stock split is a decision by the issuer's board of directors to increase

the number of shares that are outstanding by issuing more shares to current shareholders. The following adjustment is implemented: (a)

the adjusted number of shares of the index constituent = the number of shares of the index constituent on the previous business day times

the number of shares held after the split for every share held before the split; and (b) the adjusted opening price of the index constituent

= the closing price of index constituent on the previous business day times (1 / the number of shares held after the split for every share

held before the split). The divisor will remain unchanged.

5. Spin-off

A spin off is the creation of an independent company through the sale

or distribution of new shares of an existing business/division of a parent company. There are various potential treatments for a spin-off

which are decided by the index committee on a case by case basis. The adjustment for the different options of spin-off are as follows:

(a) When

a spun off company is added to the Indxx Global Robotics & Artificial Intelligence Thematic Index and no company is removed, the following

adjustment is implemented: the shares of spun off company added to the Indxx Global Robotics & Artificial Intelligence Thematic Index

= the shares of parent company included in the Indxx Global Robotics & Artificial Intelligence Thematic Index times the spin-off factor

announced by the parent company. The divisor will remain unchanged.

(b) When

a spun off company is not added and the parent company remains in the Indxx Global Robotics & Artificial Intelligence Thematic Index,

the spin-off will be adjusted for by changing the divisor to account for the change in market value, reflecting the market value of the

spun-off company. The following adjustment is implemented. (i) the shares of the spun off company added to the Indxx Global Robotics &

Artificial Intelligence Thematic Index = the shares of parent company included in the Indxx Global Robotics & Artificial Intelligence

Thematic Index times the spin-off factor announced by the parent company; (ii) the proceeds of the spun off entity = the shares of spun

off company added to the Indxx Global Robotics & Artificial Intelligence Thematic Index times the price of the spun off company given

by a data provider; (iii) the price calculated of the spun off company = the proceeds of the spun off company divided by the shares of

the parent company included in the Indxx Global Robotics & Artificial Intelligence Thematic Index; and (iv) the new price for the

parent company on the business day following the ex-date = the actual price of the parent company on the business day following the ex-date

minus the price of the spun off company given by a data provider on the ex-date. The divisor will decrease.

(c) When

the spun off company is not added and only the parent company remains in the Indxx Global Robotics & Artificial Intelligence Thematic

Index and there will be a stock adjustment, the following adjustment is implemented: (i) the shares of spun off company added to the Indxx

Global Robotics & Artificial Intelligence Thematic Index = the shares of parent company included in the Indxx Global Robotics &

Artificial Intelligence Thematic Index times the spin-off factor announced by the parent company; (ii) the proceeds of the spun off entity

= the shares of the spun off company added to the Indxx Global Robotics & Artificial Intelligence Thematic Index times the price of

the spun off company given by a data provider; (iii) the price calculated of the spun off company = the proceeds of the spun off company

divided by the shares of parent company included in the Indxx Global Robotics & Artificial Intelligence Thematic Index; and (iv) the

new price for the parent company = the actual price of the parent company on the business day following the ex-date minus the price of

the spun off company given by a data provider on the ex-date; (v) the adjustment factor of the spun off company on the business day following

the ex-date = the actual price of the parent company on the business day following the ex-date divided by the new price for the parent

company on the business day following the ex-date; and (vi) the new number of shares of the parent company on the business day following

the ex-date = the adjustment factor of the spun off company on the business day following the ex-date times the shares of parent company

included in the Indxx Global Robotics & Artificial Intelligence Thematic Index on the ex-date. The divisor will remain unchanged.

6. Addition/deletion

of a company

In case an index constituent is added, removed or replaced with another

index constituent, the following adjustment is implemented: the number of shares of the new index constituent on the business day following

the ex-date = the weight of the old index constituent on the ex-date divided by the closing price of new index constituent on the business

day following the ex-date. The divisor will remain unchanged.

7. Acquisition

An acquisition is a corporate action in which a company buys most, if

not all, of the target company's ownership stakes in order to assume control of the target firm. The adjustment made depends on which

case below describes the acquisition.

(a) If

the target company is a part of the Indxx Global Robotics & Artificial Intelligence Thematic Index but the acquiring company is not,

the target company will be removed from the Indxx Global Robotics & Artificial Intelligence Thematic Index and proceeds will be reinvested

into the Indxx Global Robotics & Artificial Intelligence Thematic Index. The divisor will decrease.

(b) If

the acquiring company is a part of the Indxx Global Robotics & Artificial Intelligence Thematic Index but the target company is not,

there will be no adjustment. The divisor will remain unchanged.

(c) If

the target company and the acquiring company are part of the Indxx Global Robotics & Artificial Intelligence Thematic Index, the adjustment

made depends on the type of consideration.

(i) If the acquisition is an all cash takeover, the target company will

be removed from the Indxx Global Robotics & Artificial Intelligence Thematic Index and proceeds will be reinvested into the Indxx

Global Robotics & Artificial Intelligence Thematic Index. The divisor will decrease.

(ii) If the acquisition is a partial stock takeover, the target company

will be removed from the Indxx Global Robotics & Artificial Intelligence Thematic Index. Shares of the acquiring company will be increased

according to stock term and cash proceeds will be reinvested into the index. The divisor will decrease.

(iii) If the acquisition is an all stock takeover, the target company

will be removed from the Indxx Global Robotics & Artificial Intelligence Thematic Index and the shares of the acquiring company will

be increased according to the stock terms. The divisor will remain unchanged.

8. Rights

offering

Rights issues give existing shareholders the right to purchase a proportional

number of new shares at a discount to the market price on a stated future date. The rights issued to a shareholder have a value, thus

compensating current shareholders for the future dilution of their existing shares' value. The following adjustment is implemented: (a)

the new shares of the index constituent to be added to the Indxx Global Robotics & Artificial Intelligence Thematic Index = the shares

of the index constituent on the previous business day times the ratio of the additional shares offered by the company on a discount; (b)

the market capitalization of the index constituent = (the shares of index constituent on the previous business day times the price of

index constituent on the previous business day) plus (the shares of index constituent on the previous business day times the ratio of

the additional shares offered by the company on a discount times the discounted price of the index constituent with respect to the market

price); and (c) the new price of the index constituent after adjusting for the additional shares = the market capitalization of the index

constituent divided by the total number of shares of the index constituent. A rights issue impacts the number of shares as well as price

thereby impacting the index divisor reflecting an increase in market capitalization. The divisor will increase.

The index committee will decide whether to participate in the rights

issue or not. If the subscription price is greater than or equal to the stock closing price, the Indxx Global Robotics & Artificial

Intelligence Thematic Index would not participate in the rights issue. If the Indxx Global Robotics & Artificial Intelligence Thematic

Index does not participate in the rights issue, there will be no adjustment to the index shares or to the divisor.

9. Delisting

Delisting refers to the practice of removing the stock of a company

from a stock exchange so that investors can no longer trade shares of the stock on that exchange. The security is removed from the Indxx

Global Robotics & Artificial Intelligence Thematic Index, and the invested amount in the delisted security will be reinvested into

the Indxx Global Robotics & Artificial Intelligence Thematic Index. The divisor will decrease.

10. Merger

A merger is the combination of two or more companies, generally by offering

the stockholders of one company securities in the acquiring company in exchange for the surrender of their stock. The target company is

removed from the Indxx Global Robotics & Artificial Intelligence Thematic Index. The index committee will decide if the surviving

company should be added to the Indxx Global Robotics & Artificial Intelligence Thematic Index. If the surviving company is added to

the Indxx Global Robotics & Artificial Intelligence Thematic Index, the divisor will increase to reflect the increase in the number

of shares.

11. Bankruptcy

Bankruptcy is a legal proceeding involving a person or business that

is unable to repay outstanding debts. The security is removed from the Indxx Global Robotics & Artificial Intelligence Thematic Index,

and the invested amount in the acquired security will reinvested into the Indxx Global Robotics & Artificial Intelligence Thematic

Index. The divisor will decrease.

12. Temporary

delisting/prolonged trading suspension

A temporary delisting/trading suspension occurs when a security stops

trading on the stock exchange for a certain time period. This usually occurs when a publicly-traded company is going to release significant

news about itself. The security is removed from the Indxx Global Robotics & Artificial Intelligence Thematic Index based on the index

committee’s decision, and the invested amount in the acquired security will be reinvested into the index. The divisor will decrease.

13. Bonus

issue of shares

A bonus share is a free share of stock given to current/existing shareholders

in a company, based upon the number of shares owned by them. The issue of bonus shares increases the total number of shares issued and

owned, but does not increase the value of the company. The ratio of the number of shares held by each shareholder remains constant. The

divisor will remain unchanged.

18

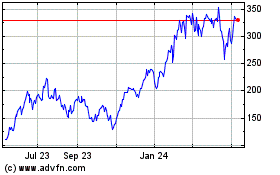

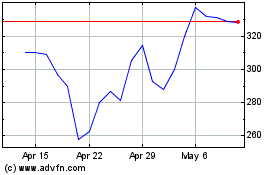

MicroSectors FANG Index ... (AMEX:FNGU)

Historical Stock Chart

From Jul 2024 to Aug 2024

MicroSectors FANG Index ... (AMEX:FNGU)

Historical Stock Chart

From Aug 2023 to Aug 2024