false

0001842556

0001842556

2024-06-17

2024-06-17

0001842556

HNRA:ClassCommonStockParValue0.0001PerShareMember

2024-06-17

2024-06-17

0001842556

HNRA:RedeemableWarrantsExercisableForThreeQuartersOfOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember

2024-06-17

2024-06-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 17, 2024

HNR ACQUISITION CORP

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41278 |

|

85-4359124 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

3730 Kirby Drive, Suite 1200

Houston, Texas 77098

(Address of principal executive offices, including

zip code)

(713) 834-1145

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title of each class: |

|

Trading symbol |

|

Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share |

|

HNRA |

|

NYSE American |

| Redeemable warrants, exercisable for three quarters of one share of Class A Common Stock at an exercise price of $11.50 per share |

|

HNRAW |

|

NYSE American |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR§230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into

a Material Definitive Agreement.

As previously disclosed,

on October 17, 2022, HNR Acquisition Corp, a Delaware corporation (the “Company”), entered

into a common stock purchase agreement (as amended, the “Common Stock Purchase Agreement”) with White Lion Capital, LLC, a

Nevada limited liability company (“White Lion”). Pursuant to the Common Stock Purchase Agreement, the Company has

the right, but not the obligation, to require White Lion to purchase, from time to time, up to $150,000,000 in aggregate gross purchase

price of newly issued shares of the Company’s Class A common stock, par value $0.0001 per share (the “Common Stock”),

subject to certain limitations and conditions set forth in the Common Stock Purchase Agreement. Capitalized terms used but not otherwise

defined herein shall have the meaning given to such terms by the Common Stock Purchase Agreement.

As previously

disclosed, on March 7, 2024, the Company entered into an Amendment No. 1 to Common Stock Purchase Agreement (the

“1st Amendment”) with White Lion. On June 17, 2024, the

Company entered into an Amendment No. 2 to Common Stock Purchase Agreement (the “2nd Amendment”) with White

Lion. Pursuant to the 2nd Amendment, the Company and White Lion agreed to amend the process of a Rapid Purchase, whereby

the parties will close on the Rapid Purchase on the trading day the notice of the applicable Rapid Purchase is given. The

2nd Amendment, among other things, also removed the maximum number of shares required to be purchased upon notice of a

Rapid Purchase, added a limit of 100,000 shares of Common Stock per individual request, and revised the purchase price of a Rapid

Purchase to equal the lowest traded price of Common Stock during the one hour following White Lion’s acceptance of the Rapid

Purchase for each request. In addition, White Lion agreed that, on any single business day, it shall not publicly resell an aggregate amount of

Commitment Shares in an amount that exceeds 7% of the daily trading volume of the Common Stock for such business day, excluding any

trades before or after regular trading hours and any block trades.

The

foregoing description of the 2nd Amendment does not purport to be complete and is qualified in its entirety by reference to

the full text of the 2nd Amendment, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated

by reference herein.

Item 3.02 Unregistered

Sales of Equity Securities

The

information set forth in “Item 1.01 Entry into a Material Definitive Agreement” relating to the issuance of Common Stock is

incorporated by reference herein in its entirety. The Company will issue the Common Stock in reliance upon the exemption from registration

provided by Section 4(a)(2) of the Securities Act and/or Rule 506(b) of Regulation D promulgated thereunder.

This

Current Report on Form 8-K shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall such securities be

offered or sold in the United States absent registration or an applicable exemption from the registration requirements and certificates

evidencing such shares contain a legend stating the same.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits

The following exhibits are being filed herewith:

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| June 20, 2024 |

HNR Acquisition

Corp |

| |

|

|

| |

By: |

/s/ Mitchell B. Trotter |

| |

Name: |

Mitchell B. Trotter |

| |

Title: |

Chief Financial Officer |

2

Exhibit 10.1

AMENDMENT

NO. 2

TO

COMMON

STOCK PURCHASE AGREEMENT

BETWEEN

HNR

Acquisition Corp.

AND

WHITE

LION CAPITAL LLC

THIS

AMENDMENT NO. 2 TO COMMON STOCK PURCHASE AGREEMENT (this “Amendment”), effective June 17, 2024 (the “Amendment

Effective Date”), is by and between HNR Acquisition Corp, a Delaware corporation (the “Company”),

and White Lion Capital, LLC, a Nevada limited liability company (the “Investor”), and amends the Common

Stock Purchase Agreement by and between the Company and Investor dated October 17, 2022, as amended by that certain Amendment No. 2, dated

as of March 7, 2024 (as amended, the “Agreement”). All capitalized terms used but not defined

herein shall have the respective meanings ascribed to them in the Agreement.

WHEREAS,

in addition to certain other adjustments, the parties desire to amend the provisions of the Agreement related to Rapid Purchases; and

WHEREAS,

in addition to the foregoing, the parties desire to amend the provisions of the Agreement related to the contractual limitations on the

public resale of Commitment Shares;

NOW,

THEREFORE, in consideration of the premises, the mutual covenants contained herein, and other good and valuable consideration, the receipt

and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

1. Amendment to Article III.

Article III of the Agreement is hereby amended

by restating Section 3.5, which shall read in its entirety as follows:

“Section 3.5 Rapid

Purchase Notice.

| (a) | Upon the terms and subject to the conditions of this Agreement, during the Commitment Period, the

Company may deliver a Rapid Purchase Notice to the Investor, subject to satisfaction of the conditions set forth in Article VII

and otherwise provided herein. The Company shall deliver the Purchase Notice Shares, not to exceed the Rapid Purchase Notice Limit, unless

waived by Investor, underlying a Rapid Purchase Notice as DWAC Shares to the Investor’s designated brokerage account alongside the

delivery of the Rapid Purchase Notice. A Rapid Purchase Notice shall be deemed delivered on the Business Day that the Investor provides

written consent of the acceptance of the Rapid Purchase Notice (the “Rapid Purchase Notice Date”). If the Investor does

not provide written consent within 15 minutes of the delivery of the Rapid Purchase Notice, the applicable Rapid Purchase Notice shall

be deemed void unless waived by both the Company and the Investor. Each party shall use its commercially reasonable efforts to perform

or fulfill all conditions and obligations to be performed or fulfilled by it under this Agreement so that the transactions contemplated

hereby shall be consummated as soon as practicable. Each party also agrees that it shall use its commercially reasonable efforts to take,

or cause to be taken, all actions and to do, or cause to be done, all things necessary, proper or advisable under applicable laws and

regulations to consummate and make effective Section 3.5 of this Agreement and the transactions contemplated herein. Each party agrees

that notwithstanding any terms under this Agreement to the contrary, subsection (i) of the Purchase Notice Limit (as defined herein) shall

be applicable to Rapid Purchases, but not subsections (ii) and (iii) of the Purchase Notice Limit. Additionally, Investor shall not consent

to accept a Rapid Purchase Notice received less than one and a half (1.5) hours prior to the close of trading on an Eligible Market. |

| (b) | The following terms shall be defined as set forth below: |

| i. | “Rapid Purchase Notice Limit” shall mean 100,000 shares. |

| (c) | The following terms shall be amended as set forth below: |

| i. | “Rapid Purchase Price” shall mean the lowest traded price of Common Stock during

the Rapid Valuation Period. |

| ii. | “Rapid Valuation Period” shall mean the one (1) hour period following the Investor’s

written consent of the acceptance of the applicable Rapid Purchase Notice by Investor. |

2. Amendment to Section 6.9.

Section 6.9 of the Agreement is hereby amended

by adding subsection (iii), as follows:

| “(iii) | On any given Business Day, the Investor shall not

publicly resell an aggregate amount of Commitment Shares in an amount that exceeds seven percent (7%) of the daily trading volume of

the Common Stock (excluding any trades before or after regular trading hours on the Eligible Market and any block, other OTC or off Eligible

Market trades) for such Business Day.” |

3. Representations

and Warranties. Each of the Investor and the Company represents and warrants that it has the authority and legal right to

execute, deliver and carry out the terms of this Amendment, that such actions were duly authorized by all necessary entity action

and that the officers executing this Amendment on its behalf were similarly authorized and empowered and that this Amendment does

not contravene any provisions of its articles of incorporation, bylaws, certificate of formation, limited liability company

agreement or other formation documents, or of any contract or agreement to which it is a party or by which any of its properties are

bound.

4. Miscellaneous.

| (a) | Except as modified by this Amendment, the Agreement continues

in full force and effect in accordance with its terms. |

| (b) | This Amendment shall be governed by and construed in accordance

with the laws of the State of New York as set forth in Section 10.11 of the Agreement and the dispute resolution provisions set forth

in the Agreement. |

| (c) | This Amendment may be executed in any number of counterparts

and by electronic transmission (which shall bind the parties hereto), each of which when so executed shall be deemed to be an original

and all of which taken together shall constitute one and the same agreement. |

** signature page follows

**

IN WITNESS WHEREOF, the parties

hereto have caused this Amendment to be duly executed by their respective authorized officer as of the Amendment Effective Date.

| |

HNR Acquisition Corp. |

| |

|

|

| |

By: |

/s/ Mitchell B. Trotter |

| |

Name: |

Mitchell B. Trotter |

| |

Title: |

Chief Financial Officer |

| |

|

|

| |

WHITE LION CAPITAL, LLC |

| |

|

|

| |

By: |

/s/ Nathan Yee |

| |

Name: |

Nathan Yee |

| |

Title: |

Managing Partner |

3

v3.24.1.1.u2

Cover

|

Jun. 17, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jun. 17, 2024

|

| Entity File Number |

001-41278

|

| Entity Registrant Name |

HNR ACQUISITION CORP

|

| Entity Central Index Key |

0001842556

|

| Entity Tax Identification Number |

85-4359124

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

3730 Kirby Drive

|

| Entity Address, Address Line Two |

Suite 1200

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77098

|

| City Area Code |

713

|

| Local Phone Number |

834-1145

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Class A Common Stock, par value $0.0001 per share |

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

HNRA

|

| Security Exchange Name |

NYSEAMER

|

| Redeemable warrants, exercisable for three quarters of one share of Class A Common Stock at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable warrants, exercisable for three quarters of one share of Class A Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

HNRAW

|

| Security Exchange Name |

NYSEAMER

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HNRA_ClassCommonStockParValue0.0001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=HNRA_RedeemableWarrantsExercisableForThreeQuartersOfOneShareOfClassCommonStockAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

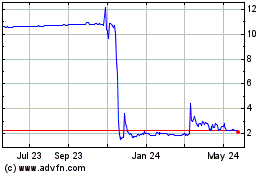

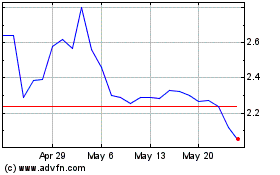

HNR Acquisition (AMEX:HNRA)

Historical Stock Chart

From Jun 2024 to Jul 2024

HNR Acquisition (AMEX:HNRA)

Historical Stock Chart

From Jul 2023 to Jul 2024