4 ETFs Riding High in Q2 - ETF News And Commentary

April 10 2014 - 3:00PM

Zacks

Though the U.S. stock market kicked off second quarter with a

record high, it lost steam in the past five trading days due to a

broad sell-off in the high growth and high beta stocks. Investors

are apprehensive of lofty valuations and warnings on Q2 earnings

(read: The Momentum Stock Crash Puts These ETFs in Focus).

Global activity is picking up but the recovery is still subdued.

This is primarily thanks to Chinese slowdown, geopolitical tensions

in Ukraine, prospect of interest rate hike sooner than expected in

the U.S., persistently low inflation in developed economies and

higher borrowing cost in emerging markets.

The trend is likely to continue at least in the near term,

suggesting an uncertain outlook on the stock markets. Meanwhile,

commodities are also seeing bumpy trading this month due to higher

volatility and global demand/supply dynamics.

Given this, while many ETFs have seen terrible trading so far in

the month, some ETFs have managed to stay in the green in the

current turbulence. Below, we have highlighted three ETFs that

stood out in the early days of April and will likely to continue to

do so as we move ahead in Q2.

First Trust ISE-Revere Natural Gas Index Fund

(FCG)

This ETF offers exposure to the U.S. stocks that derive a

substantial portion of their revenues from the exploration and

production of natural gas. It follows ISE-REVERE Natural Gas Index

and holds 30 stocks in its basket, which are well spread out across

a single component (read: 3 Energy ETFs Marching Higher in the Past

Week).

Stone Energy, Goodrich Petroleum and Penn Virginia occupy the top

three positions in the portfolio with nearly 4% of total assets

each. The fund has a blended style and is also diversified across

various market cap levels with 45% in large caps, 37% in small caps

and the rest in mid caps.

The fund has amassed $470.1 million in its asset base while sees

solid volume of nearly 509,000 shares per day. Expense ratio came

in at 60 bps. FCG has gained about 20% so far in Q2.

QuantShares U.S. Market Neutral Value Fund

(CHEP)

This ETF uses a slightly active approach and offers investors

spread return between high and low ranked stocks. This is easily

done by tracking the Dow Jones U.S. Thematic Market Neutral Value

Index, which takes long position in the undervalued stocks and

short position in the overvalued stocks in equal weights and equal

dollar amount within each sector.

This approach results in a value tilt for this product, and long

and short positions in 400 stocks, divided equally. Due to this

unique feature and active management, the fund charges higher

annual fee of 1.49% from investors (see: all Long-Short ETFs

here).

CHEP failed to attract investors as depicted by its AUM of just

$1.4 million and average daily volume of 9,000 shares. However, it

has added about 2.80% so far this month.

iShares Residential Real Estate Capped ETF

(REZ)

This fund follows the FTSE NAREIT All Residential Capped Index and

provides exposure to the U.S. residential real estate stocks and

real estate investment trusts (REITs). Holding 34 securities in its

basket, the product is largely concentrated on the top firm –

Public Storage (PSA) – at 11% while Equity Residential (EQR) and

Ventas (VTR) round off to the next two with combined 18.2%

share.

More than half of the portfolio is tilted toward large caps and

about three-fifths to value stocks. From a sector look, equity

apartment takes the top spot with 41.6%, followed by equity

healthcare (37.8%) and equity self storage (17.2%).

The product has amassed $251.1 million in AUM while trades in

volume of under 50,000 shares a day. It charges 48 bps in fees per

year and is up 2.40% month-to-date.

SPDR S&P Metals & Mining ETF (XME)

This ETF looks to give investors broad exposure to the metal and

mining industry, holding 41 stocks in its basket. This is

accomplished by tracking the S&P Metals & Mining Select

Industry Index. The fund uses equal weight methodology and does not

put more than 3.7% of assets in single security (read: A

Comprehensive Guide to Mining Industry ETFs).

In term of industrial exposure, steel make up 39% of the portfolio,

while diversified metal and mining space (18.4%) and coal &

consumable fuels (18.3%) round out the top three. From a cap look,

the product puts more focus on small cap focus with 59% of assets

while value stocks also dominate the fund portfolio.

XME has $658.5 million in AUM and is liquid with solid trading

volumes of more than 2.3 million shares per day on average. The ETF

charges 35 bps in fees and expenses and added over 2% so far this

month.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

QS-US MN VALUE (CHEP): ETF Research Reports

FT-ISE R NAT GA (FCG): ETF Research Reports

ISHARS-RES RE (REZ): ETF Research Reports

SPDR-SP MET&MIN (XME): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

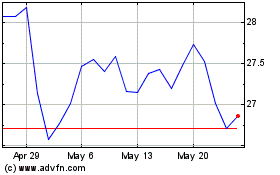

First Trust Natural Gas ... (AMEX:FCG)

Historical Stock Chart

From Oct 2024 to Nov 2024

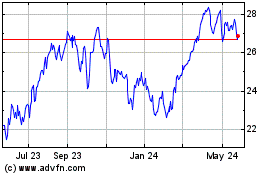

First Trust Natural Gas ... (AMEX:FCG)

Historical Stock Chart

From Nov 2023 to Nov 2024