Natural Gas ETFs Jump on Hopes of Stockpile Plunge - ETF News And Commentary

January 14 2014 - 8:00AM

Zacks

While the bout of extreme weather across much of the United States

may have derailed job growth and snarled air travel, it is

certainly helping to boost the outlook for natural gas. The popular

heating fuel is used by roughly half of Americans to warm up their

homes, and with near-record low temperatures, many were burning far

more heat than normal.

After all, here in Chicago, temperatures were approaching 50 below

(Fahrenheit) with the wind chill, while much of the rest of the

Midwest saw similarly low readings. Weather in the Northeast was

also quite chilly, while the so-called ‘polar vortex’ of cold

weather pushed many parts of the South below freezing as well (read

Beat the Cold Weather with These Hot Sector ETFs).

Due to this, many speculate that natural gas demand soared, as heat

was running near non-stop in many homes just to keep temperatures

at a decent level. And thanks to this huge level of demand across

such a large part of the country, some are looking for supplies to

drop by over 300 billion cubic feet, possibly surpassing the

previous record of 285 bcf, and crushing last year’s supply

reduction of 148 bcf in the same week.

“Traders are focusing on the fact that we’re probably going to see

a record storage withdrawal,” said Tom Saal, senior vice president

of energy trading at FCStone Latin America LLC in Miami, for a

Bloomberg article. “The market’s not ready to give up on winter

yet.”

Other Factors

It also doesn’t hurt that many are now forecasting

colder-than-normal weather across much of the Midwest and Northeast

yet again in the coming days. Though the temperatures aren’t

expected to plunge into danger territory again, the round of cold

could add to natural gas demand once more and curtail supplies

again (see all the Energy ETFs here).

And with all this frigid weather, the longer term outlook for

natural gas is improving, with some expecting the storage level at

the end of March to be just 1.4 trillion cubic feet. While that is

obviously still a lot of natural gas, it would represent a 20%

decline from the year ago time frame, suggesting we might see some

bullishness in the weeks ahead, especially if extreme conditions

remain in place.

ETF Impact

Thanks to this speculation and the hopes for more cold weather,

natural gas ETFs soared in Monday trading. The top natural gas ETF,

the

United States Natural Gas ETF (UNG), jumped by

5.75% on the day, while the more spread out across the futures

curve

UNL rose by about 3.65% in the

session.

Meanwhile, leveraged natural gas ETFs also did quite well on the

day, helping to reverse their 2014 trend. In fact,

BOIL (the 2x leveraged product) rose by about

10.5% on the day, while the triple leveraged

UGAZ

zoomed higher by 16.2% in the session (see Understanding Leveraged

ETFs).

Bottom Line

If the abnormally cold weather continues, it could really eat into

the huge stockpiles of natural gas. These massive supplies have

kept prices subdued, but with such heavy usage of the fuel for

heating purposes lately, we are likely to see a far smaller supply

of natural gas heading into the Spring.

However, keep in mind that supplies are still large—even with a big

cut to the stockpile—and that new technologies are making it far

easier to pull natural gas from the ground. The bout of higher

prices might be good news for producers, such as those found in the

natural gas equity ETF

FCG, but it might take a

while to flow through to their bottom lines (read The Polar Vortex

Could Push These Stocks Higher).

So traders might look to a bullish run in natural gas in the days

and weeks ahead, though its longer term outlook remains a bit more

uncertain. More winter weather in the weeks ahead will certainly

help natural gas ETFs heading into the Spring, though huge

supplies of the fuel mean that a trend of extreme weather is needed

to keep natural gas prices, and ETFs, rising as we move further in

2014.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days.

Click to get this free report

>>

PPO-ULT DJ-U NG (BOIL): ETF Research Reports

FT-ISE R NAT GA (FCG): ETF Research Reports

VEL-3X LNG NG (UGAZ): ETF Research Reports

US-NATRL GAS FD (UNG): ETF Research Reports

US-12M NATL GAS (UNL): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

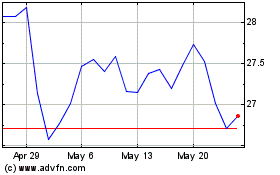

First Trust Natural Gas ... (AMEX:FCG)

Historical Stock Chart

From Oct 2024 to Nov 2024

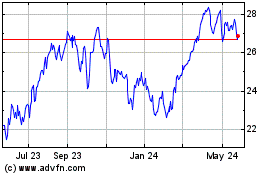

First Trust Natural Gas ... (AMEX:FCG)

Historical Stock Chart

From Nov 2023 to Nov 2024