false

0001505611

0001505611

2024-05-15

2024-05-15

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM 8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): May 15, 2024

| DecisionPoint

Systems, Inc. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

001-41376 |

|

37-1644635 |

(State

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification

No.) |

DecisionPoint

Systems, Inc.

1615

South Congress Avenue Suite 103

Delray

Beach, Florida |

|

33445 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (561) 900-3723

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol |

|

Name

on Each Exchange on

Which

Registered |

| Common

Stock, $0.001 par value |

|

DPSI |

|

NYSE

American |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition

On

May 15, 2024, DecisionPoint Systems, Inc. issued an earnings release for the quarter ended March 31, 2024. The earnings release is furnished

as Exhibit 99.1. Exhibit 99.1 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934

(the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference

in any filing under the Securities Act of 1933 of the Exchange Act, regardless of any general incorporation language in such filing.

Item

9.01 Financial Statements and Exhibits

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

DECISIONPOINT

SYSTEMS, INC. |

| |

|

|

| Dated:

May 15, 2024 |

By: |

/s/

Melinda Wohl |

| |

Name: |

Melinda

Wohl |

| |

Title: |

Chief

Financial Officer |

2

EXHIBIT

99.1

DecisionPoint

Systems Announces First Quarter 2024 Results

DELRAY

BEACH, Fla., May 15, 2024 /PRNewswire/ — DecisionPoint Systems, Inc. (NYSE American: DPSI), the leading mobility-first enterprise

services and solutions company and a leading provider of retail in-store solutions and services centered on Point-of-Sale systems, today

announced first quarter 2024 financial results for the period ended March 31, 2024.

Steve

Smith, chief executive officer of DecisionPoint Systems, commented: “Our first quarter results were impacted year over year by

not having a large project on the hardware solutions side of the business. However, our gross margin improved with the mix shift towards

services and software. We also reduced our debt by over $1.6 million and increased cash by $1.5 million.

“With

our continued focus on services, our investments in 2023 are already starting to pay off, and we anticipate our Mobile Managed Services

strategy will drive sales of our newer offerings throughout this year. During the first quarter, we continued to build out this part

of the business by introducing PointCare services, which include existing and new services. This offering served as the foundation

for an early win, as we secured a large managed services opportunity with a leading C-store chain to provide store-level, on-site services

to maintain several in-store technologies and devices. This win was a significant add to our managed services recurring revenue backlog.

It also represents an exciting opportunity to expand from providing mobile managed services for devices to delivering managed services

for an entire store or site with a much larger TAM versus discrete device-level services. We will formally launch these new service

offerings in the second quarter under the StoreCare and SiteCare brands.

“Given

our impending transaction with Graham and Barcoding, which was at a 27% premium to our closing price the night before the announcement,

we will not be hosting a conference call this quarter as we focus on running the business and preparing for the shareholder vote, with

the goal of closing the transaction in July. We think this deal strikes the right balance of rewarding our public shareholders with positioning

DecisionPoint for the next evolution as a Company.”

About

DecisionPoint Systems

DecisionPoint

Systems Inc. delivers mobility-first enterprise managed services, in-store retail solutions centered around point-of-sale technologies,

deployment, integration and support services to retail, supply chain, hospitality, healthcare and other verticals, enabling customers

to make better and faster decisions in the moments that matter—the decision points. Our mission is to help businesses consistently

deliver on those moments—improving customer service, accelerating growth, improving worker productivity and lowering risks and

costs. For more information about DecisionPoint Systems, Inc., visit https://www.decisionpt.com.

Forward-Looking

Statements

In

this press release, all statements that are not purely about historical facts, including, but not limited to, those in which we use the

words "believe," "anticipate," "expect," "plan," "intend," "estimate, "target"

and similar expressions, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. While

these forward-looking statements represent our current judgment of what may happen in the future, actual results may differ materially

from the results expressed or implied by these statements due to numerous important factors, including, but not limited to, those described

in our most recent report on SEC Form 10-K (under the headings "Risk Factors" and "Management's Discussion and Analysis

of Financial Condition and Results of Operations"), which may be revised or supplemented in subsequent reports on SEC Forms 10-Q

and 8-K. We are under no obligation, and expressly disclaim any obligation, to update the forward-looking statements in this press release,

whether as a result of new information, future events or otherwise.

Investor

Relations Contact:

Brian

Siegel, IRC, MBA

Senior

Managing Director, Hayden IR

(346)

396-8696

Brian@haydenir.com

DecisionPoint

Systems, Inc.

Consolidated

Balance Sheets

(in

thousands, except par value)

| | |

March 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| ASSETS | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash | |

$ | 5,834 | | |

$ | 4,300 | |

| Accounts receivable, net of allowance of $324 and $267 as of March 31, 2024 and December 31, 2023, respectively | |

| 19,292 | | |

| 23,768 | |

| Inventory, net | |

| 1,193 | | |

| 2,133 | |

| Deferred costs | |

| 4,158 | | |

| 3,826 | |

| Prepaid expenses and other current assets | |

| 598 | | |

| 630 | |

| Total current assets | |

| 31,075 | | |

| 34,657 | |

| Operating lease assets | |

| 3,208 | | |

| 3,392 | |

| Property and equipment, net | |

| 2,889 | | |

| 2,973 | |

| Deferred costs, net of current portion | |

| 3,744 | | |

| 3,689 | |

| Deferred tax assets, net | |

| 1,475 | | |

| 1,161 | |

| Intangible assets, net | |

| 7,317 | | |

| 7,815 | |

| Goodwill | |

| 22,204 | | |

| 22,081 | |

| Other assets | |

| 172 | | |

| 172 | |

| Total assets | |

$ | 72,084 | | |

$ | 75,940 | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 14,575 | | |

$ | 16,857 | |

| Accrued expenses and other current liabilities | |

| 5,607 | | |

| 6,566 | |

| Deferred revenue | |

| 9,222 | | |

| 8,066 | |

| Current portion of earnout consideration | |

| 5,550 | | |

| 5,370 | |

| Current portion of long-term debt | |

| 1,003 | | |

| 1,003 | |

| Current portion of operating lease liabilities | |

| 888 | | |

| 874 | |

| Total current liabilities | |

| 36,845 | | |

| 38,736 | |

| Deferred revenue, net of current portion | |

| 5,298 | | |

| 5,307 | |

| Revolving line of credit | |

| - | | |

| 1,300 | |

| Long-term debt, net of current portion | |

| 3,388 | | |

| 3,639 | |

| Noncurrent portion of operating lease liabilities | |

| 2,862 | | |

| 3,093 | |

| Long-term portion of earnout consideration | |

| 4,692 | | |

| 4,316 | |

| Other liabilities | |

| 6 | | |

| 6 | |

| Total liabilities | |

| 53,091 | | |

| 56,397 | |

| Commitments and contingencies (Note 10) | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock, $0.001 par value; 10,000 shares authorized; no shares issued or outstanding | |

| - | | |

| - | |

| Common stock, $0.001 par value; 50,000 shares authorized; 7,681 and 7,680 shares issued and outstanding, respectively | |

| 8 | | |

| 8 | |

| Additional paid-in capital | |

| 39,184 | | |

| 38,902 | |

| Accumulated deficit | |

| (20,199 | ) | |

| (19,367 | ) |

| Total stockholders’ equity | |

| 18,993 | | |

| 19,543 | |

| Total liabilities and stockholders’ equity | |

$ | 72,084 | | |

$ | 75,940 | |

DecisionPoint

Systems, Inc.

Consolidated

Statements of Income and Comprehensive Income

(in

thousands, except per share data)

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Net sales: | |

| | |

| |

| Product | |

$ | 15,317 | | |

$ | 22,166 | |

| Service | |

| 10,301 | | |

| 4,873 | |

| Net sales | |

| 25,618 | | |

| 27,039 | |

| Cost of sales: | |

| | | |

| | |

| Product | |

| 12,488 | | |

| 17,885 | |

| Service | |

| 7,119 | | |

| 3,104 | |

| Cost of sales | |

| 19,607 | | |

| 20,989 | |

| Gross profit | |

| 6,011 | | |

| 6,050 | |

| Operating expenses: | |

| | | |

| | |

| Sales and marketing expense | |

| 2,813 | | |

| 2,368 | |

| General and administrative expenses | |

| 4,096 | | |

| 2,494 | |

| Total operating expenses | |

| 6,909 | | |

| 4,862 | |

| Operating (loss) income | |

| (898 | ) | |

| 1,188 | |

| Interest expense, net | |

| (248 | ) | |

| (13 | ) |

| (Loss) income before income taxes | |

| (1,146 | ) | |

| 1,175 | |

| Income tax benefit (expense) | |

| 314 | | |

| (309 | ) |

| Net (loss) income and comprehensive (loss) income attributable to common stockholders | |

$ | (832 | ) | |

$ | 866 | |

| Net (loss) income per share attributable to stockholders: | |

| | | |

| | |

| Basic | |

$ | (0.11 | ) | |

$ | 0.12 | |

| Diluted | |

$ | (0.11 | ) | |

$ | 0.11 | |

| Weighted average common shares outstanding | |

| | | |

| | |

| Basic | |

| 7,681 | | |

| 7,417 | |

| Diluted | |

| 7,889 | | |

| 7,789 | |

DecisionPoint

Systems, Inc.

Consolidated

Statements of Cash Flows

(in

thousands)

| | |

Three Months Ended | |

| | |

March 31, | |

| | |

2024 | | |

2023 | |

| Cash flows from operating activities | |

| | |

| |

| Net (loss) income | |

$ | (832 | ) | |

$ | 866 | |

| Adjustments to reconcile net (loss) income to net cash provided by (used in) operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 743 | | |

| 564 | |

| Share-based compensation expense | |

| 279 | | |

| 196 | |

| Deferred income taxes, net | |

| (314 | ) | |

| 10 | |

| Provision for credit losses | |

| 57 | | |

| 68 | |

| Provision for inventory obsolescence | |

| (6 | ) | |

| 45 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 4,419 | | |

| (9,413 | ) |

| Inventory, net | |

| 946 | | |

| (1,551 | ) |

| Deferred costs | |

| (387 | ) | |

| (212 | ) |

| Prepaid expenses and other current assets | |

| 32 | | |

| (75 | ) |

| Accrued expenses and other current liabilities | |

| (526 | ) | |

| (1,871 | ) |

| Operating lease liabilities | |

| (33 | ) | |

| (24 | ) |

| Deferred revenue | |

| 1,147 | | |

| 6,394 | |

| Net cash provided by (used in) operating activities | |

| 3,243 | | |

| (1,496 | ) |

| Cash flows from investing activities | |

| | | |

| | |

| Purchases of property and equipment | |

| (161 | ) | |

| (176 | ) |

| Net cash used in investing activities | |

| (161 | ) | |

| (176 | ) |

| Cash flows from financing activities | |

| | | |

| | |

| Proceeds from term loan | |

| - | | |

| 5,000 | |

| Repayment of term debt | |

| (251 | ) | |

| (1 | ) |

| Line of credit, net | |

| (1,300 | ) | |

| 7,000 | |

| Proceeds from exercise of stock options | |

| 3 | | |

| 6 | |

| Net cash (used in) provided by financing activities | |

| (1,548 | ) | |

| 12,005 | |

| Change in cash | |

| 1,534 | | |

| 10,333 | |

| Cash, beginning of period | |

| 4,300 | | |

| 7,642 | |

| Cash, end of period | |

$ | 5,834 | | |

$ | 17,975 | |

| Supplemental disclosures of cash flow information | |

| | | |

| | |

| Cash paid for interest | |

$ | 147 | | |

$ | 7 | |

| Cash paid for income taxes | |

$ | 6 | | |

$ | - | |

4

v3.24.1.1.u2

Cover

|

May 15, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 15, 2024

|

| Entity File Number |

001-41376

|

| Entity Registrant Name |

DecisionPoint

Systems, Inc.

|

| Entity Central Index Key |

0001505611

|

| Entity Tax Identification Number |

37-1644635

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1615

South Congress Avenue

|

| Entity Address, Address Line Two |

Suite 103

|

| Entity Address, City or Town |

Delray

Beach

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33445

|

| City Area Code |

561

|

| Local Phone Number |

900-3723

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.001 par value

|

| Trading Symbol |

DPSI

|

| Security Exchange Name |

NYSEAMER

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

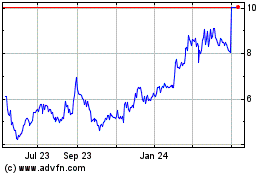

DecisionPoint Systems (AMEX:DPSI)

Historical Stock Chart

From Apr 2024 to May 2024

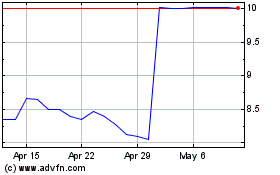

DecisionPoint Systems (AMEX:DPSI)

Historical Stock Chart

From May 2023 to May 2024