As filed with the Securities and Exchange Commission on November 16, 2021

Securities Act File No. 333-259294

Investment Company Act File No. 811-05012

U.S. SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-2

|

|

|

|

|

Registration Statement Under the Securities Act of 1933

|

|

☒

|

|

Pre-Effective Amendment No. 1

|

|

☒

|

|

Post-Effective Amendment No.

|

|

☐

|

|

|

|

|

and/or

|

|

|

|

|

|

|

Registration Statement Under the Investment Company Act of 1940

|

|

☒

|

|

Amendment No. 15

|

|

☒

|

Credit Suisse Asset Management Income Fund, Inc.

(Exact Name of Registrant as Specified In Charter)

Eleven

Madison Avenue

New York, New York 10010

(Address of Principal Executive Offices)

Registrant’s Telephone Number, including Area Code:

212-325-2000

John G. Popp

Credit Suisse Asset Management Income Fund, Inc.

Eleven Madison Avenue

New York, New York 10010

(Name and Address of Agent For Service)

Copies of

information to:

Barry P. Barbash

Justin L. Browder

Willkie Farr & Gallagher LLP

787 Seventh Avenue

New

York, New York 10019

Approximate Date of Commencement of Proposed Public Offering: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, check the following

box ☐

If any securities being registered on this Form will be offered on a delayed or continuous basis in reliance on Rule 415 under the

Securities Act of 1933 (“Securities Act”), other than securities offered in connection with a dividend reinvestment plan, check the following box ☒

If this Form is a registration statement pursuant to General Instruction A.2 or a post-effective amendment

thereto, check the following box ☒

If this Form is a registration statement pursuant to General Instruction B or a post-effective

amendment thereto that will become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box ☐

If this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction B to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box ☐

It is proposed that this filing will

become effective (check appropriate box):

|

☐

|

when declared effective pursuant to Section 8(c) of the Securities Act

|

If appropriate, check the following box:

|

☐

|

This [post-effective] amendment designates a new effective date for a previously filed [post-effective

amendment] [registration statement].

|

|

☐

|

This Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the

Securities Act, and the Securities Act registration statement number of the earlier effective registration statement for the same offering is: .

|

|

☐

|

This Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, and the

Securities Act registration statement number of the earlier effective registration statement for the same offering is: .

|

|

☐

|

This Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, and the

Securities Act registration statement number of the earlier effective registration statement for the same offering is: .

|

Check each box that appropriately characterizes the Registrant:

|

☒

|

Registered Closed-End Fund

(closed-end company that is registered under the Investment Company Act of 1940 (the “Investment Company Act”)).

|

|

☐

|

Business Development Company (closed-end company that intends or has

elected to be regulated as a business development company under the Investment Company Act).

|

|

☐

|

Interval Fund (Registered Closed-End Fund or a Business Development

Company that makes periodic repurchase offers under Rule 23c-3 under the Investment Company Act).

|

|

☒

|

A.2 Qualified (qualified to register securities pursuant to General Instruction A.2 of this Form).

|

|

☐

|

Well-Known Seasoned Issuer (as defined by Rule 405 under the Securities Act).

|

|

☐

|

Emerging Growth Company (as defined by Rule 12b-2 under the Securities

and Exchange Act of 1934).

|

|

☐

|

If an Emerging Growth Company, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act.

|

|

☐

|

New Registrant (registered or regulated under the Investment Company Act for less than 12 calendar months

preceding this filing).

|

-2-

CALCULATION OF REGISTRATION FEE UNDER THE SECURITIES ACT OF 1933

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of Securities Being Registered

|

|

Amount Being

Registered(1)

|

|

|

Proposed

Maximum

Offering Price Per

Share

|

|

|

Proposed

Maximum

Aggregate

Offering Price

|

|

Amount of

Registration

Fee(2)

|

|

|

Common Stock, $0.001 par value per share

|

|

|

|

|

|

|

|

|

|

$250,000,000

|

|

|

$23,175

|

|

|

(1)

|

There are being registered hereunder a presently indeterminate number of shares of common stock to be offered

on an immediate, continuous or delayed basis.

|

|

(2)

|

Amount represents $109.10 previously paid to register $1,000,000 of Common Stock, plus $23,065.90 to

register the additional $249,000,000 of Common Stock registered hereby.

|

THE REGISTRANT HEREBY AMENDS THIS

REGISTRATION STATEMENT ON SUCH DATE OR DATES AS MAY BE NECESSARY TO DELAY ITS EFFECTIVE DATE UNTIL THE REGISTRANT SHALL FILE A FURTHER AMENDMENT THAT SPECIFICALLY STATES THAT THIS REGISTRATION STATEMENT SHALL THEREAFTER BECOME EFFECTIVE IN

ACCORDANCE WITH SECTION 8(a) OF THE SECURITIES ACT OF 1933, AS AMENDED, OR UNTIL THIS REGISTRATION STATEMENT SHALL BECOME EFFECTIVE ON SUCH DATE AS THE COMMISSION, ACTING PURSUANT TO SECTION 8(a), MAY DETERMINE.

-3-

The information in this Prospectus is not complete and may be changed. The Fund may not

sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This Prospectus is not an offer to sell these securities and is not soliciting offers to buy these securities in any state where

the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED NOVEMBER 16, 2021

Preliminary Base Prospectus

$250,000,000

CREDIT SUISSE ASSET MANAGEMENT INCOME FUND, INC.

Shares of Common Stock

Credit Suisse

Asset Management Income Fund, Inc. (“Fund,” “we,” “us” or “our”) is a diversified, closed-end management investment company with a leveraged capital structure. The

Fund’s investment objective is current income consistent with the preservation of capital.

We may offer, from time to time, in one or more

offerings, our shares of common stock, par value $.001 per share (“Shares”). Shares may be offered at prices and on terms to be set forth in one or more supplements to this Prospectus (each, a “Prospectus Supplement”). You should

read this Prospectus and the applicable Prospectus Supplement carefully before your invest in our Shares.

Our Shares may be offered directly to one or

more purchasers, through agents designated from time to time by us, or to or through underwriters or dealers. The Prospectus Supplement relating to the offering will identify any agents or underwriters involved in the sale of our Shares, and will

set forth any applicable purchase price, fee, commission or discount arrangement between us and our agents or underwriters, or among our underwriters, or the basis upon which such amount may be calculated. We may not sell any of our Shares through

agents, underwriters or dealers without delivery of a Prospectus Supplement describing the method and terms of the particular offering of our Shares.

Our Shares are listed on the NYSE American under the symbol “CIK.” The last reported sale price of our Shares, as reported by the NYSE American on

November 15, 2021 was $3.52 per Share. The net asset value of our Shares at the close of business on November 15, 2021, was $3.44 per Share.

Investment in the Shares involves certain risks and special considerations, including risks of leverage and of investing in lower-rated securities

(commonly known as “junk bonds”). For a discussion of these and other risks, see “Risks and Special Considerations.”

Shares of

closed-end investment companies frequently trade at a discount to their net asset value. If the Fund’s Shares trade at a discount to its net asset value, the risk of loss may increase for purchasers in a

public offering. See “Risks and Special Considerations.”

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved these securities or passed upon the adequacy of this Prospectus. Any representation to the contrary is a criminal offense.

This Prospectus, together with any Prospectus Supplement, sets forth concisely the information about the Fund that a prospective investor

should know before investing. You should read this Prospectus and applicable Prospectus Supplement, which contain important information, before deciding whether to invest in the Shares. You should retain the Prospectus and Prospectus Supplement for

future reference. A Statement of Additional Information (“SAI”), dated November [●], 2021, containing additional information about the Fund, has been filed with the Securities and Exchange Commission (“SEC”) and is

incorporated by reference in its entirety into this Prospectus. A copy of the SAI can be obtained without charge by writing to the Fund at c/o Credit Suisse Asset Management,

i

LLC, Eleven Madison Avenue, New York, New York 10010, by calling

1-800-293-1232, or from the SEC’s website at http://www.sec.gov. Copies of the Fund’s Annual Report and Semi-Annual

Report and other information about the Fund may be obtained upon request by writing to the Fund, by calling 1-800-293-1232, or by

visiting the Fund’s website at www.credit-suisse.com/us/funds.

Our Shares do not represent a deposit or obligation of, and are not guaranteed or

endorsed by, any bank or other insured depository institution, and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve Board or any other government agency.

Prospectus dated November [●], 2021

ii

TABLE OF CONTENTS

You should rely only on the information contained in, or incorporated by reference into, this Prospectus and any

related Prospectus Supplement in making your investment decisions. The Fund has not authorized any person to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. The

Fund is not making an offer to sell the Shares in any jurisdiction where the offer or sale is not permitted. You should assume that the information in this Prospectus and any Prospectus Supplement is accurate only as of the dates on their covers.

The Fund’s business, financial condition and prospects may have changed since the date of its description in this Prospectus or the date of its description in any Prospectus Supplement.

PROSPECTUS SUMMARY

The following information is only a summary. You should consider the more detailed information contained in the Prospectus and in any

related Prospectus Supplement and in the SAI before purchasing Shares, especially the information under “Risks and Special Considerations” on page 19 of the Prospectus.

The Fund. The Fund is a diversified, closed-end management investment company.

The Fund commenced operations on March 23, 1987, following its initial public offering. See “The Fund.”

The

Fund’s Shares are listed for trading on the NYSE American under the symbol “CIK.” As of November 15, 2021, the net assets of the Fund were $179,889,329 and the Fund had outstanding 52,330,295 Shares. The last reported sales price

of the Fund’s Shares, as reported by the NYSE American on November 15, 2021 was $3.52 per Share. The net asset value (“NAV”) of the Fund’s Shares at the close of business on November 15, 2021 was $3.44 per Share. See

“Description of Shares.”

The Offering. We may offer, from time to time, in one or more offerings, up to

$250,000,000 of our Shares on terms to be determined at the time of the offering. The Shares may be offered at prices and on terms to be set forth in one or more Prospectus Supplements. You should read this Prospectus and the

applicable Prospectus Supplement carefully before you invest in our Shares. Our Shares may be offered directly to one or more purchasers, through agents designated from time to time by us, or to or through underwriters or dealers. The Prospectus

Supplement relating to the offering will identify any agents, underwriters or dealers involved in the sale of our Shares, and will set forth any applicable purchase price, fee, commission or discount arrangement between us and our agents or

underwriters, or among our underwriters, or the basis upon which such amount may be calculated. See “Plan of Distribution.” We may not sell any of our Shares through agents, underwriters or dealers without delivery of a Prospectus

Supplement describing the method and terms of the particular offering of our Shares.

Use of Proceeds. We intend to use the

net proceeds from the sale of our Shares primarily to invest in accordance with our investment objectives and policies. Proceeds will be invested within approximately 30 days of receipt by the Fund. See “Use of Proceeds.”

Investment Objective and Principal Investment Policies. For a

discussion of the Fund’s investment objective and principal investment policies, please refer to the section of the Fund’s most recent annual report

on Form N-CSR for the fiscal year ended December 31, 2020 filed on February 25, 2021 entitled “Fund Investment Objective, Policies and Risks—Investment Objective and Policies”,

which is incorporated by reference herein.

Investment Restrictions. The Fund has certain investment

restrictions that may not be changed without approval by a majority of the Fund’s outstanding voting securities. These restrictions concern issuance of senior securities, borrowing, lending, concentration, diversification and other matters. See

“Investment Restrictions.”

Use of Leverage. The Fund currently utilizes and in the future expects to continue to

utilize leverage through borrowings, including the issuance of debt securities, and derivatives, reverse repurchase agreements and dollar roll transactions, which have the effect of leverage. The Fund may use leverage up to 33

1/3% of its total assets (including the amount obtained through leverage). The Fund generally will not utilize leverage if it anticipates that the Fund’s leveraged capital structure would result in a lower return to shareholders than that

obtainable over time with an unleveraged capital structure. There can be no guarantee that the Fund will be able to accurately predict when the use of leverage will be beneficial. Use of leverage creates an opportunity for increased income and

capital appreciation for shareholders but, at the same time, creates special risks, and there can be no assurance that a leveraging strategy will be successful during any period in which it is employed.

As provided in the Investment Company Act of 1940, as amended (the “1940 Act”), and subject to certain exceptions, the Fund may

issue debt with the condition that immediately after issuance the value of its total assets, less ordinary course liabilities, exceeds 300% of the amount of the debt outstanding. Thus, as noted above, the Fund may use leverage in the form of

borrowings in an amount up to 33 1/3% of the Fund’s total assets (including the proceeds of such leverage). The total leverage of the Fund in connection with the Credit Agreement (as defined below) is currently expected to range between 20% and

30% of the Fund’s total assets. The Fund seeks a leverage

1

ratio, based on a variety of factors including market conditions and the market outlook of Credit Suisse Asset

Management, LLC (“Credit Suisse”), where the rate of return, net of applicable Fund expenses, on the Fund’s investment portfolio investments purchased with leverage exceeds the costs associated with such leverage. The Fund does not

currently intend to issue or register preferred shares or commercial paper.

The Fund has a line of credit provided by State Street

Bank and Trust Company (“State Street”). The Fund makes use of the line of credit, which is subject to annual renewal in accordance with the agreement, primarily to leverage its investment portfolio (the “Credit Agreement”).

Under the Credit Agreement, the Fund may borrow the lesser of: a) $85,000,000; b) an amount that is no greater than 331/3% of the

Fund’s total assets minus the sum of liabilities (other than aggregate indebtedness constituting leverage); and c) the Borrowing Base as defined in the Credit Agreement. The Fund’s borrowings under the Credit Agreement at

June 30, 2021 equaled $53,000,000, which was approximately 22% of the Fund’s total assets (including the proceeds of such leverage) as of such date. The Fund’s asset coverage ratio as of June 30, 2021 was

446%.

Following the completion of an offering, the Fund may increase the amount of leverage outstanding. The Fund may engage in

additional borrowings in order to maintain the Fund’s desired leverage ratio. Leverage creates a greater risk of loss, as well as a potential for more gain, for the common shares than if leverage were not used. Interest on borrowings may be at

a fixed or floating rate and generally will be based on short-term rates. The costs associated with the Fund’s use of leverage, including the issuance of such leverage and the payment of dividends or interest on such leverage, will be borne

entirely by the holders of common shares. As long as the rate of return, net of applicable Fund expenses, on the Fund’s investment portfolio investments purchased with leverage exceeds the costs associated with such leverage, the Fund will

generate more return or income than will be needed to pay such costs. In this event, the excess will be available to pay higher dividends to holders of common shares. Conversely, if the Fund’s return on such assets is less than the cost of

leverage and other Fund expenses, the return to the holders of the common shares will diminish. To the extent that the Fund uses leverage, the NAV and market price of the common shares and the yield to holders of common shares will be more volatile.

The Fund’s leveraging strategy may not be successful. See “Use of Leverage” and “Risks and Special Considerations.”

Principal and General Risks. Investing in the Fund involves certain risks.

For a discussion of the principal and general risks of investing in the Fund, please refer to the section

of the Fund’s most recent annual report on Form N-CSR for the fiscal year ended December 31, 2020 filed on February 25, 2021 entitled “Fund Investment Objectives, Policies and

Risks—Risk Factors”, which is incorporated by reference herein. You should carefully consider those risks, along with other risks relating to investments in the Fund which are described in more detail under “Risks and Special

Considerations” beginning on page 19 of this Prospectus.

Information Regarding the Investment Adviser. Credit Suisse, the

Fund’s investment adviser, is part of the asset management business of Credit Suisse Group AG, one of the world’s leading banks. Credit Suisse serves as the Fund’s investment adviser with respect to all investments and is responsible

for making all investment decisions. Credit Suisse receives from the Fund, as compensation for its advisory services, a fee, computed weekly and payable quarterly at an annual rate of 0.50% of an average weekly base amount which, with respect to

each quarter, is the average of the lower of (i) the stock price (market value) of the Fund’s outstanding shares and (ii) the Fund’s net assets, in each case determined as of the last trading day for each week

during the relevant quarter. The Investment Adviser is located at Eleven Madison Avenue, New York, New York 10010. See “Management of the Fund—Investment Adviser.”

Potential Conflicts of Interest. If the Investment Adviser’s advisory fee, as described above, is calculated based on the net

assets of the Fund, the Investment Adviser will benefit from the increase in Fund assets that will result from offerings of Shares. It is not possible to state precisely the amount of additional compensation that the Investment Adviser might receive

as a result of the offerings because it is not known how many Shares will be sold because the proceeds of offerings will be invested in additional portfolio securities, which will fluctuate in value.

Portfolio Managers. The Credit Suisse Credit Investments Group (“CIG”) is responsible for the

day-to-day portfolio management of the Fund. The current team members responsible for managing the fund are Thomas J. Flannery, David J. Mechlin, Joshua Shedroff and

Wing Chan. Thomas J. Flannery, David J. Mechlin, Joshua Shedroff and Wing Chan are the portfolio managers of the team sharing in the day-to-day responsibilities of

2

portfolio management, including overall industry, credit, duration, yield curve positioning and security

selection and industry and issuer allocations. See “Management of the Fund—Portfolio Management.”

Administrator.

State Street serves as the Fund’s administrator. The Fund pays State Street, for administrative services, a fee, exclusive of out-of-pocket expenses, calculated in

total for all the funds advised by Credit Suisse that are administered or co-administered by State Street and allocated based upon the relative average net assets of each fund, subject to an annual minimum

fee. See “Management of the Fund—Administrator.”

Custodian and Transfer Agent. State Street acts as the Fund’s

custodian pursuant to a custody agreement. Computershare Trust Company, N.A. (“Computershare”), acts as the Fund’s transfer agent and dividend-paying agent. See “Custodian, Transfer Agent and Dividend-Paying Agent.”

Dividends and Distributions. The Fund declares and pays dividends on a monthly basis. Distributions of net realized capital gains, if

any, are declared and paid at least annually. See “Dividends and Distributions” and “Dividend Reinvestment and Cash Purchase Plan.”

Dividend Reinvestment and Cash Purchase Plan. The Fund offers a Dividend Reinvestment and Cash Purchase Plan (the “Plan”) to

its common stockholders. Computershare acts as Plan Agent for stockholders in administering the Plan. Participation in the Plan is voluntary. For shareholders participating in the Plan, all dividend and capital gain distributions are reinvested in

additional Shares of the Fund either purchased on the open market, or issued by the Fund if the Shares are trading at or above their NAV. A shareholder whose Shares are held through a bank, broker or nominee should contact such bank, broker or

nominee to confirm that they are able to participate in the Plan. See “Dividends and Distributions” and “Dividend Reinvestment and Cash Purchase Plan.”

Taxation. Tax considerations for an investor in the Fund are summarized under “Federal Income Taxation.”

Repurchase of Shares. The Fund may, from time to time, take action to attempt to reduce or eliminate any market value discount from

NAV. The Board, in consultation with Credit Suisse, will periodically review the possibility of open market repurchases or tender offers for Shares of the Fund. There can be no assurance that the Board will, in fact, decide to undertake either of

these actions or, if undertaken, that such repurchases or tender offers will result in the Shares trading at a price which is equal to or close to NAV. The Fund may borrow to finance such repurchases or tenders. See “Repurchase of Shares.”

3

SUMMARY OF FUND EXPENSES

|

|

|

|

|

|

|

Shareholder Transaction Expenses

|

|

|

|

|

|

Sales Load (as a percentage of offering price)(1)

|

|

|

up to 3.00%

|

|

|

Offering Expenses (as a percentage of offering price)(1)

|

|

|

0.15%

|

|

|

Dividend Reinvestment Plan Fees (per sale or per voluntary cash payment transaction fee)

|

|

|

$5.00(2)

|

|

|

Annual Fund Operating Expenses (as a percentage of average net assets attributable to the

Fund’s common shares)

|

|

|

|

|

|

Management Fees(3)

|

|

|

0.45%

|

|

|

Interest Expense on Borrowed Funds(4)

|

|

|

0.50%

|

|

|

Other Expenses

|

|

|

0.30%

|

|

|

Total Annual Operating Expenses

|

|

|

1.25%

|

|

|

(1)

|

If the Shares are sold to or through underwriters, the Prospectus Supplement will set forth any applicable

sales load, which may be lower than 3.00%, and the estimated offering expenses.

|

|

(2)

|

The Fund bears ongoing expenses associated with the Plan which are included in “Other Expenses.”

There is no service fee payable by Plan participants for dividend reinvestments; however, shareholders are subject to other transaction costs associated with the Plan. Actual costs will vary for each participant depending on the return and number of

transactions made. For Plan participants that elect to receive voluntary cash payments, Plan participants must pay a service fee of $5.00 per transaction. Plan participants will also be charged a pro rata share of the brokerage commissions for all

open market purchases ($0.03 per share as of October 2021). In addition, if a Plan participant elects by written notice to the Plan administrator to have the plan administrator sell part or all of the shares held by the Plan administrator in the

participant’s account and remit the proceeds to the participant, the participant will also be charged a service fee of $5.00 for each sale and brokerage commissions of $0.03 per share (as of October 2021). See “Dividend Reinvestment and

Cash Purchase Plan.”

|

|

(3)

|

See “Management of the Fund—Investment Adviser.” Credit Suisse receives from the Fund, as

compensation for its advisory services, a fee, computed weekly and payable quarterly at an annual rate of 0.50% of an average weekly base amount which, with respect to each quarter, is the average of the lower of (i) the stock price (market

value) of the Fund’s outstanding shares and (ii) the Fund’s net assets, in each case determined as of the last trading day for each week during the relevant quarter.

|

|

(4)

|

The Fund may use leverage through borrowings, the costs of which are borne by holders of Shares of the Fund.

The Fund currently borrows under the Credit Agreement.

|

Example:

An investor would directly or indirectly pay the following expenses on a $1,000 investment, assuming a 5% annual return throughout the period.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Year

|

|

|

3 Years

|

|

|

5 Years

|

|

|

10 Years

|

|

|

Total Expenses Incurred

|

|

$

|

44

|

|

|

$

|

70

|

|

|

$

|

98

|

|

|

$

|

178

|

|

The above table and example are intended to assist investors in understanding the various costs and expenses directly or

indirectly associated with investing in Shares of the Fund. The “Example” assumes that all dividends and other distributions are reinvested at net asset value and that the percentage amounts listed in the table above under Total Annual

Operating Expenses remain the same in the years shown. The above table and example and the assumption in the example of a 5% annual return are required by regulations of the SEC that are applicable to all investment companies; the assumed 5% annual

return is not a prediction of, and does not represent, the projected or actual performance of the Fund’s Shares. For more complete descriptions of certain of the Fund’s costs and expenses, see “Management of the Fund” and

“Expenses.” In addition, while the example assumes reinvestment of all dividends and distributions at NAV, participants in the Fund’s dividend reinvestment and cash purchase plan may receive Shares purchased or issued at a price or

value different from NAV. See “Dividends and Distributions; Dividend Reinvestment and Cash Purchase Plan.”

The example should not be

considered a representation of past or future expenses, and the Fund’s actual expenses may be greater than or less than those shown. Moreover, the Fund’s actual rate of return may be greater or less than the hypothetical 5% return shown in

the example.

4

FINANCIAL HIGHLIGHTS

The following financial highlights table is intended to help you understand the Fund’s financial performance. Certain information reflects financial

results from a single Fund share. The information in the financial highlights for the fiscal year ended 2020 has been audited by PricewaterhouseCoopers LLP, independent registered public accounting firm, whose report appears in

the Fund’s Annual Report to Shareholders. The financial information for the period ended June 30, 2021 is unaudited. The information in the financial highlights for the fiscal years ended 2016, 2017, 2018 and 2019 was audited by

KPMG LLP, the Fund’s former independent registered public accounting firm. The Fund’s financial statements are included in the Fund’s Annual and Semi-Annual Reports and are incorporated by reference into the Prospectus and the

SAI. The Annual and Semi-Annual Reports may be obtained without charge by calling 1-800-293-1232 or visiting the Fund’s

website, www.credit-suisse.com/us/funds.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Six

Months Ended

June 30, 2021

(unaudited)

|

|

|

For the year ended December 31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

2018

|

|

|

2017

|

|

|

2016

|

|

|

Per share operating performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, beginning of year

|

|

$

|

3.42

|

|

|

$

|

3.48

|

|

|

$

|

3.21

|

|

|

$

|

3.58

|

|

|

$

|

3.48

|

|

|

$

|

3.21

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INVESTMENT OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income1

|

|

|

0.12

|

|

|

|

0.27

|

|

|

|

0.26

|

|

|

|

0.27

|

|

|

|

0.24

|

|

|

|

0.25

|

|

|

Net gain (loss) on investments, foreign currency transactions and forward foreign currency

contracts (both realized and unrealized)

|

|

|

0.11

|

|

|

|

(0.06

|

)

|

|

|

0.28

|

|

|

|

(0.37

|

)

|

|

|

0.12

|

|

|

|

0.28

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total from investment activities

|

|

|

0.23

|

|

|

|

0.21

|

|

|

|

0.54

|

|

|

|

(0.10

|

)

|

|

|

0.36

|

|

|

|

0.53

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LESS DIVIDENDS AND DISTRIBUTIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends from net investment income

|

|

|

(0.14

|

)

|

|

|

(0.27

|

)

|

|

|

(0.27

|

)

|

|

|

(0.27

|

)

|

|

|

(0.24

|

)

|

|

|

(0.25

|

)

|

|

Return of capital

|

|

|

—

|

|

|

|

—

|

|

|

|

(0.00

|

)2

|

|

|

—

|

|

|

|

(0.02

|

)

|

|

|

(0.01

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total dividends and distributions

|

|

|

(0.14

|

)

|

|

|

(0.27

|

)

|

|

|

(0.27

|

)

|

|

|

(0.27

|

)

|

|

|

(0.26

|

)

|

|

|

(0.26

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, end of year

|

|

$

|

3.51

|

|

|

$

|

3.42

|

|

|

$

|

3.48

|

|

|

$

|

3.21

|

|

|

$

|

3.58

|

|

|

$

|

3.48

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share market value, end of year

|

|

$

|

3.52

|

|

|

$

|

3.15

|

|

|

$

|

3.22

|

|

|

$

|

2.77

|

|

|

$

|

3.31

|

|

|

$

|

3.16

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENT RETURN3

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value

|

|

|

6.80

|

%

|

|

|

8.08

|

%

|

|

|

18.17

|

%

|

|

|

(2.39

|

)%

|

|

|

11.34

|

%

|

|

|

18.64

|

%

|

|

Market value

|

|

|

16.29

|

%

|

|

|

7.58

|

%

|

|

|

26.71

|

%

|

|

|

(8.89

|

)%

|

|

|

13.37

|

%

|

|

|

24.39

|

%

|

|

|

|

|

|

|

|

|

|

RATIOS AND SUPPLEMENTAL DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets, end of year (000s omitted)

|

|

$

|

183,461

|

|

|

$

|

178,641

|

|

|

$

|

182,030

|

|

|

$

|

167,897

|

|

|

$

|

187,472

|

|

|

$

|

182,019

|

|

|

Ratio of net expenses to average net assets

|

|

|

1.03

|

%4

|

|

|

1.25

|

%

|

|

|

1.92

|

%

|

|

|

1.82

|

%

|

|

|

1.06

|

%

|

|

|

0.74

|

%

|

5

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Six

Months Ended

June 30, 2021

(unaudited)

|

|

|

For the year ended December 31,

|

|

|

|

|

2020

|

|

|

2019

|

|

|

2018

|

|

|

2017

|

|

|

2016

|

|

|

Ratio of net expenses to average net assets excluding interest expense

|

|

|

0.77

|

%4

|

|

|

0.75

|

%

|

|

|

0.78

|

%

|

|

|

0.78

|

%

|

|

|

0.90

|

%

|

|

|

0.74

|

%

|

|

Ratio of net investment income to average net assets

|

|

|

7.09

|

%4

|

|

|

8.55

|

%

|

|

|

7.59

|

%

|

|

|

7.83

|

%

|

|

|

6.75

|

%

|

|

|

7.66

|

%

|

|

Asset Coverage per $1,000 of Indebtedness

|

|

$

|

4,462

|

|

|

$

|

4,162

|

|

|

$

|

4,021

|

|

|

$

|

3,373

|

|

|

$

|

5,075

|

|

|

$

|

—

|

|

|

Portfolio turnover rate5

|

|

|

28

|

%

|

|

|

36

|

%

|

|

|

35

|

%

|

|

|

39

|

%

|

|

|

64

|

%

|

|

|

53

|

%

|

|

1

|

Per share information is calculated using the average shares outstanding method.

|

|

2

|

This amount represents less than $(0.01) per share.

|

|

3

|

Total investment return at net asset value is based on the change in the net asset value of Fund shares and

assumes reinvestment of dividends and distributions, if any, at actual prices pursuant to the Fund’s dividend reinvestment program. Total investment return at market value is based on the change in the market price at which the Fund’s

shares traded on the stock exchange during the period and assumes reinvestment of dividends and distributions, if any, at actual prices pursuant to the Fund’s dividend reinvestment program. Because the Fund’s shares trade in the stock

market based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on NAV and share price.

|

|

5

|

Portfolio turnover is calculated by dividing the lesser of total purchases or sales of portfolio securities for

the reporting period by the monthly average of portfolio securities owned during the reporting period. Excluded from both the numerator and denominator are amounts relating to derivatives and securities whose maturities or expiration dates at the

time of acquisition were one year or less.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Year Ended December 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

Per share operating performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, beginning of year

|

|

$

|

3.62

|

|

|

$

|

3.84

|

|

|

$

|

3.80

|

|

|

$

|

3.60

|

|

|

$

|

3.70

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INVESTMENT OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income

|

|

|

0.25

|

|

|

|

0.25

|

|

|

|

0.28

|

|

|

|

0.32

|

|

|

|

0.30

|

|

|

Net gain (loss) on investments and foreign currency related items (both realized and

unrealized)

|

|

|

(0.40

|

)

|

|

|

(0.19

|

)

|

|

|

0.05

|

|

|

|

0.20

|

|

|

|

(0.11

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total from investment activities

|

|

|

(0.15

|

)

|

|

|

0.06

|

|

|

|

0.33

|

|

|

|

0.52

|

|

|

|

0.19

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LESS DIVIDENDS AND DISTRIBUTIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends from net investment income

|

|

|

(0.26

|

)

|

|

|

(0.27

|

)

|

|

|

(0.29

|

)

|

|

|

(0.32

|

)

|

|

|

(0.29

|

)

|

|

Return of capital

|

|

|

—

|

|

|

|

(0.01

|

)

|

|

|

(0.01

|

)

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total dividends and distributions

|

|

|

(0.26

|

)

|

|

|

(0.28

|

)

|

|

|

(0.30

|

)

|

|

|

(0.32

|

)

|

|

|

(0.29

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAPITAL SHARE TRANSACTIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

6

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Year Ended December 31,

|

|

|

|

|

2015

|

|

|

2014

|

|

|

2013

|

|

|

2012

|

|

|

2011

|

|

|

Increase to net asset value due to shares issued through at-the-market offerings

|

|

|

—

|

|

|

|

—

|

|

|

|

0.01

|

|

|

|

—

|

|

|

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value, end of year

|

|

$

|

3.21

|

|

|

$

|

3.62

|

|

|

$

|

3.84

|

|

|

$

|

3.80

|

|

|

$

|

3.60

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Per share market value, end of year

|

|

$

|

2.78

|

|

|

$

|

3.29

|

|

|

$

|

3.56

|

|

|

$

|

4.03

|

|

|

$

|

3.65

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

TOTAL INVESTMENT RETURN1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net asset value

|

|

|

(3.35

|

)%

|

|

|

1.92

|

%

|

|

|

9.34

|

%

|

|

|

14.95

|

%

|

|

|

5.35

|

%

|

|

Market value

|

|

|

(7.90

|

)%

|

|

|

(0.09

|

)%

|

|

|

(4.42

|

)%

|

|

|

20.24

|

%

|

|

|

11.02

|

%

|

|

RATIOS AND SUPPLEMENTAL DATA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net assets, end of year (000s omitted)

|

|

$

|

167,848

|

|

|

$

|

189,343

|

|

|

$

|

200,780

|

|

|

$

|

190,673

|

|

|

$

|

180,011

|

|

|

Ratio of expenses to average net assets

|

|

|

0.66

|

%

|

|

|

0.71

|

%

|

|

|

0.76

|

%

|

|

|

0.75

|

%

|

|

|

0.73

|

%

|

|

Ratio of expenses to average net assets excluding interest expense

|

|

|

0.66

|

%

|

|

|

—

|

%

|

|

|

—

|

%

|

|

|

—

|

%

|

|

|

—

|

%

|

|

Ratio of net investment income to average net assets

|

|

|

7.21

|

%

|

|

|

6.60

|

%

|

|

|

7.40

|

%

|

|

|

8.49

|

%

|

|

|

8.09

|

%

|

|

Portfolio turnover rate

|

|

|

51

|

%

|

|

|

67

|

%

|

|

|

69

|

%

|

|

|

67

|

%

|

|

|

57

|

%

|

|

1

|

Total investment return at net asset value is based on changes in the net asset value of Fund shares and

assumes reinvestment of dividends and distributions, if any, at actual prices pursuant to the Fund’s dividend reinvestment program. Total investment return at market value is based on changes in the market price at which the Fund’s shares

traded on the stock exchange during the period and assumes reinvestment of dividends and distributions, if any, at actual prices pursuant to the Fund’s dividend reinvestment program. Because the Fund’s shares trade in the stock market

based on investor demand, the Fund may trade at a price higher or lower than its NAV. Therefore, returns are calculated based on share price and NAV.

|

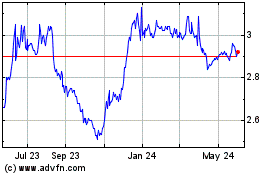

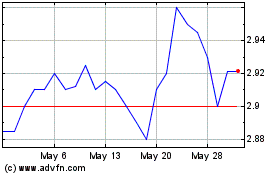

TRADING AND NET ASSET VALUE INFORMATION

In the past, the Fund’s common shares have traded at both a premium and at a discount in relation to NAV. Shares of

closed-end investment companies such as the Fund frequently trade at a discount from NAV. See “Closed-End Fund Structure.”

The Fund’s Shares are listed and traded on the NYSE American. The average weekly trading volume of the Shares on the NYSE American during the twelve

months ended September 30, 2021 was 5,526,766 shares. The following table shows for the quarters indicated: (1) the high and low sale price of the Shares at the close of trading on the NYSE

American; (2) the high and low NAV per Share; and (3) the high and low premium or discount to NAV at which the Fund’s Shares were trading at the close of trading (as a percentage of NAV).

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price

|

|

Net Asset Value

|

|

Premium/(Discount) To Net

Asset Value

|

|

Fiscal Quarter Ended

|

|

High

|

|

Low

|

|

High

|

|

Low

|

|

High

|

|

Low

|

|

|

March 31, 2019

|

|

$3.11

|

|

$2.79

|

|

$3.40

|

|

$3.21

|

|

|

(8.68)%

|

|

|

|

(13.08)%

|

|

|

June 30, 2019

|

|

$3.17

|

|

$2.98

|

|

$3.47

|

|

$3.37

|

|

|

(8.65)%

|

|

|

|

(11.57)%

|

|

|

September 30, 2019

|

|

$3.18

|

|

$3.11

|

|

$3.48

|

|

$3.41

|

|

|

(8.62)%

|

|

|

|

(8.80)%

|

|

|

December 31, 2019

|

|

$3.30

|

|

$3.11

|

|

$3.47

|

|

$3.41

|

|

|

(4.90)%

|

|

|

|

(8.80)%

|

|

|

March 31, 2020

|

|

$3.43

|

|

$2.07

|

|

$3.48

|

|

$2.52

|

|

|

(1.44)%

|

|

|

|

(17.86)%

|

|

|

June 30, 2020

|

|

$2.81

|

|

$2.23

|

|

$3.14

|

|

$2.64

|

|

|

(10.51)%

|

|

|

|

(15.53)%

|

|

|

September 30, 2020

|

|

$2.96

|

|

$2.68

|

|

$3.24

|

|

$3.12

|

|

|

(8.64)%

|

|

|

|

(14.10)%

|

|

|

December 31, 2020

|

|

$3.22

|

|

$2.91

|

|

$3.40

|

|

$3.25

|

|

|

(5.44)%

|

|

|

|

(10.46)%

|

|

|

March 31, 2021

|

|

$3.44

|

|

$3.11

|

|

$3.47

|

|

$3.42

|

|

|

(0.86)%

|

|

|

|

(9.06)%

|

|

7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Price

|

|

Net Asset Value

|

|

Premium/(Discount) To Net

Asset Value

|

|

Fiscal Quarter Ended

|

|

High

|

|

Low

|

|

High

|

|

Low

|

|

High

|

|

Low

|

|

|

June 30, 2021

|

|

$3.63

|

|

$3.33

|

|

$3.50

|

|

$3.48

|

|

|

3.71%

|

|

|

|

(4.31)%

|

|

|

September 30, 2021

|

|

$3.54

|

|

$3.38

|

|

$3.49

|

|

$3.48

|

|

|

1.43%

|

|

|

|

(2.87)%

|

|

On November 15, 2021, the per Share net asset value was $3.44 and the per Share market price was $3.52,

representing a 2.33% premium over such net asset value.

USE OF PROCEEDS

The Fund intends to invest the net proceeds of offerings in accordance with its investment objective and policies. It is anticipated that the Fund will be

able to invest substantially all of the net proceeds of an offering in accordance with its investment objective and policies within approximately 30 days after the completion of the offering. Pending such investment, the Fund anticipates investing

the proceeds in short-term securities issued by the U.S. government or its agencies or instrumentalities or in high quality, short-term or long-term debt obligations or money market instruments. See “Investment Objective” and

“Investment Policies.”

THE FUND

The Fund was organized as a corporation under the laws of the State of Maryland on February 10, 1987, and it is registered under the 1940 Act. The Fund

has been engaged in business as a diversified, closed-end management investment company since March 23, 1987, when it completed an initial public offering of shares of common stock, par value $0.001 per

share. The Fund’s common shares are traded on the NYSE American under the symbol “CIK.”

The Fund’s principal office is located

at Eleven Madison Avenue, New York, New York, 10010 and its telephone number is 1-800-295-1232.

The following provides information about the Fund’s outstanding shares as of September 30, 2021:

|

|

|

|

|

|

|

|

|

Title of Class

|

|

Amount Authorized

|

|

Amount Held by the Fund

or for Its Account

|

|

Exclusive of Amount Held

by the Fund or for Its

Account

|

|

Common Stock

|

|

100 million

|

|

0

|

|

52,326,006

|

INVESTMENT OBJECTIVE AND POLICIES

Investment Objective and Principal Investment Policies

For a discussion of the Fund’s investment objective and principal investment policies, please refer to the section

of the Fund’s most recent annual report on Form N-CSR for the fiscal year ended December 31, 2020 filed on February 25, 2021 entitled “Fund Investment Objective, Policies and Risks—Investment Objective and

Policies”, which is incorporated by reference herein.

8

Principal Portfolio Contents and Techniques

The Fund’s portfolio will be composed principally of the following investments. Additional information with respect to the Fund’s investment

policies and certain of the Fund’s portfolio investments is contained in the SAI. There is no guarantee the Fund will buy all of the types of securities or use all of the investment techniques that are described herein and in the SAI.

Lower-Rated Securities. Lower-rated securities are securities rated below investment grade quality (lower than Baa by Moody’s or lower than BBB by

S&P or comparably rated by another rating agency). Such securities are considered to have speculative elements, with higher vulnerability to default than corporate securities with higher ratings. See “Appendix A — Description of

Ratings” in the SAI for additional information concerning rating categories of Moody’s and S&P.

Lower-rated securities, though high

yielding, are characterized by high risk.

Bond prices generally are inversely related to interest rate changes; however, bond price volatility also is

inversely related to coupon. Accordingly, lower-rated securities may be relatively less sensitive to interest rate changes than higher quality securities of comparable maturity, because of their higher coupon. This higher coupon is what the investor

receives in return for bearing greater credit risk. The higher credit risk associated with lower-rated securities potentially will have a greater effect on the value of such securities than may be the case with higher quality issues of comparable

maturity, and will be a substantial factor in the Fund’s relative Share price volatility.

The ratings of Moody’s, S&P and the other rating

agencies represent their opinions as to the quality of the obligations which they undertake to rate. Ratings are relative and subjective and, although ratings may be useful in evaluating the safety of interest and principal payments, they do not

evaluate the market value risk of such obligations. Although these ratings may be an initial criterion for selection of portfolio investments, Credit Suisse also will evaluate these securities and the ability of the issuers of such securities to pay

interest and principal. To the extent that the Fund invests in lower-rated securities that have not been rated by a rating agency, the Fund’s ability to achieve its investment objectives will be more dependent on Credit Suisse’s credit

analysis than would be the case when the Fund invests in rated securities.

Senior Loans. “Senior Loans” are loans, including purchases

of loans or portions of loans via assignment from third parties, and loan participations (collectively, “Loans”) that are senior secured floating rate Loans. Senior Loans are made to corporations and other

non-governmental entities and issuers. Senior Loans typically hold the most senior position in the capital structure of the issuing entity, are typically secured with specific collateral and typically have a

claim on the assets and/or stock of the borrower that is senior to that held by subordinated debt holders and stockholders of the borrower. Collateral may include equity in a borrower’s operating companies or other tangible and intangible

assets. The proceeds of Senior Loans primarily are used to finance leveraged buyouts, recapitalizations, mergers, acquisitions, stock repurchases, dividends, and, to a lesser extent, to finance internal growth and for other corporate purposes.

Senior Loans typically have rates of interest that are determined daily, monthly, quarterly or semi-annually by reference to a base lending rate, plus a premium or credit spread. Base lending rates in common usage today are primarily LIBOR, and

secondarily the prime rate offered by one or more major U.S. banks (the “Prime Rate”) and the certificate of deposit (“CD”) rate or other base lending rates used by commercial lenders.

A Loan in which the Fund may invest typically is originated, negotiated and structured by a syndicate of lenders

(“Co-Lenders”) consisting of commercial banks, thrift institutions, insurance companies, finance companies, investment banking firms, securities brokerage houses or other financial institutions or

institutional investors, one or more of which administers the loan on behalf of the syndicate. Senior Loans that are issued by lenders that are banks are commonly referred to as “bank loans.”

Co-Lenders may sell Senior Loans to third parties (“Participants”). The Fund invests in a Senior Loan either by participating in the primary distribution as a

Co-Lender at the time the loan is originated or by buying an assignment or participation interest in the Senior Loan in the secondary market from a Co-Lender or a

Participant. Loans in which the Fund invests may include “covenant-lite” loans.

The Fund may invest in a Senior Loan at origination as a Co-Lender or by acquiring an assignment or participation interest in the secondary market from a Co-Lender or Participant. If the Fund purchases an assignment, the Fund

9

typically accepts all of the rights of the assigning lender in a Senior Loan, including the right to receive payments of principal and interest and other amounts directly from the borrower and to

enforce its rights as a lender directly against the borrower and assumes all of the obligations of the assigning lender, including any obligations to make future advances to the borrower. As a result, therefore, the Fund has the status of a Co-Lender. In some cases, the rights and obligations acquired by a purchaser of an assignment may differ from, and may be more limited than, the rights and obligations of the assigning lender. The Fund also may

purchase a participation in a portion of the rights of a Co-Lender or Participant in a Senior Loan by means of a participation agreement. A participation is similar to an assignment in that the Co-Lender or Participant transfers to the Fund all or a portion of an interest in a senior loan. Unlike an assignment, however, a participation does not establish any direct relationship between the Fund and the

borrower. In such a case, the Fund is required to rely on the Co-Lender or Participant that sold the participation not only for the enforcement of the Fund’s rights against the borrower but also for the

receipt and processing of payments due to the Fund under the Senior Loans.

The Fund may receive and/or pay certain fees in connection with its lending

activities. These fees are in addition to interest payments received and may include facility fees, commitment fees, amendment and waiver fees, commissions and prepayment fees. In certain circumstances, the Fund may receive a prepayment fee on the

prepayment of a Senior Loan by a borrower.

In certain circumstances, Loans may be deemed not to be securities, and in such circumstances, in the event of

fraud or misrepresentation by a Borrower or an arranger, Lenders and purchasers of interests in such Loans, such as the Fund, will not have the protection of the anti-fraud provisions of the federal securities laws, as would be the case for bonds or

stocks. Instead, in such cases, Lenders generally rely on the contractual provisions in the Loan agreement itself, and common-law fraud protections under applicable state law.

Second Lien and Other Secured Loans. “Second Lien Loans” are “second lien” secured floating rate Loans made by public and private

corporations and other non-governmental entities and issuers for a variety of purposes. Second Lien Loans are second in right of payment to one or more Senior Loans of the related borrower. Second Lien Loans

typically are secured by a second priority security interest or lien to or on specified collateral securing the borrower’s obligation under the Loan and typically have similar protections and rights as Senior Loans. Second Lien Loans are not

(and by their terms cannot become) subordinated in right of payment to any obligation of the related borrower other than Senior Loans of such borrower. Second Lien Loans, like Senior Loans, typically have adjustable floating rate interest payments.

Because Second Lien Loans are second to Senior Loans, they present a greater degree of investment risk but often pay interest at higher rates reflecting this additional risk.

The Fund may also invest in secured Loans other than Senior Loans and Second Lien Loans. Such secured Loans are made by public and private corporations and

other non-governmental entities and issuers for a variety of purposes, and may rank lower in right of payment to one or more Senior Loans and Second Lien Loans of the borrower. Such secured Loans typically are

secured by a lower priority security interest or lien to or on specified collateral securing the borrower’s obligation under the Loan, and typically have more subordinated protections and rights than Senior Loans and Second Lien Loans. Secured

Loans may become subordinated in right of payment to more senior obligations of the borrower issued in the future. Such secured Loans may have fixed or adjustable floating rate interest payments. Because other secured Loans rank in payment order

behind Senior Loans and Second Lien Loans, they present a greater degree of investment risk but often pay interest at higher rates reflecting this additional risk.

Second Lien Loans and other secured Loans generally are of below investment grade quality. Other than their subordinated status, Second Lien Loans and other

secured Loans have many characteristics similar to Senior Loans discussed above. As in the case of Senior Loans, the Fund may purchase interests in Second Lien Loans and other secured Loans through assignments or participations.

Collateralized Debt Obligations. The Fund may invest in collateralized debt obligations (“CDOs”), which include collateralized bond

obligations (“CBOs”), collateralized loan obligations (“CLOs”) and other similarly structured securities. CDOs are types of asset-backed securities. A CBO is ordinarily issued by a fund or other special purpose entity

(“SPE”) and is typically backed by a diversified pool of fixed income securities (which may include high risk, below investment grade securities) held by such issuer. A CLO is ordinarily issued by a trust or other SPE and is typically

collateralized by a pool of loans, which may include, among others, domestic and non-U.S. senior secured

10

loans, senior unsecured loans, and subordinate corporate loans, including loans that may be rated below investment grade or equivalent unrated loans, held by such issuer. Although certain CDOs

may benefit from credit enhancement in the form of a senior-subordinate structure, over-collateralization or bond insurance, such enhancement may not always be present, and may fail to protect the Fund against the risk of loss on default of the

collateral. Certain CDO issuers may use derivatives contracts to create “synthetic” exposure to assets rather than holding such assets directly, which entails the risks of derivative instruments described elsewhere in this Prospectus. CDOs

may charge management fees and administrative expenses, which are in addition to those of the Fund.

For both CBOs and CLOs, the cash flows from the SPE

are split into two or more portions, called tranches, varying in risk and yield. The riskiest portion is the “equity” tranche, which bears the first loss from defaults from the bonds or loans in the SPE and serves to protect the other,

more senior tranches from default (though such protection is not complete). Since it is partially protected from defaults, a senior tranche from a CBO or CLO typically has higher ratings and lower yields than its underlying securities, and may be

rated investment grade. Despite the protection from the equity tranche, CBO or CLO tranches can experience substantial losses due to actual defaults, downgrades of the underlying collateral by rating agencies, forced liquidation of the collateral

pool due to a failure of coverage tests, increased sensitivity to defaults due to collateral default and disappearance of protecting tranches, market anticipation of defaults as well as investor aversion to CBO or CLO securities as a class. Interest

on certain tranches of a CDO may be paid in kind or deferred and capitalized (paid in the form of obligations of the same type rather than cash), which involves continued exposure to default risk with respect to such payments.

Convertible Securities. Convertible securities may be converted at either a stated price or stated rate into underlying shares of common stock.

Convertible securities have characteristics similar to both fixed income and equity securities. Convertible securities generally are subordinated to other similar but non-convertible securities of the same

issuer, although convertible bonds, as corporate debt obligations, enjoy seniority in right of payment to all equity securities, and convertible preferred stock is senior to shares of common stock of the same issuer. Because of the subordination

feature, however, convertible securities typically have lower ratings than similar non-convertible securities.

Although to a lesser extent than with fixed income securities, the market value of convertible securities tends to decline as interest rates increase and,

conversely, tends to increase as interest rates decline. In addition, because of the conversion feature, the market value of convertible securities tends to vary with fluctuations in the market value of the underlying common stock. As the market

price of the underlying common stock declines, convertible securities tend to trade increasingly on a yield basis, and so may not experience market value declines to the same extent as the underlying common stock. When the market price of the

underlying common stock increases, the prices of the convertible securities tend to rise as a reflection of the value of the underlying common stock. While no securities investments are without risk, investments in convertible securities generally

entail less risk than investments in common stock of the same issuer.

Convertible securities provide for a stable stream of income with generally higher

yields than common stock and offer the potential for capital appreciation through the conversion feature, which enables the holder to benefit from increases in the market price of the underlying common stock. In return, however, convertible

securities generally offer lower interest or dividend yields than non-convertible securities of similar quality.

Credit Default Swap Agreements. The “buyer” in a credit default swap is obligated to pay the “seller” an upfront payment or a

periodic stream of payments over the term of the agreement, provided that no credit event on an underlying reference obligation has occurred. If a credit event occurs, the seller must pay the buyer the full notional value, or “par value,”

of the reference obligation in exchange for the reference obligation. As a result of counterparty risk, certain credit default swap agreements may involve greater risks than if the Fund had invested in the reference obligation directly.

If the Fund is a buyer and no credit event occurs, the cost to the Fund is the premium paid with respect to the agreement. If a credit event occurs, however,

the Fund may elect to receive the full notional value of the swap in exchange for an equal face amount of deliverable obligations of the reference entity that may have little or no value. On the other hand, the value of any deliverable obligations