Filed

Pursuant to Rule 424(b)(5)

File

No. 333-265058

Prospectus

Supplement

(To

Prospectus dated August 10, 2022)

Clough

Global Dividend and Income Fund

Up

to $10,000,000 of Shares of Beneficial Interest

Clough

Global Dividend and Income Fund (the “Fund”) has entered into a sales agreement, dated October 19, 2021 (the “Sales

Agreement”) with Virtu Americas LLC (“Virtu”), relating to the Fund’s shares of beneficial interest, no

par value per share (the “Common Shares”), offered by this Prospectus Supplement and the accompanying Prospectus dated

August 10, 2022. In accordance with the terms of the Sales Agreement, the Fund may offer and sell up to $10,000,000 of the Fund’s

Common Shares from time to time through Virtu. The Fund is a diversified, closed-end management investment company that commenced

investment operations in April 2004. The Fund’s investment objective is to provide a high level of total return and current

income.

The

Fund’s Common Shares are listed on the NYSE American (“NYSE”) under the symbol “GLV.” As of August

9, 2022, the last reported sale price for the Fund’s Common Shares was $8.35 per Common Share. As of August 9, 2022, the

last reported net asset value (“NAV”) per Common Share for the Fund’s Common Shares was $8.19.

Sales

of the Fund’s Common Shares, if any, under this Prospectus Supplement and the accompanying Prospectus may be made in negotiated

transactions or transactions that are deemed to be “at the market” as defined in Rule 415 under the Securities Act

of 1933, as amended (the “Securities Act”), including sales made directly on the NYSE or sales made to or through

a market maker other than on an exchange. Under the Investment Company Act of 1940, as amended (the “1940 Act”), the

minimum price on any day at which Common Shares may be sold will not be less than the then current NAV per Common Share plus the

per Common Share amount of the commission to be paid to Virtu (the “Minimum Price”). The Fund will determine whether

any sales of Common Shares will be authorized on a particular day. The Fund, however, will not authorize sales of Common Shares

if the price per share of the Common Shares is less than the Minimum Price. The Fund may elect not to authorize sales of Common

Shares on a particular day even if the price per share of the Common Shares is equal to or greater than the Minimum Price, or

may only authorize a fixed number of Common Shares to be sold on any particular day. The Fund will have full discretion regarding

whether sales of Common Shares will be authorized on a particular day and, if so, in what amounts.

You

should read this Prospectus Supplement and the accompanying Prospectus before deciding whether to invest in the Fund’s Common

Shares and retain it for future reference. Investing in the Fund’s Common Shares involves certain risks. You could lose

some or all of your investment. See “Risk Factors and Special Considerations” in the accompanying Prospectus. You

should consider carefully these risks together with all of the other information contained in this Prospectus Supplement and the

accompanying Prospectus before making a decision to purchase the Fund’s Common Shares.

Neither

the Securities and Exchange Commission (“SEC”) nor any state securities commission has approved or disapproved of

these securities or determined if this Prospectus Supplement or the accompanying Prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

Prospectus

Supplement dated August 22, 2022

This

Prospectus Supplement, together with the accompanying Prospectus, sets forth concisely the information that you should know before

investing. You should read the accompanying Prospectus and Prospectus Supplement, which contain important information, before

deciding whether to invest in the Fund’s Common Shares. You should retain the accompanying Prospectus and Prospectus Supplement

for future reference. A statement of additional information (“SAI”), dated August 10, 2022, as supplemented from time

to time, containing additional information, has been filed with the SEC and is incorporated by reference in its entirety into

this Prospectus Supplement and the accompanying Prospectus. This Prospectus Supplement, the accompanying Prospectus and the SAI

are part of a “shelf” registration statement that the Fund filed with the SEC. This Prospectus Supplement describes

the specific details regarding this offering, including the method of distribution See “Plan of Distribution.” If

information in this Prospectus Supplement is inconsistent with the accompanying Prospectus or the SAI, you should rely on this

Prospectus Supplement.

You

may request a free copy of the SAI, request a free copy of the Fund’s annual and semi-annual reports, request other information

or make stockholder inquiries, by calling toll-free 1-855-425-6844 or by writing to the Fund at 1290 Broadway, Suite 1000, Denver,

Colorado 80203. The Fund’s annual and semi-annual reports also are available on the Fund’s website, free of charge,

at www.cloughglobal.com (information included on the website does not form a part of this Prospectus Supplement or accompanying

Prospectus), or from the SEC’s website (http://www.sec.gov). You can review and copy documents the Fund has filed at the

SEC’s Public Reference Room. The SEC charges a fee for copies. You can get the same information free from the SEC’s

website (http://www.sec.gov). You may also e-mail requests for these documents to publicinfo@sec.gov.

The

Fund’s securities do not represent a deposit or obligation of, and are not guaranteed or endorsed by, any bank or other

insured depository institution and are not federally insured by the Federal Deposit Insurance Corporation, the Federal Reserve

Board or any other government agency.

Primary

Investment Strategies. The Fund is a diversified, closed-end management investment company registered under the Investment

Company Act of 1940, as amended (the “1940 Act”). The Fund’s investment objective is to provide a high level

of total return. The Fund seeks to pursue this objective by applying a fundamental research-driven investment process and will

invest in equity securities of companies of any market capitalization and equity-related securities, including equity swaps and

call options, as well as fixed income securities, including both corporate and sovereign debt in both U.S. and non-U.S. markets.

There is no assurance that the Fund will achieve its investment objective.

The

Fund invests in a managed mix of equity and debt securities. The Fund is flexibly managed so that, depending on the Fund’s

investment adviser’s outlook, it sometimes will be more heavily invested in equity securities or in debt or fixed income

securities. Under normal circumstances, the Fund expects to invest in securities of issuers located in at least three countries

(in addition to the United States). Unless market conditions are deemed unfavorable, the Fund expects that the market value of

the Fund’s long and short positions in securities of issuers organized outside the United States and issuers doing a substantial

amount of business outside the United States (greater than 50% of revenues derived from outside of the United States) will represent

at least 40% of the Fund’s net assets. The Fund also may invest in call options, both on specific equity securities, as

well as securities representing exposure to equity sectors or indices and fixed income indices, including options on indices.

The Fund may acquire put and call options and options on stock indices and enter into stock index futures contracts, certain credit

derivatives transactions and short sales in connection with its equity investments. In connection with the Fund’s investments

in debt securities, it may enter into related derivatives transactions such as interest rate futures, swaps and options thereon

and certain credit derivatives transactions. Investments in non-U.S. markets will be made primarily through liquid securities,

including depositary receipts (which evidence ownership of underlying foreign securities) such as American Depositary Receipts

(“ADRs”), European Depositary Receipts (“EDRs”), Exchange Traded Funds (“ETFs”) and Global

Depositary Receipts (“GDRs”), as well as in stocks traded on non-U.S. exchanges. Investments in debt may include both

investment grade and non-investment grade issues. Investments in corporate debt may include bonds issued by companies in countries

considered emerging markets. Investments in sovereign debt may include bonds issued by countries considered emerging markets.

The Fund will not invest more than 33% of its total assets, at the time of acquisition, in securities (including equity and fixed

income securities) of governments and companies in emerging markets. The Fund may also invest a portion of its assets in real

estate investment trusts, or “REITs”, but the Fund does not expect that portion to be significant.

The

Fund may use various hedging strategies for return generation, or to express a specific view on an industry or individual company.

In addition to shorting to hedge equity risk, the Fund may utilize instruments including, for example, ETFs, derivative positions

and U.S. Treasury securities as a means to seek to reduce volatility and limit exposure to market declines. These instruments

can be effective in seeking to reduce volatility, and can help to prevent the Fund from selling long positions at sub-optimal

times. The Fund may also engage in frequent portfolio turnover.

The

Fund will place a high priority on capital preservation. The Fund may use a variety of investment techniques including shorting

strategies, use of derivatives, and use of long-dated bonds, designed to capitalize on declines in the market price of equity

securities or declines in market indices (e.g., the Fund may establish short positions in specific stocks or stock indices) based

on the Fund’s investment adviser’s investment outlook. Subject to the requirements of the 1940 Act and the Internal

Revenue Code of 1986, as amended (the “Code”), the Fund will not make a short sale if, after giving effect to such

sale, the market value of all securities sold short by the Fund exceeds 30% of the value of its total assets. No assurances can

be given that the Fund’s investment objective will be achieved.

Leverage.

The Fund currently uses leverage through borrowing. More specifically, the Fund has entered into a credit agreement (the

“Credit Agreement”) with a commercial bank (“Bank”). As of May 18, 2022, the Fund had outstanding $63,000,000

in principal amount of borrowings from the Credit Agreement representing approximately 32.87% of the Fund’s total assets

(including assets attributable to the Fund’s use of leverage). The Bank has the ability to terminate the Credit Agreement

upon 179-days’ notice or following an event of default. The Fund also may borrow money as a temporary measure for extraordinary

or emergency purposes.

TABLE

OF CONTENTS

Prospectus

Supplement

Page

| Prospectus

Supplement Summary |

S-6 |

| Use

of Proceeds |

S-6 |

| Capitalization |

S-6 |

| Table

of Fees and Expenses |

S-7 |

| Distributions |

S-8 |

| Price

Range of Common Shares |

S-9 |

| Outstanding

Securities |

S-9 |

| Plan

of Distribution |

S-9 |

| Legal

Matters |

S-10 |

| Incorporation

by Reference |

S-10 |

| Additional

Information |

S-11 |

Prospectus

Page

| Prospectus

Summary |

5 |

| Cautionary

Notice Regarding Forward-Looking Statements |

18 |

| Summary

of Fund Expenses |

18 |

| Use

of Proceeds |

21 |

| The

Fund |

21 |

| Investment

Objective and Policies |

21 |

| Use

of Leverage |

38 |

| Risk

Factors and Special Considerations |

39 |

| Management

of the Fund |

50 |

| Net

Asset Value |

52 |

| Distributions |

53 |

| Dividend

Reinvestment Plan |

54 |

| Federal

Income Tax Matters |

56 |

| Description

of Capital Structure |

58 |

| Anti-Takeover

Provisions in the Declaration of Trust |

69 |

| Conversion

to Open-End Fund |

70 |

| Custodian

and Transfer Agent |

70 |

| Legal

Matters |

71 |

| Reports

to Shareholders |

71 |

| Independent

Registered Public Accounting Firm |

71 |

| Additional

Information |

71 |

| Incorporation

by Reference |

71 |

| The

Fund’s Privacy Policy |

72 |

You

should rely only on the information contained or incorporated by reference in this Prospectus Supplement and the accompanying

Prospectus. The Fund has not authorized anyone to provide you with different information. The Fund is not making an offer to sell

these securities in any jurisdiction where the offer or sale is not permitted. You should not assume that the information contained

in this Prospectus Supplement and the accompanying Prospectus is accurate as of any date other than the date of this Prospectus

Supplement and the accompanying Prospectus, respectively. The Fund’s business, financial condition, results of operations

and prospects may have changed since those dates. In this Prospectus Supplement and in the accompanying Prospectus, unless otherwise

indicated, “Fund,” refers to Clough Global Dividend and Income Fund.

CAUTIONARY

NOTICE REGARDING

FORWARD-LOOKING STATEMENTS

This

Prospectus Supplement, the accompanying Prospectus and statement of additional information contain “forward-looking statements.”

Forward-looking statements can be identified by the words “may,” “will,” “intend,” “expect,”

“estimate,” “continue,” “plan,” “anticipate,” and similar terms and the negative

of such terms. By their nature, all forward-looking statements involve risks and uncertainties, and actual results could differ

materially from those contemplated by the forward-looking statements. Several factors that could materially affect the Fund’s

actual results are the performance of the portfolio of securities the Fund holds, the price at which the Fund’s Common Shares

will trade in the public markets and other factors discussed in the Fund’s periodic filings with the SEC. Currently known

risk factors that could cause actual results to differ materially from the Fund’s expectations include, but are not limited

to, the factors described in the “Risk Factors and Special Considerations” section of the accompanying Prospectus.

The Fund urges you to review carefully that section for a more detailed discussion of the risks of an investment in the Fund’s

securities.

Although

the Fund believes that the expectations expressed in the Fund’s forward-looking statements are reasonable, actual results

could differ materially from those projected or assumed in the Fund’s forward-looking statements. The Fund’s future

financial condition and results of operations, as well as any forward-looking statements, are subject to change and are subject

to inherent risks and uncertainties, such as those disclosed in the “Risk Factors and Special Considerations” section

of the accompanying Prospectus. All forward-looking statements contained or incorporated by reference in this Prospectus Supplement

or the accompanying Prospectus are made as of the date of this Prospectus Supplement or the accompanying Prospectus, as the case

may be. Except for the Fund’s ongoing obligations under the federal securities laws, the Fund does not intend, and the Fund

undertakes no obligation, to update any forward-looking statement.

PROSPECTUS

SUPPLEMENT SUMMARY

This

is only a summary of information contained elsewhere in this Prospectus Supplement and the accompanying Prospectus. This summary

does not contain all of the information that you should consider before investing in the Fund’s shares of beneficial interest

(the “Common Shares”). You should carefully read the more detailed information contained in this Prospectus Supplement

and the accompanying Prospectus and the statement of additional information (“SAI”), dated August 10, 2022, especially

the information set forth in the Prospectus under the heading “Risk Factors and Special Considerations.”

The

Fund. Clough Global Dividend and Income Fund (the “Fund”) is a Delaware statutory trust registered as a diversified,

closed-end management investment company under the Investment Company Act of 1940, as amended (the “1940 Act”). An

investment in the Fund may not be appropriate for all investors. There can be no assurance that the Fund will achieve its investment

objective.

Adviser.

Clough Capital Partners L.P. (“Clough”), the investment adviser of the Fund, is registered with the Securities

and Exchange Commission as an investment adviser under the Investment Advisers Act of 1940, as amended. As of April 30, 2022,

Clough had approximately $2.2 billion of assets under management. Clough’s address is 53 State St., Boston, MA 02109. The

Fund pays Clough a monthly fee at the annual rate of 0.70% of the Fund’s average daily total assets.

The

Offering. Sales of the Fund’s Common Shares, if any, under this Prospectus Supplement and the accompanying Prospectus

may be made in negotiated transactions or transactions that are deemed to be “at the market” as defined in Rule 415

under the Securities Act of 1933, as amended (the “Securities Act”), including sales made directly on the NYSE or

sales made to or through a market maker other than on an exchange. The minimum price on any day at which Common Shares may be

sold will not be less than the then current NAV per Common Share plus the per Common Share amount of the commission to be paid

to Virtu (the “Minimum Price”). The Fund will determine whether any sales of Common Shares will be authorized on a

particular day. The Fund, however, will not authorize sales of Common Shares if the price per share of the Common Shares is less

than the Minimum Price. The Fund may elect not to authorize sales of Common Shares on a particular day even if the price per share

of the Common Shares is equal to or greater than the Minimum Price, or may only authorize a fixed number of Common Shares to be

sold on any particular day. The Fund will have full discretion regarding whether sales of Common Shares will be authorized on

a particular day and, if so, in what amounts.

USE

OF PROCEEDS

The

Fund estimates the net proceeds of the Offer to be approximately $10,000,000. This figure is based on the recent market price

of Common Shares of $8.35 and assumes all new Common Shares offered are sold and that the expenses related to the Offer estimated

at approximately $160,000 are paid.

Clough

anticipates that investment of the proceeds will be made in accordance with the Fund’s investment objectives and policies

as appropriate investment opportunities are identified. It currently is anticipated that the Fund will be able to invest substantially

all of the net proceeds of the offering within one week after they are received. However, delays could occur because market conditions

could result in the Clough delaying the investment of proceeds if it believes the margin of risk in making additional investments

is not favorable. See “Investment Objective and Policies” in the Prospectus. Pending such investment, the proceeds

may be held in high quality short-term debt securities and instruments.

CAPITALIZATION

Pursuant

to the Sales Agreement with Virtu, the Fund may offer and sell up to 1,197,604 of the Fund’s Common Shares from time to

time through Virtu for the offer and sale of the Common Shares under this Prospectus Supplement and the accompanying Prospectus.

There is no guarantee that there will be any sales of the Fund’s Common Shares pursuant to this Prospectus Supplement and

the accompanying Prospectus. The table below shows the Fund’s historical capitalization as of April 30, 2022 and the estimated

capitalization of the Fund assuming the sale of all 1,197,604 Common Shares that are subject to the Sales Agreement on a pro forma,

as adjusted basis as of August 9, 2022. Actual sales, if any, of the Fund’s Common Shares, and the actual application of

the proceeds thereof, under this Prospectus Supplement and the accompanying Prospectus may be different than as set forth in the

table below. In addition, the price per share of any such sale may be greater or less than $8.35 depending on the market price

of the Fund’s Common Shares at the time of any such sale. The Fund and Virtu will determine whether any sales of Common

Shares will be authorized on a particular day. The Fund and Virtu, however, will not authorize sales of Common Shares if the price

per share of the Common Shares is less than the Minimum Price. The Fund and Virtu may elect not to authorize sales of Common Shares

on a particular day even if the price per share of the Common Shares is equal to or greater than the Minimum Price, or may only

authorize a fixed number of Common Shares to be sold on any particular day. The Fund and Virtu will have full discretion regarding

whether sales of Common Shares will be authorized on a particular day and, if so, in what amounts.

The

following table sets forth the Fund’s capitalization:

●

on a historical basis as of April 30, 2022

● on

a pro forma as adjusted basis to reflect (1) the assumed sale of 1,197,604 of the Fund’s Common Shares at $8.35 per share

(the last reported sale price of the Fund’s Common Shares on NYSE on August 9, 2022) in an offering under this Prospectus

Supplement and the accompanying Prospectus, and (2) the investment of net proceeds assumed from such offering in accordance with

the Fund’s investment objective and policies, after deducting the assumed aggregate commission of $80,000 (representing

an estimated commission paid to Virtu of 0.80% of the gross sales price per share in connection with the sale of Common Shares

effected by Virtu in each offering) and offering costs payable by the Fund of $12,000.

| |

Actual

(unaudited) |

As

Adjusted

(unaudited) |

| Common Shares, no par value per

share, Unlimited shares authorized, 11,595,622 outstanding (actual) and 12,773,478 shares outstanding (as adjusted) |

$112,437,861 |

$122,345,854 |

| Total distributable earnings/(Accumulated

loss) |

$(10,835,058) |

$(10,835,058) |

| Net assets applicable to Common

Stockholders |

$101,602,803 |

$111,510,796 |

| |

|

|

| Total Capitalization |

$101,602,803 |

$111,510,796 |

TABLE

OF FEES AND EXPENSES

The

following table shows the Fund’s expenses as a percentage of net assets attributable to common shares. All expenses of the

Fund are borne, directly or indirectly, by the common shareholders. The purpose of the table and example below is to help you

understand all fees and expenses that you, as a holder of common shares, would bear directly or indirectly.

The

table assumes the use of leverage in an amount equal to 33% of the Fund’s total assets. The extent of the Fund’s assets

attributable to leverage, and the Fund’s associated expenses, are likely to vary (perhaps significantly) from these assumptions.

Interest payments on borrowings are included in the total annual expenses of the Fund.

| Shareholder

Transaction Expenses |

|

| Sales

Load (as a percentage of offering price) |

0.80% |

| Offering

Expenses Borne by the Fund1 |

0.01% |

| Dividend

Reinvestment Plan Fees2 |

None |

| Annual

Expenses |

Percentage

of

Net Assets

Attributable to

Common Shares |

| Investment

Advisory Fees3 |

0.93% |

| Interest

Payments on Borrowed Funds4 |

0.66% |

| Other

Expenses5 |

0.67% |

| Acquired

Fund Fees and Expenses |

0.27% |

| Total

Annual Fund Operating Expenses |

2.53% |

| (1) |

Estimated

maximum amount based on offering of $10,000,000 in common shares. |

| (2) |

There

will be no brokerage charges under the Fund’s dividend reinvestment plan with respect to shares of common stock issued

by the Fund in connection with the offering. However, you may pay brokerage charges if you sell your shares of common stock

held in a dividend reinvestment account. You also may pay a pro rata share of brokerage commissions incurred in connection

with your market purchases pursuant to the Fund’s dividend reinvestment plan. |

| (3) |

The

Investment Adviser fee is 0.70% of the Fund’s average daily total assets. Consequently, if the Fund has preferred shares

or debt outstanding, the investment management fee and other expenses as a percentage of net assets attributable to common

shares may be higher than if the Fund does not utilize a leveraged capital structure. |

| (4) |

Assumes

the use of leverage in the form of borrowing under the Credit Agreement representing 33% of the Fund’s total assets

(including any additional leverage obtained through the use of borrowed funds), also taking into account the additional assets

to be raised in an offer, as estimated above, at an annual interest rate cost to the Fund of 1.99%. In the event preferred

shares are issued, leverage may amount to 33% of the Fund’s total assets in the form of: (1) amounts borrowed by the

Fund under a credit agreement in an amount equal to 13% of the Fund’s total assets and (2) preferred shares offered

in an amount equal to 20% of the Fund’s total assets. |

| |

(5) |

Other

Expenses are estimated based on the Fund’s semi-annual period ending on April 30, 2022, assuming completion of the proposed

issuances. |

For

a more complete description of the various costs and expenses a common shareholder would bear in connection with the issuance

and ongoing maintenance of any preferred shares issued by the Fund, see “Risk Factors and Special Considerations—Special

Risks to Holders of Common Shares—Leverage Risk.”

Example

The

following example illustrates the expenses you would pay on a $1,000 investment in the Fund’s Common Shares, assuming a

5% annual portfolio total return.* The expenses illustrated in the following example include the estimated offering expenses of

$12,000 from the issuance of $55,000,000 million in common shares. The actual amounts in connection with any offering will be

set forth in the Prospectus Supplement if applicable.

| 1

Year |

3

Years |

5

Years |

10

Years |

| $34 |

$86 |

$142 |

$293 |

| * |

The

example should not be considered a representation of future expenses or rate of return. |

The

example is based on total Annual Expenses and Dividends on Preferred Shares shown in the table above and assumes that the amounts

set forth in the table do not change and that all distributions are reinvested at net asset value. Actual expenses may be greater

or less than those assumed. Moreover, the Fund’s actual rate of return may be greater or less than the hypothetical 5% return

shown in the example.

DISTRIBUTIONS

The

Fund, acting pursuant to a Securities and Exchange Commission (“SEC”) exemptive order and with the approval of the

Board, has adopted a plan, consistent with the Fund’s investment objective and policies to support a level distribution

of income, capital gains and/or return of capital (the “Plan”). Currently, in accordance with the Plan, until December

2022, the Fund will pay monthly distributions of one twelfth of 10% of the Fund’s adjusted year-ending monthly net asset

value (“NAV”), which is the average of the NAV’s of the last five business days of the prior calendar year.

Based on current conditions, Clough expects it will likely recommend that the rate continue to be set at 10% as per the current

policy after December 2022. Under the Plan, the Fund will distribute all available investment income to its shareholders, consistent

with the Fund’s primary investment objectives and as required by the Code. If sufficient investment income is not available

on a monthly basis, the Fund will distribute long-term capital gains and/or return of capital to shareholders in order to maintain

a level distribution. Each monthly distribution to shareholders is expected to be at the fixed amount established by the Board,

except for extraordinary distributions and potential distribution rate increases to enable the Fund to comply with the distribution

requirements imposed by the Code.

The

Board may amend, suspend or terminate the Fund’s Plan without prior notice if the Board determines in good faith that continuation

would constitute a breach of fiduciary duty or would violate the 1940 Act. The suspension or termination of the Plan could have

the effect of creating a trading discount (if the Fund’s stock is trading at or above net asset value) or widening an existing

trading discount. The Fund is subject to risks that could have an adverse impact on its ability to maintain level distributions.

Examples of potential risks include, but are not limited to, economic downturns impacting the markets, increased market volatility,

companies suspending or decreasing corporate dividend distributions and changes in the Code. Please refer to the Notes to Financial

Statements in the Annual Report to Shareholders for a more complete description of its risks.

The

level dividend rate may be modified by the Board of Trustees from time to time. If, for any monthly distribution, net investment

company taxable income, if any (which term includes net short-term capital gain) and net tax-exempt income, if any, is less than

the amount of the distribution, the difference will generally be a tax- free return of capital distributed from the Fund’s

assets. The Fund’s final distribution for each calendar year will include any remaining net investment company taxable income

and net tax-exempt income undistributed during the year, as well as all net capital gain, if any, realized during the year. If

the total distributions made in any calendar year exceed net investment company taxable income, net tax-exempt income and net

capital gain, such excess distributed amount would be treated as ordinary dividend income to the extent of the Fund’s current

and accumulated earnings and profits.

Distributions

in excess of the earnings and profits would first be a tax-free return of capital to the extent of the adjusted tax basis in the

shares. After such adjusted tax basis is reduced to zero, the distribution would constitute capital gain (assuming the shares

are held as capital assets). In addition, the amount treated as a tax-free return of capital will reduce a shareholder’s

adjusted tax basis in its shares, thereby increasing the shareholder’s potential taxable gain or reducing the potential

taxable loss on the sale of the shares. This distribution policy may, under certain circumstances, have certain adverse consequences

to the Fund and its shareholders. See “Distributions.”

PRICE

RANGE OF COMMON SHARES

The

following table shows, for each fiscal quarter since the quarter ended January 31, 2018: (i) the high and low closing sale prices

per Common Share, as reported on the NYSE American; (ii) the corresponding net asset values per Common Share; and (iii) the percentage

by which the Common Shares traded at a premium over, or discount from, the net asset values per Common Share at those high and

low closing prices. The Fund’s net asset value per Common Share is determined on a daily basis.

| Quarter

Ended | | |

Market

Price | | |

Net

Asset value at | | |

Market

Premium

(Discount)

to net Asset

Value at

| |

| |

| | |

High | | |

Low | | |

Market High | | |

Market Low | | |

Market High | | |

Market Low | |

| 2022 |

April

30 | | |

$ | 10.20 | | |

$ | 8.30 | | |

$ | 10.03 | | |

$ | 8.77 | | |

| 1.70% | | |

| -5.36% | |

| |

January

31 | | |

$ | 11.56 | | |

$ | 9.68 | | |

$ | 11.30 | | |

$ | 9.90 | | |

| 2.30% | | |

| -2.22% | |

| 2021 |

October

31 | | |

$ | 12.04 | | |

$ | 10.88 | | |

$ | 11.39 | | |

$ | 10.97 | | |

| 4.74% | | |

| 2.01% | |

| |

July

31 | | |

$ | 12.15 | | |

$ | 10.11 | | |

$ | 11.54 | | |

$ | 11.53 | | |

| 4.85% | | |

| -11.71% | |

| |

April

30 | | |

$ | 12.41 | | |

$ | 10.54 | | |

$ | 11.80 | | |

$ | 11.81 | | |

| 3.47% | | |

| -10.67% | |

| |

January

31 | | |

$ | 10.75 | | |

$ | 10.42 | | |

$ | 11.47 | | |

$ | 11.32 | | |

| -6.28% | | |

| -7.95% | |

| 2020 |

October

31 | | |

$ | 10.12 | | |

$ | 8.73 | | |

$ | 10.99 | | |

$ | 10.23 | | |

| -7.92% | | |

| -14.66% | |

| |

July

31 | | |

$ | 9.54 | | |

$ | 8.02 | | |

$ | 10.84 | | |

$ | 9.42 | | |

| -11.99% | | |

| -14.86% | |

| |

April

30 | | |

$ | 11.81 | | |

$ | 6.45 | | |

$ | 12.27 | | |

$ | 9.18 | | |

| -3.75% | | |

| -29.74% | |

| |

January

31 | | |

$ | 11.49 | | |

$ | 10.86 | | |

$ | 12.24 | | |

$ | 12.05 | | |

| -6.13% | | |

| -9.88% | |

| 2019 |

October

31 | | |

$ | 11.11 | | |

$ | 10.59 | | |

$ | 12.02 | | |

$ | 12.41 | | |

| -7.57% | | |

| -14.67% | |

| |

July

31 | | |

$ | 11.28 | | |

$ | 10.65 | | |

$ | 12.49 | | |

$ | 12.38 | | |

| -8.89% | | |

| -13.97% | |

| |

April

30 | | |

$ | 11.39 | | |

$ | 10.91 | | |

$ | 12.49 | | |

$ | 12.24 | | |

| -8.81% | | |

| -10.87% | |

| |

January

31 | | |

$ | 11.66 | | |

$ | 9.48 | | |

$ | 12.56 | | |

$ | 11.37 | | |

| -7.17% | | |

| -16.62% | |

| 2018 |

October

31 | | |

$ | 12.86 | | |

$ | 11.16 | | |

$ | 13.65 | | |

$ | 12.42 | | |

| -5.79% | | |

| -10.14% | |

| |

July

31 | | |

$ | 13.04 | | |

$ | 12.36 | | |

$ | 13.86 | | |

$ | 13.53 | | |

| -5.92% | | |

| -8.65% | |

| |

April

30 | | |

$ | 13.58 | | |

$ | 12.28 | | |

$ | 14.17 | | |

$ | 13.58 | | |

| -4.16% | | |

| -9.57% | |

| |

January

31 | | |

$ | 14.39 | | |

$ | 13.12 | | |

$ | 14.93 | | |

$ | 14.57 | | |

| -3.62% | | |

| -9.95% | |

On

August 9, 2022, the net asset value per Common Share was $8.19, trading prices ranged between $8.32 and $8.40 (representing a

premium to net asset value of 1.56% and 2.50%, respectively) and the closing price per Common Share was $8.35 (representing a

premium to net asset value of 1.92%).

OUTSTANDING

SECURITIES

As

of August 9, 2022, the Fund’s Common Shares were the only outstanding securities issued by the Fund. As of the same date,

the Fund had 12,554,214 Common Shares outstanding:

(1)

Title

of

Class |

(2)

Amount

Authorized |

(3)

Amount

Held by

Fund or for its

account |

(4)

Amount

Outstanding

Exclusive of Amount

Shown under (3) As of

August 9, 2022 |

| Common

Stock |

Unlimited |

None |

12,554,214 |

PLAN

OF DISTRIBUTION

Under

the Sales Agreement, upon written instructions from the Fund, Virtu will use its commercially reasonable efforts consistent with

its sales and trading practices, to sell, as the Fund’s sales agent, the Common Shares under the terms and subject to the

conditions set forth in the Sales Agreement. Virtu’s sales efforts will continue until the Fund instructs Virtu to suspend

sales. The Fund will instruct Virtu as to the amount of Common Shares to be sold by Virtu. The Fund may instruct Virtu not to

sell Common Shares if the sales cannot be effected at or above the price designated by the Fund in any instruction. The Fund or

Virtu may suspend the offering of Common Shares upon proper notice and subject to other conditions.

Virtu

will provide written confirmation to the Fund not later than the opening of the trading day on the NYSE following the trading

day on which Common Shares are sold under the Sales Agreement. Each confirmation will include the number of shares sold on the

preceding day, the net proceeds to us and the compensation payable by the Fund to Virtu in connection with the sales. Settlement

for sales of Common Shares will occur on the second trading day following the date on which such sales are made, or on some other

date that is agreed upon by the Fund and Virtu in connection with a particular transaction, in return for payment of the net proceeds

to the Fund. There is no arrangement for funds to be received in an escrow, trust or similar arrangement.

The

Fund will pay Virtu commissions for its services in acting as agent in the sale of Common Shares. Virtu will be entitled to compensation

of up to 200 basis points of the gross sales price per share of any Common Shares sold under the Sales Agreement, with the exact

amount of such compensation to be mutually agreed upon by the Fund and Virtu from time to time.

There

is no guarantee that there will be any sales of the Fund’s Common Shares pursuant to this Prospectus Supplement and the

accompanying Prospectus. Actual sales, if any, of the Fund’s Common Shares under this Prospectus Supplement and the accompanying

Prospectus may be less than as set forth in this paragraph. In addition, the price per share of any such sale may be greater or

less than the price set forth in this paragraph, depending on the market price of the Fund’s Common Shares at the time of

any such sale. Assuming $10,000,000 of the Fund’s Common Shares offered hereby are sold at a market price of $8.35 per share

(the last reported sale price for the Fund’s Common Shares on the NYSE on August 9, 2022), The Fund estimates that the total

cost for the offering, excluding compensation payable to Virtu under the terms of the Sales Agreement, would be approximately

$12,000.

In

connection with the sale of the Common Shares on behalf of the Fund, Virtu may, and will with respect to sales effected in an

“at the market” offering, be deemed to be an “underwriter” within the meaning of the 1933 Act, and the

compensation of Virtu may be deemed to be underwriting commissions or discounts. The Fund has agreed to provide indemnification

and contribution to Virtu against certain civil liabilities, including liabilities under the Securities Act.

The

offering of the Fund’s Common Shares pursuant to the Sales Agreement will terminate upon the earlier of (1) the sale of

all Common Shares subject to the Sales Agreement or (2) termination of the Sales Agreement. The Sales Agreement may be terminated

by the Fund in its sole discretion at any time by giving notice to Virtu. Virtu may terminate the Sales Agreement at any time

under the circumstances specified in the Sales Agreement and may terminate the Sales Agreement in its sole discretion at any time

following a period of 12 months from the date of the Sales Agreement by giving notice to the Fund. In addition, the Adviser may

terminate the Sales Agreement under the circumstances specified in the Sales Agreement.

The

principal business address of Virtu is One Liberty Plaza, 165 Broadway, New York, NY 10036.

LEGAL

MATTERS

Certain

legal matters in connection with the Common Shares have been passed upon for the Fund by K&L Gates LLP, counsel to the Fund

in connection with the offering of the Common Shares. Certain legal matters will be passed on by Duane Morris LLP as special counsel

to Virtu in connection with the offering.

INCORPORATION

BY REFERENCE

This

Prospectus Supplement and the accompanying Prospectus constitutes part of a registration statement that the Fund has filed with

the SEC. The Fund is permitted to “incorporate by reference” the information that it files with the SEC, which means

that the Fund can disclose important information to you by referring you to those documents. The information incorporated by reference

is an important part of this Prospectus Supplement and the Prospectus, and later information that the Fund files with the SEC

will automatically update and supersede this information.

The

documents listed below, and any reports and other documents subsequently filed with the SEC pursuant to Rule 30(b)(2) under the

1940 Act and Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, prior to the termination of the offering, are incorporated

by reference into this Prospectus Supplement and the Prospectus and deemed to be part of this Prospectus Supplement and the Prospectus

from the date of the filing of such reports and documents:

| ● | the

Fund’s Statement of Additional Information, dated August 10, 2022, filed with the

Prospectus (“SAI”), filed with the SEC on August 10, 2022; |

| ● | the

Fund’s Annual Report on Form N-CSR for the fiscal year ended October 31,

2021, filed with the SEC on January 10, 2022; |

| ● | the

Fund’s Semi-Annual Report on Form N-CSRS for the period ended April 30,

2022, filed with the SEC on July 7, 2022; and |

| ● | the

Fund’s definitive proxy statement on Schedule 14A for the Fund’s 2022

annual meeting of shareholders, filed with the SEC on May 27, 2022. |

ADDITIONAL

INFORMATION

The

Fund is subject to the informational requirements of the Securities Exchange Act of 1934 and the 1940 Act and in accordance therewith

files reports and other information with the SEC. Reports, proxy statements and other information filed by the Fund with the SEC

pursuant to the informational requirements of such Acts can be inspected and copied at the public reference facilities maintained

by the SEC, 100 F Street, N.E., Washington, D.C. 20549. The SEC maintains a web site at http://www.sec.gov containing reports,

proxy and information statements and other information regarding registrants, including the Fund, that file electronically with

the SEC.

This

Prospectus Supplement and accompanying Prospectus constitutes part of a Registration Statement filed by the Fund with the SEC

under the Securities Act and the 1940 Act. This Prospectus Supplement and accompanying Prospectus omits certain of the information

contained in the Registration Statement, and reference is hereby made to the Registration Statement and related exhibits for further

information with respect to the Fund and the Common Shares offered hereby. Any statements contained herein concerning the provisions

of any document are not necessarily complete, and, in each instance, reference is made to the copy of such document filed as an

exhibit to the Registration Statement or otherwise filed with the SEC. Each such statement is qualified in its entirety by such

reference. The complete Registration Statement may be obtained from the SEC upon payment of the fee prescribed by its rules and

regulations or free of charge through the SEC’s website (http://www.sec.gov).

Clough

Global Dividend and Income Fund

Up

to $10,000,000 of Shares of Beneficial Interest

PROSPECTUS

SUPPLEMENT

August

22, 2022

S-12

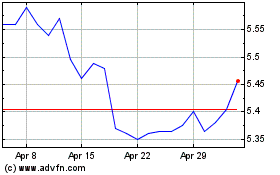

Clough Global Dividend a... (AMEX:GLV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Clough Global Dividend a... (AMEX:GLV)

Historical Stock Chart

From Jul 2023 to Jul 2024