Battalion Oil Corporation (NYSE American: BATL, “Battalion” or the

“Company”) today announced financial and operating results for the

fourth quarter and full year 2021.

Key Highlights

- Reported average daily production

of 17,283 Boepd and 16,241 Boepd in fourth quarter and full year

2021, respectively

- Proved reserves of 95.9 MMBoe, a

51% increase over year-end 2020 reserves

- Completed strategic refinancing in

November 2021; enhanced liquidity profile allows for significant

increase in activity

- Kicked off 2022 capital program in

December 2021 with 3 well-pad at Monument Draw; expect to keep one

rig running through 2022

- Maintaining flat production in 2022

while driving double digit growth in daily oil production by year

end 2022

Management Comments

Richard Little, the Company’s CEO, commented,

“Battalion had an excellent fourth quarter of 2021 from an

operational and financial perspective, and much of that is a due to

the operational success we had throughout 2021. We have talked all

year about our team’s efforts to reduce downtime and improve flow

assurance through facility upgrades and field optimization. We were

quite heavily hedged coming into the fourth quarter, and our

ability to outproduce those hedges and capture an increasing price

environment is a direct result of our ability to keep the wells

flowing consistently.”

“A key highlight of the fourth quarter, and a

real pivot point for Battalion, was our strategic refinancing. We

have demonstrated our operational proficiency in the field, and our

recent well results speak to the significant upside on our acreage

with wells that compete with the best in the basin. This term loan

represents a vote of confidence in our assets and our team’s

ability to develop them. Our intention is to ramp up activity in

2022, driving significant growth in average daily production by

year-end 2022 while remaining committed to capital discipline and

operational efficiency.”

Mr. Little continued, “2022 will be an exciting

year for Battalion. We are eager to get back to development mode,

and we believe our plan will generate substantial value growth for

our shareholders in the years to come.”

Results of Operations

Full year 2021 production averaged 16,241

barrels of oil equivalent per day (“Boepd”) compared to average

daily production of 16,858 Boepd for 2020. Average daily production

in 2020 includes approximately 600 Boepd of production associated

with divested properties which were sold in December 2020.

Excluding the impact of the divested properties, average daily

production in 2021 is in line with 2020.

Average daily oil and natural gas production was

impacted by the temporary shut-in of production amounting to

approximately 300 Boepd and 1,300 Boepd for the year ended December

31, 2021 and 2020, respectively. In February 2021, we temporarily

shut-in production due to inclement weather. In May and June 2020,

we temporarily shut-in production in response to historically low

commodity prices. Current year production was also impacted by

third-party processing curtailments and downtime resulting from

facility upgrades and repairs. In 2021, we drilled and cased 2.0

gross (2.0 net) operated wells, completed 6.0 gross (6.0 net)

operated wells, and put online 6.0 gross (6.0 net) operated

wells.

Our total operating revenues for the year ended

December 31, 2021 were approximately $285.2 million compared to

total operating revenues for the year ended December 31, 2020 of

approximately $148.3 million. The increase in revenues is primarily

attributable to an approximate $24.14 per Boe increase in average

realized prices (excluding the effects of hedging

arrangements).

Excluding the impact of hedges, Battalion

realized 98% of the average NYMEX oil price during the fiscal year

2021. Battalion realized a net loss of $77.9 million on settled

contracts during 2021.

Lease operating and workover expense was $7.96

per Boe during the full year 2021 and $7.42 per Boe during the full

year 2020 while adjusted gathering and other expense was $10.19 per

Boe during the full year 2021 and $8.53 per Boe during the full

year 2020 (see Selected Operating Data table for additional

information). Adjusted G&A was $2.48 per Boe during the full

year 2021 compared to $2.38 per Boe during the full year 2020 (see

Selected Operating Data table for additional information).

The Company reported a net loss to common

stockholders for the full year 2021 of $28.3 million and a net loss

per basic and diluted share of $1.74. After adjusting for selected

items, the Company reported net income to common stockholders for

the full year 2021 of $17.1 million and net income per basic and

diluted share of $1.05 and $1.04, respectively (see Selected Item

Review and Reconciliation table for additional information).

Adjusted EBITDA for the year ended December 31, 2021, was $72.7

million as compared to $70.1 million for the year ended December

31, 2020 (see Adjusted EBITDA Reconciliation table for additional

information).

Liquidity and Balance Sheet

On November 24, 2021, Battalion and its wholly

owned subsidiary, Halcón Holdings, LLC entered into an Amended and

Restated Senior Secured Credit Agreement (“Term Loan Agreement”)

with Macquarie Bank Limited, as administrative agent, and certain

other financial institutions party, as lenders. Pursuant to the

Term Loan Agreement, the lenders agreed to loan us (i) $200

million, which funded on November 24, 2021, and was partially used

to refinance all amounts owed under our previous Senior Credit

Agreement and (ii) up to $35 million available to be drawn up to 18

months from November 24, 2021, subject to satisfaction of certain

conditions. The maturity date of the Term Loan Agreement is

November 24, 2025. Until such maturity date, borrowings under the

Term Loan Agreement shall bear interest at a rate per annum equal

to LIBOR (or another applicable reference rate, as determined

pursuant to the provisions of the Term Loan Agreement) plus an

applicable margin of 7.00%.

As of December 31, 2021, the Company had $200.1

million of indebtedness outstanding (including $0.1 million owed

under our PPP Loan), approximately $0.3 million of letters of

credit outstanding and up to $35.0 million in delayed draw term

loans available to be drawn under our Term Loan Agreement. Total

liquidity on December 31, 2021, inclusive of $46.9 million of cash

and cash equivalents, was $81.9 million.

Proved Reserves Update

On December 31, 2021, our estimated total proved oil and natural

gas reserves, as prepared by our independent reserve engineering

firm, Netherland, Sewell & Associates, Inc. were approximately

95.9 MMBoe, consisting of 58.7 MMBbls of oil, 16.3 MMBbls of

natural gas liquids, and 125.0 Bcf of natural gas. Our reserves had

a standardized measure of discounted future cash flows of $1.1

billion using SEC prices for crude oil and natural gas, which are

based on preceding 12-month first day of the month average prices

of West Texas Intermediate (WTI) crude oil spot price of $66.55 per

Bbl and Henry Hub natural gas spot price of $3.60 per MMBtu.

Proved reserves at year-end 2021 of 95.9 MMBoe represents a 51%

increase over year-end 2020 reserves. Proved developed reserves at

year-end 2021 were 42.4 MMBoe, representing approximately 44% of

our proved reserves. Proved undeveloped reserves at year-end 2021

were 53.5 MMBoe. We maintain operational control of 99.9% of our

estimated proved reserves.

Hedging Update

The Company has designed a risk management policy to provide

partial protection against certain risks such as commodity price

declines and price differentials between the NYMEX commodity price

and the index price at the location where our production is sold.

Our objective, under the Term Loan Agreement, is to hedge

approximately 50% to 85% of our anticipated oil and natural gas

production, in varying percentages by year, and on a rolling basis

for the next four years. Details of our outstanding derivative

instruments may be found in our recently filed Annual Report on

Form 10-K.

Board Structure Update

During our annual review and approval of the Chairman of the

Board role, the Board elected Jonathan Barrett to serve as Chairman

of the Board replacing Richard Little who has served as Interim

Chairman since June 2021.

Conference Call Information

Battalion Oil Corporation has scheduled a

conference call for Tuesday, March 8, 2022, at 10:00 a.m.

Central Time. To access the live conference call, local

participants may dial +1 (646) 828-8193. All other participants may

dial (888) 394-8218 for toll free. The confirmation code for the

live conference call is 5532123. The live conference call will also

be available through the Company’s website

at www.battalionoil.com on the Events and Presentations page

under the Investors tab. The replay for the event will be available

on the Company’s website at www.battalionoil.com on the Events

and Presentations page under the Investors tab through March

31, 2022.

Forward Looking Statements

This release contains forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Statements that are not strictly historical statements

constitute forward-looking statements. Forward-looking statements

include, among others, statements about anticipated production,

liquidity, capital spending, drilling and completion plans, and

forward guidance. Forward-looking statements may often, but not

always, be identified by the use of such words such as "expects",

"believes", "intends", "anticipates", "plans", "estimates",

“projects,” "potential", "possible", or "probable" or statements

that certain actions, events or results "may", "will", "should", or

"could" be taken, occur or be achieved. Forward-looking statements

are based on current beliefs and expectations and involve certain

assumptions or estimates that involve various risks and

uncertainties that could cause actual results to differ materially

from those reflected in the statements. These risks include, but

are not limited to, those set forth in the Company's Annual Report

on Form 10-K for the fiscal year ended December 31, 2021, and other

filings submitted by the Company to the U.S. Securities and

Exchange Commission (“SEC”), copies of which may be obtained from

the SEC's website at www.sec.gov or through the Company's website

at www.battalionoil.com. Readers should not place undue reliance on

any such forward-looking statements, which are made only as of the

date hereof. The Company has no duty, and assumes no obligation, to

update forward-looking statements as a result of new information,

future events or changes in the Company's expectations.

About Battalion

Battalion Oil Corporation is an independent energy company

engaged in the acquisition, production, exploration and development

of onshore oil and natural gas properties in the United States.

Contact

Chris LangManager, Finance (832) 538-0551

| |

|

BATTALION OIL CORPORATIONCONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited)(In thousands, except per share

amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Years Ended |

| |

|

December 31, |

|

December 31, |

| |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil, natural gas, and natural gas liquids sales: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil |

|

$ |

60,284 |

|

|

$ |

34,672 |

|

|

$ |

213,512 |

|

|

$ |

125,985 |

|

|

Natural gas |

|

|

11,409 |

|

|

|

2,716 |

|

|

|

35,248 |

|

|

|

5,818 |

|

|

Natural gas liquids |

|

|

12,588 |

|

|

|

4,886 |

|

|

|

35,394 |

|

|

|

14,972 |

|

|

Total oil, natural gas, and natural gas liquids sales |

|

|

84,281 |

|

|

|

42,274 |

|

|

|

284,154 |

|

|

|

146,775 |

|

|

Other |

|

|

224 |

|

|

|

292 |

|

|

|

1,051 |

|

|

|

1,514 |

|

|

Total operating revenues |

|

|

84,505 |

|

|

|

42,566 |

|

|

|

285,205 |

|

|

|

148,289 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Production: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease operating |

|

|

12,362 |

|

|

|

9,226 |

|

|

|

43,977 |

|

|

|

42,106 |

|

|

Workover and other |

|

|

907 |

|

|

|

942 |

|

|

|

3,224 |

|

|

|

3,709 |

|

|

Taxes other than income |

|

|

3,126 |

|

|

|

2,926 |

|

|

|

12,312 |

|

|

|

10,056 |

|

|

Gathering and other |

|

|

16,960 |

|

|

|

16,741 |

|

|

|

60,396 |

|

|

|

56,016 |

|

|

Restructuring |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,580 |

|

|

General and administrative |

|

|

3,165 |

|

|

|

5,219 |

|

|

|

16,514 |

|

|

|

18,456 |

|

|

Depletion, depreciation, and accretion |

|

|

12,679 |

|

|

|

13,886 |

|

|

|

45,408 |

|

|

|

62,053 |

|

|

Full cost ceiling impairment |

|

|

— |

|

|

|

26,702 |

|

|

|

— |

|

|

|

215,145 |

|

|

Total operating expenses |

|

|

49,199 |

|

|

|

75,642 |

|

|

|

181,831 |

|

|

|

410,121 |

|

| Income (loss) from

operations |

|

|

35,306 |

|

|

|

(33,076 |

) |

|

|

103,374 |

|

|

|

(261,832 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net gain (loss) on derivative contracts |

|

|

(6,248 |

) |

|

|

(28,936 |

) |

|

|

(125,619 |

) |

|

|

38,759 |

|

|

Interest expense and other |

|

|

(3,001 |

) |

|

|

(1,745 |

) |

|

|

(8,018 |

) |

|

|

(6,634 |

) |

|

Gain (loss) on extinguishment of debt |

|

|

(122 |

) |

|

|

— |

|

|

|

1,946 |

|

|

|

— |

|

|

Total other income (expenses) |

|

|

(9,371 |

) |

|

|

(30,681 |

) |

|

|

(131,691 |

) |

|

|

32,125 |

|

| Income (loss) before income

taxes |

|

|

25,935 |

|

|

|

(63,757 |

) |

|

|

(28,317 |

) |

|

|

(229,707 |

) |

| Income tax benefit

(provision) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net income

(loss) |

|

$ |

25,935 |

|

|

|

(63,757 |

) |

|

$ |

(28,317 |

) |

|

$ |

(229,707 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per

share of common stock: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

1.59 |

|

|

$ |

(3.93 |

) |

|

$ |

(1.74 |

) |

|

$ |

(14.18 |

) |

|

Diluted |

|

$ |

1.58 |

|

|

$ |

(3.93 |

) |

|

$ |

(1.74 |

) |

|

$ |

(14.18 |

) |

| Weighted average

common shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

16,274 |

|

|

|

16,204 |

|

|

|

16,261 |

|

|

|

16,204 |

|

|

Diluted |

|

|

16,448 |

|

|

|

16,204 |

|

|

|

16,261 |

|

|

|

16,204 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

BATTALION OIL CORPORATIONCONDENSED

CONSOLIDATED BALANCE SHEETS (Unaudited)(In

thousands, except share and per share amounts) |

| |

|

|

|

|

|

|

| |

|

December 31, 2021 |

|

December 31, 2020 |

| Current

assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

46,864 |

|

|

$ |

4,295 |

|

|

Accounts receivable, net |

|

|

36,806 |

|

|

|

32,242 |

|

|

Assets from derivative contracts |

|

|

1,383 |

|

|

|

8,559 |

|

|

Restricted cash |

|

|

1,495 |

|

|

|

— |

|

|

Prepaids and other |

|

|

1,366 |

|

|

|

2,740 |

|

|

Total current assets |

|

|

87,914 |

|

|

|

47,836 |

|

| Oil and natural gas

properties (full cost method): |

|

|

|

|

|

|

|

Evaluated |

|

|

569,886 |

|

|

|

509,274 |

|

|

Unevaluated |

|

|

64,305 |

|

|

|

75,494 |

|

|

Gross oil and natural gas properties |

|

|

634,191 |

|

|

|

584,768 |

|

|

Less - accumulated depletion |

|

|

(339,776 |

) |

|

|

(295,163 |

) |

|

Net oil and natural gas properties |

|

|

294,415 |

|

|

|

289,605 |

|

| Other operating

property and equipment: |

|

|

|

|

|

|

|

Other operating property and equipment |

|

|

3,467 |

|

|

|

3,535 |

|

|

Less - accumulated depreciation |

|

|

(1,035 |

) |

|

|

(1,149 |

) |

|

Net other operating property and equipment |

|

|

2,432 |

|

|

|

2,386 |

|

| Other noncurrent

assets: |

|

|

|

|

|

|

|

Assets from derivative contracts |

|

|

2,515 |

|

|

|

4,009 |

|

|

Operating lease right of use assets |

|

|

721 |

|

|

|

310 |

|

|

Funds in escrow and other |

|

|

2,270 |

|

|

|

2,351 |

|

| Total

assets |

|

$ |

390,267 |

|

|

$ |

346,497 |

|

| |

|

|

|

|

|

|

| Current

liabilities: |

|

|

|

|

|

|

|

Accounts payable and accrued liabilities |

|

$ |

62,826 |

|

|

$ |

58,928 |

|

|

Liabilities from derivative contracts |

|

|

58,322 |

|

|

|

22,125 |

|

|

Current portion of long-term debt |

|

|

85 |

|

|

|

1,720 |

|

|

Operating lease liabilities |

|

|

369 |

|

|

|

403 |

|

|

Total current liabilities |

|

|

121,602 |

|

|

|

83,176 |

|

| Long-term debt,

net |

|

|

181,565 |

|

|

|

158,489 |

|

| Other noncurrent

liabilities: |

|

|

|

|

|

|

|

Liabilities from derivative contracts |

|

|

7,144 |

|

|

|

4,291 |

|

|

Asset retirement obligations |

|

|

11,896 |

|

|

|

10,583 |

|

|

Operating lease liabilities |

|

|

352 |

|

|

|

— |

|

|

Other |

|

|

4,003 |

|

|

|

— |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Stockholders'

equity: |

|

|

|

|

|

|

|

Common stock: 100,000,000 shares of $0.0001 par value

authorized; |

|

|

|

|

|

|

|

16,273,913 and 16,203,979 shares issued and outstanding as of |

|

|

|

|

|

|

|

December 31, 2021, and 2020, respectively |

|

|

2 |

|

|

|

2 |

|

|

Additional paid-in capital |

|

|

332,187 |

|

|

|

330,123 |

|

|

Retained earnings (accumulated deficit) |

|

|

(268,484 |

) |

|

|

(240,167 |

) |

| Total stockholders'

equity |

|

|

63,705 |

|

|

|

89,958 |

|

| Total liabilities and

stockholders' equity |

|

$ |

390,267 |

|

|

$ |

346,497 |

|

| |

|

|

|

|

|

|

|

|

| |

|

BATTALION OIL CORPORATIONCONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)(In thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Years Ended |

| |

|

December 31, |

|

December 31, |

| |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| Cash flows from

operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

25,935 |

|

|

$ |

(63,757 |

) |

|

$ |

(28,317 |

) |

|

$ |

(229,707 |

) |

| Adjustments to reconcile net

income (loss) to net cash provided by (used |

|

|

|

|

|

|

|

|

|

|

|

|

|

in) operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Depletion, depreciation, and accretion |

|

|

12,679 |

|

|

|

13,886 |

|

|

|

45,408 |

|

|

|

62,053 |

|

|

Full cost ceiling impairment |

|

|

— |

|

|

|

26,702 |

|

|

|

— |

|

|

|

215,145 |

|

|

Stock-based compensation, net |

|

|

450 |

|

|

|

785 |

|

|

|

2,010 |

|

|

|

2,578 |

|

|

Unrealized loss (gain) on derivative contracts |

|

|

(21,332 |

) |

|

|

30,172 |

|

|

|

47,721 |

|

|

|

6,143 |

|

|

Amortization of debt issuance costs |

|

|

379 |

|

|

|

— |

|

|

|

379 |

|

|

|

— |

|

|

Reorganization items, net |

|

|

— |

|

|

|

(125 |

) |

|

|

— |

|

|

|

(6,565 |

) |

|

Loss (gain) on extinguishment of debt |

|

|

122 |

|

|

|

— |

|

|

|

(1,946 |

) |

|

|

— |

|

|

Accrued settlements on derivative contracts |

|

|

261 |

|

|

|

(304 |

) |

|

|

7,030 |

|

|

|

170 |

|

|

Other expense (income) |

|

|

(338 |

) |

|

|

(138 |

) |

|

|

(567 |

) |

|

|

142 |

|

| Cash flow from operations

before changes in working capital |

|

|

18,156 |

|

|

|

7,221 |

|

|

|

71,718 |

|

|

|

49,959 |

|

|

Changes in working capital |

|

|

3,284 |

|

|

|

(4,902 |

) |

|

|

(3,146 |

) |

|

|

238 |

|

| Net cash provided by (used in)

operating activities |

|

|

21,440 |

|

|

|

2,319 |

|

|

|

68,572 |

|

|

|

50,197 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from

investing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Oil and natural gas capital expenditures |

|

|

(5,353 |

) |

|

|

(5,305 |

) |

|

|

(52,557 |

) |

|

|

(101,788 |

) |

|

Proceeds received from sales of oil and natural gas assets |

|

|

— |

|

|

|

25,529 |

|

|

|

947 |

|

|

|

29,029 |

|

|

Acquisition of oil and natural gas properties |

|

|

— |

|

|

|

(23 |

) |

|

|

— |

|

|

|

(23 |

) |

|

Other operating property and equipment capital expenditures |

|

|

(364 |

) |

|

|

(54 |

) |

|

|

(371 |

) |

|

|

(82 |

) |

|

Funds held in escrow and other |

|

|

52 |

|

|

|

2 |

|

|

|

68 |

|

|

|

510 |

|

| Net cash provided by (used in)

investing activities |

|

|

(5,665 |

) |

|

|

20,149 |

|

|

|

(51,913 |

) |

|

|

(72,354 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash flows from

financing activities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from borrowings |

|

|

229,000 |

|

|

|

29,000 |

|

|

|

374,000 |

|

|

|

148,209 |

|

|

Repayments of borrowings |

|

|

(184,064 |

) |

|

|

(49,000 |

) |

|

|

(332,085 |

) |

|

|

(132,000 |

) |

|

Debt issuance costs |

|

|

(14,220 |

) |

|

|

— |

|

|

|

(14,220 |

) |

|

|

— |

|

|

Equity issuance costs and other |

|

|

— |

|

|

|

— |

|

|

|

(290 |

) |

|

|

(32 |

) |

| Net cash provided by (used in)

financing activities |

|

|

30,716 |

|

|

|

(20,000 |

) |

|

|

27,405 |

|

|

|

16,177 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net increase

(decrease) in cash, cash equivalents and restricted

cash |

|

|

46,491 |

|

|

|

2,468 |

|

|

|

44,064 |

|

|

|

(5,980 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash, cash equivalents and

restricted cash at beginning of period |

|

|

1,868 |

|

|

|

1,827 |

|

|

|

4,295 |

|

|

|

10,275 |

|

| Cash, cash equivalents and

restricted cash at end of period |

|

$ |

48,359 |

|

|

$ |

4,295 |

|

|

$ |

48,359 |

|

|

$ |

4,295 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

BATTALION OIL CORPORATIONSELECTED

OPERATING DATA (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

|

Years Ended December 31, |

| |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Production volumes: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil (MBbls) |

|

|

800 |

|

|

|

857 |

|

|

|

3,196 |

|

|

|

3,446 |

|

|

Natural gas (MMcf) |

|

|

2,670 |

|

|

|

2,332 |

|

|

|

9,447 |

|

|

|

8,769 |

|

|

Natural gas liquids (MBbls) |

|

|

345 |

|

|

|

345 |

|

|

|

1,157 |

|

|

|

1,262 |

|

|

Total (MBoe) |

|

|

1,590 |

|

|

|

1,591 |

|

|

|

5,928 |

|

|

|

6,170 |

|

|

Average daily production (Boe/d) |

|

|

17,283 |

|

|

|

17,293 |

|

|

|

16,241 |

|

|

|

16,858 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Average prices: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil (per Bbl) |

|

$ |

75.36 |

|

|

$ |

40.46 |

|

|

$ |

66.81 |

|

|

$ |

36.56 |

|

|

Natural gas (per Mcf) |

|

|

4.27 |

|

|

|

1.16 |

|

|

|

3.73 |

|

|

|

0.66 |

|

|

Natural gas liquids (per Bbl) |

|

|

36.49 |

|

|

|

14.16 |

|

|

|

30.59 |

|

|

|

11.86 |

|

|

Total per Boe |

|

|

53.01 |

|

|

|

26.57 |

|

|

|

47.93 |

|

|

|

23.79 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cash effect of derivative

contracts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil (per Bbl) |

|

$ |

(31.06 |

) |

|

$ |

1.28 |

|

|

$ |

(23.02 |

) |

|

$ |

12.31 |

|

|

Natural gas (per Mcf) |

|

|

(1.02 |

) |

|

|

0.06 |

|

|

|

(0.46 |

) |

|

|

0.28 |

|

|

Natural gas liquids (per Bbl) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Total per Boe |

|

|

(17.35 |

) |

|

|

0.78 |

|

|

|

(13.14 |

) |

|

|

7.28 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Average prices computed after

cash effect of settlement of derivative contracts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil (per Bbl) |

|

$ |

44.30 |

|

|

$ |

41.74 |

|

|

$ |

43.79 |

|

|

$ |

48.87 |

|

|

Natural gas (per Mcf) |

|

|

3.25 |

|

|

|

1.22 |

|

|

|

3.27 |

|

|

|

0.94 |

|

|

Natural gas liquids (per Bbl) |

|

|

36.49 |

|

|

|

14.16 |

|

|

|

30.59 |

|

|

|

11.86 |

|

|

Total per Boe |

|

|

35.66 |

|

|

|

27.35 |

|

|

|

34.79 |

|

|

|

31.07 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Average cost per Boe: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Production: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Lease operating |

|

$ |

7.77 |

|

|

$ |

5.80 |

|

|

$ |

7.42 |

|

|

$ |

6.82 |

|

|

Workover and other |

|

|

0.57 |

|

|

|

0.59 |

|

|

|

0.54 |

|

|

|

0.60 |

|

|

Taxes other than income |

|

|

1.97 |

|

|

|

1.84 |

|

|

|

2.08 |

|

|

|

1.63 |

|

|

Gathering and other, as adjusted(1) |

|

|

10.67 |

|

|

|

10.52 |

|

|

|

10.19 |

|

|

|

8.53 |

|

|

Restructuring |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.42 |

|

|

General and administrative, as adjusted(1) |

|

|

2.03 |

|

|

|

3.24 |

|

|

|

2.48 |

|

|

|

2.38 |

|

|

Depletion |

|

|

7.89 |

|

|

|

8.56 |

|

|

|

7.53 |

|

|

|

9.81 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Represents

gathering and other and general and administrative costs per Boe,

adjusted for items noted in the reconciliation below: |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| General and

administrative: |

|

|

|

|

|

|

|

|

|

|

|

|

|

General and administrative, as reported |

|

$ |

1.99 |

|

|

$ |

3.28 |

|

|

$ |

2.79 |

|

|

$ |

2.99 |

|

|

Stock-based compensation: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-cash |

|

|

(0.28 |

) |

|

|

(0.49 |

) |

|

|

(0.34 |

) |

|

|

(0.42 |

) |

|

Non-recurring (charges) credits and other: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash |

|

|

0.32 |

|

|

|

0.45 |

|

|

|

0.03 |

|

|

|

(0.19 |

) |

|

General and administrative, as adjusted(2) |

|

$ |

2.03 |

|

|

$ |

3.24 |

|

|

$ |

2.48 |

|

|

$ |

2.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Gathering and other, as

reported |

|

$ |

10.67 |

|

|

$ |

10.52 |

|

|

$ |

10.19 |

|

|

$ |

9.08 |

|

|

Rig termination and stacking charges and other |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(0.55 |

) |

| Gathering and other, as

adjusted(3) |

|

$ |

10.67 |

|

|

$ |

10.52 |

|

|

$ |

10.19 |

|

|

$ |

8.53 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating costs, as

reported |

|

$ |

22.97 |

|

|

$ |

22.03 |

|

|

$ |

23.02 |

|

|

$ |

21.12 |

|

|

Total adjusting items |

|

|

0.04 |

|

|

|

(0.04 |

) |

|

|

(0.31 |

) |

|

|

(1.16 |

) |

| Total operating costs, as

adjusted(4) |

|

$ |

23.01 |

|

|

$ |

21.99 |

|

|

$ |

22.71 |

|

|

$ |

19.96 |

|

____________________________(2) General and administrative, as

adjusted, is a non-GAAP measure that excludes non-cash stock-based

compensation charges relating to equity awards under our incentive

stock plan, as well as other cash charges associated with

non-recurring (charges) credits and other. The Company believes

that it is useful to understand the effects that these charges have

on general and administrative expenses and total operating costs

and that exclusion of such charges is useful for comparison to

prior periods.(3) Gathering and other, as adjusted, is a non-GAAP

measure that excludes rig termination and stacking charges and

other costs. The Company believes that it is useful to understand

the effects that these charges have on gathering and other expense

and total operating costs and that exclusion of such charges is

useful for comparative purposes.(4) Represents lease operating

expense, workover and other expense, taxes other than income,

gathering and other expense and general and administrative costs

per Boe, adjusted for items noted in the reconciliation above.

| |

|

BATTALION OIL CORPORATIONSELECTED ITEM

REVIEW AND RECONCILIATION (Unaudited)(In

thousands, except per share amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Years Ended |

| |

|

December 31, |

|

December 31, |

| |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| As

Reported: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss), as reported |

|

$ |

25,935 |

|

|

$ |

(63,757 |

) |

|

$ |

(28,317 |

) |

|

$ |

(229,707 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Impact of Selected

Items: |

|

|

|

|

|

|

|

|

|

|

|

|

| Unrealized loss (gain) on

derivatives contracts: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Crude oil |

|

$ |

(13,525 |

) |

|

$ |

31,978 |

|

|

$ |

45,461 |

|

|

$ |

5,777 |

|

|

Natural gas |

|

|

(7,807 |

) |

|

|

(1,806 |

) |

|

|

2,260 |

|

|

|

366 |

|

| Total mark-to-market non-cash

charge |

|

|

(21,332 |

) |

|

|

30,172 |

|

|

|

47,721 |

|

|

|

6,143 |

|

| Full cost ceiling

impairment |

|

|

— |

|

|

|

26,702 |

|

|

|

— |

|

|

|

215,145 |

|

| Loss (gain) on extinguishment

of debt |

|

|

122 |

|

|

|

— |

|

|

|

(1,946 |

) |

|

|

— |

|

| Restructuring |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,580 |

|

| Rig termination and stacking

charges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,383 |

|

| Non-recurring charges

(credits) and other |

|

|

(715 |

) |

|

|

(658 |

) |

|

|

(368 |

) |

|

|

1,286 |

|

| Selected items, before income

taxes |

|

|

(21,925 |

) |

|

|

56,216 |

|

|

|

45,407 |

|

|

|

228,537 |

|

| Income tax effect of selected

items |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Selected items, net of

tax |

|

$ |

(21,925 |

) |

|

$ |

56,216 |

|

|

$ |

45,407 |

|

|

$ |

228,537 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| As

Adjusted: |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss), excluding

selected items(1)(2) |

|

$ |

4,010 |

|

|

$ |

(7,541 |

) |

|

$ |

17,090 |

|

|

$ |

(1,170 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic net income (loss) per

common share, as reported |

|

$ |

1.59 |

|

|

$ |

(3.93 |

) |

|

$ |

(1.74 |

) |

|

$ |

(14.18 |

) |

| Impact of selected items |

|

|

(1.34 |

) |

|

|

3.46 |

|

|

|

2.79 |

|

|

|

14.11 |

|

| Basic net income (loss) per

common share, excluding selected items(1)(2) |

|

$ |

0.25 |

|

|

$ |

(0.47 |

) |

|

$ |

1.05 |

|

|

$ |

(0.07 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted net income (loss) per

common share, as reported |

|

$ |

1.58 |

|

|

$ |

(3.93 |

) |

|

$ |

(1.74 |

) |

|

$ |

(14.18 |

) |

| Impact of selected items |

|

|

(1.34 |

) |

|

|

3.46 |

|

|

|

2.78 |

|

|

|

14.11 |

|

| Diluted net income (loss) per

common share, excluding selected items(1)(2)(3) |

|

$ |

0.24 |

|

|

$ |

(0.47 |

) |

|

$ |

1.04 |

|

|

$ |

(0.07 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in)

operating activities |

|

$ |

21,440 |

|

|

$ |

2,319 |

|

|

$ |

68,572 |

|

|

$ |

50,197 |

|

| Changes in working

capital |

|

|

(3,284 |

) |

|

|

4,902 |

|

|

|

3,146 |

|

|

|

(238 |

) |

| Cash flow from operations

before changes in working capital |

|

|

18,156 |

|

|

|

7,221 |

|

|

|

71,718 |

|

|

|

49,959 |

|

| Cash components of selected

items |

|

|

(1,213 |

) |

|

|

(229 |

) |

|

|

(7,635 |

) |

|

|

13,194 |

|

| Income tax effect of selected

items |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Cash flows from operations

before changes in working capital, adjusted for selected

items(1)(2) |

|

$ |

16,943 |

|

|

$ |

6,992 |

|

|

$ |

64,083 |

|

|

$ |

63,153 |

|

__________________________________(1) Net income (loss) and

earnings per share excluding selected items and cash flows from

operations before changes in working capital adjusted for selected

items are non-GAAP measures presented based on management's belief

that they will enable a user of the financial information to

understand the impact of these items on reported results. These

financial measures are not measures of financial performance under

GAAP and should not be considered as an alternative to net income,

earnings per share and cash flows from operations, as defined by

GAAP. These financial measures may not be comparable to similarly

named non-GAAP financial measures that other companies may use and

may not be useful in comparing the performance of those companies

to Battalion's performance.(2) For the year ended December 31,

2020, net income (loss) and earnings per share excluding selected

items and cash flows from operations before changes in working

capital include approximately $22.9 million of net proceeds from

hedge monetizations that occurred during the period.(3) The impact

of selected items for the three months ended December 31, 2021, and

2020 were calculated based upon weighted average diluted shares of

16.4 million and 16.2 million, respectively, due to the net income

(loss) available to common stockholders, excluding selected items.

The impact of selected items for the years ended December 31, 2021,

and 2020 were calculated based upon weighted average diluted shares

of 16.4 million and 16.2 million, respectively, due to the net

income (loss) available to common stockholders, excluding selected

items.

| |

|

BATTALION OIL CORPORATIONADJUSTED EBITDA

RECONCILIATION (Unaudited)(In

thousands) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

|

Years Ended December 31, |

| |

|

2021 |

|

2020 |

|

2021 |

|

2020 |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss), as reported |

|

$ |

25,935 |

|

|

$ |

(63,757 |

) |

|

$ |

(28,317 |

) |

|

$ |

(229,707 |

) |

| Impact of adjusting

items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

3,215 |

|

|

|

1,853 |

|

|

|

8,453 |

|

|

|

7,373 |

|

|

Depletion, depreciation, and accretion |

|

|

12,679 |

|

|

|

13,886 |

|

|

|

45,408 |

|

|

|

62,053 |

|

|

Full cost ceiling impairment |

|

|

— |

|

|

|

26,702 |

|

|

|

— |

|

|

|

215,145 |

|

|

Stock-based compensation |

|

|

450 |

|

|

|

785 |

|

|

|

2,010 |

|

|

|

2,578 |

|

|

Interest income |

|

|

(1 |

) |

|

|

(171 |

) |

|

|

(213 |

) |

|

|

(773 |

) |

|

(Gain) loss on sale of other assets |

|

|

(3 |

) |

|

|

— |

|

|

|

(18 |

) |

|

|

52 |

|

|

Restructuring |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,580 |

|

|

Loss (gain) on extinguishment of debt |

|

|

122 |

|

|

|

— |

|

|

|

(1,946 |

) |

|

|

— |

|

|

Unrealized loss (gain) on derivatives contracts |

|

|

(21,332 |

) |

|

|

30,172 |

|

|

|

47,721 |

|

|

|

6,143 |

|

|

Rig termination and stacking charges |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

3,383 |

|

|

Non-recurring charges (credits) and other |

|

|

(715 |

) |

|

|

(658 |

) |

|

|

(368 |

) |

|

|

1,286 |

|

| Adjusted EBITDA(1)(2) |

|

$ |

20,350 |

|

|

$ |

8,812 |

|

|

$ |

72,730 |

|

|

$ |

70,113 |

|

__________________________(1) Adjusted EBITDA is a non-GAAP

measure, which is presented based on management's belief that it

will enable a user of the financial information to understand the

impact of these items on reported results. This financial measure

is not a measure of financial performance under GAAP and should not

be considered as an alternative to GAAP measures, including net

income (loss). This financial measure may not be comparable to

similarly named non-GAAP financial measures that other companies

may use and may not be useful in comparing the performance of those

companies to Battalion's performance.(2) Adjusted EBITDA for the

year ended December 31, 2020, includes approximately $22.9 million

of net proceeds from hedge monetizations that occurred during the

period.

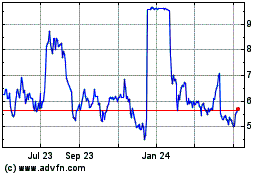

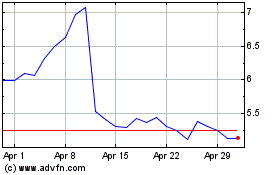

Battalion Oil (AMEX:BATL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Battalion Oil (AMEX:BATL)

Historical Stock Chart

From Jul 2023 to Jul 2024