UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

Asensus Surgical, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

☒

|

Fee paid previously with preliminary materials.

|

|

☐

|

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11

|

1 TW Alexander Drive, Suite 160

Durham, North Carolina 27703

(919) 765-8400

ADDITIONAL DEFINITIVE PROXY MATERIAL

August 7, 2024

ADJOURNMENT OF SPECIAL MEETING

Explanatory Note

On August 7, 2024, a Special Meeting of Stockholders (the “Special Meeting”) of Asensus Surgical, Inc. (the “Company”) was adjourned until Tuesday August 20, 2024, at 10:00 a.m. Eastern Time to allow stockholders additional time to vote on the proposals presented for stockholder vote at the Special Meeting. The record date remains as June 28, 2024.

QUESTIONS AND ANSWERS ABOUT THE ADJOURNMENT

|

Q:

|

Why is the Company adjourning the Special Meeting?

|

|

A:

|

The Company did not obtain proxies sufficient to approve and adopt the Merger Agreement (the “Merger Proposal”), which requires the affirmative vote of a majority of the outstanding shares of Common Stock. There are a large number of retail stockholders, many of whom own a small number of shares of Common Stock. We adjourned the meeting to give our management team and our proxy solicitor additional time to secure additional proxies for the required vote. While we have received proxies for approximately 52% of our outstanding shares with a large majority voted in favor of the Merger Proposal, we still need more votes to approve the transaction. This is a very low turnout for such an important vote and we encourage you to vote your shares as soon as possible. No matter how many shares you own or how you intend to vote, your vote is important.

|

|

Q:

|

How does the Asensus’ Board recommend that I vote?

|

|

A:

|

The disinterested members of our Board unanimously recommend that our stockholders vote “FOR” the Merger Proposal. We encourage you to read the “Reasons for Our Board’s Recommendation in Favor of the Merger” in the proxy statement on Schedule 14A filed with the Securities and Exchange Commission (the “SEC”) on July 5, 2024 for information about our Board’s decision.

|

|

Q:

|

Do I need to hold my shares now in order to vote?

|

|

A:

|

No. If you owned shares as of the record date of June 28, 2024, you are the only person who can vote your shares, even if you sold the shares after that date. The Company requests that you please vote your shares, either directly or by authorizing your broker to vote the shares, even if you don’t own the shares anymore.

|

You do not need to participate in the virtual special meeting to vote your shares. Instead, you may vote by Internet or by telephone using the instructions below, or by signing and returning your proxy card in the envelope provided.

|

A:

|

You can vote by telephone by contacting our proxy solicitor. The contact numbers are:

|

Stockholders, banks and brokers may call toll free: (855) 200-8661

Outside the U.S. and Canada: 1-520-210-9927

If you are a stockholder of record (your shares are registered directly in your name with our transfer agent), you may vote at the virtual special meeting, vote by proxy by telephone, through the Internet or, if you received a paper copy of the proxy card, by signing and returning it in the envelope provided. To vote through the Internet, go www.proxydocs.com/ASXC to and complete an electronic proxy card. You will be asked for the Control Number, which is provided on the proxy card you received by mail or electronic mail. For stockholders of record who want to attend the virtual Annual Meeting, you will be able to attend the special meeting online, view the list of stockholders of record upon request, vote your shares electronically and submit questions prior to the meeting. In order to attend the special meeting, you must register at www.proxydocs.com/ASXC using the control number on your proxy card. The registration deadline is August 19, 2024 at 5:00 p.m. Eastern Time. Please be sure to follow instructions found on your proxy card or voting instruction card and subsequent instructions that will be delivered to you via email.

If you are a beneficial owner of shares (your shares are held in the name of a brokerage firm, bank, or other nominee), you may vote by following the instructions provided in the voting instruction form or other materials provided to you by the brokerage firm, bank, or other nominee that holds your shares. To vote your shares at the special meeting, you must obtain a legal proxy from the brokerage firm, bank, or other nominee that holds your shares, and present such legal proxy from the brokerage firm, bank, or other nominee that holds your shares for admittance to the Annual Meeting. Then you must register at www.proxydocs.com/ASXC using the control number on your proxy card. The registration deadline is August 19, 2024 at 5:00 p.m. Eastern Time. Please be sure to follow instructions found on your proxy card or voting instruction card and subsequent instructions that will be delivered to you via email.

|

Q:

|

When and where is the Special Meeting now?

|

|

A:

|

The special meeting will be to be held exclusively online via live audio webcast, in a virtual meeting format, beginning promptly at 10:00 a.m. Eastern Time on August 20, 2024. In certain circumstances, the special meeting could be adjourned again to another time, date or place.

|

|

Q:

|

Can I change my AGAINST vote to FOR?

|

|

A:

|

Yes. You may change your vote up to August 19, 2024 at 5:00 p.m. Eastern Time. To do so, please call toll-free at 1-855-200-8661 or at 1-551-210-9927.

|

|

Q:

|

What will happen if the Merger is not completed?

|

|

A:

|

If the Merger Agreement is not approved by our stockholders, our stockholders will not receive any payment for their shares of Common Stock in connection with the Merger.

|

Because the Company is unlikely to be able to secure needed capital following a failed Merger vote and because of the Company’s obligation to repay the amounts due under the Secured Promissory Note, dated April 3, 2024 (the “Note”) to KARL STORZ, and the security interests supporting such obligation to pay, if the Merger Agreement is not approved and adopted by our stockholders we expect to seek bankruptcy protection in order to maximize the value of our assets as we seek an orderly liquidation of the Company. We believe that in such event, our stockholders will receive less than the merger consideration and may receive no distributions at all in a bankruptcy setting.

The Company issued the following press release to report the adjournment of the Special Meeting.

ASENSUS SURGICAL 2024 SPECIAL MEETING OF STOCKHOLDERS IS ADJOURNED

RESEARCH TRIANGLE PARK, N.C. – August 7, 2024 --(GLOBE NEWSWIRE) Asensus Surgical, Inc. (NYSE American: ASXC), a global leader of innovative digital solutions for the operating room, today announced that the Company’s Special Meeting of Stockholders, scheduled to be held on Wednesday, August 7, 2024 at 10:00 a.m. (Eastern Time) was adjourned to Tuesday August 20, 2024 at 10:00 a.m. (Eastern Time). The Special Meeting will be held virtually.

While we have received proxies for approximately 52% of our outstanding shares with a large majority voted in favor of the merger proposal, we still need more votes to approve the transaction. This is a very low turnout for such an important vote and we encourage you to vote your shares as soon as possible. No matter how many shares you own or how you intend to vote, your vote is important. The Company has adjourned the Special Meeting to allow its retail stockholders additional time to consider and vote on each of the proposals, which are described in the Proxy Statement.

| |

1.

|

Merger Proposal. To approve and adopt the Agreement and Plan of Merger, dated as of June 6, 2024 (which, as it may be amended from time to time, we refer to as the “Merger Agreement”), by and among KARL STORZ Endoscopy-America, Inc., a California corporation (“Parent”), and Karl Storz California Inc., a California corporation (“Merger Sub”), pursuant to which Asensus would be acquired by way of a merger with and into Merger Sub with Asensus surviving the merger and becoming a wholly-owned subsidiary of Parent, which we refer to as the “Merger.”

|

| |

2.

|

Merger-Related Compensation Proposal. To approve, in a non-binding advisory vote, certain compensation that may be paid or become payable to our named executive officers in connection with the Merger.

|

| |

3.

|

Adjournment Proposal. To approve one or more adjournments of the special meeting to a later date or dates if necessary or appropriate to solicit additional proxies if there are insufficient votes to approve the merger proposal at the time of the Special Meeting.

|

Each stockholder’s vote matters and is important no matter how many shares are owned. The Company requests that its stockholders please take the time to read and respond to the Company’s proxy materials that were previously provided to them and vote promptly. Voting over the phone or on the Internet will require that stockholders to have their proxy control number available. That number is printed on the proxy sent with the proxy materials to stockholders by mail or electronic copy. Stockholders who have sold their shares but were a holder of record at the close of business on June 28, 2024, the record date for the Special Meeting, remain entitled to vote, and we ask that they please take the time to vote. The Board encourages stockholders to vote “FOR” each of the proposals.

Any stockholder with questions about the Special Meeting or in need of assistance in voting their shares should contact the Company’s proxy solicitor:

Alliance Advisors

200 Broadacres Drive, 3rd Floor

Bloomfield, NJ 07003

Stockholders, banks and brokers may call toll free: (844) 858-7383

Outside the U.S. and Canada: 1-520-524-4960

About Asensus Surgical, Inc.

Asensus Surgical is revolutionizing surgery with the first intra-operative Augmented Intelligence technology approved for use in operating rooms around the world. Recognized as an award-winning leader in digital technology, Asensus is committed to making surgery more accessible and predictable while delivering consistently superior outcomes. The Company’s novel approach to digitizing laparoscopy has led to system placements globally. Led by engineers, medical professionals, and industry luminaries, Asensus is powered by human ingenuity and driven by collaboration. To learn more about the Senhance® Surgical System and the new LUNA™ System in development, visit www.asensus.com.

Forward-Looking Statements

This press release includes statements relating to the adjournment of the Asensus Special Meeting of Stockholders and the anticipated next steps. These statements and other statements regarding our future plans and goals include "forward looking statements'' within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, and are intended to qualify for the safe harbor from liability established by the Private Securities Reform Act of 1995. Forward looking statement include all statements regarding the intent, belief or current expectation of Asensus and can typically be identified by words such as “anticipate” and “may” and similar expressions, as well as variations or negatives of these words, including statements about the Company’s pursuit of stockholder approval for the Merger Agreement and Merger, and whether the Company will be successful in securing the requisite vote of its stockholders or meet all of the other required closing conditions and the actual consummation of the Merger. Such statements are subject to risks and uncertainties that are often difficult to predict, are beyond our control and which may cause results to differ materially from expectations and include, but are not limited to, the occurrence of any event, change or other circumstance that would give rise to the termination of the Merger Agreement and the fact that certain terminations of the Merger Agreement require the Company to pay a termination fee of $3,600,000; the occurrence of any event, change or other circumstance that would give rise to the termination of the Merger Agreement; whether the Company’s stockholders will approve the Merger Agreement and the Merger, whether the Company will meet all conditions required to close the Merger transaction, whether the necessary approvals will be obtained before the outside termination date in the Merger Agreement, the effect of the announcement of the Merger on the Company’s relationships with its customers, as well as its operating results and business generally; the outcome of any legal proceedings related to the Merger that may arise; retention of employees of the Company following the announcement of the Merger; the fact that the Company’s stock price may decline significantly if the Merger is not completed; and the fact that the Company may be obligated to repay amounts advanced under the promissory note issued to KARL STORZ under the circumstances described in the Note, and whether the Company will be able to repay the Note if the Merger is not completed. Additional risks and uncertainties about Asensus and its business are identified and discussed in the “Risk Factors” section of our Annual Report on Form 10-K, Quarterly Reports on Form 10‑Q and other documents filed from time to time with the SEC. Asensus undertakes no obligation to publicly update any forward-looking statement, whether written or oral, that may be made from time to time, whether as a result of new information, future developments or otherwise, except as required by law. The information set forth herein speaks only as of the date hereof.

Important Additional Information and Where to Find It

In connection with the Merger, the Company has filed with the SEC a definitive proxy statement and other relevant documents. This press release is not a substitute for the proxy statement or any other document that the Company may file with the SEC or send to its stockholders in connection with the Merger. Before making any voting decision, the Company’s stockholders are urged to read all relevant documents filed with the SEC, including the proxy statement, when they become available because they will contain important information about the Merger. Investors and security holders will be able to obtain the proxy statement and other documents filed by the Company with the SEC free of charge at the SEC’s website, www.sec.gov, or from the Company at the investor relations page of its website, www.asensus.com, Investors.

ASENSUS SURGICAL CONTACT:

INVESTORS

Mark Klausner or Mike Vallie

ICR Westwicke

invest@asensus.com

443-213-0499

MEDIA

Dan Ventresca

Matter Communications

AsensusPR@matternow.com

617-874-5488

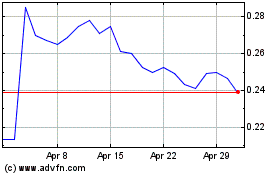

Asensus Surgical (AMEX:ASXC)

Historical Stock Chart

From Jul 2024 to Aug 2024

Asensus Surgical (AMEX:ASXC)

Historical Stock Chart

From Aug 2023 to Aug 2024