Time to Buy This Precious Metal ETF? - ETF News And Commentary

November 05 2013 - 8:00AM

Zacks

The precious metal space has been under pressure for much of 2013

as safe haven assets were shunned in favor of high growth products.

Hopes of Fed tapering had further put pressure on precious metals

as the dollar continued to gain strength (Precious Metal ETFs

Crumble in Fed Meeting Aftermath).

However, the Fed decision of ‘No Taper for now’ once again bought

life back to precious metals. While gold and silver bounced back to

trade higher, one metal which may have been overlooked by investors

during this trend towards a reversal is palladium.

Metal in Focus

Palladium is one of the most popular niche commodities and can be

considered an extremely lucrative investment avenue. Last year, the

metal lost its momentum somewhat, attributable to a weak automobile

sector and sluggish demand for jewelry.

However, with some new trends in the space, there is plenty of hope

for a return to glory for this metal in the very near future

(Inside the Palladium ETF's Recent Surge (PALL)).

Primary Driver

The primary driver behind this strength in the metal is the

Automobile sector. The automotive industry is a big driver of

demand in the palladium market, specifically in catalytic

converters to manage vehicle emissions. With a rebound in the auto

industry, the demand for the metal remains steady.

Investors should note that auto sales in the U.S. are holding

steady at over 15 million units (annual rate). This keeps the

streak of months with the rate of sales above 15 million alive, and

suggest that the automobile market is quite strong (These 3 ETFs

Could Soar on Strong Car Sales).

Additionally, the Fed’s decision to keep interest rates low will

further provide a boost to the sector as customers will be offered

cheap financing thereby increasing the demand for cars. This will

eventually result in increase in demand for palladium metal.

Also, with car sales picking up in Europe and China emerging as the

strong market for vehicles, the demand for the metal will shoot up

leading to further upside in the metal.

ETF in Focus

With the auto industry expected to remain robust globally going

forward, and demand for the metal and consequently its price on the

rise, investors may be able to take advantage of palladium. For

those who are willing to go long in palladium, the following ETF

option is available:

ETF Securities Physical Palladium Shares

(PALL)

For a bullion-backed approach to palladium ETF investing, investors

can look to ETFS Physical Palladium Shares or PALL. PALL is an ETF

which is backed by physical metal and holds the metal in the form

of bullion, or ingots. The metal is securely stored in London and

Zürich on behalf of the custodian, JP Morgan Chase Bank.

Investing in PALL represents a cost-effective and

suitable mode for investors. The transaction costs for buying and

selling the shares will be much lower than purchasing, storing and

insuring physical palladium for most investors (Palladium and

Platinum ETFs to Soar?).

This ETF is designed to track the spot price of palladium bullion.

PALL is the most liquid option available in palladium ETF space,

trading with volumes of 78,000 shares a day and it has $510 million

in assets under management.

The expense ratio of 60 basis points also appears to be on par with

other ETFs in the precious metals space, although it is obviously

higher than what we see in the much more popular gold market. The

fund delivered a return of 20.5% over a period of one year.

Bottom Line

Palladium will continue to see strong demand as the auto industry

continues to grow. Also, auto sales in China are expected to

improve if the government renews some of its policy incentives that

helped the country overtake the U.S. as the biggest auto

market.

According to the Chinese government, total vehicle sales in China

are expected to rise 7.8% to 20.8 million vehicles in 2013 from

19.3 million last year, led by strong demand for passenger vehicles

and economic recovery. So in all, palladium represents a good

investment opportunity in the precious metals space.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

SPDR-GOLD TRUST (GLD): ETF Research Reports

ETFS-PALLADIUM (PALL): ETF Research Reports

ETFS-PLATINUM (PPLT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

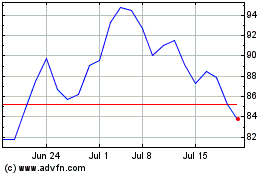

Abrdn Palladium ETF (AMEX:PALL)

Historical Stock Chart

From Oct 2024 to Nov 2024

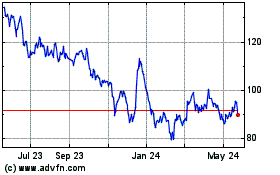

Abrdn Palladium ETF (AMEX:PALL)

Historical Stock Chart

From Nov 2023 to Nov 2024