UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR

15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the Month of August 2023

Commission File Number: 001-39621

OPTHEA LIMITED

(Translation of registrant’s name into English)

Level 4

650 Chapel Street

South Yarra, Victoria 3141

Australia

(Address of

principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

OPTHEA LIMITED |

|

|

|

|

| Date: August 24, 2023 |

|

|

|

By: |

|

/s/ Megan Baldwin |

|

|

|

|

|

|

Megan Baldwin, Ph.D. |

|

|

|

|

|

|

Chief Executive Officer and Managing Director |

Equity Raising Presentation

Institutional Placement and Accelerated Non-Renounceable Entitlement Offer (“ANREO”) August 2023 OPTHEA.COM | @OptheaLimited | ASX (OPT.AX); NASDAQ: OPT Exhibit 99.1

Important Notice and Disclaimer

IMPORTANT: You must read the following before continuing or making use of the information contained in this presentation. By attending an investor presentation, or accepting or viewing this presentation you represent and warrant that you are

entitled to receive or access the presentation in accordance with the restrictions below and agree to be bound by the limitations contained within it. This presentation is dated 24 August 2023 and has been prepared by Opthea Limited (ABN32 006 340

567) (“Company” or “Opthea”) in relation to: a placement of new fully paid ordinary shares in the Company (“New Shares”) to certain eligible institutional investors (“Placement”); and an accelerated

non-renounceable entitlement offer of New Shares to be made to existing eligible shareholders of Opthea (“Entitlement Offer”), the Placement and Entitlement Offer together, the “Offer”. For every two (2) New Shares issued

under the Offer, one (1) option will be issued. The option will have an exercise price of A$0.80 and an expiry date of 31 August 2025 (“New Options”). Application will be made for the options to be quoted on ASX. The Company reserves the

right to withdraw, or vary the timetable for, the Offer without notice. Summary information This presentation contains summary information about the Company and its activities and is current as at the date of this presentation. The information in

this presentation is of a general nature and does not purport to be complete nor does it provide or contain all the information that would be required in a prospectus or other disclosure document prepared in accordance with the requirements of the

Corporations Act 2001 (Cth) (“Corporations Act”), or that an investor should consider when making an investment decision. No representation or warranty, express or implied, is provided in relation to the accuracy or completeness of the

information. Statements in this presentation are made only as of the date of this presentation unless otherwise stated and the information in this presentation remains subject to change without notice. The Company is not responsible for updating,

nor undertakes to update, this presentation. It should be read in conjunction with the Company’s other periodic and continuous disclosure announcements lodged with the Australian Securities Exchange (“ASX”), which are available at

www.asx.com.au, and with the U.S. Securities and Exchange Commission (the “SEC”), which are available at www.sec.gov. The Company has also prepared a target market determination in respect of the New Options which is available on the

Company’s website at https://opthea.com/. This presentation may also include information derived from public or third-party sources, including public filings, research, surveys or studies conducted by third parties, including industry or

general publications and other publicly available information, that has not been independently verified. Neither Opthea nor any of its subsidiaries or any of the respective directors, officers, employees, representatives, agents or advisers of

Opthea or its subsidiaries (“Opthea Related Persons”) makes any representation or warranty with respect to the fairness, accuracy, completeness or adequacy of such information. Not financial product advice This presentation is for

information purposes only and is not a prospectus, product disclosure statement or other offer document under Australian law or the law of any other jurisdiction. This presentation has not been, nor will it be, lodged with the Australian Securities

and Investments Commission (“ASIC”). This presentation is not a financial product or investment advice, a recommendation to acquire New Shares, New Options or accounting, legal or tax advice. It has been prepared without taking into

account the objectives, financial or tax situation or needs of individuals. Any references to, or explanations of, legislation, regulatory issues or any other legal commentary (if any) are indicative only, do not summarize all relevant issues and

are not intended to be a full explanation of a particular matter. You are solely responsible for forming your own opinions and conclusions on such matters and the market, and for making your own independent assessment of the information in this

presentation. Before making an investment decision, prospective investors should consider the appropriateness of the information having regard to their own objectives, financial and tax situation and needs, and seek legal, taxation and other

professional advice appropriate to their circumstances. The Company is not licensed to provide financial product advice in respect of its securities. Cooling off rights do not apply to the acquisition of New Shares or New Options. Effect of rounding

A number of figures, amounts, percentages, estimates, calculations of value and fractions in this presentation are subject to the effect of rounding. Accordingly, the actual calculation of these figures may differ from the figures set out in this

presentation. Past performance Information relating to past performance and activities included in this presentation is given for illustrative purposes only and should not be relied upon as (and is not) an indication of the Company’s views on

its future performance or condition. Investors should note that past performance, including the past share price performance of Opthea, cannot be relied upon as an indicator of (and provides no guidance as to) future performance, including future

share price performance. The historical information included in this presentation is, or is based on, information that has previously been released to the market and is not represented as being indicative of Opthea’s views on its future

financial condition and/or performance. Trademarks and trade names This presentation may contain trademarks and trade names of third parties, which are the property of their respective owners. Third party trademarks and trade names used in this

presentation belong to the relevant owners and use is not intended to represent sponsorship, approval or association by or with any of Opthea or the Extended Parties (defined below). 2

Important Notice and Disclaimer

Financial data All dollar values are in United States dollars ($ or US$) unless stated otherwise. This presentation includes pro forma financial information which is provided for illustrative purposes only and is not represented as being indicative

of the Company’s (or anyone else's) views on the Company’s future financial position or performance. The pro-forma financial information included in this presentation is for illustrative purposes and does not purport to be in compliance

with Article 11 of Regulation S-X of the rules and regulations of the U.S. Securities and Exchange Commission. Any conversion of amounts in US$ to amounts in A$ has been conducted at the exchange rate of 0.64. Preliminary Financial Information

Throughout this presentation, we have presented certain preliminary estimated unaudited financial results and other data as of and for the fiscal year ended June 30, 2023, including preliminary estimated cash and cash equivalent amounts as of June

30, 2023. The estimated results are not a comprehensive statement of our results as of and for the fiscal year ended June 30, 2023, and our actual results may differ materially from these preliminary estimated results. Our actual results remain

subject to the completion of management’s and our audit and risk committee’s reviews and our other financial closing processes. During the course of the preparation of our consolidated financial statements and related notes and the

completion of the audit for the fiscal year ended June 30, 2023, additional adjustments to the preliminary estimated financial information presented in this presentation may be identified, and our final results for these periods may vary from these

preliminary estimates. The preliminary estimated unaudited financial and other data contained in this presentation have been prepared in good faith by, and are the responsibility of, management based upon our internal reporting as of and for the

fiscal year ended June 30, 2023. Deloitte Touche Tohmatsu, our independent registered public accounting firm, has not audited, reviewed, compiled or performed any procedures with respect to such preliminary data. Accordingly, Deloitte Touche

Tohmatsu does not express an opinion or any other form of assurance with respect thereto. Future performance / forward-looking statements This presentation contains certain forward-looking statements. The words "expect", "anticipate", "estimate",

"intend", "believe", "guidance", "should", "could", "may", "will", "predict", "plan" and other similar expressions are intended to identify forward-looking statements. Indications of, and guidance on, future financial position and performance

including the preliminary estimated unaudited financial information and pro forma data, are also forward-looking statements. Forward-looking statements in this presentation include statements regarding the timetable, conduct and outcome of the Offer

and the use of the proceeds thereof, the therapeutic and commercial potential and size of estimated market opportunity of the Company’s product in development, the viability of future opportunities, future market supply and demand, the

expected receipt of payments (including the additional potential increase of US$50 million of funding under the Development Funding Agreement (“DFA”)) and the timing of such payments, the expected cash runway, the expected timing of

completion of patient enrollment under the clinical trials and timing of top-line data, expectations about topline data based on masked pooled data, the financial condition, results of operations and businesses of Opthea, certain plans, objectives

and strategies of the management of Opthea, including with respect to the current and planned clinical trials of its product candidate, and the future performance of Opthea. Forward-looking statements, opinions and estimates provided in this

presentation are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of current conditions. Forward-looking statements, including

projections, guidance on the future financial position of the Company including the preliminary estimated unaudited financial information and pro forma data, are provided as a general guide only and should not be relied upon as an indication or

guarantee of future performance. They involve known and unknown risks and uncertainties and other factors, many of which are beyond the control of Opthea and its directors and management and may involve significant elements of subjective judgment

and assumptions as to future events that may or may not be correct. These statements may be affected by a range of variables which could cause actual results or trends to differ materially, including but not limited to the risks described in this

presentation under “Key Risks”, including risks associated with: the availability of funding, the receipt of funding under the DFA (including the additional potential increase of US$50 million of funding under the DFA), future capital

requirements, the development, testing, production, marketing and sale of drug treatments, regulatory risk and potential loss of regulatory approvals, ongoing clinical studies to demonstrate OPT-302 safety, tolerability and therapeutic efficacy,

additional analysis of data from Opthea’s Phase 3 clinical trials once unmasked, timing of completion of Phase 3 clinical trial patient enrollment and CRO and labor costs, intellectual property protections, the successful completion of the

Offer, completion of management’s and the Company’s audit and risk committee’s review and the Company’s other closing processes, and other factors that are of a general nature which may affect the future operating and

financial performance of the Company. No representation, warranty or assurance (express or implied) is given or made in relation to any forward-looking statement by any person (including the Company and Opthea Related Persons). In particular, no

representation, warranty or assurance (express or implied) is given that the occurrence of the events expressed or implied in any forward-looking statements in this presentation will actually occur. Actual results, performance or achievement may

vary materially from any projections and forward-looking statements and the assumptions on which those statements are based. The forward-looking statements in this presentation speak only as of the date of this presentation. Subject to any

continuing obligations under applicable law or any relevant ASX listing rules, the Company and Opthea Related Persons disclaim any obligation or undertaking to provide any updates or revisions to any forward-looking statements in this presentation

to reflect any change in expectations in relation to any forward-looking statements or any change in events, conditions or circumstances on which any such statement is based. Nothing in this presentation will create an implication that there has

been no change in the affairs of Opthea since the date of this presentation.

Important Notice and Disclaimer

Diagram, charts, graphs and tables Any diagrams, charts, graphs and tables appearing in this presentation are illustrative only and may not be drawn to scale. Investment risk An investment in New Shares and New Options is subject to investment and

other known and unknown risks, many of which are beyond the control of Opthea. Opthea does not guarantee any particular rate of return on the New Shares, New Options or their respective performance, nor does it guarantee any particular tax

treatment. In considering an investment in New Shares and New Options, investors should have regard to (among other things) the risks and disclosures outlined in this presentation, including the “Key Risks” section of this presentation,

before making an investment decision, and should consult their professional adviser(s) if they are in any doubt about what to do. Not an offer This presentation is not a disclosure document and should not be considered as investment advice. This

presentation is for information purposes only and should not be considered an offer or an invitation to acquire, or a solicitation or recommendation in relation to the subscription, purchase or sale of Company securities (including the New Shares

and New Options to be offered and sold in the Offer) or any other financial products and does not and will not form any part of any contract for the acquisition of New Shares or New Options. This presentation does not constitute an offer to sell, or

the solicitation of an offer to buy, any securities in the United States or any other jurisdiction in which such an offer would be illegal or impermissible. The New Shares and New Options to be issued in the Offer have not been, and will not be,

registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”) or the securities laws of any state or other jurisdiction of the United States. The New Shares and New Options to be issued in the Offer may not be

offered and sold to, directly or indirectly, any person in the United States except pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the U.S. Securities Act and applicable U.S. state securities

laws. The release, publication or distribution of this presentation (including an electronic copy) in other jurisdictions outside Australia may also be restricted by law and any such restrictions should be observed. If you come into possession of

this presentation, you should observe such restrictions and should seek your own advice on such restrictions. Any failure to comply with such restrictions may constitute a violation of applicable securities laws. Refer to the “Foreign Selling

Restrictions” section of this presentation for more information. By accepting this presentation you represent and warrant that you are entitled to receive such presentation in accordance with the above restrictions and agree to be bound by the

limitations contained herein. Disclaimer The lead manager and underwriter of the Offer (“Lead Manager”), nor any of the Company’s advisers or any of their respective affiliates, related bodies corporate, directors, officers,

partners, employees, agents and associates, have authorised, permitted or caused the issue, submission, dispatch or provision of this presentation and, except to the extent referred to in this presentation, none of them makes or purports to make any

statement in this presentation and there is no statement in this presentation which is based on any statement by any of them. To the maximum extent permitted by law, the Company, the Lead Manager, and their respective affiliates, related bodies

corporate, directors, officers, partners, employees, agents and advisers (the “Extended Parties”): (i) exclude and disclaim all liability, for any expenses, losses, damages or costs incurred by you as a result of your participation in

any offer of the New Shares and New Options and the information in this presentation being inaccurate or incomplete in any way for any reason, whether by negligence or otherwise; and (ii) make no representation or warranty, express or implied, as to

the currency, accuracy, reliability, timeliness or completeness of information in this presentation, or likelihood of fulfilment of any forward-looking statement or any event or results expressed or implied in any forward-looking statement. Pursuant

to ASX Listing Rule 7.2, the directors of the Company give notice that they reserve the right to issue any New Shares (and New Options) not issued in the Entitlement Offer (“Shortfall Shares”) to new investors or existing shareholders

within 3 months of the close of the offer at a price no less than the Offer Price. The allocation of Shortfall Shares will be within the complete discretion of the Company, having regard to factors such as the Company’s desire for an informed

and active trading market, its desire to establish a wide spread of shareholders, the size and type of funds under management of particular investors, the likelihood that particular investors will be long-term shareholders, and any other factors the

Company considers appropriate. You acknowledge and agree that determination of eligibility of investors for the purposes of the Offer is determined by reference to a number of matters, including legal requirements and the discretion of the Company

and the Lead Manager and each of the Company and the Lead Manager (and their respective Extended Parties) disclaim any duty or liability (including for negligence) in respect of the exercise or otherwise of that discretion, to the maximum extent

permitted by law. Further, you acknowledge and agree that any allocation of New Shares (and New Options) (other than pursuant to an entitlement under the Entitlement Offer) is at the sole discretion of the Company and the Lead Manager and each of

the Company and the Lead Manager (and their respective Extended Parties) disclaim any duty or liability (including for negligence) in respect of the exercise or otherwise of that discretion, to the maximum extent permitted by law. The Company and

the Lead Manager reserve the right to change the timetable in their absolute discretion including by closing the Offer early, withdrawing the Offer entirely or extending the Offer closing time (generally or for particular investor(s)) in their

absolute discretion (but have no obligation to do so), without recourse to them or notice to you. Acceptance By attending a presentation or briefing, or accepting, accessing or reviewing this presentation, you acknowledge and agree to the terms set

out in this important notice and disclaimer, including any modifications to them.

Table of Contents Content Page Opthea

Business Snapshot 6 Opthea Update 7 Equity Raising Overview 8 Sources & Uses of Funds 9 Equity Raising Timetable 10 Proforma Balance Sheet – June 30, 2023 11 Investment Highlights 12 Market Opportunity 13 Phase 2b wet AMD Trial Data 16

Phase 3 Pivotal Program 29 Current Corporate Focus 29 Key Risks 31 Summary of underwriting agreement 38 Foreign Selling Restrictions 41

Opthea Business Snapshot Opthea

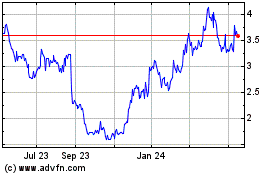

Limited Public company listed on ASX (ASX:OPT; Nasdaq:OPT) developing sozinibercept (OPT-302) for wet Age-related Macular Degeneration (“AMD”) Market capitalization prior to capital raise of approximately A$280M at 23 August 2023 and

cash on hand of US$89M at 30 June 2023 (unaudited) OPT-302 has a novel mechanism of action OPT-302 is a ‘trap’ inhibitor of VEGF-C and VEGF-D designed specifically for the eye In combination with anti-VEGF-A therapies, blocks VEGFR-2 and

VEGFR-3 activity Targets mechanisms of resistance and sub-optimal clinical response to existing therapies Large commercial potential Current and growing market opportunity estimated at >US$8B+ worldwide for wet AMD OPT-302 being developed for use

in combination with any of the existing anti-VEGF-A agents, biosimilars or novel therapies in development for wet AMD A novel approach seeking to provide additional visual acuity benefit over standard of care Potential future extension to Diabetic

Macular Edema (“DME”), Retinal Vein Occlusion (“RVO”) and other retinal clinical pathologies Primary endpoint met in Phase 2b study of OPT-302 in wet AMD OPT-302 combination therapy demonstrated superiority in visual acuity

over ranibizumab (Lucentis®) alone at 24 weeks in an international, randomized, controlled, double-masked trial of 366 patients Secondary endpoint results also supportive of primary outcome Pre-specified sub-group analyses suggest greater

activity of OPT-302 in lesion-types considered more difficult to treat with anti-VEGF-A therapy and highest unmet need Intellectual property covering OPT-302 to 2034 Granted patents in the USA (2), Europe (validated in all countries), Australia,

Brazil, Canada, China, Columbia, Indonesia, Israel, India, Japan, Korea, Mexico, Malaysia, New Zealand, Russia, Singapore & South Africa Divisional applications pending in Europe, Malaysia & USA Application pending in Philippines

Opthea Update Development Funding

Agreement (“DFA”) with Carlyle and Abingworth Completed in August 2022, total capacity US$170 million, with US$120 million committed at signing with the ability to provide an additional US$50 million Provides non-equity funding for the

development of OPT-302 for wet AMD Amounts received from Carlyle and Abingworth repaid at 4x following receipt of regulatory approval in the United States or EU No amounts owed if the clinical trials do not meet the primary endpoint or if regulatory

approval is not received Repayment split between fixed payments (7 in 6 years) and variable payments at 7% of revenues Payment schedule under the DFA: Upfront paymentUS$50 million Received Sept 2022 2nd Tranche US$35 million Received Dec 2022 3rd

TrancheUS$35 million Due by Dec 31, 2023 A new co-investor of Carlyle and Abingworth intends to participate in a funding under the DFA of US$50 million to increase total DFA funding from $120 million to $170 million which is subject to the

co-investor’s final due diligence and approvals, appropriate documentation and compliance with closing conditionsa Cash runway (proforma)* Net proceeds from the Offer of US$46.9 million, the 3rd Tranche of US$35 million under the DFA and the

additional US$50 million under the DFA (described above)a and, along with existing cash balance of US$89 million at June 30, 2023, are expected to fund the company through 3Q CY 2024, assuming, among other things that, Phase 3 clinical trial

enrollment is completed on the timeline described below. Preliminary unaudited estimated cash used in operations for FY 2023: US$121 million (reflects extensions in timeline for enrollment and higher CRO and related costs for the Phase 3 clinical

trials during the year). See slide 11 for more information. Clinical trial timeline Phase 3 clinical trials ~ 75% enrolled at the beginning of August 2023 Based on observed monthly enrollment rates in the Phase 3 program, completion of patient

enrollment is expected: COAST 1Q CY 2024 ShORe 2Q CY 2024 Top-line data expected when all patients complete 52-week treatment period OPT-302 Safety update Safety data from our completed OPT-302 trials show OPT-302 combination therapy has a safety

and tolerability profile comparable to standard of care anti-VEGF-A monotherapy. Masked data from patients that have completed the week 52 visit in the ongoing Phase 3 clinical trials show greater mean BCVA increases from baseline than results

with standard of care anti-VEGF-A monotherapy from Opthea’s Phase 2b studyb * Please refer to risk factors starting on slide 31 a There can be no assurance that the due diligence will be completed to the satisfaction of the co-investor of

Carlyle and Abingworth, that the closing terms and conditions will be satisfied or that the company will ultimately receive the additional $50 million. b Masked data represent pooled data from both OPT-302 combination and standard of care

monotherapy treatment arms. The Phase 3 clinical trial masked data are incomplete and subject to additional analysis once unmasked, and our Phase 3 clinical trials are not fully enrolled and the majority of patients enrolled in the trial have

not completed the week 52 visit. There is no assurance that standard of care monotherapy in our Phase 3 clinical trials will yield similar results to our prior clinical trials or previously published clinical trials with anti-VEGF-A

monotherapies. As a result, there can be no assurance that topline results for OPT-302 from the Phase 3 clinical trial, if completed, will be consistent with results from masked data available to date.

Assumes AUD/USD exchange rate of

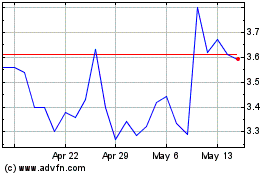

A$0.64 Last closing share price as at Wednesday 23 August 2023 5-day Volume Weighted Average Price (VWAP) to Wednesday 23 August 2023 TERP means the ‘theoretical ex-right price’ at which OPT shares should trade immediately after the

ex-date of the Offer and is adjusted for Placement Shares. TERP is a theoretical calculation only and the actual price at which OPTs shares trade at that time will depend on many factors and may not be equal to the TERP Equity Raising Overview Offer

Structure and Size Opthea is seeking to raise up to approximately A$80.0 million (US$51.2 million1) via the issue of up to approximately 173.9 million new fully paid ordinary shares (“New Shares”) An institutional Placement to raise up

to approximately A$10.0 million (US$6.4) million1 (“Placement”) A 1 for 3.07 pro-rata accelerated non-renounceable entitlement offer (“ANREO”) to raise approximately A$70.0 (US$44.8) million1 (“Entitlement Offer”)

(together, the “Equity Raising” or “Offer”) The Company in its sole discretion reserves the right to raise additional funds under the Placement (“Oversubscriptions”). Any New Shares and New Options issued as a

result of Oversubscriptions, will be issued within Opthea’s available placement capacity under LR 7.1. Options For every two (2) New Shares issued under the Offer, one (1) option will be issued. The option will have an exercise price of A$0.80

and an expiry date of 31 August 2025. The options will be issued post completion of the Retail Entitlement Offer (“New Options”). Offer Price The Equity Raising will be conducted at A$0.46 per New Share representing a 23.3% discount to

the last traded price of $0.6002 23.2% discount to the 5-day VWAP price of $0.5993 18.1% discount to TERP of A$0.5624 Use of Proceeds To continue advancing the clinical development of OPT-302 for the treatment of wet AMD, including to progress the

Phase 3 clinical program and for general corporate purposes Placement and Institutional Entitlement Offer The Placement and institutional Offer will be conducted by way of a bookbuild process on Thursday, 24 August 2023 Entitlements under the

Institutional Entitlement Offer that are not taken-up, entitlements of ineligible institutional shareholders and ineligible retail shareholders under the Entitlement Offer will also be sold in the bookbuild process. Retail Entitlement Offer The

Retail Entitlement Offer will open on Thursday, 31 August 2023 and close on Thursday, 14 September 2023 Eligible existing retail shareholders in Australia and New Zealand have the opportunity to apply for additional New Shares up to 25.0% of their

entitlement under a “Top-up Facility” (subject to scale back at the Company’s discretion) Ranking Each New Share issued under the Equity Raising will rank equally with existing fully paid ordinary shares on issue Underwriting The

Entitlement Offer is fully underwritten by MST Financial Services Pty Ltd “MST”

Sources and Uses of Funds Sources of

funds (m) A$/US$ Gross proceeds from Placement and ANREO1 80/51.2 Commission and fees (6.8)/(4.3) Net proceeds 73.2/46.9 Uses of funds (m) US$ To continue advancing the clinical development of OPT-302 for the treatment of wet AMD, including to

progress the Phase 3 clinical program and for general corporate purposes 46.9 General note: Figures should be considered indicative estimates only and reflect Opthea’s current expectations in respect of the design and scope of the proposed

Phase 3 clinical program. All figures are therefore subject to change. Proceeds of the Placement will not be sufficient to fully fund all anticipated costs of the Phase 3 clinical trials. Please refer to the ‘Key Risks’ disclosure. Note

(1): Opthea may, in its discretion, increase the amounts raised by the Placement.

Equity Raising Timetable Item Date

Trading Halt and announcement of the Equity Raising, lodgement of Offer Documents, including Prospectus with ASIC Thursday, August 24, 2023 Institutional Placement and Institutional Entitlement Offer opens Thursday, August 24, 2023 Institutional

Placement and Institutional Entitlement Offer closes Friday, August 25, 2023 Announcement of completion of the Institutional Entitlement offer, trading halt lifted, existing securities recommence trading Monday, August 28, 2023 Record Date

Entitlement Offer Monday, August 28, 2023 Despatch of Offer Prospectus Thursday, August 31, 2023 Retail Entitlement Offer opens Thursday, August 31, 2023 Settlement of New Shares issued under the Institutional Entitlement Offer and Placement Friday,

September 1, 2023 Allotment of New Shares issued under the Institutional Entitlement Offer and Placement Monday, September 4, 2023 Retail Entitlement Offer closes Thursday, September 14, 2023 Settlement of New Shares under the Retail Entitlement

Offer and any shortfall Wednesday, September 20, 2023 Announcement of results of the Retail Entitlement Offer and notification of any shortfall Thursday, September 21, 2023 Allotment and issue of New Shares and Options under the Retail Entitlement

Offer, and New Options issued under the Institutional Entitlement Offer and Placement Thursday, September 21, 2023 Trading commences on a normal basis for New Shares issued under the Retail Entitlement Offer Friday, September 22, 2023 Despatch of

holding statements for New Shares issued under the Retail Entitlement Offer Monday, September 25, 2023

June 30, 2023 Proforma Preliminary

Unaudited Balance Sheet Unaudited balance sheet at June 30, 2023 The pro forma balance sheet gives effect to the following assumptions: US$46.9 million is received from the Capital Raising the 3rd Tranche of funding of US$35 million due by December

31, 2023, under the Development Funding Agreement with Carlyle and Abingworth (DFA) is received; and Carlyle and Abingworth provides additional funding of US$50 million under the DFA as described on Slide 7 For the year ended June 30, 2023 Net loss:

US$142 million Cash used in Operations: US$121 million (reflects extension in timeline for enrollment and higher CRO and related cost for the Phase 3 clinical trials during the fiscal year) Net proceeds from the Equity Financing and receipt of funds

under the DFA, as described above, along with existing cash balance of $89 million at June 30, 2023, are expected to fund the company through 3Q CY 2024, assuming, among other things, the Phase 3 clinical trial enrollment is completed as described

on slide 7 The preliminary estimated unaudited financial information presented above remains subject to the completion of management's and our audit and risk committee's reviews and other financial closing processes. Such financial information has

also not been audited, reviewed or compiled by our independent registered public accounting firm. Refer to the disclaimer titled "Preliminary Financial Information" on slide 3 for more information. See Risk Factors starting on slide 31 for a

discussion of factors that may cause us to require additional funding earlier than expected, including additional delays in completing enrollment for our phase 3 clinical trials or higher than expected CRO and related costs to run such trials. a

There can be no assurance that the due diligence will be completed to the satisfaction of the co-investor of Carlyle and Abingworth, that the closing terms and conditions will be satisfied or that the company will ultimately receive the additional

$50 million.

* Composition of Matter and Methods

of Use Patents through 2034. **Based on annual worldwide sales of over US$8 billion in 2022 for ranibizumab and aflibercept for wet AMD. In addition, nearly half of wet AMD patients are treated with off-label bevacizumab as a lower cost

alternative anti-VEGF-A therapy. Hence, the total addressable market (TAM) for OPT-302 is potentially greater than the current combined sales of ranibizumab and aflibercept for wet AMD. Wet AMD is the leading cause of vision loss in the

elderly, impacting 3.5 million patients in the US and Europe Revenues for current standard-of-care VEGF-A inhibitors for wet AMD are >US$8 billion/year OPT-302 is: a unique and proprietary* biologic with a novel mechanism of action targeting

VEGF-C/D and validated disease pathways, being developed for use in combination with approved standard-of-care VEGF-A inhibitors a retina asset in development with clinical evidence of better visual outcomes over anti-VEGF-A therapy for wet AMD,

with well tolerated safety profile Treatment options in development focus on reducing burden of care, OPT-302 is designed to transform patient outcomes by improving vision. Better efficacy may also lead to prolonged vision responses & greater

durability of Tx FDA granted Fast-Track designation based on unmet medical need and superior Phase 2b results Pivotal Phase 3 trials in nearly 2,000 patients worldwide, completion of patient enrollment expected for COAST 1Q CY 2024 and ShORe 2Q CY

2024 OPT-302 represents an estimated >US$8 billion dollar commercial opportunity** Investment Highlights

The Unmet Medical Need for wet AMD

>45% >60% 25% Do not achieve significant vision gains Will have persisting macular fluid Will have further vision loss at 12 months & beyond Wet AMD Wet AMD is the leading cause of irreversible blindness Currently: Impacts 3.5M patients1

1.6M patients in U.S.A. 200,000 new patients each year in U.S.A. 80% are diagnosed 80% of diagnosed patients are treated 99% receive anti-VEGF-A therapy Despite treatment with anti-VEGF-A therapy2: 1U.S., EU. 2 Based on randomised, controlled

clinical trial data; >45% Fail to achieve ≥ 2 lines improvement in Best Corrected Visual Acuity (BCVA); Persisting fluid: SD-OCT CST ≥ 300 µM or Time-Domain OCT CST ≥ 250 µM

Wet AMD Large and Growing Market

Opportunity in Wet AMD OPT-302 is Anti-VEGF-A and Durability Agnostic >US$8B ~50% treated patients receive Lucentis® or Eylea ® Potential Addressable Market Wet AMD Off-label use Implied Total Addressable Market for OPT-302 in wet AMD

(Captures Lucentis, Eylea, and Avastin or biosimilar-treated patients worldwide) >$16B OPT-302 is positioned to tap into the entire VEGF-A inhibitor market Total global revenue for Lucentis and Eylea ~50% treated patients receive Avastin ®

*Eye drug Vabysmo blasts off as Roche's biggest growth driver (fiercepharma.com) New entrant trending to $2B* in revenues shows willingness to switch and impact of commercial investment

OPT-302 Combination Therapy

Achieves Broad Blockade of the Validated Pathway in Wet AMD *Bevacizumab is used ’off-label’ for the treatment of neovascular (wet) AMD. # As assessed in cell-based bioassays. VEGF: Vascular Endothelial Growth Factor; VEGFR: Vascular

Endothelial Growth Factor Receptor Used in combination with any VEGF-A inhibitor, OPT-302 blocks# VEGFR-2 and VEGFR-3 signaling, inhibiting the most important pathways driving angiogenesis and vascular leakage VEGF-A inhibition elevates VEGF-C and

VEGF-D which may contribute to sub-optimal clinical efficacy of anti-VEGF-A treatments VEGF-A inhibition elevates VEGF-C and VEGF-D which may contribute VEGF-B VEGF-A VEGF-C OPT-302 VEGFR**-1 VEGFR-2 VEGFR-3 PIGF VEGF-D **Vascular endothelial growth

factor receptor Ranibizumab (Lucentis®) Brolucizumab (Beovu®) Bevacizumab (Avastin®)* Aflibercept (Eylea®) VEGF-B PIGF VEGF-A

OPT-302 Combination Therapy

Clinical Program ShORe Phase 3 wet AMD (n=990) Comparator Ranibizumab once every month COAST Phase 3 wet AMD (n=990) Comparator Aflibercept once every two months after three monthly doses Standard Dosing OPT-302 once every month Monthly dosing

Extended Dosing OPT-302 once every two months after three monthly doses Every two months dosing Treatment naïve patients Standard Dosing OPT-302 once every month Monthly dosing Extended Dosing OPT-302 once every two months after three monthly

doses Every two months dosing Treatment naïve patients Completed Phase 1/2a wet AMD (n=51) Comparator Ranibizumab once every month OPT-302 once every month 3 x monthly dosing Treatment naïve / Prior-treated Comparator Aflibercept once

every month OPT-302 once every month 3 x monthly dosing Prior-treated Completed Phase 1b/2a DME (n=153) Comparator Ranibizumab once every month OPT-302 once every month 6 x monthly dosing Treatment naïve Completed Phase 2b wet AMD (n=366) Now

Recruiting OPT-302 pivotal registrational Phase 3 wet AMD program designed to maximize outcomes with flexible standard of care dosing regimens Note: Ranibizumab (Lucentis®); Aflibercept (Eylea®)

Phase 2b Study Overview Screening

Treatment naïve patients with neovascular AMD Key Exclusion Criteria Subfoveal fibrosis or >25% of total lesion Haemorrhage >50% total lesion Other clinically significant ocular disease Key Inclusion Criteria Active CNV >50% lesion,

classic / minimally classic / occult BCVA ≥ 25 and ≤ 60 letters CNV – choroidal neovascularisation; IVT – intravitreal; Q4W – once very 4 weeks, ITT – Intent to Treat Population, all participants who were

randomised into the study irrespective of whether study medication was administered or not, Safety Population - all participants in the ITT but excluding those who did not receive at least one dose of study medication mITT – Modified ITT

Population, all participants in the Safety Population but excludes any participant without a Baseline Visual Acuity score and/or any participant who did not return for at least one post-baseline visit Allocation Follow-up Analysis Randomised (n=366)

OPT-302 0.5 mg + 0.5 mg ranibizumab IVT Q4W x 6 n=122 sham + 0.5 mg ranibizumab IVT Q4W x 6 n=121 OPT-302 2.0 mg + 0.5 mg ranibizumab IVT Q4W x 6 n=123 Completed Study n=112 (91.8%) Completed Study n=116 (95.9%) Completed Study n=120 (97.6%)

Analysed n=122 Analysed n=119 Analysed n=121 mITT Population ITT Population

Demographic/Baseline Disease

Characteristic Sham + ranibizumab n=121 0.5 mg OPT-302 + ranibizumab n=122 2.0 mg OPT-302 + ranibizumab n=123 Mean Age – years ± SD 76.1 ± 9.48 78.8 ± 8.16 77.8 ± 8.82 Sex – n (%) Male 48 (39.7%) 49 (40.2%) 45 (36.6%)

Female 73 (60.3%) 73 (59.8%) 78 (63.4%) Caucasian Race – n (%) 117 (99.2%) 119 (99.2%) 117 (97.5%) Mean Visual Acuity (BCVA) – letters ± SD 50.7 ± 10.21 51.1 ± 8.96 49.5 ± 10.26 Mean Total Lesion Area - mm2 ± SD

6.08 ± 3.21 6.48 ± 3.30 6.62 ± 3.39 Lesion Type Predominantly classic – n (%) 15 (12.4%) 15 (12.3%) 16 (13.0%) Minimally classic – n (%) 53 (43.8%) 51 (41.8%) 53 (43.1%) Occult - n (%) 53 (43.8%) 56 (45.9%) 54 (43.9%) PCV

detected1 – n (%) 20 (16.5%) 24 (19.7%) 22 (17.9%) RAP detected2 – n (%) 15 (12.7%) 22 (18.5%) 14 (11.8%) Mean central subfield thickness (CST) - mm ±SD 412.10 ± 110.62 425.18 ± 120.45 414.12 ± 123.25 Sub-retinal

fluid (SRF) present – % participants 89.3% 84.4% 87.8% Intra-retinal cysts present – % participants 57.9% 63.9% 56.1% Intent-to-Treat (ITT) population; SD: standard deviation; BCVA: Best Corrected Visual Acuity. 1PCV - polypoidal

choroidal vasculopathy, detected by SD-OCT, FA and fundus photography. 2RAP - retinal angiomatous proliferation, detected by SD-OCT, FA and fundus photography. Phase 2b Study Demographics and Baseline Characteristics

mITT, modified Intent to Treat

population; BCVA – Best Corrected Visual Acuity. Left: Difference in Least Square Means, using Model for Repeated Measures (MRM) analysis. Right: Graph represents “as observed” data and SEM (standard error of the mean). Sham + 0.5

mg ranibizumab (n=119) 2.0 mg OPT-302 + 0.5 mg ranibizumab (n=121) 0.5 mg OPT-302 + 0.5 mg ranibizumab (n=122) Phase 2b primary endpoint achieved OPT-302 (2.0 mg) Combination Therapy Demonstrated Superiority in Visual Acuity over Ranibizumab

Monotherapy Mean Change in Best Corrected Visual Acuity Baseline to Week 24 Sham + 0.5 mg ranibizumab (n=119) 2.0 mg OPT-302 + 0.5 mg ranibizumab (n=121) 0.5 mg OPT-302 + 0.5 mg ranibizumab (n=122) Mean change in BCVA (SEM) (letters) Δ = +3.4

(p=0.0107) 20 15 10 5 0 0 4 8 12 16 20 24 Weeks All Comers +14.2 +10.8

BCVA at 6 months is typically

maintained or greater at 12 months in Phase 3 trials with VEGF-A inhibitors OPT-302 Combination Therapy Mean Visual Acuity Higher Relative to Previous VEGF-A Inhibitor Trials 121 119 240 140 304 291 301 306 360 370 6-month data 12-month data MARINA

Min. classic & Occult lesions only ANCHOR Predominantly classic lesions only OPT Phase 2b Min. classic & Occult lesions only 88 +Ran 0.5 q4w +Ran 0.5 q4w +Ran 0.5 q4w Ran 0.5 q4w Ran 0.5 q4w Aflib 2.0 q8w Aflib 2.0 q8w Ran 0.5 q4w Ran 0.5

q4w Brol 6.0 q12w Brol 6.0 q12w OPT-302 + Ranibizumab Ranibizumab Aflibercept Brolucizumab BCVA between 6 mos to 12 mos Faricimab 10.6 6.5 OPT Phase 2b All lesions OPT-302 in combination OPT Phase 2b All lesions Control arm Mean Change in BCVA from

Baseline (Letters) 334 331 Far 6.0 up to q16w Far 6.0 up to q16w All trials shown, excluding Opthea’s Phase 2b data, are Phase 3 registrational studies. Baseline BCVA values in the Phase 3 registrational studies vary. Number of patients

randomised to treatment group (n, bottom of bars). Mean change in Best Corrected Visual Acuity (BCVA) from baseline shown in ETDRS letters (top of bars). Aflib 2.0, aflibercept 2.0mg; Brol 6.0, brolucizumab 6.0mg; Far 6.0, faricimab 6.0mg; OPT-302

2.0, 2.0mg OPT-302; P2B, Phase 2b study OPT-302-1002; Ran 0.5, ranibizumab, 0.5 mg; administered every four weeks; q8w, administered every 8 weeks (following 3 x 4-weekly loading doses); q12w, administered every 12 weeks; up to q16w, administered up

to every 16 weeks based on protocol defined disease activity assessments.

Neovascular (Wet) AMD Lesion Types

Differ in Vessel Location, Leakiness, and Responsiveness to VEGF-A Inhibitors LEAST RESPONSIVE to VEGF-A inhibition MODERATELY RESPONSIVE to VEGF-A inhibition HIGHLY RESPONSIVE to VEGF-A inhibition Predominantly Classic MINIMALLY CLASSIC OCCULT A

majority of wet AMD patients, 65-80% of the real-world population, have occult and minimally classic lesions

Patients with Minimally Classic and

Occult Lesions (RAP Absent) Responded Best in Phase 2b Achieved greatest vision benefit Represents primary analysis population in OPT-302 Phase 3 program Minimally Classic and Occult Sham + 0.5 mg ranibizumab 2.0 mg OPT-302 + 0.5 mg ranibizumab

+10.3 +16.1 Δ = 5.7 *p = 0.0002 Weeks 20 15 10 5 0 0 4 8 12 16 20 24 Mean Change in BCVA (SEM) (Letters) * Unadjusted p-value.

BCVA (Snellen Equivalent) at Week

24 (Min.Classic & Occult, RAP Absent) Higher Proportion of Patients with 20/40 Vision or Better in OPT-302 Combination Group Sham + 0.5 mg ranibizumab (n=87) 2.0 mg OPT-302 + 0.5 mg ranibizumab (n=88) 42% relative increase in % of patients with

20/40 vision at week 24 compared to ranibizumab control BCVA: Best Corrected Visual Acuity. Modified Intent-to-Treat (mITT) population; as observed. 0 20 40 60 80 48.9 34.5 % Participants ≥70 letters (20/40 Snellen Equivalent) at Week 24

Reduced Retinal Thickness and

Better ‘Retinal Drying’ With OPT-302 Combination Therapy in Min.Classic & Occult, RAP Absent Patients Mean Change in CST Baseline to Week 24 Sham + 0.5 mg ranibizumab (n=87) 2.0 mg OPT-302 + 0.5 mg ranibizumab (n=88) % of

Participants with IR Cysts at Week 24 % of Participants with SRF at Week 24 mITT; as observed; top of bar – statistic, bottom of bar - n. CST: Central Subfield Thickness; SRF: Subretinal fluid; IR: Intra-retinal. % Participants -180 -140 -100

-60 86 -133.5 85 -126.8 Mean Change in CST (SEM) (µm) 0 20 40 88 14.8 87 18.4 0 20 40 86 19.8 85 28.2 % Participants

Total Lesion Area at Week 24

(Min.Classic Occult, RAP Absent) Greater Reduction in Total Lesion Area in OPT-302 2.0 mg Combination Group mITT; as observed; top of bar – statistic, bottom of bar – n. CNV: Choroidal Neovascular. Mean Change in Total Lesion Area at

Week 24 Mean Change in CNV Area at Week 24 -6 -4 -2 0 81 -4.4 80 -3.5 Mean Change in Total Lesion Area (SEM) (mm2) -6 -4 -2 0 81 -5.0 80 -3.9 Mean Change in CNV Area (SEM) (mm2)

OPT-302 Combination Therapy:

Demonstrated potential to improve vision outcomes in patients with PCV lesions Polypoidal Choroidal Vasculopathy (PCV) is a difficult-to-treat wet AMD subtype with a large unmet need In Phase 2b, OPT-302 combination therapy demonstrated potential to

improve vision outcomes for patients with PCV Sham + 0.5 mg ranibizumab (n=20) 2.0 mg OPT-302 + 0.5 mg ranibizumab (n=22) 0.5 mg OPT-302 + 0.5 mg ranibizumab (n=24) Δ = 6.7 *p = 0.0253 PCV is highly prevalent in Asian populations (up to ~60%)

Described as the most prevalent form of wet AMD worldwide 0 5 10 15 20 22 13.5 24 10.9 20 6.9 Mean Change in BCVA (SEM) (Letters) *Unadjusted p-value

Pooled Safety for Completed OPT-302

Trials Combination therapy well-tolerated and comparable to standard of care monotherapy N Participants (%) OPT-302 Any dose* N=399 (N=1,842 injections) OPT-302 2.0 mg N=263 (N=1,121 injections) Sham + anti-VEGF-A control N=169 (N=854 injections)

Ocular TEAEs - Study Eye – related to study product(s) 41 (10.2%) 22 (8.4%) 20 (11.8%) Ocular TEAEs - Study Eye – Severe 4 (1.0%) 2 (0.8%) 2 (1.2%) Intraocular inflammation – Study Eye 71,2,3 (1.8%) 31 (1.1%) 31 (1.8%) Participants

with AEs leading to treatment discontinuation 42,4-6 (1.0%) 14 (0.4%) 27,8 (1.2%) Any APTC event 44,5,9,10 (1.0%) 35,9,10(1.1%) 211,12 (1.2%) Deaths 210,13 (0.5%) 210,13 (0.8%) 214,15 (1.2%) 1Transient anterior chamber cell (trace 1-4 cells); 2 SAE

of endophthalmitis, with AE’s of hypopyon and anterior chamber cell (n=1; 0.5 mg); 3 SAE of vitritis (n=1; 0.5 mg); 4Non-fatal myocardial infarction; 5Cerebrovascular accident; 6Enteritis; 7Abdominal pain; 8Increased IOP; 9 Non-fatal angina

pectoris; 10Fatal congestive heart failure/myocardial infarction; 11Non-fatal arterial embolism; 12Embolic stroke; 13Metatstaic ovarian cancer; 14 Pneumonia; 15 infective endocarditis. * Any dose (OPT-302 0.3 mg, 0.5 mg, 1 mg or 2 mg) ** Masked data

represent pooled data from both OPT-302 combination and standard of care monotherapy treatment arms. The Phase 3 clinical trial masked data are incomplete and subject to additional analysis once unmasked, and our Phase 3 clinical trials are

not fully enrolled and the majority of patients enrolled in the trial have not completed the week 52 visit. There is no assurance that standard of care monotherapy in our Phase 3 clinical trials will yield similar results to our prior clinical

trials or previously published clinical trials with anti-VEGF-A monotherapies. As a result, there can be no assurance that topline results for OPT-302 from the Phase 3 clinical trial, if completed, will be consistent with results from masked

data available to date. Pooled safety analysis of 399 patients for completed OPT-302 trials Data Monitoring Committee (“DMC”) regularly reviews data from ongoing Phase 3 COAST and ShORe studies Safety data from our completed OPT-302

trials show OPT-302 combination therapy has a safety and tolerability profile comparable to standard of care anti-VEGF-A monotherapy. Masked data from patients that have completed the week 52 visit in the ongoing Phase 3 clinical trials show greater

mean BCVA increases from baseline than results with standard of care anti-VEGF-A monotherapy from Opthea’s Phase 2b study**

OPT-302 Phase 3 Pivotal Program

Opthea intends to submit Biologics License Application (BLA) and Marketing Authorization Application (MAA) with the FDA and EMA, respectively, following completion of the primary efficacy phase of the trials Topline Primary Data Analysis at Week 52

Sample size: 330 patients per arm, 990 per study Primary Objective: Mean change from Baseline in BCVA at Wk 52 Design: Multi-centre, double-masked, randomised (1:1:1), sham control Regulatory quality: 90% power, 5% type I error rate *Sham

administered at visits when OPT-302 is not administered. Study of OPT-302 in combination with Ranibizumab Primary Efficacy Endpoint Week 52 Wet AMD Tx-Naïve Pts Ranibizumab (0.5 mg) + OPT-302 (2.0 mg) IVT q4w x 52 wks Ranibizumab (0.5 mg) +

Sham IVT q4w x 52 wks Efficacy Phase Ranibizumab (0.5 mg) IVT q4w x 52 wks + OPT-302 (2.0 mg) IVT q4w x 12 wks; q8w x 40 wks* Safety Phase Ranibizumab (0.5 mg) + OPT-302 (2.0 mg) Ranibizumab (0.5 mg) + Sham Ranibizumab (0.5 mg) + OPT-302 (2.0 mg)

Safety Follow–up Week 100 Combination OPT-302 with Aflibercept Study Primary Efficacy Endpoint Week 52 Wet AMD Tx-Naïve Pts Aflibercept (2.0 mg) IVT q4w x 12 wks; q8w x 40 wks + OPT-302 (2.0 mg) IVT q4w x 52 wks Aflibercept (2.0 mg) +

Sham IVT q4w x 12 wks; q8w x 40 wks Efficacy Phase Aflibercept (2.0 mg) + OPT-302 (2.0 mg) IVT q4w x 12 wks; q8w x 40 wks Safety Phase Aflibercept (2.0 mg) + OPT-302 (2.0 mg) Aflibercept (2.0 mg) + Sham Aflibercept (2.0 mg) + OPT-302 (2.0 mg) Safety

Follow–up Week 100

Current Focus is on Phase 3

Recruitment BLA preparation and pre-commercial activities continue Key Dates Pre-Commercial Activities Building full commercial launch plan & initiating activities that are required to file BLA Commercial manufacturing (PPQ) Market shaping,

physician mindshare Payer/pricing research Competitive landscape, OPT-302 positioning Initial focus – US, then EU/ROW Phase 3 Execution Two trials concurrently recruiting across ~400 sites globally Key focus areas: CRO oversight Site data

entry, data cleaning Site engagement Timeline Expect to complete patient recruitment COAST Q1 CY 2024 ShORe Q2 CY 2024 Treatment period is 12 months Pre BLA meeting to be scheduled following topline data and sufficient safety period Topline data

results to follow data cleaning and database lock asap following completion patient enrollment All patients remain on study for a further 12 months for safety follow-up Intend to file BLA/MAA on basis of topline data & supplementally file safety

follow-up BLA: Biologics License Application MAA: Marketing Authorisation Application

Summary Opthea’s OPT-302 for

wet AMD Opthea Limited and OPT-302 for Wet AMD Positioned for Clinical and Commercial Success Differentiated MOA to improve efficacy OPT-302 is a biologic VEGF-C/D “trap” with no viable threat in competitive pipelines The first therapy

directly targeting VEGF-C & VEGF-D inhibiting angiogenic signaling through VEGFR-2 and VEGFR-3 Strong Phase 2b Data Superior vision gains of OPT-302 combination therapy over standard of care Anatomical improvements Safety profile similar to

standard of care in our trials to date Pivotal Phase 3 trials Informed by Phase 2b data to maximize probability of success Aligned with FDA and EMA review of protocols Granted FDA Fast Track designation Multi-billion dollar commercial opportunity

Existing > US$8 billion p.a. global market for wet AMD alone. DME, RVO, PCV provide additional clinical opportunities Coformulation with approved therapies possible, exploration underway Most advanced product in clinical development to address #1

unmet need for wet AMD patients – improvement in vision outcomes MOA: Mechanism of Action

Key Risks 48 Future capital

requirements Opthea’s activities will require substantial expenditures. Opthea’s losses from operations, including from clinical trial activities, and negative cash flows, raise substantial doubt about the ability for Opthea to

continue as a going concern without additional capital raising activities. While Opthea expects that the proceeds of the Offer, together with additional funding expected under the DFA of US$35 million due under the DFA by December 31, 2023,

the possible increased funding under the DFA of US$50m milliona and cash on hand, will provide funding to progress the activities set out in this presentation, such proceeds will not be sufficient to fully fund all anticipated costs of the Phase 3

clinical trials. In addition, Opthea’s forecast of its cash runway, following receipt of the proceeds from the Offer and under the DFA, is subject to a number of assumptions, including the timing of completion of Phase 3 clinical trial patient

enrollment and CRO and labor costs. Although the co-investor of Carlyle and Abingworth have indicated their intent to provide Opthea additional funding of US$50 million under the DFA, this is subject to final due diligence and the satisfaction

of closing conditions and there is no assurance that this funding will be received or the timing of receipt of such funding. Estimated patient enrollment timing set forth in this presentation is primarily based on Opthea’s monthly enrollment

rates for its Phase 3 clinical trials, which timing has in the past significantly fluctuated from prior estimates, including due to factors outside Opthea’s control. CRO and related costs for the Phase 3 clinical trials have also significantly

fluctuated from estimates in the past, including factors outside Opthea’s control. If patient enrollment continues to be delayed in the future, or if any additional factors cause the Phase 3 clinical trials to be further delayed or more

costly, then Opthea will need to obtain additional financing earlier than the third quarter of calendar year 2024. In addition, if Opthea is unable to complete the Offer as contemplated in this presentation, or obtain the increased US$50

million of funding under the DFA, then Opthea will need to seek additional capital from other sources, which may not be available on a timely basis or at all. In such case, Opthea could be forced to delay, limit or terminate its operations,

liquidate all or a portion of its assets and/or seek insolvency protection in the near term. Opthea’s failure to raise capital, if and when needed, could delay or suspend Opthea’s business strategy and could have a material adverse

effect on Opthea’s activities. If additional funds are raised by issuing equity, this may result in additional dilution to the Shareholders. The pricing of future security issues will also depend on the results of Opthea's scientific research

projects, market factors, demand for securities and the need for capital. If Opthea is unable to secure funding in the short term, there is a risk that Opthea will not be able to continue operating. Underwriting risk Opthea has entered into an

underwriting agreement with MST Financial Services Pty Ltd (“Lead Manager”). The Lead Manager has agreed to act as sole lead manager in relation to the Placement, and sole lead manager and underwriter in relation to the Entitlement

Offer, subject to certain terms and conditions. Details of the fees payable to the Lead Manager are included in the Appendix 3B released to ASX on the date of this presentation. If certain customary conditions are not satisfied or certain customary

termination events occur, then the Lead Manager may terminate the underwriting agreement. A summary of the underwriting agreement including events which may trigger termination of the underwriting agreement is set out in “Summary of

underwriting agreement” below. If the underwriting agreement is terminated by the Lead Manager, Opthea would need to find alternative financing to meet its future funding requirements. There is no guarantee that alternative funding could be

sourced, either at all or on satisfactory terms and conditions. See also the ‘Future capital requirements’ disclosure above. Termination of the underwriting agreement could materially adversely affect Opthea’s business, cash flow,

financial condition and results of operations. This section outlines some of the key risks associated with an investment in Opthea, together with the risks relating to participation in the Offer. Opthea’s business is subject to a number of

risk factors both specific to its business and of a general nature which may impact on its future performance and forecasts. This is not an exhaustive list of the relevant risks and the risks set out below are not presented in order of importance.

The risks set out below and other risks not specifically referred to may in the future materially adversely affect the value of Opthea shares and their performance. Accordingly, no assurance or guarantee of future performance or profitability is

given by Opthea in respect of Opthea shares. Before subscribing for Opthea shares, prospective investors should carefully consider and evaluate Opthea and its business and whether Opthea shares are suitable to acquire having regard to their own

investment objectives and financial circumstances and taking into consideration the material risk factors, as set out below. The risk factors set out below are not exhaustive, and many of them are outside the control of Opthea and its directors. In

deciding whether to participate in the Offer, you should read this presentation in its entirety and carefully consider the risks outlined in this section. Prospective investors should also consider publicly available information on Opthea, examine

the full content of this presentation and consult their financial, tax and other professional advisers before making an investment decision. Business Risks a There can be no assurance that the due diligence will be completed to the satisfaction of

the co-investor of Carlyle and Abingworth, that the closing terms and conditions will be satisfied or that the company will ultimately receive the additional $50 million.

Development Funding Agreement We

are highly reliant on the funding under the DFA including the third tranche of $35 million expected before December 31, 2023, and the potential increase in funding of US$50 million by a new co-investor of Carlyle and Abingworth (see below for

further details). The DFA contains several terms that require compliance by the company in conduct of the study including the governance by a Joint Steering Committee (“JSC”) for changes in the original protocols, study design or

timelines. Modifications require JSC approval and it will be difficult for the company to make modifications on their own. The DFA contains terms that require compliance by the company to maintain a minimum cash balance and to provide a notice to

Ocelot (the SPV established by Carlyle and Abingworth for the purposes of providing funding to Opthea) in the event it anticipates a “Going Concern” opinion in its annual financial statements or that it does not have sufficient cash to

fund its operations for the next six months. The termination provisions in the DFA on the part of Ocelot are extensive and give Ocelot a wide range of conditions to terminate the agreement. In the event of termination, unless mutual or for

breach by Carlyle and Abingworth, amounts owed by the company will be multiples of the invested capital to date. As of June 30, 2023, Ocelot has invested $85 million. A new co-investor of Carlyle and Abingworth intends to participate in

a funding under the DFA of US$50 million to increase total DFA funding from $120 million to $170 million, which is subject to the co-investor’s final due diligence and approvals, appropriate documentation and compliance with closing

conditions. There can be no assurance that a new co-investor of Carlyle and Abingworth will increase the funding by $50 million. The third tranche of $35 million is due under the terms of the DFA before December 31, 2023, however, in the event

the $35 million is not paid it would be considered a Fundamental Material Breach of the DFA by Carlyle and Abingworth. Under a Fundamental Material Breach of the DFA, Opthea has limited recourse but would have the ability to terminate the DFA.

Termination by Opthea for lack of payment of the $35 million would relieve Opthea from any repayments under the DFA. Failure to receive the third tranche of $35 million or the increased funding of $50 million would have a negative impact on our cash

runway and our ability to complete enrollment in the ongoing trials. See Risks noted above under Future Capital Requirements on slide 31. Access to capital The Opthea business model requires ongoing re-investment into clinical trials with no

revenues currently contracted. As such, Opthea will continue to rely upon cash, raised through equity or debt, to fund the business as an on-going concern, including in respect of its Phase 3 clinical trials. Any unforeseen events which restrict the

ability of Opthea to access capital is likely to affect Opthea’s ability to become profitable in future. Clinical development Clinical trials are inherently risky, and may prove unsuccessful or non-efficacious, impracticable or costly, which

may impact profitability and commercial potential. Difficulties in enrolling patients in clinical trials may cause delays to clinical trial schedules. Enrollment has been challenged, and may be challenged in the future, in part by the Covid-19

pandemic, supply chain issues, global and regional inflation, national and local recessions, hiring qualified staff at sites, Opthea’s CRO and distribution locations, local regulatory approvals, importation and custom requirements and

administrative delays. Failure, or negative or inconclusive results, can occur at many stages in development, and the results of earlier clinical trials are not necessarily predictive of future results and data from clinical trials to date may not

be indicative of results obtained when these trials are completed or in later-stage trials. Further, masked data from patients in Opthea’s Phase 3 clinical trials may not be consistent with topline results which are subject to additional

analysis once unmasked. A critical trial may fail to meet its primary or secondary endpoints and as a result inhibit product development, prevent regulatory requirements being met for marketing approval and restrict successful commercialisation. In

addition, data obtained from trials is susceptible to varying interpretations, and regulators may not interpret the data as favourably as Opthea, which may delay, limit or prevent regulatory approval. OPT-302 may fail to demonstrate a safety profile

or sufficient evidence of therapeutic efficacy in future clinical studies to support its ongoing clinical development. In addition, the ability to recruit wet AMD patients into future clinical studies, or secure clinical locations in which to

conduct those studies, may not occur at a sufficient rate to maintain program timelines. Clinical data Opthea maintains sensitive clinical data. Opthea may be subject to a cyber security attack or data breaches by employees or external parties with

either permitted or unauthorized access. There is therefore a risk that sensitive data may be exposed to the public or be permanently lost. A cyber security attack or data breach may also have implications for Opthea’s obligations under any

relevant data protection or privacy legislation. Failure to comply with such legislation or regulations can result in penalties, negative publicity and damage to its brand and reputation. Key Risks – Business Risks (cont’d)

Research and development activities

Opthea’s future success is dependent on the performance of OPT-302 in clinical trials and whether it proves to be a safe and effective treatment. OPT-302 is an experimental product in clinical development and product commercialisation

resulting in potential product sales and revenues is likely to be years away, if ever, and there is no guarantee that it will be successful. OPT-302 requires additional research and development, including ongoing clinical evaluation of safety and

efficacy in clinical trials and regulatory approval prior to marketing authorisation. Drug development is associated with a high failure rate and until Opthea is able to provide further clinical evidence of OPT-302’s ability to improve

outcomes in patients with eye disease, the future success of the product developed remains speculative. Research and development risks include uncertainty of the outcome of results, difficulties or delays in development and general uncertainty

around the scientific development of novel pharmaceutical products and any of these risks, if they were to materialize, could impact Opthea’s progress and could have a material adverse effect on Opthea’s future financial performance.

Regulatory approval Opthea operates within a highly regulated industry, relating to the manufacture, distribution and supply of pharmaceutical products. There is no guarantee that Opthea will obtain or maintain the required approvals, licenses and

registrations from all relevant regulatory authorities in all jurisdictions in which it operates. Further clinical trials may be delayed and Opthea may incur further costs if the Food and Drug Administration (FDA) and other regulatory agencies

observe deficiencies that require resolution or request additional studies be conducted in addition to those that are currently planned. Furthermore, Opthea is exposed to the risk of changes to existing, or the introduction of new, government

policies, regulations and legislation in all jurisdictions in which it operates. A failure to obtain or maintain any required approvals, licenses and registrations or any change in regulation may adversely affect Opthea’s ability to

commercialise and manufacture its treatments. Commercial risk Opthea may, from time to time, consider acquisition, licensing, partnership or other corporate opportunities for Opthea’s development programs. There can be no assurance that any

such acquisition, licensing, partnership or corporate opportunities can be concluded on terms that are, or are believed by Opthea to be, commercially acceptable. In the case of licensing and partnership opportunities, even if such terms are agreed

there is a risk that the performance of distributors and the delivery of contracted outcomes by collaborators will not occur due to a range of unforeseen factors relating to environment, technology and market conditions. Future success will also

depend on Opthea’s ability to achieve market acceptance and attract and retain customers, which includes convincing potential consumers and partners of the efficacy of Opthea’s products and Opthea’s ability to manufacture a

sufficient quantity and quality of products at a satisfactory price. Information technology Opthea relies on effective information technology, software, data centres and communication systems. There is a risk that these systems may be adversely

affected by disruption, failure, service outages or data corruption that could occur as a result of computer viruses, “bugs” or “worms”, malware, internal or external misuse by websites, cyber-attacks or other disruptions

including natural disasters, power outages or other similar events. Opthea may be significantly impacted by disruption to any of these systems or platforms. Key Risks – Business Risks (cont’d)

50 Competition The biotechnology

and pharmaceutical industries are intensely competitive and subject to rapid and significant technological change, in Australia, the United States and elsewhere, and there are no guarantees about Opthea’s ability to successfully compete.

Opthea's products may compete with existing alternative treatments that are already available to customers. In addition, a number of companies, both in Australia and internationally, are pursuing the development of products that target wet AMD and

DME. Some of these companies may have, or may develop, technologies superior to Opthea’s own technology. Some competitors of Opthea may have substantially greater financial, technical and human resources than Opthea does, as well as broader

product offerings and greater market and brand presence. Opthea’s services, expertise or products may be rendered obsolete or uneconomical or decrease in attractiveness or value by advances or entirely different approaches developed by either

Opthea or its competitors. Intellectual property Securing rights in technology and patents is an integral part of securing potential product value in the outcomes of biotechnology research and development. Competition in retaining and sustaining

protection of technology and the complex nature of technologies can lead to patent disputes. Opthea’s success depends, in part, on its ability to obtain patents, maintain trade secret protection and operate without infringing the proprietary

rights of third parties. Because the patent position of biotechnology companies can be highly uncertain and frequently involves complex legal and factual questions, neither the breadth of claims allowed in biotechnology patents nor their

enforceability can be predicted. There can be no assurance that any patents which Opthea may own, access or control will afford Opthea commercially significant protection of its technology or its products or have commercial application, or that

access to these patents will mean that Opthea will be free to commercialize its drug candidates. The granting of a patent does not guarantee that the rights of others are not infringed or that competitors will not develop technology or products to

avoid Opthea's patented technology. Patenting strategies do not cover all countries which may lead to generic competition arising in those markets. Manufacturing Scale-up of OPT-302 manufacture to support Phase 3 clinical studies has been completed

but the process is required to be validated. Process performance qualification or “PPQ” will need to be completed as part of the filing for marketing approval. As such, there is a risk that the PPQ may present technical difficulties.

Technical difficulties could include the inability to generate material that meets regulatory specifications for human administration or the product yield from manufacturing batches may be insufficient to conduct the clinical studies and support

commercialization as currently planned. Any unforeseen difficulty relating to manufacturing, including changes in methods of product candidate manufacturing or formulation, disruption to supply, shortages of input materials or changes to

arrangements with, or capacity of, any third-party manufacturers, may negatively impact Opthea’s ability to generate profit in the future. Commercialization OPT-302 has not been approved for commercial sale, and Opthea expects it to be several

years before OPT-302 is approved, if ever, and Opthea is able to commence sales of OPT-302. If OPT-302 is approved for commercial sale, Opthea’s commercialization expenses will increase significantly as it establishes sales, marketing,

distribution, manufacturing, supply chain and other commercial infrastructure. In addition, OPT-302 may not achieve adequate market acceptance among physicians, patients, healthcare payors and others in the medical community necessary for commercial

success. Covid-19 Opthea’s business was and may in the future be negatively affected by the effects of health epidemics in regions where Opthea or third parties on which Opthea relies have significant manufacturing facilities, concentrations

of clinical trial sites or other business operations. Health epidemics in regions where Opthea has concentrations of clinical trial sites or other business operations could negatively affect its business, including by causing significant disruption

in the operations of third-party manufacturers and CROs upon whom Opthea relies (for example, Covid-19 negatively impacted Opthea’s ability to initiate clinical trial sites, maintain patient enrollment and enroll new patients. Key Risks

– Business Risks (cont’d)

51 Joint venture parties, agents,

suppliers, distributors and contractors Opthea is unable to predict the risk of financial failure or default by a participant in any joint venture to which Opthea may become a party or the insolvency or managerial failure by any of the contractors

used by Opthea in any of its activities or the insolvency or other managerial failure by any of the other service providers used by Opthea for any activity. Opthea may engage with various third parties to assist with different stages of the research

and development process, including agents, suppliers, distributors and contractors, and there is no guarantee that these third parties will comply with their respective contractual obligations. Transition of certain of these third parties could

cause delay or disruption in the clinical trials. This could adversely impact Opthea’s progress and cause delays in or impede research or production, or result in cost increases. Reliance on key personnel Opthea is reliant on key personnel it

employs or engages. Loss of such personnel may have a material adverse impact on the performance of Opthea. In addition, recruiting qualified personnel is critical to Opthea’s success. This includes attracting and retaining staff with

sufficient skills to develop intellectual property. As Opthea’s business grows and progresses to Phase 3 development, it will require additional key staff for clinical development operations as well as additional key financial and

administrative personnel. There can be no assurance that Opthea will be successful in attracting and retaining qualified personnel. The loss of key personnel or the inability to attract suitably qualified additional personnel could have a material

adverse effect on Opthea’s financial performance. Insurance and uninsured risks Although Opthea maintains insurance to protect against certain risks in such amounts as it considers to be reasonable, its insurance will not cover all the

potential risks associated with its operations and insurance coverage may not continue to be available, commercially acceptable, or may not be adequate to cover any resulting liability. It is not always possible to obtain insurance against all such

risks and Opthea may decide not to insure against certain risks because of high premiums or other reasons. Product safety and efficacy Serious or unexpected health, safety or efficacy concerns with products may expose Opthea to reputational harm or

reduced market acceptance of its products, and may lead to product recalls and/or product liability claims and resulting liability, and increased regulatory reporting. There can be no guarantee that unforeseen adverse events or manufacturing defects

will not occur. Opthea may seek to obtain product liability insurance at the appropriate time in order to seek to minimise its liability to such claims, however there can be no assurance that adequate insurance coverage will be available at an