false

0001085243

0001085243

2025-03-27

2025-03-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): March 27, 2025

VIRTRA,

INC.

(Exact

name of Registrant as Specified in Its Charter)

| Nevada |

|

001-38420 |

|

93-1207631 |

| (State

or Other Jurisdiction |

|

(Commission |

|

(IRS

Employer |

| of

Incorporation) |

|

File

Number) |

|

Identification

No.) |

| 295

E. Corporate Place |

|

|

| Chandler,

AZ |

|

85225 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s

Telephone Number, Including Area Code: (480) 968-1488

Not

Applicable

(Former

Name or Former Address, if Changed Since Last Report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock, $0.0001 par value |

|

VTSI |

|

NASDAQ

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

March 27, 2025, VirTra, Inc. issued a press release announcing its financial results for the fourth quarter and year ended December 31,

2024. A copy of this press release is attached hereto as Exhibit 99.1 and incorporated herein by reference. The information contained

in the website is not a part of this Current Report on Form 8-K.

The

information under this Item 2.02, including Exhibit 99.1, is being furnished and shall not be deemed to be “filed” for the

purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the

liabilities of such section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of

1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

VIRTRA,

INC. |

| |

|

|

| Date:

March 27, 2025 |

By: |

/s/

John F. Givens II |

| |

Name: |

John

F. Givens II |

| |

Title: |

Chief

Executive Officer |

Exhibit

99.1

VirTra

Reports Fourth Quarter and Full Year 2024 Financial Results

Fourth

Quarter Bookings Grow 37% Sequentially to $12.2 Million

Year-End

Backlog Expands to $22.0 Million

CHANDLER,

Ariz. — March 27, 2025 — VirTra, Inc. (Nasdaq: VTSI) (“VirTra” or the “Company”), a global

provider of judgmental use of force training simulators and firearms training simulators for the law enforcement and military markets,

reported results for the fourth quarter and full year ended December 31, 2024. The financial statements are available on VirTra’s

website and here.

Fourth

Quarter 2024 and Recent Operational Highlights:

| ● |

Fourth

quarter bookings totaled $12.2 million, a 37% increase from Q3 2024, with a significant portion recorded in December, positioning

VirTra for revenue conversion in early 2025. |

| |

|

| ● |

Backlog

grew to $22.0 million as of December 31, 2024, reflecting continued sales momentum despite federal funding delays. |

| |

|

| ● |

Secured

contracts with government and law enforcement agencies in Europe and Latin America, reinforcing VirTra’s expansion in international

government and security training programs. |

| |

|

| ● |

Secured

first sale of the V-XR® training platform in Canada, marking early adoption of the Company’s extended reality training

technology. |

| |

|

| ● |

Maintained

robust working capital at $34.8 million, positioning the Company for sustained growth and operational agility. |

Fourth

Quarter and Full Year 2024 Financial Highlights:

| | |

For the Three Months Ended | | |

For the Twelve Months Ended | |

| All figures in millions, except per share data | |

December 31, 2024 | | |

December 31, 2023 | | |

% ∆ | | |

December 31, 2024 | | |

December

31, 2023 * | | |

% ∆ | |

| Total Revenue | |

$ | 5.4 | | |

$ | 10.9 | | |

| -50 | % | |

$ | 26.4 | | |

$ | 38.8 | | |

| -32 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross Profit | |

$ | 3.7 | | |

$ | 9.2 | | |

| -60 | % | |

$ | 19.4 | | |

$ | 27.4 | | |

| -29 | % |

| Gross Margin | |

| 68.5 | % | |

| 84.4 | % | |

| N/A | | |

| 73.7 | % | |

| 70.7 | % | |

| N/A | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net Income (Loss) | |

$ | (0.9 | ) | |

$ | 3.5 | | |

| N/A | | |

$ | 1.4 | | |

$ | 9.2 | | |

| N/A | |

| Diluted EPS | |

$ | (0.08 | ) | |

$ | 0.32 | | |

| N/A | | |

$ | 0.12 | | |

$ | 0.85 | | |

| N/A | |

| Adjusted EBITDA+ | |

$ | (1.8 | ) | |

$ | 3.0 | | |

| N/A | | |

$ | 2.9 | | |

$ | 12.4 | | |

| N/A | |

*The December

31, 2023 full-year column reflects restated financials.

+The adjusted EBITDA calculation for the three

months ended December 31, 2024 give effect to a negative $750,000 revenue adjustment.

Management

Commentary

VirTra

CEO John Givens stated, “We closed out 2024 with strong bookings momentum and an expanding backlog despite persistent challenges

in the federal funding environment. Bookings increased sequentially each quarter in 2024, demonstrating our ability to navigate the constraints

of the federal government’s Continuing Resolution and the resulting delays in contract execution. While we remain encouraged by

our growing backlog and international traction, the broader funding environment remains fluid, and we are actively working with policymakers

to ensure law enforcement agencies can access critical training resources. Over the past several months, we have met with dozens of legislators,

officials at the Department of Justice, and leadership in federal grant offices to advocate for clearer funding structures that prioritize

modern training systems. As a trusted partner for Customs and Border Protection (CBP), the Secret Service, and the Federal Law Enforcement

Training Center (FLETC), we remain focused on expanding our role in federal law enforcement training initiatives.

“We are also advancing our military

initiatives, with key milestones in the U.S. Army’s Integrated Visual Augmentation System (IVAS) program. Our final

IVAS development phase was completed 42 days ahead of schedule, leading the Army to finalize testing early and forgo

previously planned soldier assessments due to our system’s outstanding performance. The transition of IVAS to Anduril, one of

the most capable defense technology firms with a well-established track record in Department of Defense contracting, is a

significant positive development. We are actively conducting liability testing on recoil kits as part of the final

prototyping phase, and remain confident in our continued involvement, strategically positioning us to effectively support

future production-stage opportunities.

“While our sales pipeline has improved, we

recognize that there is still work to be done to reach full efficiency. We are laser-focused on accelerating sales growth through

a disciplined, strategic approach. This includes expanding and refining our sales organization, improving conversion efficiency, and

deepening engagement across our core federal and military customer base. Additionally, we are leveraging AI to drastically

reduce video editing time from days to minutes, accelerating high-quality content creation. Training content remains a key differentiator

for VirTra, and our ability to rapidly expand and enhance our scenario library strengthens our position as the industry leader in immersive

training.

“Looking

ahead, we anticipate continued variability in federal funding cycles in the near term, but the long-term need for de-escalation and tactical

training continues to expand. The steps we’ve taken to improve operational efficiency, deepen engagement with key federal agencies,

and expand our content and scenario development capabilities provide a solid foundation as we navigate 2025.”

Fourth

Quarter and Full Year 2024 Financial Results

Total revenue for the fourth quarter was $5.4

million, compared to $10.9 million in the prior year period. This decrease reflects the impact of federal budget delays and

grant disbursement pauses, which slowed contract execution and order conversion. While Q4 bookings saw strong sequential growth,

many orders came late in the quarter, limiting the Company’s ability to fulfill and recognize revenue within the period.

For

the full year 2024, total revenue was $26.4 million, compared to $38.8 million (as restated) in 2023. The decline reflects the impact

of budget delays, resulting in softer bookings in early 2024 and delayed order conversion throughout the year.

Gross profit for the fourth quarter was $3.7

million (69% of total revenue), compared to $9.2 million (84% of total revenue) in the prior year period. The decline

primarily reflects lower revenue.

For

the full year 2024, gross profit totaled $19.4 million (74% of total revenue), compared to $27.4 million (as restated) (71% of total

revenue) in 2023. This improvement in gross margin reflects a shift in product mix and operational efficiencies.

Net operating expense for the fourth quarter

was $4.2 million, a 13% increase from $3.7 million in the prior year period. The increase was driven by investments in

higher-level staff to support long-term growth, expanded sales and marketing efforts, and enhancements to IT infrastructure and

compliance for current and future contracts.

For

the full year 2024, net operating expense was $17.4 million, compared to $17.0 million in 2023.

Operating

(loss) income for the fourth quarter was $(0.5) million, compared to $1.7 million in the fourth quarter of 2023.

For

the full year 2024, operating income was $2.0 million, compared to $10.4 million in 2023.

Net (loss) income for the fourth quarter

was $(0.9) million, or $(0.08) per diluted share (based on 11.2 million weighted average diluted shares outstanding), compared

to $3.5 million, or $0.32 per diluted share (based on 11.0 million weighted average diluted shares outstanding),

in the fourth quarter of 2023.

For

the full year 2024, net income was $1.4 million, or $0.12 per diluted share (based on 11.2 million weighted average diluted shares outstanding),

compared to net income of $9.2 million (as restated), or $0.85 per diluted share (based on 11.0 million weighted average diluted shares

outstanding), in 2023.

Adjusted EBITDA, a non-GAAP metric, was $(1.8)

million (which included the $750,000 negative revenue adjustment), compared to $3.0 million in the fourth quarter of 2023.

For

the full year 2024, adjusted EBITDA, a non-GAAP metric, was $2.9 million, compared to $12.4 million in 2023.

Cash

and cash equivalents were $18.0 million at December 31, 2024.

Financial

Commentary

CFO Alanna Boudreau stated, “We saw strong

momentum in Q4 bookings, with many orders coming late in the quarter. While the timing limited revenue recognition in

the period, it contributed to a growing $22.0 million backlog that positions us well for future growth revenue growth.

Full-year 2024 results included a one-time revenue adjustment related to a 2021 international sale, which

reduced reported 2024 revenue and increased 2023 results. Additionally, net operating expense included a $275,000 lease settlement tied

to a legacy facility contract. Both adjustments were necessary to properly align financial reporting and have now been addressed.

Looking ahead, we remain focused on managing costs effectively, increasing operational efficiency even further, and converting

backlog into revenue as market conditions evolve. With a $22.0 million backlog, scalable operational infrastructure, and an expanding

international pipeline and footprint, we are well-positioned to benefit as opportunities emerge.”

Conference

Call

VirTra’s

management will hold a conference call today (March 27, 2025) at 4:30 p.m. Eastern time (1:30 p.m. Pacific time) to discuss these results.

VirTra’s Chief Executive Officer John Givens and Chief Financial Officer Alanna Boudreau will host the call, followed by a question-and-answer

period.

U.S.

dial-in number: 1-877-407-9208

International

number: 1-201-493-6784

Conference

ID: 13751824

Please

call the conference telephone number 5-10 minutes prior to the start time. An operator will register your name and organization. If you

have any difficulty connecting with the conference call, please contact Gateway Investor Relations at 949-574-3860.

The

conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s

website.

A

replay of the call will be available after 7:30 p.m. Eastern time on the same day through April 10, 2025.

Toll-free

replay number: 1-844-512-2921

International

replay number: 1-412-317-6671

Replay

ID: 13751824

About

VirTra, Inc.

VirTra

(Nasdaq: VTSI) is a global provider of judgmental use of force training simulators, firearms training simulators for the law enforcement,

military, educational and commercial markets. The company’s patented technologies, software, and scenarios provide intense training

for de-escalation, judgmental use-of-force, marksmanship, and related training that mimics real-world situations. VirTra’s mission

is to save and improve lives worldwide through practical and highly effective virtual reality and simulator technology. Learn more about

the company at www.VirTra.com.

About

the Presentation of Adjusted EBITDA

Adjusted

earnings before interest, income taxes, depreciation, and amortization and before other non-operating costs and income (“Adjusted

EBITDA”) is a non-GAAP financial measure. Adjusted EBITDA also includes non-cash stock option expense and other than temporary

impairment loss on investments. Other companies may calculate Adjusted EBITDA differently. VirTra calculates its Adjusted EBITDA to eliminate

the impact of certain items it does not consider to be indicative of its performance and its ongoing operations. Adjusted EBITDA is presented

herein because management believes the presentation of Adjusted EBITDA provides useful information to VirTra’s investors regarding

VirTra’s financial condition and results of operations and because Adjusted EBITDA is frequently used by securities analysts, investors,

and other interested parties in the evaluation of companies in VirTra’s industry, several of which present a form of Adjusted EBITDA

when reporting their results. Adjusted EBITDA has limitations as an analytical tool and should not be considered in isolation or as a

substitute for analysis of VirTra’s results as reported under accounting principles generally accepted in the United States of

America (“GAAP”). Adjusted EBITDA should not be considered as an alternative for net income, cash flows from operating activities

and other consolidated income or cash flows statement data prepared in accordance with GAAP or as a measure of profitability or liquidity.

A reconciliation of net income to Adjusted EBITDA is provided in the following tables:

| | |

For the Year Ended | |

| | |

Dec 31, | | |

Dec 31, | | |

Increase | | |

% | |

| | |

2024 | | |

2023 (Restated)

| | |

(Decrease) | | |

Change | |

| | |

| | |

| | |

| | |

| |

| Net Income (Loss) | |

$ | 1,363,681 | | |

$ | 9,150,835 | | |

$ | (7,787,154 | ) | |

| -85 | % |

| Adjustments: | |

| | | |

| | | |

| | | |

| | |

| Provision for income taxes | |

| 887,286 | | |

| 1,818,812 | | |

$ | (931,526 | ) | |

| -51 | % |

| Depreciation and amortization | |

| 1,136,812 | | |

| 928,545 | | |

$ | 208,267 | | |

| 22 | % |

| Interest (net) | |

| (182,018 | ) | |

| (20,440 | ) | |

$ | (161,578 | ) | |

| 790 | % |

| EBITDA | |

$ | 3,205,761 | | |

$ | 11,877,752 | | |

$ | (8,671,991 | ) | |

| -73 | % |

| Right of use amortization | |

| (279,592 | ) | |

| 496,127 | | |

$ | (775,719 | ) | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Adjusted EBITDA | |

$ | 2,926,169 | | |

$ | 12,373,879 | | |

$ | (9,447,710 | ) | |

| -76 | % |

Forward-Looking

Statements

The

information in this discussion contains forward-looking statements and information within the meaning of Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which are subject to the “safe harbor”

created by those sections. The words “anticipates,” “believes,” “estimates,” “expects,”

“intends,” “may,” “plans,” “projects,” “will,” “should,” “could,”

“predicts,” “potential,” “continue,” “would” and similar expressions are intended to

identify forward-looking statements, although not all forward-looking statements contain these identifying words. We may not actually

achieve the plans, intentions or expectations disclosed in our forward-looking statements and you should not place undue reliance on

our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed

in the forward-looking statements that we make. The forward-looking statements are applicable only as of the date on which they are made,

and we do not assume any obligation to update any forward-looking statements. All forward-looking statements in this document are made

based on our current expectations, forecasts, estimates and assumptions, and involve risks, uncertainties and other factors that could

cause results or events to differ materially from those expressed in the forward-looking statements. In evaluating these statements,

you should specifically consider various factors, uncertainties and risks that could affect our future results or operations. These factors,

uncertainties and risks may cause our actual results to differ materially from any forward-looking statement set forth in the reports

we file with or furnish to the Securities and Exchange Commission (the “SEC”). You should carefully consider these risks

and uncertainties described and other information contained in the reports we file with or furnish to the SEC before making any investment

decision with respect to our securities. All forward-looking statements attributable to us or persons acting on our behalf are expressly

qualified in their entirety by this cautionary statement.

Investor

Relations Contact:

Matt

Glover and Alec Wilson

Gateway

Group, Inc.

VTSI@gateway-grp.com

949-574-3860

-

Financial Tables to Follow -

VIRTRA,

INC.

BALANCE

SHEETS

| | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

| | | |

| (Restated) | |

| ASSETS | |

| | | |

| | |

| Current assets: | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 18,040,827 | | |

$ | 18,849,842 | |

| Accounts receivable, net | |

| 8,005,452 | | |

| 16,472,123 | |

| Inventory, net | |

| 14,583,400 | | |

| 12,404,880 | |

| Unbilled revenue | |

| 2,570,441 | | |

| 1,109,616 | |

| Prepaid expenses and other current assets | |

| 1,273,115 | | |

| 906,803 | |

| Total current assets | |

| 44,473,235 | | |

| 49,743,264 | |

| | |

| | | |

| | |

| Long-term assets: | |

| | | |

| | |

| Property and equipment, net | |

| 16,204,663 | | |

| 15,487,013 | |

| Operating lease right-of-use asset, net | |

| 437,095 | | |

| 716,687 | |

| Intangible assets, net | |

| 558,651 | | |

| 567,540 | |

| Security deposits, long-term | |

| 35,691 | | |

| 35,691 | |

| Other assets, long-term | |

| 148,177 | | |

| 201,670 | |

| Deferred tax asset, net | |

| 3,595,574 | | |

| 3,630,154 | |

| Total long-term assets | |

| 20,979,851 | | |

| 20,638,755 | |

| | |

| | | |

| | |

| Total assets | |

$ | 65,453,086 | | |

$ | 70,382,019 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 957,384 | | |

$ | 2,282,427 | |

| Accrued compensation and related costs | |

| 1,253,544 | | |

| 2,221,416 | |

| Accrued expenses and other current liabilities | |

| 657,114 | | |

| 3,970,559 | |

| Note payable, current | |

| 230,787 | | |

| 226,355 | |

| Operating lease liability, short-term | |

| 192,410 | | |

| 317,840 | |

| Deferred revenue, short-term | |

| 6,355,316 | | |

| 6,736,175 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 9,646,555 | | |

| 15,754,772 | |

| | |

| | | |

| | |

| Long-term liabilities: | |

| | | |

| | |

| Deferred revenue, long-term | |

| 2,282,996 | | |

| 3,012,206 | |

| Note payable, long-term | |

| 7,567,536 | | |

| 7,813,021 | |

| Operating lease liability, long-term | |

| 265,111 | | |

| 432,176 | |

| | |

| | | |

| | |

| Total long-term liabilities | |

| 10,115,643 | | |

| 11,257,403 | |

| | |

| | | |

| | |

| Total liabilities | |

| 19,762,198 | | |

| 27,012,175 | |

| | |

| | | |

| | |

| Commitments and contingencies (See Note 9) | |

| - | | |

| - | |

| | |

| | | |

| | |

| Stockholders’ equity: | |

| | | |

| | |

| Preferred stock $0.0001 par value; 2,500,000 authorized; no shares issued or outstanding | |

| - | | |

| - | |

| Common stock $0.0001 par value; 50,000,000 shares authorized;11,255,709 shares and 11,107,230 shares issued and outstanding as

of December 31, 2024 and 2023, respectively | |

| 1,125 | | |

| 1,109 | |

| Class A common stock $0.0001 par value; 2,500,000 shares authorized; no shares issued or

outstanding | |

| - | | |

| - | |

| Class B common stock $0.0001 par value; 7,500,000 shares authorized; no shares issued or

outstanding | |

| - | | |

| - | |

| Additional paid-in capital | |

| 32,915,112 | | |

| 31,957,765 | |

| Retained earnings | |

| 12,774,651 | | |

| 11,410,970 | |

| | |

| | | |

| | |

| Total stockholders’ equity | |

| 45,690,888 | | |

| 43,369,844 | |

| | |

| | | |

| | |

| Total liabilities and stockholders’ equity | |

$ | 65,453,086 | | |

$ | 70,382,019 | |

See

accompanying notes to financial statements.

VIRTRA,

INC.

STATEMENTS

OF OPERATIONS

| | |

For the years ended | |

| | |

December 31, | | |

December 31, | |

| | |

2024 | | |

2023 | |

| | |

| | |

(Restated) | |

| Revenues: | |

| | | |

| | |

| Net sales | |

$ | 26,350,819 | | |

$ | 38,791,337 | |

| Total revenue | |

| 26,350,819 | | |

| 38,791,337 | |

| | |

| | | |

| | |

| Cost of sales | |

| 6,938,304 | | |

| 11,378,264 | |

| | |

| | | |

| | |

| Gross profit | |

| 19,412,515 | | |

| 27,413,073 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| General and administrative | |

| 14,412,882 | | |

| 14,235,194 | |

| Research and development | |

| 3,003,302 | | |

| 2,794,314 | |

| | |

| | | |

| | |

| Net operating expense | |

| 17,416,184 | | |

| 17,029,508 | |

| | |

| | | |

| | |

| Income from operations | |

| 1,996,331 | | |

| 10,383,565 | |

| | |

| | | |

| | |

| Other income (expense): | |

| | | |

| | |

| Other income | |

| 829,618 | | |

| 888,464 | |

| Other (expense) income | |

| (574,982 | ) | |

| (302,382 | ) |

| | |

| | | |

| | |

| Net other income | |

| 254,636 | | |

| 586,082 | |

| | |

| | | |

| | |

| Income before provision for income taxes | |

| 2,250,967 | | |

| 10,969,647 | |

| | |

| | | |

| | |

| Provision for income taxes | |

| 887,286 | | |

| 1,818,812 | |

| | |

| | | |

| | |

| Net income | |

$ | 1,363,681 | | |

$ | 9,150,835 | |

| | |

| | | |

| | |

| Net income per common share: | |

| | | |

| | |

| Basic | |

$ | 0.12 | | |

$ | 0.85 | |

| Diluted | |

$ | 0.12 | | |

$ | .85 | |

| | |

| | | |

| | |

| Weighted average shares outstanding: | |

| | | |

| | |

| Basic | |

| 11,162,917 | | |

| 10,958,448 | |

| Diluted | |

| 11,162,917 | | |

| 10,963,477 | |

See

accompanying notes to financial statements.

VIRTRA,

INC.

STATEMENTS

OF CASH FLOWS

| | |

2024 | | |

2023 | |

| | |

For the Years Ended December 31 | |

| | |

2024 | | |

2023 | |

| | |

| | |

(Restated) | |

| Cash flows from operating activities: | |

| | | |

| | |

| Net income | |

$ | 1,363,681 | | |

$ | 9,150,835 | |

| Adjustments to reconcile net income (loss) to net cash (used in) provided by operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 1,136,812 | | |

| 928,545 | |

| Right of use amortization | |

| 279,592 | | |

| 496,127 | |

| Bad debt expense | |

| (166,640 | ) | |

| 308,657 | |

| Employee stock compensation | |

| 777,093 | | |

| 75,037 | |

| Stock reserves for future services | |

| 160,104 | | |

| 407,453 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable, net | |

| 8,633,309 | | |

| (13,777,894 | ) |

| Inventory, net | |

| (2,178,520 | ) | |

| (2,812,552 | ) |

| Deferred taxes | |

| 34,580 | | |

| (1,391,392 | ) |

| Unbilled revenue | |

| (1,460,825 | ) | |

| 6,376,375 | |

| Prepaid expenses and other current assets | |

| (366,313 | ) | |

| (375,753 | ) |

| Other assets | |

| 53,493 | | |

| 174,791 | |

| Accounts payable and other accrued expenses | |

| (5,606,536 | ) | |

| 3,810,157 | |

| Operating lease right of use | |

| (292,495 | ) | |

| (527,690 | ) |

| Deferred revenue | |

| (1,110,069 | ) | |

| 3,839,920 | |

| Net cash provided by operating activities | |

| 1,257,266 | | |

| 6,682,616 | |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchase of intangible assets | |

| - | | |

| - | |

| Purchase of property and equipment | |

| (1,845,572 | ) | |

| (1,128,187 | ) |

| Net cash used in investing activities | |

| (1,845,572 | ) | |

| (1,128,187 | ) |

| | |

| | | |

| | |

| Cash flows from financing activities: | |

| | | |

| | |

| Principal payments of debt | |

| (240,862 | ) | |

| (243,084 | ) |

| Stock issued for options exercised | |

| 20,153 | | |

| 54,900 | |

| Net cash used in financing activities | |

| (220,709 | ) | |

| (188,184 | ) |

| | |

| | | |

| | |

| Net increase (decrease) in cash | |

| (809,015 | ) | |

| 5,366,245 | |

| Cash and restricted cash, beginning of period | |

| 18,849,842 | | |

| 13,483,597 | |

| Cash and restricted cash, end of period | |

$ | 18,040,827 | | |

$ | 18,849,842 | |

| | |

| | | |

| | |

| Supplemental disclosure of cash flow information: | |

| | | |

| | |

| Income taxes paid (refunded) | |

$ | 5,505,793 | | |

$ | - | |

| Interest paid | |

$ | 241,838 | | |

$ | 248,653 | |

See

accompanying notes to financial statements.

v3.25.1

Cover

|

Mar. 27, 2025 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 27, 2025

|

| Entity File Number |

001-38420

|

| Entity Registrant Name |

VIRTRA,

INC.

|

| Entity Central Index Key |

0001085243

|

| Entity Tax Identification Number |

93-1207631

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

295

E. Corporate Place

|

| Entity Address, City or Town |

Chandler

|

| Entity Address, State or Province |

AZ

|

| Entity Address, Postal Zip Code |

85225

|

| City Area Code |

(480)

|

| Local Phone Number |

968-1488

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common

Stock, $0.0001 par value

|

| Trading Symbol |

VTSI

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Information, Former Legal or Registered Name |

Not

Applicable

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

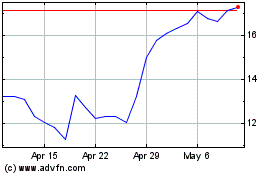

Virtra (NASDAQ:VTSI)

Historical Stock Chart

From Mar 2025 to Apr 2025

Virtra (NASDAQ:VTSI)

Historical Stock Chart

From Apr 2024 to Apr 2025