false

0001378590

0001378590

2024-08-14

2024-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): August 14, 2024

BRIDGELINE DIGITAL, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-33567

|

52-2263942

|

|

(State or other jurisdiction of incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

100 Sylvan Road, Suite G700

Woburn, MA 01801

(Address of principal executive offices, zip code)

(781) 376-5555

(Issuer's telephone number)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a -12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d -2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

BLIN

|

Nasdaq Stock Market, LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 14, 2024, Bridgeline Digital, Inc. (the “Company”) issued a press release announcing its financial results for the fiscal quarter ended June 30, 2024. A copy of that press release is attached hereto as Exhibit 99.1 (the “Press Release”).

The information in this Current Report, including the Press Release, is being furnished pursuant to Item 2.02 and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section or deemed incorporated by reference in any filing by the Company under the Exchange Act, unless specifically identified as being incorporated therein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BRIDGELINE DIGITAL, INC.

|

|

| |

(Registrant)

|

|

|

Date: August 16, 2024

|

|

|

|

| |

|

|

|

| |

By:

|

/s/ Thomas R. Windhausen

|

|

| |

|

Thomas R. Windhausen

|

|

| |

|

Chief Financial Officer

|

|

Exhibit 99.1

Bridgeline Announces Financial Results for the Third Quarter of Fiscal 2024

Woburn, Mass., August 14, 2024 - Bridgeline Digital, Inc. (NASDAQ: BLIN), a global leader in AI-powered marketing technology, today announced financial results for its fiscal third quarter ended June 30, 2024.

“AI advancements, particularly Gen-AI, are revolutionizing eCommerce. Bridgeline is uniquely positioned to displace competitors and drive innovation to fulfill this demand,” said Ari Kahn, Bridgeline’s President and Chief Executive Officer. “HawkSearch-AI stands out as the only AI-Product Discovery software equipped with Tailored-AI. It enables businesses to collaborate with intelligent agents to fine-tune merchandising and drive online revenue growth.”

Financial Highlights – Third Quarter of Fiscal Year 2024

| |

●

|

Total revenue was $3.9 million, compared to $3.9 million in the prior year period.

|

| |

●

|

Subscription and licenses revenue was $3.0 million, compared to $3.2 million in the prior year period.

|

| |

●

|

Gross profit was $2.7 million, compared to $2.6 million in the prior year period.

|

| |

●

|

Gross margin was 69% compared to 68% in the prior year period.

|

Financial Highlights – First 9 Months of Fiscal Year 2024

| |

●

|

Total revenue was $11.5 million, compared to $12.1 million in the prior year period.

|

| |

●

|

Subscription and licenses revenue was $9.1 million, compared to $9.7 million in the prior year period.

|

| |

●

|

Gross profit was $7.8 million, compared to $8.3 million in the prior year period.

|

| |

●

|

Gross margin was 68% compared to 68% in the prior year period.

|

Sales Highlights

| |

●

|

Bridgeline signed $1.4 million in new customer contracts with 23 license sales, adding over $400 thousand in annual recurring revenue.

|

| |

●

|

Artificial Intelligence is driving many search product sales. Companies recognize that their customers expect AI-powered search. This builds demand for upgrades to Bridgeline’s HawkSearch product.

|

Product Highlights

| |

●

|

Gartner recognized HawkSearch in its Magic Quadrant for Search and Product Discovery, highlighting HawkSearch’s strength in Artificial Intelligence and the B2B market.

|

| |

●

|

Info-Tech Research Group awarded HawkSearch the Champion title in Enterprise Search and recognized HawkSearch as a Top-Rated software in the category.

|

| |

●

|

FeaturedCustomers recognized HawkSearch as a Top Performer in the ‘Summer 2024 Customer Success Report’ for Enterprise Search Software.

|

| |

●

|

HawkSearch launched the GenAI-powered ’Athena’ update featuring Smart Response with conversational dialogues based on search queries, prompting follow-up questions and suggestions that imitate a personalized online sales assistant.

|

Partner Highlights

| |

●

|

BigCommerce is promoting HawkSearch ahead of all other search providers on the first page of its app store, providing tens of thousands of BigCommerce customers the ability to upgrade to HawkSearch’s AI technology.

|

| |

●

|

Optimizely is promoting HawkSearch as a top paid app in their app store and HawkSearch-AI will be showcased at Opticon 2024 in San Antonio, Texas in November.

|

| |

●

|

Moblico presented HawkSearch to many leading distributors in their presentation titled "How AI Mobile Search Empowers Contractors to Easily Access Products Anytime, Anywhere” at the Applied AI Conference in Chicago in June.

|

Customer Highlights

| |

●

|

Colonial Electric Supply, a large electrical distributor, has chosen Bridgeline's HawkSearch to power product discovery for its Optimizely website.

|

| |

●

|

Grizzly Industrial, a leading industrial supplier, selected Bridgeline's HawkSearch to power search tailored to the needs of the machinery industry on its eCommerce website.

|

| |

●

|

Sailrite, a leading crafts retailer, has integrated HawkSearch’s AI-powered Smart Search to improve its product discovery for both its B2C and B2B sites.

|

| |

●

|

A global AI technology company has selected HawkSearch’s multilingual search software to power navigation in nine languages for their customers around the globe.

|

| |

●

|

A national aftermarket automotive parts retailer has chosen HawkSearch’s AI-powered Smart Search to increase sales for its eCommerce website.

|

Other Highlights

| |

●

|

Our CEO, Ari Kahn, has been recognized as one of the most innovative leaders to watch in 2024 by Biztech Outlook. Biztech Outlook recognized Dr. Kahn as an “AI Pioneer” in a list of the most innovative leaders of 2024.

|

| |

●

|

Bridgeline has been recognized as one of the top 20 E-commerce solution providers of 2024 by Icon Outlook Technology Magazine.

|

Financial Results – Third Quarter of Fiscal Year 2024

| |

●

|

Total revenue, which is comprised of Licenses and Services revenue, was $3.9 million for the quarter ended June 30, 2024, as compared to $3.9 million for the same period in 2023.

|

| |

●

|

Subscription and licenses revenue, which is comprised of SaaS licenses, maintenance and hosting revenue and perpetual license revenue was $3.0 million for the quarter ended June 30, 2024, as compared to $3.2 million for the same period in 2023. As a percentage of total revenue, Subscription and licenses revenue was 77% of total revenue for the quarter ended June 30, 2024, compared to 81% for the same period in 2023.

|

| |

●

|

Services revenue was $0.9 million for the quarter ended June 30, 2024, as compared to $0.7 million for the same period in 2023. As a percentage of total revenue, Services revenue accounted for 23% of total revenue for the quarter ended June 30, 2024, compared to 19% for the same period in 2023.

|

| |

●

|

Cost of revenue was $1.2 million for the quarter ended June 30, 2024, as compared to $1.3 million for the same period in 2023. Gross profit was $2.7 million for the quarter ended June 30, 2024, as compared to $2.6 million for the same period in 2023.

|

| |

●

|

Gross margin was 69% for the quarter ended June 30, 2024, as compared to 68% for the same period in 2023. Subscription and licenses gross margin was 72% for three months ended June 30, 2024, as compared to 73% for the same period in 2023. Services gross margin was 58% for the three months ended June 30, 2024, as compared to 44% for the same period in 2023.

|

| |

●

|

Operating expenses were $3.1 million for the quarter ended June 30, 2024, as compared to $3.3 million for the same period in 2023.

|

| |

●

|

Operating loss for the quarter ended June 30, 2024 was $0.4 million, as compared to $0.7 million for the same period in 2023.

|

| |

●

|

The warrant liability revaluation resulted in a $0.1 million non-cash gain attributable to the change in the fair value of the warrant liabilities for the quarter ended June 30, 2024. This compares to a non-cash loss from revaluation of $0.1 million for the same period in 2023.

|

| |

●

|

Net loss for the quarter ended June 30, 2024, was $0.3 million, compared to a net loss of $0.8 million for the same period in 2023.

|

Financial Results – First 9 Months of Fiscal Year 2024

| |

●

|

Total revenue, which is comprised of Licenses and Services revenue, was $11.5 million for the nine months ended June 30, 2024, as compared to $12.1 million for the same period in 2023.

|

| |

●

|

Subscription and licenses revenue, which is comprised of SaaS licenses, maintenance and hosting revenue and perpetual license revenue was $9.1 million for the nine months ended June 30, 2024, as compared to $9.7 million for the same period in 2023. As a percentage of total revenue, Subscription and licenses revenue was 79% of total revenue for the nine months ended June 30, 2024, compared to 80% for the same period in 2023.

|

| |

●

|

Services revenue was $2.4 million for the nine months ended June 30, 2024, as compared to $2.4 million for the same period in 2023. As a percentage of total revenue, Services revenue accounted for 21% of total revenue for the nine months ended June 30, 2024, compared to 20% for the same period in 2023.

|

| |

●

|

Cost of revenue was $3.7 million for the nine months ended June 30, 2024, as compared to $3.8 million for the same period in 2023. Gross profit was $7.8 million for the nine months ended June 30, 2024, as compared to $8.3 million for the same period in 2023.

|

| |

●

|

Gross margin was 68% for the nine months ended June 30, 2024, as compared to 68% for the same period in 2023. Subscription and licenses gross margin were 72% for the nine months ended June 30, 2024, as compared to 74% for the same period in 2023. Services gross margin was 51% for the nine months ended June 30, 2024, as compared to 48% for the same period in 2023.

|

| |

●

|

Operating expenses were $9.3 million for the nine months ended June 30, 2024, as compared to $10.0 million for the same period in 2023.

|

| |

●

|

Operating loss for the nine months ended June 30, 2024, was $1.5 million, as compared to an operating loss of $1.7 million for the same period in 2023.

|

| |

●

|

The warrant liability revaluation resulted in a $0.1 million non-cash gain attributable to the change in the fair value of the warrant liabilities for the nine months ended June 30, 2024. This compares to a non-cash gain from revaluation of $0.4 million for the same period in 2023.

|

| |

●

|

Net loss for the nine months ended June 30, 2024, was $1.5 million, compared to a net loss of $1.4 million for the same period in 2023.

|

Conference Call

Bridgeline Digital, Inc. will hold a conference call today, August 14, 2024, at 4:30 p.m. Eastern Time to discuss these results. The Company’s President and Chief Executive Officer, Ari Kahn, and Chief Financial Officer, Thomas Windhausen, will host the call, followed by a question and answer period.

The details of the conference call and replay are as follows:

Bridgeline Digital Third Quarter 2024 Earnings Call

Wednesday, August 14, 2024, at 4:30 p.m. ET

https://register.vevent.com/register/BI2b1505dd9b724326b41ab5b95508ca75

Participants can register for the conference call using the above URL above.

Once registered, participants will receive dial-in numbers and unique PIN number.

Replays of the conference call will be available through the following link:

https://edge.media-server.com/mmc/p/jinrrhtm

Non-GAAP Financial Measures

This press release contains the following Non-GAAP financial measures: Adjusted EBITDA, Non-GAAP adjusted net income (loss), and Non-GAAP adjusted net earnings (loss) per diluted share.

Adjusted EBITDA is defined as earnings before interest, taxes, depreciation, amortization, stock-based compensation expense, impairment of goodwill and intangible assets, non-cash warrant related income/expense, changes in fair value of contingent consideration, restructuring and acquisition-related costs, amortization of debt discounts, preferred stock dividends and any related tax effects. Bridgeline uses Adjusted EBITDA and Non-GAAP adjusted net income (loss) as supplemental measures of our performance that are not required by, or presented in accordance with, accounting principles generally accepted in the United States ("GAAP").

Non-GAAP adjusted net income (loss) and Non-GAAP adjusted net income (loss) per diluted share are calculated as net income (loss) or net income (loss) per share on a diluted basis, excluding, where applicable, amortization of intangible assets, change in fair value of warrants, stock-based compensation, restructuring and acquisition-related costs, goodwill impairment charges, preferred stock dividends and any related tax effects.

Bridgeline's management does not consider these Non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP. The principal limitation of these Non-GAAP financial measures is that they exclude significant expenses and income that are required by GAAP to be recorded in the Company's financial statements. In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expenses and income are excluded or included in determining these Non-GAAP financial measures. To compensate for these limitations, Bridgeline management presents Non-GAAP financial measures in connection with GAAP results. Bridgeline urges investors to review the reconciliation of its Non-GAAP financial measures to the comparable GAAP financial measures, which is included in this press release, and not to rely on any single financial measure to evaluate Bridgeline's financial performance.

Our definitions of Non-GAAP Adjusted EBITDA and adjusted net income (loss) may differ from and therefore may not be comparable with similarly titled measures used by other companies, thereby limiting their usefulness as comparative measures. As a result of the limitations that Adjusted EBITDA and Non-GAAP adjusted net income (loss) have as an analytical tool, investors should not consider them in isolation, or as a substitute for analysis of our operating results as reported under GAAP.

Safe Harbor for Forward-Looking Statements

Statement under the Private Securities Litigation Reform Act of 1995

All statements included in this press release, other than statements or characterizations of historical fact, are forward-looking statements. These "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995, are based on our current expectations, estimates and projections about our industry, management's beliefs, and certain assumptions made by us, all of which are subject to change. Forward-looking statements can often be identified by words such as "anticipates," "expects," "intends," "plans," "predicts," "believes," "seeks," "estimates," "may," "will," "should," "would," "could," "potential," "continue," "ongoing," similar expressions, and variations or negatives of these words. These statements appear in a number of places and include statements regarding the intent, belief or current expectations of Bridgeline Digital, Inc. These forward-looking statements are not guarantees of future results and are subject to risks, uncertainties and assumptions, including, but not limited to, business operations and the business of our customers, suppliers and partners; our ability to retain and upgrade current customers, increasing our recurring revenue, our ability to attract new customers, our revenue growth rate; our history of net loss and our ability to achieve or maintain profitability, instability in the financial markets, including the banking sector; our liability for any unauthorized access to our data or our users' content, including through privacy and data security breaches; any decline in demand for our platform or products; changes in the interoperability of our platform across devices, operating systems, and third party applications that we do not control; competition in our markets; our ability to respond to rapid technological changes, extend our platform, develop new features or products, or gain market acceptance for such new features or products, particularly in light of potential disruptions to the productivity of our employees resulting from remote work; our ability to manage our growth or plan for future growth, and our acquisition of other businesses and the potential of such acquisitions to require significant management attention, disrupt our business, or dilute stockholder value; the volatility of the market price of our common stock, the ability to maintain our listing on the NASDAQ Capital Market; or our ability to maintain an effective system of internal controls as well as other risks described in our filings with the Securities and Exchange Commission. Any of such risks could cause our actual results to differ materially and adversely from those expressed in any forward-looking statement. Bridgeline Digital, Inc. assumes no obligation to, and does not currently intend to, update any such forward-looking statements after the date of this release, except as required by applicable law.

About Bridgeline Digital

Bridgeline is a marketing technology company that offers a suite of products that help companies grow online revenue by driving more traffic to their websites, converting more visitors to purchasers, and increasing average order value.

To learn more, please visit www.bridgeline.com or call (800) 603-9936.

Contact:

Bridgeline Digital, Inc.

Thomas R. Windhausen

Chief Financial Officer

twindhausen@bridgeline.com

BRIDGELINE DIGITAL, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share data)

(Unaudited)

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

June 30,

|

|

|

June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription and perpetual licenses

|

|

$ |

3,013 |

|

|

$ |

3,168 |

|

|

$ |

9,109 |

|

|

$ |

9,670 |

|

|

Digital engagement services

|

|

|

923 |

|

|

|

742 |

|

|

|

2,386 |

|

|

|

2,417 |

|

| Total net revenue |

|

|

3,936 |

|

|

|

3,910 |

|

|

|

11,495 |

|

|

|

12,087 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Subscription and perpetual licenses

|

|

|

846 |

|

|

|

848 |

|

|

|

2,533 |

|

|

|

2,549 |

|

|

Digital engagement services

|

|

|

384 |

|

|

|

419 |

|

|

|

1,180 |

|

|

|

1,259 |

|

| Total cost of revenue |

|

|

1,230 |

|

|

|

1,267 |

|

|

|

3,713 |

|

|

|

3,808 |

|

| Gross profit |

|

|

2,706 |

|

|

|

2,643 |

|

|

|

7,782 |

|

|

|

8,279 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Sales and marketing

|

|

|

949 |

|

|

|

1,197 |

|

|

|

2,803 |

|

|

|

3,792 |

|

|

General and administrative

|

|

|

878 |

|

|

|

779 |

|

|

|

2,425 |

|

|

|

2,367 |

|

|

Research and development

|

|

|

1,008 |

|

|

|

936 |

|

|

|

3,138 |

|

|

|

2,609 |

|

|

Depreciation and amortization

|

|

|

201 |

|

|

|

384 |

|

|

|

885 |

|

|

|

1,143 |

|

|

Restructuring and acquisition related expenses

|

|

|

53 |

|

|

|

12 |

|

|

|

68 |

|

|

|

57 |

|

| Total operating expenses |

|

|

3,089 |

|

|

|

3,308 |

|

|

|

9,319 |

|

|

|

9,968 |

|

|

Loss from operations

|

|

|

(383 |

) |

|

|

(665 |

) |

|

|

(1,537 |

) |

|

|

(1,689 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense and other, net

|

|

|

(5 |

) |

|

|

- |

|

|

|

(58 |

) |

|

|

(19 |

) |

|

Change in fair value of warrant liabilities

|

|

|

88 |

|

|

|

(107 |

) |

|

|

81 |

|

|

|

361 |

|

|

Income (loss) before income taxes

|

|

|

(300 |

) |

|

|

(772 |

) |

|

|

(1,514 |

) |

|

|

(1,347 |

) |

|

Provision for (benefit from) income taxes

|

|

|

5 |

|

|

|

9 |

|

|

|

15 |

|

|

|

25 |

|

|

Net (loss) income

|

|

$ |

(305 |

) |

|

$ |

(781 |

) |

|

$ |

(1,529 |

) |

|

$ |

(1,372 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per share attributable to common shareholders:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic net (loss) income per share

|

|

$ |

(0.03 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.13 |

) |

|

Diluted net (loss) income per share

|

|

$ |

(0.03 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.13 |

) |

|

Number of weighted average shares outstanding:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic

|

|

|

10,417,609 |

|

|

|

10,417,609 |

|

|

|

10,417,609 |

|

|

|

10,417,609 |

|

|

Diluted

|

|

|

10,430,763 |

|

|

|

10,417,609 |

|

|

|

10,430,763 |

|

|

|

10,424,187 |

|

BRIDGELINE DIGITAL, INC.

CONSOLIDATED BALANCE SHEETS

(in thousands, except share and per share data)

(Unaudited)

| |

|

June 30,

|

|

|

September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

| ASSETS |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

1,200 |

|

|

$ |

2,377 |

|

|

Accounts receivable, net

|

|

|

1,531 |

|

|

|

1,004 |

|

|

Prepaid expenses and other current assets

|

|

|

332 |

|

|

|

278 |

|

|

Total current assets

|

|

|

3,063 |

|

|

|

3,659 |

|

|

Property and equipment, net

|

|

|

87 |

|

|

|

151 |

|

|

Operating lease assets

|

|

|

205 |

|

|

|

390 |

|

|

Intangible assets, net

|

|

|

4,094 |

|

|

|

4,890 |

|

|

Goodwill, net

|

|

|

8,468 |

|

|

|

8,468 |

|

|

Other assets

|

|

|

48 |

|

|

|

73 |

|

|

Total assets

|

|

$ |

15,965 |

|

|

$ |

17,631 |

|

| |

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

|

Current portion of long-term debt

|

|

$ |

207 |

|

|

$ |

267 |

|

|

Current portion of operating lease liabilities

|

|

|

165 |

|

|

|

148 |

|

|

Accounts payable

|

|

|

1,133 |

|

|

|

1,255 |

|

|

Accrued liabilities

|

|

|

931 |

|

|

|

995 |

|

|

Deferred revenue

|

|

|

2,167 |

|

|

|

2,084 |

|

|

Total current liabilities

|

|

|

4,603 |

|

|

|

4,749 |

|

|

Long-term debt, net of current portion

|

|

|

317 |

|

|

|

435 |

|

|

Operating lease liabilities, net of current portion

|

|

|

39 |

|

|

|

241 |

|

|

Warrant liabilities

|

|

|

93 |

|

|

|

174 |

|

|

Other long-term liabilities

|

|

|

575 |

|

|

|

572 |

|

|

Total liabilities

|

|

|

5,627 |

|

|

|

6,171 |

|

| |

|

|

|

|

|

|

|

|

|

Commitments and contingencies

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders' equity:

|

|

|

|

|

|

|

|

|

|

Preferred stock - $0.001 par value; 1,000,000 shares authorized; Series C Convertible Preferred stock: 11,000 shares authorized; 350 shares issued and outstanding at June 30, 2024 and September 30, 2023

|

|

|

- |

|

|

|

- |

|

|

Common stock - $0.001 par value; 50,000,000 shares authorized; 10,417,609 shares issued and outstanding at June 30, 2024 and September 30, 2023

|

|

|

10 |

|

|

|

10 |

|

|

Additional paid-in-capital

|

|

|

101,696 |

|

|

|

101,275 |

|

|

Accumulated deficit

|

|

|

(91,106 |

) |

|

|

(89,577 |

) |

|

Accumulated other comprehensive loss

|

|

|

(262 |

) |

|

|

(248 |

) |

|

Total stockholders' equity

|

|

|

10,338 |

|

|

|

11,460 |

|

|

Total liabilities and stockholders' equity

|

|

$ |

15,965 |

|

|

$ |

17,631 |

|

BRIDGELINE DIGITAL, INC.

RECONCILIATION OF GAAP TO NON-GAAP RESULTS

(in thousands, except per share data)

(Unaudited)

| |

|

Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

June 30,

|

|

|

June 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Reconciliation of GAAP net income (loss) to Adjusted EBITDA:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net loss

|

|

$ |

(305 |

) |

|

$ |

(781 |

) |

|

$ |

(1,529 |

) |

|

$ |

(1,372 |

) |

|

Provision for income taxes

|

|

|

5 |

|

|

|

9 |

|

|

|

15 |

|

|

|

25 |

|

|

Interest expense and other, net

|

|

|

5 |

|

|

|

- |

|

|

|

58 |

|

|

|

19 |

|

|

Change in fair value of warrants

|

|

|

(88 |

) |

|

|

107 |

|

|

|

(81 |

) |

|

|

(361 |

) |

|

Amortization of intangible assets

|

|

|

184 |

|

|

|

346 |

|

|

|

796 |

|

|

|

1,032 |

|

|

Depreciation and other amortization

|

|

|

22 |

|

|

|

45 |

|

|

|

108 |

|

|

|

132 |

|

|

Restructuring and acquisition related charges

|

|

|

53 |

|

|

|

12 |

|

|

|

68 |

|

|

|

57 |

|

|

Stock-based compensation

|

|

|

127 |

|

|

|

99 |

|

|

|

368 |

|

|

|

276 |

|

|

Adjusted EBITDA

|

|

$ |

3 |

|

|

$ |

(163 |

) |

|

$ |

(197 |

) |

|

$ |

(192 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP net income (loss) to non-GAAP adjusted net income (loss):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net loss

|

|

$ |

(305 |

) |

|

$ |

(781 |

) |

|

$ |

(1,529 |

) |

|

$ |

(1,372 |

) |

|

Change in fair value of warrants

|

|

|

(88 |

) |

|

|

107 |

|

|

|

(81 |

) |

|

|

(361 |

) |

|

Amortization of intangible assets

|

|

|

184 |

|

|

|

346 |

|

|

|

796 |

|

|

|

1,032 |

|

|

Restructuring and acquisition related charges

|

|

|

53 |

|

|

|

12 |

|

|

|

68 |

|

|

|

57 |

|

|

Stock-based compensation

|

|

|

127 |

|

|

|

99 |

|

|

|

368 |

|

|

|

276 |

|

|

Non-GAAP adjusted net loss

|

|

$ |

(29 |

) |

|

$ |

(217 |

) |

|

$ |

(378 |

) |

|

$ |

(368 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of GAAP net earnings (loss) per diluted share to non-GAAP adjusted net earnings (loss) per diluted share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

GAAP net loss per diluted share

|

|

$ |

(0.03 |

) |

|

$ |

(0.07 |

) |

|

$ |

(0.15 |

) |

|

$ |

(0.13 |

) |

|

Change in fair value of warrants

|

|

|

(0.01 |

) |

|

|

0.01 |

|

|

|

(0.01 |

) |

|

|

(0.03 |

) |

|

Amortization of intangible assets

|

|

|

0.02 |

|

|

|

0.03 |

|

|

|

0.08 |

|

|

|

0.10 |

|

|

Restructuring and acquisition related charges

|

|

|

0.01 |

|

|

|

0.00 |

|

|

|

0.01 |

|

|

|

0.01 |

|

|

Stock-based compensation

|

|

|

0.01 |

|

|

|

0.01 |

|

|

|

0.04 |

|

|

|

0.03 |

|

|

Non-GAAP adjusted net loss per diluted share

|

|

$ |

(0.00 |

) |

|

$ |

(0.02 |

) |

|

$ |

(0.04 |

) |

|

$ |

(0.04 |

) |

v3.24.2.u1

Document And Entity Information

|

Aug. 14, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

BRIDGELINE DIGITAL, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Aug. 14, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-33567

|

| Entity, Tax Identification Number |

52-2263942

|

| Entity, Address, Address Line One |

100 Sylvan Road, Suite G700

|

| Entity, Address, City or Town |

Woburn

|

| Entity, Address, State or Province |

MA

|

| Entity, Address, Postal Zip Code |

01801

|

| City Area Code |

781

|

| Local Phone Number |

376-5555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

BLIN

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001378590

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

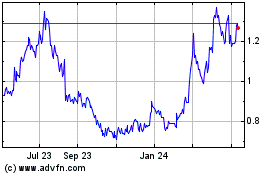

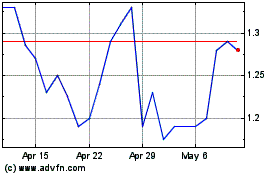

Bridgeline Digital (NASDAQ:BLIN)

Historical Stock Chart

From Jul 2024 to Aug 2024

Bridgeline Digital (NASDAQ:BLIN)

Historical Stock Chart

From Aug 2023 to Aug 2024