UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No.__)

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under §240.14a-12 |

Amesite Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other

than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| ☒ |

No fee required |

| |

|

| ☐ |

Fee paid previously with preliminary materials |

| |

|

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

AMESITE INC.

607 Shelby Street, Suite 700 PMB 214

Detroit, Michigan 48226

May 15, 2024

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held on June 18, 2024

Dear Stockholder:

We are pleased to invite you

to attend the special meeting of stockholders (the “Special Meeting”) of Amesite Inc. (the “Company”), which will

be held virtually on June 18, 2024 at 10:00 a.m. Eastern Time at www.virtualshareholdermeeting.com/AMST2024SM.

In addition to voting by submitting

your proxy prior to the Special Meeting, you also will be able to vote your shares electronically during the Special Meeting. Further

details regarding the virtual meeting are included in the accompanying proxy statement. At the Special Meeting, the holders of our outstanding

common stock will act on the following matters:

| |

1. |

To approve an amendment of the Company’s 2018 Equity Incentive

Plan (the “2018 Plan”) to (i) increase the number of shares available for issuance under the 2018 Plan by 508,488 shares and

(ii) increase the number of shares that may be issued pursuant to the exercise of incentive stock options by 508,488 shares; and |

| |

2. |

To transact such other matters as may properly come before the Special Meeting and any adjournment or postponement thereof. |

Our board of directors has

fixed May 8, 2024 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and

to vote at, the Special Meeting and at any adjournment or postponement of the meeting.

IF YOU PLAN TO ATTEND:

To be admitted to the Special

Meeting, which is being held virtually, you must have your control number available and follow the instructions found on your proxy card

or voting instruction form. You may vote during the Special Meeting by following the instructions available on the meeting website during

the meeting. Please allow sufficient time before the Special Meeting to complete the online check-in process. Your vote is very important.

If you have any questions

or need assistance voting your shares, please call our proxy solicitor, Campaign Management:

Strategic Stockholder Advisor and Proxy Solicitation

Agent

15 West 38th Street, Suite #747,

New York, New York 10018

North American Toll-Free Phone:

1-855-246-4705

Email: info@campaign-mgmt.com

Call Collect Outside North America: +1 (212) 632-8422

| |

BY ORDER OF THE BOARD OF DIRECTORS |

| |

|

| May 15, 2024 |

/s/ Ann Marie Sastry, Ph.D. |

| |

Ann Marie Sastry, Ph.D.

Chairman of the Board of Directors |

Whether or not you expect to attend the virtual

Special Meeting, we urge you to vote your shares at your earliest convenience. This will ensure the presence of a quorum at the Special

Meeting. Promptly voting your shares will save the Company the expenses and extra work of additional solicitation. An addressed envelope

for which no postage is required if mailed in the United States is enclosed if you wish to vote by mail. Submitting your proxy now will

not prevent you from voting your shares at the Special Meeting if you desire to do so, as your proxy is revocable at your option. Your

vote is important, so please act today!

AMESITE INC.

607 Shelby Street, Suite 700 PMB 214

Detroit, Michigan 48226

PROXY STATEMENT FOR THE

SPECIAL MEETING OF STOCKHOLDERS

To be held on June 18, 2024

The board of directors of

Amesite Inc. (“Amesite” or the “Company”) is soliciting your proxy to vote at the Special Meeting of Stockholders

(the “Special Meeting”) to be held on June 18, 2024, at 10:00 a.m. Eastern Time, in a virtual format online by accessing www.virtualshareholdermeeting.com/AMST2024SM,

and at any adjournment thereof.

This proxy statement contains

information relating to the Special Meeting. This Special Meeting of stockholders will be held as a virtual meeting. Stockholders attending

the virtual meeting will be afforded the same rights and opportunities to participate as they would at an in-person meeting. You will

be able to attend and participate in the Special Meeting online via a live webcast by visiting www.virtualshareholdermeeting.com/AMST2024SM.

In addition to voting by submitting your proxy prior to the Special Meeting, you also will be able to vote your shares electronically

during the Special Meeting.

We intend to begin mailing

the attached notice of the Special Meeting and the enclosed proxy card on or about May 15, 2024 to all stockholders of record entitled

to vote at the Special Meeting. Only stockholders who owned our common stock on May 8, 2024 are entitled to vote at the Special Meeting.

AMESITE INC.

TABLE OF CONTENTS

GENERAL INFORMATION ABOUT THIS PROXY STATEMENT

AND VOTING

What is a proxy?

A proxy is the legal designation

of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written

document, that document is also called a proxy or a proxy card. By completing, signing and returning the accompanying proxy card, you

are designating Ann Marie Sastry, Ph.D., Chief Executive Officer of the Company, and Sherlyn W. Farrell, Chief Financial Officer of the

Company, as your proxies for the Special Meeting and you are authorizing such proxies to vote your shares at the Special Meeting as you

have instructed on the proxy card. This way, your shares will be voted whether or not you attend the Special Meeting. Even if you plan

to attend the Special Meeting, we urge you to vote in one of the ways described below so that your vote will be counted even if you are

unable or decide not to attend the Special Meeting.

What is a proxy statement?

A proxy statement is a document

that we are required by the regulations of the United States Securities and Exchange Commission (the “SEC”) to give you when

we ask you to sign a proxy card designating Ann Marie Sastry, Ph.D. and Sherlyn W. Farrell as proxies to vote on your behalf.

Why did you send me this proxy statement?

We sent you this proxy statement

and the enclosed proxy card because our board of directors is soliciting your proxy to vote at the Special Meeting. This proxy statement

summarizes information related to your vote at the Special Meeting. All stockholders who find it convenient to do so are cordially invited

to attend the Special Meeting virtually. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete,

sign and return the enclosed proxy card or vote over the Internet or by phone.

We intend to begin mailing

the attached notice of Special Meeting and the enclosed proxy card on or about May 15, 2024 to all stockholders of record entitled to

vote at the Special Meeting. Only stockholders who owned our common stock on May 8, 2024 are entitled to vote at the Special Meeting.

What does it mean if I receive more than one

set of proxy materials?

If you receive more than one

set of proxy materials, your shares may be registered in more than one name or in different accounts. Please complete, sign, and return

each proxy card to ensure that all of your shares are voted.

How do I attend the Special Meeting?

The Special Meeting will be

held on June 18, 2024, at 10:00 a.m. Eastern Time in a virtual format online by accessing www.virtualshareholdermeeting.com/AMST2024SM.

Information on how to vote during the Special Meeting is discussed below.

Who is entitled to vote?

The board of directors has

fixed the close of business on May 8, 2024 as the record date (the “Record Date”) for the determination of stockholders entitled

to notice of, and to vote at, the Special Meeting or any adjournment or postponement thereof. On the Record Date, there were 2,542,440

shares of common stock issued and outstanding. Each share of common stock represents one vote that may be voted on each proposal that

may come before the Special Meeting.

What is the difference between holding shares

as a record holder and as a beneficial owner (holding shares in street name)?

If your shares are registered

in your name with our transfer agent, Continental Stock Transfer & Trust Company, you are the “record holder” of those

shares. If you are a record holder, these proxy materials have been provided directly to you by the Company.

If your shares are held in

a stock brokerage account, a bank or other holder of record, you are considered the “beneficial owner” of those shares held

in “street name”. If your shares are held in street name, these proxy materials have been forwarded to you by that organization.

The organization holding your account is considered to be the stockholder of record for purposes of voting at the Special Meeting. As

the beneficial owner, you have the right to instruct this organization on how to vote your shares. See “How will my shares be voted

if I give no specific instruction?” below for information on how shares held in street name will be voted without instructions provided.

Who may attend the Special Meeting?

Only record holders and beneficial

owners of our common stock, or their duly authorized proxies, may attend the Special Meeting. If your shares are held in street name,

you will need to provide a copy of a brokerage statement or other documentation reflecting your stock ownership as of the Record Date.

What am I voting on?

There is one matter scheduled for a vote:

| |

1. |

To approve an amendment of the Company’s 2018 Equity Incentive

Plan (the “2018 Plan”) to (i) increase the number of shares available for issuance under the 2018 Plan by 508,488 shares and

(ii) increase the number of shares that may be issued pursuant to the exercise of incentive stock options by 508,488 shares. |

What if another matter is properly brought

before the Special Meeting?

The board of directors knows

of no other matters that will be presented for consideration at the Special Meeting. If any other matters are properly brought before

the Special Meeting, it is the intention of the person named in the accompanying proxy to vote on those matters in accordance with his

or her best judgment.

How do I vote?

| MAIL |

|

INTERNET |

|

PHONE |

|

ONLINE AT THE MEETING |

| |

|

|

|

|

|

|

| Mailing your signed proxy card or voter instruction card. |

|

Using the Internet before the Meeting at: www.proxyvote.com |

|

By calling: 1-800-690-6903 |

|

You can vote during the Meeting at:

www.virtualshareholdermeeting.com/AMST2024SM |

Stockholders of Record

If you are a registered stockholder,

you may vote by mail, phone or online at the Special Meeting by following the instructions above. You also may submit your proxy by mail

by following the instructions included with your proxy card. The deadline for submitting your proxy by Internet is 11:59 p.m. Eastern

Time on June 17, 2024. Our board of directors’ designated proxies, Ann Marie Sastry, Ph.D. and Sherlyn W. Farrell, will vote your

shares according to your instructions. If you attend the live webcast of the Special Meeting, you also will be able to vote your shares

electronically at the Special Meeting up until the time the polls are closed.

Beneficial Owners of Shares Held in Street

Name

If you are a street name holder,

your broker or nominee firm is the legal, registered owner of the shares, and it may provide you with materials in connection with the

Special Meeting. Follow the instructions on the materials you receive to access our proxy materials and vote or to request a paper or

email copy of our proxy materials. The materials include a voting instruction card so that you can instruct your broker or nominee how

to vote your shares. Please check the voting instruction card or contact your broker or other nominee to determine whether you will be

able to deliver your voting instructions by Internet in advance of the meeting and whether, or if you attend the live webcast of the Special

Meeting, if you will be able to vote your shares electronically at the meeting up until the time the polls are closed.

All shares entitled to vote

and represented by a properly completed and executed proxy received before the Special Meeting and not revoked will be voted at the Special

Meeting as instructed in a proxy delivered before the Special Meeting. We provide Internet proxy voting to allow you to vote your shares

online, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware

that you must bear any costs associated with your Internet access, such as usage charges from Internet access providers and telephone

companies.

How many votes do I have?

On each matter to be voted

upon, you have one vote for each share of common stock you own as of the close of business on the Record Date.

Is my vote confidential?

Yes, your vote is confidential.

Only the inspector of elections, individuals who help with processing and counting your votes and persons who need access for legal reasons

will have access to your vote. This information will not be disclosed, except as required by law.

What constitutes a quorum?

To carry on business at the

Special Meeting, we must have a quorum. A quorum is present when one-third (1/3) of the shares entitled to vote, as of the Record Date,

are represented in person, or by remote communication, if applicable, or by proxy. Thus, the holders of a one-third of the voting power

of the 2,542,440 shares of common stock outstanding on the Record Date must be represented in person, or by remote communication, if applicable,

or by proxy to have a quorum at the Special Meeting. Your shares will be counted towards the quorum only if you submit a valid proxy (or

one is submitted on your behalf by your broker, bank or other nominee) or if you vote during the Special Meeting. Abstentions will be

counted towards the quorum requirement; however, because there is a single non-discretionary proposal subject to a vote at the Special

Meeting, broker non-votes will not exist in connection with the Special Meeting and will not count towards the quorum requirement. Shares

owned by the Company are not considered outstanding or considered to be present at the Special Meeting. If there is not a quorum at the

Special Meeting, either the chairperson of the Special Meeting or our stockholders entitled to vote at the Special Meeting may adjourn

the Special Meeting to a future date as allowed under applicable law.

How will my shares be voted if I give no specific

instruction?

We must vote your shares as

you have instructed. If there is a matter on which a stockholder of record has given no specific instruction but has authorized us generally

to vote the shares, they will be voted as follows:

| |

1. |

“For” the approval and adoption of an amendment of the

Company’s 2018 Equity Incentive Plan (the “2018 Plan”) to (i) increase the number of shares available for issuance under

the 2018 Plan by 508,488 shares and (ii) increase the number of shares that may be issued pursuant to the exercise of incentive stock

options by 508,488 shares. |

This authorization would exist,

for example, if a stockholder of record merely signs, dates and returns the proxy card but does not indicate how such shares are to be

voted on one or more proposals. If other matters properly come before the Special Meeting and you do not provide specific voting instructions,

your shares will be voted at the discretion of Ann Marie Sastry, Ph.D. and Sherlyn W. Farrell, the board of directors’ designated

proxies.

If your shares are held in

street name, see “What is a broker non-vote?” below regarding the ability of banks, brokers and other such holders of record

to vote the uninstructed shares of their customers or other beneficial owners in their discretion.

How are votes counted?

Votes will be counted by the

inspector of election appointed for the Special Meeting who will count votes “For” and “Against,” and abstentions.

As the only matter subject to a vote is non-discretionary, broker non-votes will not exist in connection with the Special Meeting.

What is a broker non-vote?

A “broker non-vote”

occurs when shares held by a broker in “street name” for a beneficial owner are not voted with respect to a proposal because

(1) the broker has not received voting instructions from the stockholder who beneficially owns the shares and (2) the broker lacks the

authority to vote the shares at their discretion.

Our common stock is listed

on The Nasdaq Capital Market. However, under current New York Stock Exchange (“NYSE”) rules and interpretations that govern

broker non-votes, Proposal No. 1 for the adoption of the amendment to the 2018 Plan, is considered a non-discretionary matter, and a broker

will not be permitted to exercise its discretion to vote uninstructed shares on the proposal. Because NYSE rules apply to all brokers

that are members of the NYSE, this prohibition applies to the Special Meeting even though our common stock is listed on The Nasdaq Capital

Market.

Because there is a single,

non-discretionary proposal subject to a vote at the Special Meeting, broker non-votes will not exist in connection with the Special Meeting

and therefor will not count towards the quorum requirement.

What is an abstention?

An abstention is a stockholder’s

affirmative choice to decline to vote on a proposal. Under Delaware law, abstentions are counted as shares present and entitled to vote

at the Special Meeting. Generally, unless provided otherwise by applicable law, our Bylaws (“Bylaws”) provide that an action

of our stockholders (other than for the election of directors) is approved if a majority of the votes cast affirmatively or negatively

(excluding abstentions and broker non-votes), either during the Special Meeting or by proxy, vote in favor of such action.

How many votes are required to approve each

proposal?

The table below summarizes

the proposal that will be voted on, the vote required to approve such item, and how votes are counted:

| Proposal |

|

Votes Required |

|

Voting Options |

|

Impact of

“Withhold” or

“Abstain”

Votes |

|

Impact of Broker

Non-

Votes |

| Proposal No. 1: Adoption of the Amendment to the Plan |

|

The affirmative vote of the majority of the votes cast affirmatively or negatively (excluding abstentions and broker non-votes) at the Special Meeting by the holders entitled to vote thereon. |

|

“FOR” “AGAINST” “ABSTAIN” |

|

NONE(1) |

|

NONE(2) |

| (1) |

A vote marked as an “Abstention” is not considered a vote cast and will, therefore, not affect the outcome of this proposal. |

| (2) |

Because there is a single, non-discretionary proposal subject to a

vote at the Special Meeting, broker non-votes will not exist in connection with the Special Meeting and therefor will not count towards

the quorum requirement. |

What are the voting procedures?

In voting by proxy with regard

to Proposal No. 1, you may vote in favor of or against the proposal, or you may abstain from voting on the proposal. You should specify

your respective choices on the accompanying proxy card or your vote instruction form.

Is my proxy revocable?

You may revoke your proxy

and reclaim your right to vote at any time before your proxy is voted by giving written notice to the Secretary of the Company by delivering

a properly completed, later-dated proxy card or vote instruction form or by voting during the Special Meeting. All written notices of

revocation and other communications with respect to revocations of proxies should be addressed to: Amesite Inc., 607 Shelby Street, Suite

700 PMB 214, Detroit, Michigan 48226, Attention: Secretary. Your most current proxy card or Internet proxy is the one that will be counted.

Who is paying for the expenses involved in

preparing and mailing this proxy statement?

All of the expenses involved

in preparing, assembling and mailing these proxy materials and all costs of soliciting proxies will be paid by us. In addition to the

solicitation by mail, proxies may be solicited by our officers and other employees by telephone or in person. Such persons will receive

no compensation for their services other than their regular salaries. Arrangements will also be made with brokerage houses and other custodians,

nominees and fiduciaries to forward solicitation materials to the beneficial owners of the shares held of record by such persons, and

we may reimburse such persons for reasonable out of pocket expenses incurred by them in forwarding solicitation materials. We have retained

Campaign Management as our strategic stockholder advisor and proxy solicitation agent in connection with the solicitation of proxies for

the Special Meeting. If you have any questions or require any assistance with completing your proxy, please contact Campaign Management

by telephone (toll-free within North America) at +1 (855) 246-4705 or (call collect outside North America) at +1 (212) 632-8422 or

by email at info@campaign-mgmt.com.

Do I have dissenters’ rights of appraisal?

Stockholders do not have

appraisal rights under Delaware law or under Amesite’s governing documents with respect to the matters to be voted upon at the

Special Meeting.

How can I find out the results of the voting

at the Special Meeting?

Final voting results will

be disclosed in a Current Report on Form 8-K that we expect to file with the SEC within four business days after the Special Meeting.

If final voting results are not available to us in time to file a Form 8-K with the SEC within four business days after the Special Meeting,

we intend to file a Form 8-K to publish preliminary results and, within four business days after the final results are known to us, file

an amended Form 8-K to publish the final results.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS

AND MANAGEMENT

The following table sets forth

certain information regarding beneficial ownership of shares of our common stock as of May 8, 2024 based on 2,542,440 shares of common

stock issued and outstanding by (i) each person known to beneficially own more than 5% of our outstanding common stock, (ii) each of our

directors and director nominees, (iii) our named executive officers and (iv) all directors and executive officers as a group. Shares are

beneficially owned when an individual has voting and/or investment power over the shares or could obtain voting and/or investment power

over the shares within 60 days of the Record Date. Except as otherwise indicated, the persons named in the table have sole voting and

investment power with respect to all shares beneficially owned, subject to community property laws, where applicable. Unless otherwise

indicated, the address of each beneficial owner listed below is c/o Amesite Inc., 607 Shelby Street, Suite 700 PMB 214, Detroit, Michigan

48226.

The percentage of total

voting power information is based on 2,542,440 shares of common stock outstanding as of the Record Date. We have determined beneficial

ownership in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons who possess

sole or shared voting power or investment power with respect to those securities. In addition, the rules attribute beneficial ownership

of securities as of a particular date to persons who hold options or warrants to purchase shares of common stock and that are exercisable

within 60 days of such date. These shares are deemed to be outstanding and beneficially owned by the person holding those options

or warrants for the purpose of computing the percentage ownership of that person, but they are not treated as outstanding for the

purpose of computing the percentage ownership of any other person. Unless otherwise indicated, the persons or entities identified

in this table have sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable

community property laws.

| Name of Beneficial Owner and Title of Officers and Directors | |

Shares of

Common

Stock

Beneficially

Owned | | |

Percentage | |

| Ann Marie Sastry, Ph.D., President, Chief Executive Officer, and Chairman of the Board (1) | |

| 585,848 | | |

| 22.7 | % |

| Sherlyn W. Farrell, Chief Financial Officer | |

| 315 | | |

| * | |

| Kalie Wortinger (2) | |

| 4,244 | | |

| * | |

| Brandon Owens (3) | |

| 2,561 | | |

| * | |

| J. Michael Losh, Director (4) | |

| 88,821 | | |

| 3.4 | % |

| Gilbert S. Omenn, M.D., Ph.D., Director (5) | |

| 76,064 | | |

| 2.9 | % |

| Richard T. Ogawa, Director (6) | |

| 103,405 | | |

| 3.9 | % |

| Anthony M. Barkett, Director (7) | |

| 73,266 | | |

| 2.8 | % |

| Barbie Brewer, Director (8) | |

| 83,265 | | |

| 3.2 | % |

| George Parmer, Director (9) | |

| 139,676 | | |

| 5.4 | % |

| All Executive Officers and Directors as a Group (10 persons) (10) | |

| 1,157,465 | | |

| 37.9 | % |

| | |

| | | |

| | |

| Beneficial Owner Greater than 5% Stockholders | |

| | | |

| | |

| Mark Tompkins (11) | |

| 170,259 | | |

| 6.7 | % |

| (1) |

Includes (i) 542,098 shares of common stock held by Dr. Sastry and (ii) 43,750 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of May 8, 2024 held by Dr. Sastry. |

| |

|

| (2) |

Consists of 4,244 shares of common stock underlying options that are

presently exercisable or exercisable within 60 days of May 8, 2024. |

| (3) |

Consists of 2,561 shares of common stock underlying options that are

presently exercisable or exercisable within 60 days of May 8, 2024. |

| |

|

| (4) |

Includes (i) 3,472 shares of common stock held by Mr. Losh, (ii) 34,099

shares of common stock underlying options that are presently exercisable or exercisable within 60 days of May 8, 2024 and (iii) 51,250

shares of common stock underlying restricted stock units that are presently exercisable or exercisable within 60 days of May 8, 2024,

but excludes 44,871 shares of common stock underlying deferred stock units that may be issued in the Company’s discretion upon completion

of service as a member of the board of directors, or if earlier, upon a change in control. |

| |

|

| (5) |

Includes (i) 3,472 shares of common stock held by Dr. Omenn, (ii) 21,342

shares of common stock underlying options that are presently exercisable or exercisable within 60 days of May 8, 2024 and (iii) 51,250

shares of common stock underlying restricted stock units that are presently exercisable or exercisable within 60 days of May 8, 2024,

but excludes 37,134 shares of common stock underlying deferred stock units that

may be issued in the Company’s discretion upon completion of service as a member of the board of directors, or if earlier, upon

a change in control. |

| (6) |

Includes (i) 5,556 shares of common stock held by Mr. Ogawa, (ii) 46,599

shares of common stock underlying options that are presently exercisable or exercisable within 60 days of May 8, 2024 and (iii) 51,250

shares of common stock underlying restricted stock units that are presently exercisable or exercisable within 60 days of May 8, 2024,

but excludes 37,134 shares of common stock underlying deferred stock units that

may be issued in the Company’s discretion upon completion of service as a member of the board of directors, or if earlier, upon

a change in control. |

| (7) |

Includes (i) 4,167 shares of common stock held by Mr. Barkett, (ii)

17,849 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of May 8, 2024 and (iii)

51,250 shares of common stock underlying restricted stock units that are presently exercisable or exercisable within 60 days of May 8,

2024, but excludes 37,134 shares of common stock underlying deferred stock units

that may be issued in the Company’s discretion upon completion of service as a member of the board of directors, or if earlier,

upon a change in control. |

| (8) |

Includes (i) 2,083 shares of common stock held by Ms. Brewer, (ii)

29,932 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of May 8, 2024 and (iii)

51,250 shares of common stock underlying restricted stock units that are presently exercisable or exercisable within 60 days of May 8,

2024. |

| |

|

| (9) |

Includes (i) 84,167 shares of common stock held by Mr. Parmer, (ii)

4,259 shares of common stock underlying options that are presently exercisable or exercisable within 60 days of May 8, 2024 and (iii)

51,250 shares of common stock underlying restricted stock units that are presently exercisable or exercisable within 60 days of May 8,

2024, but excludes 30,238 shares of common stock underlying deferred stock units that may be issued in the Company’s discretion

upon completion of service as a member of the board of directors, or if earlier, upon a change in control. |

| |

|

| (10) |

Includes (i) 204,635 shares of common stock underlying options that

are either presently exercisable or exercisable within 60 days of May 8, 2024 and (ii) 307,500 shares of common stock underlying restricted

stock units that are presently exercisable or exercisable within 60 days of May 8, 2024. |

| |

|

| (11) |

Mr. Tompkins’s address is Apt 1, via Guidino 23, 6900 Lugano,

Paradiso, Switzerland. Mr. Tompkins has voting and dispositive authority over the shares. |

PROPOSAL 1:

APPROVAL OF AN AMENDMENT TO THE 2018 EQUITY

INCENTIVE PLAN

Summary

On May 3, 2024, our board

of directors approved an amendment to the Company’s 2018 Equity Incentive Plan (the “2018 Plan”) to increase the number

of shares available for issuance under the 2018 Plan by 508,488 shares and increase the number of shares that may be issued pursuant to

the exercise of incentive stock options by 508,488 shares. The proposed form of amendment to our 2018 Plan is attached as Appendix A to

this Proxy Statement.

The

amendment to the 2018 Plan is intended to ensure that the Company can continue to provide an incentive to employees, directors and consultants

by enabling them to share in the Company’s future growth. If approved by the stockholders, all of the additional shares will be

available for grant as incentive stock options within the meaning of Section 422 of the Internal Revenue Code of 1986, as amended

(the “Code”), or as nonqualified stock options, restricted stock awards, stock appreciation rights, or other kinds of equity

based compensation available under the 2018 Plan. If the stockholders do not approve the amendment, no shares will be added to the number

of shares available for issuance under the 2018 Plan.

Background

On April 26, 2018, the Company’s

board of directors adopted, and the Company’s stockholders approved, the 2018 Plan. The 2018 Plan is intended to align the interests

stockholders and the recipients of awards under the 2018 Plan, and to advance the Company’s interests by attracting and retaining

directors, officers, employees and other service providers and motivating them to act in our long-term best interests. The material terms

of the 2018 Plan are set forth below:

Summary of Key Terms of the Plan

Plan term. The 2018

Plan became effective on July 23, 2018 and terminates on the tenth anniversary of its effective date, unless terminated earlier by the

Company’s board of directors.

Eligible participants.

All officers, directors, employees, consultants, agents and independent contractors, and persons expected to become officers, directors,

employees, consultants, agents and independent contractors of the Company or any of its subsidiaries are eligible to receive awards under

the 2018 Plan. The Compensation Committee of the Company’s board of directors determines the participants under the 2018 Plan. As

of the Record Date, approximately nine employees (including two executive officers) and six non-employee directors would be eligible to

participate in the 2018 Plan.

Shares authorized.

As of May 15, 2024, 1,063,652 shares of common stock are authorized for issuance under the 2018 Plan. The number of available shares will

be reduced by the aggregate number of shares that become subject to outstanding awards granted under the 2018 Plan. As of the first day

of each calendar year beginning on or after January 1, 2021, the number of shares available for all awards under the 2018 Plan, other

than incentive stock options, will automatically increase by a number equal to the least of (i) five percent (5%) of the number of shares

of the Company’s common stock that are issued and outstanding as of that date, or (ii) a lesser number of shares of the Company’s

common stock as determined by the Compensation Committee. To the extent that shares of common stock subject to an outstanding award granted

under the 2018 Plan are not issued or delivered by reason of the expiration, termination, cancellation or forfeiture of such award (excluding

shares of common stock subject to an option cancelled upon settlement in shares of common stock of a related tandem share appreciation

right or shares of common stock subject to a tandem share appreciation right cancelled upon exercise of a related option) or by reason

of the settlement of an award in cash, then those shares of common stock will again be available under the 2018 Plan, other than for grants

of incentive stock options. In addition, any shares covered by an award that have been surrendered in connection with the payment of the

award exercise or purchase price or in satisfaction of tax withholding obligations incident to the grant, exercise, vesting or settlement

of an award will be deemed not to have been issued for purposes of determining the maximum number of shares of common stock which may

be issued pursuant to all awards under the 2018 Plan. If the proposed amendment to the 2018 Plan is approved, the total number of shares

of common stock issuable under the 2018 Plan would be 1,572,140.

Award types. Awards

include non-qualified and incentive stock options, stock appreciation rights, bonus shares, restricted shares, restricted share units,

performance units and cash-based awards.

Administration. The

Compensation Committee administers the 2018 Plan. The Compensation Committee’s interpretation, construction and administration of

the 2018 Plan and all of its determinations thereunder is conclusive and binding on all persons.

The Compensation Committee

has the authority to determine the participants in the 2018 Plan, the form, amount and timing of any awards, the performance goals, if

any, and all other terms and conditions pertaining to any award. The Compensation Committee may take any action such that (i) any outstanding

options and stock appreciation rights become exercisable in part or in full, (ii) all or any portion of a restriction period on any restricted

share or restricted share units will lapse, (iii) all or a portion of any performance period applicable to any performance-based award

will lapse, and (iv) any performance measures applicable to any outstanding award will be deemed satisfied at the target level or any

other level. Subject to the terms of the 2018 Plan relating to grants to our executive officers and directors, the Compensation Committee

may delegate some or all of its powers and authority to the Chief Executive Officer and President or other executive officer as the Compensation

Committee deems appropriate.

Stock options and stock

appreciation rights. The 2018 Plan provides for the grant of stock options and share appreciation rights. Stock options may be either

tax-qualified incentive stock options or non-qualified stock options. The Compensation Committee will determine the terms and conditions

to the exercisability of each option and share appreciation right.

The period for the exercise

of a non-qualified stock option or stock appreciation right will be determined by the Compensation Committee provided that no option may

be exercised later than ten years after its date of grant. The exercise price of a non-qualified stock option and the base price of a

stock appreciation right will not be less than 100% of the fair market value of a share of our common stock on the date of grant, provided

that the base price of a share appreciation right granted in tandem with an option will be the exercise price of the related option. A

stock appreciation right entitles the holder to receive upon exercise, subject to tax withholding in respect of an employee, shares of

our common stock, which may be restricted stock, with a value equal to the difference between the fair market value of our common stock

on the exercise date and the base price of the share appreciation right.

Each incentive stock option

will be exercisable for not more than 10 years after its date of grant, unless the optionee owns greater than 10% of the voting power

of all shares of our capital stock, or a “ten percent holder,” in which case the option will be exercisable for not more than

five years after its date of grant. The exercise price of an incentive stock option will not be less than the fair market value of a share

of our common stock on its date of grant, unless the optionee is a ten percent holder, in which case the option exercise price will be

the price required by the Code, currently 110% of fair market value.

Upon exercise, the option

exercise price may be paid in cash, by the delivery of previously owned shares of our common stock, share withholding or through a cashless

exercise arrangement, as permitted by the applicable award agreement. All of the terms relating to the exercise, cancellation or other

disposition of an option or stock appreciation right upon a termination of employment, whether by reason of disability, retirement, death

or any other reason, will be determined by the Compensation Committee.

The Compensation Committee,

without stockholder approval, may (i) reduce the exercise price of any previously granted option or the base appreciation amount of any

previously granted stock appreciation right, or (ii) cancel any previously granted option or stock appreciation right at a time when its

exercise price or base appreciation amount (as applicable) exceeds the fair market value of the underlying shares, in exchange for another

option, stock appreciation right or other award or for cash.

Stock awards. The 2018

Plan provides for the grant of share awards. The Compensation Committee may grant a share award as a bonus stock award, a restricted share

award or a restricted share unit award and, in the case of a restricted share award or restricted share unit award, the Compensation Committee

may determine that such award will be subject to the attainment of performance measures over an established performance period. All of

the terms relating to the satisfaction of performance measures and the termination of a restriction period, or the forfeiture and cancellation

of a stock award upon a termination of employment, whether by reason of disability, retirement, death or any other reason, will be determined

by the Compensation Committee.

The agreement awarding restricted

share units will specify whether such award may be settled in shares of our common stock, cash or a combination thereof and whether the

holder will be entitled to receive dividend equivalents, on a current or deferred basis, with respect to such award. Prior to settlement

of a restricted share unit in shares of our common stock, the holder of a restricted share unit will have no rights as our stockholder.

Unless otherwise set forth

in a restricted stock award agreement, the holder of shares of restricted stock will have rights as our stockholder, including the right

to vote and receive dividends with respect to the shares of restricted stock, except that distributions other than regular cash dividends

and regular cash dividends with respect to shares of restricted stock subject to performance-based vesting conditions will be held by

us and will be subject to the same restrictions as the restricted shares.

Performance unit awards.

The 2018 Plan provides for the grant of performance unit awards. Each performance unit is a right, contingent upon the attainment of performance

measures within a specified performance period, to receive a specified cash amount, shares of our common stock or a combination thereof

which may be restricted stock, having a fair market value equal to such cash amount. Prior to the settlement of a performance unit award

in shares of our common stock, the holder of such award will have no rights as our stockholder with respect to such shares. Performance

units will be non-transferable and subject to forfeiture if the specified performance measures are not attained during the specified performance

period. All of the terms relating to the satisfaction of performance measures and the termination of a performance period, or the forfeiture

and cancellation of a performance unit award upon a termination of employment, whether by reason of disability, retirement, death or any

other reason, will be determined by the Compensation Committee.

Cash-based awards.

The 2018 Plan also provides for the grant of cash-based awards. Each cash-based award is an award denominated in cash that may be settled

in cash and/or shares, which may be subject to restrictions, as established by the Compensation Committee.

Performance goals.

Under the 2018 Plan, the vesting or payment of performance-based awards will be subject to the satisfaction of certain performance goals.

The performance goals applicable to a particular award will be determined by the Compensation Committee at the time of grant. The performance

goals may be one or more of the following corporate-wide or subsidiary, division, operating unit or individual measures, stated in either

absolute terms or relative terms.

Individual Limits. With

respect to non-employee directors, the maximum grant date fair value of shares that may be granted to an individual non-employee director

during any fiscal year of the Company or its subsidiaries is $150,000. In connection with a non-employee director’s commencement

of service with the Company, the per person limit set forth in the previous sentence will be $150,000.

Amendment or termination

of the 2018 Plan. The Company’s board of directors may amend or terminate the 2018 Plan as it deems advisable, subject to any

requirement of stockholder approval required by law, rule or regulation; provided, however, that no such amendment may materially impair

the rights of a holder of an outstanding award without the consent of such holder.

Change of control.

In the event of a change of control, the board of directors may, in its discretion, (1) provide that (A) some or all outstanding options

and share appreciation rights will immediately become exercisable in full or in part, (B) the restriction period applicable to some or

all outstanding stock awards will lapse in full or in part, (C) the performance period applicable to some or all outstanding awards will

lapse in full or in part, and (D) the performance measures applicable to some or all outstanding awards will be deemed to be satisfied

at the target or any other level, (2) provide that some or all outstanding awards will terminate without consideration as of the date

of the change of control, (3) require that shares of stock of the corporation resulting from such change of control, or a parent corporation

thereof, be substituted for some or all of our shares subject to an outstanding award, and/or (4) require outstanding awards, in whole

or in part, to be surrendered by the holder, and to be immediately cancelled, and to provide for the holder to receive (A) a cash payment

in an amount equal to (i) in the case of an option or share appreciation right, the number of our shares then subject to the portion of

such option or share appreciation right surrendered, whether vested or unvested, multiplied by the excess, if any, of the fair market

value of a share of our common stock as of the date of the change of control, over the purchase price or base price per share of our common

stock subject to such option or stock appreciation right, (ii) in the case of a stock award, the number of shares of our common stock

then subject to the portion of such award surrendered, whether vested or unvested, multiplied by the fair market value of a share of our

common stock as of the date of the change of control, and (iii) in the case of a performance unit award, the value of the performance

units then subject to the portion of such award surrendered; (B) shares of capital stock of the corporation resulting from such change

of control, or a parent corporation thereof, having a fair market value not less than the amount determined under clause (A) above; or

(C) a combination of the payment of cash pursuant to clause (A) above and the issuance of shares pursuant to clause (B) above.

Under the 2018 Plan, a change

of control will occur upon: (i) a person’s or entity’s acquisition of beneficial ownership of 50% or more of either our then

outstanding shares or the combined voting power of our then outstanding voting securities, but excluding certain acquisitions by the company,

its subsidiaries or employee benefit plans, or by a corporation in which our stockholders hold a majority interest; (ii) a reorganization,

merger or consolidation of the company if our stockholders do not thereafter beneficially own more than 50% of the outstanding shares

or combined voting power of the resulting company, (iii) certain changes to the incumbent directors of our Company, or (iv) a complete

liquidation or dissolution of the company or of the sale or other disposition of all or substantially all of our assets; but excluding,

in any case, the initial public offering or any bona fide primary or secondary public offering following the occurrence of the initial

public offering.

U.S. Federal Income

Tax Consequences. The following is a summary of certain United States federal income tax consequences of awards under the

2018 Plan. It does not purport to be a complete description of all applicable rules, and those rules (including those summarized here)

are subject to change.

Non-Qualified Stock

Options. A participant who has been granted a non-qualified stock option will not recognize taxable income

upon the grant of a non-qualified stock option. Rather, at the time of exercise of such non-qualified stock option, the participant

will recognize ordinary income for income tax purposes in an amount equal to the excess of the fair market value of the shares of common

stock purchased over the exercise price. We generally will be entitled to a tax deduction at such time and in the same amount that the

participant recognizes ordinary income. If shares of common stock acquired upon exercise of a non-qualified stock option are later

sold or exchanged, then the difference between the amount received upon such sale or exchange and the fair market value of such shares

on the date of such exercise will generally be taxable as long-term or short-term capital gain or loss (if the shares are a

capital asset of the participant) depending upon the length of time such shares were held by the participant.

Incentive Stock Options. In

general, no taxable income is realized by a participant upon the grant of an ISO. If shares of common stock are purchased by a participant,

or option shares, pursuant to the exercise of an ISO granted under the 2018 Plan and the participant does not dispose of the option shares

within the two-year period after the date of grant or within one year after the receipt of such option shares by the participant,

such disposition a disqualifying disposition, then, generally (1) the participant will not realize ordinary income upon exercise

and (2) upon sale of such option shares, any amount realized in excess of the exercise price paid for the option shares will be taxed

to such participant as capital gain (or loss). The amount by which the fair market value of the common stock on the exercise date of an

ISO exceeds the purchase price generally will constitute an item which increases the participant’s “alternative minimum taxable

income.” If option shares acquired upon the exercise of an ISO are disposed of in a disqualifying disposition, the participant generally

would include in ordinary income in the year of disposition an amount equal to the excess of the fair market value of the option shares

at the time of exercise (or, if less, the amount realized on the disposition of the option shares), over the exercise price paid for the

option shares. Subject to certain exceptions, an option generally will not be treated as an ISO if it is exercised more than three months

following termination of employment. If an ISO is exercised at a time when it no longer qualifies as an ISO, such option will be treated

as a nonqualified stock option as discussed above. In general, we will receive an income tax deduction at the same time and in the same

amount as the participant recognizes ordinary income.

Stock Appreciation Rights. A

participant who is granted an SAR generally will not recognize ordinary income upon receipt of the SAR. Rather, at the time of exercise

of such SAR, the participant will recognize ordinary income for income tax purposes in an amount equal to the value of any cash received

and the fair market value on the date of exercise of any shares of common stock received. We generally will be entitled to a tax deduction

at such time and in the same amount, if any, that the participant recognizes as ordinary income. The participant’s tax basis in

any shares of common stock received upon exercise of an SAR will be the fair market value of the shares of common stock on the date of

exercise, and if the shares are later sold or exchanged, then the difference between the amount received upon such sale or exchange and

the fair market value of such shares on the date of exercise will generally be taxable as long-term or short-term capital gain

or loss (if the shares are a capital asset of the participant) depending upon the length of time such shares were held by the participant.

Restricted Stock. A

participant generally will not be taxed upon the grant of restricted stock, but rather will recognize ordinary income in an amount equal

to the fair market value of the shares of common stock at the earlier of the time the shares become transferable or are no longer subject

to a substantial risk of forfeiture (within the meaning of the Code). We generally will be entitled to a deduction at the time when, and

in the amount that, the participant recognizes ordinary income on account of the lapse of the restrictions. A participant’s tax

basis in the shares of common stock will equal their fair market value at the time the restrictions lapse, and the participant’s

holding period for capital gains purposes will begin at that time. Any cash dividends paid on the shares of common stock before the restrictions

lapse will be taxable to the participant as additional compensation and not as dividend income, unless the individual has made an election

under Section 83(b) of the Code. Under Section 83(b) of the Code, a participant may elect to recognize ordinary income at the

time the restricted shares are awarded in an amount equal to their fair market value at that time, notwithstanding the fact that such

stock is subject to restrictions or transfer and a substantial risk of forfeiture. If such an election is made, no additional taxable

income will be recognized by such participant at the time the restrictions lapse, the participant will have a tax basis in the shares

of common stock equal to their fair market value on the date of their award, and the participant’s holding period for capital gains

purposes will begin at that time. We generally will be entitled to a tax deduction at the time when, and to the extent that, ordinary

income is recognized by such participant.

Restricted Stock Units. In

general, the grant of restricted stock units will not result in income for the participant or in a tax deduction for us. Upon the settlement

of such an award in cash or shares of common stock, the participant will recognize ordinary income equal to the aggregate value of the

payment received, and we generally will be entitled to a tax deduction at the same time and in the same amount.

Other Awards. With

respect to other stock-based awards, generally when the participant receives payment in respect of the award, the amount of cash

and/or the fair market value of any shares of common stock or other property received will be ordinary income to the participant, and

we generally will be entitled to a tax deduction at the same time and in the same amount.

Grants Under the 2018 Plan

Options

A summary of option activity for the

years ended June 30, 2023 and 2022 is presented below:

| Options | |

Number of

Shares | | |

Weighted Average

Exercise

Price | | |

Weighted

Average

Remaining

Contractual

Term

(in years) | |

| Outstanding at July 1, 2021 | |

| 268,510 | | |

$ | 23.52 | | |

| 8.34 | |

| Granted | |

| 10,752 | | |

| 21.12 | | |

| 9.26 | |

| Terminated | |

| (15,663 | ) | |

| 36.12 | | |

| 8.69 | |

| Outstanding at June 30, 2022 | |

| 263,599 | | |

| 22.68 | | |

| 7.34 | |

| Granted | |

| - | | |

| - | | |

| - | |

| Terminated | |

| (26,558 | ) | |

| 31.20 | | |

| 7.85 | |

| Outstanding and expected to vest at June 30, 2023 | |

| 237,041 | | |

| 21.73 | | |

| 6.39 | |

The weighted-average grant-date fair value of options

granted during the year ended June 30, 2022 was $21.12. The options contained time-based vesting conditions satisfied over one to ten

years from the grant date. During the year ended June 30, 2022, the Company issued 10,752 options. During the year ended June

30, 2023 and 2022, no options were exercised, and 26,558 and 15,633 options were terminated, respectively.

A

summary of options terminated, as well as those that vested, in the nine months ended March

31, 2024 is presented below:

| Options | |

Number of

Shares | | |

Weighted Average

Exercise

Price | | |

Weighted

Average

Remaining

Contractual

Term

(in years) | |

| Outstanding at July 1, 2023 | |

| 237,041 | | |

$ | 21.73 | | |

| 6.39 | |

| Terminated | |

| (6,355 | ) | |

$ | 16.47 | | |

| 4.99 | |

| Additional vesting | |

| 2,868 | | |

$ | 28.80 | | |

| 6.85 | |

| Outstanding at March 31, 2024 | |

| 233,554 | | |

$ | 21.64 | | |

| 5.67 | |

No options were granted or exercised during the nine months ended

March 31, 2024. During the nine months ended March 31, 2024, 6,355 options were terminated.

Restricted Stock Units

As of March 31, 2024, there

were 307,500 restricted stock units outstanding.

Deferred Stock Units

As of March 31, 2024, there

were 186,511 deferred stock units outstanding.

New Plan Benefits

All 2018 Plan awards will

be granted at the Compensation Committee’s discretion, subject to the limitations described in the 2018 Plan. Therefore, the specific

benefits and amounts that will be received or allocated to certain participants under the 2018 Plan are not presently determinable. Awards

that were granted under the 2018 Plan in fiscal year 2023 to our named executive officers and non-employee directors are described elsewhere

in this Proxy Statement and other filings made by the Company with the SEC.

Interests of Officers and Directors in this

Proposal

Members of our board of directors

and our executive officers are eligible to receive awards under the terms of the 2018 Plan, including through certain outstanding employment

agreements and grants, as well as under our Director Compensation Program and they therefore have a substantial interest in Proposal 1.

Required Vote of Stockholders

The affirmative vote of a

majority of the votes cast at the Special Meeting is required to approve the amendment to the 2018 Plan.

Board Recommendation

The board of directors unanimously

recommends a vote “FOR” Proposal 1.

OTHER MATTERS

The board of directors knows

of no other business, which will be presented to the Special Meeting. If any other business is properly brought before the Special Meeting,

proxies in the enclosed form will be voted in accordance with the judgment of the persons voting the proxies.

We will bear the cost of soliciting

proxies in the accompanying form. In addition to the use of the mails, proxies may also be solicited by our directors, officers or other

employees, personally or by telephone, facsimile or email, none of whom will be compensated separately for these solicitation activities.

We have engaged Campaign Management, LLC to assist in the solicitation of proxies. We will pay a fee of approximately $6,000 plus reasonable

out-of-pocket charges to Campaign Management, LLC for such services.

If you do not plan to attend

the Special Meeting, in order that your shares may be represented and in order to assure the required quorum, please sign, date and return

your proxy promptly. In the event you are able to attend the Special Meeting virtually, at your request, we will cancel your previously

submitted proxy.

HOUSEHOLDING

The SEC has adopted rules

that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for proxy statements and other Special Meeting

materials with respect to two or more stockholders sharing the same address by delivering a proxy statement or other Special Meeting materials

addressed to those stockholders. This process, which is commonly referred to as householding, potentially provides extra convenience for

stockholders and cost savings for companies. Stockholders who participate in householding will continue to be able to access and receive

separate proxy cards.

If you share an address with

another stockholder and have received multiple copies of our proxy materials, you may write or call us at the address or phone number

below to request delivery of a single copy of the notice and, if applicable, other proxy materials in the future. We undertake to deliver

promptly upon written or oral request a separate copy of the proxy materials, as requested, to a stockholder at a shared address to which

a single copy of the proxy materials was delivered. If you hold stock as a record stockholder and prefer to receive separate copies of

our proxy materials either now or in the future, please contact us at 607 Shelby Street, Suite 700 PMB 214, Detroit, Michigan 48226, Attn:

Secretary, or by phone at (734) 876-8130. If your stock is held through a brokerage firm or bank and you prefer to receive separate

copies of our proxy materials either now or in the future, please contact your brokerage firm or bank.

| |

BY ORDER OF THE BOARD OF DIRECTORS |

| |

|

| |

/s/ Ann Marie Sastry, Ph.D. |

| |

Ann Marie Sastry, Ph.D. |

| May 15, 2024 |

Chairman of the Board of Directors |

APPENDIX A

THIRD AMENDMENT

TO

AMESITE INC.

2018 EQUITY INCENTIVE PLAN

THIS THIRD AMENDMENT TO AMESITE

INC. 2018 EQUITY INCENTIVE PLAN (this “Amendment”) of the Amesite Inc. 2018 Equity Incentive Plan (the “Plan”)

is made as of _____________, by the Board of Amesite Inc., a Delaware corporation (the “Company”) pursuant to Section

6.2 of the Plan. All terms used but not defined herein shall have the meaning set forth in the Plan.

RECITALS

WHEREAS, the Board

of Directors (the “Board”) may amend the Plan pursuant to Section 6.2 of the Plan, provided that no such action shall materially

impair the rights of a Participant under any award without such Participant’s consent (the “Amendment Conditions”);

WHEREAS, this Amendment

satisfies the Amendment Conditions; and

WHEREAS, this Amendment

has been submitted to the holders of the outstanding stock of the Company (the “Stockholders”) and such Stockholders

have approved the adoption of this Amendment.

AGREEMENT

NOW, THEREFORE, the Board hereby amends

the Plan as follows:

1. Section 1.5 of the Plan is hereby amended and restated as follows:

1.5 Shares and Cash Available. Subject

to adjustment as provided in Section 6.7 and to all other limits set forth in this Section 1.5, 1,572,140 Shares shall be available for

awards under this Plan, of such number of Shares, 1,572,140 may be issued upon the exercise of Incentive Stock Options. The number of

Shares that remain available for future grants under the Plan shall be reduced by the sum of the aggregate number of Shares which become

subject to outstanding options, outstanding Free-Standing SARs and outstanding Share Awards and delivered upon the settlement of Performance

Units. As of the first day of each calendar year beginning on or after January 1, 2021, the number of Shares available for all awards

under the Plan, other than Incentive Stock Options, shall automatically increase by a number equal to the least of (x) 5% of the number

of Shares that are issued and outstanding as of such date, or (y) a lesser number of Shares determined by the Committee. To the extent

that Shares subject to an outstanding option, SAR, Share Award or other award granted under the Plan are not issued or delivered by reason

of (i) the expiration, termination, cancellation or forfeiture of such award (excluding Shares subject to an option cancelled upon settlement

in Shares of a related tandem SAR or Shares subject to a tandem SAR cancelled upon exercise of a related option) or (ii) the settlement

of such award in cash, then such Shares shall again be available under this Plan, other than for grants of Incentive Stock Options.

To the extent not prohibited by the

listing requirements of the Nasdaq Capital Market or any other stock exchange on which Shares are then traded or applicable laws, any

Shares covered by an award which are surrendered (i) in payment of the award exercise or purchase price (including pursuant to the “net

exercise” of an option pursuant to Section 2.1(c), or the “net settlement” or “net exercise” of a Share-settled

SAR pursuant to Section 2.2(c)) or (ii) in satisfaction of tax withholding obligations incident to the grant, exercise, vesting or settlement

of an award shall be deemed not to have been issued for purposes of determining the maximum number of Shares which may be issued pursuant

to all awards under the Plan, unless otherwise determined by the Committee. Notwithstanding anything in this Section 1.5 to the contrary,

Shares subject to an award under this Plan may not be made available for issuance under this Plan if such shares are shares repurchased

on the open market with the proceeds of an option exercise.

Other than with respect to the Assumed

Options, the number of Shares for awards under this Plan shall not be reduced by (i) the number of Shares subject to Substitute Awards

or (ii) available shares under a stockholder approved plan of a company or other entity which was a party to a corporate transaction with

the Company (as appropriately adjusted to reflect such corporate transaction) which become subject to awards granted under this Plan (subject

to applicable stock exchange requirements).

Shares to be delivered under this Plan

shall be made available from authorized and unissued Shares, or authorized and issued Shares reacquired and held as treasury shares or

otherwise or a combination thereof.

2. Miscellaneous.

a. Amendments. Except

as specifically modified herein, the Plan shall remain in full force and effect in accordance with all of the terms and conditions thereof

except that the Plan is hereby amended in all other respects, if any, necessary to conform with the intent of the amendments set forth

in this Amendment. Upon the effectiveness of this Amendment, each reference in the Plan to “the Plan,” “hereunder,”

“herein” or words of similar import shall mean and be a reference to the Plan as amended by this Amendment.

b. Severability. Each

provision of this Amendment shall be considered severable and if for any reason any provision or provisions herein are determined to be

invalid, unenforceable or illegal under any existing or future law, such invalidity, unenforceability or illegality shall not impair the

operation of or affect those portions of this Amendment that are valid, enforceable and legal.

c. Governing Law. This

Amendment shall be governed in accordance with the laws of the State of Delaware.

[Signature Page Follows]

IN WITNESS WHEREOF,

the undersigned members of the Board of the Company hereby adopt this Third Amendment to Amesite Inc. 2018 Equity Incentive Plan on ___________. This Amendment may be executed in one or more counterparts, each of which shall be deemed an original for all intents and purposes,

and all of which, when taken together, shall constitute one instrument.

| |

|

| Anthony Barkett |

|

| |

|

| |

|

| Barbie Brewer |

|

| |

|

| |

|

| J. Michael Losh |

|

| |

|

| |

|

| Richard T. Ogawa |

|

| |

|

| |

|

| Gilbert S. Omenn, M.D., Ph.D. |

|

| |

|

| |

|

| George Parmer |

|

| |

|

| |

|

| Ann Marie Sastry, Ph.D. |

|

A-3

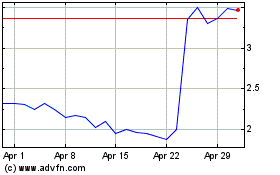

Amesite (NASDAQ:AMST)

Historical Stock Chart

From Apr 2024 to May 2024

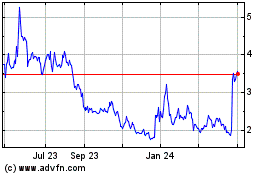

Amesite (NASDAQ:AMST)

Historical Stock Chart

From May 2023 to May 2024