- Third Quarter Operating Verticals revenues of €300.3m

- +8.5%1 year-on-year

- +1.4%1 quarter-on-quarter

- Sustained double-digit growth in Connectivity

- Nine Month Operating Verticals revenues up 3.6%1

year-on-year

- FY 2023-24 financial objectives confirmed.

Regulatory News:

Eutelsat Communications (ISIN: FR0010221234 - Euronext Paris /

London Stock Exchange: ETL) reports revenues for the Third Quarter

and Nine Months ended 31 March 2024.

In € millions

Q3 2022-23

Q3 2023-24

Change (%)

Reported

Like-for-like2

Video

169.3

160.2

-5.4

-4.9

Government Services

31.4

43.6

+38.9

+22.1

Mobile Connectivity

26.9

39.2

+45.6

+48.0

Fixed Connectivity

44.0

57.4

+30.2

+24.2

Total Operating Verticals

271.6

300.3

+10.6

+8.5

Other Revenues

0.4

0.5

+48.3

+48.2

Total

272.0

300.8

+10.6

+8.3

EUR/USD exchange rate

1.07

1.09

Note: Reported indicators include OneWeb since October

1st, 2023, and are compared to reported Eutelsat’s FY 2022-23

performance on a standalone basis.

HIGHLIGHTS

- Third Quarter and Nine-month revenues in line with

expectations.

- Video in line with overall market trend of mid-single digit

decline; base effect of nonrenewal of Digitürk contract and

Russian sanctions washed through from Q3.

- Double-digit growth in Connectivity (Government Services:

+22.1%; Mobile Connectivity: +48.0%; and Fixed Connectivity:

+24.2%), driven by incremental GEO capacity and LEO.

- All Full Year 2023-24 financial objectives confirmed.

- Successful launch of EUTELSAT 36D satellite, assuring service

continuity with optimised performance for video customers at the

36° East orbital position.

- Major $500m commercial deal with Intelsat for capacity on

OneWeb LEO constellation.

- OneWeb ground network roll-out on track.

- Refinancing of November 2025 bond completed.

THIRD QUARTER REVENUES3

Total revenues for the Third Quarter stood at €300.8 million up

10.6% on a reported basis and by 8.3% like-for-like. Revenues of

the four Operating Verticals (i.e., excluding ‘Other Revenues’)

stood at €300.3 million. They were up by 8.5% on a like-for-like

basis. Quarter-on-quarter, revenues of the four Operating Verticals

were up by 1.4% like-for-like.

Note: Unless otherwise stated, all variations indicated

hereunder are on a like-for-like basis, ie, at constant currency

and perimeter.

Video (53% of revenues)

Third Quarter Video revenues amounted to €160.2 million, down

4.9% year-on-year, in line with the broader market trend following

wash-through of the base effect of last year’s nonrenewal of the

Digitürk contract and Russian sanctions. On a quarter-on-quarter

basis revenues were down 3.9% reflecting the non-recurrence of a

one-off c.€3 million contract in Q2.

On the commercial front, Eutelsat secured several new contracts

in emerging broadcast regions, highlighting the ongoing relevance

of satellite in these markets, where sustained demand is partially

mitigating the decline in Europe. They included notably new

business on the EUTELSAT 117 West A satellite which was selected by

StarTV for the deployment of StarFlix, its new video streaming

service, and by Instituto Nacional de Radio y Televisión del Perú

which signed a multi-year capacity agreement for large-scale

content distribution to homes and IP devices across the

country.

Eutelsat also inked new business at its 7/8° West orbital

position with Télédiffusion d’Algérie which increased capacity on

the EUTELSAT 7 West A satellite to consolidate its TV and radio

channels on the country’s leading video neighbourhood. Finally, iKO

Media Group is leveraging capacity at the 16° East, 13° East, and

7/8° West orbital positions to bring its new eSports TV package,

eCLUTCH, to screens across Europe, the Middle East and Africa.

On the operational front, Eutelsat celebrated the successful

launch and deployment of its EUTELSAT 36D satellite, set to replace

EUTELSAT 36B, at the 36° East orbital position, assuring service

continuity with optimised performance for customers over its

footprint.

Fixed Connectivity (19% of revenues)

Third Quarter Fixed Broadband revenues stood at €57.4 million,

up 24.2% year-on-year on a like-for-like basis. They mainly

reflected the entry into service of KONNECT VHTS, as well as

contribution from OneWeb. Quarter-on-quarter, revenues were up by

6.7%.

On the commercial front OneWeb is gaining traction with the

activation of contracts where the service is now fully operational,

notably in South Africa where Q-KON, a leading satellite

engineering enterprise, is leveraging the constellation to deliver

digital banking services in the region, while NEC XON, a leading

African integrator of ICT solutions and part of Japan’s NEC Group,

has signed a multi-year, multimillion-dollar deal for connectivity

capacity to integrate into its suite of systems, providing secure

connectivity for enterprise customers in areas that lack

terrestrial connectivity - especially in agriculture, mining, oil

& gas and fibre back-up.

Government Services (15% of revenues)

Third Quarter Government Services revenues stood at €43.6

million, up 22.1% year-on-year. They were boosted by the

contribution of the EGNOS GEO-4 contract on HOTBIRD 13G4 from June

2023; they also embark the carry-forward effect of the Fall 2023 US

Department of Defence rate of above 80%.

Quarter-on-quarter, revenues were up by 7.2%.

The Spring 2024 renewal campaign with US Department of Defence

confirmed the improved trend of Fall 2023, with a renewal rate once

again above 80%.

Mobile Connectivity (13% of revenues)

Third Quarter Mobile Connectivity revenues stood at €39.2

million, up 48.0% year-on-year. They reflected the entry into

service of the high-throughput satellite, EUTELSAT 10B and OneWeb

growth. Quarter-on-quarter, revenues were up +11.9% underpinned by

ramp-up on OneWeb.

On the commercial front, Eutelsat extended its partnership with

Universal Satcom, the Dubai-based satellite communication system

integrator with a new multi-year capacity deal enabling Universal

Satcom to leverage Eutelsat’s geostationary ADVANCE maritime

packaged solutions in Ku-band to extend its coverage in MENA and

globally. Elsewhere, Australia’s Sat One, is leveraging the OneWeb

LEO constellation for the first-time activation of land-based

services across Australia’s remote northern and southern regions,

maritime services in Australian waters, and commercial service in

New Zealand.

Other Revenues

‘Other Revenues’ amounted to €0.5 million in the Third Quarter

versus €0.4million a year earlier and €0.1 million in the Second

Quarter. They included a negative (€1.1) million impact from

hedging operations compared to a negative impact of (€1.8) million

last year and a negative impact of (€1.6) million in the Second

Quarter.

BACKLOG

The backlog stood at €3.9 billion as of 31 March 2024 versus

€3.5 billion a year ago, and €3.9 billion at end-December 2023,

reflecting its natural erosion, especially in the Video segment, in

the absence of major renewals, offset by the contribution of

OneWeb.

It was equivalent to 3.4 times 2022-23 revenues, with Video

representing 44%.

31 March 2023

31 Dec. 2023

31 March 2024

Value of contracts (€ billions)

3.5

3.9

3.9

Value in years of revenues based on

previous year

3.1

3.5

3.4

Share of Video application (%)

61

46

44

Note: The backlog represents future revenues from

capacity or service agreements and can include contracts for

satellites under procurement. Managed services are not included in

the backlog.

NINE MONTH REVENUES

Revenues for the first Nine Months of FY 2023-24 stood at €873.5

million, up by 3.3% on a reported basis and by 3.4% at constant

currency and perimeter, underpinned by Eutelsat GEO business and

inclusion of OneWeb LEO business in the Second Quarter.

Revenues of the four Operating Verticals (excluding ‘Other

Revenues’) up 3.6% on a like-for-like basis excluding a negative

currency effect of -€20.9m.

In € millions

9m 2022-23

9m 2023-24

Change (%)

Reported

Like-for-like5

Video

535.3

491.4

-8.2

-7.0

Government Services

98.2

118.2

+20.3

+14.7

Mobile Connectivity

82.8

109.9

+32.7

+39.1

Fixed Connectivity

137.2

151.9

+10.7

+14.2

Total Operating Verticals

853.5

871.4

+2.1

+3.6

Other Revenues

-7.8

2.1

n.a

n.a

Total

845.8

873.5

+3.3

+3.4

EUR/USD exchange rate

1.03

1.08

OUTLOOK6

On the back of the performance of the first Nine Months, we

confirm our objectives7 for the Full Year 2023-24 of Operating

Vertical Revenues of between 1.25-1.30 billion euros and adjusted

EBITDA is expected in a range of €650m to €680m.

Elsewhere, cash capex8 for FY 2024 remains expected in a range

between €600m and €650m after synergies; for the period FY 2025 to

FY 2030, cash capex is expected between €600m to €700m on average

per annum.

We also continue to target leverage of c.3x in the medium

term.

++ENDS++

Third Quarter 2023-24 revenues conference call &

webcast

A conference call and webcast will be held on Tuesday, 14 May

2024 at 6:30pm CET

Click here to access the webcast

presentation.

It is not necessary to dial into the audio conference unless you

are unable to join the webcast URL

If needed, please dial:

+33 (0)1 7037 7166 (from France) +44 (0)33 0551

0200 (from the UK) +1 786 697 3501 (from the US)

Quote “Eutelsat” to the operator when connecting to the call.

Replay will be available on same link.

Financial calendar The financial calendar is provided for

information purposes only. It is subject to change and will be

regularly updated.

2 August 2024: Full Year 2023-24 results

About Eutelsat Communications Eutelsat Group is a global

leader in satellite communications, delivering connectivity and

broadcast services worldwide. The Group was formed through the

combination of Eutelsat and OneWeb in 2023, becoming the first

fully integrated GEO-LEO satellite operator with a fleet of 36

geostationary (GEO) satellites and a Low Earth Orbit (LEO)

constellation of more than 600 satellites. The Group addresses the

needs of customers in four key verticals of Video, where it

distributes more than 6,500 television channels, and the

high-growth connectivity markets of Mobile Connectivity, Fixed

Connectivity, and Government Services. Eutelsat Group’s unique

suite of in-orbit assets and on-ground infrastructure enables it to

deliver integrated solutions to meet the needs of global customers.

The Company is headquartered in Paris and Eutelsat Group employs

more than 1,700 people from more than 50 countries. The Group is

committed to delivering safe, resilient, and environmentally

sustainable connectivity to help bridge the digital divide. The

Company is listed on the Euronext Paris Stock Exchange (ticker:

ETL) and the London Stock Exchange (ticker: ETL).

Find out more at www.eutelsat.com

Disclaimer

The forward-looking statements included herein are for

illustrative purposes only and are based on management’s views and

assumptions as of the date of this document.

Such forward-looking statements involve known and unknown risks.

For illustrative purposes only, such risks include but are not

limited to: risks related to the health crisis; operational risks

related to satellite failures or impaired satellite performance, or

failure to roll out the deployment plan as planned and within the

expected timeframe; risks related to the trend in the satellite

telecommunications market resulting from increased competition or

technological changes affecting the market; risks related to the

international dimension of the Group's customers and activities;

risks related to the adoption of international rules on frequency

coordination and financial risks related, inter alia, to the

financial guarantee granted to the Intergovernmental Organization's

closed pension fund, and foreign exchange risk.

Eutelsat Communications expressly disclaims any obligation or

undertaking to update or revise any projections, forecasts or

estimates contained in this document to reflect any change in

events, conditions, assumptions or circumstances on which any such

statements are based, unless so required by applicable law.

The information contained in this document is not based on

historical fact and should not be construed as a guarantee that the

facts or data mentioned will occur. This information is based on

data, assumptions and estimates that the Group considers as

reasonable.

APPENDIX

Quarterly Reported revenues for FY 2022-23 and FY

2023-24

In € millions

Q1

Q2

Q3

Q4

FY

Q1

Q2

Q3

2022-23

2022-23

2022-23

2022-23

2022-23

2023-24

2023-24

2023-24

Video

183.5

182.4

169.3

169.5

704.8

163.5

167.6

160.2

Government Services

34.7

32.2

31.4

45.1

143.4

33.5

40.7

43.6

Mobile Connectivity

25.9

30.0

26.9

27.3

110.1

35.2

36.0

39.2

Fixed Connectivity

46.4

46.8

44.0

40.6

177.8

40.2

54.3

57.4

Total Operating Verticals

290.5

291.4

271.6

282.6

1,136.1

272.5

298.6

300.3

Other Revenues

-3.1

-5.0

0.4

3.0

-4.8

1.5

0.1

0.5

Total

287.4

286.4

272.0

285.5

1,131.3

274.0

298.7

300.8

1 Like-for-like change. 2 Change at constant currency and

perimeter. The variation is calculated as follows: i) Q3 2023-24

USD revenues are converted at Q3 2022-23 rates; ii) the

contribution of the BigBlu retail broadband operations from 1st

January 2023 to 31 March 2023 is excluded from Q3 2022-23 revenues

iii) Q3 2022-23 revenues are restated to take into account the

contribution of OneWeb as if the operation had been completed from

July 1st 2022; iv) Hedging revenues are excluded. 3 The share of

each application as a percentage of total revenues is calculated

excluding “Other Revenues”. 4 Generating €100m over 15 years. 5

Change at constant currency and perimeter. The variation is

calculated as follows: i) 9-months 2023-24 USD revenues are

converted at 9-months 2022-23 rates; ii) the contribution of the

BigBlu retail broadband operations from 1st July 2022 to 31 March

2023 is excluded from 9-months 2022-23 revenues iii) 9-months

2022-23 revenues are restated to take into account the contribution

of OneWeb as if the operation had been completed from July 1st

2022; iv) Hedging revenues are excluded. 6 Outlook based on the

deployment plan outlined in the Third Quarter 2023-2024 revenue

presentation. It assumes no further material deterioration of

revenues generated from Russian customers. 7 Based on a EUR/USD

rate of 1.00 8 Based on nominal deployment plan for the GEO fleet

and LEO constellation; excluding uncommitted projects.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240514945076/en/

Media enquiries Joanna Darlington Tel. +33 674 521 531

jdarlington@eutelsat.com

Anita Baltagi Tel. +33 643 930 178 abaltagi@eutelsat.com

Katie Dowd Tel. +1 202 271 2209 kdowd@oneweb.net

Investors Joanna Darlington Tel. +33 674 521 531

jdarlington@eutelsat.com

Hugo Laurens-Berge Tel. +33 670 80 95 58

hlaurensberge@eutelsat.com

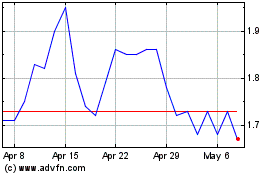

E3 Lithium (TSXV:ETL)

Historical Stock Chart

From Apr 2024 to May 2024

E3 Lithium (TSXV:ETL)

Historical Stock Chart

From May 2023 to May 2024