false

0001534708

0001534708

2024-05-13

2024-05-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): May 13, 2024

EASTSIDE

DISTILLING, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-38182 |

|

20-3937596 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

2321

NE Argyle Street, Unit D

Portland,

Oregon 97211

(Address

of principal executive offices)

(Zip

Code)

Registrant’s

telephone number, including area code: (971) 888-4264

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Common

Stock, $0.0001 par value |

|

EAST |

|

The

Nasdaq Stock Market LLC |

| (Title

of Each Class) |

|

(Trading

Symbol) |

|

(Name

of Each Exchange on Which Registered) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (CFR §230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (CFR §240.12b-2 of this chapter). Emerging growth company

☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02 Results of Operations and Financial Condition.

On

May 13, 2024, Eastside Distilling, Inc. (the “Company”) issued a press release announcing financial results for the first

quarter ended March 31, 2024. The text of the press release is furnished as Exhibit 99.1 to this current report.

The

information in this Item 2.02 and Exhibit 99.1 hereto shall not be deemed “filed” for the purposes of or otherwise subject

to the liabilities under Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Unless expressly

incorporated into a filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, the information contained

in this Item 2.02 and Exhibit 99.1 hereto shall not be incorporated by reference into any Company filing, whether made before or after

the date hereof, regardless of any general incorporation language in such filing.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

May 13, 2024

| |

EASTSIDE

DISTILLING, INC. |

| |

|

|

| |

By: |

/s/

Geoffrey Gwin |

| |

|

Geoffrey

Gwin |

| |

|

Chief

Executive Officer and Chief Financial Officer |

Exhibit

99.1

Eastside

Distilling Reports First Quarter 2024 Financial Results

Company

to Host Conference Call at 5:00 pm ET Monday May 13, 2024

PORTLAND,

Oregon, May 13, 2024 /PRNewswire/ — Eastside Distilling, Inc. (NASDAQ: EAST) (“Eastside” or the “Company”),

a consumer-focused beverage company that builds craft inspired experiential brands and high-quality artisanal products around premium

spirits, digital can printing, co-packing and mobile filling, reported first quarter financial results for the period ended March 31,

2024.

First

Quarter 2024 Highlights:

| |

● |

Craft

digitally printed a quarter-record 4.8 million cans representing a +320% increase over the prior year |

| |

|

|

| |

● |

Both operating segments made improvements in the

quarter over the prior year excluding barrel sales at Spirits |

| |

|

|

| |

● |

Company

decreased operating costs over $0.6 million |

Financial

Results

Gross

sales for the three months ending March 31, 2024 decreased to $2.5 million from $2.9 million for the three months ending March 31, 2023.

Higher digital printing sales were offset by lower mobile canning and spirits sales. Spirits sales fell due primarily to the Company’s

bulk sale of 250 barrels for gross proceeds of $0.6 million during the three months ended March 31, 2023.

Gross

profit for the three months ending March 31, 2024 decreased to $0.2 million from $0.6 million for the three months ending March 31, 2023.

Consolidated gross margin was 8% and 22% for the three months ending March 31, 2024 and 2023, respectively. Craft C+P gross margin

increased due to higher printed can volumes. Spirits gross margin decreased due to gross profit of $0.5 million from bulk sales

of barrels during the three months ended March 31, 2023.

Operating

costs for the three months ending March 31, 2024 decreased to $0.2 million from $0.6 million for the three months ending March 31, 2023

primarily due to decreased headcount and lower professional fees and sponsorship costs. The Company continues its broad restructuring

in spirits as it realigns investment focusing on the most profitable spirits brands and regions.

Net

loss for the three months ending March 31, 2024 decreased to $1.3 million from $1.6 million for the three months ending March 31, 2023.

The Company reported improved EBITDA of $(0.7) million and $(0.9) million for the three months ending March 31,

2024 and 2023, respectively. Craft’s EBITDA loss improved to $(0.3) million. Spirits reported EBITDA of $(0.1) million in the quarter.

(See description of EBITDA in “Use of Non-GAAP Measures” below.)

The

Company will give further updates on its earnings conference call.

Use

of Non-GAAP Measures

Eastside

Distilling’s management evaluates and makes operating decisions using various financial metrics. In addition to the Company’s

GAAP results, management also considers the non-GAAP measure of adjusted EBITDA as a supplement to GAAP results. Management believes

this non-GAAP measure provides useful information about the Company’s operating results and assists investors in comparing the

Company’s performance across reporting periods on a consistent basis by excluding items that it does not believe are indicative

of its core operating performance.

The

Company defines adjusted EBITDA as earnings before interest, taxes, depreciation and amortization, stock-based compensation, and other

one-time items. The final table below provides a reconciliation of this non-GAAP financial measure with the most directly comparable

GAAP financial measure.

First

Quarter 2024 Conference Call Details

Date

and Time: Monday, May 13, 2024 at 5:00 pm ET

Call-in

Information: Interested parties can access the conference call by dialing (844) 889-4332 or (412) 717-9595.

Live

Webcast Information: Interested parties can access the conference call via a live Internet webcast, which is available in the Conference

Calls section of the Company’s website at https://www.eastsidedistilling.com/conference-calls.

Replay:

A teleconference replay of the call will be available for three days at (877) 344-7529 or (412) 317-0088, replay access code #10189029.

A webcast replay will be available in the Conference Calls section of the Company’s website at https://www.eastsidedistilling.com/conference-calls

for 90 days.

About

Eastside Distilling

Eastside

Distilling, Inc. (NASDAQ: EAST) has been producing high-quality, award-winning craft spirits in Portland, Oregon since 2008. The Company

is distinguished by its highly decorated product lineup that includes Azuñia Tequilas®, Burnside Whiskeys®, Hue-Hue Coffee

Rum®, and Portland Potato Vodkas®. All Eastside spirits are crafted from natural ingredients for highest quality and taste. Eastside’s

Craft Canning + Printing subsidiary is one of the Northwest’s leading independent mobile canning, co-packing and digital can printing

businesses.

Important

Cautions Regarding Forward-Looking Statements

Certain

matters discussed in this press release may be forward-looking statements that reflect our expectations or anticipations rather than

historical fact. Such matters involve risks and uncertainties that may cause actual results to differ materially, including the following:

changes in economic conditions, general competitive factors, the Company’s ongoing financing requirements and ability to achieve

financing, acceptance of the Company’s products in the market, the Company’s success in obtaining new customers, the Company’s

ability to execute its business model and strategic plans, and other risks and related information described from time to time in the

Company’s filings with the Securities and Exchange Commission (“SEC”). A detailed discussion of the most significant

risks can be found in the “Risk Factors” section of the Company’s Annual Report on Form 10-K. The Company assumes no

obligation to update the cautionary information in this press release.

Financial

Summary Tables

The

following financial information should be read in conjunction with the audited financial statements and accompanying notes filed by the

Company with the Securities and Exchange Commission on Form 10-K for the period ended December 31, 2023, which can be viewed at www.sec.gov

and in the investor relations section of the Company’s website at www.eastsidedistilling.com/investors.

Eastside

Distilling, Inc. and Subsidiaries

Consolidated

Balance Sheets

March

31, 2024 and December 31, 2023

Dollars

in thousands, except share and per share

| | |

March

31, 2024 | | |

December

31, 2023 | |

| | |

(unaudited) | | |

| | |

| Assets | |

| | | |

| | |

| Current

assets: | |

| | | |

| | |

| Cash | |

$ | 336 | | |

$ | 403 | |

| Trade

receivables, net | |

| 673 | | |

| 559 | |

| Inventories | |

| 3,189 | | |

| 3,212 | |

| Prepaid

expenses and other current assets | |

| 498 | | |

| 363 | |

| Total

current assets | |

| 4,696 | | |

| 4,537 | |

| Property

and equipment, net | |

| 4,571 | | |

| 4,768 | |

| Right-of-use

assets | |

| 2,388 | | |

| 2,602 | |

| Intangible

assets, net | |

| 4,902 | | |

| 5,005 | |

| Other

assets, net | |

| 465 | | |

| 568 | |

| Total

Assets | |

$ | 17,022 | | |

$ | 17,480 | |

| | |

| | | |

| | |

| Liabilities

and Stockholders’ Equity (Deficit) | |

| | | |

| | |

| Current

liabilities: | |

| | | |

| | |

| Accounts

payable | |

$ | 2,392 | | |

$ | 2,076 | |

| Accrued

liabilities | |

| 739 | | |

| 575 | |

| Deferred

revenue | |

| 66 | | |

| 88 | |

| Current

portion of secured credit facilities, related party | |

| 2,680 | | |

| - | |

| Current

portion of secured credit facilities, net of debt issuance costs | |

| 364 | | |

| - | |

| Current

portion of notes payable | |

| 8,079 | | |

| 486 | |

| Current

portion of notes payable, related party | |

| 92 | | |

| 92 | |

| Current

portion of lease liabilities | |

| 903 | | |

| 888 | |

| Other

current liability, related party | |

| 587 | | |

| - | |

| Total

current liabilities | |

| 15,902 | | |

| 4,205 | |

| Lease

liabilities, net of current portion | |

| 1,596 | | |

| 1,824 | |

| Secured

credit facilities, related party | |

| - | | |

| 2,700 | |

| Secured

credit facilities, net of debt issuance costs | |

| - | | |

| 342 | |

| Notes

payable, net of current portion | |

| - | | |

| 7,556 | |

| Total

liabilities | |

| 17,498 | | |

| 16,627 | |

| | |

| | | |

| | |

| Stockholders’

equity (deficit): | |

| | | |

| | |

| Common

stock, $0.0001 par value; 6,000,000 shares authorized as of March 31, 2024 and December 31, 2023; and 1,707,751 shares and 1,705,987

shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | |

| - | | |

| - | |

| Preferred

stock, $0.0001 par value; 100,000,000 shares authorized; 2,500,000 Series B shares issued and outstanding as of both March 31, 2024

and December 31, 2023 | |

| - | | |

| - | |

| Preferred

stock, $0.0001 par value; 240,000 shares authorized; 200,000 Series C shares issued and outstanding as of both March 31, 2024 and

December 31, 2023 | |

| - | | |

| - | |

| Additional

paid-in capital | |

| 83,561 | | |

| 83,559 | |

| Accumulated

deficit | |

| (84,037 | ) | |

| (82,706 | ) |

| Total

stockholders’ equity (deficit) | |

| (476 | ) | |

| 853 | |

| Total

Liabilities and Stockholders’ Equity (Deficit) | |

$ | 17,022 | | |

$ | 17,480 | |

Eastside

Distilling, Inc. and Subsidiaries

For

the Three Months Ended March 31, 2024 and 2023

(Dollars

and shares in thousands, except per share amounts)

(Unaudited)

Consolidated

Statements of Operations:

| | |

2024 | | |

2023 | |

| | |

| | |

| |

| Sales | |

$ | 2,487 | | |

$ | 2,879 | |

| Less customer programs and excise taxes | |

| 76 | | |

| 26 | |

| Net sales | |

| 2,411 | | |

| 2,853 | |

| Cost of sales | |

| 2,225 | | |

| 2,212 | |

| Gross profit | |

| 186 | | |

| 641 | |

| Operating expenses: | |

| | | |

| | |

| Sales and marketing expenses | |

| 251 | | |

| 511 | |

| General and administrative expenses | |

| 1,105 | | |

| 1,364 | |

| (Gain) loss on disposal of property and equipment | |

| (120 | ) | |

| 6 | |

| Total operating expenses | |

| 1,236 | | |

| 1,881 | |

| Loss from operations | |

| (1,050 | ) | |

| (1,240 | ) |

| Other income (expense), net | |

| | | |

| | |

| Interest expense | |

| (248 | ) | |

| (329 | ) |

| Other income (expense) | |

| 5 | | |

| (29 | ) |

| Total other expense, net | |

| (243 | ) | |

| (358 | ) |

| Loss before income taxes | |

| (1,293 | ) | |

| (1,598 | ) |

| Provision for income taxes | |

| - | | |

| - | |

| Net loss | |

| (1,293 | ) | |

| (1,598 | ) |

| Preferred stock dividends | |

| (38 | ) | |

| (38 | ) |

| Net loss attributable to common shareholders | |

$ | (1,331 | ) | |

$ | (1,636 | ) |

| | |

| | | |

| | |

| Basic and diluted net loss per common share | |

$ | (0.78 | ) | |

$ | (2.00 | ) |

| Basic and diluted weighted average common shares outstanding | |

| 1,706 | | |

| 824 | |

Eastside

Distilling, Inc. and Subsidiaries

For

the Three Months Ended March 31, 2024 and 2023

(Dollars

in thousands)

(Unaudited)

Segments:

| (Dollars in thousands) | |

2024 | | |

2023 | |

| Craft C+P | |

| | | |

| | |

| Sales | |

$ | 1,849 | | |

$ | 1,456 | |

| Net sales | |

| 1,814 | | |

| 1,477 | |

| Cost of sales | |

| 1,765 | | |

| 1,578 | |

| Gross profit | |

| 49 | | |

| (101 | ) |

| Total operating expenses | |

| 638 | | |

| 749 | |

| Net loss | |

| (590 | ) | |

| (884 | ) |

| Gross margin | |

| 3 | % | |

| -7 | % |

| | |

| | | |

| | |

| Interest expense | |

$ | - | | |

$ | 4 | |

| Depreciation and amortization | |

| 270 | | |

| 368 | |

| Significant noncash items: | |

| | | |

| | |

| (Gain) loss on disposal of property and equipment | |

| (120 | ) | |

| 6 | |

| | |

| | | |

| | |

| Spirits | |

| | | |

| | |

| Sales | |

$ | 638 | | |

$ | 1,423 | |

| Net sales | |

| 597 | | |

| 1,376 | |

| Cost of sales | |

| 460 | | |

| 634 | |

| Gross profit | |

| 137 | | |

| 742 | |

| Total operating expenses | |

| 234 | | |

| 522 | |

| Net income (loss) | |

| (92 | ) | |

| 221 | |

| Gross margin | |

| 23 | % | |

| 54 | % |

| | |

| | | |

| | |

| Depreciation and amortization | |

$ | 36 | | |

$ | 39 | |

| | |

| | | |

| | |

| Corporate | |

| | | |

| | |

| Total operating expenses | |

$ | 364 | | |

$ | 610 | |

| Net loss | |

| (611 | ) | |

| (935 | ) |

| | |

| | | |

| | |

| Interest expense | |

$ | 248 | | |

$ | 325 | |

| | |

| | | |

| | |

| Significant noncash items: | |

| | | |

| | |

| Stock compensation | |

| 67 | | |

| 111 | |

Adjusted

EBITDA Reconciliation:

| | |

Three Months Ended March 31, | |

| | |

2024 | | |

2023 | |

| Net loss | |

$ | (1,293 | ) | |

$ | (1,598 | ) |

| Add: | |

| | | |

| | |

| Interest expense | |

| 248 | | |

| 329 | |

| Depreciation and amortization | |

| 306 | | |

| 407 | |

| EBITDA | |

| (739 | ) | |

| (862 | ) |

| (Gain) loss on disposal of property and equipment | |

| (120 | ) | |

| 6 | |

| Stock compensation | |

| 67 | | |

| 111 | |

| Adjusted EBITDA | |

$ | (792 | ) | |

$ | (745 | ) |

INVESTOR

RELATIONS CONTACT: ir@eastsidedistilling.com

This

information is being distributed to you by: Eastside Distilling, Inc.

2321

NE Argyle Street, Unit D, Portland, Oregon 97211

v3.24.1.1.u2

Cover

|

May 13, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 13, 2024

|

| Entity File Number |

001-38182

|

| Entity Registrant Name |

EASTSIDE

DISTILLING, INC.

|

| Entity Central Index Key |

0001534708

|

| Entity Tax Identification Number |

20-3937596

|

| Entity Incorporation, State or Country Code |

NV

|

| Entity Address, Address Line One |

2321

NE Argyle Street

|

| Entity Address, Address Line Two |

Unit D

|

| Entity Address, City or Town |

Portland

|

| Entity Address, State or Province |

OR

|

| Entity Address, Postal Zip Code |

97211

|

| City Area Code |

(971)

|

| Local Phone Number |

888-4264

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Trading Symbol |

EAST

|

| Security Exchange Name |

NASDAQ

|

| Title of 12(g) Security |

Common

Stock, $0.0001 par value

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(g) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection g

| Name: |

dei_Security12gTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

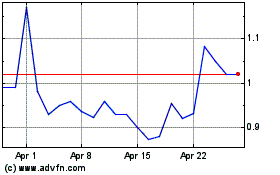

Eastside Distilling (NASDAQ:EAST)

Historical Stock Chart

From Apr 2024 to May 2024

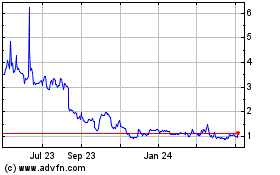

Eastside Distilling (NASDAQ:EAST)

Historical Stock Chart

From May 2023 to May 2024