false--12-31Q100000059810000005981us-gaap:FurnitureAndFixturesMember2023-12-310000005981us-gaap:RetainedEarningsMember2024-03-310000005981us-gaap:CommonStockMember2024-03-310000005981us-gaap:MachineryAndEquipmentMember2023-12-310000005981avd:CleanSeedCapitalGroupLtdMember2020-04-012020-04-010000005981avd:CreditAgreementMembersrt:MaximumMemberavd:SeniorSecuredRevolvingLineOfCreditMember2024-01-012024-03-310000005981avd:CropMembercountry:US2023-01-012023-03-310000005981us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-3100000059812023-03-3100000059812024-03-310000005981avd:LesEnterprisesPitreIncMember2022-02-112022-02-110000005981us-gaap:LandMember2024-03-310000005981us-gaap:RetainedEarningsMember2023-01-012023-03-310000005981us-gaap:TreasuryStockCommonMember2022-12-310000005981avd:CreditAgreementMemberavd:SeniorSecuredRevolvingLineOfCreditMembersrt:MinimumMember2024-01-012024-03-310000005981us-gaap:CommonStockMember2023-01-012023-03-310000005981avd:CleanSeedCapitalGroupLtdMember2024-03-3100000059812022-01-012022-12-310000005981country:US2023-01-012023-03-310000005981avd:CreditAgreementMemberavd:SeniorSecuredRevolvingLineOfCreditMember2023-12-310000005981us-gaap:AccumulatedTranslationAdjustmentMember2023-03-310000005981us-gaap:AdditionalPaidInCapitalMember2023-12-310000005981us-gaap:NonUsMember2023-01-012023-03-310000005981us-gaap:TreasuryStockCommonMember2023-12-310000005981us-gaap:AccumulatedTranslationAdjustmentMember2023-12-3100000059812024-01-012024-03-310000005981us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310000005981us-gaap:NonUsMember2024-01-012024-03-310000005981avd:BiPaMember2024-01-012024-03-310000005981avd:SeniorSecuredRevolvingLineOfCreditMemberus-gaap:FederalFundsEffectiveSwapRateMember2024-01-012024-03-310000005981avd:SeniorSecuredRevolvingLineOfCreditMembersrt:MinimumMember2024-01-012024-03-310000005981avd:IncentiveStockOptionsMember2024-03-310000005981us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000005981us-gaap:AdditionalPaidInCapitalMember2022-12-310000005981avd:AutomotiveMember2024-03-3100000059812023-01-012023-12-310000005981avd:CleanSeedCapitalGroupLtdMember2020-04-010000005981avd:NonCropMembercountry:US2023-01-012023-03-310000005981avd:SeniorSecuredRevolvingLineOfCreditMember2024-03-310000005981avd:CleanSeedCapitalGroupLtdMember2023-12-310000005981avd:CleanSeedCapitalGroupLtdMember2023-01-012023-03-310000005981avd:TimeBasedIncentiveStockOptionMember2024-01-012024-03-310000005981us-gaap:TreasuryStockCommonMember2023-03-310000005981country:US2024-01-012024-03-310000005981avd:SeniorSecuredRevolvingLineOfCreditMember2024-01-012024-03-310000005981us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-03-310000005981us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-03-310000005981us-gaap:RestrictedStockUnitsRSUMember2024-03-310000005981avd:BiPaMember2023-01-012023-03-310000005981us-gaap:RetainedEarningsMember2024-01-012024-03-310000005981us-gaap:CommonStockMember2022-03-082022-03-080000005981us-gaap:BaseRateMemberavd:SeniorSecuredRevolvingLineOfCreditMember2024-01-012024-03-310000005981us-gaap:AccumulatedTranslationAdjustmentMember2024-03-310000005981us-gaap:RetainedEarningsMember2023-03-310000005981avd:TimeBasedIncentiveStockOptionMember2023-12-310000005981us-gaap:BuildingAndBuildingImprovementsMember2024-03-310000005981avd:TermLoanMemberavd:SeniorSecuredRevolvingLineOfCreditMember2024-03-310000005981us-gaap:CommonStockMember2023-12-310000005981us-gaap:BuildingAndBuildingImprovementsMember2023-12-310000005981avd:BiPaMember2023-03-310000005981us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000005981us-gaap:FurnitureAndFixturesMember2024-03-310000005981avd:RestrictedAndUnrestrictedStockMember2024-03-310000005981us-gaap:ConstructionInProgressMember2024-03-310000005981avd:SeniorSecuredRevolvingLineOfCreditMemberavd:AmendmentCreditAgreementMembersrt:MinimumMember2024-01-012024-03-310000005981avd:LiborMember2024-01-012024-03-310000005981srt:MaximumMember2024-03-3100000059812023-01-012023-03-310000005981us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-3100000059812022-12-310000005981us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310000005981us-gaap:LandMember2023-12-310000005981avd:TimeBasedIncentiveStockOptionMember2023-01-012023-12-310000005981us-gaap:TreasuryStockCommonMember2024-03-310000005981avd:CleanSeedCapitalGroupLtdMember2024-01-012024-03-310000005981us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-3100000059812024-04-290000005981avd:LiborMemberavd:SeniorSecuredRevolvingLineOfCreditMember2024-01-012024-03-310000005981avd:TimeBasedIncentiveStockOptionMember2024-03-310000005981avd:AutomotiveMember2023-12-310000005981us-gaap:TreasuryStockCommonMember2023-01-012023-03-310000005981us-gaap:AdditionalPaidInCapitalMember2023-03-310000005981us-gaap:ConstructionInProgressMember2023-12-310000005981avd:BiPaMember2023-12-310000005981us-gaap:CommonStockMember2022-03-080000005981us-gaap:CommonStockMember2024-01-012024-03-310000005981us-gaap:RetainedEarningsMember2023-12-310000005981srt:MaximumMemberavd:SeniorSecuredRevolvingLineOfCreditMember2024-01-012024-03-310000005981avd:BiPaMember2024-03-310000005981srt:MaximumMemberavd:SeniorSecuredRevolvingLineOfCreditMemberavd:AmendmentCreditAgreementMember2024-01-012024-03-310000005981avd:AmendmentCreditAgreementMember2024-01-012024-03-310000005981avd:IncentiveStockOptionsMember2024-01-012024-03-310000005981us-gaap:RetainedEarningsMember2022-12-310000005981us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-03-3100000059812023-12-310000005981srt:MinimumMember2024-03-310000005981us-gaap:CommonStockMember2023-03-310000005981avd:CropMembercountry:US2024-01-012024-03-310000005981avd:RestrictedAndUnrestrictedStockMember2024-01-012024-03-310000005981us-gaap:AdditionalPaidInCapitalMember2024-03-310000005981avd:CreditAgreementMemberavd:SeniorSecuredRevolvingLineOfCreditMember2024-01-012024-03-310000005981srt:MaximumMemberavd:SeniorSecuredRevolvingLineOfCreditMember2024-03-310000005981us-gaap:CommonStockMember2022-12-310000005981us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000005981avd:CreditAgreementMembersrt:MaximumMemberavd:SeniorSecuredRevolvingLineOfCreditMember2024-03-310000005981avd:RestrictedAndUnrestrictedStockMember2023-12-310000005981avd:NonCropMembercountry:US2024-01-012024-03-310000005981us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310000005981us-gaap:MachineryAndEquipmentMember2024-03-31xbrli:purexbrli:sharesiso4217:USD

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE QUARTERLY PERIOD ENDED MARCH 31, 2024

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

FOR THE TRANSITION PERIOD FROM TO

Commission file number 001-13795

AMERICAN VANGUARD CORPORATION

|

|

Delaware |

95-2588080 |

(State or other jurisdiction of Incorporation or organization) |

(I.R.S. Employer Identification Number) |

|

|

4695 MacArthur Court, Newport Beach, California |

92660 |

(Address of principal executive offices) |

(Zip Code) |

(949) 260-1200

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, $0.10 par value |

|

AVD |

|

New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large Accelerated Filer |

☐ |

|

Accelerated Filer |

☒ |

Non-Accelerated Filer |

☐ |

|

Smaller reporting company |

☐ |

Emerging growth company |

☐ |

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

Indicate the number of shares outstanding of each of the issuer’s classes of common stock, as of the latest practicable date. Common Stock, $0.10 Par Value—27,984,744 shares as of April 29, 2024.

AMERICAN VANGUARD CORPORATION

INDEX

PART I. FINANCIAL INFORMATION

Item 1. FINANCIAL STATEMENTS

AMERICAN VANGUARD CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

For the three months

ended March 31 |

|

|

|

2024 |

|

|

2023 |

|

Net sales |

|

$ |

135,143 |

|

|

$ |

124,885 |

|

Cost of sales |

|

|

(92,725 |

) |

|

|

(86,348 |

) |

Gross profit |

|

|

42,418 |

|

|

|

38,537 |

|

Operating expenses |

|

|

|

|

|

|

Selling, general and administrative |

|

|

(30,621 |

) |

|

|

(26,402 |

) |

Research, product development and regulatory |

|

|

(5,706 |

) |

|

|

(8,870 |

) |

Operating income |

|

|

6,091 |

|

|

|

3,265 |

|

Change in fair value of an equity investment |

|

|

638 |

|

|

|

(22 |

) |

Interest expense, net |

|

|

(3,693 |

) |

|

|

(1,686 |

) |

Income before provision for income taxes |

|

|

3,036 |

|

|

|

1,557 |

|

Income tax (expense) benefit |

|

|

(1,484 |

) |

|

|

361 |

|

Net income |

|

$ |

1,552 |

|

|

$ |

1,918 |

|

Earnings per common share—basic |

|

$ |

0.06 |

|

|

$ |

0.07 |

|

Earnings per common share—assuming dilution |

|

$ |

0.06 |

|

|

$ |

0.07 |

|

Weighted average shares outstanding—basic |

|

|

27,844 |

|

|

|

28,367 |

|

Weighted average shares outstanding—assuming dilution |

|

|

28,128 |

|

|

|

29,073 |

|

See notes to the condensed consolidated financial statements.

AMERICAN VANGUARD CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE (LOSS) INCOME

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

For the three months

ended March 31 |

|

|

|

2024 |

|

|

2023 |

|

Net income |

|

$ |

1,552 |

|

|

$ |

1,918 |

|

Other comprehensive (loss) income: |

|

|

|

|

|

|

Foreign currency translation adjustment, net of tax effects |

|

|

(1,564 |

) |

|

|

2,546 |

|

Comprehensive (loss) income |

|

$ |

(12 |

) |

|

$ |

4,464 |

|

See notes to the condensed consolidated financial statements.

AMERICAN VANGUARD CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(In thousands, except share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

ASSETS |

|

March 31,

2024 |

|

|

December 31,

2023 |

|

Current assets: |

|

|

|

|

|

|

Cash |

|

$ |

13,709 |

|

|

$ |

11,416 |

|

Receivables: |

|

|

|

|

|

|

Trade, net of allowance for credit losses of $7,798 and $7,107, respectively |

|

|

187,197 |

|

|

|

182,613 |

|

Other |

|

|

7,395 |

|

|

|

8,356 |

|

Total receivables, net |

|

|

194,592 |

|

|

|

190,969 |

|

Inventories |

|

|

228,309 |

|

|

|

219,551 |

|

Prepaid expenses |

|

|

7,446 |

|

|

|

6,261 |

|

Income taxes receivable |

|

|

2,889 |

|

|

|

3,824 |

|

Total current assets |

|

|

446,945 |

|

|

|

432,021 |

|

Property, plant and equipment, net |

|

|

75,909 |

|

|

|

74,560 |

|

Operating lease right-of-use assets, net |

|

|

23,084 |

|

|

|

22,417 |

|

Intangible assets, net of amortization |

|

|

168,723 |

|

|

|

172,508 |

|

Goodwill |

|

|

50,469 |

|

|

|

51,199 |

|

Deferred income tax assets |

|

|

3,307 |

|

|

|

2,849 |

|

Other assets |

|

|

13,188 |

|

|

|

11,994 |

|

Total assets |

|

$ |

781,625 |

|

|

$ |

767,548 |

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

64,642 |

|

|

$ |

68,833 |

|

Customer prepayments |

|

|

28,520 |

|

|

|

65,560 |

|

Accrued program costs |

|

|

74,343 |

|

|

|

68,076 |

|

Accrued expenses and other payables |

|

|

15,927 |

|

|

|

16,354 |

|

Operating lease liabilities, current |

|

|

6,358 |

|

|

|

6,081 |

|

Income taxes payable |

|

|

5,633 |

|

|

|

5,591 |

|

Total current liabilities |

|

|

195,423 |

|

|

|

230,495 |

|

Long-term debt, net |

|

|

187,017 |

|

|

|

138,900 |

|

Operating lease liabilities, long term |

|

|

17,407 |

|

|

|

17,113 |

|

Deferred income tax liabilities |

|

|

7,157 |

|

|

|

7,892 |

|

Other liabilities |

|

|

3,038 |

|

|

|

3,138 |

|

Total liabilities |

|

|

410,042 |

|

|

|

397,538 |

|

Commitments and contingent liabilities (Note 12) |

|

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

|

Preferred stock, $0.10 par value per share; authorized 400,000 shares; none issued |

|

|

— |

|

|

|

— |

|

Common stock, $0.10 par value per share; authorized 40,000,000 shares; issued

34,754,634 shares at March 31, 2024 and 34,676,787 shares at December 31, 2023 |

|

|

3,475 |

|

|

|

3,467 |

|

Additional paid-in capital |

|

|

113,223 |

|

|

|

110,810 |

|

Accumulated other comprehensive loss |

|

|

(7,527 |

) |

|

|

(5,963 |

) |

Retained earnings |

|

|

333,613 |

|

|

|

332,897 |

|

Less treasury stock at cost, 5,915,182 shares at March 31, 2024 and December 31, 2023 |

|

|

(71,201 |

) |

|

|

(71,201 |

) |

Total stockholders’ equity |

|

|

371,583 |

|

|

|

370,010 |

|

Total liabilities and stockholders’ equity |

|

$ |

781,625 |

|

|

$ |

767,548 |

|

See notes to the condensed consolidated financial statements.

AMERICAN VANGUARD CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

For The Three Months Ended March 31, 2024 and March 31, 2023

(In thousands, except share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock |

|

|

Additional |

|

|

Accumulated Other |

|

|

|

|

|

Treasury Stock |

|

|

|

|

|

|

Shares |

|

|

Amount |

|

|

Paid-in

Capital |

|

|

Comprehensive

Loss |

|

|

Retained

Earnings |

|

|

Shares |

|

|

Amount |

|

|

Total |

|

Balance, January 1, 2024 |

|

|

34,676,787 |

|

|

$ |

3,467 |

|

|

$ |

110,810 |

|

|

$ |

(5,963 |

) |

|

$ |

332,897 |

|

|

|

5,915,182 |

|

|

$ |

(71,201 |

) |

|

$ |

370,010 |

|

Stocks issued under ESPP |

|

|

38,702 |

|

|

|

4 |

|

|

|

426 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

430 |

|

Cash dividends on common stock declared

($0.030 per share) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(836 |

) |

|

|

— |

|

|

|

— |

|

|

|

(836 |

) |

Foreign currency translation adjustment, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,564 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1,564 |

) |

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

2,005 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,005 |

|

Stock options exercised; grants,

termination and vesting of

restricted stock units

(net of shares in lieu of taxes) |

|

|

39,145 |

|

|

|

4 |

|

|

|

(18 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(14 |

) |

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,552 |

|

|

|

— |

|

|

|

— |

|

|

|

1,552 |

|

Balance, March 31, 2024 |

|

|

34,754,634 |

|

|

$ |

3,475 |

|

|

$ |

113,223 |

|

|

$ |

(7,527 |

) |

|

$ |

333,613 |

|

|

|

5,915,182 |

|

|

$ |

(71,201 |

) |

|

$ |

371,583 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance, January 1, 2023 |

|

|

34,446,194 |

|

|

$ |

3,444 |

|

|

$ |

105,634 |

|

|

$ |

(12,182 |

) |

|

$ |

328,745 |

|

|

|

5,029,892 |

|

|

$ |

(55,662 |

) |

|

$ |

369,979 |

|

Stocks issued under ESPP |

|

|

22,101 |

|

|

|

2 |

|

|

|

478 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

480 |

|

Cash dividends on common stock declared

($0.030 per share) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(851 |

) |

|

|

— |

|

|

|

— |

|

|

|

(851 |

) |

Foreign currency translation adjustment, net |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,546 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

2,546 |

|

Stock-based compensation |

|

|

— |

|

|

|

— |

|

|

|

1,474 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,474 |

|

Stock options exercised; grants,

termination and vesting of

restricted stock units

(net of shares in lieu of taxes) |

|

|

(4,466 |

) |

|

|

— |

|

|

|

5 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

5 |

|

Shares repurchased |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

27,835 |

|

|

|

(557 |

) |

|

|

(557 |

) |

Net income |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,918 |

|

|

|

— |

|

|

|

— |

|

|

|

1,918 |

|

Balance, March 31, 2023 |

|

|

34,463,829 |

|

|

$ |

3,446 |

|

|

$ |

107,591 |

|

|

$ |

(9,636 |

) |

|

$ |

329,812 |

|

|

$ |

5,057,727 |

|

|

$ |

(56,219 |

) |

|

$ |

374,994 |

|

See notes to the condensed consolidated financial statements.

AMERICAN VANGUARD CORPORATION AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

For the three months

ended March 31 |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net income |

|

$ |

1,552 |

|

|

$ |

1,918 |

|

Adjustments to reconcile net income to net cash used in operating

activities: |

|

|

|

|

|

|

Depreciation and amortization of property, plant and equipment and intangible assets |

|

|

5,441 |

|

|

|

5,539 |

|

Amortization of other long-term assets |

|

|

189 |

|

|

|

714 |

|

Provision for bad debts |

|

|

700 |

|

|

|

581 |

|

Stock-based compensation |

|

|

2,005 |

|

|

|

1,474 |

|

Change in deferred income taxes |

|

|

(1,025 |

) |

|

|

122 |

|

Change in liabilities for uncertain tax positions or unrecognized tax benefits |

|

|

35 |

|

|

|

371 |

|

Change in equity investment fair value |

|

|

(638 |

) |

|

|

22 |

|

Other |

|

|

(5 |

) |

|

|

72 |

|

Foreign currency transaction gains |

|

|

(373 |

) |

|

|

(446 |

) |

Changes in assets and liabilities associated with operations: |

|

|

|

|

|

|

Increase in net receivables |

|

|

(5,579 |

) |

|

|

(8,779 |

) |

Increase in inventories |

|

|

(9,353 |

) |

|

|

(33,731 |

) |

Increase (decrease) in prepaid expenses and other assets |

|

|

(1,466 |

) |

|

|

600 |

|

Change in income tax receivable/payable, net |

|

|

1,014 |

|

|

|

(2,965 |

) |

(Decrease) increase in accounts payable |

|

|

(3,951 |

) |

|

|

5,655 |

|

Decrease in customer prepayments |

|

|

(37,037 |

) |

|

|

(22,759 |

) |

Increase in accrued program costs |

|

|

6,399 |

|

|

|

10,660 |

|

Decrease in other payables and accrued expenses |

|

|

(332 |

) |

|

|

(500 |

) |

Net cash used in operating activities |

|

|

(42,424 |

) |

|

|

(41,452 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Capital expenditures |

|

|

(3,565 |

) |

|

|

(2,590 |

) |

Proceeds from disposal of property, plant and equipment |

|

|

23 |

|

|

|

— |

|

Acquisition of a product line |

|

|

— |

|

|

|

(703 |

) |

Intangible assets |

|

|

(25 |

) |

|

|

(15 |

) |

Net cash used in investing activities |

|

|

(3,567 |

) |

|

|

(3,308 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

Payments under line of credit agreement |

|

|

(35,346 |

) |

|

|

(27,300 |

) |

Borrowings under line of credit agreement |

|

|

83,463 |

|

|

|

72,000 |

|

Net receipt from the issuance of common stock under ESPP |

|

|

430 |

|

|

|

480 |

|

Net (payment) receipt from the exercise of stock options |

|

|

— |

|

|

|

18 |

|

Net payment from common stock purchased for tax withholding |

|

|

(14 |

) |

|

|

(13 |

) |

Repurchase of common stock |

|

|

— |

|

|

|

(557 |

) |

Payment of cash dividends |

|

|

(834 |

) |

|

|

(851 |

) |

Net cash provided by financing activities |

|

|

47,699 |

|

|

|

43,777 |

|

Net increase (decrease) in cash |

|

|

1,708 |

|

|

|

(983 |

) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

585 |

|

|

|

223 |

|

Cash at beginning of period |

|

|

11,416 |

|

|

|

20,328 |

|

Cash at end of period |

|

$ |

13,709 |

|

|

$ |

19,568 |

|

|

|

|

|

|

|

|

See notes to the condensed consolidated financial statements.

AMERICAN VANGUARD CORPORATION AND SUBSIDIARIES

Notes to the Condensed Consolidated Financial Statements

(In thousands, except share data)

(Unaudited)

1. Summary of Significant Accounting Policies — The accompanying unaudited condensed consolidated financial statements of American Vanguard Corporation and Subsidiaries (“AVD” or “the Company”) have been prepared in accordance with generally accepted accounting principles in the United States of America (“US GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. In the opinion of management, all adjustments (consisting of consolidating adjustments, eliminations and normal recurring accruals) considered necessary for a fair presentation have been included. Operating results for the three months ended March 31, 2024 are not necessarily indicative of the results that may be expected for the year ending December 31, 2024. The financial statements and related notes do not include all information and footnotes required by US GAAP for annual reports. This quarterly report should be read in conjunction with the consolidated financial statements included in the Company’s annual report on Form 10-K for the year ended December 31, 2023.

2. Leases — The Company has operating leases for warehouses, manufacturing facilities, offices, cars, railcars and certain equipment. The lease term includes the non-cancellable period of the lease plus any additional periods covered by either an option to extend (or not terminate) that the Company is reasonably certain to exercise. The Company has leases with a lease term ranging from one year to approximately 20 years.

The operating lease expense for the three months ended March 31, 2024 and 2023 was $1,936 and $1,637, respectively. Lease expenses related to variable lease payments and short-term leases were immaterial. Other information related to operating leases follows:

|

|

|

|

|

|

|

|

|

|

|

Three months

ended

March 31, 2024 |

|

|

Three months

ended

March 31, 2023 |

|

Cash paid for amounts included in the measurement of lease liabilities |

|

$ |

2,032 |

|

|

$ |

1,644 |

|

Right-of-use assets obtained in exchange for new liabilities |

|

$ |

2,382 |

|

|

$ |

1,884 |

|

The weighted-average remaining lease term and discount rate related to the operating leases as of March 31, 2024 were as follows:

|

|

|

|

|

Weighted-average remaining lease term (in years) |

|

|

4.90 |

|

Weighted-average discount rate |

|

|

4.83 |

% |

Future minimum lease payments under non-cancellable operating leases as of March 31, 2024 were as follows:

|

|

|

|

|

2024 (excluding three months ended March 31, 2024) |

|

$ |

5,433 |

|

2025 |

|

|

6,353 |

|

2026 |

|

|

4,733 |

|

2027 |

|

|

3,219 |

|

2028 |

|

|

2,236 |

|

Thereafter |

|

|

4,677 |

|

Total lease payments |

|

$ |

26,651 |

|

Less: imputed interest |

|

|

(2,886 |

) |

Total |

|

$ |

23,765 |

|

Amounts recognized in the condensed consolidated balance sheet: |

|

|

|

Operating lease liabilities, current |

|

$ |

6,358 |

|

Operating lease liabilities, long term |

|

$ |

17,407 |

|

3. Revenue Recognition —The Company recognizes revenue from the sale of its products, which include crop and non-crop products. The Company sells its products to customers, which include distributors, retailers, and growers. In addition, the Company recognizes royalty income from licensing agreements. Substantially all revenue is recognized at a point in time. The Company has one reportable segment. Selective enterprise information of sales disaggregated by category and geographic region is as follows:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Net sales: |

|

|

|

|

|

|

U.S. crop |

|

$ |

67,257 |

|

|

$ |

61,876 |

|

U.S. non-crop |

|

|

17,768 |

|

|

|

13,899 |

|

Total U.S. |

|

|

85,025 |

|

|

|

75,775 |

|

International |

|

|

50,118 |

|

|

|

49,110 |

|

Total net sales: |

|

$ |

135,143 |

|

|

$ |

124,885 |

|

The Company sometimes receives payments from its customers in advance of goods and services being provided in return for early cash incentive programs. These payments are included in customer prepayments on the condensed consolidated balance sheets. Revenue recognized for the three months ended March 31, 2024, that was included in customer prepayments at the beginning of 2024, was $37,040. The Company expects to recognize all its remaining customer prepayments as revenue in fiscal 2024.

4. Property, Plant and Equipment — Property, plant and equipment at March 31, 2024 and December 31, 2023 consists of the following:

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

Land |

|

$ |

2,765 |

|

|

$ |

2,765 |

|

Buildings and improvements |

|

|

21,328 |

|

|

|

21,088 |

|

Machinery and equipment |

|

|

150,940 |

|

|

|

148,912 |

|

Office furniture, fixtures and equipment |

|

|

10,452 |

|

|

|

10,622 |

|

Automotive equipment |

|

|

1,205 |

|

|

|

1,247 |

|

Construction in progress |

|

|

11,625 |

|

|

|

10,553 |

|

Total |

|

|

198,315 |

|

|

|

195,187 |

|

Less accumulated depreciation |

|

|

(122,406 |

) |

|

|

(120,627 |

) |

Property, plant and equipment, net |

|

$ |

75,909 |

|

|

$ |

74,560 |

|

The Company recognized depreciation expense related to property and equipment of $2,170 and $2,179 for the three months ended March 31, 2024 and 2023, respectively.

Substantially all of the Company’s assets are pledged as collateral with its lender banks.

5. Inventories — Inventory is stated at the lower of cost or net realizable value. Cost is determined by the average cost method, and includes material, labor, factory overhead and subcontracting services. Inventory reserves are recorded for excess and slow-moving inventory. The Company recorded an inventory reserve of $2,761 and $2,756 at March 31, 2024 and December 31, 2023, respectively.

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

|

December 31,

2023 |

|

Finished products |

|

$ |

199,941 |

|

|

$ |

198,935 |

|

Raw materials |

|

|

28,368 |

|

|

|

20,616 |

|

Inventories |

|

$ |

228,309 |

|

|

$ |

219,551 |

|

Finished products consist of products that are sold to customers in their current form as well as intermediate products that require further formulation to be saleable to customers.

6. Accrued Program Costs — The Company offers various discounts to customers based on the volume purchased within a defined period, other pricing adjustments, some grower volume incentives or other key performance indicator driven payments made to distributors, retailers or growers, usually at the end of a growing season. The Company describes these payments as “Programs.” Programs are a critical part of doing business in both the U.S. crop and non-crop chemicals marketplaces. These discount Programs represent variable consideration. Revenues from sales are recorded at the net sales price, which is the transaction price, less an estimate of variable consideration. Variable consideration includes amounts expected to be paid to its customers using the expected value method. Each quarter management compares individual sale transactions with Programs to determine what, if any, Program liabilities have been incurred. Once this initial calculation is made for the specific quarter, sales and marketing management, along with executive and financial management, review the accumulated Program balance and, for volume driven payments, make assessments of whether or not customers are tracking in a manner that indicates that they will meet the requirements set out in agreed upon terms and conditions attached to each Program. Following this assessment, management adjusts the accumulated accrual to properly reflect the liability at the balance sheet date. Programs are paid out predominantly on an annual basis, usually in the final quarter of the financial year or the first quarter of the following year.

7. Cash Dividends on Common Stock —The Company has declared and paid the following cash dividends in the periods covered by this Form 10-Q:

|

|

|

|

|

|

|

|

|

|

|

|

|

Declaration Date |

|

Record Date |

|

Distribution Date |

|

Dividend Per Share |

|

|

Total Paid |

|

March 11, 2024 |

|

March 27, 2024 |

|

April 10, 2024 |

|

$ |

0.030 |

|

|

$ |

836 |

|

December 15, 2023 |

|

December 29, 2023 |

|

January 12, 2024 |

|

$ |

0.030 |

|

|

$ |

834 |

|

March 13, 2023 |

|

March 24, 2023 |

|

April 14, 2023 |

|

|

0.030 |

|

|

|

851 |

|

December 12, 2022 |

|

December 28, 2022 |

|

January 11, 2023 |

|

$ |

0.030 |

|

|

$ |

851 |

|

8. Earnings Per Share — The components of basic and diluted earnings per share were as follows:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Numerator: |

|

|

|

|

|

|

Net income |

|

$ |

1,552 |

|

|

$ |

1,918 |

|

Denominator: |

|

|

|

|

|

|

Weighted average shares outstanding-basic |

|

|

27,844 |

|

|

|

28,367 |

|

Dilutive effect of stock options and grants |

|

|

284 |

|

|

|

706 |

|

Weighted average shares outstanding-diluted |

|

|

28,128 |

|

|

|

29,073 |

|

For the three months ended March 31, 2024 and 2023, no stock options or restricted stock awards were excluded from the computation of diluted earnings per share.

9. Debt — The Company has a revolving line of credit that is shown as long-term debt in the condensed consolidated balance sheets at March 31, 2024 and December 31, 2023. The Company has no short-term debt as of March 31, 2024 and December 31, 2023. The debt is summarized in the following table:

|

|

|

|

|

|

|

|

|

Long-term indebtedness ($000's) |

|

March 31, 2023 |

|

|

December 31, 2023 |

|

Revolving line of credit |

|

$ |

187,017 |

|

|

$ |

138,900 |

|

Deferred loan fees |

|

|

(1,127 |

) |

|

|

(1,218 |

) |

Total indebtedness, net of deferred loan fees |

|

$ |

185,890 |

|

|

$ |

137,682 |

|

The deferred loan fees as of March 31, 2024 are included in other assets on the condensed consolidated balance sheets.

The Company and certain of its affiliates are parties to a revolving line of credit agreement entitled the “Third Amended and Restated Loan and Security Agreement” dated as of August 5, 2021 (the “Credit Agreement”), which is a senior secured lending facility among AMVAC, the Company’s principal operating subsidiary, as Borrower Agent (including the Company and AMVAC BV), as Borrowers, on the one hand, and a group of commercial lenders led by BMO Bank, N.A. (formerly Bank of the West) as administrative agent, documentation agent, syndication agent, collateral agent and sole lead arranger, on the other hand. The Credit Agreement consists of a line of credit of up to $275,000, an accordion feature of up to $150,000, a letter of credit and swingline sub-facility (each having limits of $25,000) and has a maturity date of August 5, 2026. The Credit Agreement amended and restated the previous credit facility, which had a maturity date of June 30, 2022. With respect to key financial covenants, the Credit Agreement contains two: namely, borrowers are required to maintain a Total Leverage (“TL”) Ratio of no more than 3.5-to-1, during the first three years, stepping down to 3.25-to-1 for periods subsequent to September 30, 2024, and a Fixed Charge Coverage Ratio ("FCCR") of at least 1.25-to-1. In addition, to the extent that it completes acquisitions totaling $15 million or more in any 90-day period, AMVAC may step-up the TL Ratio by 0.5-to-1, not to exceed 4.00-to-1, for the next three full consecutive quarters. Acquisitions below $50 million do not require Agent consent.

The Company’s borrowing capacity varies with its financial performance, measured in terms of Consolidated EBITDA as defined in the Credit Agreement, for the trailing twelve-month period. Under the Credit Agreement, revolving loans bear interest at a variable rate based, at borrower’s election with proper notice, on either (i) LIBOR plus the “Applicable Margin” which is based upon the Total Leverage (“TL”) Ratio (“LIBOR Revolver Loan”) or (ii) the greater of (x) the Prime Rate, (y) the Federal Funds Rate plus 0.5%, and (z) the Daily One-Month LIBOR Rate plus 1.00%, plus, in the case of (x), (y) or (z) the Applicable Margin (“Adjusted Base Rate Revolver Loan”). The Company and the Lenders entered into an amendment to the Credit Agreement, effective March 9, 2023, whereby LIBOR was replaced by SOFR with a credit spread adjustment of 10.0 bps for all SOFR periods. The revolving loans now bear interest at a variable rate based at our election with proper notice, on either (i) SOFR plus 0.1% per annum and the “Applicable Margin” or (ii) the greater of (x) the Prime Rate, (y) the Federal Funds Rate plus 0.5%, and (z) the Daily One-Month SOFR Rate plus 1.10%, plus, in the case of (x), (y) or (z), the Applicable Margin (“Adjusted Base Rate Revolver Loan”). Interest payments for SOFR Revolver Loans are payable on the last day of each interest period (either one-, three- or six- months, as selected by the Company) and the maturity date, while interest payments for Adjusted Base Rate Revolver Loans are payable on the last business day of each month and the maturity date.

On November 7, 2023, the Company entered into Amendment Number Six to the Third Amended Loan and Security Agreement that provided relief in respect of both financial covenants. Specifically, with respect to the Maximum Total Leverage Ratio, the existing ratio of 3.5 through September 30, 2024 and 3.25 through December 31, 2024 and thereafter was changed to 5.5 through September 30, 2023, 4.5 for the periods ending December 31, 2023 and March 31, 2024, 4.0 for the period ending June 30, 2024, 3.5 through September 30, 2024 and returning to 3.25 from December 31, 2024 and thereafter. In addition, the Minimum Fixed Charge Coverage Ratio was changed from 1.25 to 1.0 for the periods ending September 30, 2023, December 31, 2023 and March 31, 2024 and returning to 1.25 for the period ending June 30, 2024 and thereafter. Further, for the duration of the covenant modification period (“CMP”), the Company is restricted from making share repurchases. Finally, the Applicable Margin (SOFR and Adjusted Base Rate) and Letter of Credit fees increase by 0.50 basis points for each tier of interest during CMP. As of March 31, 2024, the Company is in compliance with the terms of the CMP. The interest rate on March 31, 2024, was 8.30%. Interest incurred, including amortization of deferred loan fees, was $3,747 and $1,542 for the three months ended March 31, 2024 and 2023, respectively.

At March 31, 2024, according to the terms of the Credit Agreement, as amended, and based on our performance against the most restrictive covenant listed above, the Company had the capacity to increase its borrowings by up to $84,953. This compares to an available borrowing capacity of $115,002 as of December 31, 2023.

10. Comprehensive (Loss) Income — Total comprehensive (loss) income includes, in addition to net income, changes in equity that are excluded from the condensed consolidated statements of operations and are recorded directly into a separate section of stockholders’ equity on the condensed consolidated balance sheets. For the three-month periods ended March 31, 2024 and 2023, total comprehensive (loss) income consisted of net income attributable to American Vanguard and foreign currency translation adjustments.

11. Stock-Based Compensation — Under the Company’s Equity Incentive Plan of 1993, as amended (“the Plan”), all employees are eligible to receive non-assignable and non-transferable restricted stock (RSUs), options to purchase common stock, and other forms of equity. During the three months ended March 31, 2024 and 2023, the Company's stock-based compensation expense amounted to $2,005 and $1,474, respectively.

RSUs

A summary of nonvested RSUs outstanding is presented below:

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, 2024 |

|

|

|

Number

of Shares |

|

|

Weighted

Average

Grant

Date Fair

Value |

|

Nonvested shares at January 1, 2024 |

|

|

949,510 |

|

|

$ |

21.28 |

|

Granted |

|

|

51,832 |

|

|

|

10.28 |

|

Vested |

|

|

(3,712 |

) |

|

|

21.55 |

|

Forfeited |

|

|

(11,379 |

) |

|

|

21.71 |

|

Nonvested shares at March 31, 2024 |

|

|

986,251 |

|

|

$ |

20.69 |

|

As of March 31, 2024, the total unrecognized stock-based compensation expense related to RSUs outstanding was $6,816 and is expected to be recognized over a weighted-average service period of 1.8 years.

Stock Options

Time-based Incentive Stock Option Plans - A summary of the time-based inventive stock option activity for the three month ended March 31, 2024 is presented below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Options outstanding |

|

|

Weighted Average Exercise Price Per Share |

|

|

Weighted Average Remaining Contractual Life (Years) |

|

|

Aggregate Intrinsic Value |

|

Balance as of January 1, 2024 |

|

|

146,680 |

|

|

$ |

11.49 |

|

|

|

1.0 |

|

|

$ |

— |

|

Granted |

|

|

680,737 |

|

|

$ |

10.29 |

|

|

|

6.8 |

|

|

$ |

— |

|

Balance as of March 31, 2024 |

|

|

827,417 |

|

|

$ |

10.51 |

|

|

|

5.7 |

|

|

$ |

2,022 |

|

Options vested and exercisable as of March 31, 2024 |

|

|

146,680 |

|

|

$ |

11.49 |

|

|

|

0.7 |

|

|

$ |

214 |

|

As of March 31, 2024, the total unrecognized stock-based compensation expense related to stock options outstanding was $2,592 and is expected to be recognized over a weighted-average service period of 2.8 years.

12. Legal Proceedings — The Company records a liability on its consolidated financial statements for loss contingencies when a loss is known or considered probable, and the amount can be reasonably estimated. When determining the estimated loss or range of loss, significant judgment is required to estimate the amount and timing of a loss to be recorded. The Company recognizes legal expenses in connection with loss contingencies as incurred.

Department of Justice and Environmental Protection Agency Investigation. On November 10, 2016, AMVAC was served with a grand jury subpoena from the United States Attorney’s Office for the Southern District of Alabama, seeking documents regarding the importation, transportation, and management of a specific pesticide. The Company retained defense counsel to assist in responding to the subpoena and otherwise in defending the Company’s interests. AMVAC is cooperating in the investigation. After interviewing multiple witnesses (including three employees before a grand jury in February 2022) and making multiple document requests, the Department of Justice (“DOJ”) identified the Company and a manager-level employee as targets of the government’s investigation. DOJ’s investigation focused on potential violations of two environmental statutes, the Federal Insecticide, Fungicide, and Rodenticide Act (“FIFRA”) and the Resource Conservation and Recovery Act (“RCRA”), as well as obstruction of an agency proceeding and false statement statutes. In March 2022, the individual target entered into a plea agreement relating to provision of false information in a government proceeding. In July 2022, the DoJ sent correspondence to the Company’s counsel to the effect that it was focusing on potential RCRA violations relating to the reimportation of Australian containers in 2015. Our defense counsel conferred with DoJ from time to time over the past 18 months in the interest in resolving the matter. In January 2024, the Company and DoJ reached an agreement in principle, which is subject to approval by the cognizant court and with respect to which the Company has recorded a loss contingency. A Company representative intends to attend a hearing to enter a plea on the matter in late May 2024.

The governmental agencies involved in this investigation have a range of civil and criminal penalties they may seek to impose against corporations and individuals for violations of FIFRA, RCRA and other federal statutes including, but not limited to, injunctive relief, fines, penalties and modifications to business practices and compliance programs, including the appointment of a monitor. If violations are established, the amount of any fines or monetary penalties which could be assessed and the scope of possible non-monetary relief would depend on, among other factors, findings regarding the amount, timing, nature and scope of the violations, and the level of cooperation provided to the governmental authorities during the investigation. Based upon the content of agreement, in principle, the Company does not believe that the investigation will have a material adverse effect on our business prospects, operations, financial condition or cash flow.

Pitre etc. v. Agrocentre Ladauniere et al. On February 11, 2022, a strawberry grower named Les Enterprises Pitre, Inc. filed a complaint in the Superior Court, District of Labelle, Province of Quebec, Canada, entitled Pitre, etc. v. Agrocentre Ladauniere, Inc. etal, including Amvac Chemical Corporation, seeking damages in the amount of approximately $5 million arising from stunted growth of, and reduced yield from, its strawberry crop allegedly from the application of Amvac’s soil fumigant, Vapam, in spring of 2021. Examinations of plaintiff were held in mid-August 2022, during which plaintiff in effect confirmed that he had planted his seedlings before expiration of the full time interval following product application (as per the product label), that he had failed to follow the practice of planting a few test seedlings before planting an entire farm, and that he had placed his blind trust in his application adviser on all manner of timing and rate. The examination of the Company’s most knowledgeable witness took place in April 2024. The Company believes that the claims have no merit and intends to defend the matter. At this stage in the proceedings, there is not sufficient information to form a judgment as to either the probability or amount of loss; thus, the company has not set aside a reserve in connection with this matter.

Notice of Intention to Suspend DCPA. On April 28, 2022, the USEPA published a notice of intent to suspend (“NOITS”) DCPA, the active ingredient of an herbicide marketed by the Company under the name Dacthal. The agency cited as the basis for the suspension that the Company did not take appropriate steps to provide data studies requested in support of the registration review. In fact, over the course of several years, the Company cooperated in performing the vast majority of the nearly 90 studies requested by USEPA and had been working in good faith to meet the agency’s schedule. After proceedings in law and motion, the Company entered into a settlement agreement with USEPA pursuant to which the parties set a timeline for the submission of remaining studies, which, if approved by the agency, would result in reinstatement of the registration. The Company submitted the studies in question, the agency reviewed them, and the registration was reinstated in November 2023. After that reinstatement, the agency resumed registration review, during which it expressed concern over the potential health effects on farm workers in early stages of pregnancy. These concerns arose over a comparative thyroid assay (“CTA”), a relatively new and complex study, which indicated an effect on fetal rodents. In an effort to meet the agency’s concerns, over a period of several months, the Company provided significant training to USEPA on actual use patterns for Dacthal, worker re-entry practices, size of fields treated per diem and geographical focus. Nevertheless, in April 2024, USEPA concluded that, despite the mitigation measures and other information proposed by the Company and due to its safety concerns, the agency was at an impasse in advancing its registration review of the then current label. Accordingly, out of an abundance of caution, the Company submitted a significantly narrower label and voluntarily suspended sales of Dacthal pending review and potential approval of that label. The outcome of the agency’s review is uncertain at present.

13. Recent Issued Accounting Guidance — In November 2023, the FASB issued ASU No. 2023-07, “Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosure.” The ASU updates reportable segment disclosure requirements, primarily through requiring enhanced disclosures about significant segment expenses and information used to assess segment performance. The ASU is effective for fiscal years beginning after December 15, 2023 and interim periods within fiscal years beginning after December 15, 2024, with early adoption permitted. The Company is currently evaluating the impact of adopting this ASU on its disclosures.

In December 2023, the FASB issued ASU No. 2023-09, “Income Taxes (Topic 740): Improvements to Income Tax Disclosures.” The ASU includes amendments requiring enhanced income tax disclosures, primarily related to standardization and disaggregation of rate reconciliation categories and income taxes paid by jurisdiction. The guidance is effective for fiscal years beginning after December 15, 2024, with early adoption permitted, and should be applied either prospectively or retrospectively. The Company is currently evaluating the impact of adopting this ASU on its disclosures.

The Company reviewed all other recently issued accounting pronouncements and concluded that they were either not applicable or not expected to have a significant impact to its condensed consolidated financial statements.

14. Fair Value of Financial Instruments — The accounting standard for fair value measurements provides a framework for measuring fair value and requires expanded disclosures regarding fair value measurements. Fair value is defined as the price that would be received for an asset or the exit price that would be paid to transfer a liability in the principal or most advantageous market in an orderly transaction between market participants on the measurement date. This accounting standard established a fair value hierarchy, which requires an entity to maximize the use of observable inputs, where available. The following summarizes the three levels of inputs required:

•Level 1 – Quoted prices in active markets for identical assets or liabilities.

•Level 2 – Observable inputs other than quoted prices in active markets for identical assets and liabilities, quoted prices for identical or similar assets or liabilities in inactive markets, or other inputs that are observable or can be corroborated by observable market data for substantially the full term of the assets or liabilities.

•Level 3 – Inputs that are generally unobservable and typically reflect management’s estimate of assumptions that market participants would use in pricing the asset or liability.

The carrying amount of the Company’s financial instruments, which principally include cash and cash equivalents, short-term investments, accounts receivable, accounts payable and accrued expenses, approximates fair value because of the relatively short maturity of such instruments. The carrying amount of the Company’s borrowings, which are considered Level 2 liabilities, approximates fair value as they bear interest at a variable rate at current market rates.

15. Accumulated Other Comprehensive Loss — The following table lists the beginning balance, quarterly activity and ending balance of accumulated other comprehensive loss, which consists of foreign currency translation adjustments:

|

|

|

|

|

|

|

Total |

|

Balance, January 1, 2024 |

|

$ |

(5,963 |

) |

Foreign currency translation adjustment, net of tax effects of ($205) |

|

|

(1,564 |

) |

Balance, March 31, 2024 |

|

$ |

(7,527 |

) |

|

|

|

|

Balance, January 1, 2023 |

|

$ |

(12,182 |

) |

Foreign currency translation adjustment, net of tax effects of ($89) |

|

|

2,546 |

|

Balance, March 31, 2023 |

|

$ |

(9,636 |

) |

16. Equity Investments — In February 2016, AMVAC Netherlands BV made an investment in Biological Products for Agriculture (“Bi-PA”). Bi-PA develops biological plant protection products that can be used for the control of pests and disease of agricultural crops. As of March 31, 2024 and 2023, the Company’s ownership position in Bi-PA was 15%. Since this investment does not have readily determinable fair value, the Company has elected to measure the investment at cost less impairment, if any, and also records an increase or decrease for changes resulting from observable price changes in orderly transactions for the identical or a similar investment of Bi-PA. The Company periodically reviews the investment for possible impairment. There was no impairment or observable price changes on the investment during the three months ended March 31, 2024 and 2023. The investment is recorded within other assets on the condensed consolidated balance sheets and amounted to $2,869 as of March 31, 2024 and December 31, 2023.

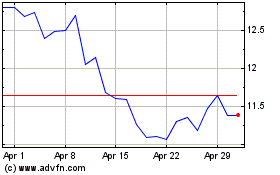

On April 1, 2020, AMVAC purchased 6.25 million shares, an ownership of approximately 8%, of common stock of Clean Seed Capital Group Ltd. (TSX Venture Exchange: “CSX”) for $1,190. The shares are publicly traded, have a readily determinable fair value, and are considered a Level 1 investment. The fair value of the stock amounted to $1,063 and $425 as of March 31, 2024 and December 31, 2023, respectively. The Company recorded a gain of $638 and a loss of $22 for the three months ended March 31, 2024 and 2023, respectively. The investment is recorded within other assets on the condensed consolidated balance sheets.

17. Income Taxes — Income tax expense was $1,484 for the three months ended March 31, 2024, as compared to income tax benefit of $361 for the three-months ended March 31, 2023. The effective income tax rate for the three months ended March 31, 2024 was computed based on the estimated effective tax rate for the full year. This calculation resulted in an effective tax rate of 48.9% for the three months ended March 31, 2024, as compared to negative 23.2% for the three months ended March 31, 2023. The increase in the effective income tax rate for the three months ended March 31, 2024 compared to the same period in the prior year is primarily attributed to an increase in losses incurred at certain entities which did not result in a benefit for income tax purposes as these entities continue to maintain a valuation allowance against their net deferred tax assets, as well as a one-time benefit from the remeasurement of certain U.S. federal and state deferred taxes in the same period in the prior year.

It is expected that $328 of unrecognized tax benefits will be released within the next twelve months due to expiration of the statute of limitations.

18. Stock Re-purchase Program — On March 8, 2022, pursuant to a Board of Directors resolution, the Company announced its intention to repurchase an aggregate number of up to 1,000,000 shares of its common stock under a 10b5-1 plan, par value $0.10 per share, in the open market over the succeeding one year, subject to limitations and restrictions under applicable securities laws. The 10b5-1 plan terminated on March 8, 2023.

The table below summarizes the number of shares of the Company’s common stock that were repurchased during the three months ended March 31, 2024 and 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended |

|

Total number of

shares purchased |

|

|

Average price paid

per share |

|

|

Total amount paid |

|

|

Maximum number of shares that may yet be purchased under the plan |

|

March 31, 2024 |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

March 31, 2023 |

|

|

27,835 |

|

|

$ |

19.96 |

|

|

$ |

557 |

|

|

|

— |

|

Pursuant to Amendment Number Six to the Third Amended Loan and Security Agreement, effective November 7, 2023, the Company is currently prevented from making stock repurchases.

19. Supplemental Cash Flow Information

|

|

|

|

|

|

|

|

|

|

|

For the three months

ended March 31 |

|

Cash paid during the period: |

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

Interest |

|

$ |

3,594 |

|

|

$ |

1,316 |

|

Income taxes, net |

|

$ |

1,350 |

|

|

$ |

2,104 |

|

Non-cash transactions: |

|

|

|

|

|

|

Cash dividends declared and included in accrued expenses |

|

$ |

836 |

|

|

$ |

851 |

|

Item 2. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS (Numbers in thousands)

FORWARD-LOOKING STATEMENTS/RISK FACTORS:

The Company, from time-to-time, may discuss forward-looking statements including assumptions concerning the Company’s operations, future results and prospects. These forward-looking statements are based on current expectations and are subject to a number of risks, uncertainties and other factors. In connection with the Private Securities Litigation Reform Act of 1995, the Company provides the following cautionary statements identifying important factors which, among other things, could cause the actual results and events to differ materially from those set forth in or implied by the forward-looking statements and related assumptions contained in the entire Annual Report. Such factors include, but are not limited to: product demand and market acceptance risks; the effect of economic conditions; weather conditions; changes in regulatory policy; the impact of competitive products and pricing; changes in foreign exchange rates; product development and commercialization difficulties; capacity and supply constraints or difficulties; availability of capital resources; general business regulations, including taxes and other risks as detailed from time-to-time in the Company’s reports and filings filed with the U.S. Securities and Exchange Commission (the “SEC”). It is not possible to foresee or identify all such factors. For more detailed information, refer to Item 3, Quantitative and Qualitative Disclosures about Market Risk, and Part II, Item 1A., Risk Factors, in this Quarterly Report on Form 10-Q.

Overview of the Company’s Performance

The global agriculture market remains stable but is characterized by mixed conditions. A strong United States dollar coupled with high grain inventory stocks has served to suppress commodity prices for both corn and soybeans. At these price levels, however, farming is still a profitable business. That said, while the distribution channel has relaxed its inventory destocking practice from last year, it continues to exercise fiscal restraint in procurement. This is also true within the non-crop markets.

Within this context, the Company’s overall financial performance during the quarter was better with respect to net sales and adjusted EBITDA and slightly below net income for the comparable period last year. During the first quarter of 2024 our sales increased by 8%, as compared to the first quarter of 2023. Regionally speaking, domestic sales increased by 12%, while international sales increased by 2%. Improvements along the supply chain allowed sales to normalize for some of the Company’s highest margin herbicides and insecticides. Improved net sales were primarily driven by increased availability of herbicides, an increase in market share in granular soil insecticides and an increase in demand for mosquito control products.

Cost of goods sold increased broadly in line with sales and were up 7%, as compared to the same quarter of 2023. This included changes in product mix, relative to the same period of last year and factory performance that was significantly better than the same period of the prior year, with both lower factory costs and slightly increased output, relative to 2023. As a result of these factors, gross margins for the business remained constant at 31%, versus the same period of 2023.

Operating expenses increased by 3% versus the first quarter of 2024, due primarily to increased general and administrative and foreign exchange expenses, audit fees, incentive compensation accruals and transformation costs, partially offset by decreased regulatory expenses. While the overall operating expenses increased on an absolute basis, they decreased as a percentage of sales to 27%, as compared to 28% in the same period of the prior year.

Interest expense increased, based upon increased average borrowings, driven by elevated interest rates and higher working capital levels as the Company starts its annual cycle that includes starting to build inventory at the start of the year to fuel sales growth planned for the rest of the year. Taxes increased by $1,845 to $1,484 during the quarter, versus the first three months of 2023, during which the company recorded income tax benefits amounting to $361. The first quarter tax result was driven in part by the effect of lower financial performance in Brazil, which requires the Company to record a valuation allowance that results in a higher, consolidated tax rate. The Company generated net income of $1,552 (or $0.06 per share) compared to $1,918 (or $0.07 per share) in the prior year.

RESULTS OF OPERATIONS

Quarter Ended March 31:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended

March 31, |

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

Change |

|

|

% Change |

|

Net sales: |

|

|

|

|

|

|

|

|

|

|

|

|

U.S. crop |

|

$ |

67,257 |

|

|

$ |

61,876 |

|

|

$ |

5,381 |

|

|

|

9 |

% |

U.S. non-crop |

|

|

17,768 |

|

|

|

13,899 |

|

|

|

3,869 |

|

|

|

28 |

% |

Total U.S. |

|

|

85,025 |

|

|

|

75,775 |

|

|

|

9,250 |

|

|

|

12 |

% |

International |

|

|

50,118 |

|

|

|

49,110 |

|

|

|

1,008 |

|

|

|

2 |

% |

Total net sales |

|

$ |

135,143 |

|

|

$ |

124,885 |

|

|

$ |

10,258 |

|

|

|

8 |

% |

Total cost of sales |

|

$ |

(92,725 |

) |

|

$ |

(86,348 |

) |

|

$ |

(6,377 |

) |

|

|

7 |

% |

Total gross profit |

|

$ |

42,418 |

|

|

$ |

38,537 |

|

|

$ |

3,881 |

|

|

|

10 |

% |

Total gross margin |

|

|

31 |

% |

|

|

31 |

% |

|

|

|

|

|

|

Our domestic crop business recorded net sales during the first quarter of 2024 that were 9% higher than those of the first quarter of 2023 ($67,257 as compared to $61,876). Overall herbicides sales were up 17% in the quarter versus this time last year. The quarter benefited from sales of the herbicide, Dacthal, which was not available during the comparable quarter in 2023 due to supply chain constraints. On a related note, the Company has meanwhile suspended sales of Dacthal for regulatory reasons (refer to Note 12 to the condensed consolidated financial statements for further details). In foliar insecticides, the Company benefited from increased cotton planting with Dibrom and Bidrin sales up 39%. In granular insecticides, sales were up 9%, with Thimet growing as a result of increased peanut crop acreage, and Index® sales in corn trending higher. These positive developments in granular pesticides were partially offset by Aztec sales which were down 37%, as sales patterns normalized. In comparison, during the same period of the prior year, customers took advantage of readily available inventory of Aztec to restock after an extended period during which that product had not been available. Soil fumigant sales were down 14% due to a shortened application window driven by cool and wet temperatures in the Northwest and a decrease in potato prices.

Our domestic non-crop business posted a 28% increase in net sales in the first quarter 2024, as compared to the same period in the prior year ($17,768 as compared to $13,899). In this category, Dibrom® and Trumpet mosquito adulticide sales were up 16% based upon predictions for stronger than normal tropical storm activity. Our OHP business was up 10%, buoyed by strong sales of its biorational portfolio and pre-emergent herbicides. Finally, private label pest strip sales were up over 100% compared to the year ago period.

Net sales of our international businesses rose by about 2% during the period ($50,118 as compared to $49,110). This group experienced sales growth in foliar and granular insecticides and growth regulators, partially offset by a decrease in soil fumigants, herbicides and fungicides sales. The Company experienced growth in Mexico and the Asia Pacific region, although weak agave prices limited the strength in Mexico and Japanese currency volatility impacted margins for sales in this region. Brazilian sales appear to have stabilized, however Canadian sales were soft, as channel inventory for our products remained high in this jurisdiction.

On a consolidated basis, gross profit for the first quarter of 2024 increased by 10% ($42,418 as compared to $38,537). Increased sales volume, normalization of supply chains and an improved factory performance all contributed to better profitability. Gross margin for the quarter remained stable compared to the year ago period at 31%.

Operating expenses increased by $1,055 or 3% to $36,327 for the three months ended March 31, 2024, as compared to the same period in 2023. The change in operating expenses by department are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

Change |

|

|