false000151722800015172282024-05-092024-05-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 9, 2024

COMMSCOPE HOLDING COMPANY, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

Delaware |

001-36146 |

27-4332098 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

3642 E. US Highway 70 Claremont, North Carolina |

|

28610 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s Telephone Number, Including Area Code: (828) 459-5000

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

|

COMM |

|

The NASDAQ Stock Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On May 9, 2024, CommScope Holding Company, Inc. (the “Company” or “CommScope”) issued a press release relating to its financial results for the first quarter of 2024. A copy of the press release, which is incorporated by reference herein, is attached hereto as Exhibit 99.1. Following the publication of the press release, the Company will host an earnings call during which its financial results for the first quarter of 2024 will be discussed.

The foregoing information (including the exhibit hereto) is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

Dated: May 9, 2024 |

|

|

COMMSCOPE HOLDING COMPANY, INC. |

|

|

|

|

|

|

|

By: |

/s/ Kyle D. Lorentzen |

|

|

|

Name: |

Kyle D. Lorentzen |

|

|

|

Title: |

Executive Vice President and |

|

|

|

|

Chief Financial Officer |

|

|

|

|

|

Exhibit 99.1

CommScope Reports First Quarter 2024 Results

First Quarter Highlights

•Net sales of $1.168 billion

•GAAP loss from continuing operations of $(262.1) million

•Non-GAAP adjusted EBITDA of $153.0 million

•Cash flow used in operations of $(177.7) million and non-GAAP adjusted free cash flow of $(154.1) million

CLAREMONT, NC, May 9, 2024 — CommScope Holding Company, Inc. (NASDAQ: COMM), a global leader in network connectivity solutions, today reported results for the quarter ended March 31, 2024.

|

|

|

|

|

|

|

|

|

|

|

|

|

Summary of Consolidated Results |

|

|

|

Q1 |

|

|

Q1 |

|

|

% Change |

|

|

|

2024 |

|

|

2023 |

|

|

YOY |

|

|

|

(in millions, except per share amounts) |

|

Net sales |

|

$ |

1,168.4 |

|

|

$ |

1,664.4 |

|

|

|

(29.8 |

)% |

GAAP income (loss) from continuing operations |

|

|

(262.1 |

) |

|

|

29.8 |

|

|

|

(979.5 |

) |

GAAP income (loss) from continuing operations per share |

|

|

(1.31 |

) |

|

|

0.07 |

|

|

|

(1,961.5 |

) |

Non-GAAP adjusted EBITDA (1) |

|

|

153.0 |

|

|

|

313.7 |

|

|

|

(51.2 |

) |

Non-GAAP adjusted net income (loss) per diluted share (1) |

|

|

(0.08 |

) |

|

|

0.34 |

|

|

|

(123.5 |

) |

|

|

|

|

|

|

|

|

|

|

(1) See “Non-GAAP Financial Measures” below. |

|

|

|

|

|

|

|

|

|

“As expected, our first quarter was a challenging quarter as we continued to deal with lower demand. On a positive note, we have begun to see early signs of recovery in our Connectivity and Cable Solutions and Outdoor Wireless Networks businesses as order rates increased sequentially in the first quarter for those two businesses. These favorable trends were offset by significantly lower demand for Networking, Intelligent Cellular and Security Solutions and Access Network Systems as customers managed inventory and timing of upgrade cycles. Overall, we continue to be bullish on medium- and long-term recovery in all of our businesses. We continue to manage the levers that we can control, such as customer interface, costs, new product development and capital. We are very focused on supporting our customers and we appreciate their support. We are confident that market conditions will improve and we are well positioned to capture the recovery in all segments,” said Chuck Treadway, President and Chief Executive Officer.

“For the first quarter, CommScope net sales declined 30% from the prior year to $1.17 billion and delivered adjusted EBITDA of $153 million, which was higher than our previously provided guidance range but down 51% from the prior year. Adjusted EPS was a loss of $(0.08) per share. Based on current visibility, we expect the first quarter to be the lowest revenue and adjusted EBITDA quarter of the year. We continue to evaluate capital structure alternatives, including asset sales, to address the upcoming debt maturities. We finished the quarter with significant liquidity of over $900 million,” said Kyle Lorentzen, Chief Financial Officer.

On January 9, 2024, CommScope completed the sale of its Home business to Vantiva SA. As a result, unless otherwise noted, these financial results relate to CommScope’s continuing operations, which include the Company’s remaining four operating segments: Connectivity and Cable Solutions (CCS), Outdoor Wireless Networks (OWN), Networking, Intelligent Cellular and Security Solutions (NICS) and Access Network Solutions (ANS). For all periods presented, amounts have been recast to reflect these changes.

Impacts of Current Economic Conditions

In 2023, macroeconomic factors such as higher interest rates, inflation and concerns about a global economic slow-down softened demand for CommScope's products, with certain customers reducing purchases as they right-size their inventories and others pausing capital spending. This industry recession has continued to negatively impact the Company's net sales in all segments for the first quarter of 2024. CommScope does not expect to begin to see a recovery in demand until in the second half of 2024.

In 2023, CommScope began implementing additional cost savings initiatives to improve profitability, and the Company continued to implement further initiatives during the three months ended March 31, 2024. These initiatives should enable the Company to take advantage of the expected recovery in demand in the second half of 2024. If the expected recovery in demand of CommScope's products does not occur in 2024, the Company's outlook will be materially impacted.

First Quarter Results and Comparisons

Net sales in the first quarter of 2024 decreased 29.8% year-over-year to $1.168 billion due to lower net sales in the CCS, NICS, OWN and ANS segments. Net sales decreased across all regions in the first quarter of 2024.

Loss from continuing operations of $(262.1) million, or $(1.31) per share, in the first quarter of 2024, decreased compared to the prior year period's income from continuing operations of $29.8 million, or $0.07 per share. Non-GAAP adjusted net loss for the first quarter of 2024 was $(20.3) million, or $(0.08) per share, versus $86.7 million, or $0.34 per share, in the first quarter of 2023.

Non-GAAP adjusted EBITDA decreased 51.2% to $153.0 million in the first quarter of 2024 compared to $313.7 during the same period last year. Non-GAAP adjusted EBITDA as a percentage of net sales decreased to 13.1% in the first quarter of 2024 compared to 18.8% in the same period last year.

Reconciliations of the reported GAAP results to non-GAAP adjusted results are included below.

First Quarter Comparisons

Sales by Region

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Change |

|

|

Q1 2024 |

|

|

Q1 2023 |

|

|

YOY |

United States |

|

$ |

757.1 |

|

|

$ |

1,147.6 |

|

|

|

(34.0 |

) |

% |

Europe, Middle East and Africa |

|

|

203.5 |

|

|

|

264.6 |

|

|

|

(23.1 |

) |

|

Asia Pacific |

|

|

135.5 |

|

|

|

144.5 |

|

|

|

(6.2 |

) |

|

Caribbean and Latin America |

|

|

47.7 |

|

|

|

69.4 |

|

|

|

(31.3 |

) |

|

Canada |

|

|

24.6 |

|

|

|

38.3 |

|

|

|

(35.8 |

) |

|

Total net sales |

|

$ |

1,168.4 |

|

|

$ |

1,664.4 |

|

|

|

(29.8 |

) |

% |

Segment Net Sales

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Change |

|

|

Q1 2024 |

|

|

Q1 2023 |

|

|

YOY |

CCS |

|

$ |

604.7 |

|

|

$ |

821.1 |

|

|

|

(26.4 |

) |

% |

NICS |

|

|

180.3 |

|

|

|

284.5 |

|

|

|

(36.6 |

) |

|

OWN |

|

|

196.0 |

|

|

|

258.4 |

|

|

|

(24.1 |

) |

|

ANS |

|

|

187.4 |

|

|

|

300.4 |

|

|

|

(37.6 |

) |

|

Total net sales |

|

$ |

1,168.4 |

|

|

$ |

1,664.4 |

|

|

|

(29.8 |

) |

% |

Segment Operating Income (Loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Change |

|

|

Q1 2024 |

|

|

Q1 2023 |

|

|

YOY |

CCS |

|

$ |

58.0 |

|

|

$ |

127.9 |

|

|

|

(54.7 |

) |

% |

NICS |

|

|

(23.0 |

) |

|

|

34.9 |

|

|

|

(165.9 |

) |

|

OWN |

|

|

33.6 |

|

|

|

49.2 |

|

|

|

(31.7 |

) |

|

ANS |

|

|

(65.7 |

) |

|

|

(25.7 |

) |

|

NM |

|

|

Corporate and other (1) |

|

|

— |

|

|

|

(3.2 |

) |

|

NM |

|

|

Total operating income |

|

$ |

2.9 |

|

|

$ |

183.1 |

|

|

|

(98.4 |

) |

% |

Segment Adjusted EBITDA (See “Non-GAAP Financial Measures,” below)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

% Change |

|

|

Q1 2024 |

|

|

Q1 2023 |

|

|

YOY |

CCS |

|

$ |

95.1 |

|

|

$ |

151.0 |

|

|

|

(37.0 |

) |

% |

NICS |

|

|

(1.1 |

) |

|

|

58.0 |

|

|

|

(101.9 |

) |

|

OWN |

|

|

44.3 |

|

|

|

59.5 |

|

|

|

(25.5 |

) |

|

ANS |

|

|

14.7 |

|

|

|

46.7 |

|

|

|

(68.5 |

) |

|

Corporate and other (1) |

|

|

— |

|

|

|

(1.5 |

) |

|

NM |

|

|

Total segment adjusted EBITDA |

|

$ |

153.0 |

|

|

$ |

313.7 |

|

|

|

(51.2 |

) |

% |

|

|

|

|

|

|

|

|

|

|

|

NM – Not meaningful |

|

|

(1)The prior year period includes general corporate costs that were previously allocated to the Home segment. These indirect costs have been classified as continuing operations for the prior year period, since they were not directly attributable to the discontinued operations of the Home segment. Beginning in the first quarter of 2024, these costs have been reallocated to CommScope’s remaining segments and partially offset by income from the Company’s transition service agreement with Vantiva SA.

•CCS - Net sales of $604.7 million decreased 26.4% from the prior year period primarily driven by a decline in Broadband.

•NICS - Net sales of $180.3 million decreased 36.6% from the prior year period primarily driven by declines in Ruckus and Intelligent Cellular Networks.

•OWN - Net sales of $196.0 million decreased 24.1% from the prior year period primarily driven by declines in Base Station Antennas and HELIAX product sales.

•ANS - Net sales of $187.4 million decreased 37.6% from the prior year period primarily driven by declines in Access Technologies and Broadband Network Solutions.

Cash Flow and Balance Sheet

•GAAP cash flow used in operations in 2024 was $(177.7) million.

•Non-GAAP adjusted free cash flow in the first quarter of 2024 was $(154.1) million after adjusting operating cash flow for $6.0 million of additions to property, plant and equipment, $9.3 million of cash paid for restructuring costs and $20.3 million of cash paid for transaction, transformation and integration costs.

•The Company ended the first quarter with $357.2 million in cash and cash equivalents.

•As of March 31, 2024, the Company had no outstanding borrowings under its asset-based revolving credit facility and had availability of $550.5 million, after giving effect to borrowing base limitations and outstanding letters of credit. The Company ended the quarter with total liquidity of approximately $907.7 million.

Conference Call, Webcast and Investor Presentation

As previously announced, CommScope will host a conference call today at 8:30 a.m. ET in which management will discuss first quarter 2024 results. The conference call will also be webcast.

The live, listen-only audio of the call will be available through a link on the Events and Presentations page of CommScope’s Investor Relations website.

A webcast replay will be archived on CommScope’s website for a limited period of time following the conference call.

During the conference call, the Company may discuss and answer questions concerning business and financial developments and trends that have occurred after quarter-end. The Company’s responses to questions, as well as other matters discussed during the conference call, may contain or constitute information that has not been disclosed previously.

About CommScope:

CommScope (NASDAQ: COMM) is pushing the boundaries of technology to create the world’s most advanced wired and wireless networks. Our global team of employees, innovators and technologists empower customers to anticipate what’s next and invent what’s possible. Discover more at www.commscope.com.

Follow us on Twitter and LinkedIn and like us on Facebook.

Sign up for our press releases and blog posts.

Investor Contact:

Massimo Disabato, CommScope

+1 630-281-3413

Massimo.Disabato@commscope.com

News Media Contact:

publicrelations@commscope.com

Non-GAAP Financial Measures

CommScope management believes that presenting certain non-GAAP financial measures enhances an investor’s understanding of our financial performance. CommScope management further believes that these financial measures are useful in assessing CommScope’s operating performance from period to period by excluding certain items that we believe are not representative of our core business. CommScope management also uses certain of these financial measures for business planning purposes and in measuring CommScope’s performance relative to that of its competitors. CommScope management believes these financial measures are commonly used by investors to evaluate CommScope’s performance and that of its competitors. However, CommScope’s use of certain non-GAAP terms may vary from that of others in its industry. Non-GAAP financial measures should not be considered as alternatives to operating income (loss), net income (loss), cash flow from operations or any other performance measures derived in accordance with U.S. GAAP as measures of operating performance, operating cash flows or liquidity. A reconciliation of each of the non-GAAP measures discussed herein to their most comparable GAAP measures is below.

Forward Looking Statements

This press release includes certain statements that constitute "forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, which reflect our current views with respect to future events and financial performance. These forward-looking statements are generally identified by their use of such terms and phrases as “intend,” “goal,” “estimate,” “expect,” “project,” “projections,” “plans,” “potential,” “anticipate,” “should,” “could,” “designed to,” “foreseeable future,” “believe,” “think,” “scheduled,” “outlook,” “target,” “guidance” and similar expressions, although not all forward-looking statements contain such terms. This list of indicative terms and phrases is not intended to be all-inclusive.

These forward-looking statements are subject to various risks and uncertainties, many of which are outside our control, including, without limitation, our dependence on customers’ capital spending on data, communication and entertainment equipment, which could be negatively impacted by a regional or global economic downturn, among other factors; the potential impact of higher than normal inflation; concentration of sales among a limited number of customers and channel partners; risks associated with our sales through channel partners; changes to the regulatory environment in which we and our customers operate; changes in technology; industry competition and the ability to retain customers through product innovation, introduction, and marketing; changes in cost and availability of key raw materials, components and commodities and the potential effect on customer pricing and timing of delivery of products to customers; risks related to our ability to implement price increases on our products and services; risks associated with our dependence on a limited number of key suppliers for certain raw materials and components; risks related to the successful execution of CommScope NEXT and other cost saving initiatives; potential difficulties in realigning global manufacturing capacity and capabilities among our global manufacturing facilities or those of our contract manufacturers that may affect our ability to meet customer demands for products; possible future restructuring actions; the risk that our manufacturing operations, including our contract manufacturers on which we rely, encounter capacity, production, quality, financial or other difficulties causing difficulty in meeting customer demands; our substantial indebtedness and restrictive debt covenants; our ability to incur additional indebtedness and increases in interest rates; our ability to generate cash to service our indebtedness; the divestiture of the Home segment and its effect on our remaining businesses; the potential separation, divestiture or discontinuance of another business or product line, including uncertainty regarding the timing of the separation, achievement of the expected benefits and the potential disruption to the business; our ability to integrate and fully realize anticipated benefits from prior or future divestitures, acquisitions or equity investments; possible future additional impairment charges for fixed or intangible assets, including goodwill; our ability to attract and retain qualified key employees; labor unrest; product quality or performance issues, including those associated with our suppliers or contract manufacturers, and associated warranty claims; our ability to maintain effective management information technology systems and to successfully implement

major systems initiatives; cyber-security incidents, including data security breaches, ransomware or computer viruses; the use of open standards; the long-term impact of climate change; significant international operations exposing us to economic risks like variability in foreign exchange rates and inflation, as well as political and other risks, including the impact of wars, regional conflicts and terrorism; our ability to comply with governmental anti-corruption laws and regulations worldwide; the impact of export and import controls and sanctions worldwide on our supply chain and ability to compete in international markets; changes in the laws and policies in the United States affecting trade, including the risk and uncertainty related to tariffs or potential trade wars and potential changes to laws and policies, that may impact our products; the costs of protecting or defending intellectual property; costs and challenges of compliance with domestic and foreign social and environmental laws; the impact of litigation and similar regulatory proceedings in which we are involved or may become involved, including the costs of such litigation; the scope, duration and impact of disease outbreaks and pandemics, such as COVID-19, on our business, including employees, sites, operations, customers, supply chain logistics and the global economy; our stock price volatility; income tax rate variability and ability to recover amounts recorded as deferred tax assets; and other factors beyond our control. These and other factors are discussed in greater detail in our 2023 Annual Report on Form 10-K and may be updated from time to time in our annual reports, quarterly reports, current reports and other filings we make with the Securities and Exchange Commission. Although the information contained in this press release represents our best judgment as of the date of this release based on information currently available and reasonable assumptions, we can give no assurance that the expectations will be attained or that any deviation will not be material. Given these uncertainties, we caution you not to place undue reliance on these forward-looking statements, which speak only as of the date made. We are not undertaking any duty or obligation to update this information to reflect developments or information obtained after the date of this press release, except to the extent required by law.

—END—

|

|

|

|

|

|

|

|

|

CommScope Holding Company, Inc. |

|

Condensed Consolidated Statements of Operations |

|

(Unaudited -- In millions, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Net sales |

|

$ |

1,168.4 |

|

|

$ |

1,664.4 |

|

Cost of sales |

|

|

766.2 |

|

|

|

1,034.2 |

|

Gross profit |

|

|

402.2 |

|

|

|

630.2 |

|

Transition service agreement income |

|

|

9.6 |

|

|

|

— |

|

Operating expenses: |

|

|

|

|

|

|

Selling, general and administrative |

|

|

199.7 |

|

|

|

232.0 |

|

Research and development |

|

|

104.4 |

|

|

|

125.6 |

|

Amortization of purchased intangible assets |

|

|

74.2 |

|

|

|

100.6 |

|

Restructuring costs (credits), net |

|

|

30.6 |

|

|

|

(11.1 |

) |

Total operating expenses |

|

|

408.9 |

|

|

|

447.1 |

|

Operating income |

|

|

2.9 |

|

|

|

183.1 |

|

Other income (expense), net |

|

|

(1.1 |

) |

|

|

5.3 |

|

Interest expense |

|

|

(167.7 |

) |

|

|

(165.1 |

) |

Interest income |

|

|

3.6 |

|

|

|

2.5 |

|

Income (loss) from continuing operations before income taxes |

|

|

(162.3 |

) |

|

|

25.8 |

|

Income tax (expense) benefit |

|

|

(99.8 |

) |

|

|

4.0 |

|

Income (loss) from continuing operations |

|

|

(262.1 |

) |

|

|

29.8 |

|

Loss from discontinued operations, net of income tax

(expense) benefit of $(17.6) and $3.8, respectively |

|

|

(97.1 |

) |

|

|

(26.4 |

) |

Net income (loss) |

|

|

(359.2 |

) |

|

|

3.4 |

|

Series A convertible preferred stock dividends |

|

|

(16.0 |

) |

|

|

(15.1 |

) |

Net loss attributable to common stockholders |

|

$ |

(375.2 |

) |

|

$ |

(11.7 |

) |

|

|

|

|

|

|

|

Basic: |

|

|

|

|

|

|

Earnings (loss) from continuing operations per share |

|

$ |

(1.31 |

) |

|

$ |

0.07 |

|

Loss from discontinued operations per share |

|

|

(0.46 |

) |

|

|

(0.13 |

) |

Loss per share |

|

$ |

(1.77 |

) |

|

$ |

(0.06 |

) |

|

|

|

|

|

|

|

Diluted: |

|

|

|

|

|

|

Earnings (loss) from continuing operations per share |

|

$ |

(1.31 |

) |

|

$ |

0.07 |

|

Loss from discontinued operations per share |

|

|

(0.46 |

) |

|

|

(0.12 |

) |

Loss per share |

|

$ |

(1.77 |

) |

|

$ |

(0.05 |

) |

|

|

|

|

|

|

|

Weighted average shares outstanding: |

|

|

|

|

|

|

Basic |

|

|

212.3 |

|

|

|

208.9 |

|

Diluted (a) |

|

|

212.3 |

|

|

|

212.1 |

|

(a) Calculation of diluted loss per share: |

|

|

|

|

|

|

Net loss attributable to common stockholders (basic and diluted) |

|

$ |

(375.2 |

) |

|

$ |

(11.7 |

) |

|

|

|

|

|

|

|

Weighted average shares (basic) |

|

|

212.3 |

|

|

|

208.9 |

|

Dilutive effect of equity-based awards |

|

|

— |

|

|

|

3.2 |

|

Denominator (diluted) |

|

|

212.3 |

|

|

|

212.1 |

|

|

|

|

|

|

|

|

See notes to unaudited condensed consolidated financial statements included in our Form 10-Q. |

|

|

|

|

|

|

|

|

|

|

CommScope Holding Company, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(In millions, except share amounts) |

|

|

|

|

|

|

|

|

|

|

Unaudited

March 31, 2024 |

|

|

December 31, 2023 |

|

Assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

357.2 |

|

|

$ |

543.8 |

|

Accounts receivable, net of allowance for doubtful accounts

of $30.0 and $32.2, respectively |

|

|

836.9 |

|

|

|

815.2 |

|

Inventories, net |

|

|

1,044.1 |

|

|

|

1,079.7 |

|

Prepaid expenses and other current assets |

|

|

169.2 |

|

|

|

145.4 |

|

Current assets held for sale |

|

|

— |

|

|

|

278.6 |

|

Total current assets |

|

|

2,407.4 |

|

|

|

2,862.7 |

|

Property, plant and equipment, net of accumulated depreciation

of $880.9 and $866.1, respectively |

|

|

455.8 |

|

|

|

500.6 |

|

Goodwill |

|

|

3,500.4 |

|

|

|

3,514.4 |

|

Other intangible assets, net |

|

|

1,499.9 |

|

|

|

1,582.7 |

|

Deferred income taxes |

|

|

480.2 |

|

|

|

615.6 |

|

Other noncurrent assets |

|

|

309.9 |

|

|

|

295.9 |

|

Total assets |

|

$ |

8,653.6 |

|

|

$ |

9,371.9 |

|

Liabilities and Stockholders' Deficit |

|

|

|

|

|

|

Accounts payable |

|

$ |

454.6 |

|

|

$ |

435.9 |

|

Accrued and other liabilities |

|

|

562.3 |

|

|

|

634.3 |

|

Current portion of long-term debt |

|

|

32.0 |

|

|

|

32.0 |

|

Current liabilities held for sale |

|

|

— |

|

|

|

307.2 |

|

Total current liabilities |

|

|

1,048.9 |

|

|

|

1,409.4 |

|

Long-term debt |

|

|

9,244.6 |

|

|

|

9,246.6 |

|

Deferred income taxes |

|

|

121.4 |

|

|

|

110.7 |

|

Other noncurrent liabilities |

|

|

392.2 |

|

|

|

411.9 |

|

Total liabilities |

|

|

10,807.1 |

|

|

|

11,178.6 |

|

Commitments and contingencies |

|

|

|

|

|

|

Series A convertible preferred stock, $0.01 par value |

|

|

1,178.1 |

|

|

|

1,162.1 |

|

Stockholders' deficit: |

|

|

|

|

|

|

Preferred stock, $0.01 par value: Authorized shares: 200,000,000; |

|

|

|

|

|

|

Issued and outstanding shares: 1,178,063 and 1,162,085, respectively,

Series A convertible preferred stock |

|

|

— |

|

|

|

— |

|

Common stock, $0.01 par value: Authorized shares: 1,300,000,000;

Issued and outstanding shares: 212,264,754 and 212,108,634,

respectively |

|

|

2.3 |

|

|

|

2.3 |

|

Additional paid-in capital |

|

|

2,545.6 |

|

|

|

2,550.4 |

|

Accumulated deficit |

|

|

(5,312.3 |

) |

|

|

(4,953.1 |

) |

Accumulated other comprehensive loss |

|

|

(265.3 |

) |

|

|

(266.7 |

) |

Treasury stock, at cost: 14,499,840 shares and

14,424,126 shares, respectively |

|

|

(301.9 |

) |

|

|

(301.7 |

) |

Total stockholders' deficit |

|

|

(3,331.6 |

) |

|

|

(2,968.8 |

) |

Total liabilities and stockholders' deficit |

|

$ |

8,653.6 |

|

|

$ |

9,371.9 |

|

|

|

|

|

|

|

See notes to unaudited condensed consolidated financial statements included in our Form 10-Q. |

|

|

|

|

|

|

|

|

|

|

CommScope Holding Company, Inc. |

|

Condensed Consolidated Statements of Cash Flows (1) |

|

(Unaudited -- In millions) |

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Operating Activities: |

|

|

|

|

|

|

Net income (loss) |

|

$ |

(359.2 |

) |

|

$ |

3.4 |

|

Adjustments to reconcile net income (loss) to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation and amortization |

|

|

112.7 |

|

|

|

164.1 |

|

Equity-based compensation |

|

|

11.2 |

|

|

|

13.5 |

|

Deferred income taxes |

|

|

87.4 |

|

|

|

(30.0 |

) |

Changes in assets and liabilities: |

|

|

|

|

|

|

Accounts receivable |

|

|

(19.9 |

) |

|

|

175.3 |

|

Inventories |

|

|

31.4 |

|

|

|

(31.9 |

) |

Prepaid expenses and other assets |

|

|

(71.9 |

) |

|

|

10.2 |

|

Accounts payable and other liabilities |

|

|

(26.8 |

) |

|

|

(318.3 |

) |

Other |

|

|

57.4 |

|

|

|

(32.4 |

) |

Net cash used in operating activities |

|

|

(177.7 |

) |

|

|

(46.1 |

) |

Investing Activities: |

|

|

|

|

|

|

Additions to property, plant and equipment |

|

|

(6.0 |

) |

|

|

(14.4 |

) |

Proceeds from sale of property, plant and equipment |

|

|

— |

|

|

|

41.0 |

|

Other |

|

|

8.6 |

|

|

|

9.3 |

|

Net cash generated by investing activities |

|

|

2.6 |

|

|

|

35.9 |

|

Financing Activities: |

|

|

|

|

|

|

Long-term debt repaid |

|

|

(8.0 |

) |

|

|

(8.0 |

) |

Long-term debt repurchases |

|

|

— |

|

|

|

(50.0 |

) |

Tax withholding payments for vested equity-based compensation awards |

|

|

(0.2 |

) |

|

|

(5.0 |

) |

Other |

|

|

— |

|

|

|

1.9 |

|

Net cash used in financing activities |

|

|

(8.2 |

) |

|

|

(61.1 |

) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

(3.3 |

) |

|

|

0.5 |

|

Change in cash and cash equivalents |

|

|

(186.6 |

) |

|

|

(70.8 |

) |

Cash and cash equivalents at beginning of period |

|

|

543.8 |

|

|

|

398.1 |

|

Cash and cash equivalents at end of period |

|

$ |

357.2 |

|

|

$ |

327.3 |

|

|

|

|

|

|

|

|

(1) The cash flows related to discontinued operations have not been segregated. Accordingly, the Condensed Consolidated Statements of Cash Flows include the results of continuing and discontinued operations. |

|

|

|

|

|

|

|

|

See notes to unaudited condensed consolidated financial statements included in our Form 10-Q. |

|

|

|

|

|

|

|

|

|

|

CommScope Holding Company, Inc. |

|

Reconciliation of GAAP Measures to Non-GAAP Adjusted Measures |

|

(Unaudited -- In millions, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

March 31, |

|

|

|

2024 |

|

|

2023 |

|

Income (loss) from continuing operations, as reported |

|

$ |

(262.1 |

) |

|

$ |

29.8 |

|

Income tax expense (benefit), as reported |

|

|

99.8 |

|

|

|

(4.0 |

) |

Interest income, as reported |

|

|

(3.6 |

) |

|

|

(2.5 |

) |

Interest expense, as reported |

|

|

167.7 |

|

|

|

165.1 |

|

Other (income) expense, as reported |

|

|

1.1 |

|

|

|

(5.3 |

) |

Operating income, as reported |

|

$ |

2.9 |

|

|

$ |

183.1 |

|

Adjustments: |

|

|

|

|

|

|

Amortization of purchased intangible assets |

|

|

74.2 |

|

|

|

100.6 |

|

Restructuring costs (credits), net |

|

|

30.6 |

|

|

|

(11.1 |

) |

Equity-based compensation |

|

|

11.2 |

|

|

|

12.4 |

|

Transaction, transformation and integration costs |

|

|

8.5 |

|

|

|

0.3 |

|

Acquisition accounting adjustments |

|

|

0.1 |

|

|

|

0.5 |

|

Depreciation |

|

|

25.5 |

|

|

|

27.9 |

|

Total adjustments to operating income |

|

|

150.1 |

|

|

|

130.6 |

|

Non-GAAP adjusted EBITDA |

|

$ |

153.0 |

|

|

$ |

313.7 |

|

|

|

|

|

|

|

|

Income (loss) from continuing operations, as reported |

|

$ |

(262.1 |

) |

|

$ |

29.8 |

|

Adjustments: |

|

|

|

|

|

|

Total pretax adjustments to adjusted EBITDA |

|

|

124.6 |

|

|

|

102.7 |

|

Pretax amortization of debt issuance costs and OID (1) |

|

|

6.6 |

|

|

|

6.9 |

|

Pretax gain on debt transactions (2) |

|

|

— |

|

|

|

(7.5 |

) |

Tax effects of adjustments and other tax items (3) |

|

|

110.6 |

|

|

|

(45.2 |

) |

Non-GAAP adjusted net income (loss) |

|

$ |

(20.3 |

) |

|

$ |

86.7 |

|

GAAP EPS, as reported (4) |

|

$ |

(1.31 |

) |

|

$ |

0.07 |

|

Non-GAAP adjusted diluted EPS (5) |

|

$ |

(0.08 |

) |

|

$ |

0.34 |

|

|

|

|

|

|

|

|

(1) Included in interest expense. |

|

(2) Included in other income (expense), net. |

|

|

|

|

|

|

(3) The tax rates applied to adjustments reflect the tax expense or benefit based on the tax jurisdiction of the entity generating the adjustment. There are certain items for which we expect little or no tax effect. |

|

(4) For all periods presented, GAAP EPS was calculated using income (loss) from continuing operations in the numerator, which includes the impact of the Series A convertible preferred stock dividend. |

|

(5) Diluted shares used in the calculation of non-GAAP adjusted diluted EPS are 255.9 million and 252.1 million for the three months ended March 31, 2024 and 2023, respectively. |

|

|

|

|

|

|

|

|

See “Non-GAAP Financial Measures” above. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CommScope Holding Company, Inc. |

Sales by Region |

(Unaudited -- In millions) |

|

|

|

|

|

|

|

|

|

|

|

Sales by Region |

|

|

|

|

|

% Change |

|

|

Q1 2024 |

|

|

Q1 2023 |

|

|

YOY |

United States |

|

$ |

757.1 |

|

|

$ |

1,147.6 |

|

|

|

(34.0 |

) |

% |

Europe, Middle East and Africa |

|

|

203.5 |

|

|

|

264.6 |

|

|

|

(23.1 |

) |

|

Asia Pacific |

|

|

135.5 |

|

|

|

144.5 |

|

|

|

(6.2 |

) |

|

Caribbean and Latin America |

|

|

47.7 |

|

|

|

69.4 |

|

|

|

(31.3 |

) |

|

Canada |

|

|

24.6 |

|

|

|

38.3 |

|

|

|

(35.8 |

) |

|

Total net sales |

|

$ |

1,168.4 |

|

|

$ |

1,664.4 |

|

|

|

(29.8 |

) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CommScope Holding Company, Inc. |

Segment Information |

(Unaudited -- In millions) |

|

|

|

|

|

|

|

|

|

|

|

Segment Net Sales |

|

|

|

|

|

|

|

|

% Change |

|

|

Q1 2024 |

|

|

Q1 2023 |

|

|

YOY |

CCS |

|

$ |

604.7 |

|

|

$ |

821.1 |

|

|

|

(26.4 |

) |

% |

NICS |

|

|

180.3 |

|

|

|

284.5 |

|

|

|

(36.6 |

) |

|

OWN |

|

|

196.0 |

|

|

|

258.4 |

|

|

|

(24.1 |

) |

|

ANS |

|

|

187.4 |

|

|

|

300.4 |

|

|

|

(37.6 |

) |

|

Total net sales |

|

$ |

1,168.4 |

|

|

$ |

1,664.4 |

|

|

|

(29.8 |

) |

% |

|

|

|

|

|

|

|

|

|

|

|

Segment Adjusted EBITDA (1) |

|

|

|

|

|

|

|

|

% Change |

|

|

Q1 2024 |

|

|

Q1 2023 |

|

|

YOY |

CCS |

|

$ |

95.1 |

|

|

$ |

151.0 |

|

|

|

(37.0 |

) |

% |

NICS |

|

|

(1.1 |

) |

|

|

58.0 |

|

|

|

(101.9 |

) |

|

OWN |

|

|

44.3 |

|

|

|

59.5 |

|

|

|

(25.5 |

) |

|

ANS |

|

|

14.7 |

|

|

|

46.7 |

|

|

|

(68.5 |

) |

|

Corporate and other (2) |

|

|

— |

|

|

|

(1.5 |

) |

|

NM |

|

|

Total segment adjusted EBITDA |

|

$ |

153.0 |

|

|

$ |

313.7 |

|

|

|

(51.2 |

) |

% |

|

|

|

|

|

|

|

|

|

|

|

NM – Not meaningful |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) See “Non-GAAP Financial Measures” above. |

(2) The prior year period includes general corporate costs that were previously allocated to the Home segment. These indirect costs have been classified as continuing operations for the prior year period, since they were not directly attributable to the discontinued operations of the Home segment. Beginning in the first quarter of 2024, these costs have been reallocated to CommScope's remaining segments and partially offset by income from the Company's transition service agreement with Vantiva SA. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CommScope Holding Company, Inc. |

|

Reconciliation of GAAP to Segment Adjusted EBITDA |

|

(Unaudited -- In millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter 2024 Segment Adjusted EBITDA Reconciliation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CCS |

|

|

NICS |

|

|

OWN |

|

|

ANS |

|

|

Total |

|

Operating income (loss), as reported |

|

$ |

58.0 |

|

|

$ |

(23.0 |

) |

|

$ |

33.6 |

|

|

$ |

(65.7 |

) |

|

$ |

2.9 |

|

Amortization of purchased intangible assets |

|

|

18.5 |

|

|

|

13.9 |

|

|

|

4.0 |

|

|

|

37.8 |

|

|

|

74.2 |

|

Restructuring costs, net |

|

|

0.3 |

|

|

|

1.2 |

|

|

|

0.1 |

|

|

|

29.0 |

|

|

|

30.6 |

|

Equity-based compensation |

|

|

3.8 |

|

|

|

3.0 |

|

|

|

1.6 |

|

|

|

2.9 |

|

|

|

11.2 |

|

Transaction, transformation and integration costs |

|

|

0.4 |

|

|

|

0.8 |

|

|

|

2.4 |

|

|

|

4.9 |

|

|

|

8.5 |

|

Depreciation |

|

|

13.8 |

|

|

|

3.1 |

|

|

|

2.7 |

|

|

|

5.9 |

|

|

|

25.5 |

|

Segment adjusted EBITDA |

|

$ |

95.1 |

|

|

$ |

(1.1 |

) |

|

$ |

44.3 |

|

|

$ |

14.7 |

|

|

$ |

153.0 |

|

Segment adjusted EBITDA % of sales |

|

|

15.7 |

% |

|

|

(0.6 |

%) |

|

|

22.6 |

% |

|

|

7.8 |

% |

|

|

13.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

First Quarter 2023 Segment Adjusted EBITDA Reconciliation |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CCS |

|

|

NICS |

|

|

OWN |

|

|

ANS |

|

|

Corporate and other (1) |

|

|

Total |

|

Operating income (loss), as reported |

|

$ |

127.9 |

|

|

$ |

34.9 |

|

|

$ |

49.2 |

|

|

$ |

(25.7 |

) |

|

$ |

(3.2 |

) |

|

$ |

183.1 |

|

Amortization of purchased intangible assets |

|

|

18.9 |

|

|

|

14.3 |

|

|

|

5.5 |

|

|

|

61.7 |

|

|

|

0.2 |

|

|

|

100.6 |

|

Restructuring costs (credits), net |

|

|

(14.9 |

) |

|

|

1.9 |

|

|

|

— |

|

|

|

1.4 |

|

|

|

0.5 |

|

|

|

(11.1 |

) |

Equity-based compensation |

|

|

3.9 |

|

|

|

3.1 |

|

|

|

1.6 |

|

|

|

3.3 |

|

|

|

0.5 |

|

|

|

12.4 |

|

Transaction, transformation and integration costs |

|

|

0.1 |

|

|

|

— |

|

|

|

0.1 |

|

|

|

0.1 |

|

|

|

— |

|

|

|

0.3 |

|

Acquisition accounting adjustments |

|

|

— |

|

|

|

0.4 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

0.5 |

|

Depreciation |

|

|

15.2 |

|

|

|

3.4 |

|

|

|

3.2 |

|

|

|

5.9 |

|

|

|

0.2 |

|

|

|

27.9 |

|

Segment adjusted EBITDA |

|

$ |

151.0 |

|

|

$ |

58.0 |

|

|

$ |

59.5 |

|

|

$ |

46.7 |

|

|

$ |

(1.5 |

) |

|

$ |

313.7 |

|

Segment adjusted EBITDA % of sales |

|

|

18.4 |

% |

|

|

20.4 |

% |

|

|

23.0 |

% |

|

|

15.5 |

% |

|

NM |

|

|

|

18.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Includes general corporate costs that were previously allocated to the Home segment and are now classified as continuing operations, since the costs were not directly attributable to the discontinued operations of the Home segment. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NM – Not meaningful |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Components may not sum to total due to rounding. |

|

See “Non-GAAP Financial Measures” above. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CommScope Holding Company, Inc. |

|

Adjusted Free Cash Flow |

|

(Unaudited -- In millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Free Cash Flow |

|

|

|

|

Q1

2023 |

|

|

Q2

2023 |

|

|

Q3

2023 |

|

|

Q4

2023 |

|

|

Q1

2024 |

|

Cash flow from operations |

|

|

$ |

(46.1 |

) |

|

$ |

136.8 |

|

|

$ |

138.8 |

|

|

$ |

60.4 |

|

|

$ |

(177.7 |

) |

Capital expenditures |

|

|

|

(14.4 |

) |

|

|

(20.8 |

) |

|

|

(8.7 |

) |

|

|

(9.4 |

) |

|

|

(6.0 |

) |

Free cash flow |

|

|

|

(60.5 |

) |

|

|

116.0 |

|

|

|

130.1 |

|

|

|

51.0 |

|

|

|

(183.7 |

) |

Transaction, transformation and integration costs |

|

|

|

1.4 |

|

|

|

1.7 |

|

|

|

11.5 |

|

|

|

13.4 |

|

|

|

20.3 |

|

Restructuring costs, net |

|

|

|

19.4 |

|

|

|

31.1 |

|

|

|

40.1 |

|

|

|

27.1 |

|

|

|

9.3 |

|

Adjusted free cash flow |

|

|

$ |

(39.7 |

) |

|

$ |

148.8 |

|

|

$ |

181.7 |

|

|

$ |

91.5 |

|

|

$ |

(154.1 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See “Non-GAAP Financial Measures” above. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CommScope Holding Company, Inc. |

|

Adjusted Gross Profit and Adjusted Operating Expense |

|

(Unaudited -- In millions) |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP to Non-GAAP Adjusted Gross Profit |

|

|

Q1 2023 |

|

Q2 2023 |

|

Q3 2023 |

|

Q4 2023 |

|

Q1 2024 |

|

Gross profit, as reported |

$ |

630.2 |

|

$ |

568.8 |

|

$ |

501.0 |

|

$ |

448.3 |

|

$ |

402.2 |

|

Equity-based compensation |

|

1.6 |

|

|

1.3 |

|

|

1.1 |

|

|

1.2 |

|

|

1.1 |

|

Acquisition accounting adjustments |

|

0.5 |

|

|

0.4 |

|

|

0.3 |

|

|

— |

|

|

0.1 |

|

Patent claims and litigation settlements |

|

— |

|

|

— |

|

|

(3.5 |

) |

|

— |

|

|

— |

|

Adjusted gross profit |

$ |

632.3 |

|

$ |

570.5 |

|

$ |

498.9 |

|

$ |

449.5 |

|

$ |

403.4 |

|

Adjusted gross profit as % of sales |

|

38.0 |

% |

|

35.9 |

% |

|

37.0 |

% |

|

37.9 |

% |

|

34.5 |

% |

|

|

|

|

|

|

|

|

|

|

|

GAAP to Non-GAAP Adjusted Operating Expense |

|

|

Q1 2023 |

|

Q2 2023 |

|

Q3 2023 |

|

Q4 2023 |

|

Q1 2024 |

|

Selling, general and administrative, as reported |

$ |

232.0 |

|

$ |

230.0 |

|

$ |

209.0 |

|

$ |

202.3 |

|

$ |

199.7 |

|

Research and development, as reported |

|

125.6 |

|

|

128.3 |

|

|

102.6 |

|

|

103.2 |

|

|

104.4 |

|

Operating expenses |

$ |

357.6 |

|

$ |

358.3 |

|

$ |

311.6 |

|

$ |

305.5 |

|

$ |

304.1 |

|

Equity-based compensation |

|

10.8 |

|

|

8.6 |

|

|

9.4 |

|

|

9.6 |

|

|

10.1 |

|

Transaction, transformation and integration costs |

|

0.3 |

|

|

2.8 |

|

|

14.6 |

|

|

9.4 |

|

|

8.5 |

|

Recovery for Russian accounts receivable |

|

— |

|

|

(2.0 |

) |

|

— |

|

|

— |

|

|

— |

|

Cyber incident costs |

|

— |

|

|

3.6 |

|

|

1.5 |

|

|

0.4 |

|

|

— |

|

Adjusted operating expense |

$ |

346.5 |

|

$ |

345.3 |

|

$ |

286.1 |

|

$ |

286.1 |

|

$ |

285.5 |

|

Adjusted operating expense as % of sales |

|

20.8 |

% |

|

21.7 |

% |

|

21.2 |

% |

|

24.1 |

% |

|

24.4 |

% |

|

|

|

|

|

|

|

|

|

|

|

Components may not sum to total due to rounding. |

|

See “Non-GAAP Financial Measures” above. |

|

v3.24.1.u1

Document and Entity Information

|

May 09, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

May 09, 2024

|

| Entity Registrant Name |

COMMSCOPE HOLDING COMPANY, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Central Index Key |

0001517228

|

| Entity File Number |

001-36146

|

| Entity Tax Identification Number |

27-4332098

|

| Entity Address, Address Line One |

3642 E

|

| Entity Address, Address Line Two |

US Highway 70

|

| Entity Address, City or Town |

Claremont

|

| Entity Address, State or Province |

NC

|

| Entity Address, Postal Zip Code |

28610

|

| City Area Code |

(828)

|

| Local Phone Number |

459-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

COMM

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

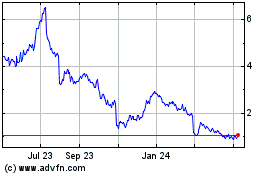

CommScope (NASDAQ:COMM)

Historical Stock Chart

From Apr 2024 to May 2024

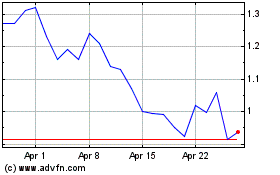

CommScope (NASDAQ:COMM)

Historical Stock Chart

From May 2023 to May 2024