0001528287false00015282872024-05-022024-05-02

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 2, 2024

NEUROPACE, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

Delaware (State or Other Jurisdiction of Incorporation) | 001-40337 (Commission File Number) | 22-3550230 (IRS Employer Identification No.) |

455 N. Bernardo Avenue Mountain View, CA (Address of principal executive offices) | | 94043 (Zip Code) |

(650) 237-2700

Registrant's telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instructions A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value per share | | NPCE | | Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On May 2, 2024, NeuroPace, Inc. (the “Company”) entered into an amendment (the “Amendment”) to the Company’s existing Term Loan Agreement, dated as of September 24, 2020 (as amended from time to time, the “Loan Agreement”), with the lenders party to the Loan Agreement and CRG Servicing LLC, as administrative agent and collateral agent for the lenders.

The Amendment extended the stated maturity date of the Loan Agreement by one year to September 30, 2026. In addition, the Amendment shortened the period during which the Company may, at its option, pay 5.0% per annum out of the 13.5% per annum of the interest that accrues under the Loan Agreement in-kind by increasing the principal amount of the loan. After giving effect to the Amendment, June 30, 2024 is the last payment date for which the Company has this option; previously, the Company had the option through the June 30, 2025 payment date.

The foregoing description of the Amendment does not purport to be complete and is subject to, and qualified in its entirety by, the full text of the Amendment, which the Company expects to file as an exhibit to the Company’s Quarterly Report on Form 10-Q for the quarter ending June 30, 2024, and upon filing will be incorporated herein by reference.

Item 2.02 Results of Operations and Financial Condition.

On May 8, 2024, the Company issued a press release announcing its financial results for the fiscal quarter ended March 31, 2024. A copy of the press release, dated May 8, 2024, is furnished hereto as Exhibit 99.1 and is incorporated herein by reference.

The foregoing information in this Item 2.02 (including the exhibit hereto) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | Press release, dated May 8, 2024 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| NeuroPace, Inc. |

| |

| Dated: May 8, 2024 | By: | /s/ Rebecca Kuhn |

| | Rebecca Kuhn |

| | Chief Financial Officer, Vice President, Finance and Administration, and Corporate Secretary |

NeuroPace Reports First Quarter 2024 Financial Results and Provides Corporate Update

Revenue increased to $18.1 million in Q1 2024, a 25% increase over Q1 2023

Extended the maturity date of the Company's term loan by one year to September 30, 2026

Maintained full-year 2024 revenue guidance of $73 to $77 million

Management scheduled to host a conference call today at 4:30 p.m. ET

Mountain View, Calif. – May 8, 2024 – NeuroPace, Inc. (Nasdaq: NPCE), a medical device company focused on transforming the lives of people living with epilepsy, today reported financial results for the first quarter ended March 31, 2024, and provided a corporate update.

Recent Highlights

•Reported total revenue of $18.1 million in the first quarter of 2024, a 25% increase compared with $14.5 million for the first quarter of 2023

•Generated strong revenue growth from both RNS System and DIXI Medical sales compared to the prior year quarter

•Extended the maturity date of its term loan by one year to September 30, 2026, increasing the Company’s financial flexibility

•Achieved an agreement milestone in its strategic biotechnology company collaboration to leverage the RNS System’s unique data monitoring and analysis capabilities

•Expanded Project CARE pilot program activities targeting clinicians outside of Level 4 comprehensive epilepsy centers in order to increase access to the RNS System for drug-resistant epilepsy patients

•Increased its commercial organization in support of RNS and DIXI sales growth and Project CARE pilot program

“We are pleased with the revenue growth and overall financial performance demonstrated in the first quarter of 2024,” said Joel Becker, Chief Executive Officer of NeuroPace. “The Company demonstrated strong year-over-year revenue growth from sales of the RNS System, as well as DIXI Medical products. We remain focused on the execution of our strategy in the current target market – which is estimated to be approximately $2 billion annually – that offers significant near-term growth opportunities in treating patients at comprehensive epilepsy centers in the U.S. In addition, we are investing in and executing on our longer-term strategy to expand our reach beyond Level 4 centers and bring NeuroPace’s total market opportunity to more than $55 billion. Our objective is to help close the treatment gap for drug-resistant epilepsy patients by expanding access to RNS therapy by increasing adoption and utilization in Level 4 centers, expanding referrals to and implants outside of Level 4 centers and expanding indications for RNS therapy, including to generalized epilepsy patients.”

“Over the past year, we have worked to find a balance between investing in topline growth and maintaining financial discipline across our business. We are proud of the success we have achieved on both of these fronts.” added Mr. Becker. “In addition, we are pleased to announce that we have extended the maturity date of our term loan by one year to September 30, 2026, which we believe further improves our financial position,” Mr. Becker concluded.

First Quarter 2024 Financial Results

Total revenue in the first quarter of 2024 grew 25% year-over-year to $18.1 million, compared with $14.5 million in the first quarter of 2023. The Company’s revenue growth was primarily driven by increased sales of

the RNS System and DIXI Medical products, offset partially by the continued decline in replacement implant revenue, which represented approximately 4% of total revenue.

Gross margin for the first quarter of 2024 was 73.6% compared to 71.7% in the first quarter of 2023. The Company’s gross margin increased primarily due to the increase in RNS products produced and sold, thereby spreading its fixed manufacturing overhead costs across more units, and some incremental benefit from service revenue from our strategic collaboration with Rapport, partially offset by the lower gross margin for distribution of DIXI Medical products.

Total operating expenses in the first quarter of 2024 were $20.9 million compared with $18.7 million in the same period of the prior year. R&D expense in the first quarter of 2024 was $5.8 million compared with $5.3 million in the first quarter of 2023. SG&A expense in the first quarter of 2024 was $15.1 million compared with $13.4 million in the prior year period. Consistent with the past few quarters, operating expenses as a percentage of revenue were lower for both R&D and SG&A expenses. The Company maintained its focus on appropriate resource allocation and cash management and remains committed to effectively managing its operating expenses without compromising revenue growth.

Loss from operations was $7.5 million in the first quarter of 2024 compared with a loss of $8.3 million in the prior year period. Net loss was $8.9 million for the first quarter of 2024 compared with $10.4 million in the first quarter of 2023.

The Company’s cash, cash equivalents and short-term investments balance as of March 31, 2024, was $58.9 million. Long-term borrowings totaled $58.0 million as of March 31, 2024. The Company’s cash burn in the first quarter of 2024 was $7.6 million, compared with cash burn of $9.8 million in the first quarter of 2023, representing another quarter of meaningful improvement attributable to the Company’s focus on operating discipline. The Company's quarterly cash burn tends to be the highest in first quarter of the fiscal year, primarily due to the timing of annual compensation-related payments.

Full Year 2024 Financial Guidance

•Total revenue to range between $73 million and $77 million, representing growth of 12% to 18% over 2023

•Gross margin to range between 72% and 74%

•Total operating expenses to range between $80 million and $84 million, including approximately $12 million in stock-based compensation, a noncash expense

NeuroPace continues to expect revenue growth to be primarily driven by increasing sales of its RNS System and higher sales of DIXI Medical stereo EEG products, while replacement implant revenue is expected to decline in 2024 versus 2023.

Webcast and Conference Call Information

NeuroPace will host a conference call to discuss the first quarter 2024 financial results after market close on Wednesday, May 8, 2024, at 4:30 P.M. Eastern Time.

Investors interested in listening to the conference call may do so by accessing a live and archived webcast of the event at https://viavid.webcasts.com/starthere.jsp?ei=1666802&tp_key=ec469bbb1b. Individuals interested in participating in the call via telephone may access the call by dialing +1-888-886-7786 and referencing Conference ID 48339803. The webcast will be archived on the Company's investor relations website at https://investors.neuropace.com/news-and-events/events and will be available for replay for at least 90 days after the event.

About NeuroPace, Inc.

Based in Mountain View, Calif., NeuroPace is a medical device company focused on transforming the lives of people living with epilepsy by reducing or eliminating the occurrence of debilitating seizures. Its novel and

differentiated RNS System is the first and only commercially available, brain-responsive platform that delivers personalized, real-time treatment at the seizure source. This platform can drive a better standard of care for patients living with drug-resistant epilepsy and has the potential to offer a more personalized solution and improved outcomes to the large population of patients suffering from other brain disorders.

Forward Looking Statements

This press release may contain forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “aims,” “anticipates,” “believes,” “could,” “estimates,” “expects,” “forecasts,” “goal,” “intends,” “may,” “plans,” “possible,” “potential,” “seeks,” “will” and variations of these words or similar expressions that are intended to identify forward-looking statements, although not all forward-looking statements contain these words. Forward-looking statements in this press release include, but are not limited to, statements regarding: NeuroPace’s current expectations, forecasts and beliefs; the extension of the maturity date of the Company’s term loan and its impact on our financial position; future financial performance, including management’s outlook for fiscal year 2024; the Company’s commitment to effectively managing its operating expenses; ability to capitalize on increased market opportunities by expanding access to treatments; and clinical trial results and indication expansion. NeuroPace may not actually achieve the plans, intentions or expectations disclosed in these forward-looking statements, and you should not place undue reliance on these forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in these forward-looking statements as a result of various factors, including: uncertainties related to market acceptance and adoption of NeuroPace’s RNS System; risks related to the pricing of the RNS System and availability of adequate reimbursement for the procedures to implant the RNS System and for clinicians to provide ongoing care for patients treated with the RNS System; the risk that NeuroPace may not realize the intended benefits of its partnership with DIXI Medical; risks related to regulatory compliance and expectations for regulatory approvals to expand the market for NeuroPace’s RNS System; NeuroPace’s reliance on contractors and other third parties, including single-source suppliers and vendors; and other important factors. These and other risks and uncertainties include those described more fully in the section titled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and elsewhere in NeuroPace’s public filings with the U.S. Securities and Exchange Commission (SEC), including its Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 5, 2024, as well as any other reports that it may file with the SEC in the future. Forward-looking statements contained in this announcement are based on information available to NeuroPace as of the date hereof. NeuroPace undertakes no obligation to update such information except as required under applicable law. These forward-looking statements should not be relied upon as representing NeuroPace’s views as of any date subsequent to the date of this press release and should not be relied upon as a prediction of future events. In light of the foregoing, investors are urged not to rely on any forward-looking statement in reaching any conclusion or making any investment decision about any securities of NeuroPace.

Investor Contact:

Jeremy Feffer

Managing Director

LifeSci Advisors

jfeffer@lifesciadvisors.com

NeuroPace, Inc.

Condensed Statements of Operations

(unaudited)

| | | | | | | | | | | | | | |

| | Three Months Ended March 31, |

| (in thousands, except share and per share amounts) | | 2024 | | 2023 |

| Revenue | | $ | 18,124 | | | $ | 14,472 | |

| Cost of goods sold | | 4,781 | | 4,100 |

| Gross profit | | 13,343 | | 10,372 |

| Operating expenses | | | | |

| Research and development | | 5,784 | | 5,263 |

| Selling, general and administrative | | 15,104 | | 13,428 |

| Total operating expenses | | 20,888 | | 18,691 |

| Loss from operations | | (7,545) | | (8,319) |

| Interest income | | 827 | | 726 |

| Interest expense | | (2,258) | | (1,965) |

| Other income (expense), net | | 51 | | (817) |

| Net loss and comprehensive loss | | $ | (8,925) | | | $ | (10,375) | |

| Net loss per share attributable to common stockholders, basic and diluted | | $ | (0.32) | | | $ | (0.41) | |

| Weighted-average shares used in computing net loss per share attributable to common stockholders, basic and diluted | | 28,285,176 | | | 25,097,262 | |

NeuroPace, Inc.

Condensed Balance Sheets

(unaudited)

| | | | | | | | | | | |

| March 31, | | December 31, |

| (in thousands, except share and per share amounts) | 2024 | | 2023 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 12,998 | | | $ | 18,058 | |

| Short-term investments | 45,947 | | 48,396 |

| Accounts receivable | 11,631 | | 12,314 |

| Inventory | 11,416 | | 11,214 |

| Prepaid expenses and other current assets | 2,262 | | 2,737 |

| Total current assets | 84,254 | | 92,719 |

| Property and equipment, net | 1,048 | | 1,003 |

| Operating lease right-of-use asset | 13,027 | | | 13,405 |

| Restricted cash | 122 | | | 122 |

| Deferred offering costs | 387 | | 387 |

| Other assets | 15 | | 15 |

| Total assets | $ | 98,853 | | | $ | 107,651 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 3,268 | | | $ | 2,332 | |

| Accrued liabilities | 7,290 | | 11,180 |

| Operating lease liability | 1,683 | | | 1,627 | |

| Deferred revenue | 869 | | | 1,090 | |

| Total current liabilities | 13,110 | | 16,229 |

| Long-term debt | 58,039 | | 56,954 |

Operating lease liability, net of current portion | 13,363 | | 13,814 |

| Total liabilities | 84,512 | | 86,997 |

| | | |

| Stockholders’ equity | | | |

| Common stock, $0.001 par value | 29 | | 28 |

| Additional paid-in capital | 527,046 | | 524,435 |

| Accumulated deficit | (512,734) | | (503,809) |

| Total stockholders’ equity | 14,341 | | 20,654 |

| Total liabilities and stockholders’ equity | $ | 98,853 | | | $ | 107,651 | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

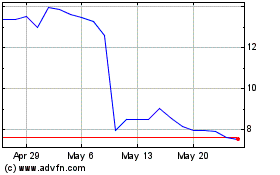

Neuropace (NASDAQ:NPCE)

Historical Stock Chart

From Apr 2024 to May 2024

Neuropace (NASDAQ:NPCE)

Historical Stock Chart

From May 2023 to May 2024