Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

May 07 2024 - 6:01AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission file number: 001-39477

GLOBAL BLUE GROUP HOLDING AG

(Translation of registrant’s name into English)

Zürichstrasse 38, 8306 Brüttisellen, Switzerland

+41 22 363 77 40

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

INFORMATION CONTAINED IN THIS REPORT ON FORM 6-K

On May 7, 2024, Global Blue Group Holding AG (the "Company") issued a press release, attached as exhibit 99.1 to this Form 6-K, providing a business update on the accelerated dynamic recovery of Tax Free Shopping ("TFS") across Continental Europe and Asia Pacific.

INCORPORATION BY REFERENCE

This Report on Form 6-K and the exhibits hereto shall be deemed to be incorporated by reference into the registration statements on Form F-3 (Nos. 333-259200, 333-267850, and 333-274233) and Form S-8 (No. 333-260108) of the Company and the prospectuses incorporated therein, and to be a part thereof from the date on which this report is filed, to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

| | | | | |

| Exhibit number | Description |

| 99.1 | |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 7, 2024

GLOBAL BLUE GROUP HOLDING AG

By: /s/ Jacques Stern

Name: Jacques Stern

Title: Chief Executive Officer

Global Blue Releases the Monthly Tax Free Shopping Business Update for April 2024 Signy, Switzerland, May 7, 2024 • Fresh data from Global Blue reveals that the global dynamic recovery for Tax Free Shopping accelerated across Continental Europe and Asia Pacific. • Globally, issued Sales in Store like-for-like recovery reached 153%1 in April 2024 compared to the same period in 2019, vs. 140%1 in Q1 2024. An accelerating worldwide recovery, compared to 2019 levels In Continental Europe, April 2024 recovery is ahead of Q1 ‘24 recovery, reaching 137%1 in April vs. 128%1 in Q1 ‘24, driven by a strong recovery in Spain (166%1), France (158%1) and Italy (145%1). Regarding origin markets, US shopper recovery accelerated, reaching 336%1 in April vs. 307%1 in Q1 ’24. The shift of the Ramadan period negatively impacted GCC recovery2, which stood at 198%1 in April vs. 277%1 in Q1 ‘24. In Asia Pacific, the recovery rate reached a record level at 194%1 in April vs. 166%1 in Q1 ‘24, fueled by a strong performance in Japan (272%1) and South Korea (144%1). In terms of origin markets, travelers from Hong Kong and Taiwan continue to lead the recovery, reaching 517%1 in April vs. 502%1 in Q1 ‘24. Following behind are North East Asia travelers, with a recovery rate of 323%1 in April vs. 287%1 in Q1 ‘24. In terms of Mainland Chinese shoppers, the worldwide issued Sales in Store like- for-like recovery reached 112%1 in April vs. 101%1 in Q1 ‘24. Within Continental Europe, Mainland Chinese shopper recovery reached 68%1 in April, in line with the previous two months. In Asia Pacific, Mainland Chinese shopper recovery accelerates, reaching 158%1 in April vs. 125%1 in Q1 ’24. 1 Recovery rate is equal to 2024 Issued Sales in Store divided by 2019 Issued Sales in Store, like- for-like (i.e.: at constant merchant scope and exchange rates). 2 Ramadan took place from March 10 to April 9 in 2024; while it took place from May 5 to June 3 in 2019.

A strong year-on-year performance for international shopping When analyzing the year-on-year variation in Tax Free Shopping growth, the worldwide issued Sales in Store like-for-like year-on-year performance reached +46% in April 2024 vs. last year. The issued Sales in Store in Continental Europe grew by +25%3 in April 2024 vs. last year, influenced by a positive dynamic across nationalities. Regarding origin markets, the issued Sales in Stores growth was positively influenced by most nationalities, with GCC shoppers leading the way with a +87%3 growth rate in April 2024, benefiting from a positive Ramadan calendar effect4. They were followed by Mainland Chinese shoppers at +47%3 and US shoppers at +23%3. In Asia Pacific, the issued Sales in Stores growth rate continues to remain high, reaching +103%3 in April 2024 vs. last year. All nationalities contributed positively, with Mainland Chinese leading the way at +262%3 in April 2024 vs. 2023, North East shoppers at +159%3 and Hong Kong and Taiwan at +52%3. 3 Growth rate variation year-on-year (2024 vs. the same period in 2023) 4 Ramadan took place from March 10 to April 9 in 2024; while it took place from March 22 to April 20 in 2023.

APPENDIX Worldwide recovery rate (versus 2019) rate Worldwide Year-on-Year Growth Rate (2024 vs. 2023) Issued SIS L/L recovery1 (in % of 2019) % Issued SIS 2019 April 2024 March 2024 February 2024 January 2024 CY Q1 2024 CY Q4 2023 France 22% 158% 160% 174% 164% 165% 140% Ita ly 24% 145% 135% 131% 111% 123% 123% Spain 14% 166% 152% 134% 153% 151% 133% Germany 13% 73% 69% 71% 70% 65% 74% Other countries 27% 129% 121% 127% 121% 126% 111% Total Continental Europe 100% 137% 130% 132% 125% 128% 118% Japan 54% 262% 235% 229% 232% 232% 225% Singapore 42% 81% 111% 84% 85% 92% 75% South Korea 4% 140% 127% 118% 131% 125% 111% Total Asia Pacific 100% 192% 181% 159% 161% 166% 150% Total worldwide 100% 153% 145% 141% 135% 140% 127% Issued SIS L/L Year-on-Year Growth3 % Issued SIS 2023 April 2024 March 2024 February 2024 January 2024 CY Q1 2024 France 26% +13% +3% +21% +11% +11% Ita ly 25% +30% +20% +44% +26% +29% Spain 15% +38% +18% +52% +31% +32% Germany 8% +15% -10% +9% +20% +6% Other countries 26% +24% +9% +30% +8% +16% Total Continental Europe 100% +25% +9% +32% +17% +19% Japan 65% +167% +146% +170% +100% +137% Singapore 27% -4% +24% +36% +15% 25% South Korea 8% +63% +96% +138% +108% 110% Total Asia Pacific 100% +103% +102% +120% +71% 97% Total worldwide 100% +46% +33% 57% +34% 40%

GLOSSARY - Gulf Cooperation Council countries include: Kuwait, Qatar, Saudi Arabia, United Arab Emirates, Bahrain, Oman - South East Asia includes: Indonesia, Thailand, Cambodia, Philippines, Vietnam, Malaysia, Singapore - North East Asia includes: Japan, South Korea MEDIA CONTACTS Virginie Alem – SVP Marketing & Communications Mail: valem@globalblue.com INVESTOR RELATIONS CONTACTS Frances Gibbons – Head of Investor Relations Mob: +44 (0)7815 034 212 Mail: fgibbons@globalblue.com ABOUT GLOBAL BLUE Global Blue is the business partner for the shopping journey, providing technology and services to enhance the experience and drive performance. With over 40 years of expertise, today we connect thousands of retailers, acquirers, and hotels with nearly 80 million consumers across 53 countries, in three industries: Tax Free Shopping, Payments and Post-Purchase solutions. With over 2,000 employees, Global Blue generated €20bn Sales in Store and €311M revenue in FY 2022/23. Global Blue is listed on the New York Stock Exchange. For more information, please visit www.globalblue.com Global Blue Monthly Intelligence Briefing, April 2024, Source: Global Blue

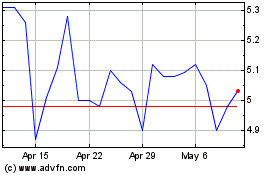

Global Blue (NYSE:GB)

Historical Stock Chart

From Apr 2024 to May 2024

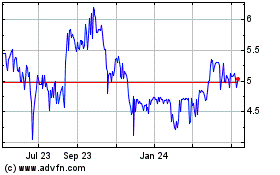

Global Blue (NYSE:GB)

Historical Stock Chart

From May 2023 to May 2024