false

0001874875

0001874875

2024-05-06

2024-05-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the

Securities Exchange Act of 1934

Date

of report (Date of earliest event reported): May 6, 2024

HOUR

LOOP, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-41204 |

|

47-2869399 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(I.R.S.

Employer

Identification

Number) |

8201

164th Ave NE #200, Redmond, WA 98052-7615

(Address

of principal executive offices)

(206)

385-0488 ext. 100

(Registrant’s

telephone number, including area code)

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2.)

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

HOUR |

|

The

Nasdaq Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

May 6, 2024, Hour Loop, Inc. (the “Company”) issued a press release announcing its financial results for the three months

ended March 31, 2024. A copy of this press release is attached hereto as Exhibit 99.1 and incorporated herein by reference. The information

contained in the website is not a part of this current report on Form 8-K.

In

accordance with General Instruction B.2 of Form 8-K, the information included in this Item 2.02, including Exhibit 99.1, shall not be

deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing

under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set

forth by specific reference in such a filing.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

HOUR

LOOP, INC. |

| |

|

|

| Dated:

May 6, 2024 |

By: |

/s/

Sam Lai |

| |

Name: |

Sam

Lai |

| |

Title: |

Chief

Executive Officer and Interim Chief Financial Officer |

Exhibit

99.1

Hour

Loop Reports First Quarter 2024 Results

Returns

to Profitability Despite Warning Signs for the Overall Economy

Provides

Full Year 2024 Revenue and Net Income Guidance

Redmond,

WA, May 6, 2024 – Hour Loop, Inc. (NASDAQ: HOUR) (“Hour Loop”), a leading online retailer, announces its financial

and operational results for the quarter ended March 31, 2024.

Financial

Highlights for First Quarter 2024:

| ● | Net

revenues increased 17.2% to $24.7 million, compared to $21.1 million in the year-ago period; |

| ● | Net

income totaled $1.1 million, compared to net loss of $1.2 million in the year-ago period;

and |

| ● | Cash

provided for operating activities was $0.5 million, compared to cash used in operating activities

of $3.3 million in the year-ago period. |

Management

Commentary

“We

are excited to report our first quarter 2024 results, in which we continued to deliver double digit revenue growth,” said Sam Lai,

CEO of Hour Loop. “The revenue growth rate for the first quarter was 17.2%, compared with the year-ago period.”

“Moreover,

our gross margin and operating margin were both improved because of efforts made for inventory quality and efficiency enhancement, operation

efficiency improvement, as well as expenses management. Overall, we believe we’ve built a solid foundation to continue generating

satisfactory growth while maintaining profitability.”

“Looking

forward, we’re cautiously optimistic. Despite an uncertain economy, we continue to see good demand for our products so far in 2024.

We are confident in our ability to continue delivering value to our vendors, customers, and shareholders.”

First

Quarter 2024 Financial Results

Net

revenues in the first quarter of 2024 were $24.7 million, compared to $21.1 million in the year-ago period. The increase was primarily

due to continued growth and maturity in our personnel and operating model, despite the overall e-commerce traffic slowdown and intense

competition.

Gross

profit percentage increased 12.9% to 58.5%, compared to 45.6% of net revenues in the comparable period a year ago. The increase was a

function of improved product costs, enhanced inventory quality and efficiency, and efforts made on margin increase.

Operating

expenses as a percentage of net revenues decreased 0.9% to 52.3%, compared to 53.2% of net revenues in the year-ago period. The decrease

reflected better management of storage fees and labor costs.

Net

income in the first quarter of 2024 was $1.1 million, or $0.03 per diluted share, compared to net loss of $1.2 million, or $0.04 per

diluted share, in the comparable year-ago period. The increase was driven by reduced costs as a result of the reasons mentioned above

and efforts made for expenses management.

As

of March 31, 2024, the Company had $2.9 million in cash and cash equivalents, compared to $2.5 million as of December 31, 2023. This

increase was mainly from the combination of an increase due to profitability and a decrease due to payments made to vendors when due.

Inventories

as of March 31, 2024, were $11.6 million, compared to $14.3 million as of December 31, 2023. The decrease represented good sales momentum

in the first quarter of 2024.

Full

Year 2024 Financial Outlook

For

the full year 2024, Hour Loop is providing guidance for net revenue to be in the range of $145 million to $172 million, representing

10% to 30% year-over-year growth. The Company expects net income in 2024 to be in the range of $0.5 million to $2 million.

About

Hour Loop, Inc.

Hour

Loop is an online retailer engaged in e-commerce retailing in the U.S. market. It has operated as a third-party seller on www.amazon.com

and has sold merchandise on its website at www.hourloop.com since 2013. Hour Loop further expanded its operations to other marketplaces

such as Walmart, eBay, and Etsy. To date, Hour Loop has generated practically all its revenue as a third-party seller on www.amazon.com

and only a negligible amount of revenue from its own website and other marketplaces. Hour Loop manages more than 100,000 stock-keeping

units (“SKUs”). Product categories include home/garden décor, toys, kitchenware, apparel, and electronics. Hour Loop’s

primary strategy is to bring most of its vendors’ product selections to the customers. It has advanced software that assists Hour

Loop in identifying product gaps so it can keep such products in stock year-round including the entirety of the last quarter (holiday

season) of the calendar year. In upcoming years, Hour Loop plans to expand its business rapidly by increasing the number of business

managers, vendors, and SKUs.

Forward-Looking

Statements

This

press release contains statements that constitute “forward-looking statements” including with respect to Hour Loop’s

business strategy, product development and industry trends. Forward-looking statements are subject to numerous conditions, many of which

are beyond the control of Hour Loop. While Hour Loop believes these forward-looking statements are reasonable, undue reliance should

not be placed on any such forward-looking statements, which are based on information available to Hour Loop on the date of this release.

These forward-looking statements are based upon current estimates and assumptions and are subject to various risks and uncertainties,

including, without limitation, those set forth in Hour Loop’s filings with the Securities and Exchange Commission, as the same

may be updated from time to time. Thus, actual results could be materially different. Hour Loop undertakes no obligation to update these

statements whether as a result of new information, future events or otherwise, after the date of this release, except as required by

law.

Investor

Contact

Finance

Department, Hour Loop, Inc.

finance@hourloop.com

HOUR

LOOP, INC.

CONSOLIDATED

BALANCE SHEETS

(In

U.S. Dollars, except for share data)

As

of March 31, 2024 and December 31, 2023

(Unaudited)

| | |

March 31, 2024 | | |

December 31, 2023 | |

| | |

| | |

| |

| ASSETS | |

| | | |

| | |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 2,922,080 | | |

$ | 2,484,153 | |

| Accounts receivable, net | |

| 537,517 | | |

| 747,650 | |

| Inventory, net | |

| 11,618,489 | | |

| 14,276,555 | |

| Prepaid expenses and other current assets | |

| 428,882 | | |

| 504,973 | |

| Total current assets | |

| 15,506,968 | | |

| 18,013,331 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 125,451 | | |

| 148,788 | |

| Deferred tax assets | |

| 953,088 | | |

| 1,304,215 | |

| Operating lease right-of-use lease assets | |

| 159,983 | | |

| 83,946 | |

| Total non-current assets | |

| 1,238,522 | | |

| 1,536,949 | |

| TOTAL ASSETS | |

$ | 16,745,490 | | |

$ | 19,550,280 | |

| | |

| | | |

| | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 3,420,221 | | |

$ | 3,812,954 | |

| Credit cards payable | |

| 1,861,435 | | |

| 4,404,445 | |

| Short-term loan | |

| 625,978 | | |

| 652,422 | |

| Operating lease liabilities-current | |

| 144,288 | | |

| 82,269 | |

| Income taxes payable | |

| 82,374 | | |

| - | |

| Accrued expenses and other current liabilities | |

| 878,603 | | |

| 1,972,512 | |

| Total current liabilities | |

| 7,012,899 | | |

| 10,924,602 | |

| | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | |

| Operating lease liabilities-non-current | |

| 23,995 | | |

| 2,363 | |

| Due to related parties | |

| 4,170,418 | | |

| 4,170,418 | |

| Total non-current liabilities | |

| 4,194,413 | | |

| 4,172,781 | |

| Total liabilities | |

| 11,207,312 | | |

| 15,097,383 | |

| Commitments and contingencies | |

| - | | |

| | |

| | |

| | | |

| | |

| Stockholders’ equity | |

| | | |

| | |

| Preferred stock: $0.0001 par value, 10,000,000 shares authorized, none issued and outstanding as of March 31, 2024 and December 31, 2023 | |

| - | | |

| - | |

| Common stock: $0.0001 par value, 300,000,000 shares authorized, 35,108,804 and 35,082,464 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively | |

| 3,510 | | |

| 3,508 | |

| Additional paid-in capital | |

| 5,763,648 | | |

| 5,727,650 | |

| Accumulated deficit | |

| (186,808 | ) | |

| (1,252,622 | ) |

| Accumulated other comprehensive loss | |

| (42,172 | ) | |

| (25,639 | ) |

| Total stockholders’ equity | |

| 5,538,178 | | |

| 4,452,897 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | |

$ | 16,745,490 | | |

$ | 19,550,280 | |

The

accompanying footnotes are an integral part of these unaudited consolidated financial statements.

HOUR

LOOP, INC.

CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (LOSS)

(In

U.S. Dollars, except for share data)

For

the Three Months Ended March 31, 2024 and 2023

(Unaudited)

| | |

Three Months Ended March 31, 2024 | | |

Three Months

Ended

March 31, 2023 | |

| | |

| | |

| |

| Revenues, net | |

$ | 24,681,122 | | |

$ | 21,067,609 | |

| Cost of revenues | |

| (10,228,916 | ) | |

| (11,451,907 | ) |

| | |

| | | |

| | |

| Gross profit | |

| 14,452,206 | | |

| 9,615,702 | |

| | |

| | | |

| | |

| Operating expenses | |

| | | |

| | |

| Selling and marketing | |

| 11,174,191 | | |

| 9,506,971 | |

| General and administrative | |

| 1,739,843 | | |

| 1,720,990 | |

| Total operating expenses | |

| 12,914,034 | | |

| 11,227,961 | |

| | |

| | | |

| | |

| Income (loss) from operations | |

| 1,538,172 | | |

| (1,612,259 | ) |

| | |

| | | |

| | |

| Other (expenses) income | |

| | | |

| | |

| Other expense | |

| (1,156 | ) | |

| (2,880 | ) |

| Interest expense | |

| (62,112 | ) | |

| (61,096 | ) |

| Other income | |

| 28,034 | | |

| 16,035 | |

| Total other expenses, net | |

| (35,234 | ) | |

| (47,941 | ) |

| | |

| | | |

| | |

| Income (loss) before income taxes | |

| 1,502,938 | | |

| (1,660,200 | ) |

| Income tax (expense) benefit | |

| (437,124 | ) | |

| 424,956 | |

| | |

| | | |

| | |

| Net income (loss) | |

| 1,065,814 | | |

| (1,235,244 | ) |

| | |

| | | |

| | |

| Other comprehensive (income) loss | |

| | | |

| | |

| Foreign currency translation adjustments | |

| (16,533 | ) | |

| 1,339 | |

| | |

| | | |

| | |

| Total comprehensive income (loss) | |

$ | 1,049,281 | | |

$ | (1,233,905 | ) |

| | |

| | | |

| | |

| Basic and diluted income (loss) per common share | |

$ | 0.03 | | |

$ | (0.04 | ) |

| Weighted-average number of common shares outstanding | |

| 35,095,602 | | |

| 35,052,666 | |

The

accompanying footnotes are an integral part of these unaudited consolidated financial statements.

HOUR

LOOP, INC.

CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In

U.S. Dollars)

For

the Three Months Ended March 31, 2024 and 2023

(Unaudited)

| | |

Three Months | | |

Three Months | |

| | |

Ended | | |

Ended | |

| | |

March 31, 2024 | | |

March 31, 2023 | |

| | |

| | |

| |

| Cash flows from operating activities | |

| | | |

| | |

| Net income (loss) | |

$ | 1,065,814 | | |

$ | (1,235,244 | ) |

| Reconciliation of net income (loss) to net cash used in operating activities: | |

| | | |

| | |

| Depreciation expenses | |

| 35,273 | | |

| 34,662 | |

| Amortization of operating lease right-of-use lease assets | |

| 42,892 | | |

| 95,635 | |

| Deferred tax assets | |

| 351,127 | | |

| (424,956 | ) |

| Stock-based compensation | |

| 36,000 | | |

| 16,332 | |

| Inventory allowance | |

| 637,058 | | |

| 642,145 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 210,133 | | |

| 9,091 | |

| Inventory | |

| 2,021,008 | | |

| 4,588,505 | |

| Prepaid expenses and other current assets | |

| 76,091 | | |

| (92,605 | ) |

| Accounts payable | |

| (392,733 | ) | |

| (1,881,078 | ) |

| Credit cards payable | |

| (2,543,010 | ) | |

| (3,977,569 | ) |

| Accrued expenses and other current liabilities | |

| (1,093,909 | ) | |

| (962,271 | ) |

| Operating lease liabilities | |

| (35,175 | ) | |

| (101,723 | ) |

| Income taxes payable | |

| 82,374 | | |

| - | |

| Net cash provided by (used in) operating activities | |

| 492,943 | | |

| (3,289,076 | ) |

| | |

| | | |

| | |

| Cash flows from investing activities: | |

| | | |

| | |

| Purchases of property and equipment | |

| (17,798 | ) | |

| (3,379 | ) |

| Net cash used in investing activities | |

| (17,798 | ) | |

| (3,379 | ) |

| | |

| | | |

| | |

| Effect of changes in foreign currency exchange rates | |

| (37,218 | ) | |

| 4,657 | |

| | |

| | | |

| | |

| Net change in cash and cash equivalents | |

| 437,927 | | |

| (3,287,798 | ) |

| | |

| | | |

| | |

| Cash and cash equivalents at beginning of period | |

| 2,484,153 | | |

| 4,562,589 | |

| | |

| | | |

| | |

| Cash and cash equivalents at end of period | |

$ | 2,922,080 | | |

$ | 1,274,791 | |

| | |

| | | |

| | |

| Supplemental disclosures of cash flow information: | |

| | | |

| | |

| Cash paid for interest | |

$ | 3,380 | | |

$ | 161,798 | |

| Cash paid for income tax | |

$ | - | | |

$ | - | |

| Noncash investing and financing activities: | |

| | | |

| | |

| Operating lease right-of-use of assets and operating lease liabilities recognized | |

$ | 123,107 | | |

$ | 28,652 | |

The

accompanying footnotes are an integral part of these unaudited consolidated financial statements.

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

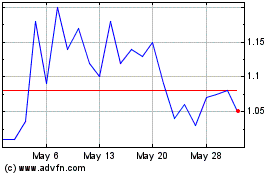

Hour Loop (NASDAQ:HOUR)

Historical Stock Chart

From Apr 2024 to May 2024

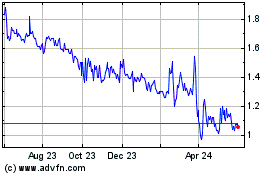

Hour Loop (NASDAQ:HOUR)

Historical Stock Chart

From May 2023 to May 2024