Hallmark Announces Second Quarter Results

August 14 2023 - 4:05PM

Hallmark Financial Services, Inc. (“Hallmark”) (NASDAQ: HALL) today

filed its Form 10-Q and announced financial results for the second

quarter and six months ended June 30, 2023.

| |

Second Quarter |

|

Year-to-Date |

|

|

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

2022 |

|

|

$ in millions: |

|

|

|

|

|

Net loss from continuing operations |

$ |

(17.8 |

) |

$ |

(67.0 |

) |

|

$ |

(57.0 |

) |

$ |

(78.7 |

) |

|

Net income (loss) from discontinued operations |

$ |

5.9 |

|

$ |

(2.4 |

) |

|

$ |

6.0 |

|

$ |

6.1 |

|

|

Net loss |

$ |

(11.9 |

) |

$ |

(69.4 |

) |

|

$ |

(51.0 |

) |

$ |

(72.6 |

) |

|

Operating loss (1) |

$ |

(12.4 |

) |

$ |

(63.9 |

) |

|

$ |

(17.4 |

) |

$ |

(75.6 |

) |

| |

|

|

|

|

|

|

$ per diluted share (2): |

|

|

|

|

| Net loss

from continuing operations |

$ |

(9.78 |

) |

$ |

(36.85 |

) |

|

$ |

(31.37 |

) |

$ |

(43.30 |

) |

|

Net income (loss) from discontinued operations |

$ |

3.23 |

|

$ |

(1.31 |

) |

|

$ |

3.29 |

|

$ |

3.35 |

|

| Net

loss |

$ |

(6.55 |

) |

$ |

(38.16 |

) |

|

$ |

(28.08 |

) |

$ |

(39.95 |

) |

|

Operating loss (1) |

$ |

(6.83 |

) |

$ |

(35.12 |

) |

|

$ |

(9.56 |

) |

$ |

(41.58 |

) |

(1) See “Non-GAAP Financial

Measures” below(2) Per share amounts have been

restated to reflect one-for-ten reverse stock split

Highlights of results from the

quarter:

- Net loss from continuing operations

in the second quarter of 2023 of $17.8 million, or $9.78 per share,

as compared to a net loss of $67.0 million, or $36.85 per share for

the comparable period in 2022. Year-to-date net loss from

continuing operations of $57.0 million, or $31.37 per share, for

2023 as compared to a net loss of $78.7 million, or $43.30 per

share, for the comparable period in 2022.

- Net income from discontinued

operations of $5.9 million, or $3.23 per share, in the second

quarter of 2023 as compared to a net loss from discontinued

operations of $2.4 million, or $1.31 per share, for the comparable

period in 2022. Year-to-date net income from discontinued

operations of $6.0 million, or $3.29 per share, for 2023 as

compared to net income of $6.1 million, or $3.35 per share, for the

comparable period in 2022.

- Net loss of $11.9 million, or $6.55

per share, in the second quarter of 2023 includes $3.1 million or

$1.72 per share related to the DARAG(a) write-off to bad debt

expense based on the final definitive award declared on June 2,

2023, compared to a net loss of $69.4 million, or $38.16 per share,

for the comparable period in 2022. Year-to-date net loss of $51.0

million, or $28.08 per share, for 2023 includes $29.1 million, or

$16.00 per share, related to the DARAG(a) write-off to bad debt

expense on the final definitive award declared on June 2, 2023, as

compared to a net loss of $72.6 million, or $39.95 per share, for

the comparable period in 2022. See Non-GAAP Financial Measures

below.

- Net combined ratio of 157.3% for

the three months ended June 30, 2023, compared to 240.9% for the

same periods the prior year. Year-to-date net combined ratio for

2023 of 185.9% as compared to 187.3% for the comparable period in

2022.

- Underlying combined ratio

(excluding net prior year development, catastrophe losses and

write-off of DARAG(a) receivable) of 119.4% for the three months

ended June 30, 2023, compared to 117.7% for the same period the

prior year. Year-to-date underlying combined ratio for 2023 of

114.9% as compared to 113.6% for the comparable period in 2022. See

Non-GAAP Financial Measures below.

- Net investment income was $4.0

million during the three months ended June 30, 2023, as compared to

$3.1 million during the same period in 2022. Year-to-date net

investment income for 2023 of $8.4 million as compared to $5.0

million for the comparable period in 2022.

- As of June 30, 2023, the Company

has $150.5 million in cash and cash equivalents. Our debt

securities were $295.8 million as of June 30, 2023 as compared to

$426.6 million as of December 31, 2022. Furthermore, 92% of debt

securities have maturities of five years or less and overall our

debt securities portfolio has an average modified duration of 0.7

years.

- The Company continues to maintain a

full valuation allowance for income tax in fiscal 2023.

- Due to the Maui, Hawaii wildfires

on August 9, 2023, we preliminarily estimate our net loss exposure

to be $7.5 million plus additional cost in the form of

reinstatement premiums to restore any necessary reinsurance layers.

The net loss and any additional cost incurred will be recognized in

our third quarter 2023 financial statements.

- On May 5, 2023, the Company entered

into an agreement with an A.M. Best rated “A” insurance company to

continue to write new business in circumstances that require an

A.M. Best financial strength rating.

|

|

a) |

As previously disclosed in Hallmark’s public filings, certain of

Hallmark’s subsidiaries were parties to an arbitration proceeding

relating to a Loss Portfolio Transfer Reinsurance Contract with

DARAG Bermuda Ltd. and DARAG Insurance Limited. On May 4, 2023, the

arbitration panel rendered an interim final award, which resulted

in a write-off of $32.9 million recognized during the first quarter

of 2023, subject to final determination of certain amounts under

settlement which may increase or decrease our total write-off. As

of March 31, 2023, our consolidated balance sheet included $3.9

million of account receivable from DARAG related to cost incurred

in which we contended we have right of reimbursement. On June 2,

2023, the final definitive binding award was declared by the

arbitration panel which resulted in an additional write-off to

Hallmark of $3.9 million, or $3.1 million if tax effected, during

the second quarter of 2023. This additional write-off results in a

total write-off of $36.8 million, or $29.1 million if tax effected,

included in our year-to-date net loss. |

Second Quarter and Year-to-Date 2023 Financial

Review

|

|

Second Quarter |

|

Year-to-Date |

|

|

|

2023 |

|

|

2022 |

|

|

|

2023 |

|

|

2022 |

|

|

($ in thousands) |

|

|

|

|

|

Gross premiums written |

$ |

54,511 |

|

$ |

56,004 |

|

|

$ |

111,683 |

|

$ |

115,337 |

|

|

Net premiums written |

$ |

43,875 |

|

$ |

37,438 |

|

|

$ |

86,256 |

|

$ |

78,707 |

|

|

Net premiums earned |

$ |

36,847 |

|

$ |

37,037 |

|

|

$ |

72,127 |

|

$ |

76,352 |

|

|

Investment income, net of expenses |

$ |

4,019 |

|

$ |

3,120 |

|

|

$ |

8,361 |

|

$ |

4,979 |

|

|

Investment gains (losses), net |

$ |

248 |

|

$ |

(3,994 |

) |

|

$ |

(392 |

) |

$ |

(3,943 |

) |

|

Net (loss) from continuing operations |

$ |

(17,785 |

) |

$ |

(67,035 |

) |

|

$ |

(57,031 |

) |

$ |

(78,712 |

) |

|

Net income from discontinued operations |

$ |

5,876 |

|

$ |

(2,382 |

) |

|

$ |

5,980 |

|

$ |

6,076 |

|

|

Net (loss) income |

$ |

(11,909 |

) |

$ |

(69,417 |

) |

|

$ |

(51,051 |

) |

$ |

(72,636 |

) |

|

Operating (loss) income (2) |

$ |

(12,416 |

) |

$ |

(63,880 |

) |

|

$ |

(17,389 |

) |

$ |

(75,597 |

) |

|

Net (loss) income per share from continuing operations basic &

diluted (1) |

$ |

(9.78 |

) |

$ |

(36.85 |

) |

|

$ |

(31.37 |

) |

$ |

(43.30 |

) |

|

Net income per share from discontinued operations - basic &

diluted |

$ |

3.23 |

|

$ |

(1.31 |

) |

|

$ |

3.29 |

|

$ |

3.35 |

|

|

Net loss per share - basic & diluted |

$ |

(6.55 |

) |

$ |

(38.16 |

) |

|

$ |

(28.08 |

) |

$ |

(39.95 |

) |

|

Operating (loss) per share - basic & diluted (2) |

$ |

(6.83 |

) |

$ |

(35.12 |

) |

|

$ |

(9.56 |

) |

$ |

(41.58 |

) |

|

Book value per share |

$ |

6.81 |

|

$ |

53.01 |

|

|

$ |

6.81 |

|

$ |

53.01 |

|

(1) Per share amounts have been

restated for a reverse stock split(2) See

“Non-GAAP Financial Measures” below

Non-GAAP Financial Measures

The Company’s financial statements are prepared

in accordance with United States generally accepted accounting

principles (“GAAP”). However, the Company also presents and

discusses certain non-GAAP financial measures that it believes are

useful to investors as measures of operating performance.

Management may also use such non-GAAP financial measures in

evaluating the effectiveness of business strategies and for

planning and budgeting purposes. However, these non-GAAP financial

measures should not be viewed as an alternative or substitute for

the results reflected in the Company’s GAAP financial statements.

In addition, the Company’s definitions of these items may not be

comparable to the definitions used by other companies.

Operating income and operating income per share

are calculated by excluding net investment gains and losses and

asset impairments or valuation allowances from GAAP net income from

continuing operations. Asset impairments and valuation allowances

are unusual and infrequent charges for the Company. Management

believes that operating income and operating income per share

provide useful information to investors about the performance of

and underlying trends in the Company’s core insurance operations.

Net income from continuing operations and net income per share from

continuing operations are the GAAP measures that are most directly

comparable to operating earnings and operating earnings per share.

A reconciliation of operating income and operating income per share

to the most comparable GAAP financial measures is presented

below.

|

|

|

Hallmark Financial Services, Inc. and

Subsidiaries |

|

Non-GAAP Financial Measures Reconciliation |

|

|

|

|

|

|

|

|

($ in thousands) |

Income (Loss)from Continuing OperationsBefore

Tax |

Less TaxEffect |

NetAfter Tax |

WeightedAverageShares Diluted |

DilutedPer Share |

|

Second Quarter 2023 |

|

|

|

|

|

Reported GAAP measures |

$ |

(17,918 |

) |

$ |

(133 |

) |

$ |

(17,785 |

) |

1,818 |

$ |

(9.78 |

) |

|

Excluded deferred tax valuation allowance |

$ |

- |

|

$ |

(2,441 |

) |

$ |

2,441 |

|

1,818 |

$ |

1.34 |

|

|

Excluded write-off receivable from reinsurer |

$ |

3,954 |

|

$ |

830 |

|

$ |

3,124 |

|

1,818 |

$ |

1.72 |

|

|

Excluded investment (gains)/losses |

$ |

(248 |

) |

$ |

(52 |

) |

$ |

(196 |

) |

1,818 |

$ |

(0.11 |

) |

|

Operating loss |

$ |

(14,212 |

) |

$ |

(1,796 |

) |

$ |

(12,416 |

) |

1,818 |

$ |

(6.83 |

) |

|

|

|

|

|

|

|

|

Second Quarter 2022 |

|

|

|

|

|

Reported GAAP measures |

$ |

(54,585 |

) |

$ |

12,450 |

|

$ |

(67,035 |

) |

1,819 |

$ |

(36.85 |

) |

|

Excluded investment (gains)/losses |

$ |

3,994 |

|

$ |

839 |

|

$ |

3,155 |

|

1,819 |

$ |

1.73 |

|

|

Operating loss |

$ |

(50,591 |

) |

$ |

13,289 |

|

$ |

(63,880 |

) |

1,819 |

$ |

(35.12 |

) |

|

|

|

|

|

|

|

|

Year-to-Date 2023 |

|

|

|

|

|

Reported GAAP measures |

$ |

(57,698 |

) |

$ |

(667 |

) |

$ |

(57,031 |

) |

1,818 |

$ |

(31.37 |

) |

|

Excluded deferred tax valuation allowance |

$ |

- |

|

$ |

(10,239 |

) |

$ |

10,239 |

|

1,818 |

$ |

5.63 |

|

|

Excluded write-off receivable from reinsurer |

$ |

36,826 |

|

$ |

7,733 |

|

$ |

29,093 |

|

1,818 |

$ |

16.00 |

|

|

Excluded investment (gains)/losses |

$ |

392 |

|

$ |

82 |

|

$ |

310 |

|

1,818 |

$ |

0.17 |

|

|

Operating loss |

$ |

(20,480 |

) |

$ |

(3,091 |

) |

$ |

(17,389 |

) |

1,818 |

$ |

(9.56 |

) |

|

|

|

|

|

|

|

|

Year-to-Date 2022 |

|

|

|

|

|

Reported GAAP measures |

$ |

(69,442 |

) |

$ |

9,270 |

|

$ |

(78,712 |

) |

1,818 |

$ |

(43.30 |

) |

|

Excluded investment (gains)/losses |

$ |

3,943 |

|

$ |

828 |

|

$ |

3,115 |

|

1,818 |

$ |

1.71 |

|

|

Operating income |

$ |

(65,499 |

) |

$ |

10,098 |

|

$ |

(75,597 |

) |

1,818 |

$ |

(41.58 |

) |

Underlying combined ratio is calculated by

excluding the impact of net favorable or unfavorable prior year

loss development and catastrophe losses from the calculation of the

net combined ratio. Management believes that the underlying

combined ratio provides useful information to investors about the

current performance of the Company's insurance operations absent

historical developments and uncontrollable events. Combined ratio

is the GAAP measure most comparable to underlying combined ratio. A

reconciliation of the underlying combined ratio to the combined

ratio is presented below.

|

|

|

|

|

|

|

|

2ndQ 2023 |

2ndQ 2022 |

YTD 2023 |

YTD 2022 |

|

Net combined ratio |

157.3 |

% |

240.9 |

% |

185.9 |

% |

187.3 |

% |

|

Impact on net combined ratio |

|

|

|

|

Net Unfavorable (Favorable) Prior Year Development |

24.5 |

% |

120.9 |

% |

16.1 |

% |

72.3 |

% |

|

Catastrophes, net of reinsurance |

2.8 |

% |

2.3 |

% |

3.8 |

% |

1.4 |

% |

|

Write-off receivable from reinsurer |

10.7 |

% |

0.0 |

% |

51.1 |

% |

0.0 |

% |

|

Underlying combined ratio |

119.4 |

% |

117.7 |

% |

114.9 |

% |

113.6 |

% |

A copy of our Form 10-Q is available on our

website at www.hallmarkgrp.com or on the SEC website at

www.sec.gov. Readers are urged to review the Form 10-Q for a more

complete discussion of our financial performance.

About Hallmark

Hallmark is a property and casualty insurance

holding company with a diversified portfolio of insurance products

written on a national platform. With six insurance subsidiaries,

Hallmark markets, underwrites and services commercial and personal

insurance in select markets. Hallmark is headquartered in Dallas,

Texas and its common stock is listed on NASDAQ under the symbol

"HALL."

Forward-looking statements in this release are

made pursuant to the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995. Investors are cautioned

that actual results may differ materially from such forward-looking

statements. Forward-looking statements involve risks and

uncertainties including, but not limited to, continued acceptance

of the Company’s products and services in the marketplace,

competitive factors, interest rate trends, general economic

conditions, the availability of financing, underwriting loss

experience and other risks detailed from time to time in the

Company’s filings with the Securities and Exchange Commission.

For further information, please contact:

Chris KenneyChief Executive Officer

817.348.1600www.hallmarkgrp.com

|

|

|

|

|

Hallmark Financial Services, Inc. and

Subsidiaries |

|

Consolidated Balance Sheets |

|

|

|

|

|

($ in thousands, except par value) |

|

Jun. 30 |

|

Dec. 31 |

|

ASSETS |

|

2023 |

|

|

2022 |

|

|

Investments: |

|

|

|

|

Debt securities, available-for-sale, at fair value (amortized cost:

$299,544 in 2023 and $434,119 in 2022; allowance for expected

credit losses of $0 in 2023) |

$ |

295,761 |

|

$ |

426,597 |

|

|

Equity securities (cost: $24,284 in 2023 and $30,058 in 2022) |

|

22,763 |

|

|

28,199 |

|

|

Total investments |

|

318,524 |

|

|

454,796 |

|

|

Cash and cash equivalents |

|

150,528 |

|

|

59,133 |

|

|

Restricted cash |

|

14,781 |

|

|

29,486 |

|

|

Ceded unearned premiums |

|

86,661 |

|

|

237,086 |

|

|

Premiums receivable |

|

49,506 |

|

|

78,355 |

|

|

Accounts receivable |

|

1,076 |

|

|

10,859 |

|

|

Receivable from reinsurer |

|

- |

|

|

58,882 |

|

|

Receivable for securities |

|

476 |

|

|

945 |

|

|

Reinsurance recoverable (net of allowance for expected credit

losses of $200 in 2023) |

|

593,635 |

|

|

578,424 |

|

|

Deferred policy acquisition costs |

|

9,858 |

|

|

8 |

|

|

Federal income tax recoverable |

|

- |

|

|

2,668 |

|

|

Prepaid pension assets |

|

239 |

|

|

163 |

|

|

Prepaid expenses |

|

1,878 |

|

|

1,508 |

|

|

Other assets |

|

22,186 |

|

|

24,389 |

|

|

Total Assets |

$ |

1,249,348 |

|

$ |

1,536,702 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

Liabilities: |

|

|

|

|

|

Senior unsecured notes due 2029 (less unamortized debt issuance

costs of $599 in 2023 and $648 in 2022) |

$ |

49,401 |

|

$ |

49,352 |

|

|

Subordinated debt securities (less unamortized debt issuance costs

of $666 in 2023 and $691 in 2022) |

|

56,036 |

|

|

56,011 |

|

|

Reserves for unpaid losses and loss adjustment expenses |

|

784,846 |

|

|

880,869 |

|

|

Unearned premiums |

|

156,394 |

|

|

292,691 |

|

|

Reinsurance payable |

|

111,176 |

|

|

128,950 |

|

|

Federal income tax payable |

|

464 |

|

|

- |

|

|

Accounts payable and other liabilities |

|

78,646 |

|

|

68,535 |

|

|

Total Liabilities |

|

1,236,963 |

|

|

1,476,408 |

|

|

Commitments and contingencies |

|

|

|

|

|

Stockholders' equity: |

|

|

|

|

|

Common stock, $1.00 par value, authorized 3,333,333 shares; issued

2,087,283 shares in 2023 and 2022 |

2,087 |

|

|

2,087 |

|

|

Additional paid-in capital |

|

124,879 |

|

|

124,740 |

|

|

(Accumulated deficit) retained earnings |

|

(84,458 |

) |

|

(33,407 |

) |

|

Accumulated other comprehensive loss |

|

(5,489 |

) |

|

(8,492 |

) |

|

Treasury stock (268,801 shares in 2023 and 2022), at cost |

|

(24,634 |

) |

|

(24,634 |

) |

|

Total Stockholders Equity |

|

12,385 |

|

|

60,294 |

|

|

Total Liabilities & Stockholders Equity |

$ |

1,249,348 |

|

$ |

1,536,702 |

|

|

|

|

Hallmark Financial Services, Inc. and

Subsidiaries |

|

|

|

|

|

Consolidated Statements of Operations |

Three Months Ended |

|

Year-to-Date |

|

($ in thousands, except per share amounts) |

June 30, |

|

June 30, |

|

|

2023 |

|

2022 |

|

|

2023 |

|

2022 |

|

|

Gross premiums written |

$ |

54,511 |

|

$ |

56,004 |

|

|

$ |

111,683 |

|

$ |

115,337 |

|

|

Ceded premiums written |

|

(10,636 |

) |

|

(18,566 |

) |

|

|

(25,427 |

) |

|

(36,630 |

) |

|

Net premiums written |

|

43,875 |

|

|

37,438 |

|

|

|

86,256 |

|

|

78,707 |

|

|

Change in unearned premiums |

|

(7,028 |

) |

|

(401 |

) |

|

|

(14,129 |

) |

|

(2,355 |

) |

|

Net premiums earned |

|

36,847 |

|

|

37,037 |

|

|

|

72,127 |

|

|

76,352 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Investment income, net of expenses |

|

4,019 |

|

|

3,120 |

|

|

|

8,361 |

|

|

4,979 |

|

|

Investment gains (losses), net |

|

248 |

|

|

(3,994 |

) |

|

|

(392 |

) |

|

(3,943 |

) |

|

Finance charges |

|

732 |

|

|

980 |

|

|

|

1,511 |

|

|

1,963 |

|

|

Other income |

|

64 |

|

|

14 |

|

|

|

134 |

|

|

29 |

|

|

Total revenues |

|

41,910 |

|

|

37,157 |

|

|

|

81,741 |

|

|

79,380 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Losses and loss adjustment expenses |

|

36,752 |

|

|

72,646 |

|

|

|

66,516 |

|

|

112,028 |

|

|

Operating expenses |

|

21,138 |

|

|

17,723 |

|

|

|

69,087 |

|

|

34,150 |

|

|

Interest expense |

|

1,938 |

|

|

1,366 |

|

|

|

3,836 |

|

|

2,630 |

|

|

Amortization of intangible assets |

|

0 |

|

|

7 |

|

|

|

0 |

|

|

14 |

|

|

Total expenses |

|

59,828 |

|

|

91,742 |

|

|

|

139,439 |

|

|

148,822 |

|

|

|

|

|

|

|

|

|

|

|

|

|

(Loss) income from continuing operations before tax |

|

(17,918 |

) |

|

(54,585 |

) |

|

|

(57,698 |

) |

|

(69,442 |

) |

|

Income tax (benefit) expense from continuing operations |

|

(133 |

) |

|

12,450 |

|

|

|

(667 |

) |

|

9,270 |

|

|

Net (loss) income from continuing operations |

$ |

(17,785 |

) |

$ |

(67,035 |

) |

|

$ |

(57,031 |

) |

$ |

(78,712 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations: |

|

|

|

|

|

|

|

|

|

|

Total pretax income from discontinued operations |

$ |

5,876 |

|

$ |

(2,965 |

) |

|

$ |

5,980 |

|

$ |

7,773 |

|

|

Income tax (benefit) expense on discontinued operations |

|

- |

|

|

(583 |

) |

|

|

- |

|

|

1,697 |

|

|

Income (loss) from discontinued operations, net of tax |

$ |

5,876 |

|

$ |

(2,382 |

) |

|

$ |

5,980 |

|

$ |

6,076 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income |

$ |

(11,909 |

) |

$ |

(69,417 |

) |

|

$ |

(51,051 |

) |

$ |

(72,636 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) basic income per share: |

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations |

$ |

(9.78 |

) |

$ |

(36.85 |

) |

|

$ |

(31.37 |

) |

$ |

(43.30 |

) |

|

Net income (loss) from discontinued operations |

|

3.23 |

|

|

(1.31 |

) |

|

|

3.29 |

|

|

3.35 |

|

|

Basic net (loss) income per share |

$ |

(6.55 |

) |

$ |

(38.16 |

) |

|

$ |

(28.08 |

) |

$ |

(39.95 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) diluted income per share: |

|

|

|

|

|

|

|

|

|

|

Net loss from continuing operations |

$ |

(9.78 |

) |

$ |

(36.85 |

) |

|

$ |

(31.37 |

) |

$ |

(43.30 |

) |

|

Net income (loss) from discontinued operations |

|

3.23 |

|

|

(1.31 |

) |

|

|

3.29 |

|

|

3.35 |

|

|

Diluted net (loss) income per share |

$ |

(6.55 |

) |

$ |

(38.16 |

) |

|

$ |

(28.08 |

) |

$ |

(39.95 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

Hallmark Financial Services, Inc. and

Subsidiaries |

|

Consolidated Segment Data |

|

|

|

|

|

Three Months Ended Jun. 30 |

|

|

|

|

|

|

|

|

|

Commercial Lines Segment |

Personal Lines Segment |

Runoff Specialty Segment |

Corporate |

Consolidated |

|

($ in thousands, unaudited) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Gross premiums written |

$ |

39,292 |

|

$ |

37,385 |

|

$ |

15,073 |

|

$ |

15,118 |

|

$ |

146 |

|

$ |

3,501 |

|

$ |

- |

|

$ |

- |

|

$ |

54,511 |

|

$ |

56,004 |

|

|

Ceded premiums written |

|

(10,510 |

) |

|

(17,890 |

) |

|

(78 |

) |

|

(74 |

) |

|

(48 |

) |

|

(602 |

) |

|

- |

|

|

- |

|

|

(10,636 |

) |

|

(18,566 |

) |

|

Net premiums written |

|

28,782 |

|

|

19,495 |

|

|

14,995 |

|

|

15,044 |

|

|

98 |

|

|

2,899 |

|

|

- |

|

|

- |

|

|

43,875 |

|

|

37,438 |

|

|

Change in unearned premiums |

|

(5,610 |

) |

|

(1,305 |

) |

|

(1,420 |

) |

|

809 |

|

|

2 |

|

|

95 |

|

|

- |

|

|

- |

|

|

(7,028 |

) |

|

(401 |

) |

|

Net premiums earned |

|

23,172 |

|

|

18,190 |

|

|

13,575 |

|

|

15,853 |

|

|

100 |

|

|

2,994 |

|

|

- |

|

|

- |

|

|

36,847 |

|

|

37,037 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

23,185 |

|

|

18,210 |

|

|

14,308 |

|

|

16,827 |

|

|

99 |

|

|

2,994 |

|

|

4,318 |

|

|

(874 |

) |

|

41,910 |

|

|

37,157 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Losses and loss adjustment expenses |

|

17,796 |

|

|

13,002 |

|

|

13,474 |

|

|

14,094 |

|

|

5,482 |

|

|

45,550 |

|

|

- |

|

|

- |

|

|

36,752 |

|

|

72,646 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-tax (loss) income |

$ |

(2,323 |

) |

$ |

(863 |

) |

$ |

(4,717 |

) |

$ |

(3,040 |

) |

$ |

(10,030 |

) |

$ |

(44,279 |

) |

$ |

(848 |

) |

$ |

(6,403 |

) |

$ |

(17,918 |

) |

$ |

(54,585 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss ratio (1) |

|

76.8 |

% |

|

71.5 |

% |

|

99.3 |

% |

|

88.9 |

% |

N/A (2) |

|

1521.4 |

% |

|

|

|

99.7 |

% |

|

196.1 |

% |

|

Net expense ratio (1) |

|

31.8 |

% |

|

34.4 |

% |

|

33.7 |

% |

|

31.6 |

% |

N/A (2) |

|

51.2 |

% |

|

|

|

57.6 |

% |

|

44.8 |

% |

|

Net combined ratio (1) |

|

108.6 |

% |

|

105.9 |

% |

|

133.0 |

% |

|

120.5 |

% |

N/A (2) |

|

1572.6 |

% |

|

|

|

157.3 |

% |

|

240.9 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Impact on net combined ratio |

|

|

|

|

|

|

|

|

|

|

|

Net Unfavorable (Favorable) Prior Year Development |

|

3.1 |

% |

|

2.1 |

% |

|

18.4 |

% |

|

11.6 |

% |

N/A (2) |

|

1421.5 |

% |

|

|

|

24.5 |

% |

|

120.9 |

% |

|

Catastrophes, net of reinsurance |

|

3.4 |

% |

|

4.3 |

% |

|

1.7 |

% |

|

0.4 |

% |

N/A (2) |

|

0.0 |

% |

|

|

|

2.8 |

% |

|

2.3 |

% |

|

Write-off receivable from reinsurer |

|

0.0 |

% |

|

0.0 |

% |

|

0.0 |

% |

|

0.0 |

% |

N/A (2) |

|

0.0 |

% |

|

|

|

10.7 |

% |

|

0.0 |

% |

|

Underlying combined ratio (1) |

|

102.1 |

% |

|

99.5 |

% |

|

112.9 |

% |

|

108.5 |

% |

N/A (2) |

|

151.1 |

% |

|

|

|

119.4 |

% |

|

117.7 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Unfavorable (Favorable) Prior Year Development |

|

715 |

|

|

378 |

|

|

2,493 |

|

|

1,835 |

|

|

5,804 |

|

|

42,560 |

|

|

- |

|

|

- |

|

|

9,012 |

|

|

44,773 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

(1) |

The net loss ratio is calculated as incurred losses and loss

adjustment expenses divided by net premiums earned, each determined

in accordance with GAAP. The net expense ratio is calculated as

total underwriting expenses offset by agency fee income divided by

net premiums earned, each determined in accordance with GAAP. The

net combined ratio is calculated as the sum of the net loss ratio

and the net expense ratio. The underlying combined ratio is the net

combined ratio excluding the impact of net prior year reserve

development and catastrophes and excluding the write-off of a

receivable from reinsurer. |

|

|

|

|

(2) |

The Company’s Runoff Segment has reached a point of maturity that

earned premium is minimal and renders any ratios no longer

meaningful. |

|

Hallmark Financial Services, Inc. and

Subsidiaries |

|

Consolidated Segment Data |

|

|

|

|

|

Year-to-Date Ended Jun. 30 |

|

|

|

|

|

|

|

|

|

Commercial Lines Segment |

Personal Lines Segment |

Runoff Segment |

Corporate |

Consolidated |

|

($ in thousands, unaudited) |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

Gross premiums written |

$ |

82,637 |

|

$ |

75,456 |

|

$ |

28,725 |

|

$ |

31,950 |

|

$ |

321 |

|

$ |

7,931 |

|

$ |

- |

|

$ |

- |

|

$ |

111,683 |

|

$ |

115,337 |

|

|

Ceded premiums written |

|

(24,999 |

) |

|

(35,633 |

) |

|

(211 |

) |

|

(150 |

) |

|

(217 |

) |

|

(847 |

) |

|

- |

|

|

- |

|

|

(25,427 |

) |

|

(36,630 |

) |

|

Net premiums written |

|

57,638 |

|

|

39,823 |

|

|

28,514 |

|

|

31,800 |

|

|

104 |

|

|

7,084 |

|

|

- |

|

|

- |

|

|

86,256 |

|

|

78,707 |

|

|

Change in unearned premiums |

|

(12,856 |

) |

|

(3,378 |

) |

|

(1,282 |

) |

|

(388 |

) |

|

9 |

|

|

1,411 |

|

|

- |

|

|

- |

|

|

(14,129 |

) |

|

(2,355 |

) |

|

Net premiums earned |

|

44,782 |

|

|

36,445 |

|

|

27,232 |

|

|

31,412 |

|

|

113 |

|

|

8,495 |

|

|

- |

|

|

- |

|

|

72,127 |

|

|

76,352 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total revenues |

|

44,811 |

|

|

36,490 |

|

|

28,744 |

|

|

33,359 |

|

|

113 |

|

|

8,495 |

|

|

8,073 |

|

|

1,036 |

|

|

81,741 |

|

|

79,380 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Losses and loss adjustment expenses |

|

33,413 |

|

|

25,914 |

|

|

24,643 |

|

|

26,673 |

|

|

8,460 |

|

|

59,441 |

|

|

- |

|

|

- |

|

|

66,516 |

|

|

112,028 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pre-tax (loss) income |

$ |

(1,497 |

) |

$ |

(1,499 |

) |

$ |

(6,492 |

) |

$ |

(4,353 |

) |

$ |

(47,225 |

) |

$ |

(54,317 |

) |

$ |

(2,484 |

) |

$ |

(9,273 |

) |

$ |

(57,698 |

) |

$ |

(69,442 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss ratio (1) |

|

74.6 |

% |

|

71.1 |

% |

|

90.5 |

% |

|

84.9 |

% |

N/A (2) |

|

699.7 |

% |

|

|

|

92.2 |

% |

|

146.7 |

% |

|

Net expense ratio (1) |

|

28.7 |

% |

|

34.1 |

% |

|

33.5 |

% |

|

30.3 |

% |

N/A (2) |

|

38.5 |

% |

|

|

|

93.7 |

% |

|

40.6 |

% |

|

Net combined ratio (1) |

|

103.3 |

% |

|

105.2 |

% |

|

124.0 |

% |

|

115.2 |

% |

N/A (2) |

|

738.2 |

% |

|

|

|

185.9 |

% |

|

187.3 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

Impact on net combined ratio |

|

|

|

|

|

|

|

|

|

|

|

Net Unfavorable (Favorable) Prior Year Development |

|

1.7 |

% |

|

-0.1 |

% |

|

11.0 |

% |

|

10.8 |

% |

N/A (2) |

|

610.2 |

% |

|

|

|

16.1 |

% |

|

72.3 |

% |

|

Catastrophes, net of reinsurance |

|

5.3 |

% |

|

2.7 |

% |

|

1.5 |

% |

|

0.3 |

% |

N/A (2) |

|

0.0 |

% |

|

|

|

3.8 |

% |

|

1.4 |

% |

|

Write-off receivable from reinsurer |

|

0.0 |

% |

|

0.0 |

% |

|

0.0 |

% |

|

0.0 |

% |

N/A (2) |

|

0.0 |

% |

|

|

|

51.1 |

% |

|

0.0 |

% |

|

Underlying combined ratio (1) |

|

96.3 |

% |

|

102.7 |

% |

|

111.5 |

% |

|

104.1 |

% |

N/A (2) |

|

128.0 |

% |

|

|

|

114.9 |

% |

|

113.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Unfavorable (Favorable) Prior Year Development |

|

769 |

|

|

(51 |

) |

|

2,992 |

|

|

3,408 |

|

|

7,839 |

|

|

51,836 |

|

|

|

|

11,600 |

|

|

55,193 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

(1) |

The net loss ratio is calculated as incurred losses and loss

adjustment expenses divided by net premiums earned, each determined

in accordance with GAAP. The net expense ratio is calculated as

total underwriting expenses offset by agency fee income divided by

net premiums earned, each determined in accordance with GAAP. The

net combined ratio is calculated as the sum of the net loss ratio

and the net expense ratio. The underlying combined ratio is the net

combined ratio excluding the impact of net prior year reserve

development and catastrophes and excluding the write-off of a

receivable from reinsurer. |

|

|

|

|

(2) |

The Company’s Runoff Segment has reached a point of maturity that

earned premium is minimal and renders any ratios no longer

meaningful. |

A photo accompanying this release is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/4fb87372-b7a9-47e0-969b-94291b3c6287

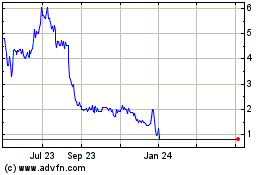

Hallmark Financial Servi... (NASDAQ:HALL)

Historical Stock Chart

From Sep 2024 to Oct 2024

Hallmark Financial Servi... (NASDAQ:HALL)

Historical Stock Chart

From Oct 2023 to Oct 2024