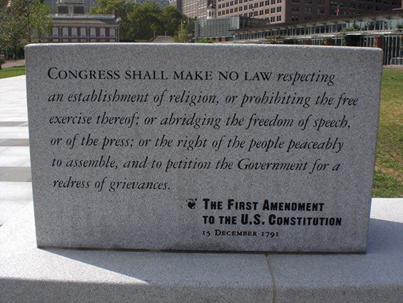

Without any doubt, the most important event of the past week was the permanent suspension of @realDonaldTrump. It reminds me of Trump’s Favorite Phrase: ‘You’re Fired’. Of course, that’s a joke, but how many talks on the internet… Either way, it looks like even the President of the USA is not endowed with Freedom of speech. In other words, censoring science has been brought to the next level and this time it’s Twitter and Facebook who decide on what you can say.

Now, let’s get to business and analyze how ended the first week of 2021. The UK, as well as the good part of the world, is suffering from the new Covid outbreak, which subsequently triggers governments to act and impose new social restrictions, business closures, and lockdowns. Undoubtedly, it will have a negative effect on the economies of those countries. In a couple of weeks, we will see the reflection on the economic data.

The JPMorgan Global PM fell from 53.1 in November to 52.7 in December, its lowest since September. In other words, the year ended with the global economy slowing down for a second time. And the reason is obvious: rising coronavirus cases dampened activity and demand, even though output still has risen over the fourth quarter as a whole.

If Covid continues to hit economies, new policy measures will be adopted and those aren’t my words or assumptions but excerpts from Policy meetings speeches. Howbeit, it wouldn’t be right to look at specific macroeconomic indicators, instead, we should look at the broader picture, especially trade and inflation.

The US, for example, reported its November trade balance deficit last week, which surged to its highest level in more than 14 years in November as businesses boosted imports to replenish inventories, offsetting a rise in exports. To be more precise, the trade gap increased by 8.0% to $68.1 billion in November, the highest level since August 2006. On the positive side, the US has become considerably less dependent on foreign sources for energy. The main reason behind the trade deficit surge could be retailers stocking their shelves and warehouses ahead of the Christmas holiday, thus pushing imports of consumer goods to a record high.

Japanese’s trade balance, on the other hand, saw an increase in 2020 (JPY 366.8 billion in November 2020, compared with a JPY 88.4 billion deficit a year earlier). Considering the first eleven months of the year, Japan posted a trade gap of JPY 73 billion, narrowing from a JPY 1509 billion shortfall in the same period of 2019.

Another crucial event was Democrats winning both races and securing the Senate. Even the attack on Capitol wasn’t able to stop the counting of Electoral College votes. Democratic Senate leader Schumer confirmed that one of the first priorities will be $2000 stimulus cheques. Having said that, deficits will not be a priority for the US government any time soon.

What to expect from the week ahead, and which events to follow closely?

As much as we want it, Covid-19 won’t disappear this year. Even vaccines apparently can’t help as new stamps emerge. Thus, one of the top indicators will continue to be the number of infections. Depending on the data, there could be more lockdowns in the first quarter, as well as the policy responses. It’s worth mentioning that after the Democrats’ startling Senate win in Georgia, Biden’s party got majority control of both houses of Congress and thus can contemplate measures to distribute fiscal support, overhaul the tax code and push for other structural reforms. In this context, many expect more stimulus packages, especially for households and small companies. Goldman Sachs analysts, on the other hand, forecasts another $600bn on top of the $900bn agreed at the end of 2020.

In terms of macroeconomic data, it would be recommendable to pay attention to fourth-quarter GDP, industrial production, and retail sales for China. In the case of the US, the Presidential inauguration (takes place on 20th January) is getting closer but tensions don’t cool down. In addition, it will be time for industrial production and retail sales data, the University of Michigan Consumer sentiment survey, jobless claims and job openings data as well as updates to the NFIB survey and the Beige Book.

In Europe, one of the most important topics will still be the UK’s transition. Besides that, we will get industrial production data. Finally, the Central Banks of South Korea and Poland could act on their interest rates. But remember, could doesn’t mean will.