Key Highlights

Ethereum faces rejection at $440, may continue selling presure

Ethereum has the chance of reaching its target price of $480

Ethereum ( ETH) Current Statistics

The current price: $412.58

Market Capitalization: $46,308,157,897

Trading Volume: $12,328,754,634

Major supply zones: $280, $320, $360

Major demand zones: $160, $140, $100

Ethereum (ETH) Price Analysis August 19, 2020

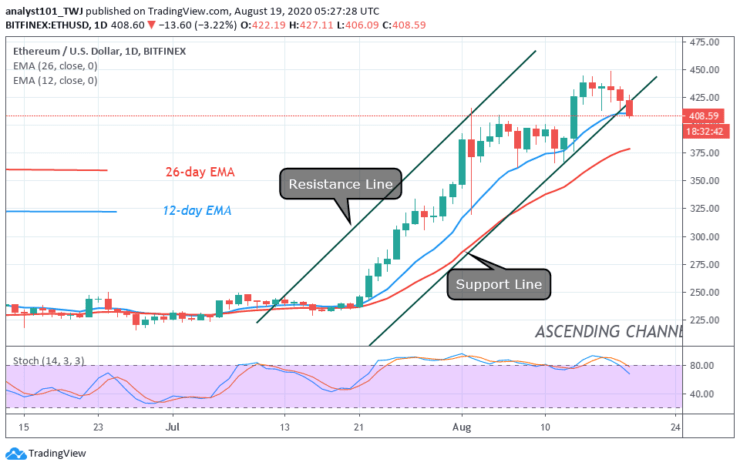

Ethereum is on a downward move as it faces rejection at the $440 overhead resistance. Buyers have thrice attempted to break the $440 resistance but to no avail. Each time ETH faces rejection at the $440 resistance; price will fall to $420 support and resumes a fresh uptrend.

The price has continued its downward move. After falling to the $420 support, it retested the $430 resistance and continued selling pressure. Ethereum risks falling to the low of $375 if price continues its fall. On the upside, a break above $440 will propel price to reach a high of $480.

ETH Technical Indicators Reading

Sellers have pushed price below the support line of the ascending channel. The implication is that price may continue its downward move. However, if price breaks below the EMAs, the selling pressure will continue downward.

Conclusion

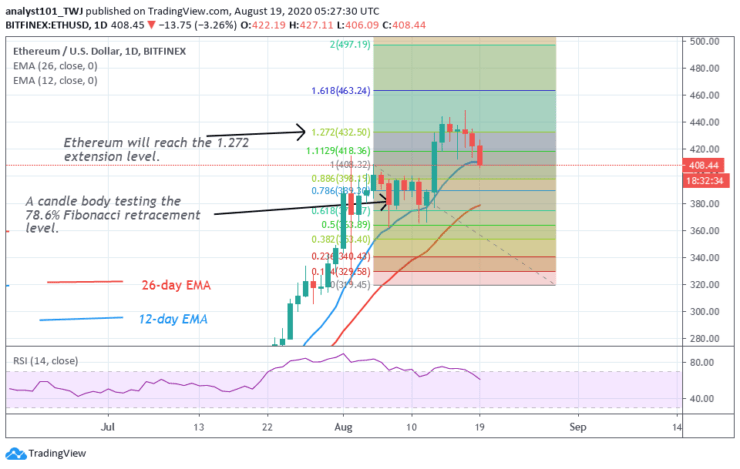

Ethereum is falling after facing rejection at the $440 resistance. It is unclear to which level price will fall and resume the uptrend. According to the Fibonacci tool, in the August 5 uptrend, a retracement candle body tested the 78.6% Fibonacci retracement level. It indicates that price will reach 1.272 extension level and reverse. If it reverses, it will return to the 78.6% retracement level where it originated.

Source: https://learn2.trade