AIM Schedule One - SDX Energy Plc (3391V)

April 08 2019 - 8:00AM

UK Regulatory

TIDMSDX

RNS Number : 3391V

AIM

08 April 2019

ANNOUNCEMENT TO BE MADE BY THE AIM APPLICANT PRIOR TO ADMISSION

IN ACCORDANCE WITH RULE 2 OF THE AIM RULES FOR COMPANIES ("AIM

RULES")

COMPANY NAME:

SDX Energy PLC ("SDX" or the "Company")

COMPANY REGISTERED OFFICE ADDRESS AND IF DIFFERENT, COMPANY

TRADING ADDRESS (INCLUDING POSTCODES) :

38 Welbeck Street

W1G 8DP, London

United Kingdom

COUNTRY OF INCORPORATION:

United Kingdom

COMPANY WEBSITE ADDRESS CONTAINING ALL INFORMATION REQUIRED

BY AIM RULE 26:

sdxenergy.com

COMPANY BUSINESS (INCLUDING MAIN COUNTRY OF OPERATION) OR,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

POLICY). IF THE ADMISSION IS SOUGHT AS A RESULT OF A REVERSE

TAKE-OVER UNDER RULE 14, THIS SHOULD BE STATED:

SDX Energy Inc (the Company's parent company and sole shareholder)

("SDX Inc") has had its common shares (the "Common Shares")

admitted to trading on the Toronto Venture Exchange ("TSX-V")

(with CUSIP number 811375) since 11 July 2008. The Common Shares

were admitted to trading on AIM on 20 May 2016 (with ISIN CA78410A1075

and SEDOL BYYLJV0).

SDX Inc proposes to complete a Canadian plan of arrangement

under section 192 of the Canada Business Corporations Act (the

"Arrangement") to introduce the Company as the new holding

company of the SDX group and pursuant to the Arrangement, the

current shareholders of SDX Inc will have their Common Shares

exchanged for Ordinary Shares in the Company, the Common Shares

will cease to be listed on the TSX-V and admitted to trading

on AIM (the "De-listing").

It is proposed that following the De-listing, the Ordinary

Shares (defined herein) will be admitted to trading on AIM

(with ISIN GB00BJ5JNL69 and SEDOL BJ5JNL6).

The London Stock Exchange has confirmed that the Company will

be treated as a quoted applicant for the purposes of the AIM

Rules for Companies as the Common Shares are admitted to trading

on AIM and that information in the public record relating to

SDX Inc, can be attributed to the Company for the purposes

of Admission.

SDX Inc is a North Africa focused oil and gas company, with

a strategy to create value through organic and inorganic production

growth and exploration success and is underpinned by a portfolio

of low cost onshore producing assets combined with onshore

exploration prospects in Egypt and Morocco.

SDX Inc's portfolio contains interests in seven concessions

in Egypt and Morocco. In Egypt, SDX Inc has a working interest

in two producing assets (50% North West Gemsa and 50% Meseda)

located onshore in the Eastern Dessert, adjacent to the Gulf

of Suez. In Morocco, SDX has a 75% working interest in the

Sebou concession situated in the Gharb Basin. These producing

assets are characterised by low operating costs making them

particularly resilient in a low oil price environment. With

last reported daily production of 3,408 boe/d net to SDX Inc

on 21 March 2019, 2P reserves of 13.1 mmboe at 31 December

2018, and positive cash flow at the corporate level down to

c.US$10/bbl Brent, these concessions provide a solid and resilient

production base for the SDX group.

SDX Inc's portfolio also includes a near term development opportunity

and exploration opportunities at South Disouq (Egypt) where

it has a 55% working interest and high impact exploration opportunities

in Morocco in Lalla Mimouna (Nord), Gharb Centre and Moulay

Bouchta Quest.

In Morocco, two further concessions; Lalla Mimouna Sud and

Moulay Bouchta Ouest, have been granted pending final approvals

from the Ministry of Energy and Ministry of Finance.

DETAILS OF SECURITIES TO BE ADMITTED INCLUDING ANY RESTRICTIONS

AS TO TRANSFER OF THE SECURITIES (i.e. where known, number

and type of shares, nominal value and issue price to which

it seeks admission and the number and type to be held as treasury

shares):

204,723,041 ordinary shares of GBP0.20 each in the capital

of SDX (the "Ordinary Shares").

CAPITAL TO BE RAISED ON ADMISSION (AND/OR SECONDARY OFFERING)

AND ANTICIPATED MARKET CAPITALISATION ON ADMISSION:

No capital to be raised on Admission. Anticipated market capitalisation

on admission is approximately GBP76 million.

PERCENTAGE OF AIM SECURITIES NOT IN PUBLIC HANDS AT ADMISSION:

40.23%

DETAILS OF ANY OTHER EXCHANGE OR TRADING PLATFORM TO WHICH

THE AIM SECURITIES (OR OTHER SECURITIES OF THE COMPANY) ARE

OR WILL BE ADMITTED OR TRADED:

None.

Prior to the Arrangement becoming effective and Admission,

the Common Shares have been admitted to trading on the TSX-V

and AIM. Following the Arrangement becoming effective, SDX

Inc. will apply to delist the Common Shares from the TSX-V

and from trading on AIM and SDX will seek admission of the

Ordinary Shares to trading on AIM.

FULL NAMES AND FUNCTIONS OF DIRECTORS AND PROPOSED DIRECTORS

(underlining the first name by which each is known or including

any other name by which each is known):

Paul Michael Welch - Chief Executive Officer

Mark Reid - Chief Financial Officer

(the "Directors")

Michael Edmond Doyle - proposed Non-Executive Chairman

David John Woodhams Mitchell - proposed Non-Executive Director

Timothy ("Tim") James Thornton Linacre - proposed Non-Executive

Director

Michael John Raynes - proposed Non-Executive Director

(the "Proposed Directors")

FULL NAMES AND HOLDINGS OF SIGNIFICANT SHAREHOLDERS EXPRESSED

AS A PERCENTAGE OF THE ISSUED SHARE CAPITAL, BEFORE AND AFTER

ADMISSION (underlining the first name by which each is known

or including any other name by which each is known):

SDX SPV Limited (Previously

called MEA Energy Investments

Limited) 19.48%

-------

Ingalls & Synder 18.35%

-------

River and Mercantile 6.15%

-------

Hargreaves Landsdowne 5.66%

-------

Highclere Investors 5.02%

-------

Mr Nikolaos D Monoyios 4.37%

-------

Dr Valerie A Brackett 3.78%

-------

NAMES OF ALL PERSONS TO BE DISCLOSED IN ACCORDANCE WITH SCHEDULE

2, PARAGRAPH (H) OF THE AIM RULES:

Not applicable.

(i) ANTICIPATED ACCOUNTING REFERENCE DATE

(ii) DATE TO WHICH THE MAIN FINANCIAL INFORMATION IN THE ADMISSION

DOCUMENT HAS BEEN PREPARED (this may be represented by unaudited

interim financial information)

(iii) DATES BY WHICH IT MUST PUBLISH ITS FIRST THREE REPORTS

PURSUANT TO AIM RULES 18 AND 19:

(i) 31 December

(ii) 31 December 2018

(iii) By 30 September 2019, Half Yearly Results for six months

ended 30 June 2019; by 31 March 2020, Annual Results for year

ended 31 December 2019; by 30 September 2020, Half Yearly Results

for six months ended 30 June 2020.

EXPECTED ADMISSION DATE:

Admission expected on 28 May 2019

NAME AND ADDRESS OF NOMINATED ADVISER:

Stifel Nicolaus Europe Limited

150 Cheapside

London

EC2V 6ET

NAME AND ADDRESS OF BROKER:

Stifel Nicolaus Europe Limited

150 Cheapside,

London,

EC2V 6ET

Cantor Fitzgerald Europe

One Churchill Place,

London,

E14 5RB

GMP FirstEnergy

85 London Wall, London,

EC2M 7AD

OTHER THAN IN THE CASE OF A QUOTED APPLICANT, DETAILS OF WHERE

(POSTAL OR INTERNET ADDRESS) THE ADMISSION DOCUMENT WILL BE

AVAILABLE FROM, WITH A STATEMENT THAT THIS WILL CONTAIN FULL

DETAILS ABOUT THE APPLICANT AND THE ADMISSION OF ITS SECURITIES:

Not applicable.

THE CORPORATE GOVERNANCE CODE THE APPLICANT HAS DECIDED TO

APPLY

From Admission, the Company will comply (or explain non-compliance)

with the Quoted Companies Alliance ("QCA") Corporate Governance

guidelines.

DATE OF NOTIFICATION:

8 April 2019

NEW/ UPDATE:

New

QUOTED APPLICANTS MUST ALSO COMPLETE THE FOLLOWING:

THE NAME OF THE AIM DESIGNATED MARKET UPON WHICH THE APPLICANT'S

SECURITIES HAVE BEEN TRADED:

AIM

THE DATE FROM WHICH THE APPLICANT'S SECURITIES HAVE BEEN SO

TRADED:

The Common Shares were admitted to trading on AIM on 20 May

2016

CONFIRMATION THAT, FOLLOWING DUE AND CAREFUL ENQUIRY, THE APPLICANT

HAS ADHERED TO ANY LEGAL AND REGULATORY REQUIREMENTS INVOLVED

IN HAVING ITS SECURITIES TRADED UPON SUCH A MARKET OR DETAILS

OF WHERE THERE HAS BEEN ANY BREACH:

The Directors and the Proposed Directors confirm that, after

due and careful enquiry, SDX Inc has adhered to all legal and

regulatory requirements involved in having its securities traded

on AIM.

AN ADDRESS OR WEB-SITE ADDRESS WHERE ANY DOCUMENTS OR ANNOUNCEMENTS

WHICH THE APPLICANT HAS MADE PUBLIC OVER THE LAST TWO YEARS

(IN CONSEQUENCE OF HAVING ITS SECURITIES SO TRADED) ARE AVAILABLE:

sdxenergy.com

DETAILS OF THE APPLICANT'S STRATEGY FOLLOWING ADMISSION INCLUDING,

IN THE CASE OF AN INVESTING COMPANY, DETAILS OF ITS INVESTING

STRATEGY:

SDX's strategy is to create shareholder value through low cost

organic and inorganic production growth and, low cost, high

impact exploration success.

The Company intends to organically increase production and

cash flow generation through an active work programme, consisting

of improvements made to existing fields and high impact exploration

and development wells being drilled to increase production

at other assets in the portfolio.

SDX also intends to leverage its strong balance sheet and its

strong regional networks to grow through the acquisition of

suitable high value asset opportunities in North Africa. The

Company actively pursues acquisition opportunities within its

area of focus, where such opportunities meet the Company's

return hurdles, and may be in active processes with multiple

parties at any one time.

SDX maintains a strict financial discipline to ensure an efficient

use of funds. The short-term objective is to achieve production

of circa 10kboe/d through the implementation of this strategy

whilst the long-term objective is to become a full cycle E&P

Company with production in excess of 75kboe/d.

A DESCRIPTION OF ANY SIGNIFICANT CHANGE IN FINANCIAL OR TRADING

POSITION OF THE APPLICANT, WHICH HAS OCCURRED SINCE THE END

OF THE LAST FINANCIAL PERIOD FOR WHICH AUDITED STATEMENTS HAVE

BEEN PUBLISHED:

There has been no significant change in the financial or trading

position of SDX Inc since 31 December 2018, being the end of

the last financial period, for which audited statements were

published, along with a Management Discussion & Analysis document,

on 22 March 2019.

A STATEMENT THAT THE DIRECTORS OF THE APPLICANT HAVE NO REASON

TO BELIEVE THAT THE WORKING CAPITAL AVAILABLE TO IT OR ITS

GROUP WILL BE INSUFFICIENT FOR AT LEAST TWELVE MONTHS FROM

THE DATE OF ITS ADMISSION:

The Directors and the Proposed Directors have no reason to

believe that the working capital available to SDX will be insufficient

for its present requirements and for at least 12 months from

the date of Admission.

DETAILS OF ANY LOCK-IN ARRANGEMENTS PURSUANT TO RULE 7 OF THE

AIM RULES:

Not applicable.

A BRIEF DESCRIPTION OF THE ARRANGEMENTS FOR SETTLING THE APPLICANT'S

SECURITIES:

The Ordinary Shares admitted to AIM will be eligible for settlement

in CREST.

A WEBSITE ADDRESS DETAILING THE RIGHTS ATTACHING TO THE APPLICANT'S

SECURITIES:

sdxenergy.com

INFORMATION EQUIVALENT TO THAT REQUIRED FOR AN ADMISSION DOCUMENT

WHICH IS NOT CURRENTLY PUBLIC:

Please refer to the Appendix to the Schedule 1 announcement

on the Company's website (sdxenergy.com) for the following

details:

* Strategy following Admission;

* Corporate Governance (post admission);

* Application of the City Code on Takeovers and

Mergers; and

* Material contracts.

Significant additional information in relation to the Admission

is included in the Circular to the shareholders of SDX Inc

dated 5 April 2019, which is available on the Company's website

(www.sdxenery.com) and on SEDAR at www.sedar.com.

A WEBSITE ADDRESS OF A PAGE CONTAINING THE APPLICANT'S LATEST

ANNUAL REPORT AND ACCOUNTS WHICH MUST HAVE A FINANCIAL YEAR

END NOT MORE THEN NINE MONTHS PRIOR TO ADMISSION AND INTERIM

RESULTS WHERE APPLICABLE. THE ACCOUNTS MUST BE PREPARED IN

ACCORDANCE WITH ACCOUNTING STANDARDS PERMISSIBLE UNDER AIM

RULE 19:

sdxenergy.com

THE NUMBER OF EACH CLASS OF SECURITIES HELD IN TREASURY:

None.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

PAACKPDQQBKDFQK

(END) Dow Jones Newswires

April 08, 2019 08:00 ET (12:00 GMT)

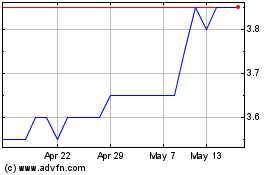

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Jul 2023 to Jul 2024