TIDMSDX

RNS Number : 9411H

SDX Energy Inc.

24 August 2016

SDX ENERGY INC

SECOND QUARTER AND HALF YEAR 2016 FINANCIAL AND OPERATING

RESULTS

Further progress with Egypt focused, high margin growth

opportunity

London, England - August 24, 2016, SDX Energy Inc. ("SDX" or the

"Company") (TSXV, AIM: SDX) announces its 2016 Second Quarter and

Half Year 2016 Financial and Operating Results (the "Quarter", "Q2

2016", "Half Year" or "6 months to June 30, 2016").

Second Quarter and Half Year 2016 Highlights:

Corporate and Financial

-- Completed successful US$11.0 million ("MM") placing raising

c.US$10.2MM after costs (of which US$1.0MM was received in July

2016) and obtained dual listing on AIM market of London Stock

Exchange plc ("AIM");

-- Key financial metrics for the 3 and 6 months ended June 30, 2016 and 2015 are:

Three months Six months

ended June ended June

30 30

------------------------------ --------------- ---------------

US$ million except 2016 2015 2016 2015

per unit amounts

------------------------------ ------- ------ ------- ------

Net Revenues 2.5 2.9 4.6 5.7

------------------------------ ------- ------ ------- ------

Netback 1.2 1.9 2.3 4.0

------------------------------ ------- ------ ------- ------

Net realized average

oil price - US$/barrel 31.80 40.72 28.01 39.10

------------------------------ ------- ------ ------- ------

Net cash (used in)/generated

from operating activities (1.0) (4.0) 0.8 (2.1)

------------------------------ ------- ------ ------- ------

Total comprehensive

(loss)/income (25.2) 1.1 (26.0) 1.9

------------------------------ ------- ------ ------- ------

-- Comprehensive loss in 3 and 6 months ended June 30, 2016 due

to write down of US$(24.7) MM in the Bakassi West, Cameroon

exploration asset as a result of decision to withdraw from

concession;

-- Invested US$6.5MM of capital expenditure into business;

-- As at June 30, 2016 cash on hand of US$6.9MM and zero debt.

Operational Highlights

-- During Q2 2016 average daily oil sales and production service

fees equated to 1,170 barrels of oil per day ("BOP/D") and average

daily natural gas and natural gas liquids production equated to 136

barrels of oil equivalent per day ("BOEP/D") (to be invoiced at a

future date to optimize Concession terms);

-- During the 6 months to June 30, 2016 average daily oil sales

and production service fees equated to 1,211 BOP/D and average

daily natural gas and natural gas liquids production equated to 145

BOEP/D (to be invoiced at a future date to optimize Concession

terms);

-- Completion of successful workover programs during the Quarter

at North West Gemsa and Meseda resulted in exit production rate at

June 30, 2016 of 1,550 BOEP/D;

-- In North West Gemsa, completed successful development well,

Al Amir SE-24, which tested at 1,714 BOP/D with 3.06 million

standard cubic feet per day ("MMSCFD") in May 2016. In addition,

completed 5 workovers in the Al Amir SE and Geyad fields which

focussed on wellbore maintenance;

-- In Meseda, completed an 8 well workover program which

included tubing string replacements, well bore cleanouts and

perforation adds. Completed strategic initiative focussed on

development optimization and increasing production. Facilities

optimization studies now underway;

-- Completed 3D seismic acquisition in South Disouq ahead of

schedule and under budget. Seismic data processing is currently

underway;

-- Completed technical review of prospectivity at South Ramadan

development concession and an evaluation of project economics is

currently underway;

Subsequent to period end:

-- SDX entered into a Deed of Assignment and Termination

relating to Bakassi West, Cameroon. On July 31, 2016 all rights,

interests, obligations and liabilities under the PSC were assigned

to SoftRock Cameroon, the only member of the original partnership

that has elected to remain in the concession; and

-- Completed fast-track processing cube for South Disouq 3D on

July 19, 2016. Preliminary prospect locations are currently being

evaluated.

2016 Guidance and Outlook:

-- Continue with well workover program at North West Gemsa;

-- Initiate redevelopment and waterflood program at Meseda;

-- Complete 3D seismic processing and interpretation for South

Disouq. Conclude well location assessment and drill carried

exploration well before year end;

-- Continue to minimise costs post business combination; and

-- Continue to explore opportunities to expand the asset base in

Egypt and in the Middle East and North Africa ("MENA").

Paul Welch, President & CEO of SDX Energy, commented:

"Having successfully raised new funds and completed our dual

listing on AIM, we are now well placed to maximize the potential

across our portfolio of Egyptian assets. We are set to carry out an

active work program on Meseda, which we expect to result in a

material increase in our net production. North West Gemsa is set to

continue delivering high margin barrels and, concurrently, we are

progressing our exciting exploration asset at South Disouq and look

forward to completing the processing and interpretation of the 3D

seismic survey ahead of a carried well later this year.

We have a solid financial position which is underpinned by

high-margin production that enables us to generate positive free

cash flow down to US$15 oil. This, combined with an active, and

potentially transformational work program, gives us a high degree

of confidence about the future."

Interim Consolidated

Balance sheet (Unaudited)

As At As At

June December

(thousands of United 30, 2016 31, 2015

States dollars)

----------------------------- ---------- ----------

Assets

Cash and cash equivalents 6,949 8,170

Trade and other receivables 8,480 6,678

Inventory 1,188 1,188

----------------------------- ---------- ----------

Current assets 16,617 16,036

Investments 2,818 2,106

Property, plant and

equipment 17,731 18,401

Intangible exploration

and evaluation assets 10,065 23,473

----------------------------- ---------- ----------

Non-current assets 30,614 43,980

Total Assets 47,231 60,016

----------------------------- ---------- ----------

Liabilities

Trade and other payables 7,743 3,556

Current income taxes 642 928

----------------------------- ---------- ----------

Current liabilities 8,385 4,484

Deferred income taxes 286 286

----------------------------- ---------- ----------

Non-current liabilities 286 286

Total Liabilities 8,671 4,770

----------------------------- ---------- ----------

Equity

Share capital 39,315 30,148

Warrants 99 99

Contributed surplus 5,369 5,175

Other comprehensive

loss (1,154) (1,154)

Retained Earnings (5,069) 20,978

----------------------------- ---------- ----------

Equity 38,560 55,246

----------------------------- ---------- ----------

Equity and Liabilities 47,231 60,016

----------------------------- ---------- ----------

Interim Consolidated Statement of

Comprehensive (Loss)/Income (Unaudited)

Three months Six months

ended June ended June

30 30

(thousands of United 2016 2015 2016 2015

States dollars, except

per share data)

------------------------------ --------- ------- ------------ -------

Revenue, net of royalties 2,521 2,900 4,631 5,715

------------------------------ --------- ------- ------------ -------

Revenue 2,521 2,900 4,631 5,715

Direct operating expense 1,290 1,004 2,289 1,675

Exploration and evaluation

expense 24,883 - 24,883 -

Depletion, depreciation

and amortization 845 436 1,662 887

Stock based compensation 100 146 194 323

Equity in income of

associate (365) (357) (712) (637)

General and administrative

expenses 912 639 1,772 1,173

------------------------------ --------- ------- ------------ -------

Operating (Loss)/Income (25,144) 1,032 (25,457) 2,294

Net finance expense/(income) (267) (227) 97 (436)

------------------------------ --------- ------- ------------ -------

(Loss)/Income before

income taxes (24,877) 1,259 (25,554) 2,730

Current income tax expense 287 264 493 766

Deferred income tax

(credit)/expense - (72) - (89)

------------------------------ --------- ------- ------------ -------

Total Current and Deferred

income tax expense 287 192 493 677

Net (Loss)/Income (25,164) 1,067 (26,047) 2,053

Other comprehensive

loss/(income)

Foreign exchange - (44) - 165

------------------------------ --------- ------- ------------ -------

Total comprehensive

(loss)/income for the

period (25,164) 1,111 (26,047) 1,888

------------------------------ --------- ------- ------------ -------

Net (loss)/income per

share

Basic $(0.455) $0.019 $(0.560) $0.036

Diluted $(0.455) $0.017 $(0.560) $0.032

------------------------------ --------- ------- ------------ -------

Interim Consolidated Statement of Changes

In Equity (Unaudited)

Six months ended

June 30

(thousands of United States dollars) 2016 2015

--------------------------------------- ---------- -------

Share Capital

Balance, beginning of period 30,148 24,512

Private placement - secondary 9,968 -

listing on the London Stock Exchange

AIM

Share issue costs (801) -

--------------------------------------- ---------- -------

Balance, end of period 39,315 24,512

Warrants

Balance, beginning of period 99 99

--------------------------------------- ---------- -------

Balance, end of period 99 99

Contributed Surplus

Balance, beginning of period 5,175 4,414

Share based payments for the

period 194 323

--------------------------------------- ---------- -------

Balance, end of period 5,369 4,737

Accumulated Other Comprehensive

Loss

Balance, beginning of period (1,154) (507)

Foreign currency translation

adjustment for the period - (165)

--------------------------------------- ---------- -------

Balance, end of period (1,154) (672)

Retained Earnings

Balance, beginning of period 20,978 10,931

Net (Loss)/Income for the period (26,047) 2,053

--------------------------------------- ---------- -------

Balance, end of period (5,069) 12,984

Total Equity 38,560 41,660

--------------------------------------- ---------- -------

Interim Consolidated Statement

of Cash Flows (Unaudited)

Three months Six months

ended June ended June

30 30

(thousands of United States 2016 2015 2016 2015

dollars)

--------------------------------- --------- --------- --------- ---------

Cash flows (used in)/from

operating activities

Income before income taxes (24,877) 1,259 (25,554) 2,730

Adjustments for:

Depletion, depreciation

and amortization 845 436 1,662 887

Exploration expense 24,883 - 24,883 -

Finance costs 7 18 83 67

Stock-based compensation 100 146 194 323

Equity in income of associate (365) (357) (712) (637)

--------------------------------- --------- --------- --------- ---------

Operating cash flow before

working capital movements 593 1,502 556 3,370

(Increase) / decrease

in trade and other receivables (2,762) (928) (1,785) 12

Increase / (decrease)

in trade and other payables 1,596 (443) 2,449 (1,379)

--------------------------------- --------- --------- --------- ---------

Cash (used in)/generated

from operating activities (573) 131 1,220 2,003

Income taxes paid (383) (4,096) (383) (4,096)

--------------------------------- --------- --------- --------- ---------

Net cash (used in)/from

operating activities (956) (3,965) 837 (2,093)

Cash flows used in investing

activities:

Property, plant and equipment

expenditures (15) (821) (15) (959)

Exploration and evaluation

expenditures (10,019) (784) (10,937) (959)

Dividends received - 966 - 966

--------------------------------- --------- --------- --------- ---------

Net cash used in investing

activities (10,034) (639) (10,952) (952)

Cash flows from/(used

in) financing activities:

Repayment of debentures - (2,052) - (2,052)

Private Placement on London

Stock Exchange AIM 9,167 - 9,167 -

Finance costs paid (8) (15) (101) (63)

--------------------------------- --------- --------- --------- ---------

Net cash from/(used in)

financing activities 9,159 (2,067) 9,066 (2,115)

Change in cash and cash

equivalents (1,831) (6,671) (1,049) (5,160)

Effect of foreign exchange

on cash and cash equivalents 109 77 (172) (313)

Cash and cash equivalents,

beginning of period 8,671 19,056 8,170 17,935

--------------------------------- --------- --------- --------- ---------

Cash and cash equivalents,

end of period 6,949 12,462 6,949 12,462

--------------------------------- --------- --------- --------- ---------

KEY FINANCIAL & OPERATING HIGHLIGHTS

Unaudited interim consolidated financial statements with

Management's Discussion and Analysis for Q2 2016 are now available

on the Company's website at www.sdxenergy.com and on SEDAR at

www.sedar.com.

Three months Six months

Unaudited Interim ended June ended June

Financial Statements 30 30

Prior

$000s except per Quarter

unit amounts (1) 2016 2015 2016 2015

------------------------------- ---------- -------- --------- --------

FINANCIAL

-------------------------------

Gross Revenues 2,789 3,384 2,900 6,173 5,715

Royalties (679) (863) - (1,542) -

---------- ---------

Net Revenues 2,110 2,521 2,900 4,631 5,715

Operating costs (999) (1,290) (1,004) (2,289) (1,675)

---------- ---------

Netback (2) 1,111 1,231 1,896 2,342 4,040

Total comprehensive

income / (loss) (883) (25,164) 1,111 (26,047) 1,888

per share (0.02) (0.45) 0.02 (0.56) 0.04

Funds from operations (37) 593 1,502 556 3,370

per share (0.00) 0.01 0.03 0.01 0.06

Cash, end of period 8,671 6,949 12,462 6,949 12,462

Working capital

(excl. cash) (3,257) 1,283 1,172 1,283 1,172

Capital expenditures 5,819 6,475 1,605 12,294 1,918

Total assets 64,907 47,231 44,333 47,231 44,333

Shareholders' equity 54,457 38,560 41,660 38,560 41,660

Common shares outstanding

(000's) 37,642 75,934 56,348 75,934 56,348

------------------------------- --------- ---------- -------- --------- --------

OPERATIONAL

------------------------------- --------- ---------- -------- --------- --------

Oil sales (bbl/d) 606 554 - 580 -

Production Service

Fee (bbl/d) 646 616 783 631 807

--------- ---------- -------- --------- --------

Total boe/d 1,252 1,170 783 1,211 807

Brent Oil Price

($/bbl) 33.73 45.54 61.72 39.63 57.77

West Gharib Oil

Price ($/bbl) 25.65 30.38 49.42 27.96 47.52

Net realized price

($/bbl) 24.46 31.80 40.72 28.01 39.10

Royalties ($/bbl) 5.96 8.11 - 7.00 -

Operating costs

($/bbl) 8.77 12.12 14.09 10.38 11.46

Netback ($/bbl) 9.73 11.57 26.63 10.63 27.64

------------------------------- --------- ---------- -------- --------- --------

(1) Denotes the three

months ended March

31, 2016.

(2) Netback is a non-GAAP measure that

represents sales net of all operating

expenses and government royalties. Management

believes that netback is a useful supplemental

measure to analyze operating performance

and provide an indication of the results

generated by the Company's principal business

activities prior to the consideration

of other income and expenses. Management

considers netbacks an important measure

as it demonstrates the Company's profitability

relative to current commodity prices.

Netback may not be comparable to similar

measures used by other companies.

Three months Six months

Proforma Combined ended June ended June

Business 30 30

Prior

$000s except per Quarter

unit amounts (1) 2016 2015 2016 2015

------------------------------- ---------- -------- --------- --------

FINANCIAL

-------------------------------

Gross Revenues 2,789 3,384 6,659 6,173 13,839

Royalties (679) (863) (1,976) (1,542) (3,722)

---------- ---------

Net Revenues 2,110 2,521 4,683 4,631 10,117

Operating costs (999) (1,290) (668) (2,289) (2,090)

---------- ---------

Netback (2) 1,111 1,231 4,015 2,342 8,027

Total comprehensive

income / (loss) (883) (25,164) 1,341 (26,047) 1,602

per share (0.02) (0.45) 0.02 (0.56) 0.03

Funds from operations (37) 593 2,269 556 4,419

per share (0.00) 0.01 0.04 0.01 0.08

Cash, end of period 8,671 6,949 12,957 6,949 12,957

Working capital

(excl. cash) (3,257) 1,283 3,515 1,283 3,515

Capital expenditures 5,819 6,475 1,875 12,294 2,376

Total assets 64,907 47,231 44,333 47,231 44,333

Shareholders' equity 54,457 38,560 41,660 38,560 41,660

Common shares outstanding

(000's) 37,642 75,934 56,348 75,934 56,348

------------------------------- --------- ---------- -------- --------- --------

OPERATIONAL

--------- ---------- -------- --------- --------

Oil sales (bbl/d) 606 554 719 580 855

Production Service

Fee (bbl/d) 646 616 783 631 807

------------------------------- --------- ---------- -------- --------- --------

Total boe/d 1,252 1,170 1,502 1,211 1,662

Brent Oil Price

($/bbl) 33.73 45.54 61.72 39.63 57.77

West Gharib Oil

Price ($/bbl) 25.65 30.38 49.42 27.96 47.52

Net realized price

($/bbl) 24.46 31.80 48.73 28.01 45.98

Royalties ($/bbl) 5.96 8.11 14.46 7.00 12.37

Operating costs

($/bbl) 8.77 12.12 4.89 10.38 6.95

Netback ($/bbl) 9.73 11.57 29.38 10.63 26.66

------------------------------- --------- ---------- -------- --------- --------

(1) Denotes the three

months ended March

31, 2016

(2) Netback is a non-GAAP measure that

represents sales net of all operating

expenses and government royalties. Management

believes that netback is a useful supplemental

measure to analyze operating performance

and provide an indication of the results

generated by the Company's principal business

activities prior to the consideration

of other income and expenses. Management

considers netbacks an important measure

as it demonstrates the Company's profitability

relative to current commodity prices.

Netback may not be comparable to similar

measures used by other companies.

About SDX

SDX is an international oil and gas exploration, production and

development company, headquartered in London, England, UK, with a

principal focus on Egypt. In Egypt, SDX has an interest in two

production concessions: North West Gemsa and West Gharib (Meseda)

both located in the Eastern Desert. SDX's portfolio also consists

of South Ramadan, a development asset in the Gulf of Suez; South

Disouq, an exploration asset in the Nile Delta. For further

information, please see the website of the Company at

www.sdxenergy.com or the Company's filed documents at

www.sedar.com.

For further information:

SDX Energy Inc.

Paul Welch

President and Chief Executive Mark Reid

Officer Chief Financial Officer

Tel: +44 203 219 5640 Tel: +44 203 219 5640

Cantor Fitzgerald Europe

(Nominated Adviser & Joint

Broker)

Sarah Wharry/Craig Francis

Tel: +44 207 7894 7000

FirstEnergy Capital LLP

(Joint Broker)

Jonathan Wright/David

van Erp

Tel: +44 207 448 0200

Celicourt (PR)

Mark Antelme/ Joanna Boon

Tel: +44 207 520 9260

Advisory

Forward-Looking Statements

Certain statements contained in this press release constitute

"forward-looking statements" as such term is used in applicable

Canadian securities laws. Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives, assumptions or future events or are

not statements of historical fact should be viewed as

forward-looking statements. In particular, statements concerning

the completion of and anticipated results from the workover

programs at Meseda and North West Gemsa; the exploration plans for

the Company's asset at South Disouq, including the completion of

the 3D seismic processing and interpretation, well location

assessment and the drilling of a carried exploration well; and the

expected results of the business combination between the Company

and Madison PetroGas Ltd., which was completed on October 1, 2015,

should be viewed as forward-looking statements.

The forward-looking statements contained in this document are

based on certain assumptions and although management considers

these assumptions to be reasonable based on information currently

available to them, undue reliance should not be placed on the

forward-looking statements because SDX can give no assurances that

they may prove to be correct. This includes, but is not limited to,

assumptions related to, among other things, commodity prices and

interest and foreign exchange rates; planned synergies, capital

efficiencies and cost-savings; applicable tax laws; future

production rates; the sufficiency of budgeted capital expenditures

in carrying out planned activities; and the availability and cost

of labour and services.

By their very nature, forward-looking statements are subject to

certain risks and uncertainties (both general and specific) that

could cause actual events or outcomes to differ materially from

those anticipated or implied by such forward-looking statements.

Such risks and other factors include, but are not limited to

political, social and other risks inherent in daily operations for

the Company, risks associated with the industries in which the

Company operates, such as: operational risks; delays or changes in

plans with respect to growth projects or capital expenditures;

costs and expenses; health, safety and environmental risks;

commodity price, interest rate and exchange rate fluctuations;

environmental risks; competition; failure to realize the

anticipated benefits of the Transaction and to successfully

integrate the Parties; ability to access sufficient capital from

internal and external sources; and changes in legislation,

including but not limited to tax laws and environmental

regulations. Readers are cautioned that the foregoing list of risk

factors is not exhaustive and are advised to reference SDX's Annual

Information Form for the year ended December 31, 2015 for a

description of additional risks and uncertainties associated with

SDX's business, including its exploration activities, which can be

found on SDX's SEDAR profile at www.sedar.com.

The forward-looking statements contained in this press release

are made as of the date hereof and SDX does not undertake any

obligation to update publicly or to revise any of the included

forward-looking statements, except as required by applicable law.

The forward-looking statements contained herein are expressly

qualified by this cautionary statement.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UOVSRNAAWUAR

(END) Dow Jones Newswires

August 24, 2016 02:00 ET (06:00 GMT)

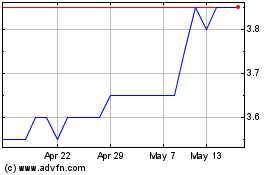

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Jun 2024 to Jul 2024

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Jul 2023 to Jul 2024