TIDMRGL

RNS Number : 1353V

Regional REIT Limited

05 August 2020

5 August 2020

REGIONAL REIT Limited

("Regional REIT", the "Group" or the "Company")

Positive Trading Update

and

Appointment of Joint Broker

Regional REIT (LSE: RGL), the regional real estate investment

specialist focused on building a diverse portfolio of income

producing regional UK core and core plus office and industrial

property assets, today announces its Group property portfolio

valuation as at 30 June 2020 which again demonstrates the strength

of the portfolio in the face of Covid-19, and an asset management

update.

Additionally, the Group announces that Panmure Gordon (UK) Ltd.

has been appointed as joint corporate broker and joint financial

adviser, alongside Peel Hunt, with immediate effect.

30 June 2020 valuation - Highly diversified portfolio

The overall valuation was GBP742.3m* (31 December 2019:

GBP787.9m), only a 3.7% portfolio decrease from 31 December 2019.

Very encouragingly, after adjusting for capital expenditure of

GBP4.5m and disposals of GBP15.1m during the period, the portfolio

only decreased 4.3% on a like-for-like basis from the 31 December

2019 valuation, and the Group's core office and industrial segment

(94.2% by value) only decreased by 3.6% on a like-for-like

basis.

The highly diversified and extensive portfolio, the

diversification of which has long been an integral part of the

Group's strategy to mitigate any risk, contains 151 properties (31

December 2019: 160).

The Group's net loan-to-value ratio is below the Company's

stated target of 40% at c.39.7% as at 30 June 2020 (31 December

2019: 38.9%).

Rent Collection Update - Remains strong in the current economic

climate

As at 31 July 2020 Q1 rent collection has continued to increase

to c. 98%. This comprises of 96% of Q1 rent paid and agreed

collections with occupiers amounting to 2%, which is ahead of

management expectations at this point in time given the current

backdrop. We anticipate collecting additional Q1 rent in due

course.

Further to the 27 July 2020 Q2 rent collection announcement,

further good progress has been achieved with an increase to c. 93%.

This comprises of 84% of Q2 rent paid, 4% who have agreed to pay

monthly and collection plans agreed with occupiers amounting to a

further 5%. The Group anticipates collecting the vast majority of

the balance of outstanding Q2 rent in due course as usual.

*As at the valuation date, the Cushman & Wakefield portfolio

valuation is subject to "material valuation uncertainty" as set out

in VPS 3 and VPGA 10 of the RICS Red Book Valuation - Global

Standards, due to the unprecedented circumstances surrounding

COVID-19. The industrial and logistics properties are not subject

to material valuation uncertainty within the Cushman &

Wakefield portfolio valuation as at the valuation date. This set of

circumstances is not unique to the Company and the material

valuation uncertainty reported within the Cushman & Wakefield

portfolio valuation is in line with the RICS material valuation

uncertainty recommendation to all RICS registered property valuers

as at the valuation date.

Asset Management Update - Further Good Progress Achieved

The Company's Asset Manager, London & Scottish Property

Investment Management, has continued to successfully manage the

assets proactively through this period, and the Company provides

the following update:

9 Portland Street, Manchester: A new rent of GBP251,679

(GBP21.50/sq.ft.) with Darwin Loan Solutions has been agreed,

representing an uplift of 59.7% against the previous rent.

Leo House, Wallington: A new rental of GBP132,000

(GBP17.00/sq.ft.) with Crimestoppers Trust, an uplift of 19.7%

against the previous rent.

30-34 Hounds Gate, Nottingham: A new letting agreement has been

signed with Ensek Ltd. for a 10-year lease (subject to break option

at year five) at a rent of GBP270,865 (GBP17.50/ sq. ft.).

Ashby Business Park, Ashby De La Zouch : An agreement for lease

has been signed with Ceva Logistics Ltd. to renew an existing lease

at a rent of GBP405,132 (GBP13.17/ sq. ft.) an uplift of 13.5%

against the previous rent.

Templeton Business Centre, Glasgow: An agreement has been signed

with the Trustees of Mental Health Network (Greater Glasgow) to

extend the lease for four years until 2024 at a rent of GBP13,768

(GBP8.00/sq. ft.).

Minton Place, Station Road, Swindon: A new rent of GBP20,790

(GBP13.50/sq.ft.) has been agreed with Optical Express Ltd until

April 2025.

Milburn House, Dean Street, Newcastle: Two leases have been

signed with Newcastle NE1 Ltd. at a combined rent of GBP25,503

(GBP9.26/sq. ft.) an uplift of 21.7% against the previous rent.

Stephen Inglis, Chief Executive Officer of London & Scottish

Property Investment Management Limited, the Asset Manager

commented:

"Regional REIT is performing well and our highly diversified

portfolio continues to demonstrate its resilience. In July, we

announced positive rent collection for Q2 which has continued to

grow and is now at 93%. With Q1 now at 98% we continue to

demonstrate the effectiveness of the unique management platform

that has been developed. Given the current economic and political

backdrop, these are exceptional collection rates and the management

team continues to work with our occupiers on the outstanding sums

due. We will be announcing further updates in due course.

On a general note I would comment that demand remains strong for

the Group's core office and industrial properties with regional

office and industrial availability reported as being at record low

levels. This shortage, partly caused by a lack of new product

coming to market, coupled with some major organisations considering

moving to a "hub and spoke" model, comprising a large city centre

presence supported by smaller multiple regional offices, leaves

Regional REIT very well positioned for the long term.

We are now increasingly confident that our consistently strong

performance during this difficult period, resulting in sector

leading income maintenance and generation, will see the portfolio

valuation (valuers are currently adjusting down based largely on

sentiment rather than transactional evidence) rewarded in the

long-term as we return to a more normal operating investment

environment.

I would also like to take this opportunity to welcome Panmure

Gordon as Regional REIT's appointed joint corporate broker."

- ENDS -

Enquiries:

Regional REIT Limited

Toscafund Asset Management Tel: +44 (0) 20 7845

6100

Investment Manager to the Group

Adam Dickinson, Investor Relations, Regional

REIT Limited

London & Scottish Property Investment Management Tel: +44 (0) 141

248 4155

Asset Manager to the Group

Stephen Inglis

Buchanan Communications Tel: +44 (0) 20 7466

5000

Financial PR regional@buchanan.uk.com

Charles Ryland / Victoria Hayns / Henry

Wilson

Peel Hunt Tel: +44 (0)20 7418

8900

Joint Corporate Broker and Financial Adviser

Capel Irwin, Carl Gough and Harry Nicholas

(Corporate)

Panmure Gordon (UK) Limited Tel: +44 (0)20 7886 2500

Joint Corporate Broker and Financial Adviser

Chloe Ponsonby (Corporate Broking) / Sapna

Shah (Corporate Finance)

About Regional REIT

Regional REIT Limited ("Regional REIT" or the "Company") and its

subsidiaries (the "Group") is a United Kingdom ("UK") based real

estate investment trust that launched in November 2015. It is

managed by London & Scottish Property Investment Management

Limited, the Asset Manager, and Toscafund Asset Management LLP, the

Investment Manager.

Regional REIT's commercial property portfolio is comprised

wholly of income producing UK assets and comprises, predominantly,

offices and industrial units located in the regional centres

outside of the M25 motorway. The portfolio is highly diversified,

with 151 properties, as at 30 June 2020, with a valuation of

GBP742.3m.

Regional REIT pursues its investment objective by investing in,

actively managing and disposing of regional core and core plus

property assets. It aims to deliver an attractive total return to

its Shareholders, targeting greater than 10% per annum, with a

strong focus on income supported by additional capital growth

prospects.

The Company's shares were admitted to the Official List of the

UK's Financial Conduct Authority and to trading on the London Stock

Exchange on 6 November 2015. For more information, please visit the

Group's website at www.regionalreit.com .

Cautionary Statement

This document has been prepared solely to provide additional

information to Shareholders to assess the Group's performance in

relation to its operations and growth potential. The document

should not be relied upon by any other party or for any other

reason. Any forward looking statements made in this document are

done so by the Directors in good faith based on the information

available to them up to the time of their approval of this

document. However, such statements should be treated with caution

due to the inherent uncertainties, including both economic and

business risk factors, underlying any such forward-looking

information.

ESMA Legal Entity Identifier ("LEI"): 549300D8G4NKLRIKBX73

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

TSTZZGGRVDVGGZM

(END) Dow Jones Newswires

August 05, 2020 02:00 ET (06:00 GMT)

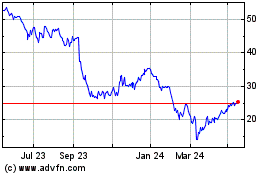

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jun 2024 to Jul 2024

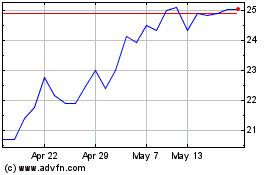

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jul 2023 to Jul 2024