TIDMRGL

RNS Number : 5473N

Regional REIT Limited

21 May 2020

21 May 2020

REGIONAL REIT Limited

("Regional REIT", the "Group" or the "Company")

Q1 Trading Update, Dividend and Outlook Statement

Regional REIT (LSE: RGL), the regional real estate investment

specialist focused on building a diverse portfolio of income

producing regional UK core and core plus office and industrial

property assets, today announces its trading update for the year to

date, its dividend declaration for the first quarter of 2020, and

provides a statement on the Group's outlook for the full year

2020.

Stephen Inglis, Chief Executive Officer of London & Scottish

Property Investment Management Limited, the Asset Manager

commented: "We are pleased to be able to deliver a reassuring

trading update for the first quarter of 2020, particularly in light

of increasingly difficult market conditions as the effects of

Covid-19 began to impact businesses across the UK in March. We are

confident in the outlook for Regional REIT due to the unique

features of our asset management platform that ensures a close

working relationship with our diverse register of quality

occupiers, of which some 50% are providing Government defined

'essential services'.

The quality and diversity of our portfolio properties and tenant

register, supported by active asset management relationships has

directly led to a first quarter 2020 rent collection of 93.9%

received by the Company. This revenue strength should ensure that a

sector leading level of income will continue to be paid to our

shareholders for the foreseeable future."

Trading Update

The Group has continued to pursue its strategy of providing

investors with an attractive return on a sustained and consistent

basis from investing in and managing, predominantly, offices and

light industrial property in the main regional centres of the UK

outside of the M25 motorway.

Since 1 January 2020 to date, the Group has exchanged on 18 new

leases, totalling 117,012 sq. ft., which, when fully occupied, will

provide approximately GBP0.8m pa of rental income.

Capital expenditure year-to-date was GBP4.8m net.

Q1 Rent Collection as at 18 May 2020:

93.9% of rent due had been collected (18 May 2019: 92.7%). This

comprises of 90.1% of Q1 2020 rent due and agreed collections from

occupiers who are now settling monthly amounting to 3.8%.

We continue to maintain close working relationships with all our

tenants through this difficult period.

First Quarter 2020 Dividend Declaration

The Company will pay a dividend of 1.90 pence per share ("pps")

for the period 1 January 2020 to 31 March 2020. The dividend

payment will be made on 17 July 2020 to shareholders on the

register as at 5 June 2020. The ex-dividend date will be 4 June

2020. The dividend will be paid as 1.90 pps as a REIT property

income distribution ("PID"). This follows the payment on 9 April

2020 of the dividend for Q4 2019 of 2.55pps.

In light of recent events, and until we have greater clarity on

the economic outlook, future quarterly dividend distributions

remain under review by the Board, having regard to, among other

things the financial position and performance of the Group,

including the levels of rental income received at the relevant

time, UK REIT requirements and the interests of shareholders.

Balance sheet and liquidity as at 31 March 2020:

-- Net loan-to-value ratio c.38.3% (31 December 2019: 38.9%);

gross borrowings GBP369.1m (31 December 2019: GBP344.0m);

-- Cash and cash equivalent balances GBP69.0m* (31 December 2019: GBP37.2m);

-- Cost of debt (including hedging) of 3.5% pa (31 December 2019: 3.5% pa);

-- No debt maturities before June 2024; weighted average debt

duration 7.1 years (31 December 2019: 7.3 years).

* Prior to payment of GBP11.0m in relation to the Q4 2019

dividend on 9 April 2020.

Portfolio as at 31 March 2020:

-- 154 properties, 1,261 units and 882 tenants, (31 December

2019: 160 properties, 1,251 units, 904 tenants) amounting to

GBP783.6m* of gross property assets (31 December 2019: GBP787.9m);

a rent roll of c. GBP63.4m pa (31 December 2019: GBP64.3m);

-- Offices (by value) were 80.3% of the portfolio (31 December

2019: 79.9%) and industrial sites 13.3% (31 December 2019: 13.7%);

England & Wales represented 81.6% (31 December 2019: 82.0%) of

the portfolio;

-- EPRA Occupancy 88.5%, versus 89.4% at 31 December 2019; 31

March 2020 like-for-like (versus 31 December 2019) occupancy was

88.5% (89.4%);

-- Average lot size increased to c. GBP5.1m (31 December 2019: GBP4.9m).

* Gross property assets based upon 31 December 2019 C&W

valuations, adjusted for subsequent disposals and capital

expenditure in the period.

Active asset management highlights - Ongoing value

optimisation:

Summary of activity in the quarter to 31 March 2020:

-- Elmbridge Court, Gloucester: Frazer-Nash Consultancy Ltd. has

renewed its leases of Unit C1 and C2 of the property (4,925 sq.

ft.) for a further five years from September this year at a rent of

GBP85,000 pa (GBP17.26/sq. ft.), an uplift of 38% against the

previous rent.

-- Oakland House, Talbot Road, Stretford, Greater Manchester:

The existing tenant, Greater Manchester Combined Authority, has

renewed its lease of the 8(th) Floor (East Wing) of the office

property (5,481 sq. ft.). The annual rent is GBP63,032 pa

(GBP11.50/sq. ft.), which is a 27% uplift to the previous rental

agreement.

-- Part Ground Floor, Betchworth House, Redhill: Current tenant

Man Energy Solutions UK Ltd. has renewed the existing lease of the

1,778 sq. ft. office unit for a further five years at a rent of

GBP42,000 pa (GBP23.62/sq. ft.), a 12% uplift against the previous

rent.

-- North Malting & North Kiln, Felaw Street, Ipswich,

Suffolk: KCOM Group Ltd. has re-geared its existing lease for the

second floor of the office property (11,897 sq. ft.), at a rent of

GBP92,000 pa (GBP7.73/sq. ft.), with the tenant's break date having

now moved out two years to 28 September 2022.

-- Gyleview House, 3 Redheughs Rigg, Edinburgh: Existing tenant

Citibase, has renewed the current lease for occupancy of the entire

serviced office property (24,503 sq. ft.) for a further five

years.

-- Braidhurst House, Lark Way, Strathclyde Business Park, and

Bellshill: New letting to ADT Fire and Security PLC on the ground

floor office premises (8,416 sq. ft.) at a rent of GBP109,408 pa

(GBP13.00/sq. ft.) for five years.

-- Commercial Street and Wellington Arcade, Brighouse: Costa

Coffee Ltd. has signed a new lease for 10 years for 3,170 sq. ft.

of previously vacant retail space at a rent of GBP40,000 pa

(GBP12.62/sq. ft.).

-- Ashby Park, Ashby De La Zouch: Brush Electrical Machines Ltd.

has let Power House (21,289 sq. ft.) for 10 years from January this

year at a rent of GBP300,000 pa (GBP14.09/sq.ft.).

-- Heathall Industrial Estate, Dumfries: Plastic Recycling

Technology Ltd. has signed a new lease for 10 years for 59,737 sq.

ft. of previously vacant space at a rent of GBP125,000 pa.

-- Trident Retail Park, Birmingham: City Electrical Factors Ltd.

has signed a new lease for 20 years for 4,931 sq. ft. of previously

vacant space at a rent of GBP43,100 pa (GBP8.74/sq. ft.).

-- Albert Edward House, Preston: Existing tenant in the

building, SpaMedica Ltd., has let additional space (3,793 sq. ft.).

The annual rent for this space is GBP37,930 pa (GBP10.00/sq.

ft.).

-- Miller Court, Tewkesbury: Rehability UK Community Ltd. has

let 2,250 sq. ft. of space for five years from February this year

at a rent of GBP35,100 pa (GBP15.60/sq. ft.).

-- The Brunel Centre, Bletchley: Peacocks Stores Ltd. has signed

a five-year lease for 3,302 sq. ft. at a rent of GBP27,500 pa

(GBP8.33/sq. ft.).

-- The Genesis Centre, Warrington: New letting to General

Insurance Distribution Ltd. for 1,946 sq. ft. at a rent of

GBP24,325 pa (GBP12.50/sq. ft.).

-- City West Business Park, Durham: New letting to Paramount

Technical Solutions Ltd. 2,874 sq. ft. at a rent of GBP23,800 pa

(GBP8.28/sq. ft.).

-- Heathall Industrial Estate, Dumfries: Current tenant Laurmar

Ltd. has extended existing lease for a further three years at a

rent of GBP65,000 pa, an 8% uplift against the previous rent.

-- Salamander Quay, Harefield: EDP Health, Safety and

Environment Consultants has signed a new lease for 10 years for

1,256 sq. ft. of space at a rent of GBP22,015 pa (GBP17.53/sq.

ft).

Sales since 1 January 2020:

January 2020 - Two attractive disposals above book value

-- Total Petrol Filling Station, Dysart Way, Leicester - GBP1.8m

-- Michigan Drive, Milton Keynes - GBP3.7m

February 2020 - Continuing to reduce retail sector exposure

-- 37 Stockwell Gate, Mansfield, Nottingham (retail) - at

auction for GBP110,000 - legal completion on 25 March 2020

-- West Stewart Street, Greenock, Greenock (retail) - at auction

for GBP275,000 - legal completion on 26 March 2020

-- 52/66 Newmarket Street, Ayr (retail) - sold prior to auction for GBP155,000

-- Whittle Court, Stoke-On-Trent (part sale) (office) - sold for GBP200,000

-- Sheldon Court, Birmingham (office) - sold for GBP2.4m

Outlook

Our confidence for the longer term continues to be underpinned

by the Group's focus on tenant relationships, asset management

initiatives coupled with our robust balance sheet. However, we

remain mindful of the backdrop of economic uncertainty and tenant

requirements in a structurally evolving property market, which

continues to be impacted by Covid-19.

Forthcoming Events

Late July/August Annual General Meeting

17 Sep 2020 Interim 2020 results announcement

12 Nov 2020 Q3 2020 Trading Update

Note : All dates are provisional and subject to change

-S -

Enquiries:

Regional REIT Limited

Toscafund Asset Management Tel: +44 (0) 20 7845

6100

Investment Manager to the Group

Adam Dickinson, Investor Relations, Regional

REIT Limited

London & Scottish Property Investment Management Tel: +44 (0) 141

248 4155

Asset Manager to the Group

Stephen Inglis

Buchanan Communications Tel: +44 (0) 20 7466

5000

Financial PR regional@buchanan.uk.com

Charles Ryland / Victoria Hayns / Henry

Wilson

About Regional REIT

Regional REIT Limited ("Regional REIT" or the "Company") and its

subsidiaries (the "Group") is a United Kingdom ("UK") based real

estate investment trust that launched in November 2015. It is

managed by London & Scottish Property Investment Management

Limited, the Asset Manager, and Toscafund Asset Management LLP, the

Investment Manager.

Regional REIT's commercial property portfolio is comprised

wholly of income producing UK assets and comprises, predominantly,

offices and industrial units located in the regional centres

outside of the M25 motorway. The portfolio is highly diversified,

with 160 properties, 904 tenants as at 31 December 2019, with a

valuation of GBP787.9m.

Regional REIT pursues its investment objective by investing in,

actively managing and disposing of regional core and core plus

property assets. It aims to deliver an attractive total return to

its Shareholders, targeting greater than 10% per annum, with a

strong focus on income supported by additional capital growth

prospects.

The Company's shares were admitted to the Official List of the

UK's Financial Conduct Authority and to trading on the London Stock

Exchange on 6 November 2015. For more information, please visit the

Group's website at www.regionalreit.com .

Cautionary Statement

This document has been prepared solely to provide additional

information to Shareholders to assess the Group's performance in

relation to its operations and growth potential. The document

should not be relied upon by any other party or for any other

reason. Any forward looking statements made in this document are

done so by the Directors in good faith based on the information

available to them up to the time of their approval of this

document. However, such statements should be treated with caution

due to the inherent uncertainties, including both economic and

business risk factors, underlying any such forward-looking

information.

ESMA Legal Entity Identifier ("LEI"): 549300D8G4NKLRIKBX73

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCBIGDURGDDGGG

(END) Dow Jones Newswires

May 21, 2020 02:00 ET (06:00 GMT)

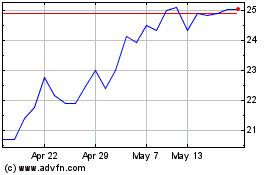

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jun 2024 to Jul 2024

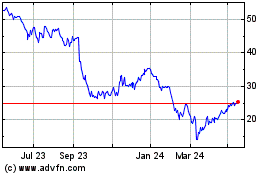

Regional Reit (LSE:RGL)

Historical Stock Chart

From Jul 2023 to Jul 2024