TIDMPLAZ

RNS Number : 2038U

Plaza Centers N.V.

31 March 2021

31 March, 2021

PLAZA CENTERS N.V.

RESULTS FOR THE YEARED 31 DECEMBER 2020

Plaza Centers N.V. ("Plaza" / "Company" / "Group") today

announces its results for the year ended 31 December 2020.

Financial highlights:

-- Reduction in total assets by EUR43.6 million to EUR12.5

million mainly due to decrease in Trading Properties as detailed

below.

-- Reduction of app. EUR40.4 million in the book value of the

Company's trading properties due to decrease of the full value of

Casa Radio project, Romania (refer to Note 5(4) in the annual

consolidated financial statements) and due to disposal of the land

plot in Brasov, Romania.

-- Consolidated cash position as of December 31, 2020 increased

by circa EUR0. 6 million to app. EUR 1.7 million (December 31,

2019: EUR1.1 million).

-- Revenue from disposal of Trading properties totaled EUR1.5

million (December 31, 2019: EUR3.7 million), which is in line with

the Company's disposal program.

-- EUR25.4 million loss recorded at an operating level (December

31, 2019: EUR4.4 million loss) mainly due to write-down of Trading

Property.

-- General & Administrative Expenses reduced to EUR1.1

million in 2020 mainly due to cost cutting of professional services

and manpower (December 31, 2019: EUR1.6 million).

-- Recorded loss of EUR33.5 million (December 31, 2019: EUR21.2

million), mainly due to finance expenses on bonds and write-down of

Trading Property.

-- Basic and diluted loss per share of EUR4.89 (31 December 2019: loss per share of EUR3.09).

Impact of the Covid-19

During 2020, the Covid-19 global health and economic crisis was

severely affecting business, leading to supply chain disruptions,

cash flow problems and, more generally, a sharp drop in its

activity. Many countries are taking significant steps in trying to

prevent the spread of the virus, such as restrictions on civilian

movements, gatherings, border closures and the like. The Company

monitors the consequences of the event and the actions taken in

countries in which it operates and assesses the risks and exposures

arising from these consequences. At this stage, the impact of the

effect of the COVID 19 included a write off of its assets (refer to

Note 6(1) and 6(2) in the annual consolidated financial

statements). In addition, caused Elbit Plaza India Real Estate

Holdings Limited (an equity accounted investee held by the Company

(50%) and Elbit Imaging Ltd. (50%)) ("EPI") to postpone the closing

of the sale of 100% stake in the SPV (subsidiary of EPI) (refer to

Note 6(b)(2) in the annual consolidated financial statements). In

addition, it caused a delay in the legal procedures against the

purchaser of the SPV which owns the plot in Bangalore India (refer

to Note 6(b)(1) in the annual consolidated financial statements).

Other than the above mentioned, at this stage, the Company is not

able to estimate the full future impact of COVID 19. However, the

Company assumes the demand of interested buyers is expected to be

smaller, which can have a material impact on the ability of the

Company to complete the sale of the plots it owns.

Material events during the period:

Update on disposal of a plot of land in Brasov, Romania :

On February 14, 2020 an indirect subsidiary completed the sale

of the plot in Brasov, Romania and signed the definitive agreement

for a total consideration of EUR 620,000 following which it

received the last instalment of EUR 570,000 (the Company already

received a down payment of EUR 50,000 in 2019).

Appointment of the Chairman of the Board of Directors:

On March 23, 2020 Mr. David Dekel was appointed as the

non-executive Chairman of the Board of Directors following a

meeting of the board held on that date.

Sale agreement of plot in Bangalore, India:

Regarding the criminal cases filed for dishonor of the cheques

which were given as security for payment of certain instalments

refer to Note 6(b)(1) in the annual consolidated financial

statements.

Until the approval of the financial statements the Purchaser

paid to EPI approximately EUR 11.2 million (INR 87.00 crores)

(Plaza part INR 43.5 crores (approximately EUR 5.6 million) out of

a total consideration of INR 356 crores (approximately EUR 41.16

million) (Plaza part INR 178 crores (approximately EUR 20.58

million) the SPV should have been received as of the said date as

per the Agreement.

At this stage, there is no clarity on payment of the remaining

amount based on the Agreement. Accordingly, the Company is taking

necessary steps to protect its interest, including, notice letters

that were sent to the Partner, and filing a motion with Court in

order to collect checks given by the Partner to secure payments

under the transaction, but were dishonored.

Environmental update on Bangalore project - India :

Regarding Environmental update on Bangalore project and the

implications on the net realizable value refer to Note 6 (1) in the

annual consolidated financial statements.

Sale agreement of plot in Chennai, India:

On February 18, 2020, the Company announced that Elbit Plaza

India Real Estate Holdings Limited (an equity accounted investee

held by the Company (50%) and Elbit Imaging Ltd. (50%)) ("EPI") has

received approximately EUR 2.1 million (Plaza part EUR 1.05

million) from the SPV (subsidiary of EPI) which owns the 74.7 acre

plot in Chennai, India.

On March 8, 2020 the Company announced that EPI and the

Purchaser have reached a revised understanding regarding the

amendment of the agreement according to which the Purchaser paid

further INR 5 crores (approximately EUR 0.625 million) and get

additional three months to complete the closing before June 3,

2020, which may be extended by another three months upon payment by

the Purchaser of an additional deposit of INR 7.5 crores

(approximately EUR 0.92 million).

On June 2, 2020 the Company announced that in light of the

ongoing lockdown due to COVID-19, the Purchaser has sought

additional time for closing (currently set for June 2, 2020) and

the parties have reached to a revised understanding the Purchaser

requests and gets an extension of 3 months to complete the closing

(i.e. up to September 2, 2020) without an additional payment of INR

7.5 crores (approximately EUR 0.9 million). The Purchaser will have

an option to extend this period of time by another 3 months (i.e.,

up to December 2, 2020) upon paying additional deposit of INR 7.50

crores (approximately EUR 0.9 million) (Plaza part INR 3.75 crores

(approximately EUR 0.45 million)).

On August 31, 2020 the Company announced further to revised

understanding regarding the amendment agreed by the parties on June

2, 2020 and due to the COVID 19 negative impact on the economic

situation in India, the Purchaser has sought additional time for

closing of the transaction (currently set for September 2, 2020),

and the parties have reached a revised understanding as follows:

(i) The Purchaser will deposit INR 1 crore (approximately EUR 0.115

million) and agrees to deposit additional INR 0.50 crore

(approximately EUR 0.0575 million) by December 1, 2020; (ii) The

Purchaser gets additional seven months to complete the closing (up

to 1, April 2021), which may be extended by another three months

(up to June 30, 2021) upon payment by the Purchaser of an

additional deposit of INR 7.5 crores (approximately EUR 0.861

million)

Accordingly, the Purchaser has deposited INR 1.50 crore (Plaza

part INR 0.75 crores (approximately EUR 0.086 million) in

accordance with his obligation in connection with the revised

understandings to the Agreement as agreed on August 31, 2020.

On March 31, 2020 the Company announced further to revise

understanding regarding the amendment agreed by EPI and the

Purchaser ("The Parties"), on August 31, 2020 The Parties have

reached a revised understanding (the "Revised Understandings") as

follows:

a. The Purchaser will deposit INR 7.5 crore (approximately EUR

0.861 million (Plaza part is approximately EUR 0.43 million)).

b. The Purchaser can complete the closing by April 30, 2021 at a

revised consideration of 96.50 crores (approximately EUR 11.6

million (Plaza part is approximately EUR 5.8 million)).

c. If the Purchaser fails to complete the closing by April 30,

2021 then the Purchaser gets additional two months to complete the

closing by June 30, 2021 but at the initial consideration of INR

108 crores (approximately EUR 13 million (Plaza part is

approximately EUR 6.5 million)).

d. According to the SPA, if the Purchaser is unable to complete

the closing within the aforesaid time periods, then the parties

will mutually appoint an international real estate consulting firm

for the purpose of identifying a third-party buyer within a period

of six months.

e. Following the deposit of the INR 7.5 crore (approximately EUR

0.861 million (Plaza part is approximately EUR 0.43 million)) by

the purchaser as agreed in the Revised Understanding stated above,

as of this date, the Purchaser has deposited a total of INR 34

crores (approximately EUR 4.1 million (Plaza part is approximately

EUR 2.05 million)).

At this stage, there is no certainty that the SPA closing will

occur.

Lawsuit against entities involved in the sale of U.S. shopping

centers in 2011:

In March 2018, a shareholder of the Company (hereinafter: " the

Plaintiff ") filed a motion with the Economic Department of the

District Court in Tel-Aviv to reveal and review internal documents

of the Company and of Elbit Imaging Ltd. (hereinafter: " Elbit ")

(hereinafter: " the Motion "), in which the Court was asked to

instruct the Company and Elbit (hereinafter together: " the

Respondents ") to provide the plaintiff with certain documents of

the respondents in connection with the sale of the U.S. Shopping

Centers in 2011 and with another project of the company in

Romania.

In February 2020, an agreement was reached between the Plaintiff

and the Respondents according to which the motion will be dismissed

by consent and the plaintiff and the respondents (hereinafter: "

the Parties ") will jointly examine the feasibility of the lawsuit

in connection with the above events.

In light of the aforesaid, an agreement was signed between the

Plaintiff, the Respondents and First Libra Israel Ltd.

(hereinafter: " Libra ") according to which Libra will finance all

the expenses of filing and managing of a new lawsuit by the

Respondents against certain parties (certain officers in the

Respondents, a portion of the heirs of Motti Zisser (the former

controlling shareholder of the Respondents and other parties) who

were involved in the Respondents' transaction for the sale of real

estate in the United States in 2011 and for which funds (brokerage

fees) were allegedly illegally transferred to private companies

controlled by the late Mr. Motti Zisser (hereinafter: " Financing

Agreemen t" and " New Lawsuit ", respectively).

The parties to the Financing Agreement agreed, inter alia, that

any consideration received as a result of the New Lawsuit (to the

extent received) (hereinafter: " the Lawsuit Funds ") will first be

used to reimburse Libra's expenses for the New Lawsuit (plus

interest and VAT) and the balance after deduction of such expenses

(hereinafter: " the Balance of the Lawsuit Funds ") will be divided

among all those involved in the New Lawsuit, so that each of the

Company and Elbit will be entitled to circa 20.75% of the Balance

of the Lawsuit Funds.

In order to ensure the distribution of the Lawsuit Funds as

stated above, both the Company and Elbit signed lien documents in

favor of Libra, the Plaintiff and the attorneys representing them

(hereinafter collectively: " the Eligibles ") with respect to the

reimbursement of expenses and their portion in the Lawsuit Funds

(hereinafter: " the Lien ").

On October 18, 2020 the parties filed the New Lawsuit (in the

amount of circa NIS 60 million (approximately EUR 15 million)).

The Final Price adjustment of Belgrade Plaza:

On June 8, 2020 the Company together with a fully owned

subsidiary signed a final settlement and waiver agreement with the

purchaser of the SPV holding the shopping and entertainment center

in Belgrade (the "Purchaser", the "Settlement" and the "Project",

accordingly) according to which the Purchaser will pay a final

amount (including the last payment for the stands and signage) of

EUR 830,000 (the "Settlement Amount") which will be the final

amount that should be paid to the Company under the share purchase

agreement between the parties for the sale of the Project, dated

January 26, 2017 (the "SPA").

The Settlement amount was paid to the Company on June 15,

2020.

Deferral of payment of Debentures and partial interests'

payment:

Refer to the below in Liquidity & Financing.

Dutch statutory auditor:

Refer to Note 16 (b)(10) in the annual consolidated financial

statements.

Annual General Meeting and the Meeting of Independent

Shareholders:

Annual general meeting of the Shareholders of the Company was

held on July 29, 2020, all the proposed resolutions were

passed.

Meeting of Independent Shareholders of the Company was held on

July 29, 2020, all the proposed resolutions were passed.

Key highlights since the period end:

Update regarding a change in Elbit Imaging Ltd holdings:

On January 11, 2021 the Company announced that since August 5,

2020 and up to January 10, 2021, Elbit Imaging Ltd. ("Elbit

Imaging") sold about 160 thousand shares of the Company, which are

held in escrow account, for an average price of NIS 0.99 and for a

total consideration of approximately NIS 159 thousand, thus, Elbit

Imaging holdings in the Company have diminished from 44.9% to 42.6%

of the Company's issued and paid-up capital.

On January, 11 2021, Elbit imaging sold about 180 thousand

shares of the Company, which are held in escrow account, for an

average price of NIS 0.60 and for a total consideration of

approximately NIS 110 thousand, thus, Elbit Imaging holdings in the

Company have diminished from 42.6% to 39.9% of the Company's issued

and paid-up capital.

On January 12, 2021, Elbit Imaging sold about 319 thousand

shares of the Company, which are held in escrow account, for an

average price of NIS 0.61 and for a total consideration of

approximately NIS 194 thousand, thus, Elbit Imaging holdings in the

Company have diminished from 39.9% to 35.3% of the Company's issued

and paid-up capital.

On January 13, 2021, Elbit Imaging sold about 442 thousand

shares of the Company, which are held in escrow account, for an

average price of NIS 0.66 and for a total consideration of

approximately NIS 291 thousand, thus, Elbit Imaging holdings in the

Company have diminished from 35.3% to 28.8% of the Company's issued

and paid-up capital.

On February 24, 2021 the Company announced that since it last

announcement, Elbit Imaging sold about 120 thousand shares of the

Company, which are held in escrow account, for an average price of

NIS 0.76 per share and for a total consideration of approximately

NIS 91 thousand, thus, Elbit Imaging holdings in the Company have

diminished from 28.8% to 27.1% of the Company's issued and paid-up

capital.

Commenting on the results, executive director Ron Hadassi

said:

"Our active focus has continued to center on asset disposals,

which were left in Romania and India, generating cash flows,

further cost cutting, tight budget control and the optimization of

the business with the aim of satisfying our obligations to our

bondholders. On the Casa Radio project, despite many efforts done

in order to receive a Government Decision confirming the transfer

of the shares to AFI Europe N.V. as well as amendment of the PPP

Agreement in line with the agreement signed with AFI Europe N.V.,

no major breakthrough was achieved. Due to the above, on November

2, 2020, the Company, Dambovita NL and AFI Europe N.V. ("AFI", and

together with the Company, the "Parties") entered into an addendum

to the pre-sale pursuant to which the Parties agreed to extend the

Long Stop Date, which is the date on which the parties will execute

a share purchase agreement, subject to the satisfaction of the

conditions precedent (the "SPA" ( . Until the date of the approval

of the consolidated financial reports, the Company and AFI continue

with their efforts to receive the authority's approval in order to

be able to execute the SPA. Still, there have been no progress

since the pre-sale agreement has been signed. In light of the above

the Company is exploring all its options in order to obtain

progress, including among others its legal options. Due to the

above, there can be no certainty that the SPA will eventually be

executed and/or that the transaction will be completed over the

coming months.

In addition, we intend to request the bondholders' approval to

postpone the repayment of the bonds from July 1, 2021 (the final

redemption date) in order to allow us to continue with the

realization of the Company' objectives."

For further details, please contact:

Plaza

Ron Hadassi, Executive Director 972-526-076-236

Notes to Editors

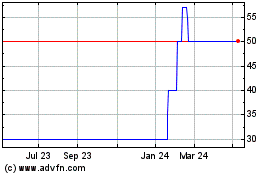

Plaza Centers N.V. ( www.plazacenters.com ) is listed on the

Main Board of the London Stock Exchange, as of 19 October 2007, on

the Warsaw Stock Exchange (LSE: "PLAZ", WSE: "PLZ/PLAZACNTR") and,

on the Tel Aviv Stock Exchange.

Forward-looking statements

This press release may contain forward-looking statements with

respect to Plaza Centers N.V. future (financial) performance and

position. Such statements are based on current expectations,

estimates and projections of Plaza Centers N.V. and information

currently available to the Company. Plaza Centers N.V. cautions

readers that such statements involve certain risks and

uncertainties that are difficult to predict and therefore it should

be understood that many factors can cause actual performance and

position to differ materially from these statements.

MANAGEMENT STATEMENT

During 2020 the management's focus has been on executing of cash

proceeds on signed SPA for the sale of Chennai project in India. In

the Bangalore project the Company together with Elbit continued to

protect its interest in the project, including, by sending notice

letters to the Partner, and filing a motion with Court in order to

collect checks received by the partner (refer also to Note 6(b)(1)

in the annual consolidated financial statements). The Company also

continued the disposals of plots of land in CEE and cost reductions

and partial repayments to its bondholders.

Because of the abovementioned issues surrounding the

satisfaction of the condition's precedent in the pre-sale

agreement, it is currently not certain whether the sale agreement

as contemplated in the pre-sale agreement would be entered into and

whether therefore the transaction with AFI would proceed. As such

the Company, Dambovita NL and AFI Europe N.V. agreed to extend the

Long Stop Date until December 31, 2021. Still, there is an

uncertainty that either the conditions precedent in the Pre-Sale

Agreement as detailed above will be met, or that the Sale Agreement

will be executed and/or that the transaction will be consummated as

presented above or at all.

Over the coming months, the Company will maintain its focus on

executing the agreement signed for the sale of Chennai project in

India and to take necessary steps to protect its interest in the

project in Bangalore India. And to also continue to take all the

necessary steps to execute the agreement with AFI Europe N.V.

Due to the board and management estimation that the Company is

unable to serve its entire debt according to the current redemption

date (July 1, 2021) in its current liquidity position, the Company

intends to request from the bondholders of both series (Series A

and Series B) postponement of the repayment of the remaining

balance of the bonds.

Results

During the year, Plaza recorded a EUR33.5 million loss

attributable to the shareholders of the Company. This is an

increase compared to the losses reported in 2019 (loss of EUR21.2

million). The losses were mainly from the Net Finance Costs which

were decreased to EUR8.1 million in 2020, from EUR16.6 million in

2019 mainly due to interests' expenses accrued on the debentures

(partly due to penalty interest calculated on the deferred

principal); and from EUR 39.8 million write-down in trading

properties and EUR15.8 million of reversal of provision (relating

to change in provision in respect to PAB) in Casa Radio project,

Romania.

Total result of operations excluding finance income and finance

cost was a loss of EUR25.4 million in 2020 compared to the reported

loss of EUR4.4 million in 2019, mainly due to the increase in the

write down of trading property as described above.

The consolidated cash position (cash on standalone basis as well

as fully owned subsidiaries) as of 31 December 2020 was EUR1.7

million (31 December 2019: EUR1.1 million).

Liquidity & Financing

Plaza ended the period with a consolidated c ash position of

circa EUR1.7 million, compared to EUR1.1 million at the end of

2019.

As of December 31, 2020, the Group's outstanding obligation to

bondholders (including accrued interests) are app. EUR97.8

million.

As disclosed by the Company in Note 8I to its annual

consolidated financial statements, the Company was not able to meet

its final redemption obligation to its (Series A and Series B)

bondholders, due on July 1, 2020, and on May 4, 2020, the

bondholders approved: (i) to postpone the final redemption date to

January 1, 2021; (ii) that on July 1, 2020 the Company will pay to

its bondholders a partial interest payment in the total amount of

EUR 250,000.

Following receiving the Settlement Amount (see Note 16(b)(9) in

the annual consolidated financial statements), and in light of the

potential negative impact of the Covid-19 on the possibility to

receive future proceeds from the Comp'ny's plots in India, the

Company decided to increase the amount to be paid to the

bondholders on July 1, 2020, from EUR 250,000 to EUR 500,000.

On November 12, 2020, the bondholders of Series A and Series B

approved: (i) to postpone the final redemption date to July 1, 2021

of all the scheduled Principal; (ii) that on January 1, 2021 the

Company will pay to its bondholders a partial interest payment in

the total amount of EUR 200,000 and to deferral all other unpaid

scheduled Interest payment.

Due to the board and management estimation that the Company is

unable to serve its entire debt according to the current bonds

repayment schedule in its current liquidity position, the Company

intends to request the bondholders of both series for postponement

of the repayment of the remaining balance of the bonds. However,

there is an uncertainty if the bondholders will approve the

request. In the case that the bondholders would declare their

remaining claims to become immediately due and payable, the Company

would not be in a position to settle those claims and would need to

enter to an additional debt restructuring or might cease to be a

going concern.

Strategy and Outlook

The Company's priorities are focused on efforts to execute the

SPA with AFI, to execute the sale of Chennai project in India and

getting further proceeds for Bangalore project. The Company also

intends to seek for bondholders' approval for postponement of the

repayment of the bonds. In addition, the Company intends to

continue the cost-cutting of its operational cost.

OPERATIONAL REVIEW

Over the course of the year to date, Plaza has continued to make

progress against its operational and strategic objectives. The

Company's current assets are summarized in the table below (as of

balance sheet date):

Asset/ Location Nature of Size Plaza's Status

Project asset sqm (GLA) effective

ownership

%

Casa Radio Bucharest, Mixed-use 467,000 75 An addendum to the

Romania retail, hotel (GBA including Pre-sale agreement

and leisure parking was signed (refer to

plus office spaces) note 5 (3) in the annual

scheme consolidated financial

statements)

------------ ---------------- ---------------- ----------- --------------------------

Amended revised agreement

in place (refer to

note 6(b)(1) in the

annual

Bangalore, Residential consolidated financial

Bangalore India Scheme 218,500 25 statements)

------------ ---------------- ---------------- ----------- --------------------------

JDA and term sheet

terminated;

SPA signed (refer to

note 6(b)(2) in in

Chennai, Residential the annual consolidated

Chennai India Scheme 302,400 50 financial statements)

------------ ---------------- ---------------- ----------- --------------------------

FINANCIAL REVIEW

Results

In 2020, the Revenue for the period derived from the disposal of

trading properties amounted to EUR1.5 million, compared to EUR3.7

million in 2019. The proceeds received in 2020 were related to the

sale of land plot in Brasov, Romania and income for the final

settlement amount in Belgrade Plaza. The proceeds received in 2019

were related to the sale of two plots (land plot in Lodz, Poland

and land plot in Miercurea Ciuc, Romania) and income for the stands

and signage in Belgrade Plaza.

In 2020, the general & administrative expenses amounted to

EUR1.1 million, a decrease compare to EUR1.6 million in 2019. The

decrease was a result of a material scale down of the Company's

activities, mainly in respect of salaries and related expenses and

professional services.

The write down of trading properties increased from EUR0.5

million loss in 2019 to EUR24 million loss in 2020.

The 2019 relates to the net change in the cost of Casa Radio

property (the change in the value of the asset minus the change in

the provision of the PAB) decreased by partial reversal of write

downs of plots in Romania. The 2020 loss relates to net write down

of Casa Radio property value in amount of EUR39.8 million minus

EUR15.8 million of reversal of provision in respect to the

construction of the Public Authority Building.

Finance income of EUR2.1 million in 2020 was mainly due to

foreign exchange movements on the debentures, which did not occur

in the end of December 31, 2019.

Finance costs decreased from EUR16.6 million in 2019 to EUR10.2

million in 2020. The main components of finance costs were

interests' expenses accrued on the debentures which includes also

penalty interest calculated on the deferred principal.

In 2020 there were no tax benefit or expenses. As of December

31, 2019, the Company recognized EUR0.07 million tax cost due to

withholding tax.

As a result, the loss for the period amounted to circa EUR33.5

million in 2020, representing a basic and diluted loss per share

for the period of EUR4.89 (2019: EUR3.09 loss).

Balance sheet and cash flow

The balance sheet as of 31 December 2020 showed total assets of

EUR12.5 million compared to total assets of EUR56.1 million at the

end of 2019, mainly as a result of the net write down of the full

value of Casa Radio, disposal of land plot in Romania resulting

payment of circa EUR0.6 million in February 2020, administrative

expenses and costs of operations which amounted to EUR1.1 million

for the 12 months of 2020 and payment of interests for bonds in

total amount of circa EUR0.7 million in 2020.

The consolidated cash position (cash on standalone basis as well

as fully owned subsidiaries) as of 31 December 2020 increased to

EUR1.7 million (31 December 2019: EUR1.1 million).

The value of the Company's trading properties decreased from

EUR40.4 million as of 31 December 2019 to nil at the end of 31

December 2020 following the disposal of land plot in Brasov, in

Romania and write down of the value of the Casa Radio project,

Romania.

Investments in equity accounted investee companies has decreased

by EUR3.7 million to circa EUR10.7 million (31 December 2019:

EUR14.4 million) mainly as a result of cash distribution of EUR1.1

million (31 December 2019: EUR0.8 million).

As of 31 December 2020, Plaza has a balance sheet liability of

EUR87.1 million from issuing bonds on the Tel Aviv Stock Exchange.

Additionally, Plaza recorded provision for interests on bonds as of

December 31, 2020, in amount of EUR10.7 million (31 December 2019:

EUR3.8 million).

As detailed above, due to the decrease of the full value of Casa

Radio project (Bucharest Romania), the provision created with

respect to the obligation connected to Casa Radio project (for the

construction of the Public Authority Building) was reversed in the

amount of EUR15.8 million.

Disclosure in accordance with Regulation 10(B)14 of the Israeli

Securities Regulations (periodic and immediate reports),

5730-1970

1. General Background

According to the abovementioned regulation, upon existence of

warning signs as defined in the regulation, the Company is obliged

to attach its report's projected cash flow for a period of two

years, commencing with the date of approval of the report"

("Projected Cash F"ow").

The Material uncertainty related to going concern was included

in the independent auditors' report and in Note 1(b) in the

consolidated financial statements as of December 31, 2020. In light

of the material uncertainty that the SPA between the Company and

AFI Europe N.V. will eventually be executed and/or that the

transaction will be consummated as presented above or at all.,

(refer to Note 5 in the consolidated financial statements as of

December 31, 2020) as well as the default of purchaser of Bangalore

project to meet payments schedule according to the signed amendment

agreement (refer to Note 6(b)(1) in the consolidated financial

statements as of December 31, 2020), the board and management

estimates that the Company is unable to serve its entire debt

according to the due date the bond holders approved to postpone the

final redemption date. Accordingly, it is expected that the Company

will not be able to meet its entire contractual obligations in the

following 12 months.

With such warning signs, the Company is providing projected cash

flow for the period of 24 months following for the coming two

years.

2. Projected cash flow

The Company has implemented the restructuring plan that was

approved by the Dutch Court on July 9, 2014 (the "Restructuring

Plan"). Under the Restructuring Plan, principal payments under the

bonds issued by the Company and originally due in the years 2013 to

2015 were deferred for a period of four and a half years, and

principal payments originally due in 2016 and 2017 were deferred

for a period of one year. During first three months 2017, the

Company paid to its bondholders a total amount of NIS 191.7 million

(EUR 49.2 million) as an early redemption. Upon such payments, the

Company complied with the Early Prepayment Term (early redemption

at the total sum of at least NIS 382 million) and thus obtained a

deferral of one year for the remaining contractual obligations of

the bonds.

In January 2018, a settlement agreement was signed by and among

the Company and the two Israeli Series of Bonds.

On November 22, 2018 the Company announced based on its current

forecasts, that the Company expected to pay the accrued interest on

Series A and Series B Bonds on December 31, 2018, in accordance

with the repayment schedule determined in the Company's

Restructuring Plan and Settlement Agreement with Series A and

Series B Bondholders from 11 January 2018 (the "Settlement

Agreement"). The Company noted that it will not meet its principal

repayment due on December 31, 2018 as provided for in the

Settlement Agreement. On February 18, 2019 the Company paid

principal of circa EUR 250,000 and Penalty interest on arrears of

EUR 150,000 following the bondholder's approval to defer principal

repayment to July 1, 2019.

In addition, during June 2019 the bondholders approved the

deferral of the full payment of principal due on July 1, 2019 and

of 58% ("deferred interest amount") of the sum of interest

(consisting of the total interest accrued for the outstanding

balance of the principal, including interest for part of the

principal payment which was deferred as of February 18, 2019, plus

interest arrears for part of the principal which was fixed on

February 18, 2019 and was not paid by the Company and all in

accordance with the provisions of the trust deed; "the full amount

of interest"), the effective date of which is June 19, 2019, and

the payment date was fixed as of July 1, 2019. The company paid on

the said date a total amount of circa EUR 1.17 million, which is

only 42% of the full amount of interest.

On July 11, 2019, the Company announced that its Romanian

subsidiary had signed a binding agreement to sell a land in Romania

(refer to Note 5(2)(c) of the consolidated financial statements as

of December 31, 2019), and that the Company would use part of the

proceeds now received by it EUR 0.75 million (hereinafter: "the

amount payable"), in order to make a partial interest payment to

the bondholders (Series A) and (Series B) issued by the Company.

The payment required changes in the repayment schedule and

amendments of the trust deeds which was approved unanimously by the

Bondholders. The amount payable was paid on August 14, 2019 and

reflects 30% of accrued interest as of that date.

On November 17, 2019, the bondholders of Series A and Series B

approved a deferral of all the scheduled Principal payment and app.

87% of deferral of the scheduled Interest payment, both, as of

December 31, 2019 to July 1, 2020.

On May 4, 2020, the bondholders of Series A and Series B

approved: (i) to postpone the final redemption date to January 1,

2021 of all the scheduled Principal; (ii) that on July 1, 2020 the

Company will pay to its bondholders a partial interest payment in

the total amount of EUR 250,000 and to deferral all other unpaid

scheduled Interest payment.

Following receiving the Settlement Amount (refer to Note

16(b)(9) of these Annual Consolidated Financial Statements), and in

light of the potential negative impact of the Covid-19 on the

possibility to receive future proceeds from the Company's plots in

India, the Company decided to increase the amount to be paid to the

bondholders on July 1, 2020, from EUR 250,000 to EUR 500,000. The

amount reflected 6.74% of accrued interest as of that date.

On November 12, 2020, the bondholders of Series A and Series B

approved: (i) to postpone the final redemption date to July 1, 2021

of all the scheduled Principal; that on January 1, 2021 the Company

will pay to its bondholders a partial interest payment in the total

amount of EUR 200,000 and to deferral all other unpaid

scheduled Interest payment. The amount reflected 1.84% of accrued interest as of that date.

The materialization, occurrence consummation and execution of

the events and transactions and of the Assumptions on which the

projected cash flow is based, including with respect to the

proceeds and timing thereof, although probable, are not certain and

are subject to factors beyond the Company's control as well as to

the consents and approvals of third parties and certain risks

factors. Therefore, delays in the realization of the Company's

assets and investments or realization at a lower price than

expected by the Company, as well as any other deviation from the

Company's Assumptions (such as additional expenses due to

suspension of trading, delay in submitting the statutory reports

etc.), could have an adverse effect on the Company's cash flow and

the Company's ability to service its indebtedness in a timely

manner.

In EUR millions 2021 2022

Cash - Opening Balance (2) 1.71 0.94

Cash flow from equity companies in India

(3) 0.8 4.3

Total Sources 2.51 5.24

Debentures - principal - -

Debentures - interest (3) - 3

Other operational costs (4) 0.30 -

G&A expenses (including property maintenance)

(5) 1.27 1.20

Total Uses 1.57 4.20

Cash - Closing Balance (2) 0.94 1.04

(1) The above cash flow is subject to the approval of the

bondholders of both series to postponement of the repayment of the

remaining balance of the bonds which are due on July 1, 2021.

(2) Total cash on standalone basis as well as fully owned subsidiaries.

(3) In 2021, the Company assumed a reception of EUR 0.8 million

which is part of the cash balances of the Chennai Project SPV. As

detailed in note 6 (b)(2) of the Consolidated Financial Statements

as of December 31, 2020) Elbit Plaza India Real Estate Holdings

Limited (an equity accounted investee held by the Company (50%)

("EPI") and the purchaser ("The Parties") signed on a revised

understanding based on which the Purchaser can complete the closing

by April 30, 2021 at a revised consideration of 96.50 crores

(approximately EUR 11.6 million (Plaza part is approximately EUR

5.8 million), but If the Purchaser fails to complete the closing by

April 30, 2021 then the Purchaser gets additional two months to

complete the closing by June 30, 2021 but at the initial

consideration of INR 108 crores (approximately EUR 13 million

(Plaza part is approximately EUR 6.5 million). Due to the

uncertainty that the closing date will occur at April 30, 2021 the

company assumed the closing date will occur during 2022 hence the

proceed it will receive will be based on the initial consideration

of INR 108 crores (approximately EUR 13 million (Plaza part is

approximately EUR 6.5 million). As mentioned above, in case the

purchaser will complete the closing by April 30, 2021 the total

proceeds the company will receive will decreased by app. EUR 0.7

million, Accordingly, the proceeds which will be repaid to the

bondholders will decreased in the same amount.

(4) Includes provision for legal costs/Arbitrations.

(5) Total general and administrative expenses includes both cost

of the Company and of all the subsidiaries.

(6) The Company didn't include any proceeds from pre-sale

agreement signed with AFI, due to the uncertainty as to the

fulfilment of the conditions set out in the preliminary agreement

as mentioned in Note 5(3)(f) of the consolidated financial

statements as of 31.12.2020, thus there can be no certainty an SPA

will eventually be executed and/or that the Transaction will be

completed.

(7) The Company didn't include any proceeds from its holding in

an indirect subsidiary (50%) which holds a property in Bangalore,

India due to the recent default of purchaser of Bangalore project

to meet payments schedule according to the signed amendment

agreement (as detailed in Note 6(1) of the Consolidated Financial

Statements as of December 31, 2020) as there can be no certainty

that the agreement will be completed, hence no resources are

expected to be available in foreseeable future at this time.

Ron Hadassi

Executive Director

31 March 2021

PLAZA CENTERS N.V.

CONSOLIDATED FINANCIAL STATEMENTS

DECEMBER 31, 2020

IN 000 EUR

CONTENTS

Page

Independent Auditors' report 2 - 6

Consolidated statement of financial position 7

Consolidated statement of profit or loss 8

Consolidated statement of comprehensive income 9

Consolidated statement of changes in equity 10

Consolidated statement of cash flows 11

Notes to the consolidated financial statements 12 - 68

- - - - - - - - - - - - - - - - - - - - - -

Kost Forer Gabbay Tel: +972-3-6232525

& Kasierer Fax: +972-3-5622555

144 Menachem Begin ey.com

Road

Tel-Aviv 6492102,

Israel

Report on the Audit of the Consolidated Financial Statements

Independent Auditors' Report

To the shareholders of Plaza Centers N.V.

Opinion

We have audited the consolidated financial statements of Plaza

Centers N.V. and its subsidiaries ("the Company"), which comprise

the consolidated statement of financial position as at December 31,

2020 and the consolidated statements of profit or loss,

comprehensive income, changes in equity and cash flows for the year

then ended, and notes to the consolidated financial statements,

including a summary of significant accounting policies.

In our opinion, the accompanying consolidated financial

statements present fairly, in all material respects, the

consolidated financial position of the Company as at December 31,

2020, and its consolidated financial performance and its

consolidated cash flows for the year then ended in accordance with

International Financial Reporting Standards as adopted by the

European Union.

Basis for Opinion

As mentioned in note 2(a) in the consolidated financial

statements, these consolidated financial statements, with our

report included, are not intended for Netherlands statutory filing

purposes.

We conducted our audit in accordance with International

Standards on Auditing. Our responsibilities under those standards

are further described in the Auditors' Responsibilities for the

Audit of the Consolidated Financial Statements section of our

report. We are independent of the Company in accordance with the

International Code of Ethics for Professional Accountants

(including International Independence Standarts) ("IESBA Code"),

and we have fulfilled our other ethical responsibilities in

accordance with the IESBA Code. We believe that the audit evidence

we have obtained is sufficient and appropriate to provide a basis

for our opinion.

Material Uncertainty Related to Going Concern

We draw your attention to Note 1(b) in the consolidated

financial statements which discloses the Company's financial

position and board and management's future plans to meet its

financial liabilities.

The board and management estimate that the Company is unable to

serve its entire debt according to the current repayment schedule

(total payments of EURO 97.8 million (current balance as of

December 31, 2020) due to bondholders on July 1, 2021) and the

Company is dependent on the bondholders' approval for any

postponement of payments. In addition, the Company is not in

compliance with the main Covenants as defined in the restructuring

plan (for more details refer also to Note 8), hence in default

which could trigger early repayment by the bondholders.

Moreover, due to recent developments related to the COVID-19

virus epidemic there is additional uncertainty as to the effect of

the short-term impacts on economic growth, business activity and

including even severe and sustained slowdown in the markets in

which the Company operates. This could also affect the ability of

the Company to complete the sale of the plots it owns.

The combination of the abovementioned conditions indicates the

existence of a material uncertainty that casts significant doubt

about the Company's ability to continue as a going concern. Our

opinion is not modified in respect of this matter.

Emphasis of Matters

We draw your attention to Note 5(3)(c) which discloses the risk

that the public authorities may seek to terminate the Public

Private Partnership Agreement ("PPP Agreement") and/or relevant

permits and/or could seek to impose delay penalties on the basis of

perceived breaches of the Company's commitments under the PPP

Agreement.

Our opinion is not modified in respect of these matters.

Key Audit Matters

Key audit matters are those matters that, in our professional

judgment, were of most significance in our audit of the

consolidated financial statements for the year ended December 31,

2020. In addition to the matter described in the Material

Uncertainty Related to Going Concern section, we have determined

the matters described below to be the key audit matters to be

communicated in our report. These matters were addressed in the

context of our audit of the consolidated financial statements as a

whole, and in forming our opinion thereon, and we do not provide a

separate opinion on these matters. For each matter below, our

description of how our audit addressed the matter is provided in

that context.

We have fulfilled the responsibilities described in the

Auditor's Responsibilities for the Audit of the Consolidated

Financial Statements section of our report, including in relation

to these matters. Accordingly, our audit included the performance

of procedures designed to respond to our assessment of the risks of

material misstatement of the consolidated financial statements. The

results of our audit procedures, including the procedures performed

to address the matters below, provide the basis for our audit

opinion on the accompanying consolidated financial statements.

The Key Audit Matter we identified is:

Key Audit Matter Our Response

Valuation of trading properties Our procedures in relation to the

We have identified the measurement management's fair value assessment

of trading properties (included of trading properties included:

in the joint venture, EPI, * Evaluation of the objectivity, independence,

as disclosed in Note 6(b)) expertise of the external valuators;

at net realizable value in

the aggregate amount of EUR

33.1 million, as a significant * Reviewed the reports prepared by the external

audit matter due to their valuators and held discussions with them in order to

size and the complexity and gain an understanding of their methodology and the

judgement required in the key assumptions which they used in performing the

valuation of trading properties. valuations.

The valuations of these properties

as of December 3 1 , 2 020

, involved significant judgements * Using our own real estate specialists to assess the

and assumptions such as capitalization methodologies used the assumptions that were made and

and discount rates, and forecasts the appropriateness of the key estimates used in the

of future rents, occupancy calculation of the fair value of the trading

levels, construction costs properties based on their knowledge of the local

and developer profits, made economic, legal, political environment, and other

by management, in reliance specific circumstances, used to analyse the

on external valuators. In appropriateness of valuations.

the context of properties

which are not yet developed,

these estimates contain further * Checked on a sample basis, the appropriateness and

risks in regards to success consistency with other information available to us of

in obtaining permits, market the inputs used by the valuators. We also assessed

condition and political environment, the appropriateness of the disclosures relating to

required to forecast all circumstances the assumptions, as we consider them important to

through and beyond project users of the financial statements.

completion.

The Company's accounting policies

regarding trading properties

are disclosed in Note 2(c)

and 2(m) to the consolidated

financial statements. The

significant estimates involved

in the valuation are disclosed

in Note 6(b).

Other information included in The Company's 2020 Annual

Report

Other information consists of the information included in the

Annual Report, other than the financial statements and our

auditor's report thereon. Management is responsible for the other

information.

Our opinion on the financial statements does not cover the other

information and we do not express any form of assurance conclusion

thereon. In connection with our audit of the financial statements,

our responsibility is to read the other information and, in doing

so, consider whether the other information is materially

inconsistent with the financial statements or our knowledge

obtained in the audit or otherwise appears to be materially

misstated. If, based on the work we have performed, we conclude

that there is a material misstatement of this other information, we

are required to report that fact. We have nothing to report in this

regard.

Responsibilities of Management and the Board of Directors for

the Consolidated Financial Statements

Management is responsible for the preparation and fair

presentation of the consolidated financial statements in accordance

with International Financial Reporting Standards, as adopted by the

European Union, and for such internal control as management

determines is necessary to enable the preparation of consolidated

financial statements that are free from material misstatement,

whether due to fraud or error.

In preparing the consolidated financial statements, management

is responsible for assessing the Company's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless

management either intends to liquidate the Company or to cease

operations, or has no realistic alternative but to do so.

The board of directors is responsible for overseeing the

Company's financial reporting process.

Auditors' Responsibilities for the Audit of the Consolidated

Financial Statements

Our objectives are to obtain reasonable assurance about whether

the consolidated financial statements as a whole are free from

material misstatement, whether due to fraud or error, and to issue

an auditors' report that includes our opinion. Reasonable assurance

is a high level of assurance but is not a guarantee that an audit

conducted in accordance with International Standards on Auditing

will always detect a material misstatement when it exists.

Misstatements can arise from fraud or error and are considered

material if, individually or in the aggregate, they could

reasonably be expected to influence the economic decisions of users

taken on the basis of these consolidated financial statements.

As part of an audit in accordance with International Standards

on Auditing, we exercise professional judgment and maintain

professional scepticism throughout the audit. We also:

-- Identify and assess the risks of material misstatement of the

consolidated financial statements, whether due to fraud or error,

design and perform audit procedures responsive to those risks, and

obtain audit evidence that is sufficient and appropriate to provide

a basis for our opinion. The risk of not detecting a material

misstatement resulting from fraud is higher than for one resulting

from error, as fraud may involve collusion, forgery, intentional

omissions, misrepresentations, or the override of internal

control.

-- Obtain an understanding of internal control relevant to the

audit in order to design audit procedures that are appropriate in

the circumstances, but not for the purpose of expressing an opinion

on the effectiveness of the Company's internal control.

-- Evaluate the appropriateness of accounting policies used and

the reasonableness of accounting estimates and related disclosures

made by management.

-- Conclude on the appropriateness of management's use of the

going concern basis of accounting and, based on the audit evidence

obtained, whether a material uncertainty exists related to events

or conditions that may cast significant doubt on the Company's

ability to continue as a going concern. If we conclude that a

material uncertainty exists, we are required to draw attention in

our auditors' report to the related disclosures in the consolidated

financial statements or, if such disclosures are inadequate, to

modify our opinion. Our conclusions are based on the audit evidence

obtained up to the date of our auditors' report. However, future

events or conditions may cause the Company to cease to continue as

a going concern.

-- Evaluate the overall presentation, structure and content of

the consolidated financial statements, including the disclosures,

and whether the consolidated financial statements represent the

underlying transactions and events in a manner that achieves fair

presentation.

-- Obtain sufficient appropriate audit evidence regarding the

financial information of the entities or business activities within

the group to express an opinion on the consolidated financial

statements. We are responsible for the direction, supervision and

performance of the group audit. We remain solely responsible for

our audit opinion.

We communicate with the board of directors regarding, among

other matters, the planned scope and timing of the audit and

significant audit findings, including any significant deficiencies

in internal control that we identify during our audit.

We also provide the board of directors with a statement that we

have complied with relevant ethical requirements regarding

independence, and communicate with them all relationships and other

matters that may reasonably be thought to bear on our independence,

and where applicable, related safeguards.

From the matters communicated with the board of directors, we

determine those matters that were of most significance in the audit

of the consolidated financial statements for the year ended

December 31, 2020, and are therefore the key audit matters. We

describe these matters in our auditors' report unless law or

regulation precludes public disclosure about the matter or when, in

extremely rare circumstances, we determine that a matter should not

be communicated in our report because the adverse consequences of

doing so would reasonably be expected to outweigh the public

interest benefits of such communication.

The partner in charge of the audit resulting in this independent

report is Mr. Itay Bar-Haim.

March 31, 2021 KOST FORER GABBAY & KASIERER

Tel Aviv, Israel A member of Ernst & Young

Global

CONSOLIDATED STATEMENT OF FINANCIAL POSITION IN '000 EUR

December 31,

--------------------

Note 2020 2019

------- --------- ---------

ASSETS

Cash and cash equivalents 3 1,709 1,126

Prepayments and other receivables 4 90 181

Total current assets 1,799 1,307

--------- ---------

Trading properties 2,5 - 40,375

Equity - accounted investees 6 10,737 14,419

Total non-current assets 10,737 54,794

--------- ---------

Total assets 12,536 56,101

========= =========

LIABILITIES AND SHAREHOLDERS' EQUITY

Bonds at amortized cost 8 87,137 86,506

Accrued interests on bonds 8 10,684 3,846

Trade payables 58 94

Other liabilities 7 409 477

--------- ---------

Total current liabilities 98,288 90,923

--------- ---------

Provisions 5(3)(e) - 15,825

Total non-current liabilities - 15,825

--------- ---------

Share capital 10 6,856 6,856

Translation reserve 10 (31,292) (29,677)

Other reserves (19,983) (19,983)

Share based payment reserve 10 35,376 35,376

Share premium 10 282,596 282,596

Accumulated deficit (359,305) (325,815)

--------- ---------

Total equity (85,752) (50,647)

--------- ---------

Total equity and liabilities 12,536 56,101

========= =========

The notes are an integral part of the consolidated financial

statements.

March 31, 2021

--------------------- ----------------- ---------------------

Ron Hadassi David Dekel

Date of approval of Executive Officer

the Chairman of the Board

financial statements of Directors

CONSOLIDATED STATEMENT OF PROFIT OR LOSS IN '000 EUR

Year ended

December 31,

------------------

Note 2020 2019

---- -------- --------

Revenues and gains

Revenue from disposal of trading properties 5 1,452 3,684

Total revenues 1,452 3,684

-------- --------

Gains and other

Other income 33 78

-------- --------

Total gains 33 78

Total revenues and gains 1,485 3,762

-------- --------

Expenses and losses

Cost of trading properties disposed 5 (580) (3,463)

Cost of operations (85) (207)

Write-down of trading properties 5 (24,000) (500)

Share in results of equity-accounted

investees 6 (1,084) (2,396)

Administrative expenses 13 (1,100) (1,577)

Other expenses (46) (67)

-------- --------

(26,895) (8,210)

Finance income 14 2,096 -

Finance costs 14 (10,176) (16,648)

(34,975) (24,858)

-------- --------

Loss before income tax (33,490) (21,096)

Income tax expense - (71)

Loss for the year (33,490) (21,167)

-------- --------

Loss attributable to:

Equity holders of the Company (33,490) (21,167)

======== ========

Earnings per share

Basic and diluted loss per share (EUR) 11 (4.89) (3.09)

======== ========

The notes are an integral part of the consolidated financial

statements.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME IN '000 EUR

Year ended

December 31,

------------------

2020 2019

-------- --------

Loss for the year (33,490) (21,167)

Other comprehensive income

Items that are or may be reclassified to profit

or loss:

Foreign currency translation differences - foreign

operations (Equity accounted investees) (1,615) (79)

Other comprehensive loss for the year, net of

income tax (1,615) (79)

Total comprehensive loss for the year (35,105) (21,246)

======== ========

The notes are an integral part of the consolidated financial

statements.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY IN '000 EUR

Capital reserve

from acquisition

Share based of

Share Share payment Translation non-controlling Accumulated

capital Premium reserves Reserve interests deficit Total

-------- -------- ----------- ----------- ---------------- ----------- --------

Balance on

January 1, 2019 6,856 282,596 35,376 (29,598) (19,983) (304,648) (29,401)

Comprehensive

income for the

year

Net loss for the

year - - - - - (21,167) (21,167)

Foreign currency

translation

differences - - - (79) - - (79)

Total

comprehensive

loss for the

year - - - (79) - (21,167) (21,246)

-------- -------- ----------- ----------- ---------------- ----------- --------

Balance on

December 31,

2019 6,856 282,596 35,376 (29,677) (19,983) (325,815) (50,647)

Comprehensive

income for the

year

Net loss for the

year - - - - - (33,490) (33,490)

Foreign currency

translation

differences - - - (1,615) - - (1,615)

-------- -------- ----------- ----------- ---------------- ----------- --------

Total

comprehensive

loss for the

year - - - (1,615) - (33,490) (35,105)

-------- -------- ----------- ----------- ---------------- ----------- --------

Balance on

December 31,

2020 6,856 282,596 35,376 (31,292) (19,983) (359,305) (85,752)

-------- -------- ----------- ----------- ---------------- ----------- --------

The notes are an integral part of the consolidated financial

statements.

CONSOLIDATED STATEMENT OF CASH FLOWS IN '000 EUR

Year ended

December 31,

------------------

2020 2019

-------- --------

Cash flows from operating activities

Loss for the year (33,490) (21,167)

Adjustments necessary to reflect cash flows used

in operating activities

Depreciation and impairment of property and equipment - 19

Net finance costs 8,080 16,648

Share of loss of equity-accounted investees, net

of tax 1,084 2,396

Income tax expense - 71

Trading properties, net 24,550 3,962

224 1,929

-------- --------

Changes in:

Trade receivables 6 (6)

Other receivables 85 (5)

Trade payables (36) 41

Other liabilities, related parties' liabilities

and provisions (68) (88)

(13) (58)

-------- --------

Interest paid (699) (2,682)

Net cash used in operating activities (488) (811)

-------- --------

Cash from investing activities

Distribution received from Equity Accounted Investees 983 782

Net cash provided by investing activities 983 782

-------- --------

Cash from financing activities

Repayment of debentures - (250)

Net cash used in financing activities - (250)

-------- --------

Increase (Decrease) in cash and cash equivalents

during the year 495 (279)

Effect of movement in exchange rate fluctuations

on cash held 88 -

Cash and cash equivalents as of January 1(st) 1,126 1,405

-------- --------

Cash and cash equivalents as of December 31(st) 1,709 1,126

======== ========

The notes are an integral part of the consolidated financial

statements.

NOTE 1: - CORPORATE INFORMATION

a. Plaza Centers N.V. ("the Company" and together with its

subsidiaries, "the Group") was incorporated and is registered in

the Netherlands. The Company's registered office is at

Pietersbergweg 283, 1105 BM, Amsterdam, the Netherlands. In past

the Company conducted its activities in the field of establishing,

operating and selling of shopping and entertainment centres, as

well as other mixed-use projects (retail, office, residential) in

Central and Eastern Europe (starting 1996) and India (from 2006).

Following debt restructuring plan approved in 2014 the Group's main

focus is to reduce corporate debt by early repayments following

sale of assets and to continue with efficiency measures and cost

reduction where possible.

The consolidated financial statements for each of the periods

presented comprise the Company and its subsidiaries (together

referred to as the "Group") and the Group's interest in jointly

controlled entities.

The Company is listed on the premium segment of the Official

List of the UK Listing Authority and to trading on the main market

of the London Stock Exchange ("LSE"), the Warsaw Stock Exchange

("WSE") and on the Tel Aviv Stock Exchange ("TASE").

The Company's immediate parent company was Elbit Ultrasound

(Luxemburg) B.V. / s.a.r.l ("EUL"), which held 44.9% of the

Company's shares, till December 19, 2018 when EUL informed that it

has signed a trust agreement according to which EUL will deposit

its shares of the Company with a trustee and no longer considers

itself to be the controlling shareholder of the Company (please

refer to note 18 (a) regarding the sale of app. 17.8% of the

Company's shares held by EUL).

b. Going concern and liquidity position of the Company:

As of December 31, 2020, the Company's outstanding obligations

to bondholders (including accrued interests) are app. EUR 97.8

million with due date that was postponed to July 1, 2021 (the

"Current Due date") (please refer to note 8).

Due to the above the Company's primary need is for liquidity.

The Company's current and future resources include the

following:

1. Cash and cash equivalents (including the cash of fully owned

subsidiaries) of approximately EUR 1.709 million.

2. The Company's part (50%) in the proceeds from the cash

balances of the Chennai Project SPV. And, from any additional

proceeds Elbit Plaza India Real Estate Holdings Limited (an equity

accounted investee held by the Company (50%) ("EPI") will receive

based on revised understanding EPI and the purchaser singed on

March 31, 2021 (As detailed in note 6 (b)(2) of the Consolidated

Financial Statements as of December 31, 2020).

Still, there is an uncertainty if and when the SPA closing will

occur

3. In addition, as detailed in note 5(3)(f), the Company and AFI

Europe N.V. entered into an addendum to the pre-sale agreement

entered into between the Parties in connection with the sale of its

subsidiary (the "SPV") which holds 75%

NOTE 1: - CORPORATE INFORMATION (Cont.)

in the Casa Radio Project (the "Project") (the "Addendum" and

the "Agreement",

respectively) pursuant to which the Parties agreed to extend the

Long Stop Date, which is the date on which the parties will execute

a share purchase agreement, subject to the satisfaction of

conditions precedent (the "SPA" ( , until December 31, 2021. The

addendum was approved by the bondholders meeting held on November

12, 2020. There can be no certainty that the SPA will eventually be

executed and/or that the transaction will be consummated as

presented above or at all.

4. Following the default of purchaser of Bangalore project to

meet payments schedule according to the signed amendment agreement

(refer to Note 6(b)(1)) there can be no certainty that the

agreement will be completed, hence at this time no resources are

expected to be available in the foreseeable future.

As of December 31, 2020, the Company is not in compliance with

the main Covenants as defined in the restructuring plan (for more

details refer also to Note 8), hence constituting an event of

default which could also trigger early repayment demand by the

bondholders.

Due to the abovementioned and due to the board and management

estimation that the Company is unable to serve its entire debt on

the Current due date, the Company intends to request the

bondholders of both series an additional postponement of the

repayment of the remaining balance of the bonds. However, there is

an uncertainty if the bondholders will approve the request. In the

case that the bondholders would declare their remaining claims to

become immediately due and payable, the Company would not be in a

position to settle those claims and would need to enter to an

additional debt restructuring or might cease to be a going concern

basis.

Due to the abovementioned conditions, a material uncertainty

exists that casts significant doubt about the Company's ability to

continue as a going concern.

c. Impact of the Covid-19

During 2020, the Covid-19 global health and economic crisis was

severely affecting

business, leading to supply chain disruptions, cash flow

problems and, more generally, a sharp drop in its activity. Many

countries are taking significant steps in trying to prevent the

spread of the virus, such as restrictions on civilian movements,

gatherings, border closures and the like. The Company monitors the

consequences of the event and the actions taken in countries in

which it operates and assesses the risks and exposures arising from

these consequences. At this stage, the impact of the effect of the

COVID 19 included a

write off of its assets (refer to note 5(3) and note 6(b)(1) and

6(b)(2)). In addition, caused Elbit Plaza India Real Estate

Holdings Limited (an equity accounted investee held by the Company

(50%) and Elbit Imaging Ltd. (50%)) ("EPI") to postpone the closing

of the sale of 100% stake in the SPV (subsidiary of EPI) (refer to

Note 6(b)(2)). In addition, it caused a delay in the legal

procedures against the purchaser of the SPV which owns the plot in

Bangalore India (refer to Note 6(b)(1)). Other than the above

mentioned, at this stage, the Company is not able to estimate the

full future impact of COVID 19. However, the Company assumes the

demand of interested buyers is expected to be smaller, which can

have a material impact on the ability of the Company to complete

the sale of the plots it owns.

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES

a. Basis of preparation of these financial statements:

The following accounting policies have been applied consistently

in the financial statements for all periods presented, unless

otherwise stated.

The consolidated financial statements have been prepared in

accordance with International Financial Reporting Standards

("IFRS"), as adopted by the European Union ("EU").

The consolidated financial statements have been prepared on the

historical cost basis.

These consolidated financial statements are not intended for

statutory filing purposes. The Company is required to file

consolidated financial statements prepared in accordance with the

Netherlands Civil Code.

At the date of approval of these financial statements the

Company had not yet submitted consolidated financial statements for

the year ended December 31, 2019 and December 31, 2020 in

accordance with the Netherlands Civil Code (for more details refer

to Note 16(b)(10)).

The consolidated financial statements were authorized to be

issued by the Board of Directors on March 31, 2021.

b. Functional and presentation currency:

These consolidated financial statements are presented in EURO

("EUR"), which is the Company's functional currency. All financial

information presented in EUR has been rounded to the nearest

thousand, unless otherwise indicated.

c. Investment property vs. trading property classification:

The Group has designated all its properties for sale. The

Company is actively seeking buyers and does not hold the properties

with the intention to gain from capital appreciation. Therefore,

management also believes that these are appropriately classified as

trading properties.

d. Functional and presentation currency

The EUR is the functional currency for Group companies (with the

exception of Indian companies - in which the functional currency is

the Indian Rupee - INR) since it is the currency of the economic

environment in which the Group operates. This is because the EUR

(and in India the INR) is the main currency in which management

determines its pricing with potential buyers and suppliers,

determine its financing activities and budgets and assesses its

currency exposures.

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

e. Operating cycle determination:

The Group is unable to clearly identify its actual operating

cycle with respect to trading properties. As such, the Group's

operating cycle relating to trading properties and corresponding

liabilities is 12 months. Trading properties and liabilities

associated therewith are presented as non-current assets and

non-current liabilities, respectively.

f. Use of estimates and judgments:

The preparation of the consolidated financial statements in

conformity with IFRS as adopted by the EU requires management to

make judgments, estimates and assumptions that affect the

application of accounting policies and the reported amounts of

assets and liabilities, income and expenses.

The estimates and associated assumptions are based on historical

experience and various other factors that are believed to be

reasonable under the circumstances, the results of which form the

basis of making the judgments about carrying values of assets and

liabilities that are not readily apparent from other sources.

Actual results may differ from these estimates.

Information about assumptions and estimation uncertainties that

have a significant risk of resulting in a material adjustment

within the next financial year are included in the following

notes:

- Note 5 - key assumptions used in determining the net

realisable value of trading properties;

- Notes 5,16 - recognition and measurement of provisions and

contingencies: key assumptions about the likelihood and magnitude

of an outflow of resources.

g. Basis of consolidation:

1. Subsidiaries:

Subsidiaries are entities controlled by the Group. The Group

controls an entity when it is exposed to, or has rights to,

variable returns from its involvement with the entity

and has the ability to affect those returns through its power

over the entity. The financial statements of subsidiaries are

included in the consolidated financial statements from the date on

which control commences until the date on which control ceases.

Where necessary, adjustments are made to the financial statements

of the subsidiaries in order to bring the accounting policies used

in line with the ones used by the Group in the consolidated

financial statements.

NOTE 2:- SIGNIFICANT ACCOUNTING POLICIES (Cont.)

2. Interests in equity-accounted investees:

The Group's interests in equity-accounted investees comprise

interests in associates and joint ventures.

Associates are those entities in which the Group has significant

influence, but not control or joint control, over the financial and

operating policies. A joint venture is an arrangement in which the

Group has joint control, whereby the Group has rights to the net

assets of the arrangement, rather than rights to its assets and

obligations for its liabilities.

Interests in associates and the joint venture are accounted for

using the equity method. They are recognised initially at cost,

which includes transaction costs. Subsequent to initial

recognition, the consolidated financial statements include the

Group's share of the profit or loss and other comprehensive income

of equity-accounted investees, until the date on which significant

influence or joint control ceases.

When the equity attributable to the owners of an associate

changes as a result of the associate selling or buying shares of

its subsidiaries (that are consolidated in its financial

statements) to third parties while retaining control in those

subsidiaries, the balance of the investment in the associate that

is presented on the Company's books

on the equity basis changes. The Company has chosen the

accounting policy of recognizing the change in the balance of the

investment in these cases directly in profit or loss.

3. Loss of control:

When the Group loses control over a subsidiary, it derecognises

the assets and liabilities of the subsidiary, and any related NCI

and other components of equity.

Any resulting gain or loss is recognised in profit or loss. Any

interest retained in the former subsidiary is measured at fair

value when control is lost.