TIDMMTVW

RNS Number : 9647H

Mountview Estates PLC

27 June 2013

Embargoed: 07.00a.m. 27 June 2013

MOUNTVIEW ESTATES P.L.C.

Final Results for the year ended 31 March 2013

MOUNTVIEW ESTATES P.L.C.

CHAIRMAN'S STATEMENT

I am pleased to report strongly increased profits for the year

ended 31 March 2013; profit before tax was GBP28.9m (2012:

GBP22.8m) an increase of GBP6.1m.

In my statement last year I reported that Mountview continued to

record good financial performance against the backdrop of a very

challenging economic climate. The economic climate continues to be

far from easy and so an increase in profits in excess of 25% must

be considered a substantial achievement.

Your Board is able to recommend an increased final dividend of

125 pence per share in respect of the year ended 31 March 2013

which is payable on 19 August 2013 to shareholders on the Register

of Members as at 19 July 2013. This will make a total dividend for

the year ended 31 March 2013 of 175 pence per share (2012: 165

pence per share) which is more than three times covered by the

earnings per share.

During the year under review we have continued to make good

purchases and have enjoyed strong growth in sales. Our financial

resources are well managed which keeps us in good position to take

advantage of suitable opportunities when they come along. Recently

recruited personnel are developing well and I am confident that the

future of the Company is in the hands of a good team.

In our second interim management statement we reported the

sudden death of Keith Langrish-Smith. Keith had joined the Company

in 1974 and was married to Elizabeth (one of the twin daughters of

Frank Sinclair, co-founder of the Company). He had planned to

retire at the end of the Company's financial year, but died

unexpectedly on 17 December 2012. Keith's easy going and affable

demeanour is missed by everyone. Indeed he may prove to have been

one of the last members of the family to have served in the

management of the Company.

Keith's loyalty and dedication to the Company is perhaps

uncommon in this day and age and it may be that it could only be

expected from a family member. Nevertheless I have a fine team

around me and I thank them all for their efforts throughout the

year which have produced results of which they can be proud.

We cannot defy all the difficulties of the economic climate but

the Company is well placed to do more than just survive and can

expect to enjoy good progress when conditions are less

difficult.

One final note relates to me personally; after more than 23

years I have decided to step down as Chairman with effect from the

Annual General Meeting. John Fulton, who has been one of our

non-executive directors since 2007, will assume the role of

non-executive Chairman and I shall remain as Chief Executive of the

Company. I believe that the time is right for me to hand over the

role of Chairman and concentrate on the day to day running and

development of the business, which continues to go from strength to

strength in difficult markets. Good Corporate Governance also

dictates the splitting of the two roles and we believe that now is

the right time to take this step.

MOUNTVIEW ESTATES P.L.C.

FINANCIAL HIGHLIGHTS

2013 2012 Increase

GBP GBP %

Turnover (millions) 56.6 42.9 31.9

Gross Profit (millions) 33.7 27.2 23.9

Profit Before Tax (millions) 28.9 22.8 26.8

Profit Before Tax excluding

investment properties

revaluation (millions) 26.3 19.6 34.2

Equity Holders' Funds

(millions) 244 227.2 7.4

Earnings per share (pence) 568 447.7 26.9

Net assets per share 62.6 58.3 7.4

Dividend per share (pence) 175 165 6.1

Mountview Estates P.L.C. advises its shareholders that,

following the issue of the final results, the relevant dates in

respect of the proposed final dividend payment of 125 pence per

share are as follows:

Ex-dividend date 17 July 2013

Record date 19 July 2013

Payment date 19 August 2013

MOUNTVIEW ESTATES P.L.C.

CONSOLIDATED INCOME STATEMENT

FOR THE YEAR ENDED 31 MARCH 2013

Year Year

ended ended

31.03.2013 31.03.2012

GBP000 GBP000

REVENUE 56,646 42,931

Cost of sales (22,906) (15,741)

GROSS PROFIT 33,740 27,190

Administrative Expenses (3,759) (3,773)

Gain on sale of investment properties 84 484

Operating profit before changes in

fair value of investment properties 30,065 23,901

Increase in fair value of investment

properties 2,602 3,208

PROFIT FROM OPERATIONS 32,667 27,109

Change in fair value of derivatives 563 (271)

Net Finance Costs (4,302) (4,033)

PROFIT BEFORE TAXATION 28,928 22,805

Taxation - current (6,511) (6,648)

Taxation - deferred (272) 1,298

Taxation (6,783) (5,350)

PROFIT ATTRIBUTABLE TO EQUITY SHAREHOLDERS 22,145 17,455

Basic and diluted earnings per share

(pence) 568.0p 447.7p

MOUNTVIEW ESTATES P.L.C.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

FOR THE YEAR ENDED 31 MARCH 2013

As at As at

31.03.2013 31.03.2012

GBP000 GBP000

ASSETS

NON-CURRENT ASSETS

Property, plant and equipment 2,337 2,441

Investment properties 27,852 26,537

30,189 28,978

CURRENT ASSETS

Inventories of trading properties 316,626 301,072

Trade and other receivables 1,198 1,371

Cash at Bank 900 987

318,724 303,430

TOTAL ASSETS 348,913 332,408

EQUITY AND LIABILITIES

Share Capital 195 195

Capital redemption reserve 55 55

Capital reserve 25 25

Other reserve 56 56

Cash flow hedge reserve - (1,040)

Retained earnings 243,641 227,928

243,972 227,219

NON-CURRENT LIABILITIES

Long-term borrowings 84,950 90,000

Deferred Tax 6,294 6,023

91,244 96,023

CURRENT LIABILITIES

Bank overdrafts and short-term

loans 8,427 3,364

Trade and other payables 1,631 1,385

Current tax payable 3,639 2,814

Derivative financial instruments - 1,603

13,697 9,166

TOTAL LIABILITIES 104,941 105,189

TOTAL EQUITY AND LIABILITIES 348,913 332,408

MOUNTVIEW ESTATES P.L.C.

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE YEAR ENDED 31 MARCH 2013

Capital Cash Flow

Share Capital Redemption Hedge Other Retained

Capital Reserve Reserve Reserve Reserves Earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Changes in equity

for

year ended 31 March

2012

Balance as at 1

April 2011 195 25 55 (2,340) 56 216,905 214,896

Reduction in hedge

reserve 1,300 1,300

Profit for the year 17,455 17,455

Dividends (6,432) (6,432)

Balance as at 31

March 2012 195 25 55 (1,040) 56 227,928 227,219

Changes in equity

for

year ended 31 March

2013

Balance as at 1

April 2012 195 25 55 (1,040) 56 227,928 227,219

Reduction in hedge

reserve 1,040 1,040

Profit for the year 22,145 22,145

Dividends (6,432) (6,432)

Balance as at 31

March 2013 195 25 55 0 56 243,641 243,972

MOUNTVIEW ESTATES P.L.C.

GROUP CASH FLOW STATEMENT

FOR THE YEAR ENDED 31 MARCH 2013

Year Year

ended ended

31.03.2013 31.03.2012

GBP000 GBP000

Cash flow from operating activities

Operating Profit 32,667 27,109

Adjustment for:

Depreciation 163 165

Loss on disposal of property, plant &

equipment 3 11

Gain on disposal of investment properties (84) (484)

(Increase) in fair value of investment

properties (2,602) (3,208)

Cash flow from operations before changes

in working capital 30,147 23,593

(Increase)/ in inventories (15,554) (41,610)

Decrease/(Increase) in receivables 173 (179)

Increase/(Decrease) in payables 246 (100)

Cash generated from operations 15,012 (18,296)

Interest paid (4,302) (4,033)

Income taxes paid (5,675) (7,107)

Net cash inflow/(outflow) from operating

activities 5,035 (29,436)

Investing activities

Proceeds from disposal of investment

properties 1,939 8,896

Capital expenditure on investment properties (567) (1,426)

Purchase of property, plant and equipment (74) (160)

Proceeds from disposal of property, plant

and equipment - 4

Net cash inflow from investing activities 1,298 7,314

Cash flow from financing activities

Increase in borrowings 687 40,000

Repayment of borrowings (5,050) (200)

Equity dividend paid (6,432) (6,432)

Net cash (outflow)/inflow from financing

activities (10,795) 33,368

Net (decrease)/increase in cash and cash

equivalent (4,462) 11,246

Opening cash and cash equivalent (2,103) (13,349)

Cash and cash equivalent at end of year (6,565) (2,103)

Notes to the Preliminary Announcement

1. Financial Information

The financial information contained in this report

does not constitute statutory accounts for the years

ended 31 March 2013 or 31 March 2012 within the

meaning of section 434 of the Companies Act 2006.

Statutory accounts for the year ended 31 March 2012

which were prepared in accordance with International

Financial Reporting Standards as adopted by the

European Union ("IFRS") and which received an unqualified

audit report and did not contain a statement under

S498(2) or (3) of the Companies Act 2006, have been

filed with the Registrar of Companies.

Financial statements for the year ended 31 March

2013 will be presented to the Members at the Annual

General Meeting on 14 August 2013. The auditors

have indicated that their report on these Financial

Statements will be unqualified.

2. Basis of Preparation

The preliminary announcement has been prepared in

accordance with International Financial Reporting

Standards as adopted by the European Union ("IFRS")

but does not contain sufficient information to comply

fully with IFRS. The Financial Statements to be

presented to Members at the 2013 AGM are expected

to comply fully with IFRS.

The preliminary announcement has been prepared under the

historical cost convention as modified by the revaluation of

investment properties.

ENDS

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR UBVRROBANURR

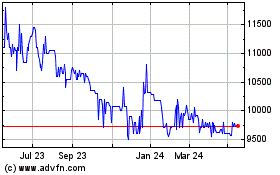

Mountview Estates (LSE:MTVW)

Historical Stock Chart

From Jun 2024 to Jul 2024

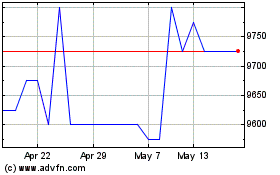

Mountview Estates (LSE:MTVW)

Historical Stock Chart

From Jul 2023 to Jul 2024