RNS No 2930q

MOLINS PLC

12th March 1998

1997 PRELIMINARY ANNOUNCEMENT

Molins PLC, the international specialist engineering company, announces its

results for the year ended 31 December 1997.

1997 1996

Turnover #254.8m #306.2m

______________ ______________

_________ ________

Operating profit (before exceptional items) #13.1m #38.3m

Exceptional items

- Restructuring costs #(17.9)m #(3.9)m

- Langston #(13.4)m -

Interest #(1.9)m #(1.0)m

____________ ____________

(Loss)/profit before taxation #(20.1)m #33.4m

____________ ____________

(Loss)/earnings per share (58.9)p 72.8p

Earnings per share (before exceptional items) 16.3p 81.0p

Dividends per share 15.0p 22.0p

Net assets #83.0m #106.1m

Net borrowings #7.3m #11.7m

Chairman, Michael Orr, commented:

"The Group's results for 1997 were very disappointing, reflecting in

particular a sharp reduction in demand in the Tobacco Machinery division and

the consequent need to restructure its operations. Substantial cost

reductions have already been made in an effort to underpin profitability.

Even so, with sterling remaining strong, we will do well to achieve improved

operating results in the current year. We will continue to take whatever

action is required to establish a sound base from which to move forward in

future years."

Issued by: Margaret George

Enquiries: Michael Orr, Chairman

Peter Grant, Acting Chief Executive and Group Finance Director

Tel: 0171 638 9571

Date: 12 March 1998

Chairman's statement

As foreshadowed, the Group's results for 1997 were very disappointing,

reflecting in particular a sharp reduction in demand in the Tobacco

Machinery division from the record level of sales last year and the

consequent need to restructure its operations.

Results

On sales of #254.8m (1996: #306.2m), down 17%, the Group operating profit

(before exceptional items) was #13.1m (1996: #38.3m). Exceptional

charges totalled #31.3m (1996: #3.9m), comprising #17.9m for

restructuring in the Tobacco Machinery division and #13.4m in respect of

accounting irregularities at Langston. Accordingly, the Group loss

before tax amounted to #20.1m (1996: profit #33.4m) and the loss after

tax to #20.6m (1996: profit #24.9m). Earnings per share (before

exceptional items) were 16.3p (1996: 81.0p) and the loss per share (after

exceptional items) was 58.9p (1996: earnings of 72.8p).

Operations

During the year under review, the Tobacco Machinery division's results

suffered from a sudden and unexpected fall in demand in its main market

for original equipment in China and, to a lesser extent, from reduced

spending by most multinationals pending the outcome of the continuing

discussions in the USA on the proposed tobacco litigation settlement.

Market prospects were further dampened by the weakness of south east

Asian currencies and the continuing strength of sterling. Sales were

down 18% to #150.5m (1996: #183.2m) and operating profits (before

exceptional items) to #9.1m (1996: #28.4m). With no signs of improvement

in prospect, the Board decided not to wait for the adverse factors in the

market to unfold in their entirety but rather to take decisive action to

restructure the division. Accordingly, the Group announced in November a

restructuring programme involving the reduction of 25% of the division's

workforce, which previously totalled some 2,000 people. Most of this

reduction was implemented by the end of the year. In addition, sub-

contract work was brought back in house wherever appropriate.

The market for corrugated board machinery remained weak for most of the

year, although order intake picked up in the fourth quarter as conditions

gradually improved. An investigation into certain accounting

irregularities at Langston gave rise to a #13.4m exceptional charge. In

summary, the investigation, which cost #1.2m, concluded that profits and

net assets had been overstated at Langston over a number of years to the

aggregate sum of US$20.8m (#12.2m) before tax and US$14.8m (#8.7m) after

tax. On sales down 31% at #70.3m (1996: #101.6m), the division achieved

a profit before exceptional items of #0.1m in 1997 against an overstated

#6.6m reported last year.

The Packaging Machinery division achieved sales of #34.0m (1996: #21.4m)

and an operating profit of #3.9m (1996: #3.3m), including a full year's

contribution from Langen, acquired in November 1996. The division's

performance reflects the weak order position of Langen at the start of

the year together with the adverse effects of the strength of sterling on

Sandiacre's profit margins. Langen's order book improved to a more normal

position during the course of the year, albeit too late to achieve more

than a small contribution to profits.

Financial position

Following the exceptional charges, which amounted to #26.3m net of tax,

Group shareholders' funds at 31 December 1997 were #82.8m against #105.9m

reported at 31 December 1996. Net assets per share were 231p (1996:

303p).

The Group's financial position remains strong. Net borrowings at the

year end of #7.3m were #4.4m lower than the previous year. Net interest

charges amounted to #1.9m (1996: #1.0m), reflecting the funding of the

Langen acquisition.

Dividend

Taking account of the 1997 results and the outlook for 1998, a reduced

final dividend of 8.5p per share (1996: 15.5p) is recommended, which,

together with the interim dividend of 6.5p per share, would make a total

for the year of 15.0p per share (1996: 22.0p), giving dividend cover of

1.1 times before exceptional items (1996: 3.6 times). If approved, the

final dividend will be paid on 20 May 1998 to ordinary shareholders

registered on 3 April 1998.

Board and management

Following Peter Harrisson's resignation from the Board in January 1998

after two years as Chief Executive, Peter Grant assumed the

responsibilities of Chief Executive in addition to his existing

responsibilities as Group Finance Director. He continues as Acting Chief

Executive for the time being and a permanent appointment will be made as

soon as alternative outside candidates have been considered. In the

meantime, Clive Chapman, formerly Managing Director, Finance and

Corporate Planning of Nestor Healthcare Group plc, has joined the Group

on an interim basis as Director of Finance. He is taking on many of the

duties of the Group Finance Director so as to allow Peter Grant to give

more time to the Chief Executive's role. Bill Baugh, an executive

director since 1987, also resigned from the Board at the end of December

and we wish him well in the appointment which he has now taken up

elsewhere.

Michael Wright, an executive director from 1985 to 1990 and a non-

executive director since then, has decided not to stand for re-election

at the Annual General Meeting as a result of increased commitments

following his appointment as Vice-Chancellor of Aston University. His

contribution to the Group's affairs throughout his term of office has

been greatly appreciated by all his colleagues. The appointment of a

further non-executive director is under consideration by the Nomination

Committee .

Employees

This has been a difficult year for the Group. As always, employees have

to cope with additional challenges in such circumstances and I should

like to thank them on your behalf for facing up to the demands placed

upon them.

Outlook

The pressures which have been felt by the Tobacco Machinery division

throughout the year are affecting all its competitors similarly, with

insufficient orders for original equipment to utilise the available

productive capacity across the industry. Demand for tobacco machinery has

fallen abruptly from the record levels of two years ago to the lowest

level for many years. There is little reason to suppose that the order

flow for original equipment will strengthen in the immediate future and,

accordingly, a further reduction in the Group's capacity cannot be ruled

out. However, subject to any exceptional costs arising from this, the

continuing flow of revenues from the sale of spares, coupled with the

actions already taken to reduce operating costs, should ensure that the

division as a whole remains profitable.

Growth prospects in the remainder of the Group's business are better.

The Corrugated Board Machinery division has benefited from the improving

market conditions and the Packaging Machinery division is beginning to

win further business internationally, albeit in markets which remain

highly competitive.

With no signs of an early recovery in the tobacco machinery market in

evidence, the Board has had to accept that the Group's capacity to earn

profits is diminished and is likely to remain so for some time to come.

Accordingly, despite the strength of the balance sheet, the Board has

decided to recommend a reduction in the final dividend to 8.5p per share

(1996: 15.5p). The reduced total of 15.0p per share (1996: 22.0p)

compares with earnings per share before exceptional items of 16.3p (1996:

81.0p).

Substantial cost reductions have already been made in an effort to

underpin profitability. Even so, with sterling remaining strong, we will

do well to achieve improved operating results in the current year. We

will continue to take whatever action is required to establish a sound

base from which to move forward in future years.

J C Orr

Chairman

12 March 1998

Group operating review

After commencing the year with a cautious but positive outlook, 1997 was

a year of adversity for much of the Group.

In April, the accounting irregularities discovered at Langston

necessitated an extensive independent investigation. Immediate action

was taken to replace certain senior management in the USA and the Group

was fortunate to be able to get a new team in and operating effectively

very quickly.

In the second half of the year it became increasingly apparent that

demand for tobacco machinery had been adversely affected by three

external factors.

First, demand from the important Chinese market all but stalled as the

authorities sought to exert stronger central control. Their action

affected production levels and reduced cash generation in a number of

factories, compromising their ability to finance investment plans. Some

orders expected in the first half were confirmed towards the end of the

year, but at lower volumes and certain shipments were delayed

temporarily, pending receipt of letters of credit.

Secondly, the continuing discussions in the USA on the proposed tobacco

litigation settlement started to affect spending by most multinationals.

The consequential increase in cigarette prices is expected to dampen

demand in the USA and productive capacity looks set to be reduced

accordingly. Furthermore, multinationals are contemplating moving

production abroad. The effect has been to reduce orders in the USA for

new machines, rebuilds and spare parts, especially in the fourth quarter

of the year.

The third factor affecting the tobacco machinery market has been the

collapse in currencies in many Asian countries, leading to a sharp fall

in capital investment. Although this market has in recent years been

less important for Molins than China and the USA, its weakness has had

the effect of reducing worldwide demand and intensifying pressure on the

industry as a whole.

The reorganisation of the Tobacco Machinery division, announced in

November, led to a reduction in the division's workforce of about 500

people, by the end of the year. The factory in Sao Paulo, Brazil, was

closed, the building sold and Molins do Brasil reopened early in 1998 in

much smaller and more suitable premises 300 miles south in Curitiba.

On a somewhat brighter note, the Packaging Machinery division saw a

substantial improvement in order intake at both Langen operations in the

second half. Sandiacre continued to show top line growth,

notwithstanding the strength of sterling. Further deliveries of tea bag

machinery were made by Molins Food Machinery.

Group investment in new plant and equipment was reduced to #5.0m (1996:

#10.0m) as the Tobacco Machinery division concentrated on retrenchment.

However, a further investment of #0.8m was made in the joint venture in

Kunming, which is scheduled to commence trading as a rebuild and parts

supplier for the Chinese market in 1998. The Group invested #9.3m (1996:

#11.1m) in product development and all divisions introduced important

enhancements to existing products as well as a number of new products.

At the end of the year net borrowings amounted to #7.3m (1996: #11.7m),

representing gearing of 9% (1996: 11%). Cash outflows of #7.9m (1996:

#1.8m) in respect of exceptional items were offset by inflows from

customers' advance payments due to the improving order books at Langston

and Langen. Despite the large exceptional charges the balance sheet

remains strong and gives the Group the strength to take any further steps

necessary to reshape the business for a resumption of growth.

Tobacco Machinery

The division implemented a major restructuring programme in response to a

substantial fall off in demand from China and an anticipated reduction in

demand in Asia and North America.

The division had a difficult trading year, particularly in its new

equipment and rebuild businesses as a result of the reduced demand,

especially in China. Consequently, overall sales were down by 18% to

#150.5m (1996: #183.2m) and operating profit before exceptional costs

down by 68% to #9.1m (1996: #28.4m).

Having entered the year with a backlog that reflected a normal

marketplace, it did not prove possible to maintain that position in the

light of reduced demand. Action was taken to realign operations,

resulting in a reduction of some 25% in the division's workforce.

At Original Equipment, Saunderton, which faced a sudden and unexpected

fall in demand in the second half, the workforce was reduced by about a

third. The new generation mid-speed range Passim filter cigarette making

combination, introduced last year, continued to strengthen its position

as a market leader. It delivered exceptional output performance for its

users, evidenced by substantial new orders received near the end of 1997

from two leading multinational customers. Product development continued

to receive priority and good progress was made with further enhancements

to the Passim range and the Concord, Pegasus and Match handling systems.

The Spares business had a disappointing year. Although there was notable

sales success in the Middle East this was offset by reduced demand from

China and North America towards the end of the year. Productivity was

below expectations, in part due to industrial disruption in support of a

pay claim. Recognising the weak market conditions, the workforce was

reduced by 55 people during the last quarter. Major changes in

manufacturing processes and business planning and control were initiated

in the year, for implementation during 1998.

In the Americas, Molins Richmond further capitalised on its successful

Pegasus high speed handling and distribution system with major export

sales and another increase in profit. Short term prospects in the USA

led to a small reduction in the workforce in November. In December,

Molins do Brasil closed its Sao Paulo plant. It re-opened in February

1998 with a much more streamlined operation in Curitiba, closer to its

major customers.

The Chinese Joint Venture has now commenced construction of its factory,

with completion planned for mid 1998. Production of parts and machine

rebuild activities for the Chinese market will commence during the second

half of the year.

The division's management team, with a blend of experienced and new

employees, has responded wholeheartedly to the challenge of facing up to

the difficult trading conditions, building on the excellent customer

relationships and the substantial installed base of Molins' equipment

throughout the world.

Corrugated Board Machinery

A difficult year against a background of weak but improving market

conditions.

The year started with a low order book as paper prices fell

substantially, leading to the large integrated forest products groups

reporting significantly reduced profitability. Sales were down by 31% to

#70.3m (1996: #101.6m) and operating profit before exceptional costs down

to #0.1m against an overstated #6.6m reported for 1996. As the year

progressed paper prices started to strengthen and progressively this gave

rise to increased quotation activity and improving order intake at

Langston.

All of Langston's manufacturing operations were consolidated at Cherry

Hill, supported by joint ventures in China and Mexico. This followed the

closure of the Hunt Valley, Maryland, factory in December 1996 and the

reorganisation of the Bristol, UK operation, in the first half of 1997,

to concentrate on sales and service activities.

The discovery of and subsequent investigation into accounting

irregularities at Langston, in the USA, caused a significant disruption

to the business. Decisive action was taken to replace certain senior

management and a number of other measures were implemented. As the year

progressed the new management team established a clear strategic

direction, the order book increased and stocks and debtors were reduced.

There was a particularly good cash inflow during the second half.

Molins Australia had a disappointing year, reporting a small loss largely

due to reduced sales following the termination of a distribution

agreement in 1996. Some jobs were cut in the middle of the year.

Working with Langston, however, Molins Australia helped to secure an

order from Amcor for further machinery to manufacture Xitex, a

revolutionary cost-reduced corrugated board.

A number of initiatives were taken by Langston to strengthen the product

range through technology licence agreements with specialist suppliers.

These included a joint development agreement with Interfic to manufacture

and sell a revolutionary double facer and a new glue machine jointly

developed with Kohler. Continued product development resulted in

improvements to the Jumbo flexo folder gluer and further advances with

Langston's leading single facer technology. Other initiatives are in

progress which will strengthen Langston's product and market position

further.

Packaging Machinery

Notwithstanding the strength of sterling, Sandiacre achieved further

sales growth but the division's results were tempered by the weak first

half order position at Langen.

Further progress was made with integrating the Langen businesses into

Molins, including establishing links with Sandiacre and other Molins'

operations. Although the overall operating performance was

disappointing, there are positive signs of potential in all parts of the

division - Langen with improving order books, Sandiacre with turnover

growth and Molins Food Machinery with its growing expertise in tea bag

machinery. Sales were up 59% to #34.0m (1996: #21.4m) and operating

profit increased by 18% to #3.9m (1996: #3.3m).

Langen in Canada and its sister company Langenpac in Holland both entered

the year with relatively low order books and, in consequence, made only a

small contribution to Group profit in the year. However, order intake

improved throughout the year and both companies entered 1998 with much

higher order books.

Throughout 1997, Langen and Langenpac continued to work on a number of

new product developments including machinery for packaging videos,

vertical and high speed case packers and a stand-alone accumulation

system. These innovations broaden the markets for the business and are

expected to result in repeat orders during 1998.

The strength of sterling has adversely impacted margins at Sandiacre,

which exports much of its vertical form fill and seal bagging machinery.

However, Sandiacre is a strong business which can withstand these effects

and is continuing to grow its volumes around the world. Sales to the USA

almost doubled during the year and repeat orders from major US food

manufacturers are starting to come through. Sandiacre's strategy of

developing relationships with multi-national producers of fast moving

consumer goods is showing results with significant orders in China, Egypt

and Russia. Much of this success can be attributed to the company's

continuing emphasis on incremental product development, with the new twin

tube D-action machine proving particularly successful.

Molins Food Machinery supplied further machines and continued to

concentrate on supporting Van den Bergh in its high-profile and

successful launch of the PG Tips Pyramid tea bag in the UK.

Research and Development

Research and development remains of considerable importance to the Group,

with expenditure of #9.3m (1996: #11.1m).

Product development takes place at each of the major sites where

significant engineering capability exists. Molins International

Technology Centre (ITC) provides the Group with a unique resource with

focused technology and specific product developments taking place on

behalf of Molins' existing businesses as well as external customers. The

ITC also facilitates awareness of technology and product development

throughout the Group.

Although the technology needs of existing businesses are diverse, the

Group's focus on materials processing and packaging has led to common

technologies being leveraged across the Group. Examples of such

technologies include independent drives, continuous motion machines and

materials sealing.

The association of the ITC with a number of international food companies

has continued. Projects have been carried out on behalf of customers

around the world, providing them with the opportunity to manufacture or

package new products or achieve efficiency gains in existing operations.

The ITC continues with its extensive involvement in developing innovative

tea bag machinery and there are a number of other technologies in the

pipeline. The tea bag machines provided to Van den Bergh have enabled it

to market the PG Tips Pyramid tea bag across the UK and increase its

share of the tea bag market. Similarly, in France, the tea bag machines

supplied to Fralib have enabled it to launch its Tchae product, a round

tea bag with string and tag, developing the market in green tea. Both

products won a Unilever award for product innovation, the Pyramid product

taking first prize overall and the Fralib product taking first place in

its category. This type of third party development work provides the

opportunity for organic growth as well as practical applications for the

development of the Group's engineering skills.

Molins investment in research and development will continue, with the

focus reflecting the changing needs of customers and world markets.

Group profit and loss account

1997 1996

Before 1997 Before 1996

exceptio Exceptio 1997 exceptio Exceptio 1996

nal nal nal nal

items items Total items items Total

For the year ended #m #m #m #m #m #m

31 December

Turnover 254.8 - 254.8 306.2 - 306.2

Cost of sales (195.5) (23.9) (219.4) (217.9) (2.8) (220.7)

_____ _____ _____ _____ _____ _____

Gross profit 59.3 (23.9) 35.4 88.3 (2.8) 85.5

Net operating (46.2) (7.4) (53.6) (50.0) (1.1) (51.1)

expenses

_____ _____ _____ _____ _____ _____

Operating 13.1 (31.3) (18.2) 38.3 (3.9) 34.4

(loss)/profit

Net interest (1.9) - (1.9) (1.0) - (1.0)

payable

_____ _____ _____ _____ _____ _____

(Loss)/profit on

ordinary

activities before 11.2 (31.3) (20.1) 37.3 (3.9) 33.4

taxation

Taxation (5.5) 5.0 (0.5) (9.6) 1.1 (8.5)

_____ _____ _____ _____ _____ _____

(Loss)/profit for

the

financial year 5.7 (26.3) (20.6) 27.7 (2.8) 24.9

Dividends

(including (5.4) - (5.4) (7.6) - (7.6)

non-equity)

_____ _____ _____ _____ _____ _____

Retained

(loss)/profit

for the year 0.3 (26.3) (26.0) 20.1 (2.8) 17.3

_____ _____ _____ _____ _____ _____

(Loss)/earnings

per 16.3p (75.2)p (58.9)p 81.0p (8.2)p 72.8p

ordinary share

Interim dividend

paid 6.5p 6.5p

October 1997

Proposed final 8.5p 15.5p

dividend

_____ _____

Total 15.0p 22.0p

_____ _____

Dividend cover

(before 1.1 3.6

exceptional items) times times

The weighted average number of ordinary shares in issue during 1997 was

34,968,954 (1996: 34,183,637)

Group balance sheet

1997 1996

As at 31 December #m #m

Fixed assets

Tangible assets 49.8 54.7

Investments 2.0 1.2

_____ _____

51.8 55.9

_____ _____

Current assets

Stocks 60.9 78.1

Debtors - due within one year 61.6 66.0

Debtors - due after more than one year 14.5 13.9

Cash at bank and in hand 9.2 9.8

_____ _____

146.2 167.8

Creditors - amounts falling due within one

year

Borrowings (1.5) (16.3)

Other creditors (81.6) (84.1)

Proposed dividend (3.0) (5.4)

_____ _____

(86.1) (105.8)

Net current assets 60.1 62.0

Total assets less current liabilities 111.9 117.9

Creditors - amounts falling due after

more than one year

Borrowings (15.0) (5.2)

Other creditors (0.7) (0.9)

_____ _____

(15.7) (6.1)

Provisions for liabilities and charges (13.2) (5.7)

_____ _____

Net assets 83.0 106.1

_____ _____

Capital and reserves

Called up share capital 9.8 9.5

Share premium account 25.5 21.0

Revaluation reserve 18.3 17.8

Profit and loss account 29.2 57.6

_____ _____

Shareholders' funds (including 82.8 105.9

non-equity interests)

Minority interests 0.2 0.2

____ _____

83.0 106.1

____ _____

Net borrowings (7.3) (11.7)

Gearing 9% 11%

Net assets - per ordinary share 231p 303p

Group cash flow statement

1997 1996

For the year ended 31 December #m #m

Cash inflow from operating activities (note 22.7 27.6

6)

Return on investments and servicing of (1.8) (1.1)

finance

Taxation (6.0) (8.2)

Capital expenditure (net) (3.8) (9.6)

Acquisitions and disposals (1.0) (20.5)

Equity dividends paid (7.7) (7.1)

____ _____

Cash inflow/(outflow) before management of

liquid

resources and financing 2.4 (18.9)

Management of liquid resources - 6.5

Financing (2.1) (0.1)

____ _____

Increase/(decrease) in cash in the period 0.3 (12.5)

____ ____

Reconciliation of net cash flow to movement in net debt

1997 1996

For the year ended 31 December #m #m

Increase/(decrease) in cash in the period 0.3 (12.5)

Cash inflow from movement in liquid resources - (6.5)

Cash outflow from decrease in debt and lease 4.8 1.5

financing

_____ _____

Change in net debt/cash resulting from cash 5.1 (17.5)

flows

Loans acquired with subsidiaries - (1.6)

Translation difference (0.7) 0.6

_____ _____

Movement in net debt/cash in the period 4.4 (18.5)

Net (debt)/cash at 1 January (11.7) 6.8

_____ _____

Net debt at 31 December (7.3) (11.7)

_____ _____

Notes to the preliminary announcement

1 The Group accounts have been prepared in accordance with applicable

accounting and financial reporting standards.

2 The financial information set out above does not constitute the Group's

statutory accounts for the years ended 31 December 1997 and 1996,

but is extracted therefrom. The Group's statutory accounts for 1997

will be filed following the Annual General Meeting. The Group's

statutory accounts for 1997 and 1996 each received an unqualified

auditors' report.

3 Segmental analysis

The results are analysed by business segment as follows:

1997 1996

1997 1996 Operating Operating 1997 1996

Turnover Turnover profit profit Net Net

assets assets

For the year ended #m #m #m #m #m #m

31 December

Tobacco 150.5 183.2 9.1 28.4 55.2 70.3

Corrugated Board 70.3 101.6 0.1 6.6 26.5 39.8

Packaging 34.0 21.4 3.9 3.3 8.6 7.7

_____ _____ _____ _____ _____ _____

254.8 306.2 13.1 38.3 90.3 117.8

_____ _____

Exceptional items (31.3) (3.9)

_____ _____

Operating (18.2) 34.4

(loss)/profit

Net interest (1.9) (1.0)

payable

_____ _____

(Loss)/profit (20.1) 33.4

before taxation

_____ _____

Net borrowings (7.3) (11.7)

_____ _____

Net assets 83.0 106.1

_____ _____

4 Turnover by geographic destination of goods

1997 1997 1996 1996

For the year ended 31 December #m % #m %

United Kingdom 24.0 9 23.8 8

Continental Europe 20.4 8 22.6 7

North America 96.4 38 115.4 38

Asia 74.8 29 108.1 35

Rest of world 39.2 16 36.3 12

_____ _____ _____ _____

254.8 100 306.2 100

_____ _____ _____ _____

5 Exceptional items

1997 1996

Exceptional 1997 1997 Exceptioal 1996 1996

items Taxation Net items Taxation Net

For the year ended #m #m #m #m #m #m

31 December

Restructuring of

Tobacco

Machinery division

- UK (11.4) 1.3 (10.1) (1.0) 0.2 (0.8)

- Overseas (6.5) - (6.5) - - -

_____ _____ _____ _____ _____ _____

(17.9) 1.3 (16.6) (1.0) 0.2 (0.8)

Rationalisation of

Corrugated

Board Machinery - - - (2.9) 0.9 (2.0)

division

Adjustments in

respect of

Langston

accounting

irregularities (13.4) 3.7 (9.7) - - -

_____ _____ _____ _____ _____ _____

(31.3) 5.0 (26.3) (3.9) 1.1 (2.8)

_____ _____ _____ _____ _____ _____

6 Reconciliation of operating profit to operating cash flows

1997 1996

For the year ended 31 December #m #m

Operating (loss)/profit (18.2) 34.4

Depreciation 6.9 6.6

Movements in restructuring and

rationalisation provisions:

- asset writedowns 3.9 0.4

- increase in provisions for liabilities and 6.4 0.8

charges

Non cash adjustments in respect of accounting

irregularities at Langston 12.2 -

Working capital movements:

- stocks 6.8 (1.2)

- debtors 8.5 2.1

- creditors and other provisions (3.8) (15.2)

- other - (0.3)

_____ _____

Net cash inflow from operating activities 22.7 27.6

_____ _____

Cash flows from exceptional items excluding (7.9) (1.8)

tax effect

Other cash flows 30.6 29.4

_____ _____

Net cash inflow from operating activities 22.7 27.6

_____ _____

END

FR SFAFUFUAUFLD

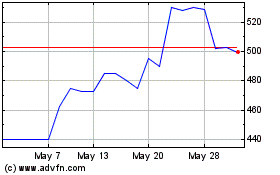

Mpac (LSE:MPAC)

Historical Stock Chart

From Jun 2024 to Jul 2024

Mpac (LSE:MPAC)

Historical Stock Chart

From Jul 2023 to Jul 2024