Molins PLC Final Results -6-

February 26 2014 - 2:01AM

UK Regulatory

Geographical information

Revenue

(by location of customer)

----------------------------------------

2013 2013 2012 2012

GBPm % GBPm %

UK 9.8 9 6.9 7

USA 27.9 27 24.1 26

Europe (excl. UK) 23.5 22 21.1 23

Americas (excl. USA) 9.5 9 9.4 10

Africa 7.3 7 6.4 7

Asia 27.2 26 25.1 27

------ ----- ------ -----

105.2 100 93.0 100

====== ===== ====== =====

3. Charges classified as non-underlying items were incurred in

respect of reorganisation of GBP0.1m (2012: GBP1.0m),

administration costs of the Group's defined benefit pension schemes

of GBP0.8m (2012: GBP0.8m), which were paid for out of the assets

of those schemes, and the financial expense on pension scheme

balances of GBP0.7m (2012: GBP0.1m). In addition, in the year to 31

December 2012 a credit of GBP1.5m was recorded relating to the

cessation of future benefit accruals from December 2012 in the

Group's UK defined benefit pension scheme. Cash payments of GBP0.7m

were made in 2013 (2012: GBP0.5m) in respect of reorganisation in

earlier periods, of which GBP0.2m (2012: GBP0.3m) was paid to the

UK defined benefit pension scheme.

4. The Group accounts for pensions under IAS 19 Employee

benefits. The 2013 accounting valuation of the UK defined benefit

pension scheme was carried out as at 31 December 2013 based on the

funding valuation carried out as at 30 June 2012, updated to

reflect conditions existing at the 2013 year end and to reflect the

specific requirements of IAS 19. The smaller USA defined benefit

pension schemes were valued as at 31 December 2013 using actuarial

data as of 1 January 2013, updated for conditions existing as at

the year end. Profit before tax includes charges in respect of the

defined benefit pension schemes' administration costs of GBP0.8m

(2012: GBP0.8m) and financing expense on pension scheme balances of

GBP0.7m (2012: GBP0.1m). Also included within profit before tax in

the 12 months to 31 December 2012 were credits totalling GBP1.5m in

respect of actions taken within the Group's defined benefit pension

scheme in the UK. Payments to the Group's UK defined benefit

pension scheme in the period included GBP1.5m in respect of the

agreed deficit recovery plan.

5. Basic earnings per ordinary share is based upon the profit

for the period of GBP3.5m (2012: GBP3.8m) and on a weighted average

of 19,399,424 shares in issue during the year (2012: 19,067,302).

The weighted average number of shares excludes shares held by the

employee trust in respect of the Company's long-term incentive

arrangements.

Underlying earnings per ordinary share amounted to 23.9p for the

year (2012: 21.8p) and is based on underlying profit for the period

of GBP4.6m (2012: GBP4.1m), which is calculated on profit before

non-underlying items.

6. Employee benefits include the net pension liability of the UK

defined benefit pension scheme of GBP2.5m (2012: GBP13.9m) and the

net pension liability of the USA defined benefit pension schemes of

GBP3.1m (2012: GBP5.3m), all figures before tax.

7. Reconciliation of net cash flow to movement in net funds

2013 2012

GBPm GBPm

Net increase in cash and cash equivalents 2.3 1.3

Cash inflow from movement in borrowings (4.2) (0.7)

------- -------

Change in net funds resulting from (1.9) 0.6

cash flows

(0.3) (0.3)

Translation movements

------- -------

Movement in net funds in the period (2.2) 0.3

Opening net funds 7.4 7.1

------- -------

Closing net funds 5.2 7.4

======= =======

8. Analysis of net funds

2013 2012

GBPm GBPm

Cash and cash equivalents - current 15.0 13.3

assets

Interest-bearing loans and borrowings (9.8) (5.9)

- non-current liabilities

------- -------

Closing net funds 5.2 7.4

======= =======

9. The Annual Report and Accounts will be sent to all

shareholders in March 2014 and copies will be available on the

Group's website at www.molins.com, or from the Company's registered

office at Rockingham Drive, Linford Wood East, Milton Keynes MK14

6LY.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SEMFAIFLSEEE

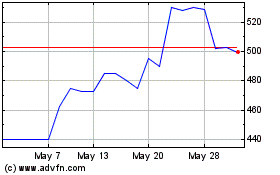

Mpac (LSE:MPAC)

Historical Stock Chart

From Jul 2024 to Aug 2024

Mpac (LSE:MPAC)

Historical Stock Chart

From Aug 2023 to Aug 2024