TIDMJZCP TIDMJZCN

JZ CAPITAL PARTNERS LIMITED (the "Company" or "JZCP")

(a closed-end collective investment scheme incorporated with limited liability

under the laws of Guernsey with registered number 48761)

LEI: 549300TZCK08Q16HHU44

SENIOR FACILITY AMMENTS

and

ENTRY INTO LOAN NOTE PURCHASE AGREEMENT

and

DISPOSAL OF ALL COMMITMENTS TO ORANGEWOOD

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES OF THE MARKET

ABUSE REGULATION (EU) NO. 596/2014 WHICH FORMS PART OF UK LAW BY VIRTUE OF THE

EUROPEAN UNION (WITHDRAWAL) ACT 2018 ("MAR").

17 May 2021

JZ Capital Partners Limited, the London listed fund that invests in US and

European microcap companies and US real estate, is pleased to announce that it

has entered into an amendment agreement with its senior lenders (the "Amended

Senior Facility Agreement") to agree to amend the terms of its senior facility

agreement (the "Senior Facility") which will, among other things, extend the

maturity date of the Senior Facility by one year until 12 June 2022 and permit

JZCP to repay its Convertible Unsecured Loan Stock due 2021 (the "CULS") when

they become due on their maturity date of 30 July 2021, notwithstanding that

the CULS are subordinated to the Senior Facility.

JZCP is also pleased to announced that it has entered into a note purchase

agreement (the "Note Purchase Agreement") with David W. Zalaznick and John

(Jay) Jordan II (together, being the "JZAI Founders", who are the founders and

principals of the Company's investment adviser, Jordan/Zalaznick Advisers, Inc.

("JZAI")) pursuant to which JZCP has agreed to issue loan notes in the amount

of US$31.5 million, with an interest rate of 6 per cent. per annum (being the

same interest payable on the CULS) and maturing on 11 September 2022 (the "Loan

Notes") to the JZAI Founders (or their respective affiliates) (the "Loan Note

Proposal").

Furthermore, JZCP announces that it has agreed with the JZAI Founders for them

(or their respective affiliates) to assume all of the Company's remaining

commitments to Orangewood Partners II-A, L.P. (the "Orangewood Fund") in the

amount of US$12.35 million (the "Orangewood Proposal" and, together with the

Loan Note Proposal, the "Proposals").

Shareholders are advised that the cash proceeds derived from the Loan Note

Proposal are intended to be used by JZCP, together with available cash at hand

(including the cash proceeds of realisations derived from the Orangewood

Proposal and the recently completed sale of JZCP's interest in George

Industries LLC ("George Industries")) to redeem the CULS which have an

aggregate amount outstanding of £38.9 million on their maturity date.

The Board believes that these updates significantly increase the Company's

ability to execute its new investment policy and, although the Amended Senior

Facility Agreement comes at an increased interest cost, it is one that the

Board believes to be compensated by the additional time afforded to maximise

the value of the Company's portfolio. Shareholders should however be aware that

both the Amended Senior Facility Agreement and the Loan Notes will mature prior

to the 1 October 2022 redemption date of the Company's zero dividend redeemable

preference shares of no par value in the capital of the Company (the "ZDP

Shares") and accordingly, unless the ZDP Shares are refinanced, extended, or,

as realisations permit, paid off, continued uncertainty will exist with regards

to their redemption.

Further details of the Amended Senior Facility Agreement, the Loan Note

Proposal and the Orangewood Proposal are set out in the sections of this

announcement below.

The Proposals (being the Loan Note Proposal and the Orangewood Proposal) are

each considered a 'Class 1 Transaction' and a 'Related Party Transaction' under

Chapters 10 and 11 respectively of the listing rules made by the Financial

Conduct Authority pursuant to section 73A of the Financial Services and Markets

Act 2000, as amended (the "Listing Rules") (with which the Company voluntarily

complies and insofar as the Listing Rules are applicable to the Company by

virtue of its voluntary compliance with the same) and therefore shareholder

approval is required for the Proposals, with the above mentioned agreements

with the JZAI Founders each being conditional upon such approval being

obtained. The entry by the Company into the Amended Senior Facility Agreement

does not constitute a Class 1 Transaction or a Related Party Transaction and,

as such, is not subject to shareholder approval.

Shareholder approval for the Proposals will accordingly be sought at an

extraordinary general meeting of the Company (the "Extraordinary General

Meeting"), which the Company intends to convene in due course by giving notice

of the Extraordinary General Meeting. A shareholder circular containing further

details of the Proposals (the "Circular") and the notice convening the

Extraordinary General Meeting, including the resolutions to be proposed at the

Extraordinary General Meeting, will be sent to shareholders in due course. A

further announcement will be made by the Company which will provide details of

the date, time and location of the Extraordinary General Meeting. This

announcement should be read in conjunction with that further announcement

together with the Circular.

The Amended Senior Facility Agreement

On 23 February 2021, the Company announced that Guggenheim Partners Europe

Limited sold its interest in the Senior Facility to clients and funds advised

and sub-advised by Cohanzick Management, LLC and CrossingBridge Advisors, LLC

(together, the "Senior Lenders"). The Company's debt obligations to the Senior

Lenders under the Senior Facility is an amount of approximately US$68.7 million

and is comprised of first out loans (being senior priority loans entitled to

repayment in full prior to any principal payments being made on the Last Out

Loans and which, as such, bear interest at a lower interest rate than the Last

Out Loans) of approximately US$28.7 million (the "First Out Loans") and last

out loans (being second priority loans entitled to repayment of principal only

after the First Out Loans are paid in full and which, as such, bear interest at

a higher interest rate than the First Out Loans) of approximately US$40.0

million (the "Last Out Loans").

As mentioned above, the Company has entered into an Amended Senior Facility

Agreement to agree to amend the terms of the Senior Facility which will, among

other things, extend the maturity date of the Senior Facility until 12 June

2022 and permit the Company to repay the CULS when they become due on their

maturity date of 30 July 2021. In order to allow time to obtain the requisite

shareholder approval relating to the Loan Note Proposal (as described below),

the maturity date of the Senior Facility was also extended on an interim basis

to 25 June 2021 until the extended maturity date of 12 June 2022 becomes

effective. As also alluded to above, the Amended Senior Facility Agreement will

similarly permit the Company to enter into the Note Purchase Agreement with the

JZAI Founders and to incur the relevant indebtedness thereunder, as well as,

permitting the Company to use the cash proceeds derived from the Loan Note

Proposal, together with available cash at hand (including the cash proceeds of

realisations derived from the Orangewood Proposal and the sale of the Company's

interest in George Industries) to redeem the CULS on their maturity date.

Failure to obtain the requisite shareholder approval in connection with the

Loan Note Proposal (as described below) will constitute an 'Event of Default',

which is a requirement of the amendments to the Senior Facility, because such

failure will mean (i) that the Company will not be able to redeem the CULS on

their maturity, and (ii) the amendments contemplated by the Amended Senior

Facility to allow for the longer-term extension of the maturity to 12 June 2022

will not become effective. In addition, even if the shareholder approval is

obtained and the Amended Senior Facility becomes effective, if the CULS are not

redeemed in full on their maturity date for any reason, then an 'Event of

Default' will arise under the Amended Senior Facility Agreement.

These amendments to the Senior Facility do, as mentioned above, come at an

increased interest cost to the Company effective as of the execution of the

Amended Senior Facility Agreement on 14 May 2021. Accordingly, the interest

rate charges under the Amended Senior Facility Agreement for the First Out

Loans will be increased from a rate of Libor + 5.75 per cent. (with a 1 per

cent. floor) to a rate of Libor + 9.75 per cent. (with a 1 per cent. floor).

Similarly, the interest rate charges for the Last Out Loans will be increased

from a rate of Libor + 11 per cent. (with a 1 per cent. floor) to a rate of

Libor + 15 per cent. (with a 1 per cent. floor), of which 4 per cent. shall be

charged as payment-in-kind interest (i.e. added to the principal balance of the

Last Out Loans instead of being paid in cash on a current basis).

The terms of the Amended Senior Facility Agreement further provide for certain

changes to the required use of future net cash proceeds derived from

realisations undertaken by the Company beyond those relaxed requirements

provided, as explained above, for the Orangewood Fund and George Industries

towards the redemption of the CULS. Whilst there will be no change to the

application of net cash proceeds for the First Out Loans (which will remain at

and still require the Company to apply 90 per cent. of such proceeds towards

their repayment), the requirement for the Last Out Loans will be increased such

that the Company will be required to apply 65 per cent. (increased from 50 per

cent.) of such proceeds towards their repayment. In addition, the cash proceeds

of realisations derived from the anticipated sale of the Company's interest in

New Vitality Holdings, LLC will also be permitted to refill the retained

proceeds investment basket under the Senior Facility.

In addition, the terms of the Amended Senior Facility Agreement also further

provide for the reallocation of availability among the permitted investment

buckets under the Senior Facility as requested by the Company, including to

reduce the cap on permitted investments to real estate assets to US$5 million

(reduced from US$10 million, as the original basket size is no longer

anticipated as being necessary), to increase the cap on permitted investments

to the Company's US microcap portfolio to US$13.5 million (increased from US$6

million) and to remove permitted investments to the Orangewood Fund, in light

of the Company's proposal to dispose of its remaining commitments to the fund

(as described further below). The reallocation as regards permitted investment

buckets has been made to better reflect the Company's anticipated requirements

but with any such permitted investments to be made in a manner that is

consistent with its new investment policy (i.e. the Company agreeing to make no

further investments outside of its existing obligations and/or to the extent

which an investment may be made to support an existing portfolio company).

The implementation of the Amended Senior Facility Agreement is subject to the

satisfaction of various conditions precedent, including, among others, the Note

Purchase Agreement becoming effective, compliance with, and there being no

default under, the Senior Facility and the Amended Senior Facility Agreement,

compliance with the representations and warranties under the Senior Facility

and the Amended Senior Facility Agreement, and the delivery of a number of

closing deliverables, including a compliance certificate (which shall confirm

that, among other things, the asset cover ratio is greater than 3.25:1.00 and

that there have been no events that call into question in any material respect

the ability of the Company to perform its obligations under the Senior Facility

and the Amended Senior Facility Agreement). The Amended Senior Facility

Agreement shall only become effective following the satisfaction of such

conditions precedent.

Notwithstanding the foregoing as to the conditionality of the Amended Senior

Facility Agreement, there are certain amendments contained within the agreement

which have become effective upon its execution, and regardless of whether or

not the above conditions precedent are satisfied and the rest of the agreement

ultimately becomes effective in due course. The increased rates of interest,

the interim extension of the maturity date to 25 June 2021 and the 'Event of

Default' upon failure to obtain the requisite shareholder approval in

connection with the Loan Note Proposal, each as described above, are effective

from the date of execution of the Amended Senior Facility Agreement.

The Loan Note Proposal

As mentioned above, the Company has entered into a Note Purchase Agreement with

the JZAI Founders pursuant to which it has agreed to issue Loan Notes in the

amount of US$31.5 million, with an interest rate of 6 per cent. per annum and

maturing on 11 September 2022 to the JZAI Founders (or their respective

affiliates).

Specifically, pursuant to the Note Purchase Agreement, John (Jay) Jordan II (or

his affiliates) on the one hand has agreed to purchase US$16.75 million of the

Loan Notes, equating to approximately 53.17 per cent. of the full amount of the

Loan Notes being issued by the Company. On the other hand, David W. Zalaznick

(or his affiliates) has agreed to purchase the remaining US$14.75 million of

the Loan Notes, equating to approximately 46.83 per cent. of the full amount of

the Loan Notes. The Note Purchase Agreement also provides that the Loan Notes

will be jointly and severally guaranteed by certain of the Company's

subsidiaries, namely JZCP Realty Ltd and JZCP Special LP Ltd (the "Guarantors"

and, together with the Company, the "Obligors").

As referred to above, the aggregate principal amount of the Loan Notes is

US$31.5 million. The cash proceeds derived from the issuance of the Loan Notes

are, as also referred to above, intended to be used by the Company, together

with available cash at hand (including the cash proceeds of realisations

derived from the Orangewood Proposal and the sale of the Company's interest in

George Industries) to redeem the CULS on their maturity date.

The terms of the Note Purchase Agreement provide that the interest rate on the

Loan Notes will be 6 per cent. per annum payable semi-annually on each of 31

March and 30 September of each year, commencing on the first such date to occur

after the issuance of the Loan Notes. This interest rate has been set at the

same rate as that which is payable on the CULS.

As noted above, the maturity date of the Loan Notes shall be 11 September 2022.

The Company does however have the ability, subject to the prior repayment of

the Senior Facility in full, to make optional redemptions of the outstanding

Loan Notes, in whole or in part (in integral multiples of US$100,000), at its

election at any time on a pro rata basis amongst the JZAI Founders, provided it

complies with the relevant notice requirements prescribed by the Note Purchase

Agreement.

The Note Purchase Agreement also includes representations, warranties and

undertakings given by the Company and the JZAI Founders which are considered to

be customary for agreements of this nature and which largely reflect the terms

of the Senior Facility. Further detail of the terms of the Note Purchase

Agreement will be set out in the Circular.

The obligations of the Obligors pursuant to the Note Purchase Agreement,

including the payment of principal of and interest on the Loan Notes

thereunder, will also be secured obligations, provided that such obligations

will be fully subordinated to all loans outstanding and the other obligations

of the Company to the Senior Lenders under the Amended Senior Facility

Agreement. The security will take the form of a lien granted over all of the

assets of the Obligors, as set out in various security documents to be entered

into by, among others, the Obligors. Interests owned by JZCP Realty Ltd. which

relate to real estate investments will not form part of the security. The JZAI

Founders, together with, among others, the Senior Lenders, will also enter into

a subordination and intercreditor agreement which, among other things, governs

the ranking of the security under the Note Purchase Agreement and the Amended

Senior Facility Agreement and provides that indebtedness and liens under the

Note Purchase Agreement will be fully subordinated to the indebtedness and

liens under the Senior Facility, including restrictions on the ability of

secured parties under the Note Purchase Agreement to exercise remedies whilst

the Senior Facility is outstanding. Further detail of the terms of the

subordination and intercreditor agreement and security documents will be set

out in the Circular.

Finally, the issuance of the Loan Notes is subject to a number of conditions,

including the approval of the Company's ordinary shareholders of both the Loan

Note Proposal and the Orangewood Proposal, with the latter also being a

requirement of the amendments to the Senior Facility. The Loan Notes Proposal

is also subject to the delivery of a number of closing deliverables, including

executed transaction documents which are in an agreed form (including the

aforementioned security documents and subordination and intercreditor

agreement), as well as certain bring-down certificates, one of which contains a

no material adverse change condition relating to the Company for the period

since its most recent financial year end, 28 February 2021.

The Note Purchase Agreement provides that the Loan Note Proposal will become

effective on or before 25 June 2021 (being the interim maturity date of the

Senior Facility as extended under the Amended Senior Facility Agreement),

provided the relevant conditions precedent to effectiveness have been satisfied

on or prior to that date.

It is expected that the Loan Notes will be issued on 30 July 2021 (prior to the

anticipated redemption of the CULS on their maturity date) assuming the

resolutions to be proposed at the Extraordinary General Meeting relating to

both the Loan Note Proposal and the Orangewood Proposal are passed by the

Company's ordinary shareholders and the other conditions to the Loan Note

Proposal are satisfied or waived.

The Orangewood Proposal

Lastly and as also mentioned above, the Company has agreed with the JZAI

Founders for them (or their respective affiliates) to assume all of the

Company's remaining commitments to the Orangewood Fund in the amount of

US$12.35 million. The Orangewood Fund is a portfolio investment of the Company.

Orangewood Partners II Manager, L.P. ("Orangewood"), the manager of the

Orangewood Fund, is a New York-based investment firm that seeks to work in

partnership with founders, owners and management teams to help provide

businesses with additional capital, resources, operational capabilities and

expertise to generate long-term performance. The key individuals important to

the business of the Orangewood Fund are the principals of Orangewood.

The Orangewood Proposal represents a continuation of the Company's previously

announced strategy of realising value from its investment portfolio. As

announced by the Company on 17 September 2020, the Company previously agreed

with the JZAI Founders to reduce the Company's commitments to the Orangewood

Fund in the amount of US$4.25 million. This transaction was considered to be a

smaller related party transaction of the Company pursuant to Chapter 11 of the

Listing Rules (insofar as they apply to the Company by virtue of its voluntary

compliance with the same). Following the completion of that transaction, the

Company further reduced its commitments to the Orangewood Fund by an additional

aggregate amount of US$6.65 million in a series of two transactions with the

same third party institutional investor.

As also announced by the Company on 17 September 2020, the Company's intention

with respect to its remaining commitments to the Orangewood Fund was to further

reduce them such that the balance of its commitments were, if and to the extent

possible, transferred in full. Accordingly, the Orangewood Proposal represents

the Company's delivery on its previously stated intention to dispose of all of

its commitments to the Orangewood Fund.

As at the date of this announcement (and following completion of the

above-mentioned earlier transactions), the Company has capital commitments to

the Orangewood Fund of US$12.35 million, of which approximately US$2.99 million

have been funded (the "JZCP Funded Commitments") and approximately US$9.36

million remain as being unfunded (the "JZCP Unfunded Commitments").

Consistent with the Company's previously announced desire to reduce its

commitments in accordance with its investment policy, the Company has agreed to

transfer its commitments to the Orangewood Fund in full (amounting to US$12.35

million) pursuant to the Orangewood Proposal, with such commitments being taken

over by the JZAI Founders (or their respective affiliates). Specifically, the

reduction in the Company's commitments to the Orangewood Fund would be effected

by the JZAI Founders (or their respective affiliates):

a) having sold, transferred and assigned to them the full amount of the JZCP

Funded Commitments of approximately US$2.99 million; and

b) assuming the commitments, liabilities, duties, responsibilities and

obligations in respect of the full amount of the JZCP Unfunded Commitments of

approximately US$9.36 million.

The price payable by the JZAI Founders (or their respective affiliates) to the

Company for the transfer of its commitments will be set by reference to an

effective date of 19 February 2021. As at the date of this announcement, the

price payable is to be approximately US$3.16 million, which is equivalent to:

(i) the JZCP Funded Commitments as at the effective date of US$5.42 million;

(ii) less interest income received by the Company from investors entering the

Orangewood Fund in the second close of the Orangewood Fund which occurred on 10

July 2020; (iii) plus interest accrued thereon at a rate of 8 per cent. per

annum from the date such commitments were funded through to the effective date;

and (iv) as further adjusted to reflect the capital and interest inflows and

outflows from or to, as the case may be, the Company made pursuant to the final

close of the Orangewood Fund which occurred after the effective date on 9 March

2021. Shareholders should however be aware that the final price payable by the

JZAI Founders (or their respective affiliates) to the Company will be subject

to further adjustments that relate to the period from the date of this

announcement to the closing date of the transaction and as such the final price

payable will be: (i) increased by the amount of any new investments or capital

contributions made, or deemed to be made, by the Company to the Orangewood

Fund; and (ii) decreased by the amount of any dividends or distributions made

by the Orangewood Fund to the Company, in each case, occurring during that

period. The cash proceeds received by the Company in connection with the

Orangewood Proposal are, as is referred to above, intended to be used by it,

together with the cash proceeds derived from the Loan Note Proposal and

available cash at hand (including realisations from the sale of the Company's

interest in George Industries) to redeem the CULS on their maturity date.

The resultant effect of the Orangewood Proposal would be that the Company would

have its commitments to the Orangewood Fund reduced in full by US$12.35

million, with the Company receiving an expected amount of approximately US$3.16

million in cash, subject to any further adjustments during the period between

the date of this announcement and the closing date (as described above) and

less expenses associated with the Orangewood Proposal. In addition, the Company

would dispose in full of its obligations to fund cash commitments of

approximately US$9.36 million relating to the JZCP Unfunded Commitments.

The Orangewood Proposal will be effected by the entry into a suite of transfer

and withdrawal agreements between the Company and the JZAI Founders, each of

which will contain various representations, warranties and undertakings which

are considered to be customary for agreements of this nature. Further detail of

the terms of the transfer and withdrawal agreements will be set out in the

Circular.

Finally, the reduction in the Company's commitments to the Orangewood Fund will

be subject to a number of conditions, including the approval of the Company's

ordinary shareholders of the Orangewood Proposal. The reduction will not

however be conditional upon the approval of the Company's ordinary shareholders

of the Loan Note Proposal. The Orangewood Proposal will otherwise be subject to

the delivery of a number of closing deliverables, including the execution of

certain transaction documents and delivery by the Company of relevant tax

forms.

The reduction in the Company's commitments to the Orangewood Fund will become

effective on the date falling no later than five business days after, and

assuming that, the shareholder approval to the Orangewood Proposal is obtained,

assuming the other conditions to the Orangewood Proposal are also satisfied or

waived.

Related Party Transactions, Class 1 Transactions and shareholder approval

The Company's issuance of the Loan Notes and the entry into the Note Purchase

Agreement is considered a 'Related Party Transaction' under Chapter 11 of the

Listing Rules (with which the Company voluntarily complies and insofar as the

Listing Rules are applicable to the Company by virtue of its voluntary

compliance). Furthermore, the Company disposing of all of its commitments to

the Orangewood Fund is also considered a 'Related Party Transaction' under

Chapter 11 of the Listing Rules in the same way.

JZAI is the Company's investment adviser pursuant to an investment advisory and

management agreement dated 23 December 2010 between the Company and JZAI, as

amended from time to time, and, under the Listing Rules, is therefore

considered a "Related Party" of the Company. As founders and principals of

JZAI, the JZAI Founders are associates of JZAI and are also considered Related

Parties of the Company. In addition, each of the JZAI Founders are substantial

shareholders of the Company as they are each entitled to exercise, or to

control the exercise of, 10 per cent. or more of the votes able to be cast at a

general meeting of the Company. As such, each of the JZAI Founders are

considered to be Related Parties of the Company on this basis as well. The

Proposals, which involve the JZAI Founders as Related Parties of the Company,

are each considered to involve a transaction and arrangements between the

Company and its Related Parties. Accordingly, the JZAI Founders as Related

Parties and the Proposals as transactions and arrangements between them would

be considered Related Party Transactions under Chapter 11 of the Listing Rules,

insofar as the Listing Rules are applicable to the Company by virtue of its

voluntary compliance with the same. As such, the Proposals, each as a Related

Party Transaction of the Company, require the approval of shareholders.

The relevant resolutions are to be proposed at the Extraordinary General

Meeting in relation to the Proposals, each as a Related Party Transaction of

the Company, and are being proposed to seek shareholder approval for (i) the

Company's issuance of the Loan Notes and (ii) the Company to dispose of all of

its commitments to the Orangewood Fund.

The JZAI Founders are considered to be Related Parties of the Company and, as

such, will undertake not to vote, and will take all reasonable steps to ensure

that their respective associates will not vote, on the relevant resolutions.

Because of their size when aggregated together with the smaller related party

transaction mentioned above, the Proposals will each also constitute a 'Class 1

Transaction' for the purposes of the Listing Rules. Therefore, the approval of

shareholders is also required pursuant to Chapter 10 of the Listing Rules,

insofar as the Listing Rules are applicable to the Company by virtue of its

voluntary compliance with the same.

Further details of the Proposals and the notice convening the Extraordinary

General Meeting will be included in the Circular to be sent to shareholders in

due course.

Market Abuse Regulation

The information contained within this announcement is considered by the Company

to constitute inside information as stipulated under MAR. Upon the publication

of this announcement, this inside information is now considered to be in the

public domain. The person responsible for arranging the release of this

announcement on behalf of the Company is David Macfarlane, Chairman.

For further information:

Ed Berry +44 (0)7703 330 199

FTI Consulting

David Zalaznick +1 (212) 485 9410

Jordan/Zalaznick Advisers, Inc.

Sam Walden +44 (0) 1481 745385

Northern Trust International Fund

Administration Services (Guernsey)

Limited

Important Notice

This announcement also includes statements that are, or may be deemed to be,

"forward-looking statements". These forward-looking statements can be

identified by the use of forward-looking terminology, including the terms

"believes", "estimates", "anticipates", "expects", "intends", "may", "will" or

"should" or, in each case, their negative or other variations or comparable

terminology. These forward-looking statements relate to matters that are not

historical facts. By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on circumstances that

may or may not occur in the future. Forward-looking statements are not

guarantees of future performance. The Company's actual investment performance,

results of operations, financial condition, liquidity, policies and the

development of its strategies may differ materially from the impression created

by the forward-looking statements contained in this announcement. In addition,

even if the investment performance, result of operations, financial condition,

liquidity and policies of the Company and development of its strategies, are

consistent with the forward-looking statements contained in this announcement,

those results or developments may not be indicative of results or developments

in subsequent periods. These forward-looking statements speak only as at the

date of this announcement. Subject to their legal and regulatory obligations,

each of the Company, JZAI and their respective affiliates expressly disclaims

any obligations to update, review or revise any forward-looking statement

contained herein whether to reflect any change in expectations with regard

thereto or any change in events, conditions or circumstances on which any

statement is based or as a result of new information, future developments or

otherwise.

END

(END) Dow Jones Newswires

May 17, 2021 02:00 ET (06:00 GMT)

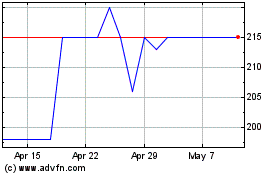

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jun 2024 to Jul 2024

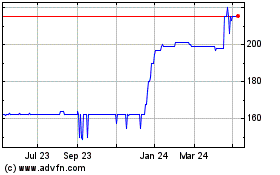

Jz Capital Partners (LSE:JZCP)

Historical Stock Chart

From Jul 2023 to Jul 2024