Disposal

September 27 2010 - 3:17AM

UK Regulatory

TIDMHGT

RNS Number : 3166T

HG Capital Trust PLC

27 September 2010

Set out below is the text of a press release issued today by HgCapital, which

manages the investment portfolio of HgCapital Trust plc alongside those of other

institutional clients.

HgCapital has agreed to sell 63.5% of its investment in Visma for cash, and will

following the transaction retain on behalf of clients 17.7% of the equity in the

company. HgCapital Trust plc, the listed investment trust which invests in all

HgCapital's deals alongside its institutional clients, will immediately realise

estimated cash proceeds of GBP39.1 million and continue to retain a stake in

Visma valued at GBP22.5 million, providing further potential upside through

ongoing exposure to Scandinavia's leading provider of regulatory-driven SME

business software and BPO services. The total value of cash and the retained

stake, GBP61.7 million, compares to a carrying value of GBP40.9 million in the

Net Asset Value of the Trust at 31 August 2010, an uplift of GBP20.8 million

(66.9 pence per share). Following completion of this transaction the estimated

Net Asset Value of HgCapital Trust plc will be GBP312.8 million (1,005.7 pence

per share*) and liquid resources are estimated to be GBP60.0 million (19% of the

estimated Net Asset Value). The deal is subject to regulatory clearance with

completion expected in November 2010.

* Assuming all subscription shares in issue are exercised at their minimum price

of 950 pence, the diluted Net Asset Value per share would be 996.4 pence per

share.

HgCapital sells Visma to KKR at an Enterprise Value of NOK11.0 billion (GBP1.2

billion).

London, 26 September 2010: HgCapital has today announced the sale of 63.5% of

its stake in Visma Holding ("Visma"), the leading software and BPO services

business in the Nordic region, based in Oslo, Norway to KKR at an enterprise

value of NOK11.0 billion / GBP1.2 billion. HgCapital invested GBP82 million in

Visma in 2006 and has since then completed a number of bolt-on acquisitions and

other strategic investments (c. GBP19 million additional capital invested). The

return on all capital invested (including the unrealised stake) delivers an IRR

of 37% and an investment multiple of 3.7x original cost for HgCapital's clients.

HgCapital clients will retain 36.5% of their stake in Visma (17.7% of the total

business), providing further upside potential through an ongoing exposure to the

number one provider of mission critical accounting, resource planning and

payroll software and related BPO services to small and medium-sized enterprises

in the Nordic region.

This transaction represents another successful outcome driven by HgCapital's

thematic sector investment approach. HgCapital's TMT team identified

regulatory-driven, subscription-based software in 2003 as an attractive

sub-sector with scope for considerable growth over the following decade. Over

the past seven years HgCapital has completed five SME software investments

operating in four geographic markets. During the period, these HgCapital

companies have also made more than 40 bolt-on acquisitions. Visma represents the

fourth realisation by HgCapital in this sub-sector, having previously exited

Iris in the UK for 3.4x cost / 60% IRR, Addison in Germany for 3.7x cost / 57%

IRR and Computer Software Group in the UK for 2.1x cost / >500% IRR.

Since the NOK4.3 billion (GBP382 million) public to private acquisition of Visma

in 2006, HgCapital's TMT and Portfolio Management teams have worked closely with

Visma's management to grow the business both organically and through

acquisition. Under HgCapital's ownership, Visma's EBITDA increased by over 265%

from NOK320 million in 2006 to over NOK865 million forecast for 2010. During

this period Visma also completed more than 25 bolt-on acquisitions and grew

total revenues by an average of 16% per annum (with an average of 10% organic

growth over the four year period). Over the same period, operating margins

improved from 14% to 20%, whilst Visma's operational performance proved

resilient through the recent recession, with revenues and EBITDA growing by 11%

and 23% respectively in 2009. It is also worth noting that the number of

employees increased from 2,512 to 4,200 under HgCapital's ownership.

Visma management and employees will increase their ownership percentage in the

business as a result of this transaction.

The valuation multiple of Visma at exit is similar to that achieved by HgCapital

on its three other realised SME software investments, which were all realised at

multiples in excess of 12x current year EBITDA, reflecting the key features that

HgCapital looks for in the businesses it acquires: a strong market position,

growth, and high levels of recurring revenue, profits and cash-flow.

Commenting on the realisation, Alex King, Head of the TMT team, stated: "We are

delighted with the way Visma has developed over the past four years and we look

forward to the management delivering further growth in the business with our new

partners KKR. We are also pleased to welcome KKR as a co-investor in Visma,

since their global scale, and extensive experience in both the technology sector

and the Nordic region makes them ideal partners. The ongoing success of Visma

underlines the strength of HgCapital's sector-led investment approach and the

support we bring as a partner to our portfolio companies."

Nic Humphries, CEO of HgCapital, added: "Visma is the latest successful example

of our ongoing investment focus on companies with predictable revenues,

protected business models, platforms for growth and opportunities for

performance improvement. Our deep sub-sector knowledge enabled us to bring the

knowledge of a trade partner to Visma's management, with the added flexibility

and investment horizons of a financial buyer. Our partial exit allows us to

maintain exposure to the significant further upside that we see in Visma over

the coming years. It is another example of us backing strong, high growth

businesses which generate more jobs even through the economic crisis in the

so-called "knowledge economy" sectors in Western Europe."

Oystein Moan, CEO of Visma said "We are very pleased to have a prestigious

global firm such as KKR as a new key investor in Visma and look forward to

continuing to grow in the future with their and HgCapital's continued support."

Roger Mountford, Chairman of HgCapital Trust, said: "We are extremely pleased

with this news from our manager HgCapital and the very positive impact it will

deliver to the Trust's net asset value and liquidity. Strategically, it is

highly beneficial for the Trust to realise for cash a part of its largest

investment at an attractive price, while retaining a material exposure to a very

successful company operating in a sector in which the manager has deep

knowledge. The Trust continues to hold substantial liquid funds for deployment

in new investments identified through HgCapital's strong sector focus."

HgCapital and Visma were advised in this transaction by ABG Sundal Collier,

Morgan Stanley and UBS.

- Ends -

For further details please contact:

+----------------------+------------------+------------------+

| HgCapital: | Alex King | +44 (0)20 7089 |

| | | 7888 |

+----------------------+------------------+------------------+

| HgCapital Trust: | Roger Mountford | +44 (0)20 7089 |

| | | 7888 |

+----------------------+------------------+------------------+

| Maitland: | Neil Bennett | +44 (0)20 7379 |

| | | 5151 |

+----------------------+------------------+------------------+

| | | +44 (0)7900 |

| | | 000777 |

+----------------------+------------------+------------------+

About HgCapital Trust plc

HgCapital Trust plc is an investment trust whose shares are listed on the London

Stock Exchange. The Trust is a client of HgCapital, giving investors exposure

to a portfolio of high-growth private companies, through a liquid vehicle. New

investments and existing portfolio companies are managed by HgCapital, an

experienced and well resourced private equity firm with a long-term track record

of delivering superior risk-adjusted returns for its investors. The Trust has

won the Investment Week Private Equity Investment Trust of the Year in 2005,

2006, 2007, 2008 and 2009. For further details, please see

www.hgcapitaltrust.com

About HgCapital

HgCapital is a sector focused private equity investor in the European

mid-market. The Partnership focuses on investments with enterprise values

ranging from GBP50-GBP500 million. Its business model combines sector

specialisation with dedicated, pro-active support to portfolio companies and the

corresponding management expertise across all phases of the investment process.

HgCapital manages over GBP3 billion for some of the world's leading

institutional and private investors. For further details, please see

www.hgcapital.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISPGUBCBUPUUMQ

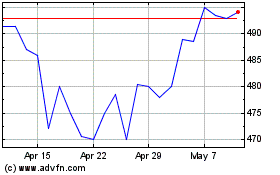

Hg Capital (LSE:HGT)

Historical Stock Chart

From May 2024 to Jun 2024

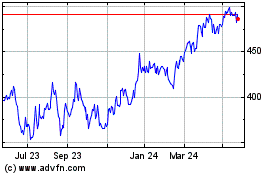

Hg Capital (LSE:HGT)

Historical Stock Chart

From Jun 2023 to Jun 2024