TIDMAPEO

RNS Number : 1116T

abrdn Private Equity Opp Trst plc

16 March 2023

abrdn Private Equity Opportunities Trust plc

Legal Entity Identifier (LEI): 2138004MK7VPTZ99EV13

16 March 2023

abrdn Private Equity Opportunities Trust plc ("APEO" or "the

Company") announces its estimated net asset value ("NAV") at 28

February 2023

-- Estimated NAV at 28 February 2023 was 745.9 pence per share

(estimated NAV at 31 January 2023 was 731.5 pence per share), a

2.0% increase from the month of January.

-- Excluding new investments, 76.3% by value of portfolio dated

31 December 2022 (estimated NAV at 31 January 2023 was 98.8% dated

30 September 2022)

-- APEO paid GBP10.8 million of drawdowns and received GBP1.5

million of distributions during the month of February

-- Outstanding commitments of GBP699.1 million at 28 February 2023

-- Liquid resources (cash balances plus undrawn credit

facilities) were GBP 238.4 million as at 28 February 2023

APEO's valuation policy for private equity funds and

co-investments is based on the latest valuations reported by the

managers of the funds and co-investments in which the Company has

interests. In the case of APEO's valuation at 28 February 2023,

excluding new investments, 76.3% by value of the portfolio

valuations were dated 31 December 2022. The value of these

investments is therefore calculated as the 31 December 2022

valuation, adjusted for subsequent cashflows over the period to 28

February 2023.

Of the remaining portfolio, the majority, being 22.8% by value

of the portfolio valuations excluding new investments, were dated

30 September 2022. The value of these investments is calculated as

the 30 September 2022 valuation, adjusted for subsequent cashflows

over the period to 28 February 2022. This is an update from the

estimated NAV at 31 January 2023, whereby 98.8% of the portfolio

valuations, excluding new investments, were dated 30 September

2022, adjusted for subsequent cashflows over the period to 31

January 2023.

Estimated NAV

At 28 February 2023, APEO's estimated NAV was 745.9 pence per

share (estimated net assets GBP1,146.8 million), representing a

2.0% per share increase from the estimated NAV at 31 January 2023

of 731.5 pence per share (estimated net assets GBP1,124.6 million).

The 14.4 pence increase in NAV per share reflected gains arising

primarily from a 2.2% constant currency uplift in the valuation of

investments as at 31 December 2022 received to date and a 1.7%

appreciation in the dollar versus sterling during February,

partially offset by a 0.7% depreciation in the euro versus sterling

during February.

The 2.2% constant currency uplift in the valuation of

investments to date was driven by APEO's co-investment portfolio,

which increased by 7.4% constant currency over the quarter to 31

December 2022, with notable quarterly uplifts in Action, European

Camping Group and Uvesco. In addition, APEO's primary fund

investments portfolio has generated an increase of 0.9% in constant

currency over the same period, as underlying portfolio companies

continued to experience earnings growth and comparable multiples

were relatively stable given the trend in public markets in the

quarter.

Drawdowns and distributions

APEO paid GBP10.8 million of drawdowns and received GBP1.5

million of distributions during the month of February. The

distributions received generated realised gains and income of

GBP0.5 million.

Investment activity

There were no new commitments to announce from the month of

February.

Commitments

The Company had GBP699.2 million of outstanding commitments at

28 February 2023. The Manager believes that around GBP73.8 million

of the Company's existing outstanding commitments are unlikely to

be drawn.

Credit facility and cash balances

The Company has a GBP300.0 million syndicated revolving credit

facility provided by The Royal Bank of Scotland International

Limited, Societe Generale and State Street Bank International GmbH,

and it expires in December 2025. The Company made no repayments to

or drawdowns from the facility during the month of February, with a

total of GBP83.8 million drawn at 28 February 2023. The remaining

undrawn balance of the facility at 28 February 2023 was therefore

GBP216.2 million.

In addition, the Company had cash balances of GBP22.2 million at

28 February 2023 . Liquid resources, calculated as the total of

cash balances and the undrawn balance of the credit facility, were

therefore GBP238.4 million as at 28 February 2023.

Update from the Manager

The latest update from the Manager is available within the

Latest News section of the Company website;

www.abrdnpeot.co.uk.

Future announcements

The Company is expecting to announce its estimated NAV at 31

March 2023 on or around 18 April 2023.

Additional detail about APEO's NAV and investment

diversification can be found on APEO's website. Neither the

contents of the Company's website nor the contents of any website

accessible from hyperlinks on the Company's website is incorporated

into, or forms part of, this announcement.

For further information please contact Alan Gauld at abrdn

Capital Partners LLP (0131 528 4424)

Notes:-

abrdn Private Equity Opportunities Trust plc is an investment

company managed by abrdn Capital Partners LLP, the ordinary shares

of which are admitted to listing by the UK Listing Authority and to

trading on the Stock Exchange and which seeks to conduct its

affairs so as to qualify as an investment trust under sections

1158-1165 of the Corporation Tax Act 2010. The Board of abrdn

Private Equity Opportunities Trust plc is independent of abrdn plc

and Phoenix Group Holdings.

The Company intends to release regular estimated NAV updates

around ten business days after each month end. A breakdown of

APEO's portfolio can be obtained in the latest monthly factsheet,

which is published on APEO's website at:

www.abrdnpeot.co.uk

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVJAMITMTIBBLJ

(END) Dow Jones Newswires

March 16, 2023 03:00 ET (07:00 GMT)

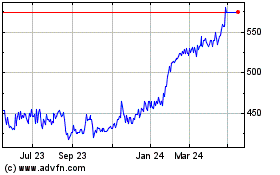

Abrdn Private Equity Opp... (LSE:APEO)

Historical Stock Chart

From Jun 2024 to Jul 2024

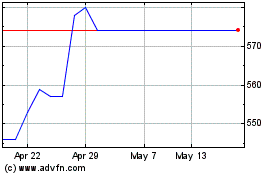

Abrdn Private Equity Opp... (LSE:APEO)

Historical Stock Chart

From Jul 2023 to Jul 2024