TIDMAPEO

RNS Number : 4174O

abrdn Private Equity Opp Trst plc

31 January 2023

abrdn Private Equity Opportunities Trust plc

Legal Entity Identifier (LEI): 2138004MK7VPTZ99EV13

ANNUAL FINANCIAL REPORT FOR THE YEARED 30 SEPTEMBER 2022

FINANCIAL HIGHLIGHTS

As at As at

30 September 30 September

2022 2021

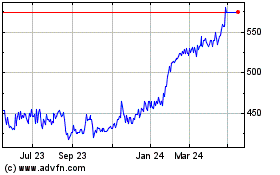

Net Asset Value Total Return(*+) 14.1% 37.9%

------------------------------------- ------------- -------------

Share Price Total Return(*+) -15.1% 60.6%

------------------------------------- ------------- -------------

FTSE All - Share Index Total Return -4.0% 27.9%

------------------------------------- ------------- -------------

Net Assets GBP1,158.1m GBP1,036.0m

------------------------------------- ------------- -------------

Share Price 410.0p 498.0p

------------------------------------- ------------- -------------

Expense Ratio(*+) 1.06% 1.10%

------------------------------------- ------------- -------------

(*) Considered to be an Alternative Performance Measure.

(+) A Key Performance Indicator by which the performance of the

Manager is measured by the Board.

HIGHLIGHTS TO 30 SEPTEMBER 2022

-- NAV Performance - APEO has shown strong annual Net Asset

Value ("NAV") growth in spite of the difficult backdrop in both the

global economy and financial markets. NAV total return ("NAV TR")

for the year to 30 September 2022 was 14.1% versus -4.0% for the

FTSE All-Share Index. The valuation of the underlying portfolio

increased by 10.5% during the period (excluding FX).

-- Share Price Performance - The deterioration in public market

sentiment during the year led to share price pressures across the

sector during 2022. In that context, APEO's share price total

return was -15.1% during the year to 30 September 2022 and

therefore underperformed the -4.0% total return from the FTSE

All-Share, APEO's comparator index.

-- Investment Activity - APEO made twelve new primary

investments, nine new direct co-investments and two new secondary

investments during the year. Direct co-investment has continued to

grow as a proportion of the portfolio and has now reached a

portfolio of 22 underlying companies and 19.1% of NAV.

-- Realisations - The portfolio generated record levels of

realisations (distributions and secondary sales) during the year

under review, with distributions of GBP210.2 million (30 September

2021: GBP197.6 million). In addition, APEO received an additional

GBP15.7 million (2021: GBP1.1 million) from proceeds from secondary

sales relating to two fund positions.

-- Outstanding Commitments - Outstanding commitments at the

year-end amounted to GBP678.9 million (2021: GBP557.1 million). The

overcommitment ratio of 42.8% at year-end (2021: 32.5%) was at the

lower end of APEO's target range (30-75%).

-- Balance Sheet - APEO had cash and cash equivalents of GBP30.3

million (2021: GBP29.7 million) at year-end. APEO also had GBP138.0

million remaining undrawn on its GBP200.0 million revolving credit

facility at 30 September 2022 (2021: GBP200.0 million undrawn).

Following year-end, the revolving credit facility was increased to

GBP300.0 million in size and extended in duration by a year (to

December 2025).

TEN YEAR FINANCIAL RECORD

2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

============= ======== ========= ======== ======== ======== ========= =========== ======== ========== ===========

Per share

data

============= ======== ========= ======== ======== ======== ========= =========== ======== ========== ===========

NAV

(diluted)

(p)

^ 243.4 257.4 281.6 346.4 389.6 430.2 461.9 501.0 673.8 753.2

============= ======== ========= ======== ======== ======== ========= =========== ======== ========== ===========

Share price

(p) 198.0 230.0 214.0 267.3 341.5 345.5 352.0 320.0 498.0 410.0

============= ======== ========= ======== ======== ======== ========= =========== ======== ========== ===========

Discount to

diluted(^)

NAV per

Share

(%)(*+) (18.6) (10.6) (24.0) (22.8) (12.3) (19.7) (23.8) (36.1) (26.1) (45.6)

============= ======== ========= ======== ======== ======== ========= =========== ======== ========== ===========

Dividend per

Share

(p) 5.00 5.00 5.25 5.40 12.00 12.40 12.80 13.20 13.60 14.40

============= ======== ========= ======== ======== ======== ========= =========== ======== ========== ===========

Expense

Ratio(*+1)

(%) 0.99 0.96 0.98 0.99 1.14(2) 1.10 1.09 1.10 1.10 1.06

============= ======== ========= ======== ======== ======== ========= =========== ======== ========== ===========

Returns data

============= ======== ========= ======== ======== ======== ========= =========== ======== ========== ===========

NAV Total

Return(*+)

(%) 9.1 7.7 11.9 24.8 14.9 13.3 10.5 11.7 37.9 14.1

============= ======== ========= ======== ======== ======== ========= =========== ======== ========== ===========

Total

Shareholder

Return(*+)

(%) 23.4 19.1 (4.0) 27.9 31.9 5.8 5.7 (4.6) 60.6 (15.1)

============= ======== ========= ======== ======== ======== ========= =========== ======== ========== ===========

Portfolio

data

============= ======== ========= ======== ======== ======== ========= =========== ======== ========== ===========

Net Assets

(GBPm) 401.2 409.1 438.7 532.6 599.0 661.4 710.1 770.3 1,036.0 1,158.1

============= ======== ========= ======== ======== ======== ========= =========== ======== ========== ===========

Top 10

Managers as

a % of net

assets(3) 68.4 65.0 65.2 65.0 58.9 63.6 67.9 67.8 62.9 65.1

============= ======== ========= ======== ======== ======== ========= =========== ======== ========== ===========

Top 10

investments

as a % net

assets 51.7 52.9 48.6 45.9 47.7 48.4 53.9 48.3 40.3 35.6

------------- -------- --------- -------- -------- -------- --------- ----------- -------- ---------- -----------

Source: The Manager & Refinitiv

1 For further information on the calculation of the expense ratio,

as well as the ongoing charges of the Company, please refer to the

Alternative Performance Measures.

2The incentive fee arrangement ended on 30 September 2016. Following

the end of the incentive fee period, a single management fee of 0.95%

per annum of the NAV of the Company replaced the previous management

and incentive fees.

3 The top 10 managers as a % of net assets do not strictly represent

the current core private equity managers of the APEO portfolio.

* Considered to be an Alternative Performance Measure.

+ A Key Performance Indication by which the performance of the Manager

is measured by the Board.

^ There are no diluting elements to the net asset value per equity

share calculation in 2022.

An introduction to abrdn Private Equity Opportunities Trust plc

(the "Company" or "APEO")

- A diversified portfolio of private equity funds and

co-investments principally focused on the European mid-market.

- APEO partners with some of the leading private equity firms in

Europe, through funds and co-investments. Our 12 core European

private equity relationships represent around 59% of portfolio

NAV.

- Through funds and co-investments, these private equity firms

then invest into market-leading private companies, some of which

are household names, but many of which are not widely known.

- This approach, developed over 21 years, has created a

portfolio that provides underlying exposure to over 650 underlying

private companies via funds and co-investments, well-balanced

across sectors and vintages.

% Exposure as at

Sector 30 September

2022

Information technology 20

Healthcare 20

Industrials 18

Consumer discretionary 14

Consumer staples 12

Financials 11

Materials 4

Energy 1

Based on the latest available information from underlying

managers. Figures represent % of total value of underlying private

company exposure. This excludes any underlying funds and

co-investments held through the Company portfolio.

Our Pillars - The key pillars that have guided our business for

more than 21 years and differentiate us in our industry

Access - APEO gives investors access to high quality private

equity managers and private companies

Private equity can be a challenging asset class to access and

navigate.

Our long-term market presence and local networks provide us with

insights and relationships that, we believe, unlock some of the

best opportunities for investment in private equity funds and

co-investments, alongside our core private equity managers. We work

hard to find and foster these relationships so we become strong and

reliable partners to these core managers. This enables us to build

and maintain a diversified and high quality portfolio of underlying

private companies.

As an investment trust listed on the London Stock Exchange, APEO

offers shareholders an opportunity to invest in these private

equity funds and co-investments for as little as the price of one

share. As APEO's shares are listed on the London Stock Exchange,

they provide daily tradable access to an asset class which is

normally relatively illiquid.

Expertise - The Investment Management team has specialist

knowledge in European markets

The Investment Manager has a large and well established team of

investment professionals. They have managed APEO for over 21 years,

since its inception, and have generated consistent performance over

that time.

The European private equity market is a complex investment

arena, with multiple strategies and managers to choose from, not to

mention the different cultural and technical nuances across the

various countries. The Investment Manager's specialist expertise is

a key asset in navigating these complexities and honing in on the

best private equity managers, funds and co-investments for our

shareholders.

Alongside our European focus, we also have exposure to the North

American market through our European managers and selectively

through North American focused funds.

Geography of the Underlying Portfolio as at 30 September

2022

Exposure %

North America 23

United Kingdom 17

Nordics 14

France 13

Germany 12

Benelux 9

Spain 3

Italy 3

Switzerland 1

Based on the latest available information from underlying

managers. Figures represent % of total value of underlying private

company exposure. This excludes any underlying fund and

co-investments held through APEO's portfolio.

Geographic exposure is defined as the geographic region where

underlying portfolio companies are headquartered.

In addition to the above, 4% of underlying portfolio companies

are based in European countries not separately disclosed above,

while 1% are based in countries outside of Europe, excluding North

America.

APEO has no Russian, Ukrainian or Belarussian headquartered

companies. These three countries make up less than 1% of the

underlying company revenues

Focus - the APEO portfolio is focused on one of the most

established and consistently performing parts of the growing

private markets universe

Our objective is to build and manage a carefully selected and

continually evolving portfolio of the best private equity funds and

co-investments available in the European market. We do this by

partnering with 12 core European private equity manager

relationships, a selective approach in a market where there are

thousands of private equity managers to choose from.

Diversification is a well-recognised means of managing

investment risk and we achieve that through a portfolio of around

50 "active" private equity fund investments, that in turn have

exposure to over 650 underlying portfolio companies. But we also

believe it is important to have conviction and to concentrate our

firepower. We do this by selecting and focusing our capital with a

group of a dozen or so core buyout managers and partnering with

them through primary commitments to their funds, providing

liquidity to their investors through secondary transactions and

making direct co-investments alongside them in private

companies.

Consistency - APEO has a history and track record of more than

20 years

We take a rigorous and disciplined approach to investment

analysis that delivers consistent long term investment returns

across market cycles.

Private equity is often perceived to be a risky business, but

our historic track record proves that steady NAV performance and

consistent growth are possible. What's more, stability does not

have to translate into reduced returns; our NAV has grown over ten

times since launch.

STRATEGIC REPORT

INVESTMENT STRATEGY

Investment Objective

The Company's investment objective is to achieve long-term total

returns through holding a diversified portfolio of private equity

funds and direct investments into private companies alongside

private equity managers ("co-investments"), a majority of which

will have a European focus.

Investment Policy

The Company: (i) commits to private equity funds on a primary

basis; (ii) acquires private equity fund interests in the secondary

market; and (iii) makes direct investments into private companies

via co-investments. Its policy is to maintain a broadly diversified

portfolio by country, industry sector, maturity and number of

underlying investments.

The objective is for the portfolio to comprise around 50

"active" private equity fund investments; this excludes funds that

have recently been raised, but have not yet started investing, and

funds that are close to or being wound up. The Company may also

invest up to 20% of its assets in co-investments.

The Company may also hold direct private equity investments or

quoted securities as a result of distributions in specie from its

portfolio of fund investments. The Company's policy is normally to

dispose of such assets where they are held on an unrestricted

basis.

To maximise the proportion of invested assets, the Company

follows an over-commitment strategy by making commitments which

exceed its uninvested capital. In making such commitments, the

Manager, together with the Board, will take into account the

uninvested capital, the value and timing of expected and projected

cashflows to and from the portfolio and, from time to time, may use

borrowings to meet drawdowns. The Board has agreed that the

over-commitment ratio should sit within the range of 30% to 75%

over the long-term.

The Company's maximum borrowing capacity, defined in its

articles of association, is an amount equal to the aggregate of the

amount paid up on the issued share capital of the Company and the

amount standing to the credit of the reserves of the Company.

However, it is expected that borrowings would not normally exceed

30% of the Company's net assets at the time of drawdown.

The Company's non-sterling currency exposure is principally to

the euro and US dollar. The Company does not seek to hedge this

exposure into sterling, although any borrowings in euros and other

currencies in which the Company is invested would have such a

hedging effect.

Cash held pending investment is invested in short-dated

government bonds, money-market instruments, bank deposits or other

similar investments. Cash held pending investment may also be

invested in other listed investment companies or trusts. The

Company will not invest more than 15% of its total assets in such

listed equities.

The investment limits described above are all measured at the

time of investment.

Portfolio Construction Approach

Investments made by APEO are typically with or alongside private

equity firms with whom the Manager has an established relationship

of more than 10 years.

As at 30 September 2022, APEO directly held 75 separate fund

investments (2021: 64) comprising of primary and secondary fund

interests, as well as 22 co-investments (2021: 13).

Through its portfolio of directly held investments, the Company

indirectly has exposure to a diverse range of underlying private

companies, as well as additional underlying fund of fund and

co-investment interests. At 30 September 2022, APEO's underlying

portfolio included exposure to 655 separate underlying private

companies (2021: 578), 41 underlying fund investments (2021: 36)

and 9 underlying co-investments (2021: 9).

APEO predominantly invests in European mid-market companies.

Around 76% (2021: 79%) of the total value of underlying private

company exposure is invested in European domiciled operating

companies and the Board expects this to remain the case over the

longer term, with a weighting towards North Western Europe. This

has been APEO's

geographic focus since its inception in 2001 and where it has a

strong, long-term track record. However, APEO also selectively

seeks exposure to North American mid-market companies, as a means

to access emerging growth or investment trends that cannot be fully

captured by investing in Europe alone.

APEO has a well-balanced portfolio in terms of non-cyclical and

cyclical exposure. Currently the largest single sector exposure

represents 20% of the total value of underlying private company

exposure(1) (2021: 21%) and it is expected that no single sector

will be more than 30% of the portfolio over the longer term. Over

time, the Manager anticipates a continuation of the recent shift

toward sectors that are experiencing long-term growth (such as

Technology and Healthcare) at the expense of more cyclical sectors,

such as Industrial and Consumer Discretionary.

Environmental, Social and Governance ("ESG") is a strategic

priority for the Board and the Manager. APEO aims to be an active,

long-term responsible investor and ESG is a fundamental component

of APEO's investment process. Further detail on the Manager's

approach to ESG is set out below.

(1) Excludes underlying fund and co-investments indirectly held

through the Company portfolio.

CHAIR'S STATEMENT

Introduction

In my first year as Chair, I am delighted to present APEO's

Annual Report & Accounts for the financial year to 30 September

2022, a year in which the portfolio has delivered a resilient NAV

performance in the face of a challenging backdrop in both the

global economy and financial markets. This performance is credited

to our focused Investment Strategy, the capabilities of our

Investment Manager, and an active Board.

2022 has been a year of some key milestones for APEO. Most

notably, following shareholder approval at the AGM in early March,

the Company changed its name from Standard Life Private Equity

Trust plc to abrdn Private Equity Opportunities Trust plc to align

itself with the Manager's rebrand. And, on the back of a sustained

period of growth for shareholders, APEO was rewarded with a

promotion to the FTSE 250 Index for the first time in its

history.

Of course, I remain mindful that the macroeconomic environment

and financial markets have changed materially in 2022, culminating

in higher borrowing rates and inflationary price pressures. This

will invariably result in a tougher period for both corporate

earnings and the valuation environment in private equity. That

said, APEO has held a focused and consistent strategy for over 21

years, and we continue to take comfort from the quality and

diversified nature of the existing and evolving portfolio.

Investment Performance & Discount

The deterioration in public market sentiment during the year,

including private equity investment trusts, led to share price

pressures across the sector during 2022. Disappointingly, APEO's

share price total return was -15.1% during the year to 30 September

2022 and therefore underperformed the -4.0% total return from the

FTSE All-Share, APEO's comparator index, during the same

period.

In contrast, APEO's NAV performance remained strong during the

year, with NAV per share total return of 14.1%, outperforming the

FTSE All-Share Index. This resilient NAV performance is testament

to APEO's investment and relationship strategy, which has remained

focused on partnering with a relatively small cohort of

high-quality private equity firms, predominately in the European

mid-market.

As a result of the contrast between the share price and NAV

performance during the year, the share price discount to NAV at 30

September 2022 widened to 45.6%. The discount ranged between 11.2%

and 46.7% during the year, and averaged 28.0%, which was slightly

narrower than the 29.9% average of its close peer group.

The Board does not have a stated discount control policy. That

said, the Board and Manager monitor the discount on a regular basis

to ensure that APEO is not an outlier when compared to other

investment companies with a similar investment approach and

shareholder structure. The Board has bought back its own shares in

the past and is seeking shareholder approval to do so again, as we

keep this matter under active and careful consideration. Suffice to

say there is always a balance to consider in terms of buying-back

shares on an accretive discount and preserving cash liquidity for

investment purposes. The Board is also cognisant of APEO's

relatively concentrated shareholder register and, when considering

buybacks, we are mindful of liquidity in the Company's shares,

which we believe is a key long-term focus of our shareholders.

Commitments, Investments & Distributions

The 12 months ended 30 September 2022 was an active year for

investment, continuing the momentum seen in 2021. APEO made

commitments totalling GBP340.3 million (2021: GBP307.1 million). In

line with our investment policy, these commitments were well across

twelve new primary commitments (GBP257.2 million), two new

secondary investments (GBP17.1 million), nine new direct

co-investments (GBP65.7 million), and one follow-on investment in

an existing co-investment. Of particular note is the fact that

direct co-investment has continued to grow as a proportion of the

portfolio and has now reached a portfolio of 22 underlying

companies and 19.1% of portfolio NAV (2021: 13 underlying companies

and 10.5% of portfolio NAV). Outstanding commitments at the year

end amounted to GBP678.9 million (2021: GBP557.1 million).

APEO received GBP210.2 million of distributions (2021: GBP197.6

million) from underlying investments during the year, another

annual record for APEO, exceeding the previous year's record total.

The realised return from the ongoing investment operations of

APEO's core portfolio equated to 2.2 times cost (2021: 2.8 times

cost). In addition, APEO received an additional GBP15.7 million

(2021: GBP1.1 million) from proceeds from secondary sales relating

to two fund positions, meaning that APEO received a total of

GBP225.9 million cash proceeds during the financial year (2021:

GBP198.7 million). The Manager focused on reinvesting distributions

into new investment opportunities during the year, amounting to

total drawdowns of GBP253.6 million (2021: GBP184.2 million).

Dividends

APEO has paid three interim dividends of 3.6 pence per share

and, in December 2022, the Board announced that a fourth interim

dividend of 3.6 pence per share would be paid on 27 January 2023 to

shareholders on the register on

23 December 2022. This will make a total dividend for the year

to 30 September 2022 of 14.4 pence per share. This represents an

increase of 5.9% on the 13.6 pence per share paid for the year to

30 September 2021.

Liquidity and Bank Facility

At the year end, APEO had cash and cash equivalents of GBP30.3

million (2021: GBP29.7 million). APEO also had GBP138.0 million

remaining undrawn (2021: GBP200.0 million undrawn) on its GBP200.0

million revolving credit facility at 30 September 2022.

Following the year-end, the revolving credit facility was

increased to GBP300.0 million and the maturity extended by a year

to December 2025. The larger facility, provided by RBS

International, Société Générale and State Street Bank

International, will provide APEO with additional capacity for new

investments in the months and years ahead.

Environmental, Social & Governance ("ESG")

The Board continues to believe that integrating ESG best

practice into APEO's investment process will help to generate

stronger, more sustainable returns for shareholders over the long

term. Accordingly, the Board monitors the Manager's commitment to

ESG factors closely and encourages it to stay close to the latest

market developments in this area. The majority of our portfolio is

managed by third-party managers and the Board takes comfort from

the Manager's policy to invest only with private equity firms who

the Manager believes are ESG market leaders or have a strong

cultural commitment to improve their ESG credentials.

The Board has encouraged the Manager to continue to raise ESG

standards across the industry and to publicise the work that it has

done in this area. For further detail of the Manager's approach to

ESG, including an ESG case study, is set out below.

Investment Manager

Each year, the Board, through the Management Engagement

Committee, considers whether the continued appointment of the

Manager is in the best interests of shareholders as a whole.

Following its most recent review, the Board considers that the

Manager continues to have suitably qualified personnel and robust

operational processes to deliver APEO's investment objective over

the long term for shareholders.

Board

Christina McComb retired from the Board following the conclusion

of the AGM in March 2022. Christina served on the Board since 2013,

the last 3 years as Chair. On behalf of the Board, I would like to

thank Christina for her considerable contribution to APEO and wish

her well in her future endeavours.

AGM and Manager's Presentation

The Board intends to hold APEO's AGM at the Balmoral Hotel, 1

Princes Street, Edinburgh, EH2 2EQ at 12:30 pm on 22 March 2023.

The meeting will include a presentation by the Manager and will be

followed by lunch. This is a good opportunity for shareholders to

meet the Board and the Manager and the Board encourages you to

attend. The Notice of the Meeting is contained in the Annual

Report.

Outlook

The broader financial markets and the outlook for the global

economy have shifted materially during the year, with the developed

economies of the world moving from a Covid-recovery phase in late

2021 to a much more challenging environment in 2022. Both the Board

and the Manager expect this tough environment to persist in the

short to medium term, which will continue to have an impact on the

performance of APEO as inflationary pressures persist in the

underlying portfolio companies and private equity valuations

continue to experience headwinds.

I have always viewed private equity as a long-term asset class

where new investment decisions are often made with a five-year time

horizon in mind. Whilst the immediate road ahead appears more

uncertain, the governance model of private equity has proved many

times in the past, most notably during the global financial crisis

of 2008-09, that it facilitates nimble and active ownership and

allows underlying businesses to adapt more quickly to changing

market circumstances. Periods of market dislocation have previously

offered up new and different opportunities for investment, which

private equity firms have proved adept at generating and

completing.

A key lesson from past crises is to ensure that you have ample

balance sheet capacity to take advantage of these attractive new

investment opportunities, particularly given distributions from

private equity funds tend to slow down during these periods of

dislocation. In that context, I'd again highlight that, following

the financial year end, APEO increased the size of its revolving

credit facility to GBP300.0 million.

With so much new capital having flowed into private equity in

recent years and some recent dramatic shifts in the shape of

investor portfolios, it is inevitable that investors will look to

re-balance their asset allocations and portfolio weightings over

the coming quarters, which in turn is beginning to fuel activity in

the secondary market - APEO is well placed to take advantage of

opportunities in this part of the market.

APEO has invested for over 21 years, emerging in the aftermath

of the dot-com bubble, through the global financial crisis and the

Covid-19 pandemic. Our strategy has historically worked through the

cycle. I believe that the quality and diversification of the

existing portfolio, and its strong balance sheet, will help to

position APEO well during these challenging market conditions and

will allow APEO to continue to generate attractive long-term

returns to shareholders in the coming years.

Alan Devine

Chair,

30 January 2023

PRINCIPAL RISKS & UNCERTAINITIES

The Board and Audit Committee carry out a regular and robust

review of the risk environment in which APEO operates. The Board

also identifies emerging risks such as a material change in the

geopolitical or macroeconomic environment, or developments in

climate change from an investor attitude or regulatory expectation,

which might affect the APEO's underlying investments.

During the financial year, the outlook for the global economy

changed. The world's developed economies moved from a Covid-19

recovery state to a much more challenging environment as

geopolitical uncertainty impacted equity markets and inflation

impacted the margins of underlying portfolio companies. Private

equity valuations experienced high levels of pressure.

The Board has also discussed the potential impact of climate

change with the Manager. APEO is committed to being an active,

long-term responsible investor and ESG is a fundamental component

of its investment process. The Manager commits APEO's capital with

private equity managers who demonstrate strong adherence to ESG

principles and processes or have a cultural commitment to improve

their ESG credentials. Focus on climate change is part of that

assessment. The private equity industry is still relatively early

in its response to climate change and the Manager is focused on

engaging with its portfolio of private equity managers to help

promote further positive change.

The Board is aware that there are a number of risks which, if

realised, could have a material adverse effect on APEO

and its financial condition, performance and prospects. The

Board monitors APEO's principal and emerging risks

regularly, alongside the Manager, and the operating and control

environment in which APEO operates.

The Board considers its risk appetite in relation to each

principal risk and monitors this on an ongoing basis. Where a risk

is approaching or is outside the tolerance level, the Board will

take action to manage the risk. Currently, the Board considers the

risks to be managed within acceptable levels.

The principal risks faced by APEO relate to the Company's

investment activities and these are set out below.

Risk Definition Tolerance Mitigation / Update

-------------------------------- ---------------------------------- --------- ---------------------------------

Market (increased) a) Pricing risk Medium a) The decline in publicly-listed

APEO is at risk of the economic equities during the year has put

cycle impacting listed financial pressure on private equity

markets and hence potentially valuations. Investments in APEO's

affecting the pricing of portfolio are generally subject

underlying investments and timing to private equity guidelines

of exits. such as IPEV with respect of

b ) Currency risk valuations.

APEO has a material proportion of Private equity market deal

its investments and cash balances activity has declined in 2022 and

in currencies other than this expected to continue into

sterling and is therefore 2023. This will likely extend the

sensitive to movements in foreign timing of some investment exits

exchange rates. and distributions. Subsequent

to the year end, APEO increased

the size of its revolving credit

facility to GBP300.0 million

to help mitigate this risk.

Inflation and interest rate rises

have the potential to impact both

the valuations of the

existing underlying portfolio and

the pricing of new investments in

the future.

Pricing risk is mitigated by APEO

having a diversified portfolio of

fund investments and

co-investments.

b) The Manager monitors APEO's

exposure to foreign currencies

and reports to the Board on

a regular basis. It is not the

APEO's policy to hedge foreign

currency risk. APEO's

non-sterling

currency exposure is primarily to

the euro and the US dollar.

During the year ended 30

September 2022, sterling

depreciated by 2.1% relative to

the euro

(2021: appreciated 5.5%) and

depreciated by 17.2% relative to

the US dollar (2021: appreciated

4.3%).

This movement in the euro and the

US dollar had a net positive

impact on the net assets of

APEO.

================================ ================================== ========= =================================

Liquidity (Unchanged) The risk that APEO is unable to Low APEO manages its liquid

meet short-term financial demands. investments to ensure that

sufficient cash is available to

meet contractual

commitments and also seeks to

have cash available to meet other

short-term needs. Additional

short-term flexibility is

achieved through the use of the

revolving multi-currency loan

facility,

which was extended to GBP300.0

million shortly after the

financial year end.

APEO had cash and cash

equivalents of GBP30.3 million

(2021: GBP29.7 million) as at 30

September

2022.

================================ ================================== ========= =================================

Over-commitment (Unchanged) The risk that APEO is unable to Medium APEO makes commitments to private

settle outstanding commitments to equity funds, which are typically

fund investments. drawn over three to five

years. Hence APEO will tolerate a

degree of over-commitment risk in

order to deliver long-term

investment performance.

In order to mitigate this risk,

the Manager ensures that APEO has

appropriate levels of resources,

whether through resources

available for investment or the

revolving credit facility,

relative

to the levels of overcommitment.

The Manager will also forecast

and assess the maturity of the

underlying portfolio to determine

likely levels of distributions in

the near term.

The Manager will also track the

over-commitment ratio and ensure

that it sits within the range,

agreed with the Board, of 30% to

75% over the long term.

At 30 September 2022 APEO had

GBP678.9 million (2021: GBP557.1

million) of outstanding

commitments,

with GBP69.9 million (2021:

GBP46.7 million) expected not to

be drawn. The over-commitment

ratio was 42.8% (2021: 32.5%).

================================ ================================== ========= =================================

Credit (Unchanged) The exposure to loss from failure Low APEO places funds with authorised

of a counterparty to deliver deposit takers from time to time

securities or cash for and, therefore, is potentially

acquisitions at risk from the failure of such

or disposals of investments or to an institution.

repay deposits. APEO's cash is held by BNP

Paribas Securities Services S.A.,

which is rated 'A+' by S&P Global

Ratings.

The credit quality of the

counterparties is kept under

regular review. Should the credit

quality

or the financial position of

these financial institutions

deteriorate significantly, the

Manager

would move cash balances to other

institutions.

================================ ================================== ========= =================================

Investment selection (Unchanged) The risk that the Manager makes Medium The Manager undertakes detailed

decisions to invest in funds due diligence prior to investing

and/or co-investments that are in, or divesting, any fund

not accretive to APEO's NAV over or co-investment. It has an

the long term. experienced team which monitors

market activity closely. APEO's

management team has

long-established relationships

with the third party fund

managers in the

Company's portfolio which have

been built up over many years.

ESG factors are integrated into

the investment selection process

and the Board and the Manager

believes that will improve

investment decision making and

help to generate stronger, more

sustainable returns.

================================ ================================== ========= =================================

Operational (Unchanged) The risk of loss or a missed Low The Manager's business continuity

opportunity resulting from a plans, and approach to cyber

regulatory failure or a failure security risk, are reviewed

relating to people, processes or on an ongoing basis alongside

systems. those of APEO's key service

providers.

The Board has received reports

from its key service providers

setting out their existing

business

continuity framework. Having

considered these arrangements,

the Board is confident that a

good level of service will be

maintained in the event of an

interruption to business

operations

or other major event, including

another global pandemic.

================================ ================================== ========= =================================

APEO's financial risk management objectives and policies are

contained in note 18 to the financial statements.

Review of performance

An outline of the performance, market background, investment

activity and portfolio during the year under review and the

performance over the longer term, as well as the investment

outlook, are provided in the Highlights, Chair's Statement, and

Investment Manager's Review. Details of APEO's investment

portfolio, the ten largest investments and the top ten underlying

private company investments are shown below.

STAKEHOLDER ENGAGEMENT AND RESPONSIBLE MANAGEMENT

Section 172 Statement

The Board is required to describe how the Directors have

discharged their duties and responsibilities over the course of the

financial year following the guidelines set out in the UK under

section 172 (1) of the Companies Act 2006 (the "s172 Statement").

This Statement provides an explanation of how the Directors have

promoted the success of APEO for the benefit of its shareholders as

a whole, taking into account the likely long-term consequences of

decisions, the need to foster relationships with all stakeholders

and the impact of APEO's operations on the environment.

Stakeholders

APEO is an investment trust and is externally managed, has no

employees, and is overseen by an independent non-executive board of

directors. The Board makes decisions to promote the success of APEO

for the benefit of the shareholders as a whole, with the ultimate

aim of delivering its investment objective to achieve long-term

total returns.

The Directors set APEO's investment mandate, monitor the

performance of all service providers (including the Manager), and

are responsible for reviewing strategy on a regular basis. All this

is done with the aim of preserving and enhancing shareholder value

over the longer term.

The following section discusses how the actions taken by the

Board work towards ensuring that the interests of all stakeholders

are appropriately considered. In line with the FRC Guidance, this

statement focuses on stakeholders that are considered key to APEO's

business and does not therefore cover every one of APEO's

stakeholders.

Shareholders

The Board is committed to maintaining open channels of

communication and to engaging with shareholders. The Board seeks

shareholder feedback in order to ensure that decisions are taken

with the views of shareholders in mind. These shareholder

communications include:

Annual General Meeting

The AGM provides an opportunity for the Directors to engage with

shareholders, answer their questions and meet them informally. At

the AGM there is typically a presentation on APEO's performance and

the future outlook as well as an opportunity to ask questions of

the Manager and Board. The next AGM will take place on 22 March

2023 in Edinburgh and the Board encourages shareholders to attend

the AGM, and for those unable to attend, to lodge their votes by

proxy on all of the resolutions put forward. For more information

on how to lodge proxy votes in advance of the AGM, please see the

Annual Report.

Shareholder Meetings

Unlike trading companies, shareholders in investment companies

often meet representatives of the Manager rather than members of

the Board. Feedback from the Manager's meetings with shareholders

is provided to the Board at every meeting. The Chair, Senior

Independent Director and other members of the Board are also

available to meet with shareholders to understand their views at

any time during the year.

Publications

APEO publishes a full annual report each year that contains a

strategic report, governance section, financial statements and

additional information. The report is available online and in paper

format. APEO also produces a half-yearly report each year. The

purpose of these reports is to provide shareholders with a clear

understanding of APEO's activities, portfolio, financial position

and performance. The Manager also publishes a Monthly Factsheet,

and a Monthly Net Asset Value Statement. The purpose of these

publications is to keep shareholders abreast of APEO's

developments.

Investor Relations and Website

APEO subscribes to the Manager's Investor Relations programme.

APEO's website contains a range of information and includes a full

monthly portfolio listing of APEO's investments as well as podcasts

and presentations by the Manager. Details of financial results, the

investment process and Manager together with APEO announcements and

contact details can be found at: abrdnpeot.co.uk.

Keeping in Touch

The Board encourages shareholder feedback and invites

shareholders to write to the Board at its registered office. The

Board has also set up an email account to encourage shareholders to

write directly to the Board. Shareholders are invited to email any

feedback or questions to the Board at APEOT.Board@abrdn.com. Any

questions received will be replied to by either the Manager or

Board via the Company Secretary.

The Manager

The Manager's performance is critical for APEO to achieve its

investment objective and the Board maintains a close and

constructive working relationship with the Manager. The Board meets

the Manager at formal Board meetings five times per year and more

regularly as necessary. The Board Members also keep in touch with

the Manager informally throughout the year and receive reports and

updates as appropriate. During the year, the Management Engagement

Committee, on behalf of the Board, reviewed the continued

appointment of Manager, and the terms of the Management Agreement,

and believes that the continued appointment of the Manager is in

the best interests of shareholders.

Suppliers

As an investment trust, APEO has outsourced its entire

operations to third party suppliers. The Board is responsible for

selecting the most appropriate outsourced service providers and,

alongside the Investment Manager, monitors their services to ensure

a constructive working relationship. The Board, through the

Investment Manager, maintains regular contact with its key

suppliers, namely the Company Secretary, the Administrator, the

Registrar, the Depositary and the Broker, and receives regular

reporting from them. The Board, via the Management Engagement

Committee, ensures that the arrangements with service providers are

reviewed at least annually. The aim is to ensure that contractual

arrangements remain in line with best practice, services being

offered meet the requirements and needs of APEO and performance is

in line with the expectations of the Board, Manager, and other

relevant stakeholders. The Audit Committee considers the internal

controls at these service providers to ensure they are fit for

purpose.

Debt Providers

On behalf of the Board, the Manager maintains a positive working

relationship with RBS International, Société Générale and State

Street Bank International, the providers of APEO's multi-currency

revolving credit facility, and provides regular updates on business

activity and compliance with its loan covenants.

Investee Funds and Companies

Responsibility for actively monitoring the activities of

investment managers, funds and companies, which make up APEO's

portfolio, has been delegated by the Board to the Manager.

On behalf of the Board and its stakeholders, the Manager invests

in a carefully selected range of private equity managers, built

from years of established relationships and proprietary research.

The Manager assesses all investment opportunities and participates

on the advisory boards of some investments.

The Board is responsible for overseeing the work of the Manager

and this is not limited solely to the investment performance of the

investments. The Board also has regard for environmental (including

climate change), social and governance matters that subsist within

the portfolio companies. Please see the Manager's approach to ESG

below for more details.

Principal Decisions

Pursuant to the Board's aim of promoting APEO's long-term

success, the following principal decisions were taken during the

year:

- The Investment Manager's Review below details the key

investment decisions taken during the year. In the opinion of the

Board, the performance of the investment portfolio is the key

factor in determining the long-term success of APEO. Accordingly,

at each Board meeting the Directors discuss performance in detail

with the Investment Manager. As explained in more detail below,

during the year the Management Engagement Committee decided that

the continuing appointment of the Manager was in the best interests

of shareholders.

- During the year, the Board agreed to increase APEO's

syndicated multi-currency revolving credit facility from GBP200.0

million to GBP300.0 million. The facility, which is provided by RBS

International, Société Générale and State Street Bank

International, was extended in October 2022, subsequent to the year

end. The Board decided to extend the facility in light of the

strong pipeline of investment opportunities in primary funds,

secondaries and co-investments believing that an extended loan

facility would allow the Manager to take advantage of emerging

investment opportunities.

- The level of dividend to be paid to shareholders was carefully

assessed during the financial year. The Board is pleased to have

paid three quarterly dividends of 3.6 pence per share and to have

announced a fourth quarterly dividend payment of 3.6 pence per

share making a total dividend for the year to 30 September 2022 to

14.4 pence per share. This represents a dividend yield of 3.5%,

based on the APEO Share Price at 30 September 2022, and is an

increase of 5.9% on the 13.6 pence per share paid for the year to

30 September 2021.

- Following the Manager's sale of the Standard Life brand the

Phoenix Group in May 2021, the Board agreed to recommend to

shareholders that the Company change its name to abrdn Private

Equity Opportunities Trust plc. Shareholders overwhelmingly voted

in favour of the name change at the AGM in March 2022. The Board

believes that the proposed name change aligns APEO with the

Manager's new brand and comes at an exciting time in APEO's

development.

- As reported in the Annual Report to 30 September 2021, the

Board appointed Alan Devine as Chair on 22 March 2022, following

Christina McComb's retirement from the Board. The Board agreed that

Alan Devine is an experienced Board Member, having served as Senior

Independent Director since 2019 and, has a breadth of experience in

debt markets and private equity backed business.

Board Diversity Policy

The Board's statement on diversity is set out in the Statement

of Corporate Governance in the Annual Report.

At 30 September 2022, there were three male and two female

Directors on the Board.

Modern Slavery Act

Being a company that does not offer goods and services to

customers and has no turnover, the Board considers that APEO is not

within the scope of the Modern Slavery Act 2015. APEO is therefore

not required to make a slavery and human trafficking statement. In

any event, the Board considers APEO's supply chains, dealing

predominantly with professional advisers and service providers in

the financial services industry, to be low risk in relation to this

matter.

Streamlined Energy and Carbon Reporting ("SECR") Statement:

Greenhouse Gas Emissions and Energy Consumption Disclosure

APEO has no employees, premises or operations either as a

producer or provider of goods and services. Therefore, it is not

required to disclose energy and carbon information as there are

zero emissions associated or attributed to the Company and no

underlying global energy consumption.

Viability Statement

The Board has decided that five years is an appropriate period

over which to consider its viability. The Board considers this to

be an appropriate period for an investment trust company with a

portfolio of private equity investments and the financial position

of the Company.

In determining this time period the Directors considered the

nature of APEO's commitments and it's associated cash flows.

Generally the private equity funds and co-investments in which APEO

invests call monies over a five year period, whilst they are making

investments, and these drawdowns should be offset by the more

mature funds and co-investments, which are realising their

investments and distributing cash back to APEO. The Manager

presents the Board with a comprehensive review of APEO's detailed

cash flow model on a regular basis, including projections for up to

five years ahead depending on the expected life of the commitments.

This analysis takes account of the most up to date information

provided by the underlying managers, together with the Manager's

current expectations in terms of market activity and

performance.

The Directors have also carried out an assessment of the

principal risks as noted above and discussed in note 18 to the

financial statements that are facing APEO over the period of the

review. These include those that would threaten its business model,

future performance, solvency or liquidity such as over-commitment,

liquidity and market risks. When considering the risks, the Board

reviewed the impact of stress testing on the portfolio, including

multiple downside scenarios which modelled a reduction in forecast

distributions from 50% to 100% in an extreme downside case and the

impact this would have on liquidity and deployment. Under an

extreme downside scenario which involved i) a 100% reduction in

forecast distributions over a 12 months period; ii) all underlying

General Partner debt facilities being drawn simultaneously; and

iii) a 25% reduction in portfolio valuations spread over a period

of 12 months, a significant adjustment to planned deployment would

be required to maintain sufficient liquid resources over the

financial year to 30 September 2023 and over the period through to

January 2024. From January 2024 onwards, the implied resumption of

forecast distribution activity then provides sufficient liquidity

in this extreme downside scenario.

By having a portfolio of predominantly fund investments,

diversified by manager, vintage year, sector and geography; by

assessing market and economic risks as decisions are made on new

commitments; and by monitoring APEO's cash flows together with the

Manager, the Directors believe APEO is able to withstand economic

cycles. The Directors are also aware of APEO's indirect exposure to

ongoing risks through underlying funds.

These are continually assessed by the Manager monitoring the

underlying managers themselves and by participation on a number of

fund advisory boards.

Based on the results of this analysis, and the ongoing ability

to adjust the portfolio, the Directors have a reasonable

expectation that APEO will be able to continue in operation and

meet its liabilities as they fall due over the five year period

following the date of this report.

Future Strategy

The Board intends to maintain the strategic policies set out in

the Strategic Report for the year ending 30 September 2023 as it is

believes that these are in the best interests of shareholders.

Long-Term Investment

The Manager's investment process seeks to outperform its

comparator index over the longer term. The Board has in place the

necessary procedures and processes to continue to promote APEO's

long-term success. The Board will continue to monitor, evaluate and

seek to improve these processes as APEO continues to grow over

time, to ensure that the investment proposition is delivered to

shareholders and other stakeholders in line with their

expectations.

On behalf of the Board

Alan Devine

Chair

30 January 2023

INVESTMENT MANAGER'S REVIEW

INTRODUCTION TO THE MANAGER - HOW WE INVEST

In order to achieve the investment objective, maintain a

balanced portfolio and take advantage of opportunities as they

arise, APEO invests in three types of private equity

investment:

1. Primary Investment

APEO commits to investing in a new private equity fund. The

committed capital will generally be drawn over a three to five year

period as investments in underlying private companies are made.

Proceeds are then returned to APEO when the underlying companies

are sold, typically over a four to five year holding period.

Primary investment has been the core focus of APEO's Investment

Objective since its inception in 2001. Primary investments can

provide APEO with:

-- consistent exposure to leading private equity managers;

-- underlying portfolio diversification;

-- a steady, predictable cashflow profile; and

-- help drive APEO's dealflow in secondaries and co-investments.

2. Secondary Investment

APEO acquires a single fund interest or a portfolio of fund

interests from another investor, with the prior approval of the

private equity managers of the target funds. APEO pays the seller a

cash amount for the interests and takes on any outstanding

commitments to the target funds.

Typically this would occur at a point where the target funds

have already invested the majority of its capital. The price paid

in this type of transaction will reflect the age profile of the

funds, the quality of the managers and the quality of the

underlying portfolios. Secondaries allow the Manager to gain

exposure to funds of new or existing managers a later stage in a

fund's life.

Therefore they typically have a shorter investment duration than

a primary investment. Secondaries are opportunistic in nature and

their availability is dependent on multiple market and

deal-specific factors.

3. Co-investment

APEO makes direct investments into private companies alongside

other private equity managers. APEO's strategy is to invest

alongside private equity managers with which abrdn Private Equity

has made a primary investment.

Co-investment was introduced to the Investment Objective in

2019. The Manager is seeking to build a diversified portfolio of

around 30 co-investments in order to mitigate concentration

risk.

INVESTMENT MANAGER'S REVIEW

Summary of the Year

The portfolio has shown strong performance during the financial

year, in spite of headwinds in the broader financial markets and

the uncertain global economic backdrop. APEO's 21-year-old strategy

of partnering with a small group of top performing private equity

firms, focusing on underlying businesses in the mid-market

(enterprise values between GBP100 million and GBP1 billion) and

targeting diversification across a range of resilient sectors

continues to position it well. This has been reflected in continued

strong trading in the underlying portfolio and robust realisation

activity, helping APEO to deliver a NAV TR of 14.1% during period,

an outperformance of 18.1% to the FTSE All-Share, which declined by

-4.0%.

A large part of this performance relates to the record

realisation activity that APEO has seen during the year. The

Company received GBP210.2 million of distributions from underlying

funds during the year (2021: GBP197.6 million), exceeding the

record total seen in the prior year. These realisations came at an

average uplift of 20% when compared with the unrealised valuation

two quarters prior, therefore driving valuation increases. Notable

exits in the portfolio were General Life (European fertility clinic

group), Benvic (European developer and producer of thermoplastic

solutions) and Sbanken (Norwegian online bank).

The portfolio of private companies continues to perform well,

with the top 50 largest underlying portfolio companies by value

showing average revenue and EBITDA growth of 23% and 24%

respectively in the twelve months to 30 September 2022.

That has helped drive the resilient valuation performance in the

unrealised book, in spite of declining listed market comparable

multiples. We are particularly pleased about progress in APEO's

co-investment portfolio, which has seen a valuation uplift of 51.8%

on a constant currency basis during the year. The co-investment

portfolio now stands at 22 underlying companies and 19.1% of NAV,

close to our target of 25%.

The impact of listed equity market declines seen in 2022 has

been most apparent in the publicly listed company exposures APEO

has. As a reminder, the Company is not a long-term holder of listed

shares but saw strong IPO activity in the portfolio in 2021, with

successful listings including Moonpig (UK-based online gifting

business), Dr Martens (leading consumer footwear brand) and Inpost

(self-service lockers for ecommerce consumers). Listed companies

equated to 12.4% of the portfolio at the beginning of the financial

year. Through a combination of realisations and a decline in the

aggregate value of this cohort over twelve months to 30 September

2022, listed companies now equate to 5.4%of the portfolio.

The war in Ukraine had a minimal direct impact on APEO during

the year. The Company has no Russian, Belarussian or Ukrainian

headquartered businesses in its portfolio of 655 separate

underlying companies. In addition, through discussions with the

private equity managers in APEO's portfolio, we estimate that

revenues from these countries accounted for less than 1% of

aggregate underlying portfolio company revenues at the start of the

financial year, and have declined further since then. That said,

the indirect impacts are materialising in the portfolio, mainly

through the war exacerbating already elevated energy and raw

materials pricing, impacting upon the margins of many of APEO's

underlying businesses.

On the new investment side, the 12 months ended 30 September

2022 was another active year for investment. APEO made commitments

totalling GBP340.3 million (2021: GBP307.1 million), with twelve

new primary investments, two secondary investments, nine direct

co-investments and one follow-on investment in an existing

co-investment. These new fund commitments are aligned with our

long-term strategy of backing private equity firms that have a

mid-market orientation and have proven expertise within one or more

specified sectors. As aforementioned, we are delighted with the

strong deployment in co-investments during the year and the good

balance in deployment across our key sectors. Whilst secondary

deployment in the year was modest relative to primary and

co-investment, we are excited by the potential of the two new

investments and see a window of strong secondary opportunities

emerging as we move into the new financial year.

In terms of cashflows, the aforementioned exit activity has

helped drive record levels of distributions. The realised return

from the ongoing investment operations of APEO's core portfolio

equated to 2.2 times cost (2021: 2.8 times cost). In addition, APEO

received an additional GBP15.7 million (2021: GBP1.1 million) from

proceeds from secondary sales relating to two fund positions,

meaning that APEO earned a total of GBP225.9 million cash proceeds

during the financial year (2021: GBP198.7 million). We have focused

on reinvesting distributions into new investment opportunities

during the period, and therefore drawdowns during the year totalled

GBP253.6 million (2021: GBP184.2 million). This figure includes

GBP74.7 million of new co-investment and secondaries, which is

deployment directly under the Manager's control. The balance sheet

remains in a strong position with cash and cash equivalents of

GBP30.3 million (2021: GBP29.7 million). APEO also had GBP138.0

million remaining undrawn on its GBP200.0 million revolving credit

facility at 30 September 2022 (2021: GBP200.0 million undrawn). We

are also delighted that, immediately following the year-end, the

revolving credit facility was increased to GBP300.0 million and the

maturity extended by a year to December 2025. The larger facility,

provided by RBS International, Société Générale and State Street

Bank International, will provide APEO with ample liquidity for new

investments in the months and years ahead.

Performance

The NAV TR for the year ended 30 September 2022 was 14.1% versus

-4.0% for the FTSE All-Share Index. The valuation of the portfolio

at 30 September 2022 increased 10.5% on the prior year on a

constant currency basis, with a further increase of 5.1%

attributable to FX gains during the year, principally due to the

weakness of pound sterling compared to US dollar and the Euro.

The increase in value of the NAV on a per share basis was 79.4p.

This was principally made up of unrealised and realised gains and

income of 102.4p, partially offset by dividends and costs

associated with management fee, administrative and financing of

23.0p.

The unrealised gains in the year are attributable to the strong

performance of the underlying portfolio. At 30 September 2022 the

top 50 largest underlying portfolio companies by value in APEO

exhibited average last twelve months ("LTM") revenue and EBITDA

growth of 23% and 24% respectively. Realised gains were derived

from full or partial sales of companies during the 12-month period,

which were at an average uplift of 20% to the unrealised value two

quarters prior.

Pence per share

NAV as at 1 October 2021 673.8

Net unrealised losses at constant

FX on portfolio(1) -5.0

Net realised gains and income from

portfolio 74.0

Net unrealised FX gains on portfolio 32.7

Net income from other assets 0.7

Dividends paid -14.0

Management fee, administrative and

finance costs -9.0

NAV as at 30 September 2022 753.2

(1) Includes the reversal of previously recognised unrealised

gains that have realised during the financial year and are

therefore included in Net realised gains

and income from portfolio.

Drawdowns

Amount - GBPmillion

Vitruvian IV 11.0

Altor V (including secondary purchase) 10.3

Nordic Capital X 9.7

Cinven 7 9.2

Advent Tech II 8.6

Other 204.9

During the year GBP253.6 million was invested into existing and

new underlying companies. GBP176.7 million of this figure related

to primary fund drawdowns, with the remainder related to

co-investment and secondary deployment, which are fully under the

control of the Manager and as planned. Secondary and co-investment

activity are covered in detail later in the review.

Primary fund drawdowns during the year were mainly used to fund

new underlying investments into portfolio companies, with notably

large drawdowns relating to the following new portfolio

companies:

- CFC Underwriting (Vitruvian IV) - global leader and category

innovator in the cyber security insurance market;

- Inovalon (Nordic Capital X) - US-based provider of cloud-based

healthcare software and data analytics;

- BioAgilytix (Cinven 7) - global healthcare contract research organisation;

- McAfee (Advent Tech II) - global provider of cyber security protection;

- STARK Group (CVC Fund VII) - distributor of heavy building materials in Northern Europe.

We estimate that APEO had around GBP113.3 million held on

underlying fund credit facilities at 30 September 2022 (30

September 2021: GBP47.3 million), and we expect that this will all

be drawn over the next 12 months.

Realisations

Amount - GBPmillion

Investindustrial Growth 20.2

Altor Fund IV 16.9

Equistone VI (secondary sale) 15.5

Astorg VI 14.2

Permira V 13.0

Other 146.1

GBP210.2 million of distributions were received from funds

during the year, which is a record annual total for APEO. Exit

activity was driven by the strong market appetite for high quality

private companies in resilient sectors following the global

pandemic. Both trade and financial buyers remain active during the

period, albeit the demand for IPOs declined significantly in the

second half of the year. The headline realised return from the

portfolio equated to 2.2 times cost (30 September 2021: 2.8 times

cost).

In addition, APEO sold its fund positions in Equistone Fund VI

and IK Small Cap Fund III for portfolio management reasons,

contributing a further GBP15.7 million in proceeds and meaning that

an aggregate total of GBP225.9 million was received from

distributions and secondary sales during the period.

Outstanding Commitments

As at 30 September Outstanding Commitments Outstanding commitments

in excess of undrawn loan

facility and case resources

as a % of portfolio NAV

(GBPmillion)

2018 33.6 369.3

2019 47.4 450.3

2020 30.9 471.4

2021 32.5 557.1

2022 42.8 678.9

Commitments

APEO made commitments totalling GBP340.3 million during the year

(2021: GBP307.1 million). These commitments were well diversified,

with twelve new primary investments, two secondary investments,

nine direct co-investments and one follow-on investment in an

existing co-investment. The total outstanding commitments at 30

September 2022

were GBP678.9 million (30 September 2021: GBP557.1 million).

The value of outstanding commitments in excess of liquid

resources as a percentage of portfolio value increased to 42.8% in

the financial year (30 September 2021: 32.5%). This is largely due

to the strong investment activity during the year ended 30

September 2022. This figure is at the lower end of our long-term

target range of 30-75%. We estimate that GBP69.9 million of the

reported outstanding commitments are unlikely to be drawn down, due

to the nature of private equity investing, with private equity

funds not always being fully drawn.

Investment Activity

Primary Funds

GBP257.2 million was committed to twelve new primary funds

during the year ended 30 September 2022 (2021: GBP175.7 million

into eight new primary funds). As a reminder, APEO's primary fund

strategy is to partner with private equity firms, principally in

Europe, that have genuine sector expertise and operational value

creation capabilities and have a core mid-market buyout

orientation, i.e. focusing on businesses with an enterprise value

between GBP100 million and GBP1 billion. The firms that APEO has

partnered with during period fulfil most, if not all, of this

criteria and all are relationships with who the Manager known for

many years, often decades.

Investment GBPm Description

--------------------------------- ---- ---------------------------------------------------------------------------

Capiton VI 16.9 European lower mid-market fund with a focus in Pharma, MedTech, Industrial

Automation and

Sustainable Consumption.

================================= ==== ===========================================================================

Great Hill Equity Partners VIII 14.6 Growth-focused private equity fund based in the United States.

================================= ==== ===========================================================================

Windrose Health Investors Fund VI 15.1 Mid-market buyout fund based in the United States, that has a specialist

focus on the healthcare

sector.

================================= ==== ===========================================================================

PAI VIII 25.1 Pan-European upper mid-market fund focused on Food & Consumer, Business

Services, General

Industrials and Healthcare.

================================= ==== ===========================================================================

IK Partnership II 20.8 Pan-European mid-market fund focused on co-control and minority

opportunities in Food & Consumer,

Business Services, Healthcare and Financial Services.

================================= ==== ===========================================================================

Hg Saturn 3 25.8 European buyout fund focused on Software and B2B Services.

================================= ==== ===========================================================================

Advent Global Private Equity X 25.2 Global buyout fund which focuses on attractive niches within business and

financial services,

healthcare, industrial, retail and technology sectors.

================================= ==== ===========================================================================

ArchiMed MP 2 25.1 Healthcare specialist fund, focused on European and North American

mid-market companies.

================================= ==== ===========================================================================

Investindustrial Growth III 25.2 Southern European lower mid-market fund focused on niches within the

Industrials, Business

Services and Consumer & Leisure sectors.

================================= ==== ===========================================================================

Nordic Capital XI 25.2 Northern European buyout fund, principally focused on the Healthcare,

Technology & Payments

and Financial Services sectors.

================================= ==== ===========================================================================

One Peak Growth III 12.9 European growth fund which targets rapidly growing technology and

tech-enabled

companies.

================================= ==== ===========================================================================

Latour Capital IV 25.4 French mid-market buyout fund which focuses principally on companies in the

Business Services

and Industrials sectors.

--------------------------------- ---- ---------------------------------------------------------------------------

Case study - primary - Investindustrial

Investindustrial is a leading private equity manager in Southern

Europe with excellent networks and a high quality and

well-resourced team.

Investment : Investindustrial Growth III

Fund size : EUR1bn target

APEO's commitment : EUR30 million

Commitment year : 2022

Geographic focus : Western Europe but with a focus on Southern

Europe

Target company size : Lower mid-market

Sectors : Industrials, Healthcare & Services, Consumer and

Technology

Investment strategy : Buyout / Growth

Overview

-- Founded in 1990, out of an industrial conglomerate owned by

the Bonomi family and with more than EUR11 billion of raised fund

capital, Investindustrial is one of Europe's leading private equity

managers. The firm is focused on taking majority or control

positions in mid-market companies, primarily across the Industrial,

Healthcare & Services, Consumer and Technology sectors.

-- Investindustrial has a strong Southern European heritage and

specialism but today operates globally, with a team of c.160

professionals representing 21 nationalities, based across offices

in Switzerland, Spain, United Kingdom, France, United States,

Luxembourg, and China.

-- The firm covers the entire mid-market across its mid-market

and growth investment strategies. The growth strategy is

differentiated by its focus on the attractive lower mid-market

space and specialism in Southern Europe. It also benefits from the

wider Investindustrial platform, with access to the firm's regional

offices and dedicated resources across business development

(focused on driving international organic and acquisitive growth),

capital markets, digitisation and ESG.

APEO's Exposure

-- The Manager's relationship with Investindustrial goes back 15

years, with a first commitment to Investindustrial IV in 2008.

abrdn has committed to every Investindustrial fund since that

time.

-- APEO first invested with Investindustrial in 2018 through