Zurich Insurance CEO Steps Down--Update

December 01 2015 - 5:41AM

Dow Jones News

By John Letzing

ZURICH-- Zurich Insurance Group AG capped a tumultuous period

for the Swiss insurer on Tuesday, by parting ways with Chief

Executive Martin Senn.

The Zurich-based company said Mr. Senn will step down by the end

of this year. He will be replaced on an interim basis by Chairman

Tom de Swaan, while a permanent successor is sought.

Mr. Senn, who joined Zurich Insurance in 2006 as chief

investment officer before later assuming the CEO role in 2010,

oversaw the company through a trying period that included the

tragic death of a top executive, a series of management changes,

and a recent retreat from a significant acquisition.

During a conference call with reporters, Mr. de Swaan thanked

Mr. Senn for having "guided Zurich through a challenging

environment." The company will pursue external candidates for the

CEO job, Mr. de Swaan said, while declining to lay out a timetable

for the search.

Mr. Senn, a former executive at Credit Suisse Group AG and Swiss

Life Holding AG, held the top job at Zurich Insurance during an

unusually difficult chapter in its 143-year history.

In June, Zurich Insurance said Chief Risk Officer Axel Lehmann

was stepping down, and would be replaced by the company's chief

investment officer.

Then in the following month, Zurich Insurance unveiled a bold

plan to bolster its business: the acquisition of U.K.-based RSA

Insurance Group PLC, potentially valued at more than $8

billion.

In early September, the company said the CEO of its general

insurance unit, Mike Kerner, was being replaced by Kristof

Terryn--a Zurich Insurance executive who had been running the

global life business. Roughly two weeks later, Zurich Insurance

called off its pursuit of RSA, citing mounting troubles at the

general insurance unit.

At that same time, the company warned that it would report a

weaker-than-expected third-quarter profit for general

insurance.

Mr. Senn said during the conference call on Tuesday that the

profit warning, in addition to the company's need to back away from

the RSA acquisition, were factors in his decision to step

aside.

Last month, Zurich Insurance reported a 79% decline in

third-quarter net profit, and an operating loss of $183 million for

the general insurance business in the period. The company said it

would cut roughly 200 jobs at the general insurance unit.

Mr. de Swaan said on Tuesday that despite the recent turmoil,

the company remains "on track." By early next year, he said, Zurich

Insurance should detail its plans for deploying roughly $3 billion

in excess capital.

In February of last year, Zurich Insurance warned that it

expected about $600 million in charges related to restructuring its

business. The following month, the company said it planned to shed

as much as 1.5% of its workforce in a bid to cut costs. The company

later reported a 3% decline in net profit for 2014.

And back In August, 2013, the company was shaken by the suicide

of Chief Financial Officer Pierre Wauthier, who left behind a note

blaming the company's then-chairman, Josef Ackermann, for creating

an unbearable work culture. Mr. Ackermann issued a statement

rejecting blame for Mr. Wauthier's death, and abruptly resigned. He

was replaced by Mr. de Swaan. The episode rattled investor

confidence.

Write to John Letzing at john.letzing@wsj.com

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

December 01, 2015 05:26 ET (10:26 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

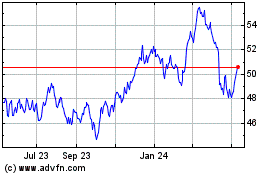

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Jun 2024 to Jul 2024

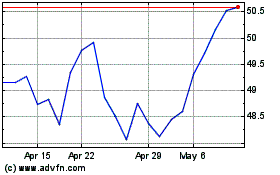

Zurich Insurance (QX) (USOTC:ZURVY)

Historical Stock Chart

From Jul 2023 to Jul 2024